Monolithic Microwave IC Market Size, Share and Trends, 2025 To 2030

Monolithic Microwave IC Market by Component (Power Amplifiers, Low Noise Amplifiers, Switches), Material Type (GaAs, InP, GaN), Frequency Band (L, S, C, X, Ku, K, Ka, V, W), Technology (MESFET, HEMT, pHEMT, mHEMT, E- pHEMT) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The monolithic microwave IC market is projected to reach USD 23.91 billion by 2030 from USD 14.53 billion in 2025, at a CAGR of 10.5% from 2025 to 2030. The market is driven by rising demand for MMICs from automotive industry, the automotive sector is growing rapidly with the advancement in vehicle electrification, and autonomous vehicles. MMICs have been widely used with radar systems in adaptive cruise control, collision prevention, and blind-spot detection systems.

KEY TAKEAWAYS

-

BY COMPONENTAttenuators segment is expected to witness highest CAGR in monolithic microwave IC market during the forecast period. Attenuators are essential for managing signal strength, ensuring optimal performance in high-frequency environments, especially with the deployment of 5G advanced technology and its increasing demand for precise signal control in different applications, such as telecommunications and consumer electronics, As more devices need efficient signal processing capabilities, this sector will continue to grow and find itself in a favorable position in the MMIC overall market.

-

BY MATERAL TYPEMarket for gallium arsenide segment is projected to account for largest market share during the forecast timeline, The dominant position of gallium arsenide segment can be attributed to its enhanced performance characteristics such as high efficiency, low noise figure, and thermal stability which makes it ideal for applications in the area of high frequencies. Such applications are in the wireless communication and radar systems areas and aerospace technologies.

-

BY TECHNOLOGYHEMT to hold significant market share during the forecast period. HEMT's performance in high-frequency, high-power, and low-noise applications, making it a ideal choice across industries like telecommunications, defense, and aerospace. HEMTs are known for having good electron mobility, which makes the switching speed higher and power consumption lower than the conventional FETs.

-

BY FREQUENCY BANDKa frequency band segment is expected to hold largest market share during forecast period, Ka-band frequencies find extensive application in satellite communications, high-speed broadband, radar systems, and even in 5G advanced networks. This range between 27 and 40 GHz is highly applicable in satellite communication and in next-generation technologies that include 5G advanced-which need a bandwidth in order to smoothly transmit data from one device to another

-

BY APPLICATIONConsumer/enterprise electronics segment is expected to hold largest market share in monolithic microwave IC market during forecast period,the consumer and enterprise electronics segment are anticipated to dominate the monolithic microwave IC market due to the need for high-performance electronic devices, which require signal processing capabilities that are more efficient.

-

BY REGIONThe aerospace materials market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Europe is the largest market for aerospace materials and is home to several prominent aerospace companies. It is also witnessing new aircraft projects that are contributing to the increasing adoption of aerospace materials products.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Syensqo (Belgium), Toray Industries, Inc. (Japan), and Mitsubishi Chemical Group Corporation (Japan)have entered into a number of agreements and partnerships to cater to the growing demand for aerospace materials across innovative applications.

The monolithic microwave IC market is witnessing steady growth, driven by the popularity of multimedia applications and broadband Internet has led to an ever-increasing demand for high data throughputs in cellular and wireless networks. The frequency bands such as K-band, and Ka- band which encompasses frequencies from 18 GHz to 27 GHz and 26.5 GHz to 40 GHz, offers a substantial amount of spectrum that is ideal for high-capacity wireless communication links by surging the adoption of K-band & ka-band frequency band to meet increasing bandwidth requirements of cellular and wireless networks. Thereby, fulfilling the requirement for high transfer rates for a large amount of data in the competitive digital and computing world

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The monolithic microwave integrated circuit (MMIC) market is experiencing transformations due to emerging trends and disruptions. The rollout of 5G networks and the push toward 6G is driving demand for MMICs in RF front-end modules, power amplifiers, and beamforming applications. Expansion of KA band applications in the growth of satellite communications and as the demand increases for high-throughput satellites (HTS) and low-earth orbit (LEO) satellite constellations, the Ka-band (26.5-40 GHz) is essential. Moreover, the growth of smart sensors, edge computing, and industrial automation is increasing the demand for MMICs in IoT-enabled devices, driving the need for MMICS.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of next-generation warfare techniques

Level

-

High development cost

Level

-

Growing preference for compact and miniaturized devices

-

Global surge in space programs

Level

-

Streamlining designing and cost-effective manufacturing of MMIC

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of next-generation warfare techniques

Growing adoption of next-generation warfare tactics is likely to boost the demand for the monolithic microwave integrated circuit (MMIC) market significantly. As countries invest in next-generation warfare systems to maintain strategic advantages, advanced electronic components such as MMICs are essential. The trend can be seen in the emphasis on technologies like hypersonic, AI-driven systems, and advanced radar technologies.

Restraint: High development cost

The high development cost of monolithic microwave integrated circuits (MMICS) present a significant restraint on the market's growth. As the technologies used for designing MMICs are constantly evolving, the financial investment required for research, development, and production remains substantial. The raw materials used in MMIC production, such as Gallium Arsenide (GaAs), Gallium Nitride (GaN), and Indium Phosphide (InP), are expensive compared to traditional silicon.

Opportunity:Growing preference for compact and miniaturized devices

As consumers increasingly favor smaller, more portable electronic devices, the need for compact MMICS has surged. MMICs allow the incorporation of several functions within a single chip, thus allowing the reduction in size and weight without sacrificing performance. Modern consumers favor portability, slimmer designs, and increased functionality which necessitates advanced components packaged into smaller form factors.

Challenge: Streamlining designing and cost-effective manufacturing of MMIC

Designing robust MMICs presents several significant challenges such as to navigate and ensure optimal performance and reliability. One of the primary hurdles is managing higher frequency requirements. As the demand for faster communication systems increases, MMICs must operate at higher frequencies, which introduces complexities in design due to increased heat generation and the need for effective thermal management solutions.

Monolithic Microwave IC Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

MMICs for Ku-band and millimeter-wave satellite communications, phased array radars, and wireless backhaul. | High efficiency, wide frequency coverage, improved signal integrity, size and weight reduction in systems. |

|

MMICs in 5G infrastructure, small cells, and mobile devices for high-frequency RF front-end modules. | Enables higher data rates, compact form factor, extended coverage, enhanced reliability in harsh environments |

|

Custom MMICs for radar, synthesizers, and mission-critical communications with advanced packaging for rugged use. | Reduced SWaP (Size, Weight, and Power), ultra-low phase noise, improved reliability in extreme conditions. |

|

MMICs based on advanced silicon and BiCMOS for automotive radar, GPS, and wireless base stations. | Superior integration, improved thermal management, economies of scale, smaller board footprint, low noise. |

|

Wideband MMICs for RF, microwave, and millimeter-wave applications in telecom, aerospace, and defense sectors. | Accelerated design cycles, modularity, flexible system integration, high RF performance across wide bands. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The monolithic microwave IC ecosystem mainly consists of raw material providers, MMIC manufacturers, suppliers & distributors, and end users. Raw materials procured for the manufacturing of MMICs include semiconductor materials such as silicon (Si), silicon germanium (SiGe), gallium arsenide (GaAs), gallium nitride (GaN), and indium phosphide (InP). Manufacturers are responsible for designing and manufacturing of MMICs with advanced semiconductor technologies. Similarly, suppliers and distributors bridge the gap between manufacturers and end-users. They source MMICs from manufacturers, manage the logistics, ensuring timely delivery to various markets. Finally, end users, including companies in telecommunications, automotive, and defense sectors, utilize MMICs in their products to achieve high-frequency communication and improved signal processing capabilities.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Monolithic Microwave IC Market, By Component

Attenuators segment is expected to witness highest CAGR in monolithic microwave IC market during the forecast period. Attenuators are essential for managing signal strength, ensuring optimal performance in high-frequency environments, especially with the deployment of 5G advanced technology and its increasing demand for precise signal control in different applications, such as telecommunications and consumer electronics, As more devices need efficient signal processing capabilities, this sector will continue to grow and find itself in a favorable position in the MMIC overall market.

Monolithic Microwave IC Market, By Material Type

Market for gallium arsenide segment is projected to account for largest market share during the forecast timeline. The dominant position of gallium arsenide segment can be attributed to its enhanced performance characteristics such as high efficiency, low noise figure, and thermal stability which makes it ideal for applications in the area of high frequencies. Such applications are in the wireless communication and radar systems areas and aerospace technologies. Advances in the fabrication processes used in producing MMICs enhance their performance and reliability and hence fuel increased demand for GaAs-based MMICs. In addition, the increasing demand for compact and efficient electronic devices in various industries is driving the adoption of GaAs technology.

Monolithic Microwave IC Market, By Technology

HEMT to hold significant market share during the forecast period. HEMTs are known for having good electron mobility, which makes the switching speed higher and power consumption lower than the conventional FETs. These characteristics make them more valuable in the telecommunications and aerospace industries where efficiency and performance are crucial. The growing demand for advanced communication technologies, especially 5G expansions, is contributing to the wide adoption of HEMT-based MMICs. Its wide application in highly advanced radar and electronic warfare products in the defense sector also enhances its strong position in the market. Additionally, HEMT-based MMICs find a wide and diverse application base in satellite systems, especially through space exploration and communication, attributed to their greater reliability and processing of large-scale data.

Monolithic Microwave IC Market, By Frequency

The Ka-band segment is projected to capture a considerable share of the market, displaying high flexibility and responsiveness to changing trends within the industry. With the increasing spread of advanced technology across the world, the use of the Ka band is increasingly gaining popularity, which further boosts its market position. This frequency range is essential for achieving the performance required by advanced applications, including high-speed internet access and secure military communications, through the use of MMICs. Moreover, the increasing number of space missions and advancements in defense technologies are contributing to the rising adoption of Ka band MMICs. Military operations depend more on the sophisticated communication system, the need for robust MMIC solutions that can operate effectively within this frequency range. Hence, adoption of Ka band MMICs is being driven by increasing demand for high-speed internet and other advanced communication systems owing to their greater performance in signal clarity and processing capabilities.

Monolithic Microwave IC Market, By Application

The consumer and enterprise electronics segment are anticipated to dominate the monolithic microwave IC market. The growth in cloud computing and data centers demands advanced communication infrastructures that can handle high-frequency signals and large volumes of data. MMICs are critical in achieving these performance requirements, enabling faster data transfer rates and improved connectivity. Furthermore, the small size and ability to be integrated in MMICs, makes them ideal for the modern electronic device with space considerations as a big concern. Operating at microwave frequencies increases their effectiveness and therefore makes them desirable in both consumer and enterprise applications.

REGION

Asia Pacific to be fastest-growing region in global MMIC market during forecast period

The major drivers for the growth of MMIC market in Asia Pacific are the expanding cellular infrastructure in the region and the increasing number of telecom equipment shipments in countries such as China and India. The Asia-Pacific market benefits from the increasing number of manufacturers such as WIN Semiconductors (China), ASB Inc. (South Korea) and Mitsubishi Electric Corporation (Japan) that specialize in MMIC technology, which increases competition and innovation. Investment in telecommunications infrastructure, especially in 5G and 5G advanced networks, is also a significant factor driving the demand for MMICs.

Monolithic Microwave IC Market: COMPANY EVALUATION MATRIX

In the monolithic microwave IC market matrix, Qorvo, Inc. (Star) leads with a strong market share and extensive product footprint, have a robust market presence, and adopt effective business strategies. These are the leading players in terms of developments such as product launches, innovative technologies, and the adoption of strategic growth plans.Mitsubishi Electric Corporation (Emerging Leader) is gaining visibility with imore substantial product innovations than those of their competitors. They have highly focused product portfolios. While Qorvo, Inc. dominates through scale and a diverse portfolio, Mitsubishi Electric Corporation shows significant potential to move toward the leaders’ quadrant as demand for high-strength alloys continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.84 Billion |

| Market Forecast in 2030 (Value) | USD 23.91 Billion |

| Growth Rate | CAGR of 10.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

WHAT IS IN IT FOR YOU: Monolithic Microwave IC Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Total RFIC Market size including MMIC |

|

|

RECENT DEVELOPMENTS

- June 2024 : Qorvo, Inc. (US) launched Ku-Band satellite communications (SATCOM) terminals with three new MMIC power amplifiers. These products are the latest additions to a family of devices designed to enhance performance and efficiency in satellite uplink systems, supporting the growing demand for high-speed data communications in defense and aerospace applications. The output power of the amplifier family ranges from 8W to 55W, providing flexibility to choose the optimal power required for each specific requirement.

- June 2024 : Qorvo, Inc. (US) launched three new highly integrated RF multi-chip modules (MCMs) designed for advanced radar applications. The new modules leverage Qorvo’s packaging and optimal process technology to deliver the compact size, superior performance, lower noise and reduced power consumption needed for modern phased array and multifunction radar systems.

- November 2024 : MACOM (US) acquired ENGIN-IC, Inc. (“ENGIN-IC”), a fabless semiconductor company that designs advanced Gallium Nitride (“GaN”) monolithic microwave integrated circuits (“MMICs”) and integrated microwave assemblies. It is expected that ENGIN-IC’s design capabilities will strengthen MACOM’s ability to serve its target markets and gain market share.

Table of Contents

Methodology

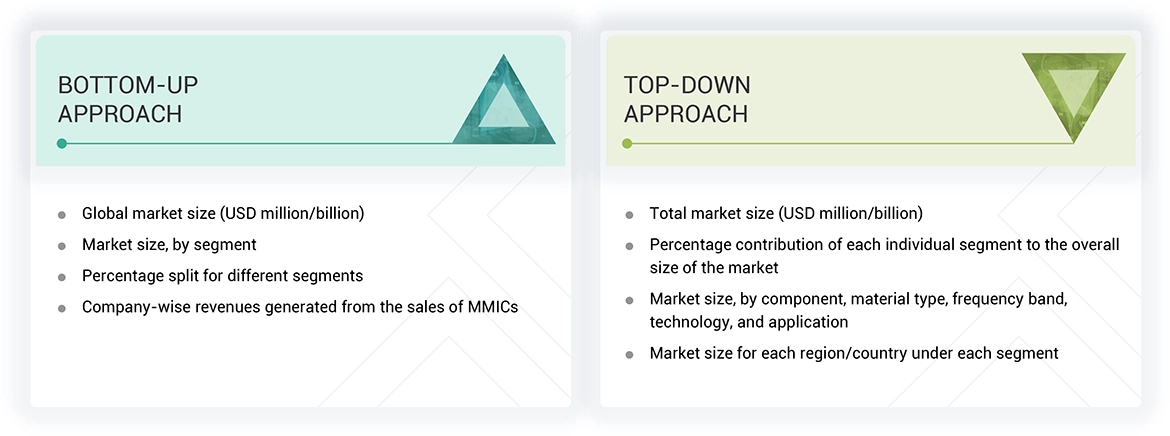

The study involved four major activities in estimating the current size of the monolithic microwave IC market—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the supply chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Source |

Web Link |

|

Semiconductor Industry Association |

https://www.semiconductors.org/ |

|

Semiconductor Equipment and Materials International (SEMI) |

https://www.semi.org/en |

|

Global Semiconductor Alliance (GSA) |

https://www.gsaglobal.org/ |

|

World Semiconductor Council |

https://www.semiconductorcouncil.org/ |

|

Semiconductor Portal Inc. |

https://www.semiconportal.com/ |

|

Electronic Components Industry Association (ECIA) |

https://www.eciaauthorized.com/en |

|

International Journal of Scientific & Engineering Research (IJSER) |

https://www.ijser.in/ |

|

International Organization of Scientific Research (IOSR) |

https://www.iosrjournals.org/iosr-jdms.html |

|

International Journal of Engineering Trends and Technology (IJETT) |

https://www.ijettjournal.org/ |

|

International Journal of Engineering Development and Research (IJEDR) |

https://www.ijedr.org/ |

Primary Research

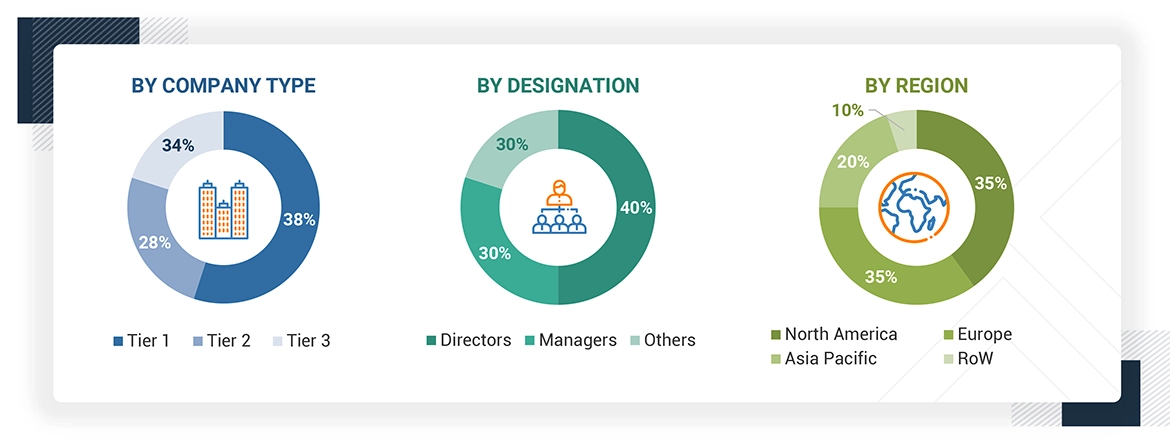

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the supply chain market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of supply chain solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: The three tiers of the companies are defined based on their total revenue in 2023: Tier 1 - revenue greater than USD 1 billion; Tier 2 - revenue between USD 500 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 500 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Monolithic Microwave IC Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Monolithic microwave integrated circuits (MMICs) consist of electronic devices placed on semiconductor wafers and are designed to operate in frequencies ranging from 300 MHz to 300 GHz. MMICs are used for high-frequency switching, power amplification, low-noise amplification, and microwave mixing functions, among other functions. These circuits were originally fabricated using gallium arsenide (GaAs), an III-V compound semiconductor with a high transistor speed and a semi-insulating substrate.

The major characteristics of MMICs are high breakdown voltage, high thermal conductivity, effective operability at high frequencies (up to microwave range), excellent power handling capability, and efficient power amplification. The use of MMICs for Radio Frequency (RF) transmissions and receptions is one of the major factors contributing to the increased demand for MMICs, with a significant focus on the development of microwave frequency (>1 GHz) RF-power amplifiers for widening the application base of RF devices. With the increasing demand for these circuits for use in applications such as consumer electronics, wireless communication infrastructure, automotive, aerospace & defense, the market for MMICs is expected to grow at a significant rate during the forecast period.

Key Stakeholders

- Raw material suppliers

- Electronic design automation (EDA) and design tool vendors

- Original equipment manufacturers (OEMs)

- Integrated device manufacturers (IDMs)

- Original design manufacturers (ODMs)

- ODM and OEM technology solution providers

- Assembling, testing, and packaging vendors

- Technology, service, and solution providers

- Intellectual property (IP) core and license providers

- Suppliers and distributors

- Government and other regulatory bodies

- Technology investors

- Research institutes and organizations

- Market research and consulting firms

Report Objectives

- To describe, segment, and forecast the monolithic microwave IC market, in terms of value based on component, material type, frequency band, technology, and application

- To describe and forecast the monolithic microwave IC market, by component, in terms of volume

- To describe and forecast the market for four key regions, namely North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the market dynamics (drivers, restraints, opportunities, and challenges) influencing the growth of the monolithic microwave IC market

- To provide a detailed overview of the supply chain and ecosystem pertaining to the monolithic microwave IC, along with their average selling prices

- To strategically analyze the ecosystem, tariffs & regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches & developments, expansions, partnerships, and acquisitions in the monolithic microwave IC market

- To strategically profile the key players in the monolithic microwave IC market and comprehensively analyze their market ranking and core competencies

- To analyze the impact of Impact of Gen AI/AI on the market and macroeconomic outlook for each region.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the monolithic microwave IC market

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company in the monolithic microwave IC market.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Monolithic Microwave IC Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Monolithic Microwave IC Market