Europe Surgical Robots Market Size, Growth, Share & Trends Analysis

Europe Surgical Robots Market by Product (Instruments & Accessories, Robotic Systems [Laparoscopy, Orthopedic], Services), Application (Urological Surgery, Orthopedic Surgery), End User (Hospitals, Clinics, ASCs) - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe Surgical Robots market, valued at USD 2.10 billion in 2024, stood at USD 2.38 billion in 2025 and is projected to advance at a resilient CAGR of 14.0% from 2025 to 2031, culminating in a forecasted valuation of USD 5.21 billion by the end of the period. The market is influenced largely by the growing preference for minimally invasive surgeries, as these robotic systems make it possible to achieve more precision, less invasive incisions, less blood loss, and quicker patient recovery. The elderly population and the increasing incidence of chronic diseases such as cancer, orthopedic disorders, and cardiovascular diseases are resulting in rising surgical volumes, thus promoting the need for robot-assisted surgeries.

KEY TAKEAWAYS

-

By CountryBased on country, in 2024, France accounted for the largest share of 25.5% of the Europe surgical robots market.

-

By OfferingBased on offering, the instruments & accessories segment accounted for a larger share of 58.2% of the surgical robots market in 2024.

-

By ApplicationBased on application, in 2024, the general surgery segment accounted for the largest share of 27.9% of the surgical robots market.

-

By End UserBased on end user, the hospitals & clinics segment held the highest growth rate in the surgical robots market druing the forecast period.

-

Competitive Landscape - Key PlayersIntuitive Surgical and Medtronic Plc were recognized as star players due to their established strong product portfolio.

-

Competitive Landscape - StartupsMoon Surgical and Robocath have established themselves as among startups and SMEs due to their strong product portfolio and business strategy.

The expansion of the port of surgical robots in Europe is mostly a result of the growing desire for minimally invasive surgeries. The reason is that such interventions performed with robotic systems can be more accurate, have smaller incisions, less blood loss, and the recovery of the patient can be faster. The aging of the population and the increase in the incidence of lifestyle diseases like cancer, orthopedic disorders, and cardiovascular diseases have led to a larger volume of surgeries, which have also contributed to the demand for robot-assisted surgeries. The advantages are that the surgical interventions using robots are more accurate, have smaller incisions, less blood loss, and the patient's recovery can be faster. Moreover, current innovation features such as improved 3D visualization, better instrument dexterity, AI incorporation, and image-guided surgery are attracting a large number of applications in clinical settings and gaining the acceptance of surgeons. Alongside these enhancers, a sound healthcare infrastructure, increasing hospital investments, good reimbursement in the major countries, and raising surgeon training and education programs are collectively working as the fuel for the adoption pace, which is spreading fast throughout Europe and thus summing up the market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions affecting the Europe surgical robots market customers’ customers are changing the way healthcare providers deliver surgical care and the way patients experience surgery results. As a result of patients requiring less invasive, more accurate, and safer surgical methods, and also due to their higher expectations of a fast recovery and a short stay in the hospital, hospitals and surgical centers are forced to make a decision to invest in advanced robotic technologies. On the other hand, healthcare systems are put under pressure to increase their operational efficiency, cost control, and attainment of better clinical outcomes, which are effects of value-based care models and a rise in the number of surgeries because of the aging of the population and the prevalence of chronic diseases. The fast upgrade of robotic platforms, AI-powered decision support, image-guided surgery, and data analytics are some of the factors that are disrupting the traditional surgical workflows and, at the same time, making them more accurate, consistent, and scalable across various specialties. These changes have a direct impact on healthcare providers’ purchasing decisions, thus leading to a faster transition to recurring revenue models, expanded use cases, and deeper technology integration in the Europe surgical robots market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advantages of robot-assisted surgery

-

Technological advancements

Level

-

High cost of robotic systems

Level

-

Growing adoption in minimally invasive surgery (MIS)

-

Rising geriatric population

Level

-

Surgical errors

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advantages of robot-assisted surgery

The robot-assisted systems are the leading reason why the Europe surgical robots market is changing so fast, as they contribute so much to surgical precision, control, and repeatability, which are typical features of robotic surgery rather than the conventional one. Robotic platforms provide the surgeon with a high-definition 3D visualization, tremor filtration, and improved instrument dexterity; therefore, the surgeon is able to perform complex minimally invasive operations with a higher level of precision. As a result, there are smaller incisions, less bleeding, a lowered risk of complications, and faster patient recovery, which is consistent with the region's focus on patient safety and quality of healthcare. Besides that, robot-assisted surgery enhances surgeon ergonomics; the physical strain and fatigue of the surgeon during long operations are lessened, hence, procedural efficiency at a higher level is facilitated. The resulting advantages, such as a shorter period staying in the hospital, faster return to normal activities, and better clinical outcomes, make robotic surgery very appealing to European hospitals and healthcare systems; thus, the extensive use of it in different surgical specialties has been the trend.

Restraint: High cost of robotic systems

The high cost of robot systems is still a significant factor holding back the Europe surgical robots market, as it is limiting the adoption of such systems mainly in smaller hospitals and clinics. The initial capital investment to obtain robotic platforms is very high, and it is made even more difficult by the ongoing expenses such as maintenance, service contracts, software updates, and the recurring cost of instruments and accessories. Moreover, hospitals have to spend money on surgeon training, certification, and operating room integration, which further increases the total cost of ownership. Budget limitations in public healthcare systems and cost-containment pressures in a number of European countries may make purchasing decisions slower and system upgrade visits less frequent. Therefore, the high financial burden of wielding robotic systems has been the main reason why the penetration of such systems has not been extensive in Europe despite their obvious clinical benefits.

Opportunity: Growing adoption in minimally invasive surgery (MIS)

The Europe surgical robots market is majorly influenced by the increasing use of minimally invasive surgery (MIS) techniques, which is a crucial opportunity for the same. Healthcare providers are opting for procedures that cause less patient trauma and have better clinical outcomes. MIS is a methods that use smaller incisions, and thereby the surgeries cause less blood loss, have a lower risk of infection, reduced post-operative pain, and faster patient recovery as compared to open surgeries. Surgical robotic systems, through high-definition 3D visualization, dexterity improvement by the use of articulated instruments, tremor filtration, and enhanced accuracy in cramped spaces of the body, make MIS more effective. In fact, these are the factors that make it possible for surgeons to carry out complex operations with higher accuracy and more often, even if the cases are difficult. With European hospitals and ambulance surgery centers concentrating on patient outcome improvement, hospital stay shortening, and operating room efficiency increase, the robot-assisted MIS procedures in different fields like urology, gynecology, general surgery, and orthopedics are in great demand, thus the market is expanding.

Challenge: Surgical errors

Surgical errors in ambulatory surgery centers (ASCs) represent a significant challenge for the Europe surgical robots market. The reason is that ASCs generally function under the conditions of a large number of patients, a small medical staff, and shorter time for a procedure, compared to big hospitals. Even if robotic systems are a source of precision and stability, a lack of surgeon experience, insufficiently trained personnel, or a problem with workflow integration in ASCs may be the cause of a higher chance of errors, especially in the first phase of the implementation. Furthermore, ASCs are probably limited in terms of space, provision of technical support, and emergency backup infrastructure, which are extremely important in case of the occurrence of complications during robot-assisted procedures. Variances in clinical protocols and the lack of familiarity with the handling of complex robotic cases are also able to raise concerns on patient safety to a great extent. These factors may lead to a slower rate of adoption and increased scrutiny by regulators and healthcare providers. Therefore, the execution of correct training, standardization of protocols, and the establishment of strong support systems are essential to solving this problem in the European ASC environment.

EUROPE SURGICAL ROBOTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Surgical robotic systems and precision instruments are created for minimally invasive procedures in urology, gynecology, thoracic, and general surgery. They are equipped with 3D visualization, multi-jointed instruments, and improved ergonomics to facilitate surgical maneuvers that are highly controlled. | They help to increase surgical precision and dexterity, lessen tissue damage and the risk of complications, thus, contribute to faster patient recovery, and also, make complex minimally invasive procedures more consistent and reproducible. |

|

It is an orthopedic robot platform that merges CT-based planning with a robotic arm for knee and hip arthroplasty. It allows surgeons to carry out an individual implant alignment and bone preparation that is tailored to the patient's specific anatomy. | Accuracy of implant positioning can be improved, joint stability and alignment can be enhanced, post-operative variability can be reduced, and long-term functional outcomes of joint replacement can be supported. |

|

A robotic guidance, navigation, and planning system that is mainly used for spine surgery. It combines 3D planning, AI-enhanced imaging, and exact robotic guidance to help with the accurate placement of the screw and the execution of complex spinal corrections. | They can raise the accuracy of spinal instrumentation, lower the chances of the deviations happening intraoperatively, give the surgeon more control over the high-risk procedures, and make the whole process of spine surgeries safer and more predictable. |

|

A small, portable, robotic-assisted platform that is compact and handheld is engineered for partial as well as total knee arthroplasty. It employs real-time intraoperative mapping to assist surgeons in achieving exact ligament balancing and bone reshaping; thus, no preoperative CT scans are needed. | They can help to keep the knee reconstruction individualized; increase the accuracy of the bone preparation; decrease the fluctuation of the soft-tissue balancing; and, also, in the outpatient and ASC settings, the workflow can be uplifted in terms of efficiency. |

|

Multi-specialty robotic platforms that merge data analytics, navigation, and robotic guidance to optimize knee and hip arthroplasty as well as brain surgeries. Deliver real-time anatomical information for personalized surgical implementation. | Help to elevate the precision of implant alignment, improve the surgeon's decision-making process by providing real-time data, lower the chances of complications, and make it possible to have the same results in different orthopedic and neurosurgical surgeries. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe surgical robots market ecosystem heavily relies on the interaction of five major groups, which include robotic system manufacturers, component suppliers, healthcare providers, regulators, and training organizations. On one side, prominent university hospitals, cancer centers, as well as large-volume orthopedic and urology clinics, are major buyers who drive the demand for robotic platforms, instruments, and digital services, as they raise the number of minimally invasive procedures and renovate operating rooms. Mainly, the market is controlled by the EU Medical Device Regulation (MDR), according to which surgical robots and their software should receive CE marking by notified bodies. This process requires detailed technical documentation, clinical evidence, and post-market surveillance; thus, it increases the entry barriers and is advantageous to global manufacturers with ample resources. Professional societies and training institutions like European specialty colleges and robotic surgery groups offer well-organized curricula, simulation programs, and certification schemes that standardize surgeon training and credentialing; thus, they have a great impact on the adoption and the use of robotic systems in a responsible manner. Together, these stakeholders, the industry, hospitals, regulators, and professional organizations, are a major force behind innovation, safety, and compliance, as well as the gradual diffusion of state-of-the-art surgical robotics from top centers to a wider range of hospitals and ambulatory care settings throughout Europe.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Surgical Robots Market, by Offering

In the Europe surgical robots market, the instruments and accessories segment is leading the offering segment mainly because of their repeated usage and high replacement frequency as compared to the capital equipment like robotic systems. Robotic instruments, end effectors, disposable tools, and procedure-specific accessories are fabricated for a limited number of operations and thus have to be replaced regularly in order to maintain safety and performance standards. The increasing number of robot-assisted surgeries in general surgery, orthopedics, and urology, consequently, leads to an upsurge in the demand for these consumables. Besides that, the proliferation of multi-specialty robotic platforms and the requirement for highly precise, application-specific instruments are the factors that have further empowered their dominance. As hospitals and surgical centers are paying attention to system efficiency and clinical outcomes, continuous procurement of instruments and accessories is what keeps them in the leading position in the Europe surgical robots market.

Europe Surgical Robots Market, by Application

Within the Europe surgical robots market, general surgery is the application segment that has the most significant influence as a result of the high number and the wide variety of operations performed in this category. Surgical robotic systems are extensively employed in general surgeries like hernia repair, colorectal procedures, bariatric surgery, and cholecystectomy, in which the advanced visualization, precision, and instrument dexterity help the rapidly growing complex minimally invasive techniques. The rising trend of robot-assisted minimally invasive surgery, mainly because of the positive outcomes such as fewer complications, shorter hospital stays, and quicker recovery, has resulted in the general surgery field being the most extensive in surgical robots usage. Moreover, the presence of flexible, multi-specialty robotic platforms and the increasing surgeon skills in European hospitals have been the main factors behind the general surgery department holding the first position in the surgical robots market.

Europe Surgical Robots Market, by End User

Hospitals and clinics are the main consumers of the Europe surgical robots market. They are the ones with a high volume of surgeries, an advanced technological setting, and the financial ability to acquire such systems. These institutions carry out many complicated surgeries in general surgery, orthopedics, urology, and gynecology, where robotic assistance most of all brings accuracy, safety, and better clinical outcomes. Access to skilled surgeons, a multidisciplinary team, and established reimbursement routes are the reasons why hospitals and large clinics can also take advantage of the use of robotic platforms to the fullest extent. In addition, the fact that they are the centers of referral and first to use advanced medical technologies, and also continuous investments in the new generation of operating rooms, keep them in the leading position in the Europe surgical robots market.

REGION

France held the largest share in Europe surgical robots market in 2024

France was the main influencer of the Europe surgical robots market and held the major share due to its strong healthcare system, the widespread practice of minimally invasive and robot-assisted surgical procedures, and a high number of advanced public and private hospitals. The country boasts a solid network of highly specialized and university hospitals, which are in the process of purchasing robotic systems to improve surgery precision and patient outcomes. Convenient reimbursement methods, government support for healthcare modernization, and a rising number of surgeon training and certification programs have been the factors that have made the adoption process faster. Besides that, the increasing burden of chronic diseases and the rise in surgical volumes in general surgery, urology, and orthopedics have, thus, maintained France at the forefront of the Europe surgical robots market.

EUROPE SURGICAL ROBOTS MARKET: COMPANY EVALUATION MATRIX

In the Europe surgical robots market matrix, Intuitive Surgical (US) (Star) and Stryker (US) (Star) lead with their unmatched global presence, strong brand recognition, and comprehensive portfolios of surgical robots products. CMR Surgical (UK) (Emerging Leader) is rapidly gaining traction with its versatile products, which offer surgical robots for various applications such as general surgery, orthopedic surgery, and urological surgery.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Intuitive Surgical (US)

- Stryker (US)

- Medtronic (US)

- Smith+Nephew (UK)

- Zimmer Biomet (US)

- Siemens Healthineers AG (Germany)

- Renishaw Plc (UK)

- Johnson & Johnson (US)

- Globus Medical, Inc (US)

- CMR Surgical (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 2.10 Billion |

| Market Forecast, 2031 (Value) | USD 5.21 Billion |

| Growth Rate | CAGR of 14.0% from 2025 to 2031 |

| Years Considered | 2024–2031 |

| Base Year | 2024 |

| Forecast Period | 2025–2031 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | Germany, UK, France, Spain, Italy, Rest of Europe |

| Parent & Related Segment Reports |

Surgical Robots Market APAC Surgical Robots Market |

WHAT IS IN IT FOR YOU: EUROPE SURGICAL ROBOTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Further Breakdown of Other Applications in the Market | Insights on other applications involved in the market |

| Company Information | Market Share Analysis, by Country (Germany and UK) & Competitive Leadership Mapping for Established Players in the Market | Insights on market share analysis by country |

| Geographic Analysis | Further Breakdown of the Rest of Europe surgical robots market into Russia, Switzerland, Denmark, Austria, and Others | Country-level demand mapping for new product launches and localization strategy planning |

RECENT DEVELOPMENTS

- July 2025 : Intuitive Surgical’s newest system, da Vinci 5, was granted the CE mark in Europe for minimally invasive procedures in both adults and children, thus indicating its regulatory debut in the European market with additional features aimed at increasing the precision and the surgeon's comfort.

- May 2025 : The FDA’s approval of the da Vinci Single-Port system for transanal local excision marks a significant step in expanding robotic capabilities in colorectal surgery. By enabling natural-orifice access for lesion removal and excision procedures, the system reduces the need for external incisions, leading to less tissue trauma, reduced scarring, and faster postoperative recovery. This clearance increased the clinical value of the SP platform and widens its use across soft-tissue procedures.

- April 2025 : CMR Surgical secured more than USD 200 million in capital to fasten the global market rollout of its Versius Surgical Robotic System, aid product development (including Versius Plus), and finance clinical trials in the areas of paediatric and transoral surgery.

Table of Contents

Methodology

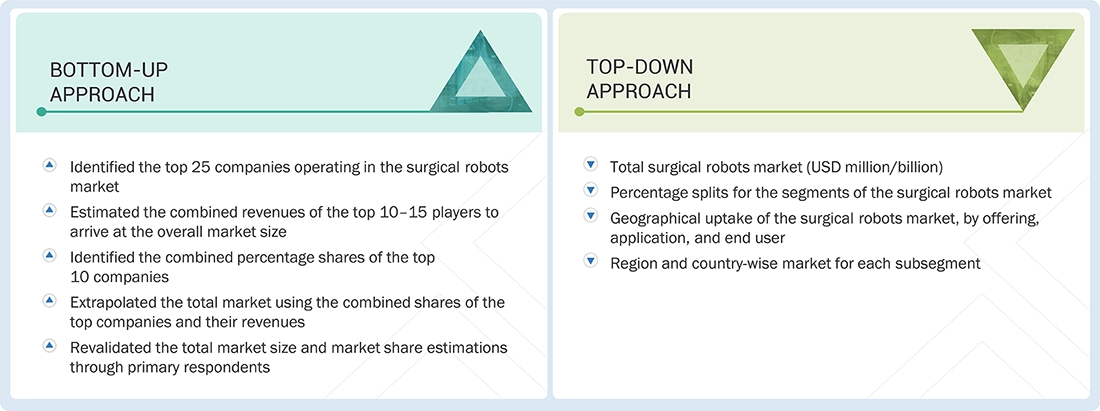

This study involved four major activities in estimating the current size of the Europe surgical robots market. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was employed to identify and collect information relevant to the comprehensive, technical, market-oriented, and commercial study of the Europe surgical robots market. It was also used to obtain important information about key players, market classification, and segmentation according to industry trends, as well as key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the Europe surgical robots market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the Europe surgical robots market. All the major product manufacturers were identified at the country/regional level. Revenue mapping was conducted for the respective business segments and subsegments for the major players. Also, the Europe surgical robots market was split into various segments and subsegments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various surgical robot manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from Europe surgical robots (or the nearest reported business unit/product category)

- Revenue mapping of major players to be covered

- Extrapolation of the revenue mapping of the listed major players to derive the market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the Europe surgical robots market

The above-mentioned data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets, and is presented in this report.

Europe Surgical Robots Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Europe surgical robots market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macroindicators and regional trends from both demand- and supply-side participants.

Market Definition

Surgical robots are the latest medicinal gadgets developed to aid surgeons in carrying out complicated surgeries with more control, precision, and flexibility than they would have achieved had they operated using traditional means. Such systems normally consist of robotic arms equipped with specialized equipment and high-definition cameras, which are manipulated by a surgeon through a console. Surgical robots facilitate minimal invasion of surgery and reduce recovery time of patients, hence minimizing problems and optimizing the overall surgical outcome.

Key Stakeholders

- Surgical robot and related device manufacturing companies

- Manufacturers of surgical robotic system equipment and instruments

- Suppliers and distributors of surgical robot systems

- Third-party refurbishers/suppliers

- Healthcare startups, consultants, and regulators

- Hospitals (public and private)

- Ambulatory surgery centers (ASCs)

- Academic medical institutes

- Surgeons, physicians, and operating room staff

- Government agencies

- Group purchasing organizations (GPOs)

- Corporate entities

- Government institutes

- Market research & consulting firms

- Contract manufacturing organizations (CMOs)

- Venture capitalists & investors

Report Objectives

- To define, describe, and forecast the Europe surgical robots market by offering, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, challenges, and opportunities)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall Europe surgical robots market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches & approvals, acquisitions, expansions, partnerships, deployments, agreements, and collaborations in the overall Europe surgical robots market

- To benchmark players within the market using the proprietary Company Evaluation Matrix, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakdown of the Rest of Europe surgical robots market into Russia, Switzerland, Denmark, Austria, and others

- Further breakdown of the Rest of Asia Pacific surgical robots market into South Korea, Taiwan, and others

- Further breakdown of the Rest of Latin America surgical robots market into Argentina, Colombia, Chile, Ecuador, and others

- Further breakdown of the Southeast Asia surgical robots market into Malaysia, Singapore, New Zealand, and others

Competitive Landscape Assessment

- Market share analysis, by region (North America and Europe), which provides market shares of the top 3–5 key players in the Europe surgical robots market

- Company Evaluation Matrix for established players in the US

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Surgical Robots Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Surgical Robots Market