Healthcare Analytics Market Size, Growth, Share & Trends Analysis

Healthcare Analytics Market by Type (Predictive, Diagnostic), Application (Claim, RCM, Fraud, Precision Health, RWE, Imaging, Supply Chain, Workforce, Population Health), End User (Payer, Hospital, ACO, ASC), AI, Market Insights, Trends - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global healthcare analytics market, valued at US$44.83 billion in 2024, stood at US$55.52 billion in 2025 and is projected to advance at a resilient CAGR of 24.6% from 2025 to 2030, culminating in a forecasted valuation of US$166.65 billion by the end of the period. Growth is supported by rising healthcare data volumes, expansion of AI and advanced analytics, greater focus on value-based care, population health management, and the need to improve clinical outcomes, operational efficiency, and cost control across healthcare systems.

KEY TAKEAWAYS

-

BY REGIONNorth America dominates the market, with a share of 46.1% in 2024.

-

BY COMPONENTBy component, the services segment is projected to grow at the highest CAGR of 25.1% during the forecast period.

-

BY TYPEBy type, predictive analytics is expected to register the highest CAGR of 26.5% during the forecast period.

-

BY APPLICATIONBy application, the clinical analytics segment is expected to dominate the market.

-

BY END USERBy end user, the providers segment is expected to dominate the market.

-

COMPETITIVE LANDSCAPEOptum Inc., Oracle, and Merative were identified as some of the star players in the market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPELuma Health Inc. and Kyruus Inc., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The healthcare analytics market continues to expand as healthcare organizations increasingly leverage advanced analytics and AI to transform clinical, financial, and operational decision-making. The shift toward value-based care, growing use of real-world data, and demand for predictive insights to manage costs, improve patient outcomes, and optimize resource utilization are key factors accelerating market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The healthcare analytics market is being disrupted by a shift from descriptive, license-based tools to AI-driven, value-based analytics, driven by new use cases, cloud platforms, ecosystem partnerships, with growing adoption across payers, hospitals & clinics, ambulatory surgery centers, pharma & medical device supply chains, and post-acute care organizations to deliver outcome-focused insights.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Favorable government initiatives for electronic health record adoption

-

Growing venture capital investments in startups

Level

-

High cost of analytics solutions

-

Growing concerns about data breach

Level

-

Increasing focus on value-based medicine

-

Growing use of analytics in healthcare

Level

-

Concerns regarding inaccurate and inconsistent data

-

Lack of maintenance of medical records

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Favorable government initiatives for electronic health record adoption

In the US, various federal mandates, such as the American Recovery and Reinvestment Act of 2009 (ARRA) and the implementation of ICD-10 code sets, encourage healthcare organizations to adopt EHRs, focus on the quality of care to meet pay-for-performance initiatives, and improve information exchange between different health systems. The adoption of these initiatives helps providers collect patient data electronically and supports data integration and management of chronic diseases. The EHR Incentive Programs under Medicare and Medicaid offer substantial financial support to eligible professionals (EPs), providing a significant incentive for adopting and meaningfully using electronic health records (EHR).

Restraint: High cost of analytics solutions

One of the most significant hindrances to the growing popularity of the healthcare analytics market is the high cost of advanced analytics solutions, thereby hindering a significant level of adoption, especially within healthcare facilities that are more budget-conscious. The application of healthcare analytics solutions can generate improvements in various healthcare-related decisions, but the high implementation, subscription, or licensing fees are significant barriers to the end users. As a consequence, only the top-notch hospitals that actually possess the financial ability to invest in the applicable solutions are able to make effective use of big data for making informed healthcare-related decisions. Advanced on-premises solutions for the healthcare industry cost more than USD 200,000 to implement, along with the same amount for the annual subscription/licensing fees.

Opportunity: Increasing focus on value-based medicine

According to the American Journal of Managed Care, value-based medicine is the practice of medicine centered on the objective value (improvement in length of life and/or quality of life) provided by healthcare interventions, as determined by using a set of standardized parameters (commonly used to assess value and cost-effectiveness). Future healthcare trends will be more focused on quality, emphasizing the quality of services offered and developing new approaches to value-based medicine and care management. Over time, most hospitals recognize the inefficiencies of traditional methods in patient care, quality assurance, and cost management. As a result, healthcare BI solutions will become a top priority for hospital investments in logistics management, HIE, and predictive disease analysis.

Challenge: Concerns regarding inaccurate and inconsistent data

The importance of EHRs in healthcare analytics projects surpasses that of any other data source. Most patient data enters the health IT ecosystem through EHRs, but as patient data is moved, coded, translated, exchanged, analyzed, and reported, there are numerous opportunities for errors that can seriously affect patient care. Inaccurate data can pose significant health risks to patients and create substantial liability for providers. Without robust, accurate, timely, clean, and complete data, healthcare organizations cannot go beyond basic recordkeeping or develop advanced analytics capabilities. This directly impacts the use of analytical tools and hampers the growth of the healthcare analytics market.

HEALTHCARE ANALYTICS MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Delivers real-world evidence, population health, and clinical performance analytics using claims and EHR data. | Improved clinical outcomes, evidence-based decision-making, support for value-based care. |

|

Provides advanced analytics, AI, and predictive modeling for population health, risk stratification, and fraud detection. | Predictive insights, risk reduction, optimized healthcare operations. |

|

Offers analytics for population health management, care coordination, and payer–provider performance optimization. | Cost reduction, improved care quality, data-driven population health strategies. |

|

Enables clinical, financial, and operational analytics through integrated EHR, data platforms, and cloud analytics. | Enterprise-wide visibility, improved interoperability, scalable analytics infrastructure. |

|

Focuses on EHR-derived analytics to support clinical research, quality measurement, and real-world evidence generation. | Actionable provider insights, improved research efficiency, enhanced care quality reporting. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The healthcare analytics market ecosystem consists of key players (Veradigm, Optum, Oracle) that offer healthcare analytics solutions such as population health analytics, RWE, predictive & analytics, and others; startups (Healthverity, Kyruus); cloud-service providers (Amazon Web Services, IBM Cloud), supporting scalable deployment, secure data exchange, and enterprise-wide access across multi-site healthcare networks; and end users, including healthcare providers, who are adopting healthcare analytics solutions to improve clinical outcomes, operational efficiency, and cost management.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Healthcare Analytics Market, By Component

In 2024, the services segment held the largest market share in the healthcare analytics market as organizations increasingly depend on implementation, integration, consulting, and managed services to maximize the value of analytics investments. The complexity of healthcare data, need for interoperability across EHRs and legacy systems, regulatory compliance requirements, and shortage of in-house analytics expertise have further increased reliance on service providers, reinforcing services as a dominant revenue contributor.

Healthcare Analytics Market, By Type

In 2024, descriptive analytics held the largest market share in the healthcare analytics market, as it is the most widely adopted approach for summarizing historical and real-time data through dashboards, reports, and performance metrics. Its dominance is driven by immediate usability, lower implementation complexity, and strong demand from healthcare providers and payers to monitor clinical performance, utilization, costs, and quality outcomes, forming the foundation for advanced predictive and prescriptive analytics.

Healthcare Analytics Market, By Application

In 2024, the clinical analytics segment held the largest market share in the healthcare analytics market, driven by its critical role in enhancing patient outcomes, improving care quality, and informing clinical decision-making. The widespread use of clinical analytics across hospitals and healthcare providers for monitoring patient outcomes, reducing clinical variability, supporting evidence-based care, and meeting quality reporting requirements has reinforced it as the most widely adopted analytics segment.

Healthcare Analytics Market, By End User

In 2024, the providers segment held the largest market share in the healthcare analytics market, driven by their growing reliance on data-driven insights to improve clinical outcomes, operational efficiency, and cost management. Hospitals and provider networks increasingly use analytics for clinical performance monitoring, population health management, resource optimization, and value-based care reporting, reinforcing providers as the primary end users of healthcare analytics solutions.

REGION

Asia Pacific to be fastest-growing region in eClinical solutions Market market during forecast period

The Asia Pacific is expected to be the fastest-growing region in the healthcare analytics market, driven by rapid digitalization of healthcare systems, increasing adoption of cloud and AI-based analytics, and rising investments in health IT across emerging economies. Large patient populations, expanding hospital networks, government-led health initiatives, and growing demand for cost-efficient, data-driven care are accelerating analytics adoption across the region.

HEALTHCARE ANALYTICS MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMPANY EVALUATION MATRIX

In the healthcare analytics market matrix, Optum, Inc. (Star) leads with a dominant market position, offering healthcare analytics solutions for population health management, care coordination, cost optimization, and value-based care decision-making. Citiustech Inc. (Emerging Leader) offers capabilities in data engineering, AI-enabled analytics, real-world evidence, and payer–provider analytics, supporting value-based care.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Merative (US)

- SAS Institute Inc. (US)

- Optum, Inc. (US)

- Oracle (US)

- Veradigm LLC (US)

- ExlService Holdings, Inc. (US)

- CitiusTech Inc (US)

- Health Catalyst (US)

- CVS Health (US)

- Inovalon (US)

- McKesson Corporation (US)

- MedeAnalytics, Inc. (US)

- Cotiviti, Inc. (US)

- Datavant (US)

- Definitive Healthcare, LLC. (US)

- Komodo Health, Inc. (US)

- athenahealth(US)

- IQVIA (US)

- Wipro (India)

- Cloudera, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 44.83 Billion |

| Market Forecast in 2030 (value) | USD 166.65 Billion |

| Growth Rate | CAGR of 24.6% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: HEALTHCARE ANALYTICS MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiling of leading healthcare analytics vendors (Optum, SAS Institute, Oracle) covering analytics capabilities, data sources (EHR, claims, RWE), AI/ML maturity, cloud deployment models, and pricing approaches. | Enables competitive benchmarking, identifies capability and data gaps, and supports vendor shortlisting, partnership evaluation, and market positioning strategies. |

| Regional Market Entry Strategy | Assessment of region-wise healthcare analytics adoption, provider digital maturity, data interoperability standards, regulatory frameworks (HIPAA, GDPR), and healthcare analytics ecosystems across North America, Europe, Asia Pacific, and emerging markets. | Reduces entry risk, accelerates compliance readiness, supports localization of analytics platforms, and helps prioritize high-growth healthcare markets. |

| Local Risk & Opportunity Assessment | Evaluation of data privacy and security risks, data quality challenges, AI governance requirements, reimbursement models, and growth opportunities in population health, value-based care, and real-world evidence analytics. | Strengthens risk mitigation planning, informs secure analytics investments, highlights high-growth use cases, and identifies regions with strong analytics adoption potential. |

| Technology Adoption by Region | Mapping adoption of descriptive, predictive, and prescriptive analytics, AI/ML platforms, cloud data lakes, and interoperability with EHR and payer systems across key countries. | Guides region-specific product roadmap, supports phased deployment of advanced analytics capabilities, and aligns offerings with evolving healthcare data and compliance requirements. |

RECENT DEVELOPMENTS

- June 2025 : SAS launched the SAS Health Cost of Care Analytics solution, which uses AI and analytics to help payers and providers analyze care episodes, reduce costs, and improve outcomes.

- April 2024 : Oracle and DNAnexus, Inc. partnered to help scientists and medical experts handle, examine, and work together on multi-omic, clinical, and real-world data.

- February 2024 : Oracle and Obvio Health, Inc. partnered to integrate diverse data in decentralized clinical trials and analyze health data from several sources for clinical trials globally.

Table of Contents

Methodology

The study involved five major activities to estimate the current size of the Healthcare Analytics market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of Healthcare Analytics Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

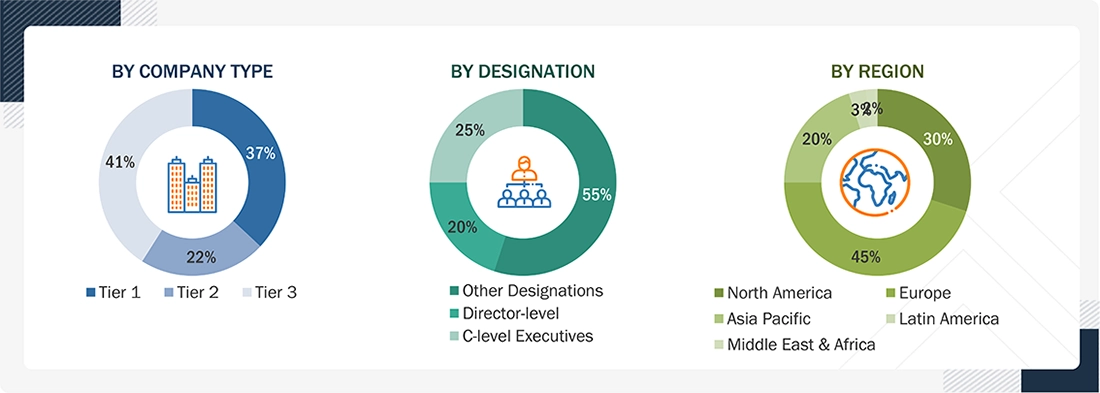

Extensive primary research was conducted after acquiring basic knowledge about the global Healthcare Analytics market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

The following is a breakdown of the primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined on the basis of their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the healthcare analytics market. These methods were also used extensively to estimate the size of various subsegments in the market.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Healthcare Analytics Market.

Market Definition

Healthcare analytics is the efficient use of data and related business insights developed through statistical, quantitative, predictive, comparative, diagnostics, and other emerging applied analytical models. These tools help reveal and understand historical data patterns, predict future outcomes, and provide actionable insights to drive fact-based decision-making for the improved clinical, financial, and operational performance of healthcare organizations.

Stakeholders

- Stakeholders

- Healthcare IT firms

- Healthcare Analytics Vendors

- Health Insurance Exchanges

- Healthcare Payers

- Healthcare Providers

- Venture Capitalists

- Research and Consulting Firms

- Accountable Care Organizations (ACOs)

Report Objectives

- To define, describe, and forecast the global Healthcare Analytics market based on component, type, application, end-user, and region.

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall Healthcare Analytics market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically analyze the market structure profile the key players of the Healthcare Analytics market and comprehensively analyze their core competencies.

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, agreements, sales contracts, and alliances in the Healthcare Analytics market during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Healthcare Analytics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Healthcare Analytics Market

User

Jul, 2022

Which major players have been included in the healthcare analytics market study? .

Noah

Mar, 2022

Can you share the detailed information on technological advancements in the Healthcare Analytics Market?.

Jeremy

Mar, 2022

In what way COVID19 is Impacting the global growth of the Healthcare Analytics Market?.

Christian

Mar, 2022

Can you enlighten us about the key players operating in the global Healthcare Analytics Market?.