Industrial Evaporators Market

Industrial Evaporators Market by Construction Type (Shell & Tube Evaporators, Plate Evaporators), Functionality (Falling Film, Rising Film), End-use Industry (Food & Beverage, Pharmaceutical, Automotive), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global industrial evaporators market is expected to grow from USD 22.10 billion in 2025 to USD 28.14 billion by 2030, with a CAGR of 5.0% during the forecast period. Industrial evaporators are essential in the food & beverage industry. The rising adoption of zero liquid discharge (ZLD) and minimum liquid discharge (MLD) practices across manufacturing sectors is a key driver for this market's growth. These systems are used in various end-use industries, including pharmaceuticals, chemicals and petrochemicals, electronics and semiconductors, pulp and paper, food & beverage, and automotive. Increasing environmental regulations and the global push toward sustainable practices are encouraging industries to adopt advanced evaporators for wastewater treatment and ZLD systems. Additionally, growing water scarcity is prompting a shift toward water reuse and recycling, making evaporators vital components in industrial processes.

KEY TAKEAWAYS

-

BY CONSTRUCTION TYPEThe industrial evaporators market comprises shell & tube and plate evaporators. Shell & tube evaporators hold the largest market share as they offer high durability, operational reliability, and versatility in handling a wide range of process fluids, making them the preferred choice for large-scale industrial and chemical processing applications.

-

BY FUNCTIONALITYFalling film evaporators hold the largest market share as they provide high heat transfer efficiency, gentle product handling, and lower energy consumption, making them ideal for continuous operations in industries such as food processing, chemicals, and wastewater treatment.

-

By END-USE INDUSTRYThe food and beverage industry holds the largest market share as evaporators are widely used for concentration and dehydration processes, enabling efficient production, improved product quality, and extended shelf life.

-

BY REGIONThe industrial evaporators market covers Europe, North America, Asia Pacific, South America, and the Middle East & Africa. The Asia Pacific holds the largest market share due to rapid industrialization, stricter wastewater regulations, and growing investments in zero-liquid-discharge and water reuse technologies across key manufacturing sectors.

-

COMPETITIVE LANDSCAPEKey market players have adopted organic and inorganic strategies in this market. Veolia Water Technologies (France), Sumitomo Heavy Industries (Japan), and SPX Flow (US) are some of the key players in this market. These companies have a strong presence in their domestic regions and have emphasized regional diversification through expansions and inorganic growth to expand their market reach.

The industrial evaporators market is experiencing steady growth, driven by increasing regulatory focus on wastewater reduction, the rising adoption of zero-liquid-discharge systems, and growing investments in sustainable industrial operations. Expanding deployment across chemical, food and beverage, pharmaceutical, and power generation sectors is broadening the market outlook. Ongoing advancements in evaporator design, including energy-efficient MVR and hybrid systems, along with strategic collaborations between technology providers and engineering firms, are reshaping the competitive landscape and supporting long-term market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on end-user industries is driven by changing operational priorities and environmental pressures such as stricter wastewater discharge rules, increasing focus on zero liquid discharge systems, and rising freshwater costs. Key sectors, including chemicals, food and beverage, pharmaceuticals, and power generation, are increasingly adopting evaporation-based treatment technologies to reduce waste and promote water reuse. Downstream stakeholders, including regulators, consumers, and sustainability-focused investors, are demanding measurable improvements in efficiency, compliance, and environmental performance. These trends are transforming industrial operations and investment strategies, creating significant growth opportunities for manufacturers, integrators, and solution providers in the industrial evaporators market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expanding food & beverage industry

-

Rapid adoption of ZLD and MLD in manufacturing sector

Level

-

High initial investment

-

Energy-intensive operation

Level

-

Industrialization in developing countries

-

Rise in demand for desalination

Level

-

Lack of skilled workforce

-

Corrosion and fault issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expanding food & beverage industry

Industrial evaporators are vital in the food & beverage industry for concentrating and preserving perishable goods across sectors like dairy, juice, brewing, and sugar. They remove water without harming nutritional or sensory qualities. Growth is driven by rising demand for processed foods. Evaporators improve shelf life, reduce storage needs, and cut costs, aiding global distribution. Advances in technology—such as falling film and multiple-effect systems—boost energy efficiency and product quality, aligning with sustainable practices. The shift toward preservative-free foods and growing markets in Asia-Pacific, Latin America, and Africa increase demand for these systems, supporting industry expansion.

Restraint: High initial investment

While industrial evaporators offer operational and product-quality advantages for the food & beverage industry, their high capital costs remain a barrier, especially for small and medium-sized enterprises (SMEs). Beyond initial expenses, they need substantial investments in installation, maintenance, and skilled training. Modern evaporator technologies, like multi-effect and mechanical vapor recompression units, are energy-efficient and produce high-quality outputs, but come at premium prices. Customization to industry needs can increase costs further. These financial burdens limit access for businesses in developing regions or startups, often leading them to use less efficient methods that hurt product quality and competitiveness. Additionally, the long ROI can deter investors, as lengthy payback periods and evolving technology reduce confidence. Despite these costs, evaporators are essential for modernizing food processing, boosting shelf life, reducing waste, and supporting sustainable growth.

Opportunity: Industrialization in developing countries

Ongoing industrialization in developing nations is creating growth opportunities for industrial evaporators in the food & beverage industry. Driven by macroeconomic and demographic factors, urbanization and rising incomes boost demand for packaged foods and modern production methods. Local manufacturers face pressure to modernize, adopting technologies like evaporators for product concentration and preservation. Government initiatives, such as India’s “Make in India' and African strategies, promote domestic manufacturing, increasing demand for advanced equipment. Growth in cold chain infrastructure and export-focused agribusinesses further drive investments in value-added processing, with evaporators extending shelf life and enabling export. The emphasis on reducing food loss and enhancing energy efficiency also boosts interest in sustainable evaporator systems, supporting environmental and economic goals.

Challenge: Lack of skilled workforce

The growth of industries like food & beverages, pharmaceuticals, chemicals, and wastewater treatment drives demand for industrial evaporators. However, a major challenge is the shortage of qualified technical professionals needed for design, installation, and maintenance. This skills gap causes delays, cost overruns, safety risks, and hampers the adoption of advanced, energy-efficient systems. Addressing this requires investments in workforce development through collaborations between industry, education, and government. Without these efforts, the long-term growth of the market faces significant risks.

Industrial Evaporators Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Delivers advanced industrial evaporator and crystallization systems designed for wastewater minimization, resource recovery, and process water recycling. These solutions integrate seamlessly with treatment facilities to help industries achieve zero-liquid-discharge goals. | Enables closed-loop water operations, minimizes waste discharge, and ensures long-term compliance with tightening environmental standards. |

|

Provides high-efficiency evaporators engineered for thermal separation, concentration, and purification across chemical, food, and pharmaceutical industries. Its modular systems are optimized for energy recovery and process scalability. | Enhances process efficiency, reduces thermal energy demand, and delivers consistent product yield with lower operational expenditure. |

|

Designs versatile evaporator systems with automated controls and robust materials for continuous and demanding industrial applications. The company emphasizes ease of maintenance and operational reliability. | Improves process reliability, extends equipment lifecycle, and ensures optimal performance under varying industrial load conditions. |

|

Develops compact evaporator units integrating advanced heat exchange and vapor recovery technologies. These are suited for facilities with limited space or specialized process requirements. | Delivers high concentration performance in limited footprints, reduces utility consumption, and supports efficient thermal resource management. |

|

Offers customized multiple-effect and mechanical vapor recompression (MVR) evaporators tailored to energy-intensive industries. Its smart monitoring and predictive maintenance systems ensure long-term operational efficiency. | Achieves superior energy recovery, ensures sustainable plant operation, and lowers overall lifecycle costs through intelligent system integration. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The industrial evaporator ecosystem is characterized by the presence of well-established and financially robust manufacturers. These companies have demonstrated longevity in the industry, offering a diversified product portfolio complemented by comprehensive global sales and marketing networks. Key players in this market include Veolia Water Technologies (France), Sumitomo Heavy Industries, Ltd. (Japan), SPX Flow Inc. (US), Alfa Laval (Sweden), and GEA Group AG (Germany).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Evaporators Market, By End-Use Industry

The food & beverage industry is expected to grow faster than other sectors due to key factors like rapid population growth and urbanization in emerging economies, which boost demand for processed, packaged, and convenience foods. Consumers prioritize convenience, driving demand for ready-made, ready-to-cook, and takeaway options, and expect better processing, packaging, and preservation. A focus on health and wellness also pushes demand for organic, clean-label, and functional foods, prompting companies to innovate with new products and technologies. E-commerce and food delivery boost the need for safe, sustainable packaging, fueling growth. Stringent food safety regulations lead companies to adopt advanced quality control and automation, integrating IoT, AI, and smart packaging to improve shelf life and supply chain transparency. Rising consumer expectations, changing lifestyles, digital adoption, and regulatory demands synergistically drive the industry forward.

Industrial Evaporators Market, By Construction Type

Among evaporators, plate evaporators are expected to grow fastest, driven by demand for compact, energy-efficient systems in industries like food, pharma, and HVAC. They offer high thermal performance and space efficiency, with a larger surface area for faster heat transfer and lower energy use. Their small size suits space-limited environments, appealing to facilities focused on flexibility and cost savings. As environmental and regulatory pressures increase, industries shift from traditional shell-and-tube systems to eco-friendly plate evaporators that support green manufacturing. Technological improvements—like enhanced corrosion resistance and easier maintenance—expand their applications. As industries aim for cost savings, energy efficiency, and sustainability, adoption of plate evaporators will rise, making them vital for the industry's growth.

Industrial Evaporators Market, By Functionality

The MVR segment is expected to grow fastest in the industrial evaporators market due to its energy efficiency and demand for sustainable processes. MVR plants compress and reuse vapor, consuming less power than thermal systems. This efficiency is vital in energy-heavy industries like food, chemicals, pharmaceuticals, and wastewater treatment, where reducing operational costs is key. Stricter environmental regulations, including limits on greenhouse gases and waste, are driving MVR adoption. Governments and regulators favor cleaner, energy-efficient technologies to lower carbon footprints. The focus on circular economy principles also boosts MVR's use for heat recycling and water conservation. Advances in compressor design and automation have also improved system reliability and scalability, making them accessible to small and medium-sized businesses.

REGION

Asia Pacific to register highest CAGR during forecast period

The Asia Pacific industrial evaporators market is anticipated to experience rapid growth during the forecast period, influenced by economic, industrial, and environmental factors. Leading nations such as China, India, and Japan are leveraging accelerated industrialization and urbanization to advance their manufacturing sector, which consequently drives demand for industrial evaporators across various industries, including food & beverage, pharmaceuticals, chemicals, and electronics. Notably, the food & beverage industry significantly catalyzes this growth. The rising consumer preference for packaged and processed foods necessitates efficient drying and concentration processes, typically facilitated by industrial evaporators. This trend is further supported by increased applications in dairy processing, juice concentration, and protein manufacturing, aligning with evolving lifestyle patterns and rising disposable income in the region. Environmental sustainability is also a pivotal consideration, as stricter regulations regarding wastewater treatment and ZLD initiatives compel industries to adopt modern evaporator technologies. These systems ensure compliance and enhance operational efficiency by reducing water consumption and minimizing environmental impact. Additionally, technological advancements, such as mechanical vapor recompression (MVR) and falling film evaporators, are gaining traction due to their high energy efficiency and compatibility with heat-sensitive materials, positioning them favorably within a competitive market landscape.

Industrial Evaporators Market: COMPANY EVALUATION MATRIX

In the industrial evaporators market matrix, Alfa Laval (Star) leads with a strong market share and broad product footprint, supported by its advanced evaporation technologies and integrated thermal solutions across the chemical, food, and wastewater treatment industries. Saltworks Technologies, Inc. (Emerging Leader) is gaining visibility with its innovative modular evaporator systems and focus on zero-liquid-discharge applications, strengthening its position through technology-driven efficiency and sustainability. Other notable players are actively expanding their offerings to meet rising demand for energy-efficient, scalable, and regulation-compliant evaporation systems, positioning themselves to capture future growth opportunities in this evolving market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 21.19 BN |

| Market Forecast in 2030 (Value) | USD 28.14 BN |

| Growth Rate | 0.05 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Industrial Evaporators Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Chemical & Petrochemical Plants | Assessment of evaporator system performance under varying effluent compositions. | Improved process efficiency and thermal energy utilization. |

| Food & Beverage Manufacturers | Evaluation of energy-efficient evaporators for concentration and byproduct recovery. | Lower energy consumption and improved yield quality. |

| Pharmaceutical Companies | Performance benchmarking of evaporators for solvent recovery and water-for-injection (WFI) reuse. | Ensures regulatory compliance and process consistency. |

| Electronics & Semiconductor Manufacturers | Feasibility assessment of evaporator systems for ultra-pure water recovery and metal-laden wastewater treatment. | Enables high recovery of process water for reuse. |

| Food & Beverage Producers | Evaluation of evaporators for product concentration, flavor retention, and byproduct recovery. | Increases yield quality and reduces energy intensity. |

| Desalination & Water Reuse Facilities | Evaluation of evaporator technology integration in brine minimization and zero-liquid-discharge setups. | Expands water reuse capacity and reduces discharge volumes. |

RECENT DEVELOPMENTS

- April 2025 : Veolia Water Technologies and Tampa Bay Water entered into an agreement. Veolia will lead the design, construction, and operation of an expansion project to increase drinking water capacity for customers in the Gulf Coast region of Florida. This project has increased Veolia’s activities in the US municipal water industry, provided experience with large-scale water infrastructure in the region, and added to its list of completed projects in North America.

- January 2025 : De Dietrich launched a cutting-edge short-path evaporation system specifically engineered for vegetable oil refining. This advanced system is designed to extract high-value compounds, such as squalene, sterols, tocopherols, and omega-3 fatty acids.

- January 2025 : The GEA Dairy Evaporator eZero reflects GEA’s dedication to sustainability by reducing reliance on fossil fuels and supporting the transition to renewable energy. The system can reduce energy consumption by up to 60% and reduce CO2 emissions by up to 100% compared to traditional MVR evaporators, depending on specific plant operations, resource availability, and the electricity emission factor. When powered by green electricity, the system can achieve net-zero CO2 emissions, potentially including offsetting measures based on the energy provider’s mix.

- April 2024 : H2O GmbH expanded its VACUDEST system range to meet the growing demand for larger wastewater treatment solutions, introducing the new VACUDEST XL 22,500, which treats 22,500 cubic meters of wastewater annually. This new model bridges the gap between the XL 16,000 and the top-tier XXL 30,000.

- March 2020 : GEA Group AG secured a follow-up contract from Utkal Alumina International to supply a third line of multi-flash evaporators for its alumina refinery in Orissa, India. This expansion aimed to increase the refinery’s production capacity, with GEA providing advanced technology to support high-throughput, energy-efficient processing.

Table of Contents

Methodology

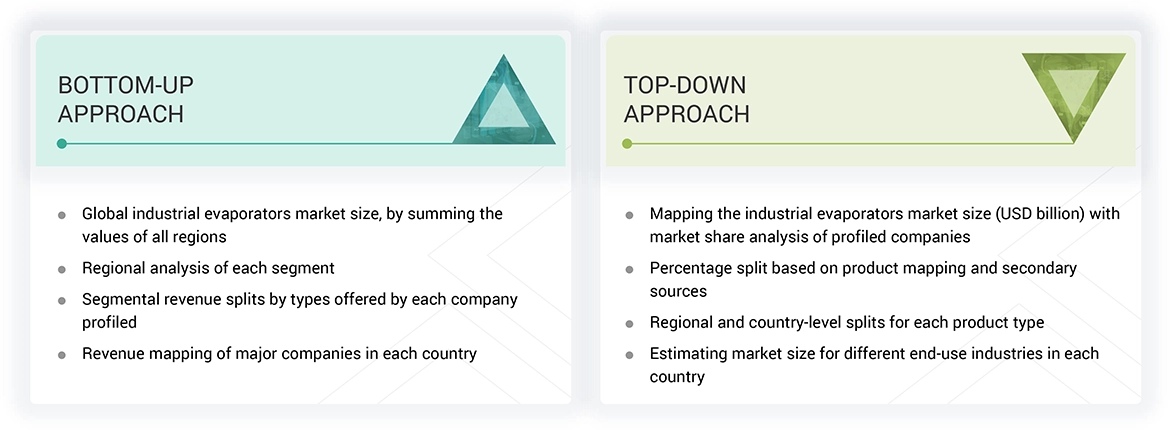

The study involved four major activities in estimating the size of the industrial evaporators market. Exhaustive secondary research was done to collect information related to the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across the industrial evaporators value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; Industrial evaporators manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about key developments from a market-oriented perspective.

Primary Research

The industrial evaporators market comprises several stakeholders, such as raw material suppliers, technology support providers, Industrial evaporators manufacturers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the industrial evaporators market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

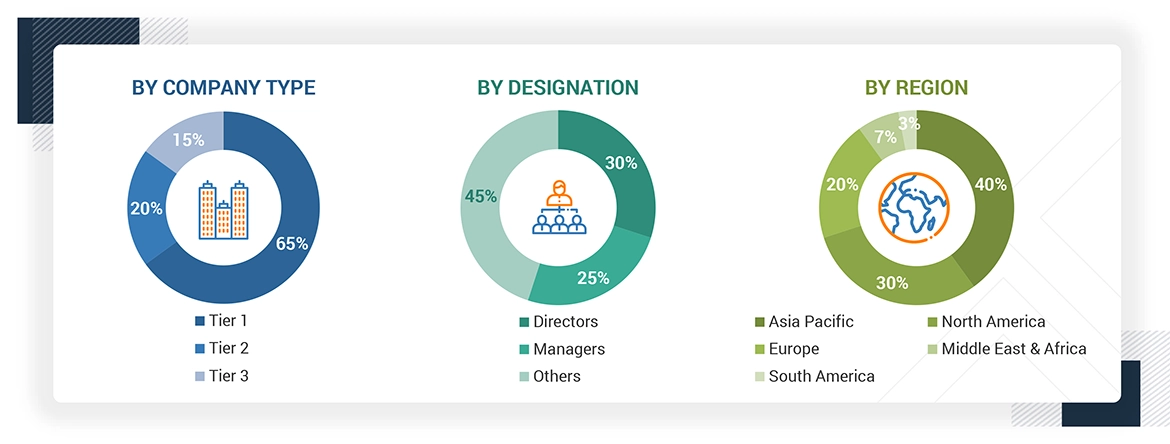

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the industrial evaporators market. These approaches were also used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following: The following segments provide details about the overall market size estimation process employed in this study:

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the industrial evaporators market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key quantitative and qualitative insights.

Global Industrial Evaporators Market Size: Bottom-Up and Top-Down Approaches

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to the Handbook of Evaporation Technology, industrial evaporators are specialized process equipment designed primarily for the concentration of solutions containing target products or for the recovery of solvents, predominantly water. These systems are fundamentally based on three essential principles: heat transfer, vapor-liquid separation, and energy efficiency. Heat is typically delivered through the condensation of steam, which is transferred indirectly via metal surfaces. The selection of construction materials is influenced by several factors, including the frequency of cleaning required and the corrosiveness of the fluids in use. Common materials employed in the construction of these systems include copper, aluminum alloys, carbon steel, various grades of stainless steel (304 and 316), high-alloy or duplex stainless steels, titanium, nickel, graphite, and rubber-lined carbon steel.

In operation, the feed solution is introduced into the evaporator, where it traverses a heating surface. The application of heat induces the evaporation of water, resulting in a more concentrated solution. This vapor is subsequently separated and condensed, while the concentrated liquid either undergoes further processing in an additional evaporator or is collected as the final product. A typical industrial evaporator comprises four principal components: a heating unit, a concentration chamber, a vapor separation section, and a condenser. Given their high efficiency, industrial evaporators are extensively utilized across various industries involved in liquid and chemical processing. They are particularly advantageous in applications that require low-temperature operations, such as food and pharmaceutical production, and play a significant role in effluent and wastewater treatment.

Stakeholders

- Raw material manufacturers

- Technology support providers

- Manufacturers of industrial evaporators

- Traders, distributors, and suppliers

- Regulatory bodies and government agencies

- Research & development (R&D) institutions

- End-use industries

- Consulting firms, trade associations, and industry bodies

- Investment banks and private equity firms

Report Objectives

- To analyze and forecast the market size of industrial evaporators market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global industrial evaporators market based on construction type, functionality, end-use industry, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on major regions: Asia Pacific, Europe, North America, Middle East & Africa, and South America, along with their respective key countries

- To track and analyze the competitive developments, such as agreements, product launches, and expansions, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Key Questions Addressed by the Report

What is the key driver for the industrial evaporators market?

The expanding food & beverage industry, rapid adoption of ZLD (Zero Liquid Discharge) & MLD (Minimal Liquid Discharge) in the manufacturing sector, and booming chemical and pharmaceutical industries are driving forces for the industrial evaporators market.

Which region is expected to register the highest CAGR in the industrial evaporators market during the forecast period?

Asia Pacific is estimated to register the highest CAGR during the forecast period.

Which is the major end-use industry of industrial evaporators?

The major end-use industry of industrial evaporators is food & beverage, where they are extensively used for concentrating liquids such as fruit juices, dairy products, and sauces, as well as for preserving products by reducing water content to inhibit microbial growth and ensure consistent quality.

Who are the major players in the industrial evaporators market?

Key players operating in the market include Veolia Water Technologies (France), Sumitomo Heavy Industries, Ltd. (Japan), SPX Flow Inc. (US), Alfa Laval (Sweden), and GEA Group AG (Germany).

What is the total CAGR expected to be recorded for the industrial evaporators market from 2025 to 2030?

The market is expected to record a CAGR of 5.0% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Evaporators Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Evaporators Market