Europe ROV Market Size & Growth Analysis

Europe ROV Market By Size (Observation Class, Small, Work-Class), Application (Military & Defense, Oil & Gas, Environmental Protection & Monitoring, Oceanography, Archaeology & Exploration), System, Speed, Propulsion, and Country - Forecast To 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

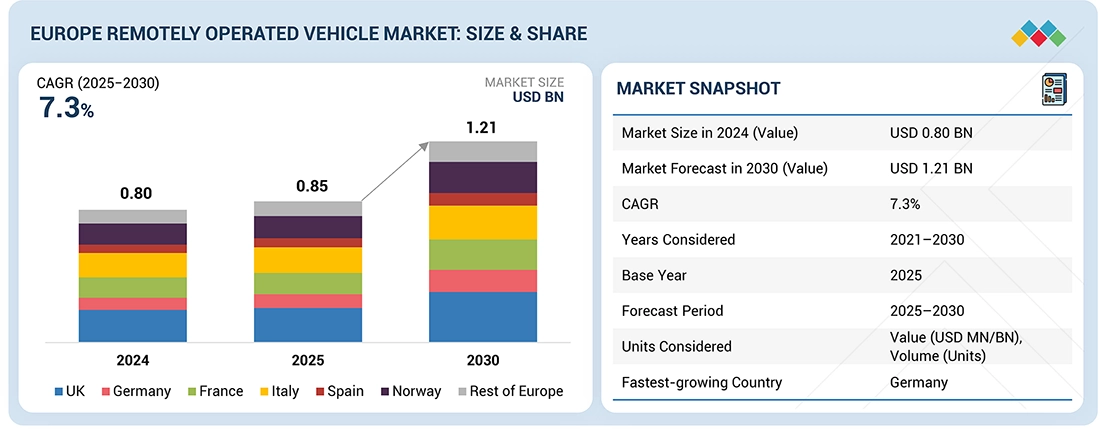

The Europe Remotely Operated Vehicle Market is anticipated to rise from USD 0.85 billion in 2025 to USD 1.21 billion by 2030 at a CAGR of 7.3%. In volume terms, it is likely to reach 9,229 units by 2030, from 5,314 units in 2025. This growth is fueled by the expansion of offshore wind projects across the North Sea. There is increased regulatory pressure throughout Europe for improved marine environmental monitoring systems.

KEY TAKEAWAYS

-

By CountryThe UK is estimated to account for a 24.6% revenue share in 2025.

-

By SizeThe observation class segment is expected to register the highest CAGR of 10.9%.

-

By ApplicationThe military & defense segment is expected to be dominant during the forecast period.

-

Competitive LandscapeExail Technologies, Saipem S.p.A., and BAE Systems were identified as star players in the remotely operated vehicle market in Europe, given their strong market share and product footprint.

The remotely operated vehicle market in Europe is witnessing accelerated demand driven by rising adoption of ROVs for subsea cable installation and integrity monitoring to support the region’s accelerating energy interconnector and digital infrastructure projects.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

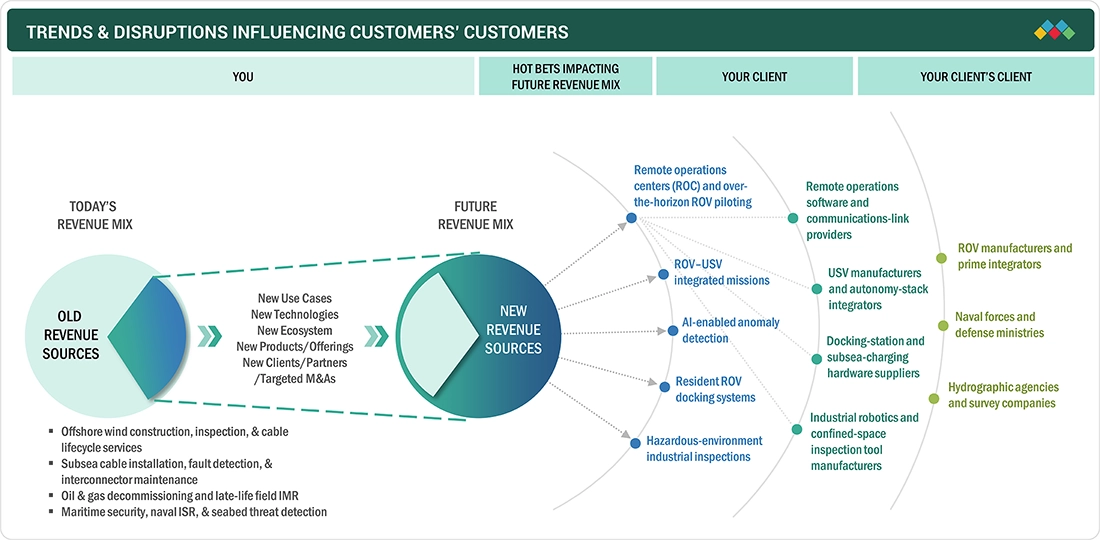

The impact on customers’ customers in the remotely operated vehicle market in Europe is driven by expanding offshore wind construction, increasing subsea cable installation demands, and next-generation inspection workflows across the North Sea, Baltic, and Mediterranean regions. End users are moving toward remote operation centers, ROV and USV hybrid missions, and more automated inspection setups. The aim is to improve safety, lower vessel costs, and keep operations running with fewer breaks. At the same time, more attention on decommissioning, resident ROV use, and improved imaging tools is helping boost efficiency across subsea work. This is also speeding up demand for modern ROV platforms, data-driven inspection services, and mission-critical subsea operations in European waters.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of offshore wind farms across North Sea and Baltic regions

-

Regulatory pressure for decommissioning and late-life field integrity

Level

-

Limited availability of offshore vessels and high day-rate volatility

-

Fragmented regulatory and certification requirements across EU and non-EU waters

Level

-

Accelerated growth of subsea interconnectors and HVDC cable projects

-

Surge in adoption of hybrid ROV–USV remote operations

Level

-

Harsh offshore weather conditions

-

Talent shortages in advanced subsea engineering and ROV pilot teams

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of offshore wind farms across North Sea and Baltic regions

The rapid expansion of fixed and floating offshore wind projects is fueling high demand for ROV-supported foundation inspections, scour monitoring, subsea cable surveys, and construction support. As Europe accelerates toward its 2030 renewable energy targets, operators increasingly rely on ROVs to maintain offshore assets. These systems help reduce operation and maintenance costs and ensure compliance with stricter safety and environmental regulations for offshore wind developments.

Restraint: Limited availability of offshore vessels and high day-rate volatility

Europe continues to face shortages of IMR survey and construction vessels. Offshore wind decommissioning and oil and gas projects are all competing for the same limited fleet capacity. This leads to high and unstable day rates, which increase overall project costs and can delay crucial subsea inspection and maintenance work.

Opportunity: Accelerated growth of subsea interconnectors and HVDC cable projects

The shift in Europe’s energy mix requires an extensive network of subsea power links connecting the UK, the Nordic region, and mainland Europe. This is creating steady demand for ROV work such as burial depth checks, cable lay support, fault detection, and integrity monitoring. These long-term projects are making ROV providers key partners for grid stability and cross-border energy security.

Challenge: Harsh offshore weather conditions

Harsh North Sea storms, winter swells, and unpredictable weather often limit the time available for safe offshore operations. This increases risks to project schedules, raises costs, and encourages operators to depend more on better planning tools and automation to keep inspection work progressing in challenging offshore conditions.

Europe ROV Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offshore wind developers required detailed foundation, jacket, and export-cable inspections across North Sea and Baltic wind farms, where high currents and low visibility made manual or diver-based inspections unreliable during construction and O&M phases. | Enhances structural integrity monitoring, minimizes turbine downtime through early anomaly detection, and supports long-term O&M planning across Europe’s expanding offshore wind infrastructure. |

|

Transmission operators needed ROV-based burial-depth verification, touchdown-point mapping, and fault localization for HVDC interconnector cables linking the UK, Nordics, and Central Europe, where precise seabed tracking is required to maintain corridor integrity. | It helps keep power transmission secure by improving confidence in cable routes and cutting outage time through faster defect detection. It also supports compliance with interconnector integrity management rules. |

|

Commercial fleet operators deployed Saab Seaeye Falcon ROVs for critical port-facility inspections, hull surveys, and underwater security assessments across major European harbors, enabling rapid inspection where turbidity and traffic conditions restricted diver use. | It strengthens port security monitoring reduces day to day disruptions and delivers clear inspection data needed for maintaining maritime infrastructure. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The remotely operated vehicle market ecosystem in Europe is shaped by prominent OEMs such as TechnipFMC, BAE Systems, Saipem, and DeepOcean, supported by specialized innovators, including Kystdesign, Stinger Technology, Blueye Robotics, and SeaDrone. These companies combine advanced sensing systems, strong manipulators, and mission-ready tools to deliver reliable ROV platforms. The systems are used for offshore wind installation, subsea cable inspection, decommissioning support, and maritime security work across European waters.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Remotely Operated Vehicle Market, By Size

Work-class ROVs dominate the European market due to their high thrust, advanced tooling interfaces, and reliability in tough sea conditions. They are the top choice for deepwater inspection, subsea construction, and intervention tasks. Their ability to operate in the challenging conditions of the North Sea and Norwegian Continental Shelf is vital for offshore wind installation, oil & gas field life extension, and pipeline repairs. As Europe speeds up offshore wind growth and subsea electrification, work-class ROVs remain crucial tools for energy companies, maritime authorities, and subsea engineering firms across the region.

Europe Remotely Operated Vehicle Market, By Propulsion

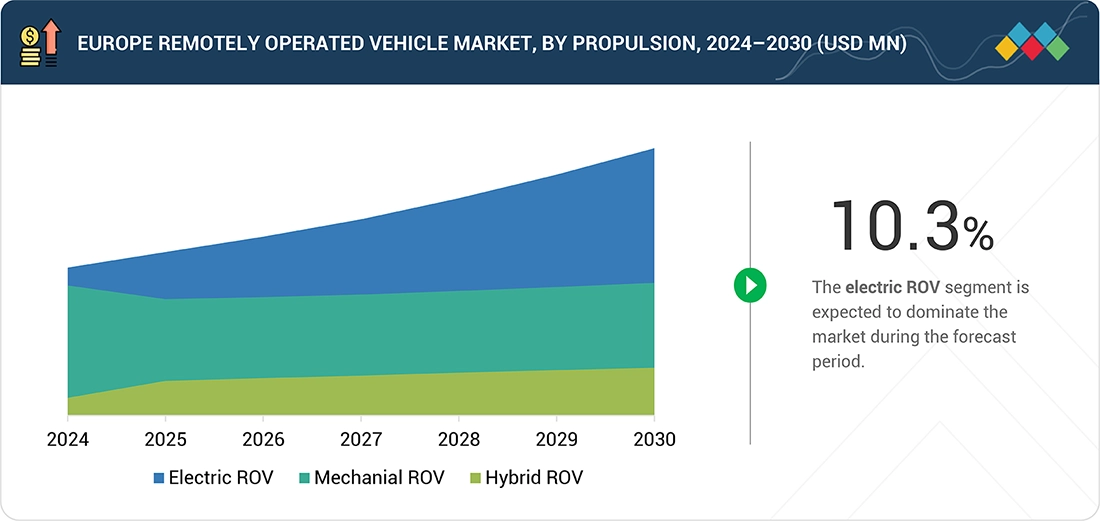

Electric ROVs are the leading propulsion type in Europe, driven by operators’ shift toward lower-carbon subsea operations, less reliance on vessels, and better cost efficiency. Advances in compact electric thrusters, high-density battery systems, and smart power management have greatly improved durability and maneuverability for mid- and deepwater tasks. Their quiet operation, low maintenance requirements, and suitability for inspection, survey, and environmental monitoring make electric ROVs the preferred choice. They are now widely used in offshore wind projects, subsea cable inspections, and scientific research missions across Europe.

Europe Remotely Operated Vehicle Market, By Application

Military & defense applications remain the largest segment, supported by Europe’s increasing investments in maritime security, port protection, seabed surveillance, and mine countermeasure modernization programs. NATO navies are increasingly using ROVs for hull inspections, route surveys, underwater threat detection, and mine neutralization. Civil agencies are also expanding their use of ROVs for border security, protecting underwater infrastructure, and environmental monitoring, which further strengthens this segment. As geopolitical tensions and maritime activity rise across the Mediterranean, Baltic, and North Sea, defense-driven ROV procurement continues to accelerate throughout Europe.

REGION

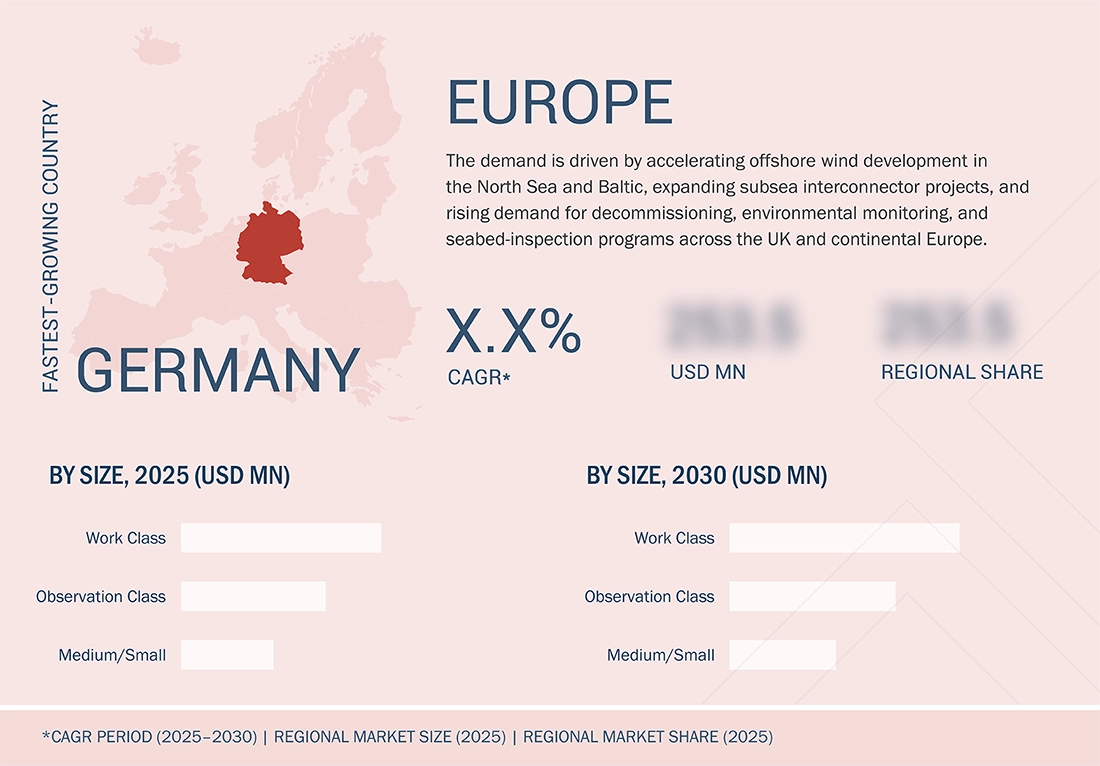

Germany to be fastest-growing country in Europe Remotely operated vehicle (ROV) Market during forecast period

Germany's remotely operated vehicle market is anticipated to grow at the highest CAGR during the forecast period, driven by the rapid expansion of offshore wind projects in the North Sea and the increased demand for high-precision subsea inspection across energy and marine infrastructure end users.

Europe ROV Market: COMPANY EVALUATION MATRIX

In the remotely operated vehicle market in Europe, TechnipFMC (Star) holds the leading position with a strong market share and extensive product presence. Its intervention-ready ROV systems are widely used across offshore wind, oil and gas, and subsea construction projects. ATLAS Elektronik (Emerging Leader) is gaining traction by focusing on more advanced autonomous functions, integrated mission systems, and increased adoption in defense programs. While TechnipFMC continues to lead through scale, experience, and proven deployments, ATLAS Elektronik clearly shows potential to move closer to the top tier. This shift is driven by growing demand for high-performance, mission-critical subsea systems among both commercial and government users.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- TechnipFMC (UK)

- BAE Systems (UK)

- Saipem S.p.A. (Italy)

- DeepOcean (Norway)

- Exail Technologies (France)

- Kystdesign AS (Norway)

- ATLAS Elektronik GmbH (Germany)

- Indel-Partner Ltd. (Russia)

- SeaDrone Inc. (Spain)

- FORSEA Robotics (France)

- Ocean Modules Sweden AB (Sweden)

- Idrobotica SA (Switzerland)

- Blueye Robotics AS (Norway)

- Stinger Technology AS (Norway)

- Hydromea SA (Switzerland)

- Argus Remote Systems AS (Norway)

- SubSea Mechatronics (SSMROVS) (Spain)

- Gerotto Federico Srl (Italy)

- GAYMARINE SRL (Italy)

- Subsea Tech (France)

- DRASS Group Srl (Italy)

- Rovtech Solutions Ltd (UK)

- SR Robotics (Poland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.73 Billion |

| Market Forecast in 2030 (Value) | USD 1.14 Billion |

| Growth Rate | CAGR of 7.9% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | UK, Germany, France, Italy, Spain, Norway, Netherlands, Sweden, Denmark, Belgium |

WHAT IS IN IT FOR YOU: Europe ROV Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at regional/global level to gain understanding of market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for more targeted understanding of total addressable market |

RECENT DEVELOPMENTS

- March 2025 : DeepOcean (Norway) secured a subsea tie-back and intervention contract in the UK. This has expanded the use of its work-class ROVs for construction support, integrity checks, and IMR across several North Sea offshore projects.

- February 2025 : TechnipFMC (UK) and Saipem (Italy) announced a SURF partnership that combines vessels and ROV capabilities. This move strengthens their ability to manage large subsea construction projects, cable laying support, and decommissioning work in European waters.

- January 2025 : Oceaneering International (UK) secured several decommissioning and inspection contracts in the North Sea. Its work-class ROV fleet is being utilized more for pipeline surveys, structure removal verification, and late-life field IMR tasks.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the Europe ROV Market. Exhaustive secondary research was done to collect information on the Europe ROV Market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analysis was conducted to estimate the overall market size. After that, market breakdown and data triangulation procedures were employed to estimate the sizes of various segments and subsegments within the Europe ROV Market.

Secondary Research

During the secondary research process, various sources were consulted to identify and collect information for this study. The secondary sources included government sources, such as SIPRI; corporate filings, including annual reports, press releases, and investor presentations from companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Europe ROV Market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across Europe. Primary data was collected through questionnaires, emails, and telephonic interviews.

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the Europe ROV Market. The research methodology used to estimate the size of the market included the following details:

- Key players in the Europe ROV Market were identified through secondary research, and their market shares were determined through a combination of primary and secondary research. This included a study of the annual and financial reports of the top market players, as well as extensive interviews with leaders, including directors, engineers, marketing executives, and other key stakeholders of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the Europe ROV Market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Data Triangulation

After determining the overall market size, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Market Definition

A Remotely Operated Vehicle (ROV) is an unmanned, tethered underwater system operated from a surface vessel or platform, designed to perform real-time inspection, intervention, survey, maintenance, and manipulation tasks in subsea environments. ROVs rely on an umbilical cable for power, control, and high-bandwidth data transmission, enabling continuous operator oversight and precise maneuverability at varying ocean depths.

Stakeholders

- Original equipment manufacturers (OEMs)

- Manufacturers and OEMs

- Component and Subsystem Suppliers

- System Integrators

- End Users

- Service Providers

- Regulatory and Certification Bodies

- Research & Technology Institutions

- Investors and Funding Agencies

Research Objectives

- To define, describe, and forecast the Europe ROV Market based on Size, Application, System, Propulsion, Speed, and region.

- To identify and analyze the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the degree of competition in the market by analyzing recent developments adopted by leading market players

- To provide a detailed competitive landscape of the market, along with a ranking analysis of key players, and an analysis of startup companies in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

- To provide a detailed competitive landscape of the Europe ROV Market, along with a market share analysis and revenue analysis of key players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe ROV Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe ROV Market