Healthcare Digital Signage Market

Healthcare Digital Signage Market by Offering (Hardware, Software, and Services), Product Type (Standalone Displays and Video Walls), Display Size (More than 52 inch, 32 inch to 52 inch, and Less than 32 inch), and Country - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

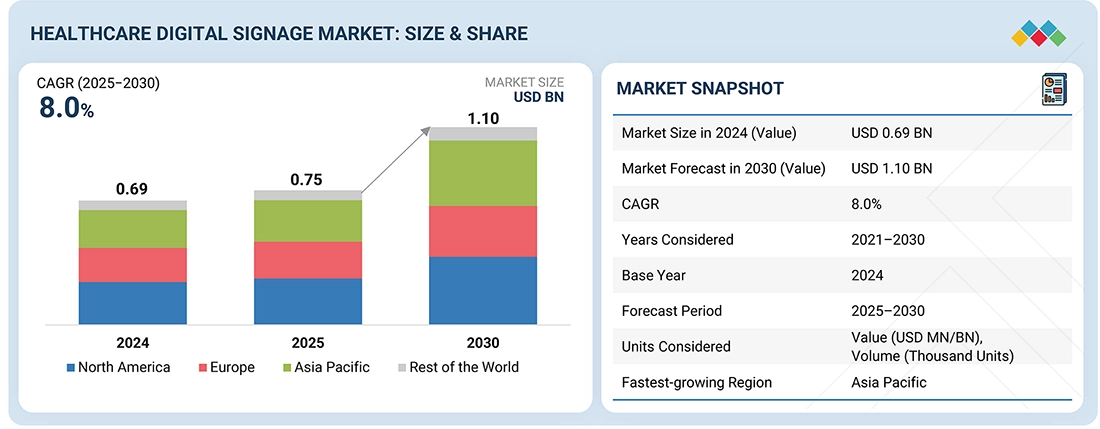

The healthcare digital signage market is projected to grow from USD 0.75 billion in 2025 to USD 1.10 billion by 2030, at an 8.0% CAGR. Increasing emphasis on improving patient experience, rising adoption of dynamic wayfinding and queue management systems, and growing demand for real-time clinical and operational communication across hospitals and clinics are accelerating the adoption of digital signage solutions in the healthcare sector.

KEY TAKEAWAYS

-

By RegionBy country, North America is expected to dominate the market, growing at a CAGR of 8.0% during the forecast period.

-

By Product TypeBy product type, the video walls segment is expected to register the highest CAGR.

-

By OfferingBy offering, the hardware segment is expected to dominate the market.

-

By Display SizeBy display size, the more than 52 inch segment is expected to dominate the market.

-

Competitive LandscapeCompanies Samsung and LG are identified as some of the star players in the healthcare digital signage market, given their strong market share and product footprint.

-

Competitive LandscapeCompanies Intuiface among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The healthcare digital signage market is experiencing steady growth, driven by the rising need for real-time patient communication, digital wayfinding, and workflow optimization across hospitals, clinics, and emergency care facilities. Demand for high-resolution displays, SoC-based signage solutions, and cloud-managed networks is increasing as healthcare providers prioritize operational efficiency, safety compliance, and improved patient experience. Growing partnerships between display manufacturers, CMS providers, and system integrators, along with continued investment in AI-enabled communication tools and interactive kiosk technologies, are transforming digital engagement across the healthcare ecosystem and reshaping the vertical’s technology landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The healthcare digital signage market is undergoing a transformation as hospitals transition from static displays to intelligent, data-driven communication ecosystems. This change is driven by the need for real-time patient updates, digital wayfinding, safety alerts, and operational dashboards that improve efficiency. Innovations like AI-driven messaging, interactive check-in kiosks, 4K/8K medical displays, and cloud-managed signage are reshaping content delivery and workflow automation. Leading providers investing in healthcare-focused digital signage platforms, high-brightness displays, and smart solutions aim to capture emerging opportunities. As digital transformation accelerates, organizations focus on technologies that enhance patient experience, streamline flow, support clinical communication, and enable secure, centrally managed networks, shifting future healthcare signage revenue.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for real-time patient communication

-

Increasing adoption of digital wayfinding and self-service kiosks

Level

-

High upfront deployment and integration costs

-

Limited IT expertise in smaller healthcare facilities

Level

-

Rising investments in AI-driven patient engagement platforms

-

Expansion of telehealth and digital consultation ecosystems

Level

-

Ensuring strict regulatory compliance across healthcare settings

-

Managing real-time content accuracy and system uptime

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for real-time patient communication

The rising demand for real-time patient communication is a major driver of the healthcare digital signage market. Hospitals and clinics increasingly rely on digital displays to deliver instant updates on appointments, wait times, care instructions, and emergency alerts, improving overall patient experience and operational efficiency. Real-time communication reduces administrative workload, minimizes patient anxiety, and enhances workflow coordination across departments. With the growing adoption of connected healthcare systems, the integration of digital signage with EHRs, nurse call systems, and IoT platforms is accelerating. This shift toward immediate, accurate, and automated information delivery continues to fuel strong demand for digital signage solutions in healthcare environments.

Restraint: High upfront deployment and integration costs

Despite strong interest, high initial investment requirements for hardware, networking, CMS platforms, and IT integration remain a major barrier to healthcare digital signage adoption. Hospitals often operate under budget constraints, making it difficult to allocate funds for large-scale deployments, especially across multi-facility networks. Integration with existing hospital information systems, cybersecurity frameworks, and patient data platforms also raises costs. These financial and technical challenges slow market uptake among smaller providers and delay modernization efforts across healthcare environments.

Opportunity: Rising investments in AI-driven patient engagement platforms

Growing investment in AI-powered communication and engagement platforms presents a major opportunity for the healthcare digital signage market. AI enables dynamic, personalized content delivery for patients, automates queue and appointment updates, and supports intelligent triage and emergency alerts. Healthcare providers increasingly seek solutions that improve clinical communication, reduce administrative workload, and enhance patient satisfaction. As AI capabilities expand, ranging from predictive analytics to adaptive messaging, digital signage becomes a central tool for transforming patient experience and operational efficiency.

Challenge: Ensuring strict regulatory compliance across healthcare settings

Ensuring strict regulatory compliance is a significant challenge for the healthcare digital signage market. Hospitals must adhere to standards such as HIPAA, FDA guidelines, and regional data privacy laws, which require the secure handling of patient information and controlled content delivery. Digital signage placed in clinical, diagnostic, or patient-care zones must also meet safety, accessibility, and device-certification requirements. These varied compliance obligations increase system complexity, lengthen deployment timelines, and raise integration costs, often slowing large-scale adoption across healthcare facilities.

Healthcare Digital Signage Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses Samsung & LG digital signage for patient communication, wayfinding, and campus-wide information boards | Improves patient navigation, enhances experience, and standardizes communication |

|

Deploys NEC and BrightSign displays for appointment updates, health education, and internal messaging | Ensures real-time information, boosts patient engagement, and improves communication flow |

|

Utilizes Omnivex CMS for digital directories, wait-time screens, and operational dashboards | Streamlines patient flow, reduces congestion, and enhances operational efficiency |

|

Implements LG & Samsung signage for emergency alerts, doctor schedules, and patient education displays | Enhances transparency, reduces bottlenecks, and improves patient satisfaction |

|

Uses Visix and Omnivex signage for wayfinding, safety notices, and staff communication across facilities | Enables instant updates, supports compliance, and improves public guidance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The healthcare digital signage market ecosystem includes display panel manufacturers such as Samsung, LG Electronics, Sharp/NEC, and Leyard, alongside digital signage solution providers including BrightSign, STRATACACHE, Visix, Omnivex, and Broadsign. These companies deliver high-brightness displays, secure media players, and CMS platforms used for patient communication, wayfinding, emergency alerts, and operational dashboards in hospitals and clinics. Collaboration across hardware suppliers, software vendors, and system integrators is driving innovation and supporting the adoption of data-driven, real-time communication networks across healthcare facilities.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

Healthcare Digital Signage Market, By Product Type

In 2024, standalone displays remained the largest product type in the healthcare digital signage market, supported by their widespread use across hospital lobbies, waiting rooms, diagnostic centers, and emergency departments. Their reliability, ease of installation, and compatibility with existing hospital IT systems make them the preferred choice for patient communication, wayfinding, and real-time alerts. Growing demand for high-brightness, 4K/8K-ready displays continues to strengthen standalone units as the dominant solution in healthcare environments.

Healthcare Digital Signage Market, By Offering

Hardware accounted for the largest share of the healthcare digital signage market in 2024, driven by increasing deployment of advanced LCD, LED, and SoC-based displays across healthcare facilities. Hospitals are investing in high-durability screens, secure media players, and interactive kiosks to modernize patient engagement and streamline communication workflows. Continuous advancements in display technology and rising demand for energy-efficient, medical-grade hardware reinforce its position as the leading offering category within the sector.

Healthcare Digital Signage Market, By Display Size

Displays larger than 52 inches represented the largest display-size segment in 2024, as hospitals and clinics increasingly adopt large-format screens for waiting areas, navigation zones, emergency communication points, and administrative hubs. Their ability to deliver superior visibility, support multi-zone content, and enhance patient awareness makes them essential for high-traffic healthcare settings. The shift toward digital transformation and centralized communication networks continues to boost demand for large-format, ultra-wide healthcare signage displays.

REGION

North America to be the fastest-growing region in healthcare digital signage market during forecast period

The healthcare digital signage market in North America is witnessing strong growth driven by the region’s increasing focus on smart hospital infrastructure, real-time communication, and patient experience enhancement. Rising demand for high-brightness 4K/8K displays, SoC-based signage, and interactive check-in systems is supported by advancements in AI-enabled messaging, digital wayfinding, and emergency alert technologies. The presence of leading signage providers, growing investment in healthcare IT modernization, and expanding adoption of cloud-managed display networks across hospitals and clinics continue to accelerate market expansion across the region.

Healthcare Digital Signage Market: COMPANY EVALUATION MATRIX

In the healthcare digital signage market matrix, Samsung and LG Electronics (Star) lead with strong global presence and advanced healthcare-focused display portfolios, driving large-scale adoption across hospitals, clinics, emergency departments, and diagnostic centers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Samsung Electronics Co., Ltd. (South Korea)

- LG Electronics (South Korea)

- Sharp NEC Display Solutions (Japan)

- Barco (Belgium)

- STRATACACHE (including Scala) (US)

- BrightSign LLC (US)

- Omnivex Corporation (Canada)

- Broadsign (Canada)

- Visix, Inc. (US)

- Daktronics (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.69 Billion |

| Market Forecast in 2030 (Value) | USD 1.10 Billion |

| Growth Rate | CAGR of 8.0% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Region Covered | North America, Europe, Asia Pacific, and Rest of the World. |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hospital Chains & Healthcare Networks |

|

|

| Clinics & Outpatient Centers |

|

|

| Digital Signage Hardware Providers |

|

|

| CMS & Software Vendors |

|

|

| System Integrators & Solution Providers |

|

|

RECENT DEVELOPMENTS

- November 2025 : In November 2025, Aceso Interactive partnered with Samsung Electronics America to deliver advanced patient engagement and digital signage solutions for hospitals. The collaboration focuses on enhancing communication, interactive care experiences, and integrated healthcare display technologies across North American healthcare systems.

- January 2025 : In January 2025, LG Electronics and BrightSign introduced an integrated signage solution featuring LG’s UV5N UHD displays, which run BrightSignOS. The platform offers secure, cloud-managed 4K communication for hospitals, enabling centralized control, high-brightness performance, and reliable enterprise-grade deployment across healthcare environments.

- May 2024 : In May 2024, Boston Medical Group upgraded its digital signage network from AxisTV 9 to AxisTV Signage Suite, improving resolution, functionality, and content delivery. The transition enhances patient and staff communication, modernizing the organization’s digital information infrastructure across its healthcare facilities.

Table of Contents

Methodology

The study involved four major activities in estimating the healthcare healthcare digital signage market size. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the healthcare digital signage market. The secondary sources included the Digital Signage Federation, International Sign Association, IAA Global, annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the healthcare digital signage market has been obtained from the secondary data available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry's supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends and key developments undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information about the market across four main regions—Asia Pacific, North America, Europe, and the Rest of the World (the Middle East & Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and other related key executives from major companies and organizations operating in the healthcare digital signage market size or related markets.

After completing market engineering, primary research was conducted to gather information and verify and validate critical numbers from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most primary interviews have been conducted with the market's supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches and several data triangulation methods have been used to estimate and validate the size of the overall healthcare digital signage market and other dependent submarkets. Key players in the market have been identified through secondary research, and their market positions in the respective geographies have been determined through both primary and secondary research. This entire procedure includes studying top market players’ annual and financial reports and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives for key insights (qualitative and quantitative).

All percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. Data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Digital signage refers to the installation of digital signs, billboards, and other display devices to provide visual information. Its major function is to communicate informational or promotional messages. The goal of healthcare digital signage is to deliver specific messages to specified groups of individuals, such as internal office teams, school children, or potential brand customers.

This digital setup displays multimedia or video content for information or advertising objectives. It uses LCD, OLED, direct-view LED, micro-LED, and other displays, such as projection cubes and e-paper, to display digital photos, videos, web sites, weather data, restaurant menus, and text. It is employed in a variety of venues, including retail establishments, transportation networks, public places, museums, stadiums, hotels, restaurants, and office buildings.

Key Stakeholders

- Raw material suppliers

- Digital Signage Hardware Providers

- Digital Signage Software Providers

- Digital Signage Service Providers

- Display Panel Manufacturers

- Display Material and Component Suppliers

- Research organizations

- Original equipment manufacturers (OEMs)

- Technology investors

- Analysts and strategic business planners

- Government bodies, venture capitalists, and private equity firms

- End users

Report Objectives

- To define, describe, estimate, and forecast the healthcare digital signage market size, in terms of value, on the basis of offering, display size, product type, installation location, application, and enterprise size.

- To define, analyze and forecast the healthcare digital signage market size, by product type, in terms of volume

- To forecast the market size of concerned segments with respect to 4 main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide a detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the value chain, market ecosystem; trends/disruptions impacting customer’s business; technology analysis; pricing analysis; Porter’s five forces model; key stakeholders & buying criteria; case study analysis; trade analysis; patent analysis; key conferences & events, 2024–2025; regulations related to the healthcare digital signage market; size and investment and funding scenario.

- To profile key players and comprehensively analyze their market ranks and core competencies, along with detailing the competitive landscape for market leaders

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

- To track and analyze competitive developments such as product launches and acquisitions, and research and development (R&D) activities in the healthcare digital signage market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape to the market leaders

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5 players) based on various blocks of the supply chain

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Healthcare Digital Signage Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Healthcare Digital Signage Market