Europe Remote Patient Monitoring Market Size, Growth, Share & Trends Analysis

Europe Remote Patient Monitoring (RPM) Market By Offering {Software [Transmission (synchronous)], Integrated Device (Wearable, Implant, Handheld)}, Function (Cardiac, Glucose, Multiparameter), Application (Diabetes, Cardio), End User - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe remote patient monitoring (RPM) market is projected to reach USD 11.22 billion by 2030 from USD 6.87 billion in 2025, at a CAGR of 10.3% from 2025 to 2030. Market growth is driven by rising investments in home-based care models, strengthening cross-border digital health infrastructure, and increasing demand from providers for real-time patient data to support early intervention, reduce readmissions, and improve care continuity across decentralized settings.

KEY TAKEAWAYS

-

By CountryBy country, Germany accounted for the largest share of 27.2% of the Europe remote patient monitoring (RPM) market in 2024.

-

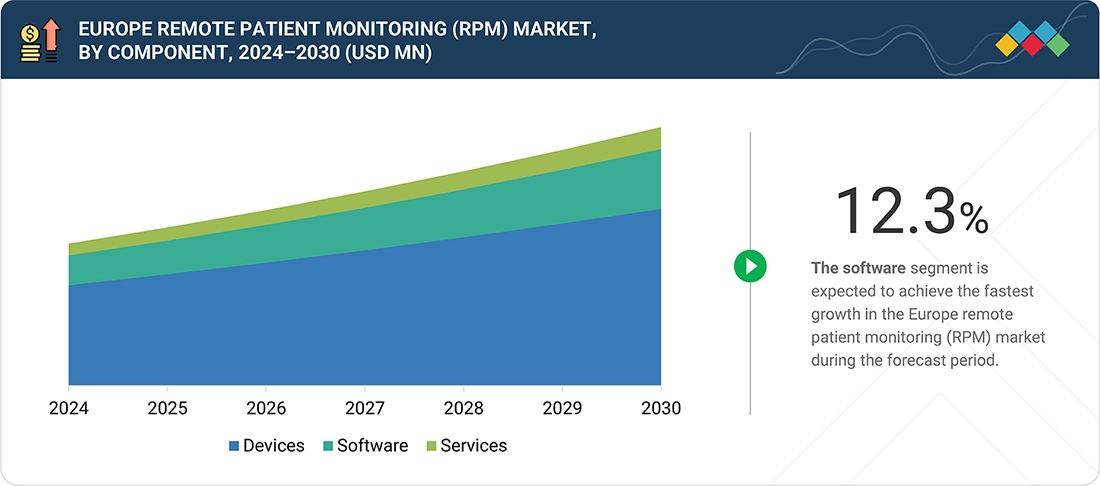

By ComponentBy component, the software segment is expected to register the highest CAGR of 12.3% during the forecast period.

-

By IndicationBy indication, the mental health segment is projected to grow at the highest rate of 11.6% from 2025 to 2030.

-

By End UserBy end user, the healthcare providers segment accounted for the largest share of the Europe remote patient monitoring (RPM) market in 2024.

-

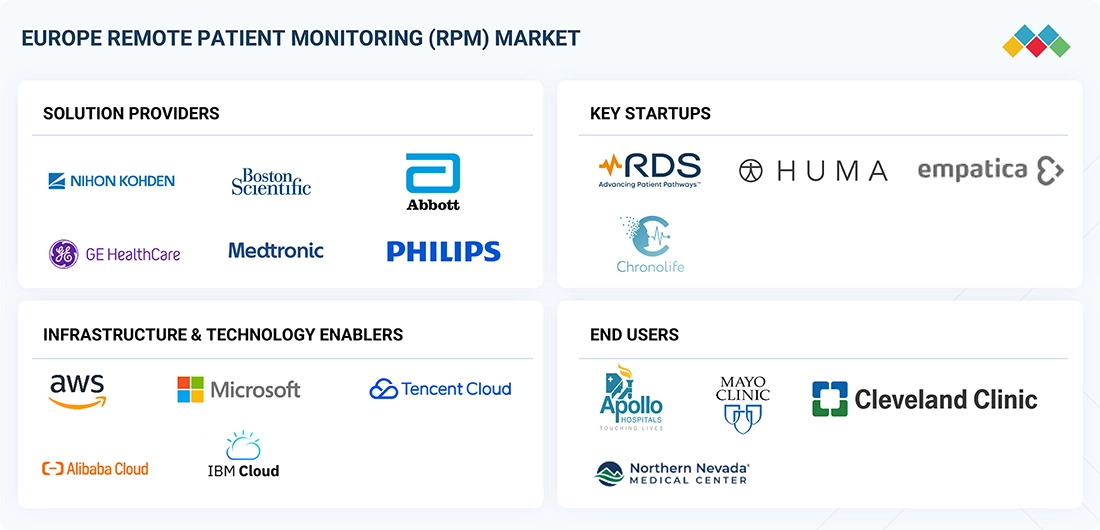

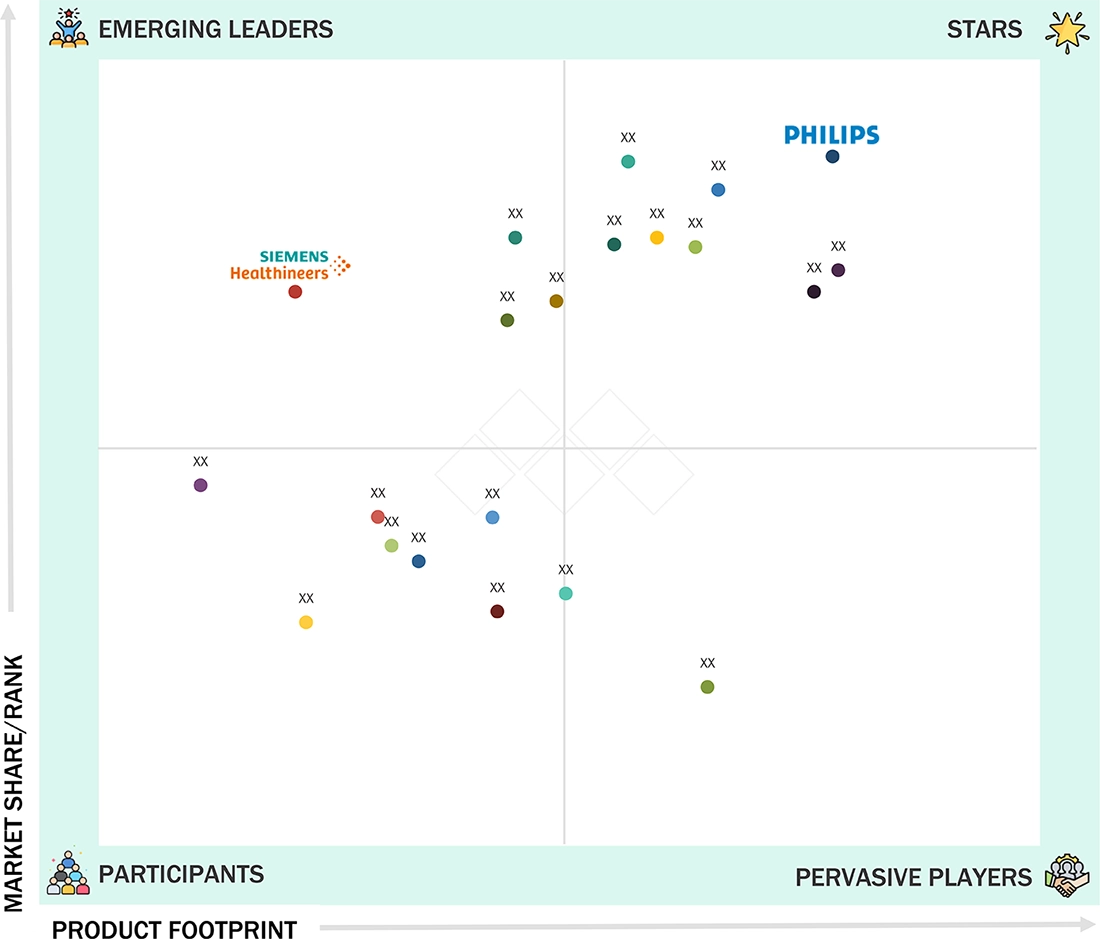

Competitive LandscapeKoninklijke Philips N.V., Medtronic, and GE Healthcare were identified as the Star players in the Europe remote patient monitoring (RPM) market, given their strong market share and product footprint.

-

Competitive LandscapeRDS SAS, Huma, and Chronolife have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The remote patient monitoring market in Europe is growing quickly due to the shift toward preventive and community-based care. Stronger national investments in digital infrastructure are raising the expectations for data-driven decision-making across health systems. The expansion of electronic health record connectivity and demand for longitudinal patient insights are increasing adoption. As providers manage aging populations, RPM is emerging as a key enabler of continuity, efficiency, and proactive clinical intervention across Europe.

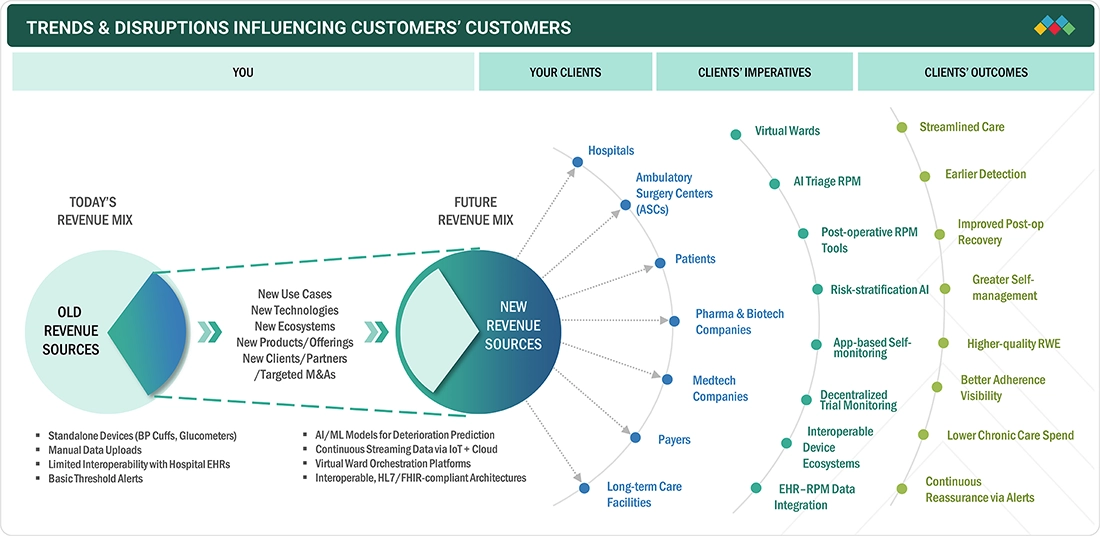

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Europe remote patient monitoring landscape is changing as hospitals, payers, medtech firms, and pharma companies shift from device-led monitoring to integrated AI-enabled virtual care ecosystems. This shift reflects the need to improve outcomes, reduce system strain, enhance patient experiences, and enable real-time data intelligence. Legacy hardware models are giving way to cloud-based interoperable and predictive platforms. Customers now expect continuous monitoring with earlier intervention and seamless digital care pathways. This transition signals a move toward software-first and analytics-driven RPM models that deliver efficiency, clinical precision, and long-term value across Europe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Europe's aging population straining healthcare system capacity

-

EU-wide digital health infrastructure initiatives

Level

-

Fragmented reimbursement models across 27 Member States

-

Legacy EHR variability hindering seamless RPM interoperability

Level

-

NextGenerationEU Recovery Fund supporting digital health investment

-

Data integration platforms emerging as strategic differentiators

Level

-

Complex multilayer compliance under MDR and AI Act

-

High integration burden across Europe’s fragmented health IT

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Europe's aging population straining healthcare system capacity

Europe’s demographic pressure is directly accelerating RPM adoption. According to Eurostat’s 2024 Demography Report, the share of EU residents aged over 65 years reached 21.6% while the population aged 80 years and above rose to 6.1%. Eurostat highlights that this shift is increasing the demand for long-term and chronic care services. The OECD also reports persistent healthcare workforce shortages, with several EU countries operating below recommended nurse-to-population ratios. This situation creates pressure for hospitals to move chronic disease management away from inpatient settings. RPM offers scalable support through virtual wards, proactive chronic care management, and reduced readmissions. As health systems in Germany, Italy, France, and Spain face rapid population aging, RPM becomes a strategic tool to protect capacity while controlling costs.

Restraint: NextGenerationEU Recovery Fund supporting digital health investment

Reimbursement heterogeneity remains the most significant commercialization barrier for RPM vendors. According to the World Health Organization’s 'Digital Health in the European Region' report, EU member states follow 'highly varied reimbursement and evidence frameworks' for digital health, forcing case-by-case national evaluations. Likewise, a 2023 European Observatory study highlights substantial divergence in HTA criteria, pricing rules, and assessment timelines, with only a few mature markets, such as Germany’s DiGA and France’s ETAP, offering clear reimbursement pathways. For RPM companies, this fragmentation raises market-entry costs, slows tender cycles, and prevents unified EU-wide scaling. Vendors must build modular value dossiers and pursue high-maturity markets first before sequential expansion. The inconsistent reimbursement landscape ultimately delays adoption despite proven clinical and operational benefits.

Opportunity: Accelerated drug discovery and reduced pharmaceutical development timelines

The NextGenerationEU program is a major accelerator for RPM scale-up. According to the European Commission, the €800 billion Recovery Plan is the largest stimulus package ever financed in Europe, with over 20% of national allocations directed toward digital transformation. This funding includes healthcare modernization across member states. Countries such as Spain, Italy, and Portugal have allocated RRF funds to telehealth platforms, hospital-at-home programs, and interoperable data infrastructure that support RPM deployment. The Commission’s 2023 RRF Implementation Review confirms that investments in digital health are a top spending priority across multiple member states. This creates a unique window for RPM vendors to access publicly funded procurement, accelerate platform adoption, and integrate AI-enabled monitoring into national care pathways. RRF capital effectively lowers adoption barriers and drives structural modernization of Europe’s care delivery models.

Challenge: Complex multilayer compliance under MDR and AI Act

Compliance demands are rising under the EU regulatory regime. The European Commission reports higher certification costs and documentation requirements under MDR, with SMEs facing longer approval timelines. The EU AI Act, adopted in 2024, classifies clinical AI systems as high risk and imposes strict obligations on transparency, robustness, post-market surveillance, and data governance. The European Council notes that AI-enabled medical software requires ongoing monitoring with clear risk controls, which affects RPM platforms using predictive analytics. These overlapping rules extend time to market and raise compliance budgets. They also require a strong regulatory strategy with early evidence generation. Vendors offering AI-driven RPM must embed MDR-grade quality systems and explainable AI frameworks early to avoid delays in payer and provider adoption.

europe-remote-patient-monitoring-rpm-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

End-to-end virtual ward and chronic disease RPM platforms integrating wearables, connected sensors, and the Philips HealthSuite cloud. | Reduced readmissions, improved clinical workflow efficiency, scalable virtual care, and enhanced triage accuracy. |

|

Continuous glucose monitoring (CGM) and cardiac monitoring devices integrated with digital dashboards for clinicians and patients. | Better glycemic control, reduced acute events, stronger patient engagement, and improved real-time decision-making. |

|

Remote cardiac and vitals monitoring with AI-enabled analytics connected to enterprise imaging and hospital command centers. | Early deterioration detection, enhanced care coordination, improved hospital throughput, and lower ICU transfers. |

|

Connected home blood pressure, ECG, and cardiovascular monitoring devices integrated into population health platforms. | Improved hypertension management, fewer cardiovascular complications, stronger adherence, and validated home-based vitals data. |

|

Device-driven RPM for cardiac rhythm, diabetes, and respiratory patients using cloud-based care management solutions and predictive analytics. | Lower emergency events, optimized disease management, improved therapy adherence, and reduced clinician workload. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe remote patient monitoring ecosystem is evolving into a technology-driven network shaped by hospitals, ASCs, payers, medtech manufacturers, pharma companies, and digital health platform providers. As countries expand virtual ward programs and chronic care pathways, vendors must integrate devices with AI-enabled analytics and interoperable cloud platforms that comply with MDR and emerging EU data frameworks, such as EHDS. Growing payer focus on cost containment is adding pressure from demographic change and workforce shortages. This dynamic is accelerating collaboration across providers, regulators, and technology suppliers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Remote Patient Monitoring Market, By Component

Based on component, the Europe RPM market is segmented into devices, software, and services. In 2024, devices held the largest share of the market due to the wide deployment of connected sensors, wearables, cardiac monitors, glucose monitors, and home-based vital sign devices. National initiatives in the UK, Germany, and the Nordics have accelerated the procurement of validated RPM devices for heart failure, COPD, and post-acute monitoring. The devices segment also benefits from strong adoption by medtech leaders with established reimbursement pathways for specific hardware. This installed base supports continued expansion of software and services.

Europe Remote Patient Monitoring Market, By Indication

By indication, the Europe RPM market is segmented into cardiology, diabetes, oncology, neurology, sleep disorders, wellness improvement, respiratory disorders, mental health, and other indications. In 2024, cardiology accounted for the largest share, supported by the region’s substantial cardiovascular disease burden and strong evidence for remote monitoring in heart failure, arrhythmia management, and post-operative cardiac care. According to the European Society of Cardiology, CVD causes over 3.9 million deaths annually across Europe, making continuous monitoring a clinical and economic priority. National virtual ward programs in the UK, Germany, and the Nordics increasingly focus on cardiac pathways leveraging connected ECG devices, implantable monitors, and AI-enabled deterioration alerts to reduce readmissions, optimize capacity, and improve outcomes.

Europe Remote Patient Monitoring Market, By End User

By end user, the Europe RPM market includes healthcare providers, healthcare payers, patients, pharmaceutical & biotechnology companies, medtech companies, and other end users. In 2024, healthcare providers held the largest share due to capacity pressure, workforce shortages, and the rapid growth of virtual ward programs across the UK, Germany, France, and the Nordics. The European Commission projects a shortfall of over 4 million healthcare workers by 2030, which increases reliance on remote monitoring outside hospitals. Providers are adopting AI-enabled vitals tracking, connected sensors, and continuous monitoring platforms. These tools help reduce readmissions, improve bed use, and scale home-based care that supports long-term system sustainability.

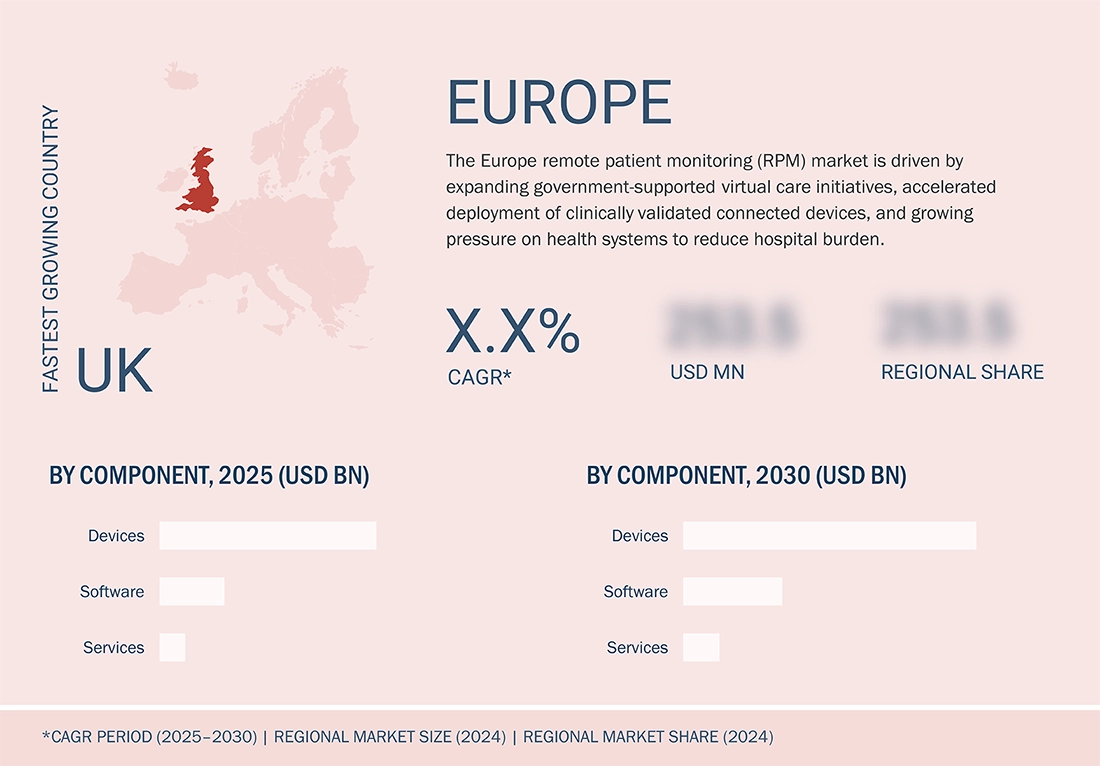

REGION

The UK is growing at fastest rate in Europe remote patient monitoring (RPM) market

The UK is growing at the fastest rate in the Europe remote patient monitoring market due to a strong shift toward community-based care and new digital procurement models. The NHS Long Term Plan prioritizes remote management of chronic conditions. The 2024 NHS Delivery Framework supports wider adoption of remote vitals tracking across Integrated Care Systems. Strong vendor onboarding through NHS frameworks, with clearer reimbursement and higher clinician acceptance, is enabling rapid national rollout. This momentum positions the UK as the fastest-growing RPM market in Europe.

europe-remote-patient-monitoring-rpm-market: COMPANY EVALUATION MATRIX

Philips (Star) leads with a sophisticated device-to-cloud ecosystem, strong hospital partnerships, and a proven track record of deploying virtual wards and continuous monitoring programs across major EU health systems. Its interoperable HealthSuite platform and broad connected device portfolio position it as the region’s most scalable RPM provider. Siemens Healthineers (Emerging Leader) is rapidly expanding into connected care, leveraging its digital platforms and AI capabilities to integrate remote monitoring into clinical workflows. As Siemens accelerates the development of remote vitals, predictive analytics, and care coordination tools, it is emerging as a strong challenger shaping Europe’s next wave of RPM adoption.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (US)

- Siemens Healthineers AG (Germany)

- GE Healthcare (US)

- OMRON Corporation (Japan)

- Oracle (US)

- Boston Scientific Corporation (US)

- Abbott (US)

- Nihon Kohden Corporation (Japan)

- Baxter (US)

- Biotronik (Germany)

- VivaLNK, Inc (US)

- Teladoc Health, Inc (US)

- ResMed (US)

- AliveCor, Inc (US)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- iRhythm Inc. (US)

- Beijing Choice Electronic Tech Co., Ltd (China)

- Biotronik (Germany)

- Masimo (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.16 BN |

| Market Forecast in 2030 (Value) | USD 11.22 BN |

| Growth Rate | 10.3% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, UK, France, Italy, Spain, Rest of Europe |

| Parent & Related Segment Reports |

remote patient monitoring market US Remote Patient Monitoring (RPM) Market |

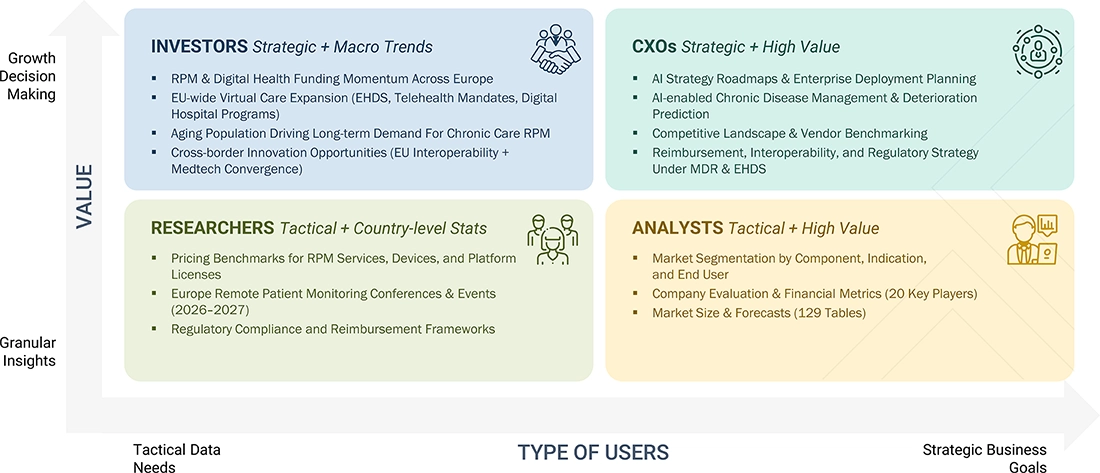

WHAT IS IN IT FOR YOU: europe-remote-patient-monitoring-rpm-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Map the Europe RPM landscape | Constructed an integrated view of the European RPM ecosystem covering leading vendors, provider networks, payer entities, telemonitoring operators, and regulatory institutions across major EU markets. | Enables strategic clarity on market structure, partnership pathways, and high-value entry points across a fragmented healthcare environment. |

| Understand regulatory, data, and interoperability complexity | Delivered an in-depth assessment of MDR, GDPR, EU AI Act, and national digital health mandates, along with EHR fragmentation and interoperability gaps impacting RPM deployment. | Reduces operational and compliance risk, accelerates cross-market scalability, and informs product design aligned with Europe’s regulatory and data governance landscape. |

| Identify high-ROI RPM use cases for European stakeholders | Prioritized clinical, operational, and reimbursement-aligned use cases in chronic care, post-acute monitoring, cardiometabolic disease, and home-based care workflows. | Supports focused solution development, maximizes adoption potential, and aligns roadmap investments with segments demonstrating measurable budget impact and reimbursement momentum. |

| Benchmark competitive positioning across Europe | Benchmarked European and global RPM players to identify capability gaps, pricing patterns, and differentiation levers. | Strengthens competitive strategy, sharpens value propositions, and uncovers whitespace opportunities across mature and emerging EU markets. |

| Assess payer and public-sector funding mechanisms | Analyzed EU-level and national funding streams (EU4Health, Horizon Europe, Digital Europe) and reimbursement frameworks influencing RPM scale-up. | Enhances revenue planning, improves market access strategy, and supports alignment with funding priorities that accelerate provider and payer adoption. |

| Build a Europe-fit go-to-market strategy | Delivered commercialization guidance across partnerships, pricing models, distribution channels, and procurement cycles specific to EU healthcare ecosystems. | Drives accelerated market penetration, shortens sales cycles, and optimizes resource deployment across high-growth markets such as DACH, Nordics, UK, and France. |

RECENT DEVELOPMENTS

- January 2025 : Medtronic secured US FDA approval for the MyCareLink Smart Monitor, the world’s first app-based remote monitoring solution for pacemaker patients. The approval enables a more streamlined, patient-centric cardiac monitoring workflow, reducing reliance on traditional in-clinic devices and advancing Medtronic’s leadership in connected cardiac care.

- November 2024 : Philips received FDA 510(k) clearance, expanding the capabilities of its Radiology Operations Command Center (ROCC) to include remote scanning and protocol management. The upgrade allows technologists to perform real-time modifications to MR and CT scanner consoles, strengthening Philips’ position in advanced, remotely assisted imaging operations.

- August 2024 : Medtronic and Abbott entered into a strategic partnership to integrate Abbott’s FreeStyle Libre continuous glucose monitoring technology with Medtronic’s insulin delivery systems. The collaboration enables automated insulin adjustments to enhance diabetes management and broadens global access to advanced, closed-loop insulin delivery solutions for people living with diabetes.

Table of Contents

Methodology

The study involved major activities in estimating the current market size for the remote patient monitoring market. Exhaustive secondary research was done to collect information on the remote patient monitoring industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the remote patient monitoring market.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of remote patient monitoring market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the remote patient monitoring market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) . This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the remote patient monitoring market. These methods were also used extensively to estimate the size of various subsegments in the market.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the remote patient monitoring market.

Market Definition

The Europe Remote Patient Monitoring (RPM) Market involves the use of technology to remotely monitor and manage patients' health conditions outside of traditional healthcare settings as well as in patient settings. It leverages devices such as wearables, sensors, and mobile applications to track vital signs and chronic diseases. RPM allows healthcare providers to access real-time data for better decision-making and personalized care.

Stakeholders

- RPM Equipment and devices Manufacturers

- Suppliers and Distributors of RPM Equipment

- RPM software provider

- Healthcare IT Service Providers

- Healthcare Insurance Companies/Payers

- Healthcare Institutions/Providers (Hospitals, Clinics, Medical Groups, Physician Practices, Diagnostic Centers, and Outpatient Clinics)

- Venture Capitalists

- Government Bodies/Regulatory Bodies

- Corporate Entities

- Accountable Care Organizations

- RPM Resource Centers

- Research and Consulting Firms

- Medical Research Institutes

- Clinical Departments

Report Objectives

- To define, describe, and forecast the Europe remote patient monitoring market based on component, indication, end user, and region.

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall remote patient monitoring market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically analyze the market structure profile of the key players of the remote patient monitoring market and comprehensively analyze their core competencies.

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, funding, grant, agreements, sales contracts, product testing, FDA approval, product approval, and alliances in the remote patient monitoring market during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Remote Patient Monitoring (RPM) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Remote Patient Monitoring (RPM) Market