Green Hydrogen Market

Green Hydrogen Market By Technology (Alkaline, PEM), Renewable Source (Wind, Solar), End-use Industry (Mobility, Power, Chemical, Industrial, Grid Injection), and Region (North America, Europe, APAC, MEA, and Latin America) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The green hydrogen market is projected to grow from USD 2.79 billion in 2025 to USD 74.81 billion by 2032, at a CAGR of 60.0% during the forecast period. The green hydrogen market is experiencing rapid growth, driven by global efforts to reduce carbon emissions and advancements in electrolysis and renewables. Government support through policies and investments is also boosting growth. Its versatility and scalability make green hydrogen a key player in the transition to sustainable energy. The market is even being propelled by its increasing use in fuel cell electric vehicles (FCEVs) and high-energy-intensive industries like steel and ammonia production, further driving demand and market expansion.

KEY TAKEAWAYS

-

BY REGIONNorth America is the fastest-growing region, in terms of value, with a CAGR of 69.7% during the forecast period.

-

BY RENEWABLE SOURCEBy renewable source, the wind energy segment led the green hydrogen market, accounting for a 48.9% share in terms of value in 2024.

-

BY TECHNOLOGYBy technology, the green hydrogen market was dominated by alkaline electrolysis technology, accounting for a 61.2% share of the overall market in terms of value in 2024.

-

BY END-USE INDUSTRYBy end-use industry, the mobility sector is the largest segment of the green hydrogen market, accounting for a 57.7% share of the overall market in terms of value in 2024.

-

BY DISTRIBUTION CHANNELBy distribution channel, the pipeline segment is expected to dominate the market during the forecast period.

-

BY PRODUCTION SCALEBy production scale, the large-scale production segment is expected to dominate the market during the forecast period.

-

BY PURITY LEVELBy purity level, the ultra-high purity segment is expected to be the fastest-growing segment during the forecast period.

-

BY STORAGEBy storage, the compressed gas storage segment is expected to dominate the market during forecast period.

-

Competitive Landscape - Key PlayersAir Liquide, Air Products and Chemicals, Inc., and Engie were identified as some of the star players in the green hydrogen market (global), given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsABO Energy KGaA, Green Hydrogen Systems, and Hydrogenea GmbH, among others, have distinguished themselves as startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The industry is driven by the increasing demand from the mobility segment, the power industry, the development of electrolysis technologies, and the low cost of producing renewable energy is expected to drive the green hydrogen market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Green hydrogen, produced using renewable energy sources, offers several benefits over traditional fossil fuels. It reduces greenhouse gas emissions, helping combat climate change. In the automotive sector, green hydrogen can be used in fuel cell electric vehicles (FCEVs), offering higher efficiency compared to internal combustion engines. FCEVs powered by green hydrogen have longer ranges and shorter refueling times than battery electric vehicles (BEVs), making them more practical for long-distance travel. Additionally, as the cost of renewable energy continues to decline, the production of green hydrogen is becoming more affordable, enhancing its viability as a mainstream fuel option.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Decarbonization targets & net-zero commitments

-

•Rapid growth of renewable energy capacity

Level

-

•High production costs

-

•Limited infrastructure

Level

-

•Emergence of hydrogen hubs & industrial clusters

-

•Hydrogen in heavy mobility

Level

-

•Hydrogen storage & transport complexity

-

•Electrolyzer manufacturing constraints

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Decarbonization targets & net-zero commitments

Among the factors pushing the green hydrogen market with the greatest strength, decarbonization targets and net-zero obligations rank highest, because they foster regulatory pressure, long-term demand certainty, and clean energy solutions investment momentum that is quite strong. More than 90 countries, which account for over 80% of the world’s economic output, have already set or are in the process of setting net-zero targets for the years 2050 to 2070, and a lot of them point to green hydrogen as being crucial for the decarbonization of those areas that cannot be electrified. The most challenging sectors, such as steel, oil refining, ammonia production, maritime transport, and heavy-duty vehicles, which are responsible for approximately 30% of the world's CO2 emissions, can be replaced by green hydrogen, considered one of the few viable alternatives to fossil-based feedstocks and fuels. Meanwhile, the growing carbon pricing, such as the EU ETS, where carbon prices are generally between USD 65-90/ton, has made grey hydrogen more expensive and is closing the cost gap with renewable hydrogen. Furthermore, corporate climate pledges have created a demand pull, which is even more pronounced in the case of over 4,000 companies that have either net-zero or science-based targets in place. Consequently, their operations, particularly with regard to industrial processes and supply chains, will require the use of low-carbon hydrogen. Along with that, various governments offer tax credits, such as the U.S. IRA 45V tax credit, the EU Hydrogen Bank, and India’s National Green Hydrogen Mission, which are among the most notable examples aimed at supporting this transition. All in all, these factors and policies make green hydrogen a pillar of the world’s decarbonization efforts.

Restraint: High production costs

The high production costs of renewable hydrogen are a major factor that is limiting the market for its green variety. The most important cost factor is the electricity price, which alone represents in the range of 50% to 70% of the total cost of green hydrogen production. While the prices of renewable energy are declining, they are still not low enough in many places to challenge grey hydrogen, which is produced very cheaply from natural gas with no carbon capture involved. Consequently, the price of green hydrogen is typically between USD 4 and USD 7 per kilogram, while grey hydrogen costs between USD 1 and USD 2 per kilogram. Additionally, the electrolyzer systems required for water splitting into hydrogen and oxygen remain costly, with a capital cost ranging from USD 900 to USD 1,500 per kilowatt for PEM systems and from USD 700 to USD 1,000 per kilowatt for alkaline systems. The factors that lead to more expensive electrolyzer production include limited production capacity and reliance on essential minerals, such as iridium and platinum, for PEM electrolyzer manufacture. In addition, the low utilization rates resulting from the unreliability of solar and wind power cause a drop in total efficiencies, so the electrolyzers are only used at a fraction of their capacity, which in turn increases the cost of hydrogen per unit output. The expensive methods of producing hydrogen act as a barrier to the investment decision-making process, making it difficult for companies to compete with fossil fuels, and the slow growth of green hydrogen is hindered by infrastructure development across various sectors.

Opportunity: Emergence of hydrogen hubs & industrial clusters

The rise of hydrogen hubs and industrial clusters has a significant impact on the green hydrogen market; these ecosystems, which work together, lower production costs, unite demand, and fast-track the marketing of hydrogen technologies on a large scale. Hydrogen hubs connect producers, consumers, and infrastructure developers in one area, thereby sharing pipelines, storage, renewable-energy supply, and offtake agreements, which will considerably enhance the project’s economics. In place of independent factories, hubs allow for the utilization of scale, which results in the price of green hydrogen being reduced to the range of USD 4-7/kg, a typical rate, and moving towards more competitive rates as production increases to hundreds of megawatts or gigawatts. The governments are backing this model very strongly. To illustrate, the United States Hydrogen Hubs Program has allocated USD 7 billion to establish seven regional hydrogen hubs, each of which is expected to produce up to 1 million tons of clean hydrogen annually. Likewise, the European Hydrogen Backbone initiative aims to establish hydrogen pipelines with a length of 28,000 km by 2030, thereby directly linking industrial clusters across Europe. In the Middle East, Saudi Arabia’s NEOM megaproject, among others, will combine megawatt-scale electrolysis plants with solar/wind and downstream ammonia production, making the region a potential major exporter worldwide. Such hubs will also group the demand originating from steel, chemical, refining, shipping, and mobility industries, and thus indirectly increase the financial viability through long-term offtake agreements. The spread of the hub model in various nations will lead to the global green hydrogen scenario changing quickly due to the fact that the risk of investment will be shared and the infra structure developed in a coordinated manner.

Challenge: Hydrogen storage & transport complexity

The intricacies associated with hydrogen storage and transport emerge as the most significant barrier to the market of green hydrogen, as, due to the nature of its physical and chemical properties, hydrogen is very challenging and expensive to manage compared to traditional fuels. Hydrogen possesses a very low volumetric energy density, which is about one-third as much as natural gas and nearly 1/10th as much as gasoline, and this makes it necessary to either store it at very high pressures (350–700 bar), liquefy it at -253°C, or turn it into derivatives like ammonia or methanol. Technically, all of these processes are very demanding and add significantly to the cost of the hydrogen market. The reason behind this is that, for instance, compressing hydrogen to 700 bar consumes a huge amount of energy, and the tanks specially designed for that pressure are costly and heavy. Hydrogen that has been liquefied faces even more serious hurdles: besides the cryogenic cooling, which is very energy-intensive and accounts for 30–40% of the total energy content of hydrogen, boil-off losses occur because hydrogen's boiling point is extremely low. The same applies to transporting hydrogen via pipelines; boiling off existing natural gas pipelines cannot be done at such a high mixing level, as hydrogen causes the metal to lose its toughness, which in turn leads to the formation of cracks and leaks, thereby increasing the risk. The cost of laying down the pipelines specifically for hydrogen is 2-3 times that of natural gas pipelines. Moreover, the hydrogen atoms are the smallest among all the gases, thus more likely to escape and necessitate advanced detection and safety systems. The combination of these difficulties pushes up the overall cost of infrastructure, hampers the advancement of large-scale deployment, and undermines the competitiveness of green hydrogen against other low-carbon alternatives.

green-hydrogen-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

HYBRIT produces steel using green hydrogen for Direct Reduced Iron (DRI), replacing coal-based blast furnaces. | Reduces CO2 emissions by up to 95% | Enables fossil-free steel production | Helps steelmakers meet EU and global net-zero standards |

|

Yara uses green hydrogen to produce ammonia for fertilizers, reducing reliance on grey hydrogen from natural gas. | Cuts emissions in ammonia production (a major CO2 source) | Supports sustainable agriculture | Creates export opportunities for green ammonia fuel |

|

Shell integrates green hydrogen into refinery operations to replace grey hydrogen used for hydrocracking and desulfurization. | Displaces fossil-derived hydrogen | Helps refineries comply with tightening carbon regulations | Supports production of low-carbon fuels |

|

Fuel-cell heavy-duty trucks powered by green hydrogen for logistics fleets. | Zero tailpipe emissions | Longer range and faster refueling than battery trucks | Ideal for heavy, long-haul transport |

|

Hydrogen-powered passenger trains operating on non-electrified rail routes. | Zero-emission rail transport | Avoids expensive overhead electrification | Quiet, efficient operations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The green hydrogen market operates through an ecosystem that integrates renewable energy supply, hydrogen production, infrastructure, and end-use applications to create a complete value chain. Renewable energy providers such as Ørsted, NextEra Energy, and ACWA Power generate low-cost solar and wind power that serves as the foundation for green hydrogen production. Electrolyzer and hydrogen producers, including Nel Hydrogen, Thyssenkrupp Nucera, and Plug Power, convert this renewable electricity into hydrogen through advanced PEM and alkaline electrolysis technologies. Storage and transport players, such as Air Liquide, Linde, and Chart Industries, enable the safe and efficient movement of hydrogen through compression, liquefaction, pipelines, and cryogenic systems, forming the backbone of the supply infrastructure. Finally, end-use industries ranging from HYBRIT’s green steelmaking to Toyota and Hyundai’s fuel-cell mobility solutions, Maersk’s hydrogen-derived maritime fuels, and Siemens Energy’s hydrogen-ready power turbines drive commercial demand and real-world deployment. Together, these interconnected nodes support the rapid scale-up of green hydrogen, enabling global decarbonization across industry, transportation, and energy systems.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Green Hydrogen Market, By Technology

The segment of PEM electrolysis is anticipated to be the most progressive and its growth will be the highest among others during the projected period owing to its technical merits and being the best option for renewable energy integration. Proton Exchange Membrane (PEM) systems are characterized by their rapid response times, high current densities, and flexibility in operation, which definitely suit the pairing with solar and wind power that are irregular. The countries are fast tracking green hydrogen implementation; thus, the very ability of PEM technology to manage renewable loads efficiently and the non-preferential treatment it gets are among the factors pushing the adoption of PEM technology at hydrogen hubs and large utilities involving coal and gas plants. Moreover, PEM electrolyzers occupy less area, yield high-quality hydrogen, and allow for rapid changes in load which are crucial for the battery, industrial, and electricity grid applications. The major companies such as Nel, Plug Power, and Siemens Energy are not only increasing their cooperation but also the related costs as well as the technological advancement; thus, the forward movement of the market is facilitated. Particularly, the strong government backing along with the growing requirement for green hydrogen production that is both trustworthy and economically viable has made the PEM technology the main player in the market expansion of the next decade.

Green Hydrogen Market, By End-Use Industry

The mobility segment is estimated to be the most rapidly expanding segment in terms of value over the projected period, with the extensive use of hydrogen-powered transport in heavy-duty, long-range, and commercial applications being the primary factor behind this growth. FCEVs, which are composed of fuel-cell electric vehicles, trucks, buses, trains, and ships, have markedly improved the situation where refueling time is a limitation, and the performance range is very critical, with fast refueling, long driving range, and high energy density. Many governments have subsidized hydrogen electricity through zero-emission mandates, hydrogen roadmaps, and national water plans, thereby facilitating the demand for green hydrogen in logistics, public transportation, and freight corridors. The refurbishment of major automotive and transportation industry giants like Toyota, Hyundai, Alstom, and Maersk will contribute to a more rapid decrease in carbon emissions as they move to fuel-cell platforms and hydrogen-based fuels. On the one hand, hydrogen has the potential to dominate the future due to the growing demand in the mobility sector, where refueling infrastructure is being developed, and green hydrogen is becoming more competitively priced.

REGION

North America is estimated to account for the largest market share during the forecast period

North America is projected to be the fastest-growing region in the green hydrogen market, in both value and volume, during the forecast period, driven by strong policy support, rapid project development, and substantial investment across the US and Canada. The US is driving regional momentum through the Inflation Reduction Act (IRA), which offers the world’s most attractive incentives for clean hydrogen production, including the 45V tax credit, significantly lowering the cost of green hydrogen. Additionally, the U.S. Department of Energy’s USD 7 billion investment in Regional Clean Hydrogen Hubs is accelerating the build-out of integrated production, storage, and end-use ecosystems. Major renewable energy developers, electrolyzer manufacturers, and industrial users are expanding their capacity to meet the growing demand in the mobility, refining, ammonia, and power sectors. Canada is also advancing hydrogen infrastructure and export-oriented green ammonia projects. With abundant renewable resources, robust policy frameworks, and growing industry adoption, North America is well-positioned for the fastest growth in the global green hydrogen market.

green-hydrogen-market: COMPANY EVALUATION MATRIX

In the Green Hydrogen market matrix, Linde PLC (Star) leads with a strong market share and extensive product footprint, driven by its Green Hydrogen solutions, which are adopted by various end users. Lhyfe (Emerging Leader) demonstrates substantial product innovations compared to its competitors. While Linde PLC dominates through scale and a diversified portfolio, Lhyfe’s Green Hydrogen shows significant potential to move toward the leaders’ quadrant as demand for green hydrogen continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Air Liquide (France)

- Air Products and Chemicals, Inc. (US)

- ENGIE (France)

- Uniper SE (Germany)

- Siemens Energy (Germany)

- LHYFE (France)

- Toshiba Energy Systems & Solutions Corporation (Japan)

- Nel (Norway)

- Ørsted (Denmark)

- Bloom Energy (US)

- Linde PLC (Ireland)

- Cummins Inc. (US)

- H&R GROUP (Germany)

- w2e Technology, LLC (US)

- Sinosynergy (China)

- ABO Energy KGaA (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.74 BN |

| Market Size in 2032 (Value) | USD 74.81 BN |

| Growth Rate | CAGR of 60% from 2025 to 2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | The report defines, segments, and projects the size of the green hydrogen market based on renewable source, technology, end-use industry, distribution channel, production scale, purity level, storage, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, including product launches, agreements, acquisitions, and expansions, in the market. |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: green-hydrogen-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Green Hydrogen Project Developers & Electrolyzer Operators |

|

|

| Renewable Energy Developers (Solar, Wind, Hybrid RE Plants) |

|

|

| Electrolyzer OEMs (PEM, Alkaline, SOEC Manufacturers) |

|

|

RECENT DEVELOPMENTS

- February 2025 : Air Liquide advances European decarbonization with two major hydrogen projects: the 200 MW ELYgator plant in Rotterdam and a 250 MW joint venture with TotalEnergies in Zeeland. Together, they represent over USD 1.15 billion in investment, producing 50,000 tons of renewable hydrogen annually and avoiding 500,000 tons of CO2 emissions each year.

- July 2024 : Air Products announced plans to develop a network of permanent, commercial-scale hydrogen refueling stations (HRSs) along major Trans-European Transport Network (TEN-T) corridors. These stations will feature advanced fueling technology, multiple pressure options, and onsite liquid hydrogen storage to enable liquid fueling. The initiative aims to strengthen Europe’s hydrogen infrastructure, providing reliable and convenient refueling for heavy-duty hydrogen-powered transport and supporting a resilient hydrogen ecosystem across the region.

- June 2024 : ExxonMobil and Air Liquide have partnered to advance low-carbon hydrogen and ammonia production at ExxonMobil’s Baytown, Texas, facility. Under the agreement, Air Liquide will transport low-carbon hydrogen via its existing pipeline network and construct four Large Modular Air Separation Units (LMAS) to supply 9,000 tons of oxygen and 6,500 tons of nitrogen per day, primarily powered by low-carbon electricity, thereby minimizing the project’s carbon footprint.

- November 2023 : Air Products has partnered with Chengzhi Shareholding Co. Ltd., a Chinese state-owned high-tech group, to promote transport decarbonization in China’s Yangtze River Delta. Through their joint venture, the companies have launched their first commercial-scale hydrogen fueling station in Changshu, Jiangsu province, designed to supply city buses and heavy-duty logistics trucks, marking a major step toward developing China’s hydrogen mobility infrastructure.

Table of Contents

Methodology

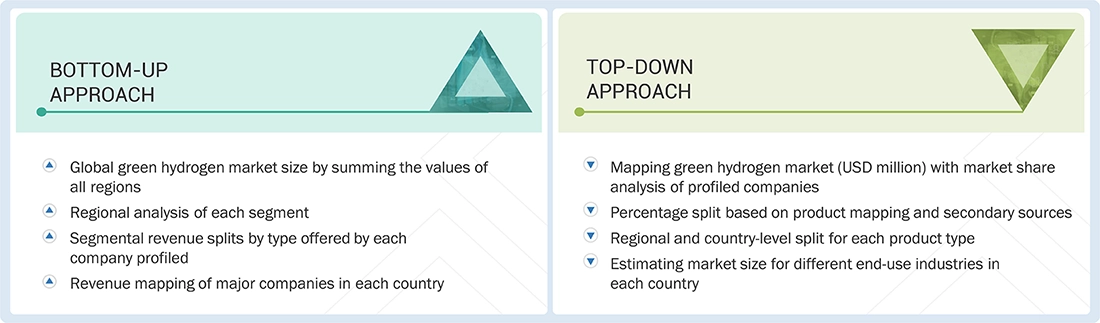

The research methodology used to estimate the current size of the green hydrogen market consisted of four major activities. Extensive secondary research was performed to acquire detailed information about the market, peer markets, and parent markets. These findings, assumptions, and metrics were verified through primary research with experts from both the demand and supply sides of the green hydrogen value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The estimation of market sizes for various segments and subsegments in the market was finalized using full market segmentation and data triangulation techniques.

Secondary Research

The research methodology for estimating and forecasting the green hydrogen market begins with gathering data on key vendors' revenues by doing secondary research. The secondary research process involves consulting a range of secondary sources, including Hoover's, Bloomberg Businessweek, Factiva, the World Bank, and industry-specific journals. These secondary sources encompass annual reports, press releases, investor presentations, white papers, certified publications, articles from recognized authors, regulatory notifications, trade directories, and databases. Also, vendor offerings are taken into consideration to inform market segmentation.

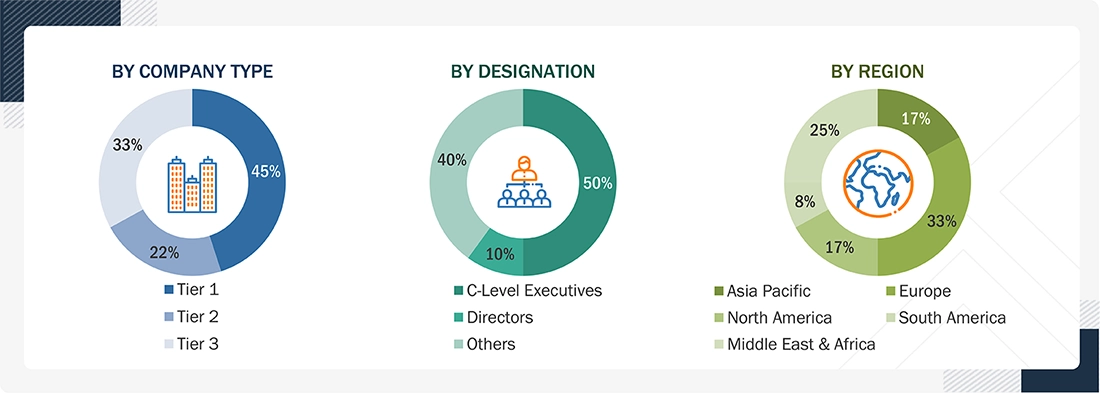

Primary Research

The green hydrogen market comprises several stakeholders, including raw material suppliers, processors, end-product manufacturers, and regulatory organizations, throughout the supply chain. The demand side of this market is characterized by the development of various industries, including mobility, power, chemicals, industrial, and grid injection, among others. The supply side is characterized by advancements in technology and a wide range of diverse applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the total size of the green hydrogen market. These approaches have also been used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following.

The following segments provide details about the overall market size estimation process employed in this study:

- Extensive primary and secondary research was done to identify the key players.

- The value chain and market size in terms of value of the green hydrogen market were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were collected through secondary sources and verified through primary sources.

- All possible parameters that affect the market were covered in this research study and are viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives, is included in this research.

Green Hydrogen Market : Top-Down and Bottom-Up Approach

Data Triangulation

After estimating the overall market size using the above estimation process, the market was split into various segments and subsegments. Data triangulation and market segmentation techniques, along with the market engineering process, were employed to obtain precise market analysis data for each segment and its subsegments.

Research Methodology: The research methodology used to estimate and forecast the global market size began by aggregating data and information from various levels, including country-level data.

Market Definition

According to the US Department of Energy, green hydrogen is carbon-free hydrogen produced through the electrolysis of renewable and nuclear resources. The electrolysis process uses electricity to split water into hydrogen and oxygen, a process that takes place in a unit called an electrolyzer. Electrolyzers are available in small and large sizes. Small-capacity electrolyzers are used for small-scale distributed hydrogen production. In the case of large-capacity electrolyzers, hydrogen production facilities can be tied directly to renewable or other non-greenhouse-gas-emitting forms of electricity production.

Key Stakeholders

- Green Hydrogen Plant Operators and Electrolyzer Manufacturers

- Renewable Energy Project Developers and Utility Power Providers

- Associations and Industrial Bodies such as the Hydrogen Council, ISO/IEC, IRENA, and National Energy Agencies

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the market size of green hydrogen, in terms of value and volume

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the green hydrogen market

- To analyze and forecast the size of various segments (renewable source, technology, end-use industry, distribution channel, production scale, purity level, and storage) of the green hydrogen market based on five major regions—North America, Europe, Asia Pacific, South America, Middle East & Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, including expansions, product launches, partnerships, and acquisitions, to understand the market's competitive landscape

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the green hydrogen market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakdown of the Rest of Europe surgical robots market into Russia, Switzerland, Denmark, Austria, and others

- Further breakdown of the Rest of Asia Pacific surgical robots market into South Korea, Taiwan, and others

- Further breakdown of the Rest of Latin America surgical robots market into Argentina, Colombia, Chile, Ecuador, and others

- Further breakdown of the Southeast Asia surgical robots market into Malaysia, Singapore, New Zealand, and others

Competitive Landscape Assessment

- Market share analysis, by region (North America and Europe), which provides market shares of the top 3–5 key players in the surgical robots market

- Competitive leadership mapping for established players in the US

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Green Hydrogen Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Green Hydrogen Market