Merging Unit Market

Merging Unit Market By Type (Standalone, Integrated), Voltage (Low, Medium, High), Configuration (With Relay, Without Relay), End User (Utilities, Industrial, Commercial, Data Centers, Renewable Energy, Transportation, Others), Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global merging unit market is projected to reach USD 477.7 million by 2030 from an estimated USD 367.4 million in 2025, at a CAGR of 5.4%. The merging unit market is demonstrating strong momentum with consistent growth expected over the coming years. Across regions, advancements in digital substations and rising automation trends continue to accelerate the adoption of merging units. Utilities and renewable energy segments prominently boost the demand as industry participants prioritize modernization, improved reliability, and seamless integration with emerging grid technologies. Regulatory support, evolving standards, and a focus on enhanced grid efficiency further spur deployments. Major regions witness robust activity in retrofit and new build projects, making the outlook positive for solution providers and innovators contributing to the evolving future of sustainable power infrastructure.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific accounted for a 36% share of the merging unit market in 2024.

-

BY TYPEBy type, the standalone merging units segment is expected to register the highest CAGR of 5.6% between 2025 and 2030.

-

BY VOLTAGEBy voltage, the medium voltage segment is projected to grow at a CAGR of 5.8% during the forecast period.

-

BY CONFIGURATIONBy configuration, the with relay output segment is expected to dominate the merging unit market from 2025 to 2030.

-

BY END USERBy end user, the renewables segment is expected to capture the largest share of the merging unit market in 2030.

-

COMPETITIVE LANDSCAPEGE Vernova, Hitachi Energy and Arteche were identified as star players in the merging unit market, as they focus on product launches and investments to strengthen their product portfolio in the market.

There is an increasing need to merge units as the movement toward the digital substation and the use of the IEC 61850-based automation gains momentum. Modernization of grids is done by utilities to enhance reliability, minimize downtime, and be able to exchange real-time data. This necessitates the replacement of copper wiring by fiber-based sampled values. The trend of growing integration of renewables, the growing number of substation refurbishment projects and the more rigorous grid-stability standards provide additional incentives to use them. Traditional, non-standardized and un-scalable designs will need to be merged to create standardized interoperable protection and future-proof control architectures as OEMs and utilities drive towards. Their capacity to lower the cost of installation, flexibility and their ability to assist in advanced protection capabilities, keeps their demand in the market high.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The merging unit market is projected to grow during the forecast period by value. Key trends driving merging unit demand include rapid digital substation adoption, IEC 61850 standardization, and growing renewable penetration requiring accurate, real-time protection. Disruptions such as fiber-optic architectures replacing copper wiring, rising cybersecurity needs, and increasing retrofit projects in aging grids further accelerate the shift toward flexible, interoperable, and automation-ready merging units.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Rapid digital substation deployment in accordance with IEC 61850 standards

-

•Rising grid automation and modernization investments

Level

-

•Limited technical expertise to support digital protection systems

Level

-

•Massive retrofit potential in aging transmission & distribution infrastructure

Level

-

•Stringent cybersecurity requirements to protect merging units as critical interfaces in digital substations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid digital substation deployment in accordance with IEC 61850 standards

The quick implementation of digital substations in accordance with IEC 61850 standards will lead to a major boost in the merging unit market globally. Since utilities and grid operators move digital substations, the demand for merging units, which collect and digitize analog signals of traditional instrument transformers, will drastically rise. Its growth is supported by the implementation of IEC 61850 Edition 2.1 that suggests the introduction of enhanced interoperability, real-time monitoring, and enhanced cybersecurity measures in mixed-vendor settings. Main solutions such as PCM600 and IET600 of Hitachi Energy are certified under this new edition, which simplifies the engineering and configuration of the digital substations, which enhances integration of merging units and its project implementation is quicker. Moreover, digital substations can provide high cost savings, safety improvement, and asset management. The shift to process bus architectures and virtualized protection and control systems continue to enhance the pace of merging unit implementation in upgrades and new projects in the brownfield. Other recent implementations have shown decreases in engineering labor, cabling downsizing, and increased reliability, which has enabled transition to the concept of unmanned substations and remote diagnostics. All in all, the increased pace of digitalization and greater IEC 61850 compliance is turning the merging units into the necessity of the present-day power grids.

Restraint: Limited technical expertise to support digital protection systems

One of the limitations on the integration of the unit market is the lack of qualified specialists familiar with the IEC 61850-based protection, sampling and substation automation. Most utilities, particularly in developing areas, do not have engineers who have been trained on the configuration, commissioning and maintenance of the sample-value systems. These skills cut short down the speed of digital substation projects, drives up commissioning expenses, and extends project schedules. Consequently, areas with untrained engineers might be reluctant to install digital substations in units of merging format, which restricts expansion in the market. In the case of merging units, this shortage of skilled workforce poses major obstacles. The misalignment between MU output and protection IED logic, the incorrect configuration of SV streams or poor time synchronization (PTP/IEEE 1588), as well as improper time synchronization between the volumetric signal and the protective relay itself may endanger the reliability of the system. Reports at utilities have been made at the Digital Substation forums, which have reported incidences of commissioning delays due to the lack of expertise in dealing with MU interoperability among vendors. This adds costs to the projects, protracts commissioning schedules, and reduces the level of trust in digital substitution adoption.

Opportunity: Massive retrofit potential in aging transmission & distribution infrastructure

The aging transmission and distribution (T&D) infrastructure worldwide presents a massive retrofit opportunity for the merging unit market. Many existing substations are based on legacy analog technology, which is costly to maintain, less reliable, and lacks the flexibility required for modern grid demands. Retrofitting these substations with digital elements such as merging units enables utilities to extend the life of their assets while modernizing essential functions without complete replacement. Merging units are critical in this retrofit trend by bridging the gap between conventional instrument transformers and the digital protection and control IEDs compliant with IEC 61850 standards. They convert analog signals from existing transformers into digital data streams transmitted over optical fiber or Ethernet-based process buses. This approach allows utilities to retain primary equipment while gaining the substantial benefits of digital substations, including enhanced safety, reduced wiring complexity, smaller physical footprint, and improved data accuracy for protection and monitoring. The retrofit potential is underscored by the urgency of upgrading aging grids to accommodate increasing renewable energy integration, decentralized generation, and smart grid functionalities. A fully digital or hybrid substation architecture increases system resilience, operational efficiency, and cybersecurity, and critical aspects as grids become more complex.

Challenge: Stringent cybersecurity requirements to protect merging units as critical interfaces in digital substations

Stringent cybersecurity requirements have become a major challenge for the merging unit market as digital substations increasingly rely on Ethernet based communication for protection and control. Merging units transmit high speed sampled value data and GOOSE messages, making them critical points in the substation’s communication chain. Research highlights that IEC 61850 communication, while efficient, was not originally designed with strong built in security. This creates vulnerabilities where attackers could spoof or manipulate sampled values or protection messages, potentially causing false trips, relay mis operations, or blocking protection functions. IEC 62351 provides guidelines for securing these communications through authentication and encryption, but many existing IEDs and merging units still lack full compliance, especially in real time environments where even milliseconds of delay can compromise system performance. Implementing cybersecurity in process bus networks adds further complexity for utilities and vendors. Adding cryptographic protection can introduce latency, requiring merging units to balance security with the strict timing needs of protection systems. In addition, utilities must deploy certificate management systems, secure key handling processes, and continuous monitoring to protect multivendor IEC 61850 systems. This significantly increases cost and engineering effort, particularly in regions where OT cybersecurity expertise is limited. As a result, the need to meet rigorous cybersecurity demands slows down merging unit adoption and complicates digital substation deployment.

merging-unit-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integrating renewable energy sources into grid with advanced substation automation technology | Facilitates precise measurement and control of power flow | Supports grid stability | Faster response times | Enhanced cybersecurity through standardized digital communication |

|

Modernizing aging transmission and distribution infrastructure with digital substations and retrofits | Enables real-time digital signal conversion from legacy transformers | Better asset management | Reduced maintenance costs | Improved safety through reduced copper wiring |

|

Deploying digital substations for enhanced grid automation and real-time data acquisition | Improved protection accuracy | Faster fault detection | Reduced wiring complexity | Seamless integration with IEC 61850 protocols | Enhanced operational efficiency and grid reliability |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market map provides a quick snapshot of the key stakeholders involved in the merging unit market, from manufacturers, raw material provides, and component providers to end users. This list is not exhaustive and is meant to give an idea of key market players.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Merging Unit Market, by End User

The merging unit market serves a range of end users, such as utilities, industrial, commercial, data centers, renewable energy, transportation, and others. The fastest-growing end user market is the renewable energy sector due to the sudden shift toward clean energy and decentralized power generation. The wind, solar, and hybrid power stations are increasingly demanding the modern substation infrastructures to effectively incorporate the changing energy sources into the grid. Digital substations (with merging units) allow precise and high-speed transmission of current and voltage transformer data to protection devices and control devices. This is crucial in managing the intermittency and variability of generating renewable energy and in keeping the grid stable and reliable. The combination of units helps in real-time monitoring, protection and control, which are necessary in the integration of distributed energy resources (DERs) within the transmission and distribution systems. With the growing installation of renewable sources, grid operators focus on digital architectures that meet the IEC 61850-standard, as they are required to provide interoperability, quicker fault handling, and remote control. Additionally, most renewable sources require remote or offshore construction where the cost of conventional wiring is high and unfeasible. Merging units minimize copper consumption, improve the installation process and minimize maintenance costs, which are very appealing to renewable uses. With the international policy favoring renewable energy and the falling prices of wind and solar energy technologies and the rising investments in intelligent grids, the renewable energy sector is creating a wave of demand among the merging unit.

Merging Unit, By Type

The merging unit market is segmented by application into standalone and integrated merging units. The requirement on individual merging units is expanding as utilities and industrial operators move to flexible and modular digital substations architectures. Standalone merging units are more adaptable as opposed to integrated solutions, which are usually specific to protection and control systems. Therefore, they can be used in greenfield and brownfield substations. They enable utilities to upgrade existing substations without changing all remaining legacy equipment, which can incrementally upgrade the substation, minimizing costs and time. Standalone MUs are also interoperable with multivendor IEC 61850 devices, which makes them efficient in utilities requiring to have standardized and future-proof solutions which can easily be integrated with various protection relays, bay control units, and SCADA systems. The capability of standalone merging units to make installation simpler and make physical wiring complex is another important reason behind its growth. Standalone MUs improve accuracy of protection and data quality to monitor. They expand the system more easily and especially in areas with high renewable energy integration or in areas with swelling distribution networks. The federation of retrofit flexibility, cost reduction and facilitation of the present-day digital substitution modernization contributes to the increasing number of standalone merging unit implementation in utilities and industrial setups globally.

Merging Unit, By Configuration

The with relay output configuration is the fastest-growing segment in the merging unit market due to its ability to combine digital measurement with direct protection functionality. Merging units with relay outputs digitize current and voltage signals for transmission over IEC 61850 process bus and provide direct tripping or control signals to circuit breakers and other protective devices. This eliminates the need for additional standalone relays in certain applications, simplifying system architecture and reducing installation and wiring costs. Utilities and industrial operators increasingly prefer this configuration because it supports faster fault detection and response, which is critical in modern high-speed protection schemes, especially in grids with high renewable penetration or complex network topologies. Furthermore, merging units with relay outputs offer higher reliability and easier integration in new and retrofit projects. They enable multivendor interoperability, ensuring that the merging unit can work seamlessly with various IEDs while maintaining compliance with IEC 61850 standards. This flexibility is particularly attractive for utilities modernizing aging substations without a full system overhaul. The growing emphasis on digital substations, enhanced automation, and reduced maintenance complexity drives adoption of this configuration. As utilities seek to optimize operational efficiency, reduce costs, and enhance grid resilience, the merging unit segment with relay output continues to witness the fastest growth globally

Merging Unit, By Voltage

The high-voltage (>36 kV) segment takes leading position in the merging unit market as it is an essential part of the transmission systems, and reliability, accuracy, and real-time control are the most important aspects. High levels of protection and control are required to avoid cascading failures or large scale outages. Combining units in this category offer quick precise digitization of current and voltage signals, which are delivered to protection relays and control systems though process bus communication in an IEC 61850 standard. The rise of modernization of outdated transmission networks, the necessity to make the system reliable, integrate renewable energy, and increase demand has boosted the adoption of digital substations in transmission networks, which has led to a strong demand to merge units in the high-voltage category. High-voltage infrastructure, the high cost, and long lifespan also influence to undertake a retrofit and upgrade project with merging units allowing an efficient modernization without necessarily replacing the entire substation. Digital instrumentation is also crucial in utilities, with less copper cabling, less maintenance and safer. The strategic operational significance, extensive implementation of digital solutions and modernization efforts put the >36 kV segment in the merging unit market.

REGION

North America to be fastest-growing region in global mering unit market during forecast period

North America is the fastest-growing region in the merging unit market due to extensive grid modernization initiatives, strong investments in renewable energy integration, and strict regulatory requirements for grid reliability and safety. Utilities in the US and Canada are rapidly adopting digital substations and process bus architectures, driving the deployment of advanced merging units. The regional market growth is further fueled by the proliferation of distributed energy resources, the rising focus on cybersecurity, and favorable government support for smart grid and energy infrastructure upgrades. This dynamic investment climate accelerates technology adoption and market expansion for merging unit suppliers.

merging-unit-market: COMPANY EVALUATION MATRIX

In the merging market matrix, GE Vernova (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across industries utilities and renewable energy. Siemens (Emerging Leader) is gaining traction with high-efficiency merging units. While Hitachi Energy dominates with scale, GE Vernova shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- GE Vernova (US)

- Hitachi Energy (Switzerland)

- Arteche (Spain)

- Schweitzer Engineering Laboratories, Inc. (US)

- Ingeteam (Spain)

- ABB (Switzerland)

- Schneider Electric (France)

- Siemens (Germany)

- Efacec (Portugal)

- Toshiba Corporation (France)

- CYG Sunri Co., Ltd. (China)

- NR Electric Co., Ltd (Jiangsu)

- Powercap Electric SDN. BHD. (Malaysia)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| GE Vernova (US) | GE Vernova (US) |

| Hitachi Energy (Switzerland) | Hitachi Energy (Switzerland) |

| Arteche (Spain) | Arteche (Spain) |

| Schweitzer Engineering Laboratories, Inc. (US) | Schweitzer Engineering Laboratories, Inc. (US) |

| Ingeteam (Spain) | Ingeteam (Spain) |

| ABB (Switzerland) | ABB (Switzerland) |

| Schneider Electric (France) | Schneider Electric (France) |

| Siemens (Germany) | Siemens (Germany) |

| Efacec (Portugal) | Efacec (Portugal) |

| Toshiba Corporation (France) | |

| CYG Sunri Co., Ltd. (China) | |

| NR Electric Co., Ltd (Jiangsu) | |

| Powercap Electric SDN. BHD. (Malaysia) | |

WHAT IS IN IT FOR YOU: merging-unit-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Merging Unit Manufacturer | Mapping merging unit products across different end users | Support entry into utilities value chain with tailored opportunity mapping |

RECENT DEVELOPMENTS

- 3/1/2025 12:00:00 AM : Schneider Electric unveiled its One Digital Grid Platform, a unified architecture that combines protection, control, automation and “standalone merging unit” capability under its PowerLogic P7 platform. The platform is aimed at simplifying operations for utilities, accelerating grid digitalization, and enabling faster deployment of IEC 61850 process-bus systems.

- 5/1/2025 12:00:00 AM : ABB signed an agreement to acquire the wiring accessories business of Siemens in China. The business includes wiring accessories, smart home systems, smart door-locks and related home-automation products. Under the deal, the Siemens brand will continue under a licensing agreement. The acquisition gives ABB access to Siemens’ expansive distribution network across 230 cities in China, as well as their regional sales, manufacturing and management capabilities.

- 1/1/2024 12:00:00 AM : Hitachi Energy’s launched SAM600 3.0, a modular process interface unit that can function as a merging unit, a switchgear control unit, or both in a single device. As a merging unit, it converts analog signals from instrument transformers into IEC 61850 digital data for process-bus architectures. As a switchgear control unit, it interfaces directly with breakers and switches to reduce copper wiring and simplify substation layouts.

- 10/1/2025 12:00:00 AM : Power Grid Components (PGC), a Blackstone-backed grid-equipment manufacturer, acquired Vizimax Inc., adding the company’s advanced point-on-wave controlled switching and inrush-current mitigation technology to its portfolio of essential grid components. Although the purchase price was not disclosed, the acquisition significantly strengthens PGC’s capabilities by incorporating Vizimax’s flagship SynchroTeq platform, which reduces electrical and mechanical stress on transformers and circuit breakers, improves grid reliability, and extends asset life.

Table of Contents

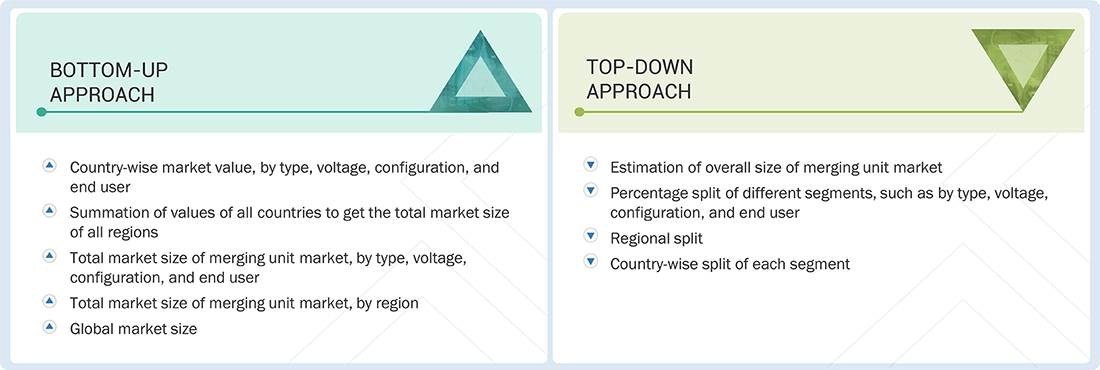

Methodology

The study involved major activities in estimating the current size of the merging unit market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the merging unit market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global merging unit market. The other secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

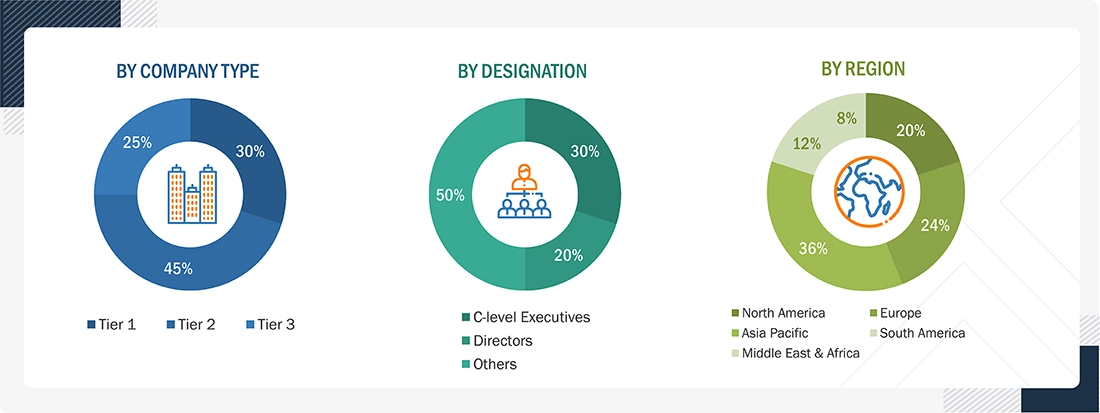

The merging unit market comprises a diverse ecosystem of stakeholders, including merging unit manufacturers, technology vendors, system integrators, and service providers, throughout the value chain. On the demand side, market growth is supported by increasing adoption of merging units in a range of applications spanning utility substations, renewable energy plants, heavy industrial sites, and commercial facilities, which is driven by the need for improved digitalization, interoperability, and operational efficiency. Modern grid modernization initiatives, efforts to integrate distributed renewables, and mandates for compliance with IEC 61850 standards fuel the demand for advanced merging unit solutions.

Note: “Others” include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the merging unit market and its dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes the study of the annual and financial reports of top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the merging unit market.

Merging Unit Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using the top-down and bottom-up approaches.

Market Definition

A merging unit (MU) is a smart electronic unit applied in digital substations to transform analog signals of current transformers (CTs) and voltage transformers (VTs) to digital Sampled Values (SVs) in accordance with IEC 61850 standards. It measures and transmits these measurements to protection relays, control systems, and monitoring equipment using fiber-optic communication, which is digitized, time synchronized, and sent to the relays. A merging unit allows better precision, less installation complexity, and higher dependability of substations by substituting the traditional copper wiring with digital streams of data. It serves as a key interface between primary equipment and secondary systems, allowing the entirely automated, adaptable, and interoperable operations of a grid in a contemporary power network.

Key Stakeholders

- Government & research organizations

- Institutional investors

- Investors/Shareholders

- Environmental research institutes

- Manufacturers’ associations

- Merging unit manufacturers, dealers, and suppliers

- System integrators and EPC contractors

- Organizations, forums, alliances, and associations

- Renewable power generation and equipment manufacturing companies

- Public & private power generation, transmission & distribution companies (utilities)

- Industrial, commercial, and data center owners

- State and national regulatory authorities

- Venture capital firms

Report Objectives

- To describe and forecast the merging unit market, by type, voltage, configuration, and end user, in terms of value

- To describe and forecast the merging unit market for various segments with respect to five main regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, in terms of value

- To describe and forecast the merging unit market, by region, in terms of volume

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the merging unit supply chain analysis, use case analysis, key stakeholders and buying criteria, patent analysis, trade analysis, tariff analysis, regulations, macroeconomic outlook, pricing analysis, Porter’s five forces analysis, impact of Gen AI/AI, and the 2024 US tariff impact

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the market’s competitive landscape

- To analyze growth strategies, such as acquisitions, investments, expansions, and product launches, adopted by market players in the merging unit market

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Detailed analysis and profiling of additional market players (up to five)

Company Information

- Further breakdown of the Merging Unit, by country

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Merging Unit Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Merging Unit Market