4

MARKET OVERVIEW

Explore transformative mobility innovations driven by electrification, regulatory challenges, and cross-sector integration opportunities.

47

4.2.1.1

ELEVATED DEMAND FOR NEW MOBILITY SOLUTIONS

4.2.1.2

INNOVATIONS IN ELECTRIC PROPULSION AND BATTERY TECHNOLOGY

4.2.1.3

SUBSTANTIAL INVESTMENT AND ACTIVE OEM PARTICIPATION

4.2.2.1

REGULATORY AND CERTIFICATION UNCERTAINTY

4.2.2.2

LIMITED BATTERY RANGE AND PAYLOAD CONSTRAINTS

4.2.2.3

HIGH DEVELOPMENT AND PRODUCTION COSTS

4.2.3.1

EXPANSION INTO MEDICAL AND EMERGENCY SERVICES

4.2.3.2

RISE OF CARGO AND LOGISTICS APPLICATIONS

4.2.3.3

DEFENSE AND GOVERNMENT ADOPTION

4.2.4.1

INFRASTRUCTURE DEVELOPMENT AND INTEGRATION

4.2.4.2

POOR PUBLIC ACCEPTANCE AND SAFETY PERCEPTION

4.2.4.3

TALENT SHORTAGE AND SUPPLY CHAIN INSTABILITY

4.3

UNMET NEEDS AND WHITE SPACES

4.3.1

BATTERY ENDURANCE, CHARGING SPEED, AND GROUND INFRASTRUCTURE LIMITATIONS

4.3.2

WEATHER SENSITIVITY AND PERFORMANCE CONSTRAINTS

4.3.3

INSURANCE, LIABILITY, AND OPERATIONAL RISKS

4.3.4

NOISE FOOTPRINT MANAGEMENT AND COMMUNITY ACCEPTANCE

4.4

INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

4.4.1

DEFENSE MOBILITY MODERNIZATION AND MULTI-MISSION INTEGRATION

4.4.2

URBAN TRANSPORT TRANSFORMATION AND SMART CITY INTEGRATION

4.4.3

COMMERCIAL LOGISTICS AND TIME-CRITICAL DELIVERY NETWORKS

4.5

STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5

INDUSTRY TRENDS

Navigate evolving electric aircraft trends with insights on market dynamics, pricing, and investment shifts.

54

5.2

MACROECONOMIC OUTLOOK

5.2.2

GDP TRENDS AND FORECAST

5.2.3

TRENDS IN GLOBAL ELECTRIC AIRCRAFT INDUSTRY

5.2.4

TRENDS IN GLOBAL EVTOL AIRCRAFT INDUSTRY

5.3.1

R&D ENGINEERS (~30%)

5.3.2

RAW MATERIAL SUPPLIERS (~10%)

5.3.3

COMPONENT AND PRODUCT MANUFACTURERS (~10%)

5.3.4

ASSEMBLERS AND INTEGRATORS (~30%)

5.4.2

SOLUTION AND SERVICE PROVIDERS

5.5

INVESTMENT AND FUNDING SCENARIO

5.6.1

INDICATIVE PRICING ANALYSIS, BY AIRCRAFT MODEL

5.6.2

INDICATIVE PRICING ANALYSIS, BY REGION

5.7

COMPARATIVE STUDY OF EVTOL AIRCRAFT MODELS

5.8.1

IMPORT SCENARIO (HS CODE 8802)

5.8.2

EXPORT SCENARIO (HS CODE 8802)

5.9

KEY CONFERENCE AND EVENTS

5.10

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.11.1

JOBY AVIATION – ELECTRIC PROPULSION AND AIRCRAFT CERTIFICATION PLATFORM

5.11.2

ARCHER AVIATION – MANUFACTURING-FOCUSED EVTOL COMMERCIALIZATION

5.11.3

BETA TECHNOLOGIES – INTEGRATED AIRCRAFT AND CHARGING ECOSYSTEM

5.12

IMPACT OF 2025 US TARIFF

5.12.2

PRICE IMPACT ANALYSIS

5.12.3

IMPACT ON COUNTRIES/REGIONS

5.12.4

IMPACT ON END USERS

5.12.4.1

COMMERCIAL SECTOR

5.12.4.2

GOVERNMENT & MILITARY

6

TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

AI-driven innovations and patent insights redefine eVTOL technologies with transformative market applications.

75

6.1.1

SOLID-STATE BATTERY TECHNOLOGY

6.1.2

DISTRIBUTED ELECTRIC PROPULSION AND SMART POWER MANAGEMENT

6.1.3

AUTONOMOUS FLIGHT CONTROL AND AI-DRIVEN NAVIGATION

6.1.4

HYBRID-ELECTRIC PROPULSION

6.2

COMPLEMENTARY TECHNOLOGIES

6.2.1

LIGHTWEIGHT COMPOSITE AIRFRAME MATERIALS

6.2.2

NEXT-GENERATION THERMAL MANAGEMENT AND COOLING

6.2.3

DIGITAL?VERTIPORT INFRASTRUCTURE

6.2.4

ADVANCED NOISE REDUCTION AND ACOUSTIC OPTIMIZATION TECHNOLOGY

6.3

TECHNOLOGY/PRODUCT ROADMAP

6.5.1

TOP USE CASES AND MARKET POTENTIAL

6.5.2

CASE STUDIES OF AI IMPLEMENTATION

6.5.3

INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

6.5.4

CLIENTS’ READINESS TO ADOPT GEN AI

7

REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES

Regulatory policies and sustainability initiatives accelerate global eVTOL market growth and carbon reduction.

85

7.1

REGIONAL REGULATIONS AND COMPLIANCE

7.1.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

7.2

SUSTAINABILITY INITIATIVES

7.2.1

CARBON IMPACT REDUCTION

7.3

SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

7.3.1

SUSTAINABILITY IMPACT ON EVTOL AIRCRAFT MARKET

7.3.2

REGULATORY POLICIES DRIVING EVTOL AIRCRAFT DEPLOYMENT

7.4

CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8

CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

Understand stakeholder influence and unmet needs to optimize cost-effective, scalable solutions.

97

8.1

DECISION-MAKING PROCESS

8.2

KEY STAKEHOLDERS IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

8.2.1

KEY STAKEHOLDERS IN BUYING PROCESS

8.3

ADOPTION BARRIERS AND INTERNAL CHALLENGES

8.4

UNMET NEEDS OF END USERS

8.4.1

NEED FOR EXTENDED RANGE AND MULTI-MISSION OPERATIONAL CAPABILITIES

8.4.2

NEED FOR ENHANCED SAFETY, RELIABILITY, AND AIRSPACE INTEGRATION

8.4.3

NEED FOR LOWER-COST, SCALABLE, AND RAPIDLY DEPLOYABLE SOLUTIONS

9

EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY (MARKET SIZE & FORECAST TO 2035, USD MILLION & UNITS)

Market Size & Growth Rate Forecast Analysis to 2035 in USD Million and Units | 6 Data Tables

102

9.2

CLASSIFICATION OF EVTOL AIRCRAFT BASED ON HYBRID LIFT TECHNOLOGY

9.2.1

LIFT PLUS CRUISE WITH PARTIAL PROPELLER VECTORING

9.2.1.1

USE CASE: MIDNIGHT BY ARCHER AVIATION

9.2.1.2

USE CASE: GENERATION 6 EVTOL BY WISK AERO

9.2.2

CYCLOIDAL ROTOR WITH FIXED-WING CONFIGURATION

9.2.2.1

USE CASE: BLACKBIRD BY CYCLOTECH

9.2.2.2

USE CASE: CYCLOTECH HYBRID EVTOL AIRCRAFT

9.2.3

BLADELESS PROPULSION WITH HYBRID LIFT

9.2.3.1

USE CASE: CAVORITE X5 BY HORIZON AIRCRAFT

9.2.3.2

USE CASE: CITYHAWK BY URBAN AERONAUTICS

9.3.1

RISE IN URBAN CONGESTION AND DEMAND FOR SUSTAINABLE MOBILITY

9.3.1.1

USE CASE: VX4 BY VERTICAL AEROSPACE

9.4.1

LOWER ENGINEERING COMPLEXITY AND FASTER CERTIFICATION PATH

9.4.1.1

USE CASE: VOLOCITY BY DIAMOND AIRCRAFT INDUSTRIES

9.5.1

ELEVATED DEMAND FOR URBAN AND REGIONAL AIR MOBILITY

9.5.1.1

USE CASE: JOBY S4 BY JOBY AVIATION

10

EVTOL AIRCRAFT MARKET, BY MTOW (MARKET SIZE & FORECAST TO 2035, USD MILLION)

Market Size & Growth Rate Forecast Analysis to 2035 in USD Million | 3 Data Tables

109

10.2

CLASSIFICATION OF EVTOL AIRCRAFT BASED ON APPLICATION

10.2.1

AIR TAXIS/AIR METROS/AIR SHUTTLES

10.2.1.1

USE CASE: VX4 BY VERTICAL AEROSPACE

10.2.1.2

USE CASE: JOBY S4 BY JOBY AVIATION

10.2.2

CARGO TRANSPORT/LAST-MILE DELIVERY

10.2.2.1

USE CASE: CHAPARRAL C1 BY ELROY AIR

10.2.2.2

USE CASE: FALCON BY DRONAMICS

10.2.3

SPECIAL MISSION & OTHER APPLICATIONS

10.2.3.1

USE CASE: ALIA-250 BY BETA TECHNOLOGIES

10.2.3.2

USE CASE: VOLODRONE BY DIAMOND AIRCRAFT INDUSTRIES

10.3.1

SURGE IN DEMAND FOR LIGHTWEIGHT AND QUICKLY DEPLOYABLE AIR MOBILITY SOLUTIONS

10.3.1.1

USE CASE: EH216-S BY EHANG

10.4.1

NEED FOR MID-WEIGHT, MULTI-PASSENGER EVTOL PLATFORMS

10.4.1.1

USE CASE: MIDNIGHT BY ARCHER AVIATION

10.5.1

INFRASTRUCTURE INVESTMENTS IN REGIONAL VERTIPORTS AND PROGRESS IN CERTIFICATION FRAMEWORKS

10.5.1.1

USE CASE: CHAPARRAL C1 BY ELROY AIR

11

EVTOL AIRCRAFT MARKET, BY PROPULSION (MARKET SIZE & FORECAST TO 2035, USD MILLION)

Market Size & Growth Rate Forecast Analysis to 2035 in USD Million | 3 Data Tables

115

11.2

CLASSIFICATION OF EVTOL AIRCRAFT PROPULSION BASED ON HYDROGEN CATEGORY

11.2.1.1

USE CASE: CITYHAWK H2 BY URBAN AERONAUTICS

11.2.1.2

USE CASE: ZA600 VTOL CONCEPT BY ZEROAVIA

11.2.2

HYDROGEN FUEL CELL

11.2.2.1

USE CASE: SKAI BY ALAKA’I TECHNOLOGIES

11.2.2.2

USE CASE: HY4 VTOL CONCEPT BY H2FLY

11.3.1

SHIFT TOWARD ZERO-EMISSION AND LOW-NOISE URBAN AIR MOBILITY

11.3.1.1

USE CASE: MIDNIGHT BY ARCHER AVIATION

11.4.1

NEED TO MITIGATE RANGE AND PAYLOAD LIMITATIONS

11.4.1.1

USE CASE: CHAPARRAL C1 BY ELROY AIR

12

EVTOL AIRCRAFT MARKET, BY OPERATING RANGE (MARKET SIZE & FORECAST TO 2035, USD MILLION)

Market Size & Growth Rate Forecast Analysis to 2035 in USD Million | 3 Data Tables

120

12.2

CLASSIFICATION OF EVTOL AIRCRAFT BASED ON MISSION PROFILE AND OPERATING ENVIRONMENT

12.2.1

URBAN INTRA-CITY OPERATIONS

12.2.1.1

USE CASE: EH216-S BY EHANG

12.2.1.2

USE CASE: JOBY S4 BY JOBY AVIATION

12.2.2

INTER-CITY & REGIONAL CONNECTIVITY MISSIONS

12.2.2.1

USE CASE: VA-X4 BY VERTICAL AEROSPACE

12.2.2.2

USE CASE: ALIA-250 BY BETA TECHNOLOGIES

12.2.3

SPECIAL-PURPOSE & NON-PASSENGER MISSIONS

12.2.3.1

USE CASE: VOLODRONE BY DIAMOND AIRCRAFT INDUSTRIES

12.2.3.2

USE CASE: CHAPARRAL C1 BY ELROY AIR

12.3.1

HEIGHTENED DEMAND FOR SHORT-RANGE, HIGH-FREQUENCY EVTOL OPERATIONS

12.3.1.1

USE CASE: GENERATION 6 BY WISK AERO

12.4.1

NEED FOR LONG-RANGE AND HIGH-SPEED REGIONAL AIR MOBILITY

12.4.1.1

USE CASE: CAVORITE X5 BY HORIZON AIRCRAFT

13

EVTOL AIRCRAFT MARKET, BY SYSTEM (MARKET SIZE & FORECAST TO 2035, USD MILLION)

Market Size & Growth Rate Forecast Analysis to 2035 in USD Million | 3 Data Tables

125

13.2

CLASSIFICATION OF EVTOL AIRCRAFT BASED ON SUPPORTING AND ENABLING TECHNOLOGY STACK

13.2.1

SITUATIONAL AWARENESS & PERCEPTION FRAMEWORKS

13.2.1.1

USE CASE: JOBY S4 BY JOBY AVIATION

13.2.2

HEALTH MONITORING & PREDICTIVE DIAGNOSTICS ARCHITECTURE

13.2.2.1

USE CASE: JOBY S4 BY JOBY AVIATION

13.2.2.2

USE CASE: MIDNIGHT BY ARCHER AVIATION

13.2.3

SECURE COMMUNICATION & DATA HANDLING CONCEPTS

13.2.3.1

USE CASE: GENERATION 6 BY WISK AERO

13.2.3.2

USE CASE: VA-X4 BY VERTICAL AEROSPACE

13.3.1

INNOVATIONS IN HIGH-ENERGY-DENSITY AND FAST-CHARGING BATTERY TECHNOLOGIES

13.4

ELECTRIC MOTORS & ENGINES

13.4.1

ADVANCEMENTS IN HIGH-EFFICIENCY ELECTRIC PROPULSION SYSTEMS

13.5

AEROSTRUCTURES & CABIN INTERIORS

13.5.1

RISING DEMAND FOR LIGHTWEIGHT AND HIGH-STRENGTH AIRFRAME MATERIALS

13.6.1

NEED FOR ADVANCED FLIGHT CONTROL AND AUTOMATION SYSTEMS IN EVTOL OPERATIONS

13.7.1

RAPID ADOPTION OF FLIGHT AUTOMATION AND AUTONOMOUS OPERATION SOFTWARE IN EVTOL AIRCRAFT

14

EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION (MARKET SIZE & FORECAST TO 2035, USD MILLION)

Market Size & Growth Rate Forecast Analysis to 2035 in USD Million | 3 Data Tables

132

14.2

CLASSIFICATION OF EVTOL AIRCRAFT BASED ON OPERATIONAL CONTROL AND HUMAN–MACHINE INTERACTION

14.2.1

GROUND-ASSISTED OPERATIONS CONCEPT

14.2.1.1

USE CASE: EH216-S BY EHANG

14.2.1.2

USE CASE: GENERATION 6 BY WISK AERO

14.2.2

HUMAN-CENTRIC CONTROL PHILOSOPHY

14.2.2.1

USE CASE: MIDNIGHT BY ARCHER AVIATION

14.2.2.2

USE CASE: ALIA-250 BY BETA TECHNOLOGIES

14.2.3

TRANSITION PATHWAYS TOWARD HIGHER AUTOMATION

14.2.3.1

USE CASE: GENERATION 6 BY WISK AERO

14.2.3.2

USE CASE: EH216-S BY EHANG

14.3.1

RISE IN AIRSPACE DIGITALIZATION

14.3.1.1

USE CASE: EH216-S BY EHANG

14.4.1

CURRENT REGULATORY REQUIREMENTS AND PASSENGER TRUST

14.4.1.1

USE CASE: MIDNIGHT BY ARCHER AVIATION

15

EVTOL AIRCRAFT MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2035, USD MILLION)

Market Size & Growth Rate Forecast Analysis to 2035 in USD Million | 3 Data Tables

137

15.2

AIR TAXIS/AIR METROS/AIR SHUTTLES

15.2.1

GROWING URBAN CONGESTION AND DEMAND FOR TIME-EFFICIENT MOBILITY

15.2.1.1

USE CASE: JOBY S4 BY JOBY AVIATION

15.3

CARGO TRANSPORT/LAST-MILE DELIVERY

15.3.1

CONSUMER DEMAND FOR QUICK, CONTACTLESS, AND SUSTAINABLE LOGISTICS

15.3.1.1

USE CASE: CHAPARRAL C1 BY ELROY AIR

15.4

SPECIAL MISSION & OTHER APPLICATIONS

15.4.1

EXPANDING DEMAND FOR RAPID EMERGENCY RESPONSE AND SPECIALIZED AERIAL SERVICES

15.4.1.1

USE CASE: ALIA-250 BY BETA TECHNOLOGIES

16

EVTOL AIRCRAFT MARKET, BY REGION (MARKET SIZE & FORECAST TO 2035, USD MILLION)

Comprehensive coverage of 8 Regions with country-level deep-dive of 17 Countries | 252 Data Tables.

141

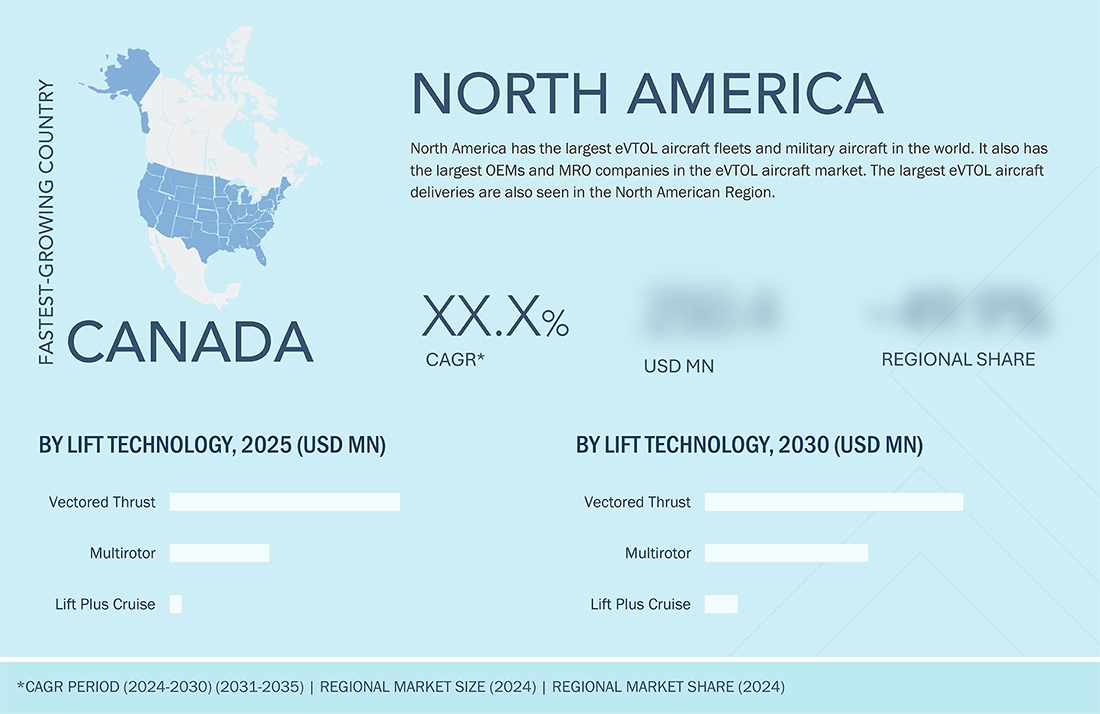

16.2.1.1

MATURE REGULATORY FRAMEWORKS, ADVANCED AEROSPACE ECOSYSTEM, AND SUSTAINED CAPITAL INVESTMENT TO DRIVE MARKET

16.2.2.1

FOCUS ON SUSTAINABLE AVIATION AND REMOTE MOBILITY TO DRIVE MARKET

16.3.1.1

REGULATORY LEADERSHIP AND STRONG AEROSPACE ECOSYSTEM TO DRIVE MARKET

16.3.2.1

ADVANCED INDUSTRIAL CAPABILITIES AND GOVERNMENT-BACKED URBAN AIR MOBILITY PROGRAMS TO DRIVE MARKET

16.3.3.1

ESTABLISHED AEROSPACE ECOSYSTEM AND NATIONAL INVESTMENT IN SUSTAINABLE AVIATION TO DRIVE MARKET

16.3.4.1

STRONG SUSTAINABILITY AGENDA AND RAPID INNOVATION WITHIN AVIATION TO DRIVE MARKET

16.3.5.1

STRONG AEROSPACE MANUFACTURING ECOSYSTEM AND HIGH URBAN MOBILITY DEMAND TO DRIVE MARKET

16.4.1.1

URBAN CONGESTION AND PREMIUM MOBILITY TO DRIVE MARKET

16.4.2.1

RAPID URBANIZATION AND FOCUS ON MODERNIZING MOBILITY INFRASTRUCTURE TO DRIVE MARKET

16.4.3.1

ADVANCED REGULATORY FRAMEWORKS AND TECHNOLOGY LEADERSHIP TO DRIVE MARKET

16.4.4.1

STRONG DEMAND FOR REGIONAL MOBILITY AND WELL-ESTABLISHED AVIATION TESTING ENVIRONMENT TO DRIVE MARKET

16.4.5.1

GOVERNMENT-LED ADVANCED AIR MOBILITY ROADMAP AND STRONG TECHNOLOGY ECOSYSTEM TO DRIVE MARKET

16.4.6

REST OF ASIA PACIFIC

16.5

MIDDLE EAST & AFRICA

16.5.1.1.1

ADVANCED AIR MOBILITY VISION AND EARLY REGULATORY ENGAGEMENT TO DRIVE MARKET

16.5.1.2.1

SMART CITY DEVELOPMENT AND LARGE-SCALE INFRASTRUCTURE INVESTMENT TO DRIVE MARKET

16.5.2.1

APPLICATION-DRIVEN AIR MOBILITY DEMAND TO DRIVE MARKET

16.5.3

REST OF MIDDLE EAST & AFRICA

16.6.1.1

AEROSPACE MANUFACTURING STRENGTH AND URBAN CONGESTION TO DRIVE MARKET

16.6.2.1

SIGNIFICANT DEMAND FOR TOURISM MOBILITY TO DRIVE MARKET

16.6.3.1

AVIATION SERVICES CAPABILITY AND INTERCITY CONNECTIVITY NEED TO DRIVE MARKET

17

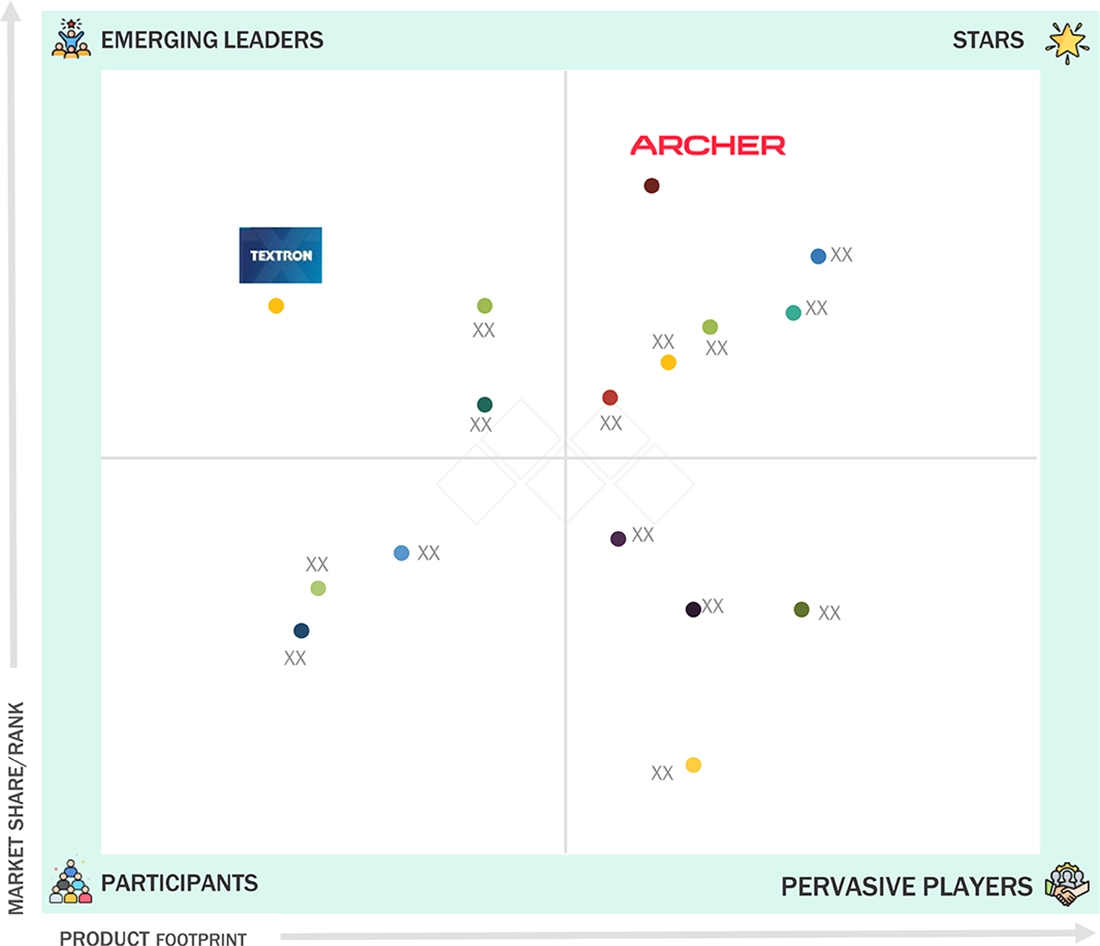

COMPETITIVE LANDSCAPE

Discover market leaders' winning strategies and emerging competitors reshaping the competitive landscape.

213

17.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025

17.3

REVENUE ANALYSIS, 2021–2024

17.4

MARKET SHARE ANALYSIS, 2024

17.5

BRAND/PRODUCT COMPARISON

17.6

COMPANY VALUATION AND FINANCIAL METRICS

17.7

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

17.7.5.1

COMPANY FOOTPRINT

17.7.5.2

REGION FOOTPRINT

17.7.5.3

LIFT TECHNOLOGY FOOTPRINT

17.7.5.4

OPERATING RANGE FOOTPRINT

17.7.5.5

APPLICATION FOOTPRINT

17.8

COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

17.8.1

PROGRESSIVE COMPANIES

17.8.2

RESPONSIVE COMPANIES

17.8.5

COMPETITIVE BENCHMARKING

17.8.5.1

LIST OF START-UPS/SMES

17.8.5.2

COMPETITIVE BENCHMARKING OF START-UPS/SMES

17.9

COMPETITIVE SCENARIO

17.9.1

PRODUCT LAUNCHES/DEVELOPMENTS

17.9.3

OTHER DEVELOPMENTS

18

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

237

18.1.1

ARCHER AVIATION INC.

18.1.1.1

BUSINESS OVERVIEW

18.1.1.2

PRODUCTS/SOLUTIONS OFFERED

18.1.1.3

RECENT DEVELOPMENTS

18.1.1.3.2

OTHER DEVELOPMENTS

18.1.1.4.2

STRATEGIC CHOICES

18.1.1.4.3

WEAKNESSES AND COMPETITIVE THREATS

18.1.2

VERTICAL AEROSPACE

18.1.9

JAUNT AIR MOBILITY

18.1.10

BETA TECHNOLOGIES

18.1.11

DIAMOND AIRCRAFT INDUSTRIES

18.1.12

XTI AEROSPACE INC.

18.1.13

LIFT AIRCRAFT INC.

18.2.10

DORONI AEROSPACE, INC.

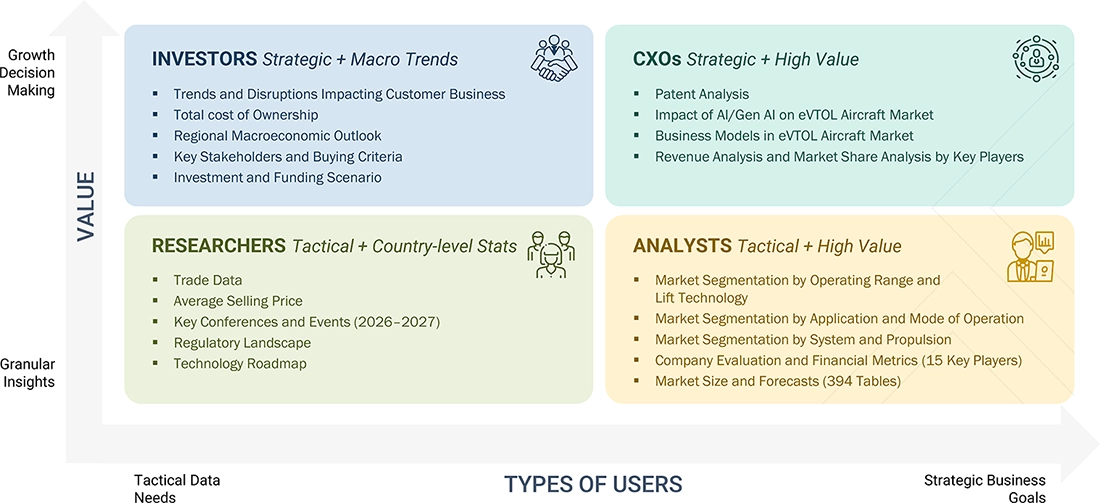

19

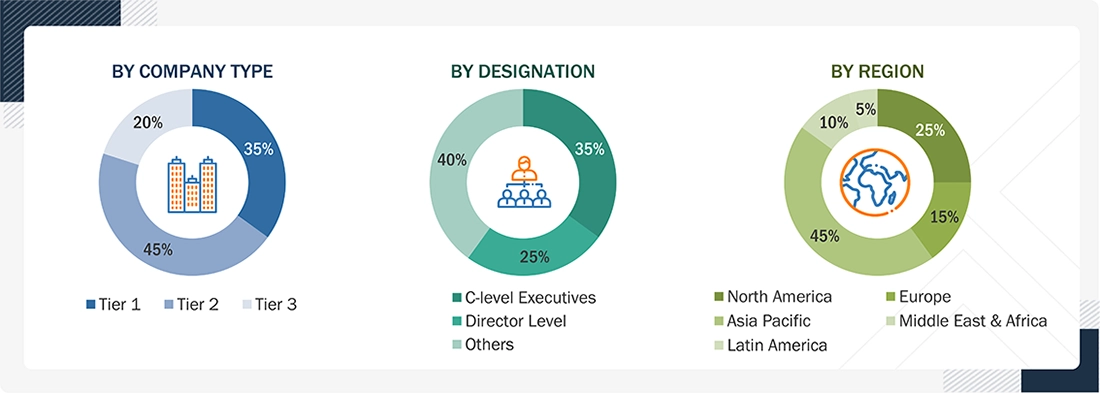

RESEARCH METHODOLOGY

298

19.1.1.1

KEY DATA FROM SECONDARY SOURCES

19.1.2.1

PRIMARY INTERVIEW PARTICIPANTS

19.1.2.2

KEY DATA FROM PRIMARY SOURCES

19.1.2.3

BREAKDOWN OF PRIMARY INTERVIEWS

19.1.2.4

INSIGHTS FROM INDUSTRY EXPERTS

19.2

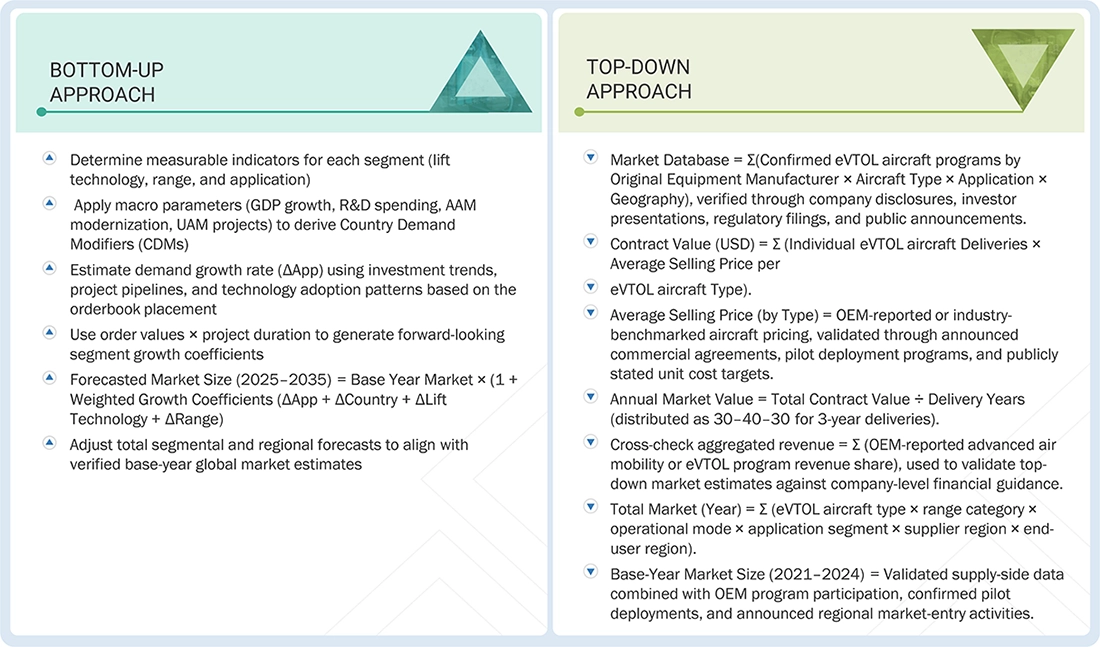

MARKET SIZE ESTIMATION

19.2.1

BOTTOM-UP APPROACH

19.2.3

BASE NUMBER CALCULATION

19.3.1

SUPPLY-SIDE INDICATORS

19.3.2

DEMAND-SIDE INDICATORS

19.5

RESEARCH ASSUMPTIONS

19.6

RESEARCH LIMITATIONS

20.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

20.3

CUSTOMIZATION OPTIONS

TABLE 1

USD EXCHANGE RATES

TABLE 2

UNMET NEEDS AND WHITE SPACES

TABLE 3

STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

TABLE 4

GDP PERCENTAGE CHANGE, BY COUNTRY, 2021–2029

TABLE 5

ROLE OF COMPANIES IN ECOSYSTEM

TABLE 6

INDICATIVE PRICING ANALYSIS, BY AIRCRAFT MODEL, 2024 (USD MILLION)

TABLE 7

INDICATIVE PRICING ANALYSIS, BY REGION, 2024 (USD MILLION)

TABLE 8

IMPORT DATA FOR HS CODE 8802-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 9

EXPORT DATA FOR HS CODE 8802-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 10

KEY CONFERENCES AND EVENTS, 2026

TABLE 11

US-ADJUSTED RECIPROCAL TARIFF RATES

TABLE 12

MODEL-WISE PRICE IMPACT ANALYSIS

TABLE 13

EVTOL AIRCRAFT OPERATIONAL VOLUME, BY LIFT TECHNOLOGY, 2021–2025 (UNITS)

TABLE 14

EVTOL AIRCRAFT OPERATIONAL VOLUME, BY OPERATING RANGE, 2021–2025 (UNITS)

TABLE 15

EVTOL AIRCRAFT OPERATIONAL VOLUME, BY APPLICATION, 2021–2025 (UNITS)

TABLE 17

NEXT-GENERATION BATTERY TECHNOLOGIES SHAPING EVTOL AIRCRAFT ENERGY SYSTEMS

TABLE 18

AUTONOMOUS FLIGHT AND AI SYSTEMS SHAPING EVTOL AIRCRAFT OPERATIONS

TABLE 19

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22

MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 23

REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 24

GLOBAL DESIGN, STRUCTURAL, AND OPERATIONAL STANDARDS

TABLE 25

GLOBAL ELECTRICAL, COMMUNICATION, AND CYBERSECURITY STANDARDS

TABLE 26

GLOBAL QUALITY, ENVIRONMENTAL, AND COMPLIANCE STANDARDS

TABLE 27

CARBON IMPACT REDUCTION

TABLE 28

ECO APPLICATIONS

TABLE 29

GLOBAL REGULATORY FRAMEWORKS IMPACTING EVTOL AIRCRAFT MARKET

TABLE 30

CERTIFICATIONS, LABELING, AND ECO-STANDARDS

TABLE 31

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PROPULSION (%)

TABLE 32

KEY BUYING CRITERIA, BY PROPULSION

TABLE 33

EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 34

EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 35

EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 36

EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (UNITS)

TABLE 37

EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (UNITS)

TABLE 38

EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (UNITS)

TABLE 39

EVTOL AIRCRAFT MARKET, BY MTOW, 2021–2024 (USD MILLION)

TABLE 40

EVTOL AIRCRAFT MARKET, BY MTOW, 2025–2030 (USD MILLION)

TABLE 41

EVTOL AIRCRAFT MARKET, BY MTOW, 2031–2035 (USD MILLION)

TABLE 42

EVTOL AIRCRAFT MARKET, BY PROPULSION, 2021–2024 (USD MILLION)

TABLE 43

EVTOL AIRCRAFT MARKET, BY PROPULSION, 2025–2030 (USD MILLION)

TABLE 44

EVTOL AIRCRAFT MARKET, BY PROPULSION, 2031–2035 (USD MILLION)

TABLE 45

EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 46

EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 47

EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 48

EVTOL AIRCRAFT MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 49

EVTOL AIRCRAFT MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 50

EVTOL AIRCRAFT MARKET, BY SYSTEM, 2031–2035 (USD MILLION)

TABLE 51

EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 52

EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 53

EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031–2035 (USD MILLION)

TABLE 54

EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 55

EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 56

EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 57

EVTOL AIRCRAFT MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 58

EVTOL AIRCRAFT MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 59

EVTOL AIRCRAFT MARKET, BY REGION, 2031–2035 (USD MILLION)

TABLE 60

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 61

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 62

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2031–2035 (USD MILLION)

TABLE 63

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 64

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 65

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 66

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 67

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 68

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 69

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 70

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 71

NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 72

US: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 73

US: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 74

US: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 75

US: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 76

US: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 77

US: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 78

US: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 79

US: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 80

US: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 81

CANADA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 82

CANADA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 83

CANADA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 84

CANADA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 85

CANADA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 86

CANADA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 87

CANADA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 88

CANADA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 89

CANADA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 90

EUROPE: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 91

EUROPE: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 92

EUROPE: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2031–2035 (USD MILLION)

TABLE 93

EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 94

EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 95

EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 96

EUROPE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 97

EUROPE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 98

EUROPE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 99

EUROPE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 100

EUROPE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 101

EUROPE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 102

UK: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 103

UK: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 104

UK: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 105

UK: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 106

UK: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 107

UK: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 108

UK: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 109

UK: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 110

UK: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 111

GERMANY: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 112

GERMANY: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 113

GERMANY: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 114

GERMANY: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 115

GERMANY: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 116

GERMANY: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 117

GERMANY: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 118

GERMANY: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 119

GERMANY: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 120

FRANCE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 121

FRANCE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 122

FRANCE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 123

FRANCE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 124

FRANCE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 125

FRANCE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 126

FRANCE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 127

FRANCE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 128

FRANCE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 129

IRELAND: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 130

IRELAND: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 131

IRELAND: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 132

IRELAND: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 133

IRELAND: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 134

IRELAND: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 135

IRELAND: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 136

IRELAND: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 137

IRELAND: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 138

SPAIN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 139

SPAIN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 140

SPAIN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 141

SPAIN: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 142

SPAIN: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 143

SPAIN: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 144

SPAIN: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 145

SPAIN: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 146

SPAIN: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 147

REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 148

REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 149

REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 150

REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 151

REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 152

REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 153

REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 154

REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 155

REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 156

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 157

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 158

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2031–2035 (USD MILLION)

TABLE 159

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 160

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 161

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 162

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 163

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 164

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 165

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 166

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 167

ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 168

CHINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 169

CHINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 170

CHINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 171

CHINA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 172

CHINA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 173

CHINA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 174

CHINA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 175

CHINA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 176

CHINA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 177

INDIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 178

INDIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 179

INDIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 180

INDIA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 181

INDIA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 182

INDIA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 183

INDIA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 184

INDIA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 185

INDIA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 186

JAPAN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 187

JAPAN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 188

JAPAN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 189

JAPAN: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 190

JAPAN: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 191

JAPAN: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 192

JAPAN: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 193

JAPAN: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 194

JAPAN: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 195

AUSTRALIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 196

AUSTRALIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 197

AUSTRALIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 198

AUSTRALIA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 199

AUSTRALIA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 200

AUSTRALIA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 201

AUSTRALIA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 202

AUSTRALIA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 203

AUSTRALIA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 204

SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 205

SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 206

SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 207

SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 208

SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 209

SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 210

SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 211

SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 212

SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 213

REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 214

REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 215

REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 216

REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 217

REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 218

REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 219

REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 220

REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 221

REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 222

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 223

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 224

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2031–2035 (USD MILLION)

TABLE 225

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 226

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 227

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 228

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 229

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 230

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 231

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 232

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 233

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 234

UAE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 235

UAE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 236

UAE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 237

UAE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 238

UAE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 239

UAE: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 240

UAE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 241

UAE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 242

UAE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 243

SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 244

SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 245

SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 246

SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 247

SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 248

SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 249

SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 250

SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 251

SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 252

SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 253

SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 254

SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 255

SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 256

SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 257

SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 258

SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 259

SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 260

SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 261

REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 262

REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 263

REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 264

REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 265

REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 266

REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 267

REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 268

REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 269

REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 270

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 271

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 272

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2031–2035 (USD MILLION)

TABLE 273

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 274

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 275

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 276

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 277

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 278

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 279

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 280

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 281

LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 282

BRAZIL: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 283

BRAZIL: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 284

BRAZIL: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 285

BRAZIL: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 286

BRAZIL: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 287

BRAZIL: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 288

BRAZIL: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 289

BRAZIL: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 290

BRAZIL: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 291

MEXICO: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 292

MEXICO: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 293

MEXICO: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 294

MEXICO: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 295

MEXICO: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 296

MEXICO: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 297

MEXICO: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 298

MEXICO: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 299

MEXICO: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 300

ARGENTINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2021–2024 (USD MILLION)

TABLE 301

ARGENTINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2030 (USD MILLION)

TABLE 302

ARGENTINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031–2035 (USD MILLION)

TABLE 303

ARGENTINA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2021–2024 (USD MILLION)

TABLE 304

ARGENTINA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2030 (USD MILLION)

TABLE 305

ARGENTINA: EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2031–2035 (USD MILLION)

TABLE 306

ARGENTINA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 307

ARGENTINA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 308

ARGENTINA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031–2035 (USD MILLION)

TABLE 309

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025

TABLE 310

EVTOL AIRCRAFT MARKET: DEGREE OF COMPETITION

TABLE 311

REGION FOOTPRINT

TABLE 312

LIFT TECHNOLOGY FOOTPRINT

TABLE 313

OPERATING RANGE FOOTPRINT

TABLE 314

APPLICATION FOOTPRINT

TABLE 315

LIST OF START-UPS/SMES

TABLE 316

COMPETITIVE BENCHMARKING OF START-UPS/SMES

TABLE 317

EVTOL AIRCRAFT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021–2025

TABLE 318

EVTOL AIRCRAFT MARKET: DEALS, 2021–2025

TABLE 319

EVTOL AIRCRAFT MARKET: OTHER DEVELOPMENTS, 2021–2025

TABLE 320

ARCHER AVIATION INC.: COMPANY OVERVIEW

TABLE 321

ARCHER AVIATION INC.: PRODUCTS/SOLUTIONS OFFERED

TABLE 322

ARCHER AVIATION INC.: DEALS

TABLE 323

ARCHER AVIATION INC.: OTHER DEVELOPMENTS

TABLE 324

VERTICAL AEROSPACE: COMPANY OVERVIEW

TABLE 325

VERTICAL AEROSPACE: PRODUCTS/SOLUTIONS OFFERED

TABLE 326

VERTICAL AEROSPACE: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 327

VERTICAL AEROSPACE: DEALS

TABLE 328

EVE HOLDING, INC.: COMPANY OVERVIEW

TABLE 329

EVE HOLDING, INC.: PRODUCTS/SOLUTIONS OFFERED

TABLE 330

EVE HOLDING, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 331

EVE HOLDING, INC.: DEALS

TABLE 332

EVE HOLDING, INC.: OTHER DEVELOPMENTS

TABLE 333

EHANG: COMPANY OVERVIEW

TABLE 334

EHANG: PRODUCTS/SOLUTIONS OFFERED

TABLE 335

EHANG: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 337

EHANG: OTHER DEVELOPMENTS

TABLE 338

JOBY AVIATION: COMPANY OVERVIEW

TABLE 339

JOBY AVIATION: PRODUCTS/SOLUTIONS OFFERED

TABLE 340

JOBY AVIATION: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 341

JOBY AVIATION: DEALS

TABLE 342

JOBY AVIATION: OTHER DEVELOPMENTS

TABLE 343

AIRBUS: COMPANY OVERVIEW

TABLE 344

AIRBUS: PRODUCTS/SOLUTIONS OFFERED

TABLE 345

AIRBUS: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 347

TEXTRON INC.: COMPANY OVERVIEW

TABLE 348

TEXTRON INC.: PRODUCTS/SOLUTIONS OFFERED

TABLE 349

TEXTRON INC.: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 350

TEXTRON INC.: DEALS

TABLE 351

WISK AERO: COMPANY OVERVIEW

TABLE 352

WISK AERO: PRODUCTS/SOLUTIONS OFFERED

TABLE 353

WISK AERO: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 354

WISK AERO: DEALS

TABLE 355

WISK AERO: OTHER DEVELOPMENTS

TABLE 356

JAUNT AIR MOBILITY: COMPANY OVERVIEW

TABLE 357

JAUNT AIR MOBILITY: PRODUCTS/SOLUTIONS OFFERED

TABLE 358

JAUNT AIR MOBILITY: DEALS

TABLE 359

BETA TECHNOLOGIES: COMPANY OVERVIEW

TABLE 360

BETA TECHNOLOGIES: PRODUCTS/SOLUTIONS OFFERED

TABLE 361

BETA TECHNOLOGIES: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 362

BETA TECHNOLOGIES: DEALS

TABLE 363

BETA TECHNOLOGIES: OTHER DEVELOPMENTS

TABLE 364

DIAMOND AIRCRAFT INDUSTRIES: COMPANY OVERVIEW

TABLE 365

DIAMOND AIRCRAFT INDUSTRIES: PRODUCTS/SOLUTIONS OFFERED

TABLE 366

DIAMOND AIRCRAFT INDUSTRIES: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 367

DIAMOND AIRCRAFT INDUSTRIES: DEALS

TABLE 368

DIAMOND AIRCRAFT INDUSTRIES: OTHER DEVELOPMENTS

TABLE 369

XTI AEROSPACE INC.: COMPANY OVERVIEW

TABLE 370

XTI AEROSPACE INC.: PRODUCTS/SOLUTIONS OFFERED

TABLE 371

XTI AEROSPACE INC.: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 372

XTI AEROSPACE INC.: DEALS

TABLE 373

LIFT AIRCRAFT INC.: COMPANY OVERVIEW

TABLE 374

LIFT AIRCRAFT INC.: PRODUCTS/SOLUTIONS OFFERED

TABLE 375

LIFT AIRCRAFT INC.: PRODUCT LAUNCHES

TABLE 376

LIFT AIRCRAFT INC.: DEALS

TABLE 377

LIFT AIRCRAFT INC.: OTHER DEVELOPMENTS

TABLE 378

AUTOFLIGHT: COMPANY OVERVIEW

TABLE 379

AUTOFLIGHT: PRODUCTS/SOLUTIONS OFFERED

TABLE 380

AUTOFLIGHT: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 381

AUTOFLIGHT: DEALS

TABLE 382

AUTOFLIGHT: OTHER DEVELOPMENTS

TABLE 383

VOLANT AEROTECH: COMPANY OVERVIEW

TABLE 384

VOLANT AEROTECH: PRODUCTS/SOLUTIONS OFFERED

TABLE 385

VOLANT AEROTECH: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 386

VOLANT AEROTECH: DEALS

TABLE 387

VOLANT AEROTECH: OTHER DEVELOPMENTS

TABLE 388

ARC AERO SYSTEMS: COMPANY OVERVIEW

TABLE 389

SKYDRIVE INC.: COMPANY OVERVIEW

TABLE 390

ELECTRA.AERO: COMPANY OVERVIEW

TABLE 391

MANTA AIRCRAFT: COMPANY OVERVIEW

TABLE 392

AIR VEV LTD: COMPANY OVERVIEW

TABLE 393

URBAN AERONAUTICS: COMPANY OVERVIEW

TABLE 394

SKYRYSE, INC.: COMPANY OVERVIEW

TABLE 395

ASCENDANCE: COMPANY OVERVIEW

TABLE 396

PIVOTAL: COMPANY OVERVIEW

TABLE 397

DORONI AEROSPACE, INC.: COMPANY OVERVIEW

FIGURE 1

EVTOL AIRCRAFT MARKET SEGMENTATION

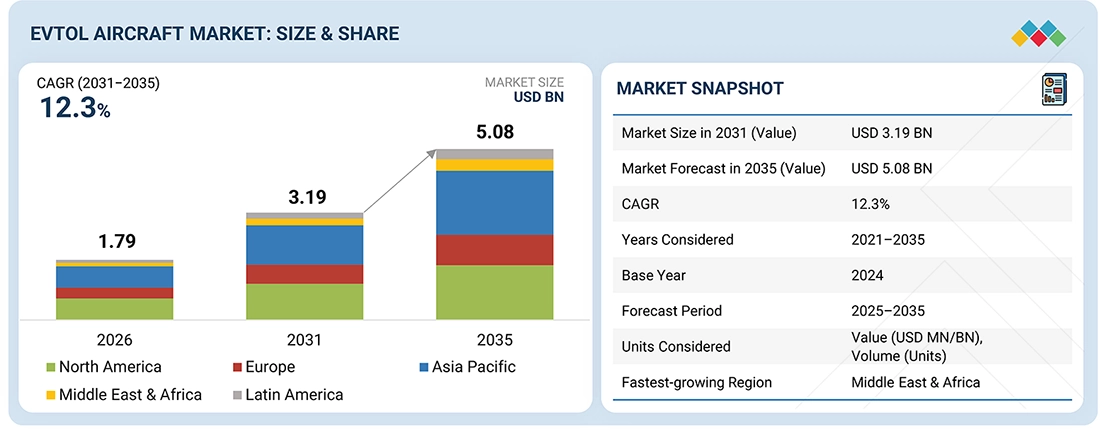

FIGURE 3

GLOBAL EVTOL AIRCRAFT MARKET, 2021–2035

FIGURE 4

MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN EVTOL AIRCRAFT MARKET

FIGURE 5

DISRUPTIONS INFLUENCING GROWTH OF EVTOL AIRCRAFT MARKET

FIGURE 6

HIGH-GROWTH SEGMENTS IN EVTOL AIRCRAFT MARKET

FIGURE 7

MIDDLE EAST & AFRICA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

FIGURE 8

URBAN CONGESTION, RAPID MOBILITY NEEDS, AND ADVANCES IN ELECTRIC AND AUTONOMOUS FLIGHT TECHNOLOGIES TO DRIVE MARKET

FIGURE 9

≤200 KM SEGMENT HELD HIGHER SHARE THAN >200 KM SEGMENT IN 2025

FIGURE 10

LIFT PLUS CRUISE TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

FIGURE 11

CARGO TRANSPORT/LAST-MILE DELIVERY TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

FIGURE 12

PILOTED SEGMENT WAS LARGER THAN AUTONOMOUS SEGMENT IN 2025

FIGURE 13

EVTOL AIRCRAFT MARKET DYNAMICS

FIGURE 14

TOP 10 EVTOL AIRCRAFT, BY ORDER COMMITMENT (UNITS)

FIGURE 15

REGIONAL DISTRIBUTION OF EVTOL ORDER COMMITMENTS (ORDER MARKET SHARE, 2024)

FIGURE 16

VALUE CHAIN ANALYSIS

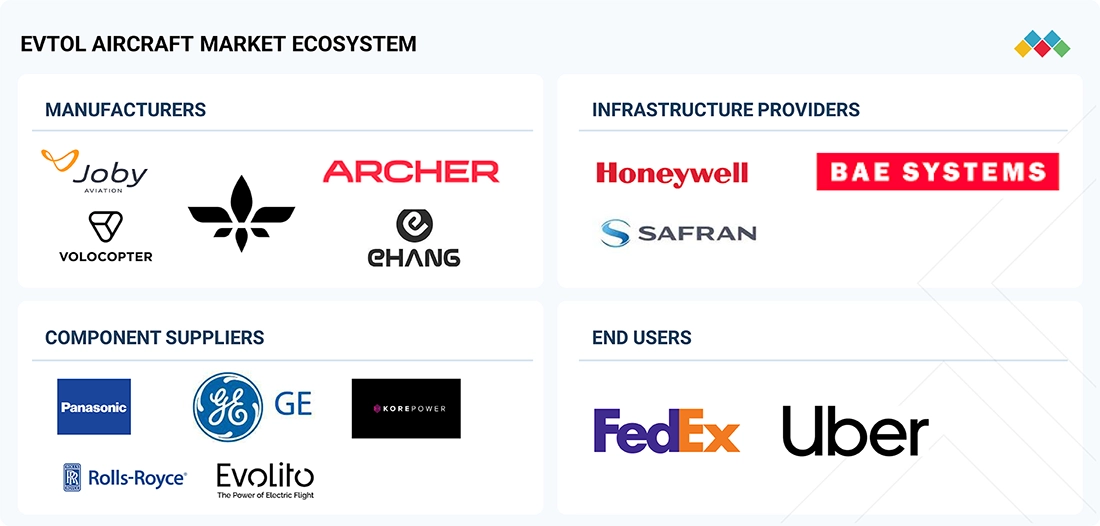

FIGURE 17

ECOSYSTEM ANALYSIS

FIGURE 18

INVESTMENT AND FUNDING SCENARIO, 2021–2025

FIGURE 19

COMPARATIVE STUDY OF PRICE AND RANGE OF EVTOL AIRCRAFT MODELS

FIGURE 20

COMPARATIVE STUDY OF PRICE AND MTOW OF EVTOL AIRCRAFT MODELS

FIGURE 21

COMPARATIVE STUDY OF PRICE AND PASSENGER CAPACITY OF EVTOL AIRCRAFT MODELS

FIGURE 22

IMPORT DATA FOR HS CODE 8802-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

FIGURE 23

EXPORT DATA FOR HS CODE 8802-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

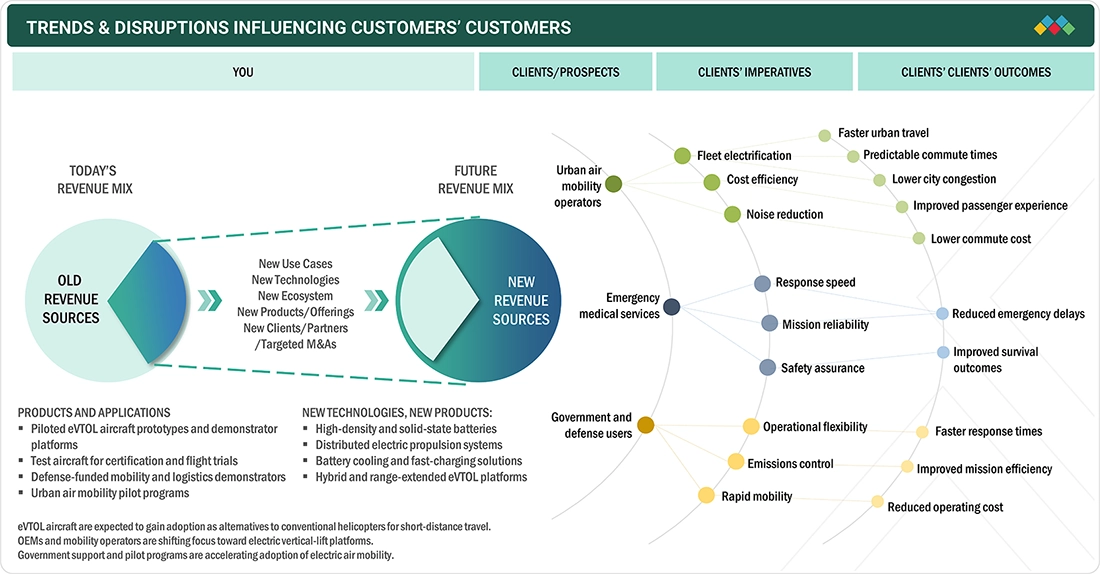

FIGURE 24

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 25

TECHNOLOGY ROADMAP, 2020–2035

FIGURE 26

PATENT ANALYSIS

FIGURE 27

IMPACT OF AI/GEN AI

FIGURE 28

FUTURE APPLICATIONS

FIGURE 29

DECISION-MAKING FACTORS

FIGURE 30

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PROPULSION

FIGURE 31

KEY BUYING CRITERIA, BY PROPULSION

FIGURE 32

ADOPTION BARRIERS AND INTERNAL CHALLENGES

FIGURE 33

EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2025–2035 (USD MILLION)

FIGURE 34

EVTOL AIRCRAFT MARKET, BY MTOW, 2025–2035 (USD MILLION)

FIGURE 35

EVTOL AIRCRAFT MARKET, BY PROPULSION, 2025–2035 (USD MILLION)

FIGURE 36

EVTOL AIRCRAFT MARKET, BY OPERATING RANGE, 2025–2035 (USD MILLION)

FIGURE 37

EVTOL AIRCRAFT MARKET, BY SYSTEM, 2025–2035 (USD MILLION)

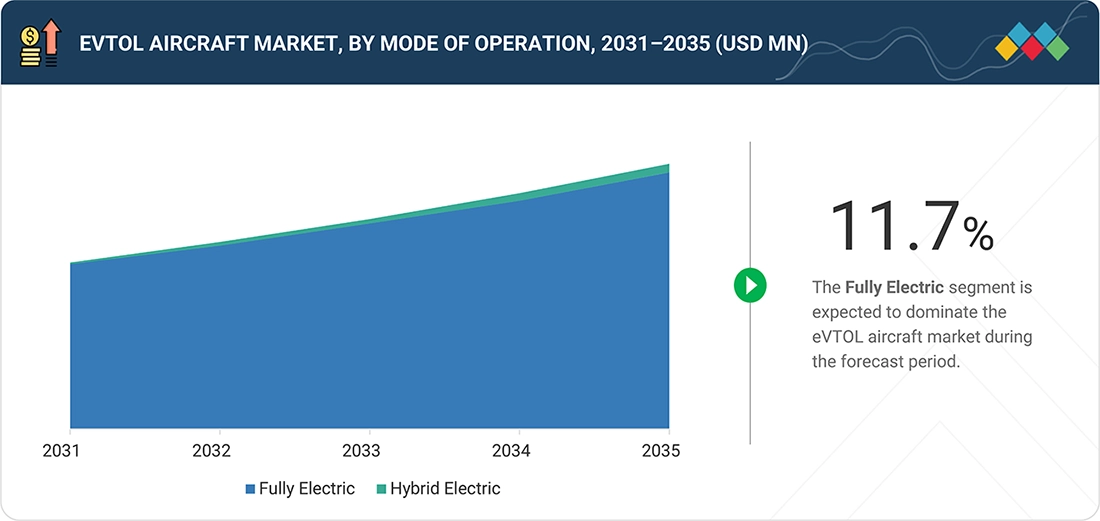

FIGURE 38

EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2025–2035 (USD MILLION)

FIGURE 39

EVTOL AIRCRAFT MARKET, BY APPLICATION, 2025–2035 (USD MILLION)

FIGURE 40

EVTOL AIRCRAFT MARKET, BY REGION, 2025–2035

FIGURE 41

NORTH AMERICA: EVTOL AIRCRAFT MARKET SNAPSHOT

FIGURE 42

EUROPE: EVTOL AIRCRAFT MARKET SNAPSHOT

FIGURE 43

ASIA PACIFIC: EVTOL MARKET SNAPSHOT

FIGURE 44

MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET SNAPSHOT

FIGURE 45

LATIN AMERICA: EVTOL MARKET SNAPSHOT

FIGURE 46

REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021–2024

FIGURE 47

MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

FIGURE 48

BRAND/PRODUCT COMPARISON

FIGURE 49

FINANCIAL METRICS (EV/EBITDA)

FIGURE 50

COMPANY VALUATION (USD BILLION)

FIGURE 51

COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

FIGURE 52

COMPANY FOOTPRINT

FIGURE 53

COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

FIGURE 54

EHANG: COMPANY SNAPSHOT

FIGURE 55

JOBY AVIATION: COMPANY SNAPSHOT

FIGURE 56

AIRBUS: COMPANY SNAPSHOT

FIGURE 57

TEXTRON INC.: COMPANY SNAPSHOT

FIGURE 58

WISK AERO: COMPANY SNAPSHOT

FIGURE 59

JAUNT AIR MOBILITY: COMPANY SNAPSHOT

FIGURE 60

XTI AEROSPACE INC.: COMPANY SNAPSHOT

FIGURE 61

RESEARCH DESIGN MODEL

FIGURE 62

RESEARCH DESIGN

FIGURE 63

BOTTOM-UP APPROACH

FIGURE 64

TOP-DOWN APPROACH

FIGURE 65

DATA TRIANGULATION

Soumyadeb

Aug, 2019

Surveying new developments in the aerospace market - the abstract would enable the management to judge if further study in the area is required. .

Tylo

May, 2019

We are currently researching and developing out own evtol craft, and I am seeking more information on the economics of the evtol market..