LATAM Surgical Staplers Market Size, Growth, Share & Trends Analysis

LATAM Surgical Staplers Market by Type (Linear, Circular, Skin, Curved), Technology (Manual, Powered), Usability (Disposable, Reusable), Application (Abdominal & Pelvic Surgery, General Surgery, Orthopedic Surgery), End User- Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

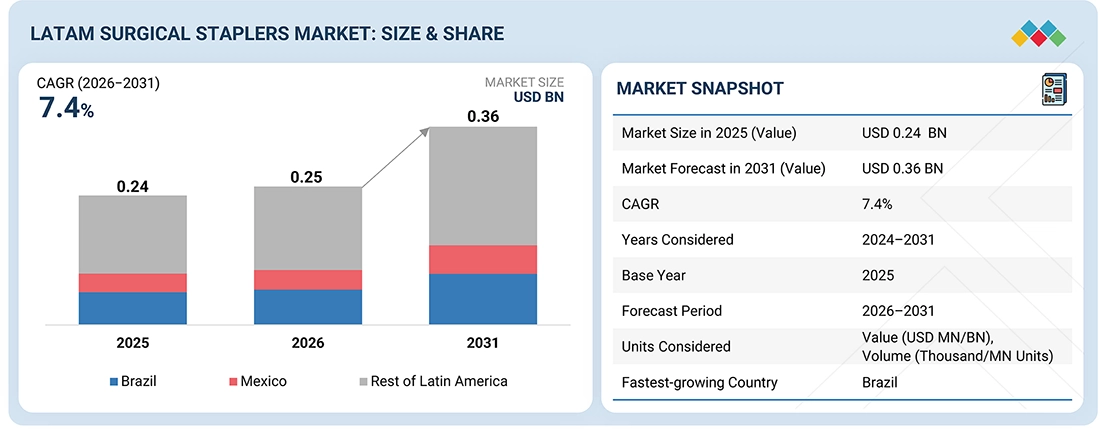

The LATAM surgical staplers market, valued at US$0.24 billion in 2025, stood at US$0.25 billion in 2026 and is projected to advance at a resilient CAGR of 7.4% from 2026 to 2031, culminating in a forecasted valuation of US$0.36 billion by the end of the period. Private organizations across Latin America play a crucial role in transferring expertise and knowledge from one operating room to another within the continental surgical environment. The large private hospital chains in Brazil and Mexico are busy either expanding or planning new investments in state-of-the-art operating rooms. Hospitals focus on quick procedures and efficient surgery times while aiming for consistent results. As a result, they prefer using surgical staplers. This common practice across hospitals has led to ongoing demand for staplers and their supplies, helping to ensure a stable and growing market.

KEY TAKEAWAYS

-

BY CountryBrazil is expected to register the highest CAGR of 7.7% during the forecast period.

-

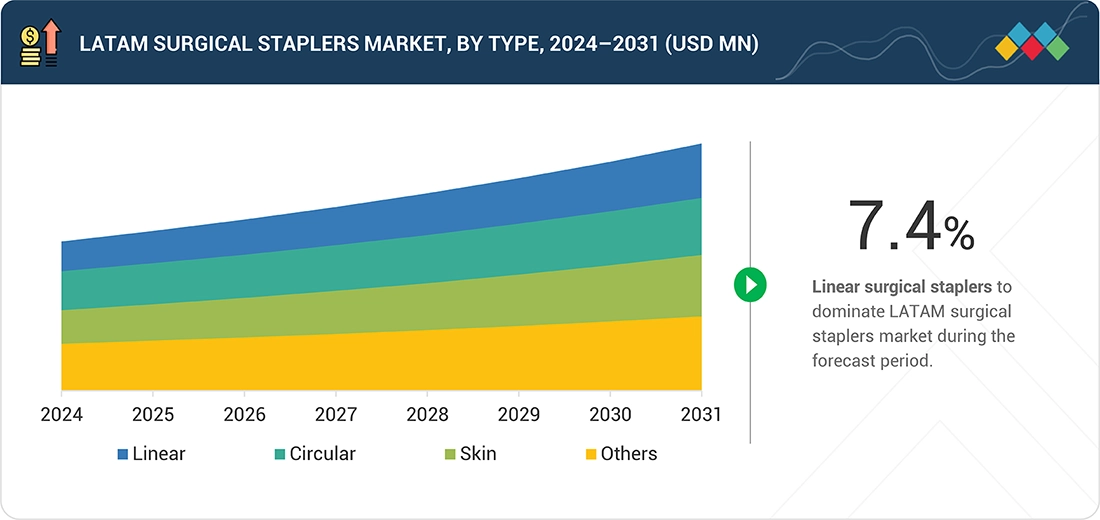

BY TYPEBy type, linear surgical staplers led the market, accounting for a share of 35.6% in 2025.

-

BY TECHNOLOGYBy technology, manual surgical staplers dominated the market, accounting for a share of 58.3% in 2025.

-

BY USABILITYBy usability, reusable staplers are expected to record the highest CAGR during the forecast period.

-

BY APPLICATIONBy application, the abdominal & pelvic surgery segment captured the largest market share of 37.5% in 2025.

-

BY END USERBy end user, hospitals are expected to be the fastest-growing segment during the forecast period.

-

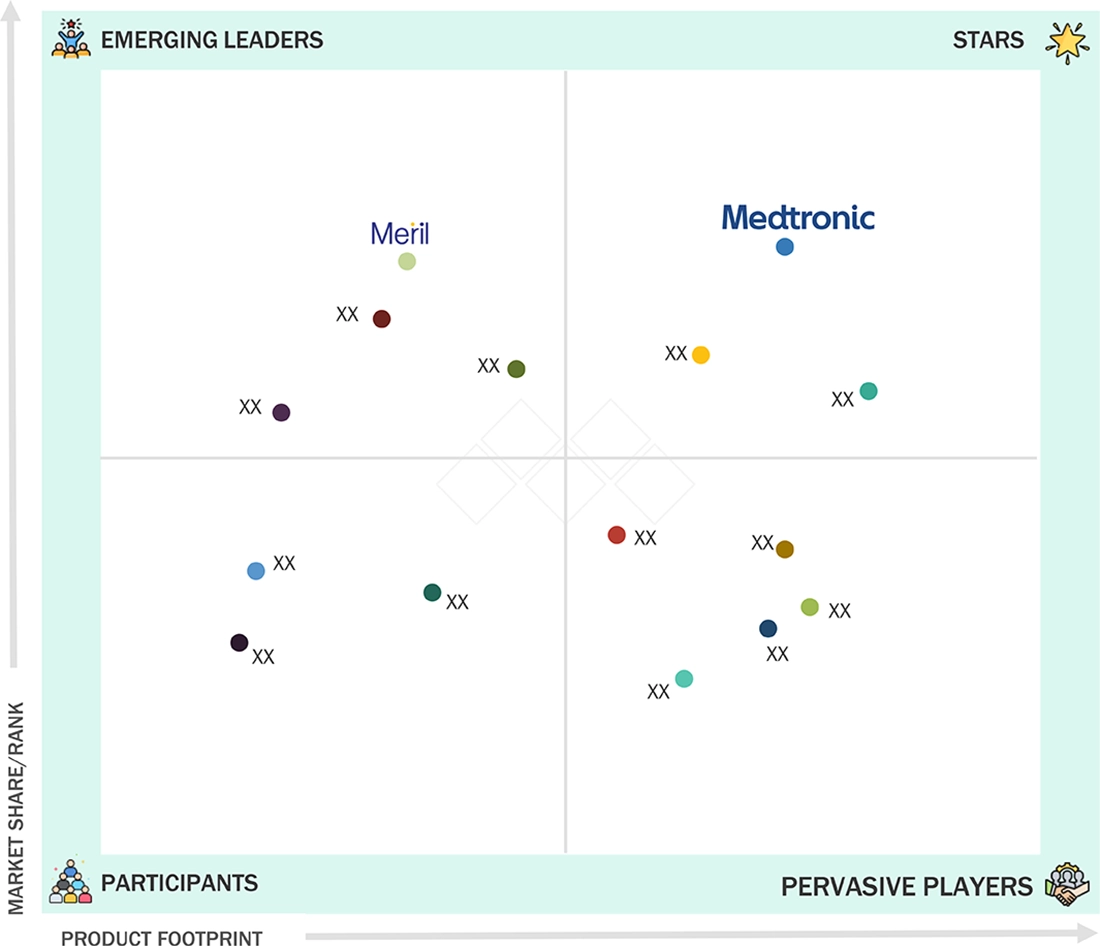

COMPETITIVE LANDSCAPE - KEY PLAYERSMedtronic plc, Johnson & Johnson (Ethicon, Inc.), and Lepu Medical Technology (Beijing) Co., Ltd. were identified as "star" players in the LATAM surgical staplers market, as they focus more on innovation and have broad industry coverage and strong operational and financial strength.

-

COMPETITIVE LANDSCAPE - STARTUPSWaston Medical Corporation, Touchstone International Medical Science Co., Ltd., and Victor Medical Instruments Co., Ltd. distinguished themselves among startups and SMEs due to their strong product portfolio and business strategies.

Countries such as Mexico, Brazil, and Costa Rica attract medical tourists with affordable elective surgeries. Common procedures include gastrointestinal, bariatric, cosmetic, and gynecological surgeries, which often use advanced surgical staplers. These countries import high-quality technology to ensure their hospitals meet international health standards, leading to more use of advanced stapling systems.

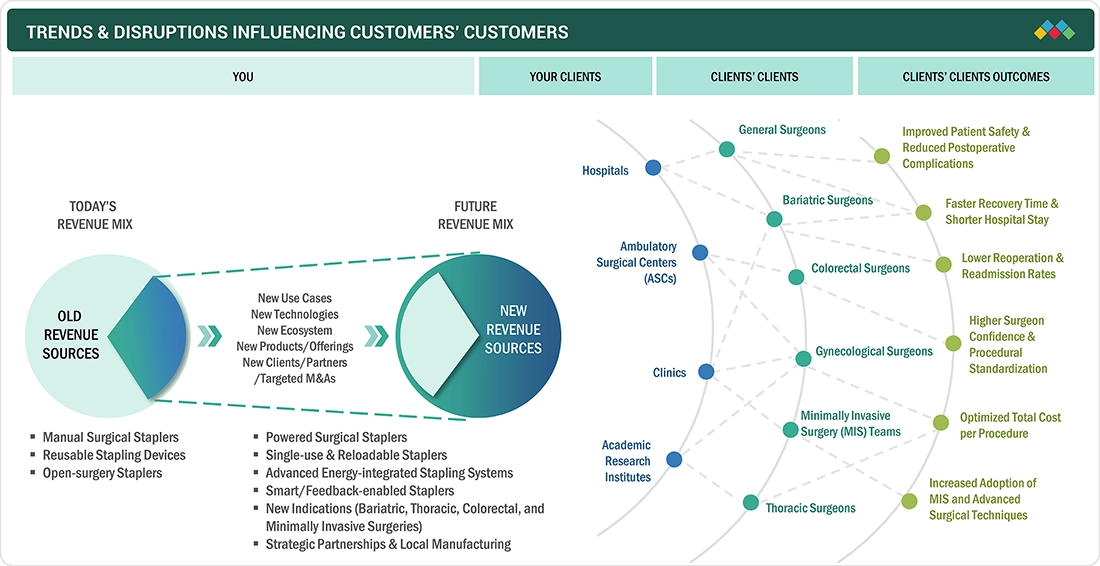

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The evolving landscape of the Latin America surgical staplers market is driven by increasing surgical procedure volumes and the gradual adoption of minimally invasive surgeries across key countries such as Brazil, Mexico, and Argentina. Hospitals are prioritizing cost-efficient and reliable stapling solutions to balance budget constraints with clinical outcomes. The growing preference for disposable staplers, along with incremental adoption of powered devices in tertiary care centers, is influencing purchasing decisions. At the same time, dependence on imports, pricing pressures, and uneven regulatory frameworks are reshaping competitive dynamics, while expanding private healthcare facilities and medical tourism are supporting demand for advanced stapling technologies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid Adoption of Minimally Invasive Surgeries

-

Increasing Number of Surgeries Linked to Prevalence of Chronic Diseases

Level

-

High Cost of Advanced Surgical Staplers

-

Risk of Complications and Device Failures

Level

-

Integration of Surgical Staplers with Robotic Surgery Systems

-

Expanding into Resource-limited Areas for Greater Impact

Level

-

Difficulties in Incorporating into Established Surgical Procedures

-

High Compliance Costs of New EU Safety and Environmental Regulations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid adoption of minimally invasive surgeries

Rapid adoption of minimally invasive surgeries (MIS) is a key driver of the LATAM surgical staplers market, as hospitals increasingly shift toward laparoscopic and endoscopic procedures to reduce patient recovery time, postoperative complications, and length of hospital stay. Countries such as Brazil, Mexico, and Argentina are witnessing rising volumes of MIS across gastrointestinal, bariatric, colorectal, and gynecological surgeries, directly increasing demand for advanced stapling devices. Surgical staplers enable secure tissue closure and consistent staple lines in confined operative fields, making them essential for MIS. Additionally, growing surgeon preference for disposable and powered staplers, along with expanding private healthcare infrastructure, is accelerating adoption across the region.

Restraint: High cost of advanced surgical staplers

The high price of advanced staplers, along with the need for significant research and development and specialized materials, limits market growth. Adding features like robotic compatibility and intelligent sensors makes manufacturing more complex and expensive, which drives up the final price. This high cost is a major barrier for many healthcare providers, particularly smaller hospitals and clinics in budget-sensitive areas. In emerging economies, where affordability is crucial, such devices are often out of reach. Even in developed markets, healthcare systems face cost pressures and seek to cut expenses, which makes it hard to adopt expensive devices. While advanced staplers do offer clinical benefits, many users see them as a luxury rather than a necessity, especially when cheaper options such as traditional suturing exist. Additionally, hospital reimbursement policies can further discourage investment in these devices, as many insurers do not fully cover their costs, making it less attractive for healthcare facilities to purchase them and reducing their market reach.

Opportunity: Expanding into resource-limited areas for greater impact

Expanding the availability of surgical staplers into low-resource settings presents a unique and impactful opportunity. Regions with limited access to advanced medical technologies often face challenges in providing effective surgical care, leading to higher complication rates and more extended recovery periods. Manufacturers can address a critical gap in global healthcare provision by introducing cost-effective, robust, and easy-to-use surgical staplers explicitly designed for these environments. The key to capitalizing on this opportunity lies in developing surgical staplers that are affordable and adapted to the infrastructural limitations of low-resource settings. These devices should be durable, requiring minimal maintenance, and designed for ease of use to accommodate the training levels of local medical personnel. Such innovations could dramatically improve the standard of care, enhancing patient outcomes and reducing the overall healthcare burden. The strategic benefits of targeting these markets include tapping into a new customer base, expanding global reach, and potentially securing partnerships with international health organizations and governments; this expansion is not solely about market penetration but also about building a reputation for social responsibility and commitment to improving healthcare standards worldwide.

Challenge: Difficulties in incorporating into established surgical procedures

Integrating advanced staplers into established surgical protocols presents a formidable challenge, primarily due to inherent resistance to change in medical practices. Surgeons and healthcare facilities often rely on conventional methods that have proven effective over time, making them cautious about adopting newer technologies that introduce an element of risk and uncertainty. This resistance is increased by the extensive training needed for advanced staplers. New surgical staplers offer advanced features that can improve procedures, but they require extensive training to use safely and effectively. This learning curve may make surgical teams hesitant to adopt them, as they weigh potential disruptions against the benefits. It's crucial to have solid evidence showing that these new tools lead to better patient outcomes, faster surgeries, or fewer complications; without this data, teams may stick with familiar methods. To encourage adoption, it is important to provide focused educational programs that offer training and ongoing support. These programs should address specific concerns and clearly demonstrate the practical advantages of using the new staplers in real surgical situations.

LATAM SURGICAL STAPLERS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A broad range of advanced staplers for general, bariatric, and colorectal surgeries, designed to meet the requirements of large public and private hospitals in LATAM. | Reliable performance | reduced operating room time | broad clinical acceptance |

|

|

Comprehensive stapling portfolio for open and minimally invasive procedures, aligned with LATAM surgeon preferences and clinical protocols. | Precision closure | improved outcomes |

|

Precision stapling systems adapted for GI, thoracic, and colorectal surgeries, with focused support for emerging LATAM markets. | Cost-effective accuracy | lower complication risk |

|

Ergonomic and versatile staplers for open and laparoscopic operations, tailored to LATAM regulatory and hospital procurement needs. | Consistent performance | surgeon comfort |

|

Disposable staplers designed for routine surgeries in cost-conscious LATAM settings, with emphasis on safety and ease of use. | Easy handling | safe closure | value pricing |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The LATAM surgical staplers ecosystem comprises key manufacturers such as Medtronic, Johnson & Johnson Services, Inc. (Ethicon, Inc.), Lepu Medical Technology, B. Braun, and 3M, driving innovation in surgical solutions. These companies produce surgical staplers used in wound closure and complex surgical procedures. Supporting this supply chain are raw material suppliers such as Thermo Fisher Scientific, BASF, and Thyssenkrupp, which provide essential metals and polymers for manufacturing. The end users include leading healthcare service providers, such as Hospital Israelita Albert Einstein (Brazil), Fundación Santa Fe de Bogotá (Colombia), Hospital Italiano de Buenos Aires (Argentina), and Clínica Alemana (Chile). This interconnected network promotes operational efficiency, innovation, and growth within the LATAM surgical staplers market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

LATAM Surgical Staplers Market, by Type

In surgical training programs across Latin America, linear staplers are a key focus. Experienced surgeons know how to use them effectively, making it easier for them to adopt this technique. Linear stapling is a common practice in gastrointestinal and colorectal surgeries, contributing to its popularity and a significant market share in the region.

LATAM Surgical Staplers Market, by Technology

For decades, manual staplers have been in use and are deeply anchored in surgical practice all over LATAM. Their handling and reliability are comfortable for surgeons, so they rarely require additional training. This historical comfort among physicians, coupled with favorable and consistent clinical outcomes, strengthens hospitals' preference for manual staplers and maintains their large market share.

LATAM Surgical Staplers Market, by Usability

Patient safety and infection control have become priorities for most hospitals across the LATAM region with high-volume surgical centers. Disposable staplers help prevent cross-contamination because they do not require sterilization like reusable staplers, which can vary in effectiveness. This is particularly important in countries such as Brazil, Mexico, and Argentina, where there is a high volume of surgeries. As regulations promote efforts to reduce hospital-acquired infections, disposable staplers are becoming the preferred choice in both public and private healthcare facilities.

LATAM Surgical Staplers Market, by Application

Abdominal surgeries, particularly gastrointestinal and colorectal procedures, are among the most frequently performed surgeries in Latin America. This trend is driven by a rise in colorectal cancers, gastric disorders, and digestive diseases in countries such as Brazil, Mexico, and Argentina. As a result, there is a significant demand for surgical staplers, especially since multiple stapler firings are often required for tissue transection and anastomosis. Given that abdominal procedures are the most common in terms of both frequency and complexity, they represent the primary area of stapler usage within the Latin American market.

LATAM Surgical Staplers Market, by End User

In Latin America, tertiary and multi-specialty hospitals typically handle the majority of complex surgeries, including those for gastrointestinal, colorectal, bariatric, thoracic, and oncological conditions. These surgeries require a significant number of surgical staplers for tissue transection and anastomosis tasks. Compared to ambulatory centers, hospitals treat a larger number of patients and deal with more complicated cases, leading to higher consumption of staplers. Consequently, hospitals are one of the primary user segments in the surgical staplers market in Latin America.

REGION

Brazil to be fastest-growing country in LATAM surgical staplers market during forecast period

Brazil, like many other Latin American countries, has higher spending and broader coverage for private health insurance. Private hospitals prioritize efficiency and advanced surgical tools, such as staplers. Due to the current payer mix that favors private insurance, Brazil has emerged as the leader in the Latin American surgical staplers market.

LATAM SURGICAL STAPLERS MARKET: COMPANY EVALUATION MATRIX

In the LATAM surgical staplers market, Medtronic plc (Star) has a strong and established product portfolio and a vast geographic presence. Meril Life Sciences Pvt Ltd. (Emerging Leader) has substantial product innovations compared to its competitors. While the company offers a broad product portfolio, there is an opportunity to further strengthen its business development strategy to support sustained growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. – Ethicon, Inc. (US)

- Lepu Medical Technology (Beijing) Co., Ltd. (China)

- 3M (US)

- B. Braun SE (Germany)

- Intuitive Surgical Operations, Inc. (US)

- Frankenman International Ltd. (China)

- CONMED Corporation (US)

- Reach Surgical (China)

- Smith+Nephew (UK)

- Welfare Medical Ltd. (UK)

- Meril Life Sciences Pvt. Ltd. (India)

- XNY Medical (China)

- Purple Surgical (UK)

- Lexington Medical Center (US)

- Ningbo Verykind Medical Device Co., Ltd. (China)

- Waston Medical Corporation (China)

- Suture Planet (India)

- Dolphin Suture (India)

- Touchstone International Medical Science Co. Ltd. (China)

- NewGen Surgical (US)

- Edges Medicare Private Limited (India)

- Golden Stapler Surgical Co., Ltd. (China)

- Victor Medical Instruments Co., Ltd. (China)

- Volkmann Medizintechnik GmbH (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 (Value) | USD 0.24 BN |

| Revenue Forecast in 2031 (Value) | USD 0.36 BN |

| Growth Rate | 7.4% |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand/Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Countries Covered | Brazil, Mexico, Rest of Latin America |

| Parent & Related Segment Reports |

Surgical Staplers Market APAC Surgical Staplers Market |

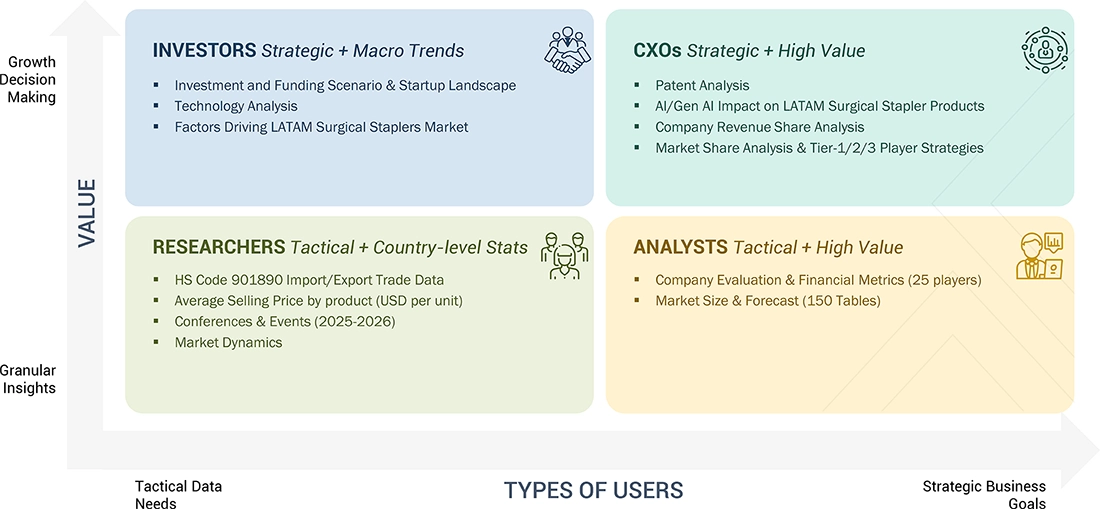

WHAT IS IN IT FOR YOU: LATAM SURGICAL STAPLERS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of surgical staplers, by type, including linear, circular, curved, purse-string, and skin staplers, along with analysis by manual vs. powered devices and disposable vs. reusable formats in LATAM countries. | Evaluation of staple-line integrity, tissue compression consistency, ergonomic design, and reload compatibility to enhance surgical outcomes and efficiency in LATAM hospitals and clinics |

| Company Information | Detailed profiles of key LATAM and global manufacturers operating in the region, including product portfolios, manufacturing footprint, distribution networks, and recent developments in countries such as Brazil, Mexico, Argentina, and Colombia. | Competitive benchmarking of leading players across LATAM, highlighting positioning by price, product breadth, and innovation, enabling strategic market insights |

| Geographic Analysis | In-depth regional assessment of the LATAM surgical staplers market covering Brazil, Mexico, Argentina, Colombia, Chile, and other key countries. | Country-level market sizing, CAGR forecasts, procedure volume analysis, and adoption trends for major LATAM markets to guide market entry and growth strategies |

RECENT DEVELOPMENTS

- May 2024: Covidien Japan, Inc., a subsidiary of Medtronic Plc, and HOGY Medical Co., Ltd. signed a service-level agreement to collaborate on the sale of SuReFInD, a marking medical device used for lung cancer patients. The goal is to provide a comprehensive solution by integrating this method with Endo GIA, Medtronic Covidien’s surgical stapler, to assist in lesion resection.

- May 2024: Johnson & Johnson (Ethicon, Inc.) (US) launched the ECHELON LINEAR Cutter (Linear Surgical Stapler)—a linear cutter designed with a combination of innovative, proprietary technologies, including 3D-Stapling Technology and Gripping Surface Technology (GST), which offer advanced features that enhance staple line security. These capabilities have been shown to help surgeons minimize risks and improve patient outcomes.

- May 2024: Lexington Medical (US) launched the AEON-powered Stapling System (Linear Surgical Stapler), an advanced next-generation surgical stapling platform. This system is designed to deliver the optimized stapling experience. The powered stapler is ergonomic, lightweight, and user-friendly.

- December 2021: Intuitive Surgical, Inc. (US) received FDA approval for the SureForm 30 Curved-Tip Stapler, a linear surgical stapler. The FDA has approved Intuitive's fully wristed, 8 mm SureForm 30 Curved-Tip Stapler and its reloads (gray, white, and blue) for use in general, thoracic, gynecologic, urologic, and pediatric surgeries.

Table of Contents

Methodology

This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the LATAM Surgical Staplers Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the LATAM Surgical Staplers Market. Primary sources from the demand side included hospitals, clinics, researchers, lab technicians, purchase managers etc, and stakeholders in corporate & government bodies.

Market Size Estimation

The market size for LATAM Surgical Staplers Marketwas calculated using data from four different sources, as will be discussed below. Each technique concluded and a weighted average of the four ways was calculated based on the number of assumptions each approach made. The market size for LATAM Surgical Staplers Marketwas calculated using data from three distinct sources, as will be discussed below:

Data Triangulation

The entire market was split up into four segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at the precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from both paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of surgical staplers. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Surgical staplers are a type of specialized medical device that could be used during surgery to close wounds or to remove or separate tissues. Stapling is generally faster and more accurate than suturing because staple lines are both more uniform and less likely to bleed or experience air leaks. These devices can either be hand-powered or battery-powered.

Stakeholders

- Surgical stapler manufacturers

- Surgical stapler suppliers and distributors

- Healthcare associations/institutes

- Distributors, Channel Partners, and Third-party Suppliers

- Healthcare Service Providers

- Academic Medical Centers and Universities

- Business Research and Consulting Service Providers

- Venture Capitalists and Other Government Funding Organizations

Report Objectives

- To define, describe, and forecast the LATAM Surgical Staplers Marketbased on by type, technology, usability, application, end user and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall surgical staplers market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the LATAM Surgical Staplers Marketin North America, Europe, the Asia Pacific, Latin America, Middle East & Africa and GCC Countries

- To profile the key players and comprehensively analyze their market shares and core competencies in the surgical staplers market

- To track and analyze competitive developments such as partnerships, expansions, acquisitions, collaborations, product launches, agreements, and other developments in the surgical staplers market

- To benchmark players within the LATAM Surgical Staplers Marketusing the Company Evaluation Quadrant framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the LATAM Surgical Staplers Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in LATAM Surgical Staplers Market