US Remote Patient Monitoring (RPM) Market Size, Growth, Share & Trends Analysis

US Remote Patient Monitoring (RPM) Market by Offering {Software [Transmission (synchronous)], Integrated Device (Wearable, Implant, Handheld)}, Function (Cardiac, Glucose, Multiparameter), Application (Diabetes, Cardio, Neuro), End User - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The US Remote Patient Monitoring (RPM) Market, valued at US$14.15 billion in 2024, stood at US$16.09 billion in 2025 and is projected to advance at a resilient CAGR of 12.6% from 2025 to 2030, culminating in a forecasted valuation of US$29.13 billion by the end of the period. The US remote patient monitoring industry is driven by technological innovations in FDA-approved wearable devices, mobile health applications, and monitoring solutions.

KEY TAKEAWAYS

-

By ComponentBy component, the software segment is expected to register the highest CAGR of 14.6% during the forecast period.

-

By IndicationBy indication, the cardiology segment accounted for the largest share of 29.0% of the US remote patient monitoring (RPM) market in 2024.

-

By End UserBy end user, the patients segment is expected to register the highest CAGR of 13.1% during the forecast period.

-

Competitive LandscapeKoninklijke Philips N.V., OMRON Healthcare Inc., and Medtronic were identified as Star players in the US remote patient monitoring (RPM) market, given their strong market share and product footprint.

-

Competitive LandscapeCareSimple Inc., TimeDoc, Inc., and MD Revolution Inc. have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The remote patient monitoring (RPM) market in US is expanding steadily due to the growing adoption of home healthcare services and an increasing prevalence of chronic conditions in the country, along with the need for optimized efficiency and outcomes in healthcare delivery. The evolution of connected devices and analytics enabled by AI and cloud-enabled RPM solutions, along with the increasing adoption of hospital-at-home programs, is transforming the US RPM market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The operations of end users in the US remote patient monitoring (RPM) market are influenced by various factors, including changing patient demands, value-based care, and shifting trends in healthcare service delivery. Hospitals, ambulatory centers, home health organizations, and insurance companies are among the major end users of RPM solutions, focusing significantly on continuous patient monitoring and controlling costs. With the increasing trend of home health services, managing chronic patients, and delivering digitally oriented health services, coupled with reimbursement issues and data protection, these factors directly impact operations in the US RPM market. These trends are propelling the adoption of scalable, interoperable, and AI-driven RPM platforms in the US market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Digital transformation of patient care across US healthcare system

-

Shift toward routine adoption of virtual care by patients and clinicians

Level

-

Interoperability limitations and EHR integration challenges within US healthcare systems

-

Fragmented reimbursement policies and complex billing requirements

Level

-

Growing adoption of hospital-at-home and advanced care-at-home models in US

-

Expansion of chronic care management and remote therapeutic monitoring programs

Level

-

Limited integration of social determinants of health into US RPM programs

-

Data privacy, cybersecurity, and HIPAA compliance concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Digital transformation of patient care across US healthcare system

The digital transformation of patient care within the US healthcare sector is a key driver of the growth in the remote patient monitoring (RPM) market, due to the increased adoption of connected technologies by providers to offer continuous patient care outside traditional clinical environments. Healthcare organizations are beginning to integrate RPM with iCare, electronic health records, telehealth, and virtual care platforms to facilitate the proactive management of chronic conditions, post-discharge patient care, and the implementation of the hospital-at-home model. This digitally enabled and patient-centric approach to patient care enables improved clinical access and reduces the need for in-person encounters, thereby driving the adoption of RPM in US hospitals, ASCs, and home health organizations.

Restraint: Interoperability limitations and EHR integration challenges within US healthcare systems

Despite the escalating adoption of remote patient monitoring solutions in the US market, interoperability constraints and EHR interoperability factors are the primary factors restraining market growth. Many remote patient monitoring solutions and devices are unable to integrate easily with popular EHR solutions. Such situations lead to the creation of health information silos. The unstandardized health IT infrastructure in the US health organizations makes it even more difficult to exchange health information in real-time.

Opportunity: Growing adoption of hospital-at-home and advanced care-at-home models in US

The rising adoption of hospital-at-home and advanced care-at-home programs in the US is a major opportunity for the RPM market. This is because healthcare organizations are adopting RPM technology platforms to provide acute and post-acute care in patients' homes due to the benefits they offer, including constant patient observation and real-time notifications. With the aim of relieving pressure on inpatient capacity and curbing healthcare expenditure, the RPM technology platform is becoming a crucial component in scaling up care at home.

Challenge: Limited integration of social determinants of health into US RPM programs

One of the biggest challenges in the US remote patient monitoring (RPM) market is the underutilization of social determinants of health (SDOH) in remote patient monitoring. Many remote patient monitoring solutions are centered on clinical and biometric information, while housing, nutrition, connectivity, and support as SDOH continue to be underrepresented in the remote patient monitoring process. Such underutilization may impact the effectiveness of remote patient monitoring strategies, particularly for vulnerable populations.

US Remote Patient Monitoring (RPM) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Virtual care management and connected monitoring for chronic conditions (diabetes, COPD, heart disease) | Reduces hospital readmissions, improves outcomes and patient engagement, and lowers care costs |

|

VitalSight home blood pressure and weight monitoring linked to clinicians | Enables early intervention, better hypertension control, and continuous patient oversight |

|

MyCareLink Smart and Vital Sync for remote monitoring of implantable and hospital-to-home patients | Early detection of complications, reduced hospital stay, and improved chronic care management |

|

Deployment of RPM/virtual care solutions by combining GE’s inpatient/acute monitoring portfolio with home-based virtual care and remote monitoring | Extends hospital-grade monitoring to home, improves capacity, and reduces readmissions |

|

CardioMEMS HF System for remote monitoring of heart failure patients | Cuts hospitalizations and mortality, enables proactive treatment, and enhances quality of life |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The US remote patient monitoring market comprises equipment and wearable device manufacturers, remote patient monitoring software solution providers, connectivity solution/cloud services providers, and end-user stakeholders, including hospitals, home healthcare services organizations, insurance companies, and patients. These solutions enable the recording of real-time health information that can be transmitted via cloud services and integrated into clinical systems, making remote health services possible. The demand for improved healthcare outcomes and cost-effective, home-based care services primarily comes from end-user stakeholders.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Remote Patient Monitoring (RPM) Market, By Component

As of 2024, the devices segment represents the largest share of the remote patient monitoring (RPM) market in the US and is expected to maintain its leadership position through the end of 2025. These devices, which include wearable sensors, blood pressure monitors, glucose meters, pulse oximeters, and cardiac monitors, are fundamental to RPM initiatives. They play a crucial role in enabling continuous and simultaneous data streams from patients around the clock. The accuracy of these devices, along with advancements in sensor technology, the availability of cellular networks, and their user-friendly design, makes them essential for managing chronic diseases, monitoring patients after hospitalization, and supporting the hospital-at-home model in the US.

US Remote Patient Monitoring (RPM) Market, By Indication

In 2024, the US remote patient monitoring (RPM) market was primarily dominated by the cardiology segment. This strong position is largely due to the high number of patients suffering from cardiac diseases. Key applications of RPM technologies include monitoring patients with hypertension, heart failure, and arrhythmias. These technologies play a crucial role in the early detection of complications and in ensuring that patients adhere to their medication regimens. Furthermore, RPM technology has proven to be effective in helping healthcare providers prevent hospitalizations. The favorable reimbursement landscape and clinical practices that support RPM technology have also contributed to the cardiology segment's prominence in the US RPM market.

US Remote Patient Monitoring (RPM) Market, By End User

The healthcare providers segment is expected to drive the US remote patient monitoring market, primarily due to an increased focus by hospitals, physician practices, and health systems on remote patient monitoring solutions to support chronic care management, post-acute care, and value-based care delivery models. The use of remote patient monitoring by healthcare organizations has enabled continuous patient monitoring of vital signs using connected medical devices, wearables, and remote patient monitoring solutions, aiming to facilitate early interventions and prevent hospitalizations that were previously preventable. The emphasis by Medicare on reimbursing positive remote patient monitoring services has contributed significantly to enhancing operational efficiency and patient care among healthcare organizations.

US Remote Patient Monitoring (RPM) Market: COMPANY EVALUATION MATRIX

In the US remote patient monitoring (RPM) market, Abbott (Star) is a market leader due to the widespread adoption of its CGM system and cardiomyopathy monitors. Additionally, the clinical acceptance of its solutions further solidifies its position at the top. On the other hand, Teladoc Health, Inc., an emerging leader in the market, is expanding its Chronic Care Online solution. This expansion is driven by analytics and powered by artificial intelligence, giving Teladoc significant potential to move toward a leadership position in this sector. While Abbott has a stronghold with its product offerings, Teladoc's promising developments indicate it could become a formidable competitor in the future.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Koninklijke Philips N.V. (Netherlands)

- OMRON Corporation (Japan)

- Medtronic (Ireland)

- GE Healthcare (US)

- Abbott (US)

- Oracle (US)

- NIHON KOHDEN CORPORATION (Japan)

- Siemens Healthineers AG (Germany)

- Baxter (US)

- BioBeat (Israel)

- Biotronik (Germany)

- VitalConnect (US)

- VivaLNK, Inc. (US)

- Clear Arch, Inc. (US)

- Optum, Inc. (Vivify Health) (US)

- Blue Spark Technologies, Inc (US)

- Lightbeam (US)

- Cloud Diagnostics Canada ULC (Canada)

- Teladoc Health, Inc. (US)

- Dexcom (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 14.15 Billion |

| Market Forecast in 2030 (Value) | USD 29.13 Billion |

| Growth Rate | CAGR of 12.6% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | US |

| Parent & Related Segment Reports |

remote patient monitoring market Europe Remote Patient Monitoring (RPM) Market |

WHAT IS IN IT FOR YOU: US Remote Patient Monitoring (RPM) Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Map the US RPM ecosystem | Structured mapping of RPM device manufacturers, software platforms, providers, home healthcare agencies, payers, pharmacies, employers, and regulators (CMS, FDA, ONC) | Clear visibility into ecosystem dynamics and partnership opportunities |

| Understand RPM integration with US healthcare infrastructure | Analysis of RPM–EHR integration (Epic, Oracle Health), connectivity standards (FHIR, HL7, cellular/Bluetooth), cloud deployment, and HIPAA requirements | Reduced integration risk and faster implementation timelines |

| Identify high-ROI RPM use cases for providers and payers | Prioritized use cases across cardiology, diabetes, COPD, post-acute care, and hospital-at-home programs | Focus on scalable, reimbursement-aligned RPM models |

| Benchmark competitors in the US RPM landscape | Capability benchmarking of key RPM players (Abbott, Biofourmis, Teladoc Health, Masimo, Philips, Dexcom) | Identification of competitive gaps and differentiation opportunities |

| Assess policy, reimbursement, and regulatory impacts | Evaluation of CMS RPM/RTM CPT pathways, Medicare Advantage adoption, FDA device requirements, and state telehealth policies | Improved reimbursement readiness and regulatory compliance |

| Build a GTM strategy aligned with US RPM demand | GTM framework covering provider-led vs. payer-led models, pricing strategy, distribution channels, and hospital-at-home adoption | Stronger commercialization execution and revenue predictability |

RECENT DEVELOPMENTS

- December 2025: Artella Solutions and VivaLink formed a collaboration to offer an end-to-end ambulatory cardiac monitoring solution, incorporating the wearable ECG technologies of VivaLink and the real-time cardiac monitoring SaaS offered by Artella.

- October 2025: Koninklijke Philips N.V. has inked a strategic collaborative agreement on patient monitoring solutions with the Hoag Health System in the US, aiming to standardize and optimize patient monitoring practices at the two acute care hospitals of Hoag Health System. According to the strategic partnership, the patient monitoring system of Hoag Health System would adopt Philips’ EMaaS Solution. The system would incorporate the PIC iX Central Monitoring Solution.

- February 2025: Teladoc Health acquired Catapult Health to enhance the management of chronic illnesses in the US by offering combined at-home testing and telehealth solutions, as well as other monitoring-enabled preventive healthcare solutions.

Table of Contents

Methodology

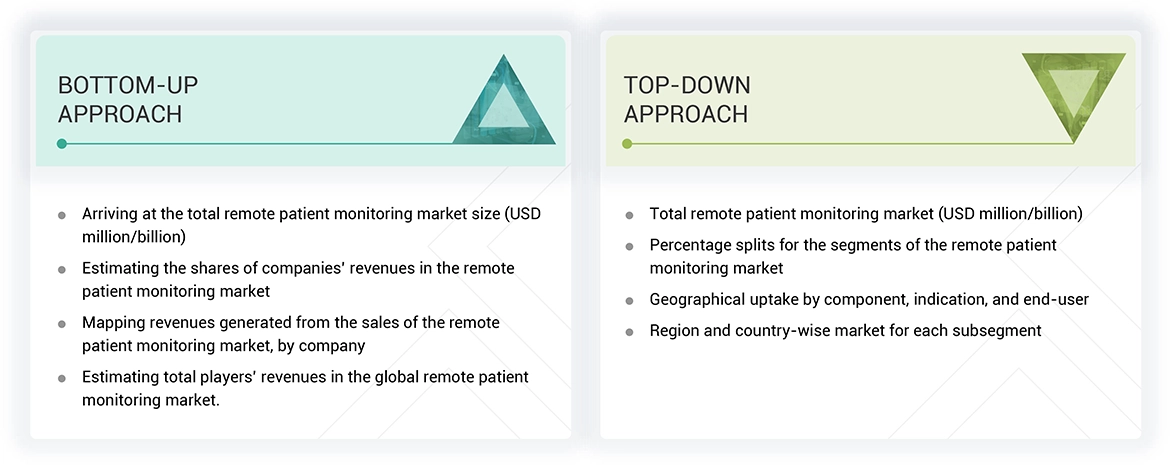

The study involved major activities in estimating the current market size for the US remote patient monitoring market. Exhaustive secondary research was done to collect information on the US remote patient monitoring industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the US remote patient monitoring market.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of US remote patient monitoring market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the US remote patient monitoring market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others). This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the US remote patient monitoring market. These methods were also used extensively to estimate the size of various subsegments in the market.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the US remote patient monitoring market.

Market Definition

The remote patient monitoring (RPM) market involves the use of technology to remotely monitor and manage patients' health conditions outside of traditional healthcare settings as well as in patient settings. It leverages devices such as wearables, sensors, and mobile applications to track vital signs and chronic diseases. RPM allows healthcare providers to access real-time data for better decision-making and personalized care.

Stakeholders

- RPM Equipment and devices Manufacturers

- Suppliers and Distributors of RPM Equipment

- RPM software provider

- Healthcare IT Service Providers

- Healthcare Insurance Companies/Payers

- Healthcare Institutions/Providers (Hospitals, Clinics, Medical Groups, Physician Practices, Diagnostic Centers, and Outpatient Clinics)

- Venture Capitalists

- Government Bodies/Regulatory Bodies

- Corporate Entities

- Accountable Care Organizations

- RPM Resource Centers

- Research and Consulting Firms

- Medical Research Institutes

- Clinical Departments

Report Objectives

- To define, describe, and forecast the US remote patient monitoring market based on component, indication, end user, and region.

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall US remote patient monitoring market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically analyze the market structure profile of the key players of the US remote patient monitoring market and comprehensively analyze their core competencies.

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, funding, grant, agreements, sales contracts, product testing, FDA approval, product approval, and alliances in the US remote patient monitoring market during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Remote Patient Monitoring (RPM) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Remote Patient Monitoring (RPM) Market