High-performance Polyamides Market

High-performance Polyamides Market by Type (PA 11, PA 12, PA 9T, PA 46, PARA, PPA, Other Types), Manufacturing Process (Injection & Blow Molding), End-Use Industry (Automotive, Electrical & Electronics, Medical, Industrial) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The High Performance Polyamide (HPPA) market is projected to reach USD 2.72 billion by 2029 from USD 2.08 billion in 2024, at a CAGR of 5.5% from 2024 to 2029. The global high-performance polyamides market is projected to experience significant and rapid growth throughout the forecasted period. This surge in demand can be attributed to a variety of factors, particularly the increasing use of high-performance polyamides across several key industries. Notably, sectors such as automotive, electrical and electronics, medical, and industrial applications are driving this upward trend, as manufacturers seek materials that offer superior strength, heat resistance, and durability.

KEY TAKEAWAYS

-

BY TYPEThe type segment of high performance polyamides includes PA12, PA11, PA46, PA9T, PARA, PPA and other types. Polyamide 12 (PA12) is predicted to be the segment with the highest growth rate due to lightweight properties, chemical resistance, and processability that enable the new application trends.

-

BY MANUFACTURING PROCESSThe manufacturing process includes injection molding and Blow molding. Injection molding is estimated to have the highest CAGR for high-performance polyamides due to its efficiency, affordability, and capacity for the manufacture of complex, precise components in big numbers. Its processing allows lightweight yet tough parts with specifications compliant with the challenging demands of various sectors like automobile, electronics, and consumer appliances.

-

BY END-USE INDUSTRYThe end-use industry includes automotive, electrical & electronics, medical, industrial, and other end-use industries. As demand for high-performance plastics to be used in medical devices, surgical instruments, and diagnostic equipment continues to increase, the medical market is the fastest-growing sector in the HPPA. These materials have excellent chemical resistance, sterilizability, and biocompatibility that is necessary for healthcare applications. Furthermore, healthcare infrastructure across the globe which lets the incorporation of advanced medical procedures are all resulting in more HPPA components being used in these applications.

-

BY REGIONThe High Performance Polyamide market covers Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa. Asia Pacific is the fastest-growing region in the HPPA market due to rapid industrialization, expanding manufacturing capabilities, and growing demand across automotive, electronics, and medical sectors.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, BASF (Germany), Arkema S.A. (France), and Celanese Corporation (US)have entered into a number of agreements and partnerships to cater to the growing demand for High Performance Polyamide across innovative applications.

The growing demand for high-performance polyamides (HPPA) is owing to their capacity to address the transforming requirements of various industries that need lightweight, strong, and high-performance components. Materials such as these are crucial in the automotive sector for reducing vehicle weight while maintaining strength; this helps with better fuel economy, lower emissions, and better performance, especially in the fast-growing electric vehicle market. High-performance polyamides are of high value in electronics and electrical applications due to their great thermal stability and insulating properties. Such materials resist extreme operating conditions, thus serving well for their intended uses, including connectors, circuit boards, or wire insulation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions affect consumers' businesses. These shifts influence the revenues of end users. As a result, the revenue changes for end users are likely to impact the revenues of High Performance Polyamide suppliers, which, in turn, affect the revenues of High Performance Polyamide manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand in automotive industry

-

Increasing demand for recyclable materials

Level

-

Presence of alternative materials

-

Higher cost of high performance polyamides

Level

-

Emerging applications in Evs

-

Ability to substitute metals

Level

-

Difficulty in processing high performance polyamides

-

Fluctuating raw material prices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Increase in demand for recyclable materials

The growing demand for recyclable material is pushing the high-performance polyamides market, with sustainability being the priority focus for all industries. As there are increased environmental pressures and a demand for circular economy patterns, organizations are now seeking not only long-lasting and high-performing material but also material that are recyclable and sustainable. High-performance polyamides like PA 11 and PA 12 are recyclable and reusable, and hence a more environmentally friendly choice than conventional materials, which are less recyclable. This increased demand for recyclable materials is driven by increasing environmental regulations and consumer pressure for greener products, especially in the automotive and transportation, electrical & electronics, and other industrial sectors.

Restraint: Presence of alternative materials

The availability of substitute materials is a major hindrance in the high-performance polyamides industry, as businesses are exposed to various substitute materials that can have similar or even better properties depending on the purpose. For example, polyphenylene sulfide (PPS), polyetheretherketone (PEEK), and liquid crystal polymers (LCPs) which are prominent engineering thermoplastics can be used to substitute high-performance polyamides because they possess superior thermal and chemical resistance, along with resistance to extreme conditions. Sometimes, these alternatives even surpass high-performance polyamides in particular applications, where accuracy, resistance to temperature, and chemical stability are paramount.

Opportunity: Emerging application of high-performance polyamides in Evs

The exponential expansion in EV production will provide a stimulus for the high-performance polyamides market. With nearly 14 million EVs sold globally in 2023, a phenomenal 35% year-on-year growth, the automotive industry is rapidly moving toward sustainable mobility. In 2024 EVs accounted for 18% of all car sales, up significantly from 2% in 2018, reflecting the speed of change in the sector. This development leads to a huge demand for high-performance materials that can fulfill the stringent performance requirements of electric vehicles. High-performance polyamides, such as PA 12 and PA 6, are perfectly positioned for this purpose because they can replace metals in key EV components, including battery cases, electrical connections, and under-hood parts. These polyamides provide superior performance at high temperatures, fuel, oil, and other chemical resistance, and the capacity to undergo high mechanical stress, which are all a requirement for EV use.

Challenge:Difficulty in processing high-performance polyamides

The challenge of processing high-performance polyamides is a major problem in the high-performance polyamides market. These compounds, although they provide improved mechanical properties, chemical resistance, and thermal stability, tend to call for special equipment and processing methods that are more complicated than those required for regular polymers. For example, high-performance polyamides such as PA 12, and PA 46 tend to demand more severe processing conditions, close moisture level control, and sophisticated processes like high-pressure blow molding or injection molding. Such demanding processing requirements are costly, restrict throughput, and cause problems in scaling up production for high-volume applications. Also, their natural ability to retain moisture may bring about inconsistency in material performance while being processed, resulting in imperfections such as warping or dimensional instability.

High Performance Polyamides Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Manufacturing of engine intake manifolds, valve covers, and timing chain covers for the BMW 7 Series using high-performance polyamide 66 (PA66) and carbon fiber reinforced polyamide compounds (AKROMID® B3 CGM 15/20). These components replace traditional metal parts in high-temperature engine compartments, requiring materials that can withstand temperatures up to 150°C and resist chemical exposure from engine fluids | Lightweight construction with 20% weight reduction compared to traditional materials, superior thermal stability for consistent performance in engine heat, excellent chemical resistance against oils and coolants. |

|

Construction of structural components and electrical housings for the Airbus A350 XWB using carbon fiber reinforced polymer composites and high-performance polyamide systems. The aircraft utilizes more than 50% composite materials by structure, with polyamide-based components in wing structures, fuselage panels, and electrical/avionics housings that must withstand extreme temperature cycling from -65°C to +95°C during flight operations | 25% reduction in fuel costs through significant weight savings (up to 70% lighter than steel), exceptional dimensional stability under thermal cycling, and superior electrical insulation properties for critical avionics protection. |

|

Implementation of high-performance polyamide electrical housings and insulation components in the SIVACON 8PS LDM busbar trunking system for wind turbines, handling currents up to 8,200A. The system uses halogen-free polyamide compounds that must withstand extreme weather conditions, electrical stress, and maintain insulation integrity | Halogen-free design for environmental safety and low fire load, exceptional electrical insulation up to 1,000V AC rated voltage, weather resistance for long-term outdoor exposure, maintenance-free operation throughout 20+ year turbine lifespan. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The High Performance Polyamide market ecosystem consists of raw material suppliers (Kanto chemical Co., Inc., Gujarat State Fertilizer & Chemicals Limited), High Performance Polyamide manufacturers (Syensqo, BASF), distributor (Tri-Mack, GMM Pfaudler) and end users (General Motors, Boeing). The raw material suppliers provide monomers and amino acids to the high-performance polyamide manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

High Performance Polyamide Market, By Type

Polyamide 12 (PA12) is the most sought-after material in the high-performance polyamides market as a result of its superior property balance that enables it to fit numerous applications. PA 12 is best known for its capacity to substitute metals in numerous industries by providing superior flexibility, lightweight properties, and strength. This makes it particularly attractive in the automotive, electronics, and industrial sectors, where metal parts are being replaced with high-performance plastics to reduce weight and improve fuel efficiency. As compared to other polyamides such as PA 11, PA 12 is superior with respect to moisture resistance, lower density, and ease of processing. Such properties enable PA 12 to exhibit better dimensional stability and performance in all types of environments ranging from humid or extreme conditions.

High Performance Polyamide Market, By Manufacturing Process

Injection molding is estimated to have the highest CAGR for high-performance polyamides due to its efficiency, affordability, and capacity for the manufacture of complex, precise components in big numbers. Its processing allows lightweight yet tough parts with specifications compliant with the challenging demands of various sectors like automobile, electronics, and consumer appliances. High-performance polyamides in injection molding provide superior mechanical strength, thermal resistance, and chemical stability, which are well-suited for applications such as engine parts, connectors, and electrical enclosures. With industries emphasizing product efficiency, minimizing the cost of production, and complying with strict environmental regulations, the growing usage of injection molding for the manufacture of high-performance polyamide components is propelling the market.

High Performance Polyamide Market, By End-use Industry

The automotive sector takes the biggest market share in the high-performance polyamides market as a result of the growing demand for strong, light, and high-performance materials that can enhance vehicle efficiency, safety, and sustainability. High-performance polyamides play a crucial role in producing different automotive parts, such as engine components, fuel systems, electrical connectors, and interior systems, since they possess high thermal stability, chemical resistance, and mechanical properties. Luxury automakers, particularly in markets such as Germany and Spain, are at the forefront of embracing high-performance polyamides to achieve vehicle performance enhancement and weight savings in accordance with tight regulations governing fuel efficiency and emissions. Demand for advanced materials is most sought after in luxury cars, where elite performance, aesthetics, and safety are paramount.

REGION

Asia Pacific to be fastest-growing region in global High Performance Polyamide market during forecast period

Asia Pacific is the largest market for high-performance polyamide with respect to the dominance of the automotive industry, increasing production of electric vehicles, and ongoing industrialization. The Asia Pacific automotive market, majorly in countries like China, Japan, and India, is the largest in the world, with a huge focus on light-weighting programs for improvements in fuel economy and emissions control. Hence, the high-performance polyamides become a necessity for parts such as engine parts, fuel systems, and electrical systems. Moreover, rise in electric cars with government subsidies in countries such as China and India is also spurring up demand for polyamides in lightweight and high-performance battery parts, wire, and interior trim. Moreover, major polyamide manufacturers are building a sizable number of plants in the region, thereby making further investments toward establishing Asia-Pacific as the top destination for high-performance polyamide production and consumption.

High Performance Polyamides Market: COMPANY EVALUATION MATRIX

In the High Performance Polyamide market matrix, BASF (Star) leads due to its robust market share and expansive product range, leveraging its established global presence and consistently strong record in delivering advanced, corrosion-resistant reinforcement materials across multiple applications. Envalior (Emerging Leader) is increasingly gaining market momentum through strategic regional initiatives and innovative product developments, although its reach remains comparatively smaller with a more limited international footprint. While BASF dominates through scale and a diverse portfolio, Envalior shows significant potential to move toward the leaders’ quadrant as demand for high-strength alloys continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 2.13 Billion |

| Market Forecast in 2029 (Value) | USD 2.72 Billion |

| Growth Rate | CAGR of 5.5% from 2024-2029 |

| Years Considered | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: High Performance Polyamides Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Raw Material Supplier |

|

|

| High Perforamce Polyamide Manufacturers |

|

|

| End User |

|

|

RECENT DEVELOPMENTS

- November 2024 : Arkema partnered with Authentic Material to create innovative compounds that combine recycled leather with Rilsan polyamide 11 and Pebax TPE pellets, marketed under the Qilin brand. These new materials can be processed through 3D printing or traditional methods and target key markets such as luxury goods, fashion, consumer electronics, automotive interiors, and sports equipment.

- October 2024 : Evonik and BASF agreed on the first delivery of biomass-balanced ammonia with a reduced CO2 footprint. Evonik planned to incorporate ammonia BMBcert in its production of sustainable products like VESTAMIN IPD eCO and VESTAMID eCO Polyamide 12.

- July 2024 : BASF and Ningbo Yaohua Electric Technology Co., Ltd. collaborated to develop a concept switchgear cabinet emphasizing sustainability and efficiency. This innovative cabinet utilizes BASF’s high-performance materials, specifically Ultramid polyamide and Ultradur polybutylene terephthalate, which are recyclable and more energy-efficient compared to traditional thermosetting materials. The use of these materials enhances the cabinet’s recyclability and reduces carbon emissions throughout its life cycle.

Table of Contents

Methodology

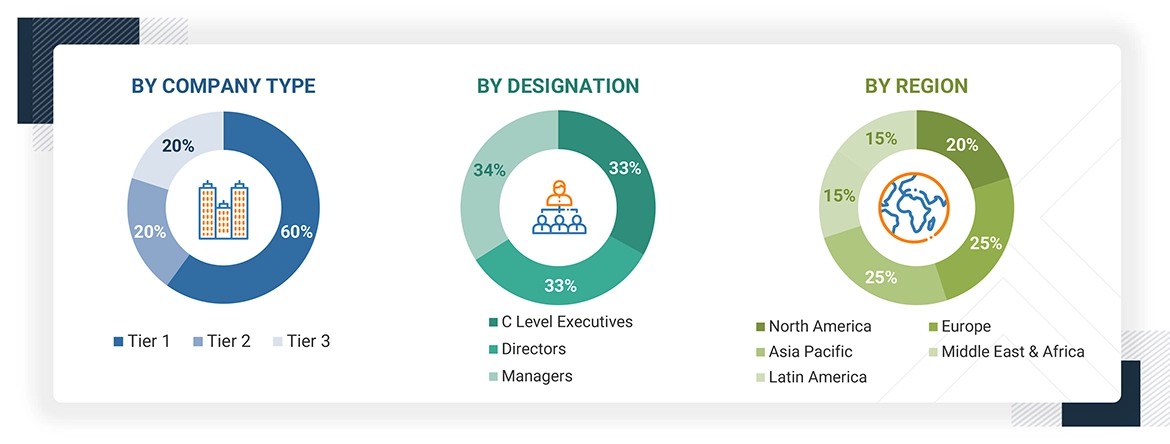

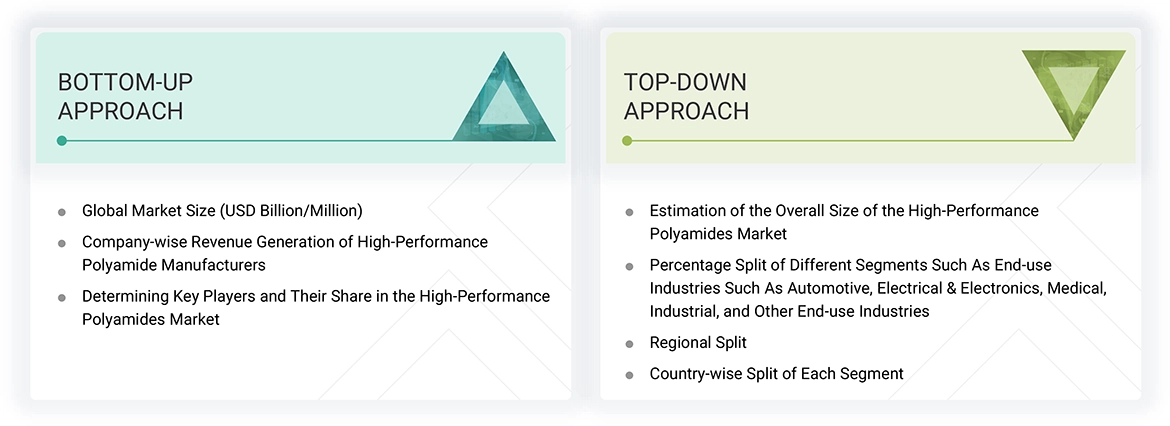

The study involves two major activities in estimating the current market size for the high-performance polyamides market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering high-performance polyamides and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the high-performance polyamides market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the high-performance polyamides market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from high-performance polyamides industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to resin type, fiber type, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking high-performance polyamides services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of high-performance polyamides and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the high-performance polyamides market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on the demand for high-performance polyamides in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the high-performance polyamides industry for each application. For each end-use, all possible segments of the high-performance polyamides market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

High-performance polyamides (also referred to as HPPA) are engineering plastics that possess greater thermal, mechanical, and chemical properties in comparison to other standard polyamides. Their melting point is above 300°F, so they find critical applications in the high end-use sector. The most common types of high performance polyamide include PA11, PA12, PA46, PPA (Polyphthalamide), and PARA (Polyarylamide). These materials are excellent in heat resistance and chemical stability with low moisture absorption and high mechanical strength and are used by the automotive, aerospace, electrical & electronics, medical, and oil & gas industries. Performance under high-stress conditions, including elevated temperatures and harsh environments, underlines their importance in critical applications, such as automotive fuel systems, electrical connectors, and industrial machinery.

Stakeholders

- High-performance polyamides Manufacturers

- High-performance polyamides Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the high-performance polyamides market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global high-performance polyamides market, by type, by fiber type, by manufacturing process, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the High-performance Polyamides Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in High-performance Polyamides Market