Intelligent Robotics Market Size, Share, Trends and Growth

Intelligent Robotics Market by Robot Type (Industrial Robots, Service Robots (Ground, Underwater), Collaborative Robots), Mobility (Fixed, Mobile), Application (Personal & Domestic Assistance, Industrial Automation and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The intelligent robotics market is projected to reach USD 50.33 billion by 2030 from USD 13.99 billion in 2025, at a CAGR of 29.2% from 2025 to 2030. The increasing focus on industrial automation is a key driver for the intelligent robotics market, as manufacturers are increasing productivity, reducing operating costs, and improving the accuracy of production processes.

KEY TAKEAWAYS

- The Asia Pacific intelligent robotics market accounted for a 42.0% revenue share in 2024.

- By mobility type, the mobile robots segment is expected to account for the largest market share in 2030.

- By robot type, service robots segment to account for largest market share of 81.9% in 2024.

- By application, industrial automation segment is expected to register the highest CAGR of 34.6% during forecast period.

- Company Intuitive Surgical, iRobot Corporation, and ECOVACS were identified as some of the star players in the intelligent robotics market (global), given their strong market share and product footprint.

- Companies Pal Robotics and Agile Robots SE, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialised niche areas, underscoring their potential as emerging market leaders

The intelligent robotics market is witnessing steady growth, driven by the increasing requirement for health services automation acts as a significant driver for the intelligent robotics market. Hospitals and clinics are adopting intelligent robots for surgical help, patient monitoring, and logistics to increase efficiency and accuracy. These robots help reduce human error, support overburdened medical staff, and ensure consistent care delivery.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The intelligent robotics market is undergoing a transformative shift driven by a growing demand for advanced, multi-functional systems. Traditional sources of revenue, such as fixed automation systems and single-task robots, are gradually replaced by more dynamic solutions enabled by technologies such as Al, IoT, and machine learning. This transition generates new revenue streams, as robotics solutions evolve to meet the diverse and complex needs of various end-user industries. Key innovation hotspots, such as industrial automation, healthcare automation, and consumer robotics, are reshaping the future revenue mix. These advancements directly influence industries including logistics, agriculture, and defense, ultimately leading to measurable shifts in client revenues. The evolving landscape prioritizes personalization, efficiency, and ROI, underscoring the need for flexible, intelligent robotics systems tailored to specific applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid digital transformation and AI integration in critical sectors

-

Rising adoption of composite materials for enhanced performance and durability.

Level

-

Reluctance to adopt new technologies across SMEs due to financial and operational barriers

-

Complexities associated with interoperability and integration of robotics systems

Level

-

Shortage of skilled workforce and high labor costs

-

Rising implementation of smart city projects

Level

-

High technical complexity and commercialization issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid digital transformation and AI integration in critical sectors

Rapid virtual transformation and the deployment of artificial intelligence (AI) in crucial sectors are drastically accelerating the growth of the intelligent robotics market. As industries transition to accelerated operations and production ecosystems, the demand for robotics systems capable of real-time decision-making, predictive analytics, and self-sustaining functioning has intensified. Intelligent robots, powered by AI algorithms and devices, are deployed to perform complex responsibilities with greater performance, adaptability, and accuracy than conventional robotic systems.

Restraint:Reluctance to adopt new technologies across SMEs due to financial and operational barriers

There is limited adoption of intelligent robotics by small- and medium-sized businesses (SMBs) due to economic and operational obstacles, which act as a large restraint in market development. Investment costs with high promotion, including purchases, integration, and maintenance of intelligent robot systems, often exceed the capital budget for small companies.

Opportunity: Rising implementation of smart city projects

The implementation of smart city projects provides a key opportunity for the intelligent robotics market, as urban centers quickly use advanced technologies to increase infrastructure, services, and quality of life. Smart cities rely on automation, real-time data, and paired systems to create a strong demand for intelligent robotics in areas such as public safety, waste management, transport, monitoring, and maintenance.

Challenge: High technical complexity and commercialization issues

High technical complexity and challenges with commercialization provide significant obstacles to the broad use of intelligent robotics. Developing intelligent robots requires the integration of advanced hardware components, software algorithms, and AI functions, all of which must be designed to function reliably in complex and dynamic industrial environments e . Ensuring accurate coordination between sensors, actuators, machine learning models, and control systems requires R&D investment and engineering expertise, making the development process more expensive

Intelligent Robotics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Robotic-assisted minimally invasive surgery using the da Vinci system with advanced 3D visualization and instrument precision. | Enhanced surgical dexterity, increased procedural precision, shorter recovery, reduced patient trauma. |

|

AI-powered floor-cleaning robots (DEEBOT) with object recognition and self-cleaning mopping systems. | Automated, efficient cleaning, remote monitoring, smart mapping, enhanced safety and convenience |

|

Consumer robot vacuums with advanced navigation, mapping, suction technologies, and debris compaction. | Superior floor cleaning, adaptive to home layouts, user-friendly design, hands-free operation. |

|

Industrial robots for material handling, welding, painting, and assembly, enabling high flexibility and low maintenance. | Flexible automation, long maintenance intervals, increased safety, reduced production downtime. |

|

High-precision robots for manufacturing, logistic automation, and electronics assembly. | Consistent productivity, reliable material handling, enhanced accuracy, safety in hazardous tasks. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The intelligent robotics ecosystem highlights the categories, products, and new emerging technologies that would boost the demand for intelligent robotics. A snapshot of the market ecosystem is provided below. Under component, technology & software suppliers, key players, such as NVIDIA Corporation (US), Advanced Micro Devices, Inc. (US), and Intel Corporation (US), enhance the upstream landscape. In the designers & manufacturers segment, firms such as Intuitive Surgical (US), ECOVACS (China), iRobot Corporation (US), and ABB (Switzerland) expand coverage across industrial, collaborative, and robotics. For system integrators, ABB (Switzerland), and FANUC CORPORATION (Japan), among others, provide the inclusion that reflects deeper penetration in industrial automation and process integration. On the distributors front, Arrow Electronics, Inc. (US), and Avnet, Inc. (US) represent critical channels for component availability and product reach. Finally, end use can be broadened to include major robotics adopters such as Apollo Hospitals (India), Amazon.com, Inc. (US), and DHL (Germany), ensuring a more complete and industry-representative ecosystem view.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Intelligent Robotics Market, By Robot Type

Service robots segment to account for largest market share in 2030. In healthcare, service robots are increasingly applied to monitoring patients, assisting during surgery, and taking care of elderly people, offsetting labor shortages and providing precision in critical operations. In logistics, autonomous mobile robots (AMRs) and drones optimize warehouse operations, last-mile delivery, and inventory management. The increasing need for contactless services, particularly in the post-pandemic era, has also been responsible for driving adoption in retail and public applications. Falling sensor prices, better battery performance, and greater cloud connectivity are expanding service robot affordability and scalability. With the focus of industries on safety, efficiency, and customer satisfaction, the demand for smart service robots is anticipated to be greater than other categories, driving their adoption in worldwide intelligent robotics.

Intelligent Robotics Market, By Mobility

Mobile robots segment is expected to account for the largest market share in 2030. The use of mobile robots is propelled by their applications in logistics, healthcare, defense, and manufacturing industries. These robots, with the ability to navigate changing environments on their own, are best suited for applications such as warehouse transportation, hospital delivery, and monitoring.

Intelligent Robotics Market, By Application

Personal & domestic assistance segment is expected to attain largest market size in intelligent robotics market during forecast period. The fast-growing AI developments fuel the growth of the personal & domestic assistance segment, the increasing demand from consumers for convenience, and the expanding older population worldwide. Intelligent robots within this category are increasingly adopted for applications ranging from cleaning and caregiving to home monitoring and personal companionship. These robots utilize machine learning, speech recognition, and environment sensing technologies to offer sophisticated functions with high autonomy and flexibility in residential settings.

REGION

Asia Pacific to be fastest-growing region in global intelligent robotics market during forecast period

The Asia Pacific intelligent robotics industry is fueled by rapid industrialization, favorable government policies, and robust technology adoption in leading economies such as China, Japan, South Korea, and India. The region emerges as the electronics, automotive, and semiconductor manufacturing hub globally. Industries are moving rapidly to adopt smart robotics to boost productivity, quality, and operating efficiency. China, specifically, is heavily investing in robotics as part of its “Made in China 2025” initiative to minimize dependence on overseas automation technologies and dominate advanced manufacturing.

Intelligent Robotics Market: COMPANY EVALUATION MATRIX

In the intelligent robotics companies matrix, Intuitive surgical (Star) leads with a strong market share and extensive product footprint, These are the leading market players in terms of new developments, such as product launches, innovative technologies, and the adoption of strategic growth plans. Tesla (Emerging Leader) is gaining visibility with its highly focused product portfolio, strengthening its position through innovation and product offerings. While Intuitive surgical dominates through scale and a diverse portfolio, Tesla shows significant potential to move toward the leaders’ quadrant as demand for intelligent robotics continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 11.19 Billion |

| Market Forecast in 2030 (Value) | USD 50.33 Billion |

| Growth Rate | CAGR of 29.2 % from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Intelligent Robotics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Industrial Automation Company |

|

|

RECENT DEVELOPMENTS

- March 2025, : ABB expanded its portfolio of robotic solutions for logistics and e-commerce supply chains by adding two AI-powered functional modules to its Item Picking family. It features ABB’s AI-based vision technology, which has been tested by leading fashion retail and logistics companies. The Fashion Inductor and Parcel Inductor offer solutions for two of the most critical logistics processes, i.e., item picking and sorter induction.

- March 2025 : NVIDIA Corporation released NVIDIA Holoscan 3.0, the real-time AI sensor processing platform. This latest version provides dynamic flow control, empowering developers to design more robust, scalable, and efficient systems. With physical AI rapidly evolving, Holoscan 3.0 is built to adapt, making it easier to tackle dynamic environmental challenges.

- February 2025 : Dassault Systèmes joined mosaixx, KUKA AG’s digital ecosystem for industrial software solutions, offering KUKA customers an easy way to purchase and use Dassault Systèmes’ 3DEXPERIENCE platform and applications. Dassault Systèmes and KUKA AG, along with KUKA Digital, are creating opportunities for companies to drive the development of more efficient and adaptable solutions to transform operations.

Table of Contents

Methodology

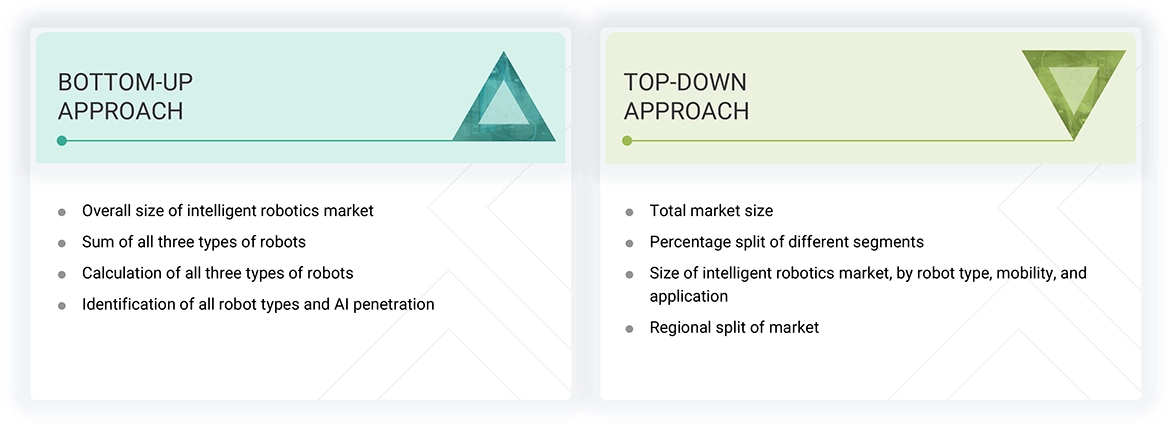

The study involved major activities in estimating the current market size for the intelligent robotics market. Exhaustive secondary research was done to collect information on the intelligent robotics market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the intelligent robotics market.

Secondary Research

The secondary research for this study involved gathering information from various credible sources. These included company annual reports, investor presentations, press releases, whitepapers, certified publications, and articles from reputable associations and government publications. Additional data was obtained from corporate filings, professional and trade associations, journals, and industry-recognized authors. Research from consortiums, councils, and gold- and silver-standard websites, directories, and databases also contributed to the qualitative framework. Key global sources such as the International Trade Centre (ITC) and the International Monetary Fund (IMF) were consulted to support and validate the market analysis.

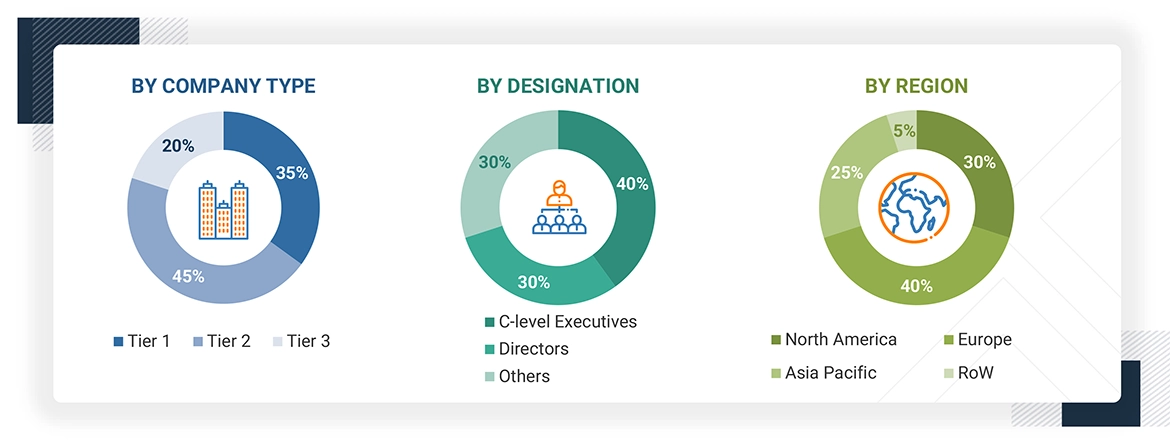

Primary Research

Extensive primary research has been conducted after gaining knowledge about the intelligent robotics market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand side (end-use industries) and supply side (equipment manufacturers, integrators, and distributors) across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 60% and 40% of the primary interviews were conducted with the parties on the demand and supply sides, respectively. This primary data was collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report uses top-down and bottom-up approaches to estimate and validate the intelligent robotics market size and the size of various dependent submarkets. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research processes. This entire research methodology includes the study of annual and financial reports of top players, as well as interviews with experts such as CEOs, VPs, directors, and marketing executives to obtain key insights (quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through the primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed input and analysis from MarketsandMarkets, and finally, the data has been presented in this report. The figures given below show the overall market size estimation process employed for the purpose of this study.

Bottom-Up Approach

- Identifying end users who are either using or are expected to use intelligent robotics

- Analyzing major providers of intelligent robotics and original equipment manufacturers (OEMs), as well as studying their portfolios and understanding different technologies used

- Analyzing historical and current data pertaining to the market, in terms of volume, for each product segment of the intelligent robotics market

- Analyzing the average selling price of intelligent robotics based on different technologies used in different products

- Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the market size

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information

- Tracking the ongoing developments and identifying the upcoming ones in the market that include investments, research and development, product launches, collaborations, and partnerships undertaken, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand intelligent robotics and related raw materials, as well as products designed and developed to analyze the breakup of the scope of work carried out by the key companies’ manufacturing panels

- Verifying and cross-checking the estimate at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts in MarketsandMarkets

Top-Down Approach

- Focusing on top-line investments and expenditures being made in the ecosystems of various end users

- Calculating the market size considering revenues generated by major players through the cost of the intelligent robotics systems

- Segmenting each intelligent robotics application in each region and deriving the global market size based on region

- Acquiring and analyzing information related to revenues generated by players through their key product offerings

- Conducting multiple on-field discussions with key opinion leaders involved in developing various intelligent robotics offerings

- Estimating the geographic split using secondary sources based on various factors, such as the number of players in a specific country and region, and the types of intelligent robotics systems used in robot type, mobility, and application

Intelligent Robotics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market size has also been validated using the top-down and bottom-up approaches.

Market Definition

Intelligent robotics is the field that focuses on creating robots capable of perceiving, understanding, and reacting to their environment autonomously, often using techniques such as machine learning and artificial intelligence. These robots can execute programmed tasks, learn from experience, adapt to new situations, and make decisions based on their understanding of the world.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Technology solution providers

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- End users and prospective end users

- Regulatory bodies and industry associations

Report Objectives

- To define, describe, segment, and forecast the size of the intelligent robotics market, by mobility, robot type, application, and region, in terms of value, and robot type in terms of volume

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To give detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, pricing analysis, key conferences and events, key stakeholders and buying criteria, Porter’s five forces analysis, investment and funding scenario, and regulations pertaining to the market

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive market landscape

- To analyze strategic approaches, such as product launches, collaborations, and partnerships, in the intelligent robotics market

- To analyze the impact of the macroeconomic outlook for each region, Gen AI/AI, and the 2025 US tariff on the intelligent robotics market

Available Customizations

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Intelligent Robotics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Intelligent Robotics Market