Magnesium Oxide (MgO) Market

Magnesium Oxide (MgO) Market by Product Type (CCM, DBM, FM), Purity (High, Medium, Low), Source (Natural, Synthetic), Application (Animal Feed, Steel Making & Cement, Glass & Ceramics, Electronics, Pharmaceuticals, Fertilizers) - Global Forecast to 2030

Updated on : November 27, 2025

MAGNESIUM OXIDE MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The magnesium oxide (MgO) market is projected to reach USD 6.31 billion by 2030 from USD 5.63 billion in 2025, recording a CAGR of 2.3% from 2025 to 2030. The market growth can be attributed to the increasing steel production, the rising demand for advanced refractory applications, extensive use in construction & building materials, and the growing applications in advanced ceramics & electronic components.

KEY TAKEAWAYS

-

BY PRODUCT TYPEThe magnesium oxide market comprises caustic calcined magnesia, dead burned magnesia, and fused magnesia. Dead-burned magnesia is the highest-growing subsegment due to extensive usage in steel making and cement applications.

-

BY SOURCEKey sources are natural and synthetic. Synthetic magnesium oxide is growing in popularity for high-purity magnesium oxide in industries such as pharmaceuticals, food processing, and electronics, contributing to the overall demand.

-

BY GRADEThe grade segment includes food grade, pharmaceutical grade, industrial grade, and refractory grade. The refractory grade segment is growing as it is a critical material for manufacturing refractory bricks and linings used in high-temperature furnaces, kilns, and reactors.

-

BY FORMThe form segment includes powder, granules, and flakes. The increasing use of powder magnesium oxide in pharmaceuticals, fertilizers, and rubber industries drives the segment.

-

BY PURITYThe purity segment includes high-purity, medium-purity, and low-purity. The rising demand for high-purity magnesium oxide is growing as there is the mounting demand in electronics, pharmaceuticals, and food industries.

-

BY APPLICATIONKey applications included animal feed, steel making & cement, glass & ceramics, electronics, pharmaceuticals, fertilizers, and other applications. The steel making & cement growing application as MgO is widely used as a refractory material in steel furnaces and slag conditioning, owing to its high melting point and ability to resist corrosion at elevated temperatures, enhancing furnace efficiency and lifespan.

-

BY END-USE INDUSTRYKey end-use industries include food & beverages, construction, agriculture, healthcare, cosmetics, and other end-use industries. The construction industry is growing as MgO is increasingly used in boards, panels, and cement formulations due to its fire resistance, durability, and eco-friendly properties, supporting the global shift toward sustainable and high-performance building materials.

-

BY REGIONMagnesium oxide market covers Europe, North America, Asia Pacific, South America, and the Middle East & Africa. Asia Pacific is the largest market for magnesium oxide. It is home to several prominent magnesium oxide companies and is witnessing growing construction sector, all contributing to the increasing adoption of magnesium oxide products.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and expansions. For instance, in July 2025, Martin Marietta Magnesia Specialties (US) completed the acquisition of Premier Magnesia, LLC (Premier), a privately-owned producer of magnesia-based products with operations in Nevada, North Carolina, Indiana and Pennsylvania. The acquisition enhances Martin Marietta’s position as the leading producer of natural and synthetic magnesia-based products in the US.

The magnesium oxide (MgO) market is witnessing steady growth, owing to the growing demand in steel making, cement, and electronics applications and massive industrial growth in Asia Pacific. Deals and developments, including strategic partnerships between OEMs and material suppliers, acquisition and investments, also reshape the market landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses arises from evolving customer trends or market disruptions. Hot belts are the clients of magnesium oxide manufacturers, and target applications are the clients of magnesium oxide manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of magnesium oxide manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MAGNESIUM OXIDE MARKET DYNAMICS

Level

-

Increasing steel production and rising demand for advanced refractory applications

-

Extensive use in construction and building materials

Level

-

High production costs

-

Competition from alternatives

Level

-

Rising adoption in wastewater treatment

-

Emerging role of magnesium oxide in advanced battery technologies

Level

-

Quality consistency and technological limitations

-

Environmental and regulatory pressures

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing steel production and rising demand for advanced refractory applications

The global magnesium oxide (MgO) market is experiencing vigorous growth, supported essentially by the increasing steel production and the demand pattern for refractory applications. Since steel is used for industrialization and infrastructure, the increased production capacity in markets such as China, India, and Brazil results in higher consumption of refractory-grade magnesium oxide. From the good thermal stability to high melting point to corrosive resistance, magnesium oxide finds use with refractory materials in furnaces, kilns, and ladles for steelmaking purposes. Activities emphasizing energy efficiency with extended life expectancy of refractory linings have consequently increased the requirements of high-purity advanced magnesium oxide materials. This naturally complements with global infrastructure-building activity, automobile manufacturing, and construction activities, thereby positioning magnesium oxide as an enabler of contemporary steel production techniques.

Restraint: High production costs

The magnesium oxide market is confronted with history of having high production costs, affecting its competitivity and profitability. Some energy-intensive processes involved in manufacturing magnesium oxide are calcination of magnesite or seawater-based extraction, needing a high-temperature furnace and a huge input of fuel. Perspective energy prices and environmental protectionism raise the prices of operations for the producers. There arise other costs that haul up with exploitation of excellent quality raw material and equipment, along with transportation. Marking heightened levels of expenses are advanced grades of magnesium oxide, especially those for use in refractory, pharmaceutical, and electronic fields of applications, as they must be processed and purified even more precisely. With all these costs weighing away, price fluctuation becomes common, and this becomes a major hindrance in allowing small-scale manufacturers to grow.

Opportunity: Rising adoption in wastewater treatment

The magnesium oxide market has witnessed high drainage in wastewater treatment owing to its ability to neutralize, remove heavy metals, and stabilize sludge. Magnesium oxide acts as an alkali Agent cheaper and environmentally safer compared to lime and caustic soda. Due to its high reactivity, magnesium oxide keeps the pH levels constant in the treatment of industrial effluents coming from chemicals, textiles, and mining. Another responsibility of magnesium oxide is to floor down odors and pathogens from the treated water. More stringent regulations pertaining to wastewater discharge standards being imposed upon industries, with sustainable water management being considered a global cause, thus opportunities grow for magnesium oxide in wastewater treatment.

Challenge: Quality consistency and technological limitations

The most common problem in the magnesium oxide (MgO) market is related to inconsistent quality and to technical limitations inhibiting its broader acceptance across industries. Variations in the raw material feedstock and their method of production make it almost impossible to sustain the same purity, particle size, and reactivity. This variation would adversely affect the behavior of magnesium oxide in applications that require exactness and reliability such as refractories, pharmaceuticals, and electronics. Variations in the raw material feedstock and their method of production make it almost impossible to sustain the same purity, particle size, and reactivity. The existing technologies often cannot produce at higher efficiencies the state-of-the-art magnesium oxide required by such demanding industrial applications, such as optical and medical materials. Lack of innovation in production technologies also affects their cost and environmental friendliness. With the demand from industries for improved performance and consistency, it becomes crucial to intensify efforts to surmount these technological hurdles to give magnesium oxide its rightful potential.

Magnesium Oxide (MgO) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Produces refractory bricks and linings using high-purity MgO for furnaces, kilns, and ladles in steelmaking | Withstands extreme temperatures | Enhances furnace life | Reduces downtime | Improves energy efficiency in steel production |

|

Supplies MgO as a neutralizing agent and heavy metal stabilizer in industrial wastewater treatment | Provides effective pH control | Reduces heavy metal toxicity | Offers an eco-friendly alternative to caustic chemicals |

|

Produces MgO supplements for livestock feed and agricultural soil enrichment | Enhances animal nutrition | Prevents magnesium deficiency in cattle | Improves crop yield by balancing soil pH |

|

Develops pharmaceutical-grade MgO used as an antacid, laxative, and dietary supplement | Supports digestive health | Relieves acidity | Provides a vital source of magnesium for human nutrition |

|

Produces MgO-based boards and cements for fireproofing and lightweight construction materials | Offers fire resistance | Moisture protection |Sustainability advantages over traditional cement |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MAGNESIUM OXIDE MARKET ECOSYSTEM

The magnesium oxide ecosystem consists of raw material suppliers (e.g., Magna Magnesitas Navarras, RK Minerals), magnesium oxide producers (e.g., Martin Marietta Magnesia Specialties, RHI Magnesita), distributors (e.g., Dr.Magnesia, SoleChem), and end users (e.g., Arcelor Mittal, Syngenta). Raw materials such as magnesite is processed into caustic calcined magnesia, dead-burned magnesia, and fused magnesia for use in various applications. End users drive demand for industries such as food & beverage, construction, agriculture, healthcare, cosmetics, and other end-use industries, while producers deliver magnesium oxide in various forms including powder, granules, and flakes. Collaboration across the value chain is key to innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MAGNESIUM OXIDE MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Magnesium Oxide (MgO) Market, By Application

Based on application, the demand for magnesium oxide is majorly high in the steel industry and for cement applications. Magnesium oxide is one of the key raw materials used as a refractory lining for steel production processes to ensure durability and maintenance of high temperature in operations such as furnaces and converters. Since steel is a precursor for infrastructure, automobiles, and urban development, its rising production will invariably pull up the magnesium oxide demand. Additionally, in the construction industry, magnesium oxide-based cement and boards are becoming an alternate solution with superior fire resistance, durability, and greener properties than conventional ones. The rapid stimulation in building houses, infrastructure renovation, and industrial construction across emerging economies, especially Asia Pacific, subsequently acts as a demand multiplier. As urbanization and development investments accelerate, so does the demand for magnesium oxide in the domains of steel making and cement production.

Magnesium Oxide (MgO) Market, By End-use industry

The construction segment dominates in demand due to rapid urbanization and the demand for residential housing. Magnesium oxide is largely used in cement, boards, and other kinds of building materials that are more fireproof, durable, and eco-friendly than conventional materials. With the increasing urban migration worldwide, there has been ever-growing demand for low-cost, durable, and green housing solutions, especially in emerging economies of the Asia Pacific and Africa regions. MgO-based construction materials are more preferred for modern housing activities as they improve safety, life span, and promotion of green building. This steady growth in residential and infrastructure construction thus maintains the sector among lead drivers of magnesium oxide consumption on a global level.

REGION

Asia Pacific to be fastest-growing region in global magnesium oxide (MgO) market during forecast period

During the forecast period, Asia Pacific will be the fastest-growing region in the global magnesium oxide (MgO) market, with its growth fuelled by strong industrialization, rapid urbanization, and ever-expanding infrastructure projects. Countries such as China, India, and Japan are top consumers. The demand coming from steel, cement, agriculture, and environmental applications is also strong. China being the leading steel producer motivates massive magnesium oxide consumption for refractories, while India's construction and manufacturing facilities further momentum. Furthermore, m interest in environmentally friendly wastewater treatment, along with agricultural use of magnesium oxide for soil conditioning and animal feed supplementation, drives the regional market. Investment in industrial capacity is rising, while the governments of several Asia Pacific countries support infrastructure and environmental management. This will make the region the prime growth hub of the global magnesium oxide (MgO) market.

Magnesium Oxide (MgO) Market: COMPANY EVALUATION MATRIX

In the magnesium oxide market matrix, Magnezit Group (Star) leads with a strong market share and extensive product footprint, driven by its large magnesium oxide plant which is adopted for refractory and other applications. Tateho Chemical Industries Co., Ltd. (Emerging Leader) is gaining visibility with its specialized magnesium oxide solutions for steelmaking and cement applications, strengthening its position through innovation and niche product offerings. While Magnezit Group dominates through scale and diversified portfolio, Tateho Chemical Industries Co., Ltd. shows significant potential to move toward the leaders’ quadrant as demand for magnesium oxide continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.55 Billion |

| Market Forecast in 2030 (Value) | USD 6.31 Billion |

| CAGR (2025–2030) | 2.3% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | • Product Type (Caustic Calcined Magnesia, Dead Burned Magnesia, and Fused Magnesia) |

| Regions Covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Magnesium Oxide (MgO) Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Energy & Storage Technologies | • Benchmark magnesium oxide as additive for electrolyte stability and thermal management | • Identify reliable magnesium oxide suppliers for next-gen batteries |

| Automotive & Mobility | • Forecast magnesium oxide demand in steel, EV batteries, and coatings | • Enable secure sourcing of magnesium oxide for EV and steel supply chains |

| Construction & Infrastructure | • Market sizing of magnesium oxide -based cement, boards, and panels | • Drive adoption of magnesium oxide in sustainable construction |

| Industrial Chemicals & Materials | • magnesium oxide production capacity mapping across APAC, EU, NA | • Assess supply /demand gaps for competitive advantage |

RECENT DEVELOPMENTS

- July 2025 : Martin Marietta Magnesia Specialties completed the acquisition of Premier Magnesia, LLC (Premier), a privately-owned producer of magnesia-based products with operations in Nevada, North Carolina, Indiana and Pennsylvania. The acquisition enhances Martin Marietta’s position as the leading producer of natural and synthetic magnesia-based products in the United States.

- January 2025 : RHI Magnesita completed the USD 423 million acquisition of Resco Group, following an agreement reached in April 2024. The acquisition significantly strengthens RHI Magnesita’s North American operations, expanding its presence in the petrochemical, cement, and aluminum sectors. Resco’s extensive U.S. plant network will accelerate the company’s “local for local” production strategy, enabling more onshore manufacturing and shorter supply chains. This represents RHI Magnesita’s largest acquisition since the 2017 merger of RHI and Magnesita, marking a major step toward future growth in the refractory market.

- July 2024 : LUVOMAG magnesium oxide pastes have been a trusted material in rubber manufacturing for many years. In 2023, Lehmann&Voss&Co. began modernizing these products in response to customer needs, focusing on improved processability, longer shelf life, and easier handling. To achieve this, the company announced investment in its Hamburg-Wandsbek site, covering production and packaging operations.

Table of Contents

Methodology

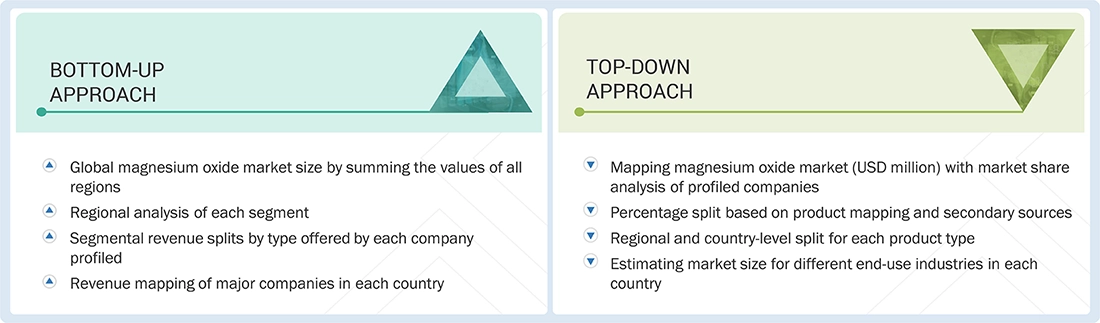

The study involved four major activities in estimating the current size of the magnesium oxide (MgO) market: exhaustive secondary research collected information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across the magnesium oxide value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; gold- and silver-standard websites; magnesium oxide manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the pool of key players, market classification, and segmentation according to industry trends, to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

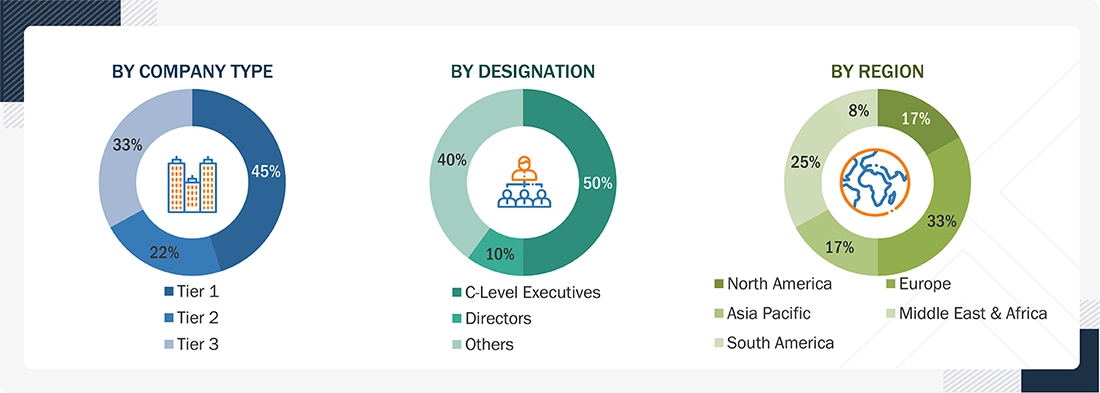

The magnesium oxide (MgO) market comprises several stakeholders, such as raw material suppliers, technology support providers, magnesium oxide manufacturers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the magnesium oxide (MgO) market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the total size of the magnesium oxide (MgO) market. These approaches have also been used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following:

The following information provides details about the overall market size estimation process employed in this study:

- Key players in the market were identified through secondary research.

- Market shares in the respective regions were identified through primary and secondary research.

- Primary and secondary research determined the value chain and market size of the magnesium oxide (MgO) market, in terms of value and volume.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying the annual and financial reports of the top market players and interviewing industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Data Triangulation

The magnesium oxide (MgO) market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides in the oil & gas sector.

Market Definition

Magnesium oxide is an inorganic compound composed of one magnesium (Mg) atom bonded to one oxygen (O) atom, represented as MgO. It is an essential magnesium oxide and is commonly found in nature as the mineral periclase. Magnesium oxide is a white, odorless powder with a high melting point. It is known for its remarkable physical and chemical properties, making it valuable in various industrial and scientific applications.

Stakeholders

- Magnesium oxide manufacturers

- Magnesium oxide traders, distributors, and suppliers

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environment support agencies

- Investment banks and private equity firms

Report Objectives

- To analyze and forecast the market size of the magnesium oxide (MgO) market, by product type, source, grade, form, purity, application, and end-use industry, in terms of value

- To analyze and forecast the market size of the magnesium oxide (MgO) market, by product type, in terms of volume

- To forecast the size of various market segments based on five major regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their respective key countries, in terms of value

- To provide detailed information regarding the major factors influencing the market growth, such as drivers, restraints, challenges, and opportunities

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To track and analyze the competitive developments, such as acquisitions, partnerships, expansions, and investments, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Magnesium Oxide (MgO) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Magnesium Oxide (MgO) Market