Mold Release Agents Market

Mold Release Agents Market by Type (Water-based, Solvent-based), Application (Die-casting, Rubber Molding, Plastic Molding, Concrete, PU Molding, Wood Composite & Panel Pressing, Composite Molding), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

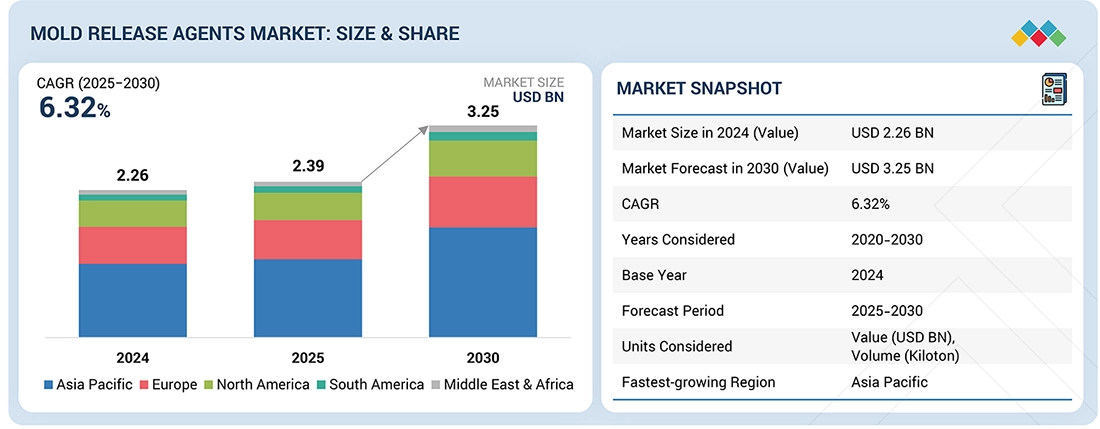

The global mold release agents market is projected to grow from USD 2.39 billion in 2025 to USD 3.25 billion by 2030, representing a compound annual growth rate (CAGR) of 6.32%. The primary drivers of this growth are the increasing production of molded components and the rising demand for improved surface finishes and long mold lifespans. Additionally, environmental regulations are encouraging the use of water-based and eco-friendly release agents. Moreover, advancements in the production processes of these agents are further contributing to the market expansion.

KEY TAKEAWAYS

-

By RegionAsia Pacific dominated the global mold release agents market in 2024, accounting for a market share of 49.8% in terms of value.

-

By TypeBy type, the water-based mold release agents segment is projected to be the fastest-growing segment with a CAGR of 6.46%, in terms of value, between 2025 and 2030.

-

By ApplicationBy application, the PU molding segment is projected to register the highest CAGR of 6.86%, in terms of value, during the forecast period.

-

Competitive Landscape - Key PlayersFreudenberg Group, Daikin Industries, Ltd., and Dow Inc. are identified as key players in the global mold release agents market. These companies have strong market presence and extensive product portfolios.

-

Competitive Landscape - Startups/SMEsParker-Hannifin Corporation, Ampacet Corporation, and Chukyo Yushi Holdings Co., Ltd., among other emerging players, have carved out solid positions within specialized niche segments, highlighting their potential to evolve into future market leaders.

The mold release agents market is anticipated to experience significant growth in the coming years, driven by their rising demand in applications, such as die-casting, polyurethane (PU) molding, concrete, and rubber molding. As industries place greater emphasis on operational efficiency, surface finish, and regulatory compliance, there is a noticeable shift toward high-performance products. Mold release agents facilitate a smooth release and help maintain product quality, which makes them a preferred choice across various sectors.

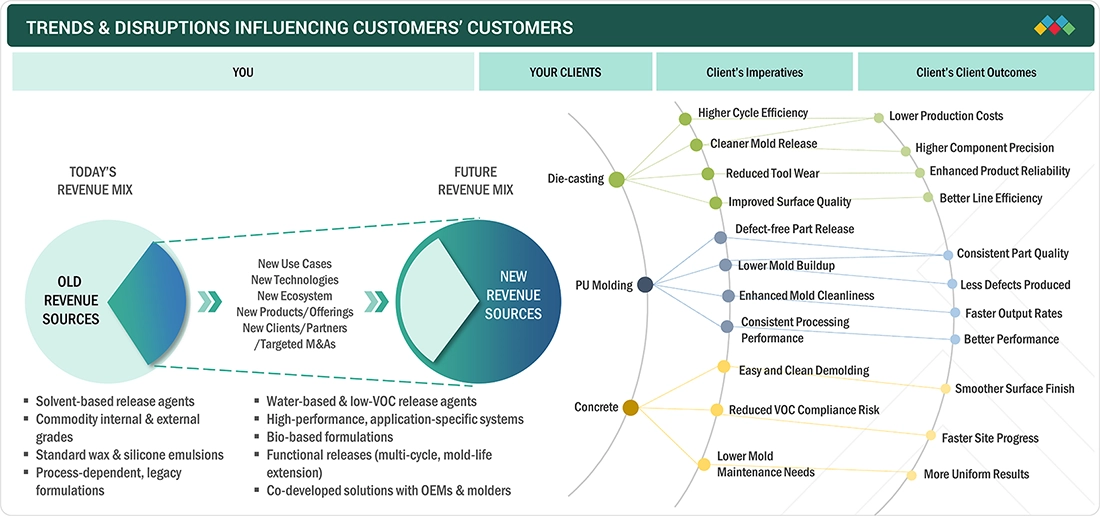

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The influence of the mold release agents market on consumer business stems from customer trends and disruptions. The primary end users of mold release agents include industries involved in die-casting, polyurethane (PU) molding, concrete production, rubber molding, and others. Shifts in trends or disruptions will affect the revenue of these end users. This revenue impact on end users will influence the profits of hot bets, which, in turn, will affect the revenue of mold release agent manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid growth of automotive and construction industries

-

Rising consumption in high-performance manufacturing applications

Level

-

Stringent regulations on solvent-based mold release agents

-

Rising use of non-stick coatings on molds

Level

-

Infrastructure development in emerging economies

Level

-

Fluctuating raw material prices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising consumption in high-performance manufacturing applications

The use of mold release agents has significantly increased in the manufacturing industry. Industries such as plastic, rubber, composites, wood, and polyurethane (PU) are now utilizing mold release agents on a large scale. The rising demand for rubber molded products—such as gaskets and seals, including rotary shaft seals, O-rings, dust seals, washtub seals, and heat exchanger gaskets—is a key factor driving this increase. Additionally, there is a growing need for medical equipment and supplies, such as syringe cups and blood vial stoppers, as well as for sporting goods like golf ball cores and cover hoses, and soles and midsoles for athletic shoes. Moreover, the demand for PU products, including foam for automotive seating, furniture, carpets, insulation backing foam, rigid PU foam for insulation and refrigeration panels, and shoe soles, is also contributing to the increased use of mold release agents. Furthermore, positive research findings highlighting the application of mold release agents in road construction for asphalt release and the production of elastomeric products, glass products, and electrical products are further propelling market growth.

Restraint: Rising use of non-stick coatings on molds

The effectiveness of non-stick coatings is restraining the growth of the mold release agents market. Non-stick coatings are made from materials such as fluoropolymers, elastomers, or ceramics. These materials help prevent materials from adhering to molds. Non-stick coatings provide several beneficial properties, including low surface energy, anti-adhesion characteristics, hydrophobicity, high chemical and heat resistance, good mechanical strength, a low coefficient of friction, non-wetting capabilities, high dielectric strength, a low dissipation factor, very high surface resistivity, and stability at elevated temperatures. Some common non-stick or anti-stick coatings include polytetrafluoroethylene (PTFE), fluorinated ethylene propylene (FEP), Teflon, physical vapor deposition (PVD), and plasma-assisted chemical vapor deposition (PACVD). PTFE, which is typically applied in one coat, offers the highest operating temperature of any fluoropolymer, reaching up to 500°F. FEP is similar to PTFE but provides superior release properties for non-stick applications, making it ideal for molds with operating temperatures up to 450°F. Teflon is widely used to coat molds, and Teflon mold release solutions are employed in nearly every rotational molding application.

Opportunity: Infrastructure development in emerging economies

The rapid development of infrastructure in emerging markets, driven by government investments in roads, housing, and industrial facilities, is a key opportunity for the growth of molded and precast components. This surge in infrastructure development boosts the consumption of mold release agents, which enhance demolding efficiency and improve the surface finish of these components. Additionally, the increasing adoption of modern construction methods and the rising foreign investments are strengthening the domestic manufacturing sector, contributing to a heightened demand for mold release agents.

Challenge: Fluctuating raw material prices

Mold release agents are made from a variety of raw materials, including natural oils, waxes, petroleum products, heavy metal soaps, molybdenum, solvents, and others. Climate change can impact the supply chain for some of these materials, particularly natural oils, which are dependent on specific climatic conditions and seasons. Additionally, fluctuations in crude oil prices affect the costs of these raw materials, which, in turn, influence the overall price of the final product. Frequent changes in raw material prices create challenges for manufacturers of mold release agents. It becomes essential to plan production costs carefully and secure long-term supply agreements. Sudden price increases can raise manufacturing costs and disrupt budgets, often requiring companies to raise product prices, which may harm customer relationships. This price instability can reduce profit margins, ultimately slowing down investments in new products.

MOLD RELEASE AGENTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of form-release agents in precast concrete elements, ready-mix formwork, and architectural concrete molds | Clean demolding without surface damage | Reduced formwork cleaning time | Improved concrete surface finish | Extended mold and form life |

|

Application of mold release agents in casting polyurethane, silicone rubber, epoxy, and composite parts for prototyping and production | Easy separation of complex molds | Protection of master molds | Reduced tear and defect rates | Improved casting repeatability |

|

Use of mold release agents in compression, transfer, and injection molding of rubber seals, gaskets, and plastic components | Improved part release | Reduced mold fouling | Consistent surface quality | Lower scrap rates | Increased tool life |

|

Application of die-casting mold release and lubricant agents for aluminum engine blocks, structural parts, and e-mobility components | Prevention of metal soldering | Improved surface finish and thermal control of dies | Reduced cycle times | Longer die life |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The mold release agents market ecosystem includes raw material suppliers, manufacturers, distributors, and end users to form an integrated value chain. Raw material suppliers provide critical inputs, such as silicones, fluoropolymers, waxes, and specialty hydrocarbons. Manufacturers formulate these raw materials into internal and external mold release agents, which are capable of providing effective demolding, surface finish quality, and mold protection. Thereafter, mold release agents are commercialized and scaled through distributors, who ensure regional availability, technical support, and supply chain efficiency. End users are involved in various applications of these agents. Some of these applications are die-casting, PU molding, concrete, rubber molding, composite molding, plastic molding, and wood composites & panel pressing. The demand for mold release agents stems from the need for increased productivity, minimized scraps, and environmental regulations. There is close coordination in the value chain to develop high-performance, low-VOC, and sustainable release agents.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Mold Release Agents Market, By Type

In 2024, the water-based mold release agents segment led the market in terms of value. This dominance was attributed to their low VOC emissions, regulatory compliance, and improved workplace safety. Industries such as automotive, rubber, plastic, and polyurethane (PU) molding find water-based mold release agents particularly advantageous for adhering to environmental regulations. Moreover, these agents are cost-effective, easy to process, and reduce mold buildup, resulting in increased production efficiency. The growing emphasis on sustainability practices among original equipment manufacturers (OEMs) and converters has also contributed to the leading position of this market.

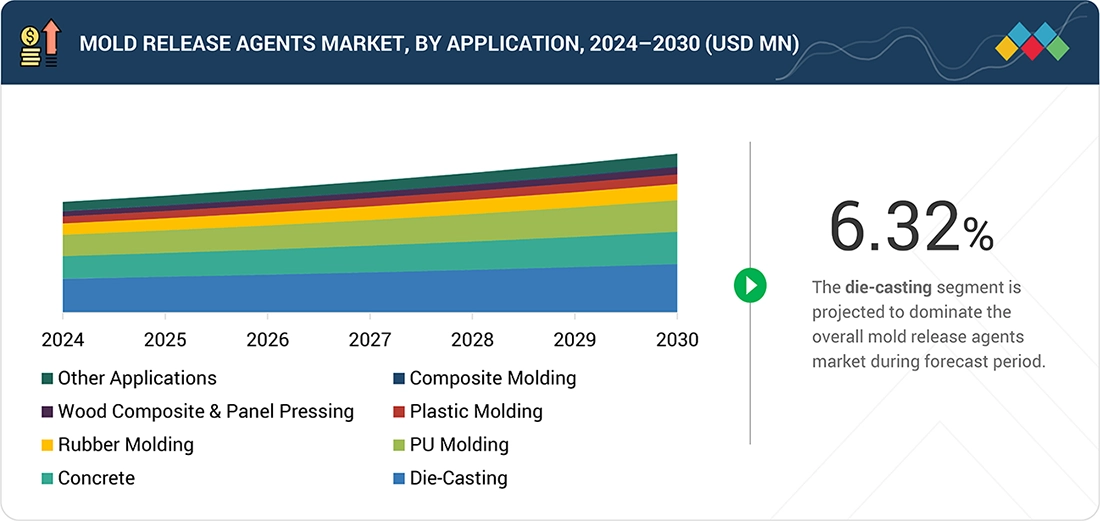

Mold Release Agents Market, By Application

In 2024, the die-casting segment accounted for the largest share of the market by value due to the extensive use of mold release agents in each cycle and the essential need for consistent part quality. Die-casting utilizes high-performance and heat-resistant release agents to enhance mold longevity. Additionally, the increase in production volume and automation in die-casting processes further contributed to the dominance of this market segment.

REGION

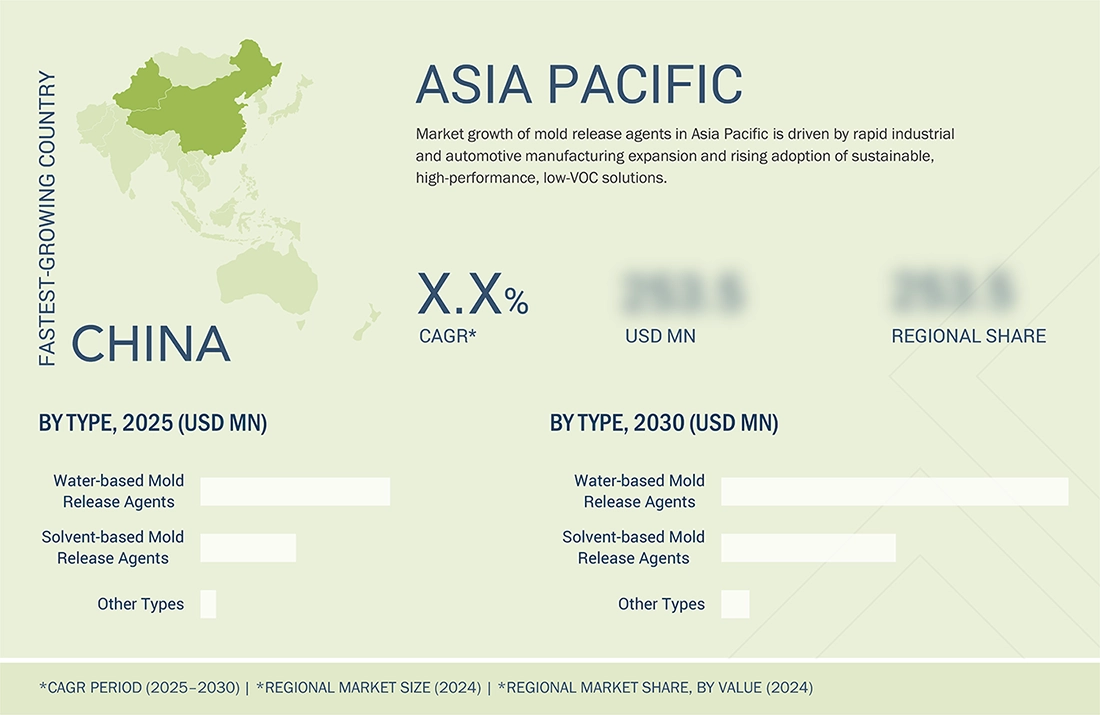

Asia Pacific accounted for the largest share of the global mold release agents market in 2024

In 2024, Asia Pacific accounted for the largest share of the global mold release agents market in terms of value. This growth is driven by the region's strong manufacturing facilities and high production volumes. The demand for mold release agents in Asia Pacific is further bolstered by key industries, such as automotive, construction, rubber, and plastics. Additionally, rapid industrialization, urban development, and increased production of electronics have contributed to market expansion in the region. The availability of low-cost raw materials and significant production capacities also plays a vital role in generating value within this market.

MOLD RELEASE AGENTS MARKET: COMPANY EVALUATION MATRIX

Freudenberg Group (Star) leads the mold release agents market owing to its broad global presence and a wide range of high-performance offerings in the automotive, rubber, plastics, and industrial segments. Its leadership position is established due to its expertise in advanced materials and focus on sustainable product offerings for its customers. On the other hand, Dow Inc. (Emerging Leader) is gaining traction through its advanced material expertise and increasing emphasis on sustainable and high-efficiency mold release solutions. Dow Inc. has the potential to shift toward the leaders’ quadrant as there is a growing requirement for mold release agents in eco-friendly and process-optimized solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Freudenberg Group (Germany)

- Daikin Industries, Ltd. (Japan)

- Henkel AG & Co. KGaA (Germany)

- LANXESS AG (Germany)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Dow Inc. (US)

- Michelman, Inc. (US)

- Marbocote Ltd. (UK)

- McGee Industries, Inc. (US)

- Miller-Stephenson, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.26 Billion |

| Market Forecast in 2030 (Value) | USD 3.25 Billion |

| Growth Rate | CAGR of 6.32% from 2025–2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, South America |

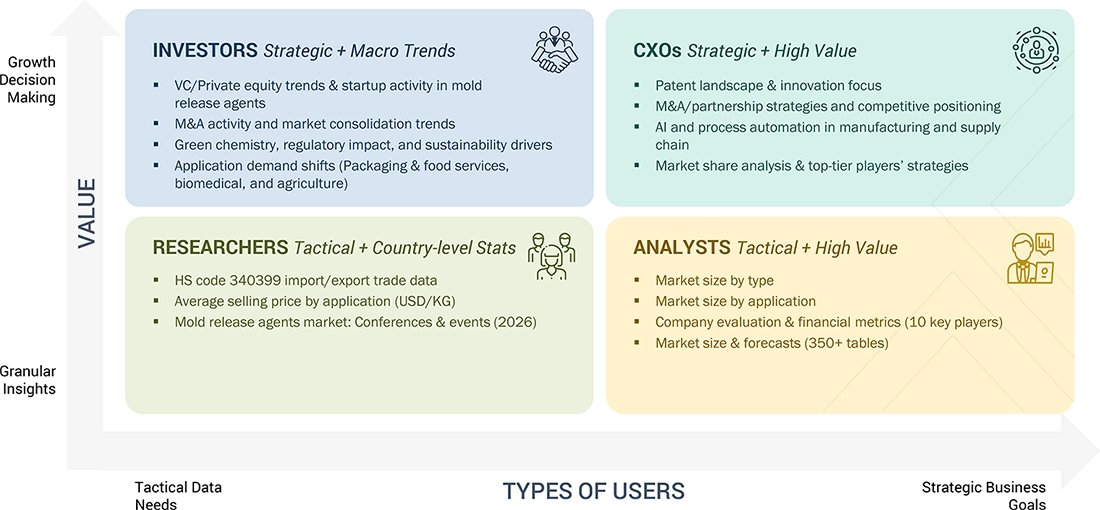

WHAT IS IN IT FOR YOU: MOLD RELEASE AGENTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Manufacturer of Europe-based Mold Release Agents |

|

|

| Manufacturer of Asia Pacific-based Mold Release Agents |

|

|

RECENT DEVELOPMENTS

- February 2024 : LANXESS AG finished and started its Rhenodiv production line extension in Jhagadia. The company’s Rhein Chemie business unit can produce much more due to this new facility. The facility will be able to meet the expanding demand from the Asian tires and rubber goods markets and the Indian sub-continent.

- November 2023 : Chem-Trend L.P., a subsidiary of Freudenberg Group, acquired the Mavcoat brand of mold release products from Maverix Solutions, Inc. Through the acquisition, Mavcoat products will be incorporated into Chem-Trend’s worldwide manufacturing network and product portfolio, facilitating local supply and servicing.

Table of Contents

Methodology

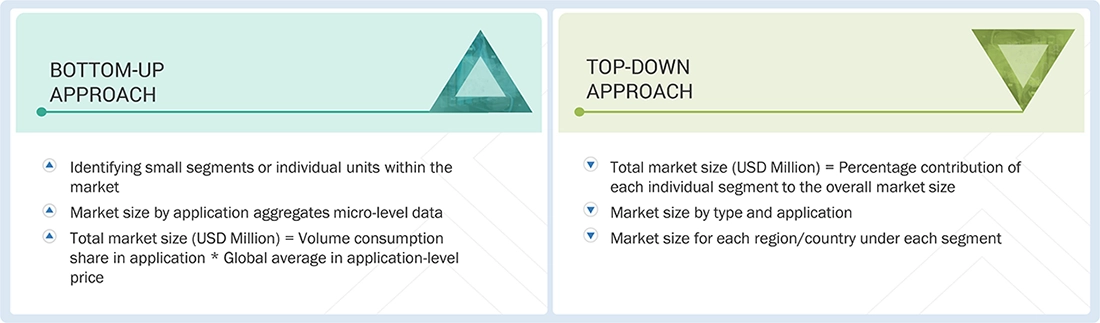

The study involved four major activities in estimating the market size for the global mold release agents market. Intensive secondary research was done to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

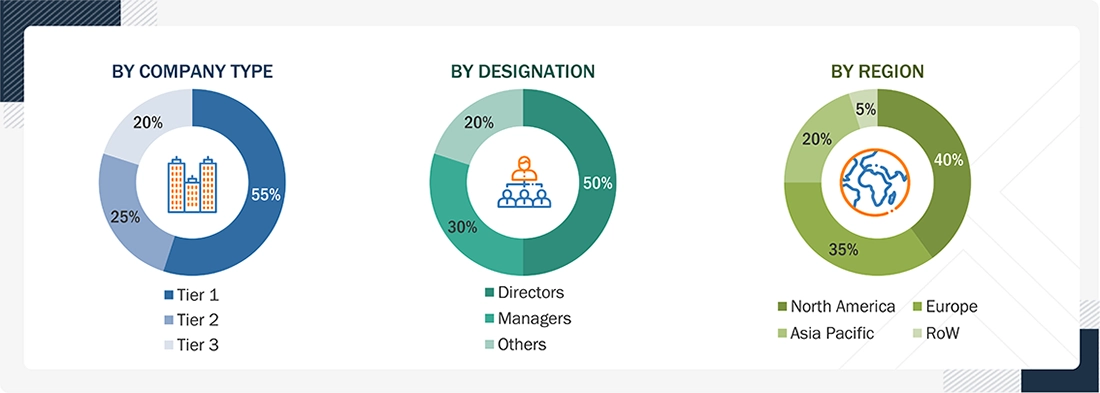

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The global mold release agents market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized from key opinion leaders in various applications for the global mold release agents market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Freudenberg Group |

Global Strategy & Innovation Manager |

|

Daikin Industries, Ltd. |

Technical Sales Manager |

|

Henkel AG & Co. KGaA |

Senior Supervisor |

|

LANXESS AG |

Production Supervisor |

|

Shin-Etsu Chemical Co., Ltd. |

Production Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global mold release agents market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Mold release agents Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into respective segments and subsegments. To realize the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the mold release agents industry.

Market Definition

Mold release agents are film-forming lubricating oils, solid lubricants, waxes, or fluids that prevent materials from sticking to an underlying surface. They are applied to the mold surfaces for easy removal of the molded parts and to avoid stick-ups. They provide lubricity and extend mold life, improve surface quality, and reduce scrap & defect rates of the molded parts. Mold release agents may be wiped, sprayed, or brushed on the surface.

Key Stakeholders

- Mold release agents manufacturers

- Raw material manufacturers

- Government planning commissions and research organizations

- Industry associations

- End-use industries

- R&D institutions

Report Objectives

- To analyze and forecast the size of the global mold release agents market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the global mold release agents market

- To define, describe, and segment the global mold release agents market based on type, and application

- To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, South America, and the Middle East & Africa in the global mold release agents market

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall global mold release agents market

- To identify and analyze opportunities for stakeholders in the global mold release agents market

- To strategically profile key players and comprehensively analyze their core competencies in the global mold release agents market

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional product type or type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Mold Release Agents Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Mold Release Agents Market

Adesh

Mar, 2017

Market size data, market trends, market size by application, market shares of major suppliers, year wise changes in market shares over 5 years in India.