2

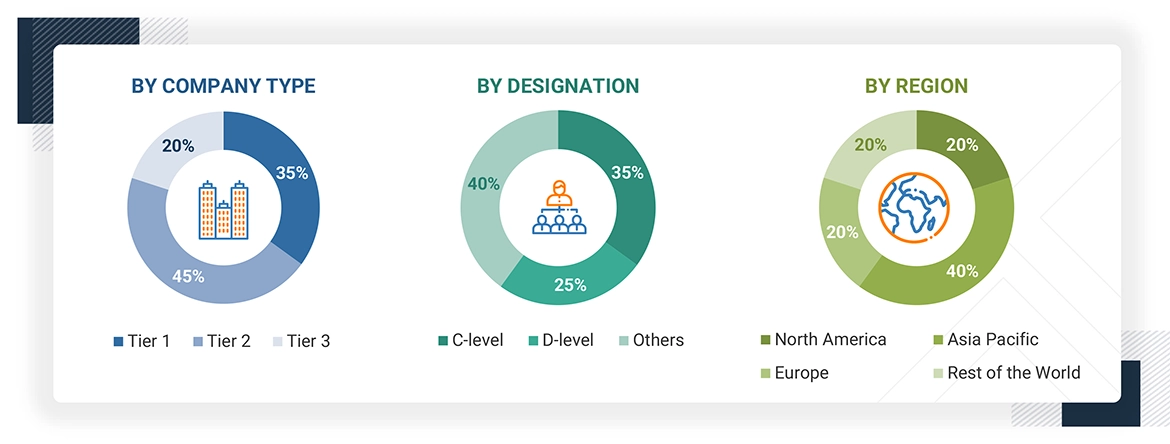

RESEARCH METHODOLOGY

34

5

MARKET OVERVIEW

Regulatory shifts and tech innovations drive multi-beam echo sounder market growth amid operational challenges.

49

5.2.1.1

Regulatory enforcement of environmental compliance in coastal and inland projects

5.2.1.2

Increased investments in hydrographic surveys by government agencies

5.2.1.3

Expansion of global maritime fleet

5.2.1.4

Growing adoption in defense and maritime security

5.2.2.1

High cost of integration

5.2.2.2

Operational limitations under shallow water conditions

5.2.3.1

Rapid integration of multi-beam echo sounders with autonomous underwater and surface vehicles

5.2.3.2

Innovations in multi-beam echo sounder technology

5.2.3.3

Increased deployment of submarine infrastructure

5.2.4.1

Substantial data volume and complex post-processing

5.2.4.2

Shortage of skilled workforce

5.3

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.6.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.6.2

APPLICATION-WISE REGULATIONS FOR MULTI-BEAM ECHO SOUNDERS

5.6.3

REGULATORY FACTORS IMPACTING MULTI-BEAM ECHO SOUNDER MANUFACTURERS/END USERS

5.7.1

IMPORT SCENARIO (HS CODE 9015)

5.7.2

EXPORT SCENARIO (HS CODE 9015)

5.8

KEY STAKEHOLDERS AND BUYING CRITERIA

5.8.1

KEY STAKEHOLDERS IN BUYING PROCESS

5.9.1

SEABAT T-SERIES MULTI-BEAM ECHO SOUNDER SYSTEM

5.9.2

SEABAT T20 MULTI-BEAM ECHO SOUNDER

5.9.3

SEABAT 7125 SV2 MULTI-BEAM ECHO SOUNDER

5.10

KEY CONFERENCES AND EVENTS, 2025–2026

5.11

MACROECONOMIC OUTLOOK

5.12.1

AVERAGE SELLING PRICE, BY VESSEL TYPE AND KEY PLAYER

5.12.2

AVERAGE SELLING PRICE TREND, BY REGION

5.14

TOTAL COST OF OWNERSHIP

5.15

INVESTMENT AND FUNDING SCENARIO

5.16.3

PRICE IMPACT ANALYSIS

5.16.4

IMPACT ON COUNTRY/REGION

5.16.5

IMPACT ON END-USE INDUSTRIES

5.20

APPLICATION TRENDS FOR MULTI-BEAM ECHO SOUNDER MARKET

5.20.1

HYDROGRAPHIC SURVEYING FOR NAUTICAL CHARTING

5.20.2

OFFSHORE WIND FARM DEVELOPMENT AND MONITORING

5.20.3

SUBSEA PIPELINE AND TELECOMMUNICATIONS CABLE INSPECTION

5.20.4

MINE COUNTERMEASURES AND SEABED INTELLIGENCE

5.20.5

ENVIRONMENTAL MONITORING AND SEABED HABITAT MAPPING

5.20.6

PORT CONSTRUCTION, MAINTENANCE, AND DREDGING OPERATIONS

5.20.7

INLAND WATERBODY MAPPING AND FLOODPLAIN MANAGEMENT

5.21

GROWTH OPPORTUNITIES FOR MULTI-BEAM ECHO SOUNDER MARKET

5.21.1

COMMERCIAL APPLICATIONS

5.21.2

DEFENSE APPLICATIONS

5.21.3

RESEARCH APPLICATIONS

5.22.1.1

Real-time digital beamforming and signal processing

5.22.1.2

Backscatter processing and classification

5.22.1.3

Real-time data fusion and software integration

5.22.1.4

AI-powered seafloor classification

5.22.1.5

Dual-head and split-aperture configuration

5.22.2

ADJACENT TECHNOLOGIES

5.22.2.1

Side scan sonar systems

5.22.2.2

LiDAR bathymetry

5.22.2.3

Acoustic Doppler Current Profilers

5.23

IMPACT OF MEGATRENDS

5.23.1

RAPID ADOPTION OF UNCREWED AND AUTONOMOUS MARITIME SYSTEMS

5.23.2

RISE OF OCEAN MONITORING

5.23.3

OFFSHORE RENEWABLE ENERGY EXPANSION

5.23.4

DIGITALIZATION AND REAL-TIME DATA DELIVERY

5.23.5

STRATEGIC MARITIME SURVEILLANCE AND DEFENSE

5.24

SUPPLY CHAIN ANALYSIS

6

MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

93

6.2

APPLICATION-RELATED INSIGHTS

6.3.1

RISE OF NATIONAL OR REGIONAL MAPPING PROGRAMS

6.4

ROUTE SURVEY FOR MARITIME INDUSTRIES

6.4.1

ELEVATED DEMAND FOR ROUTE SAFE INSTALLATION AND LONG-TERM ASSET MONITORING

6.5

SUBSEA INFRASTRUCTURE AS-LAID MAPPING & INSPECTION

6.5.1

NEED FOR ASSET INTEGRITY MANAGEMENT IN OFFSHORE OIL & GAS AND SUBSEA RENEWABLES

6.6.1

EMPHASIS ON MARITIME SITUATIONAL AWARENESS AND ANTI-SUBMARINE WARFARE

7

MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 3 Data Tables

99

7.2.1

COASTAL MAPPING AND PORT SURVEYS DRIVE HIGH-FREQUENCY MULTI-BEAM ECHO SOUNDER ADOPTION

7.3.1

REGIONAL SURVEY PROGRAMS AND COASTAL INFRASTRUCTURE PROJECTS SUSTAIN DEMAND

7.4.1

OFFSHORE SURVEY EXPANSION SUPPORT MULTI-BEAM ECHO SOUNDER DEPLOYMENT

7.5.1

OCEAN MAPPING AND SUBSEA INFRASTRUCTURE DEMANDS PROPEL GROWTH

8

MULTI-BEAM ECHO SOUNDER MARKET, BY PLATFORM

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 6 Data Tables

103

8.2

PLATFORM-RELATED INSIGHTS

8.3

CREWED VS. UNCREWED VESSELS

8.4

REMOTE-CONTROLLED VS. AUTONOMOUS VESSELS

8.5

SURFACE VS. UNDERWATER VESSELS

9

MULTI-BEAM ECHO-SOUNDER MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

109

9.2

END-USER-RELATED INSIGHTS

9.3

HYDROGRAPHIC AGENCIES

9.3.1

NATIONAL CHARTING OBLIGATIONS PROMOTING LONG-TERM ADOPTION

9.4.1

OPERATIONAL EXPANSION OF OFFSHORE SECTORS

9.5

MARITIME CONSTRUCTION

9.5.1

RAPID DEPLOYMENT IN PRE- AND POST-LAY SURVEYS AND PROGRESS MONITORING

9.6.1

TREND OF DIGITAL PORT INFRASTRUCTURE AND AUTOMATED CHANNEL MONITORING

9.7

GOVERNMENT ENVIRONMENTAL RESEARCH & MONITORING AGENCIES

9.7.1

ENVIRONMENTAL MANDATES SUPPORTING CONTINUOUS MONITORING

9.8

PUBLIC & PRIVATE EDUCATIONAL/RESEARCH ESTABLISHMENTS

9.8.1

ACADEMIC INSTITUTIONS BROADENING USE OF MULTI-BEAM ECHO SOUNDERS IN MARINE SCIENCE

10

MULTI-BEAM ECHO SOUNDER MARKET, BY REGION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 272 Data Tables

114

10.2.3

COUNTRY-SPECIFIC COASTAL CHARACTERISTICS

10.2.4.1

Government funding and naval modernization to drive market

10.2.5.1

Government-led hydrographic initiatives and Arctic sovereignty programs to drive market

10.3.3

COUNTRY-SPECIFIC COASTAL CHARACTERISTICS

10.3.4.1

Substantial investments in naval modernization and port infrastructure to drive market

10.3.5.1

Offshore energy developments to drive market

10.3.6.1

Focus on maritime infrastructure and scientific research to drive market

10.3.7.1

Growing offshore oil & gas and wind sectors to drive market

10.3.8.1

Environmental monitoring efforts under EU directives to drive market

10.4.3

COUNTRY-SPECIFIC COASTAL CHARACTERISTICS

10.4.4.1

Sovereignty mapping and naval expansion to drive market

10.4.5.1

Growing maritime footprint to drive market

10.4.6.1

Strong maritime research institutions and active port operations to drive market

10.4.7.1

High investments in naval modernization and marine research to drive market

10.4.8

REST OF ASIA PACIFIC

10.5

MIDDLE EAST & AFRICA

10.5.3

COUNTRY-SPECIFIC COASTAL CHARACTERISTICS

10.5.5.1

National hydrography and coastal management initiatives to drive market

10.5.6.1

Expansion and modernization of maritime infrastructure to drive market

10.5.7.1

Institutional investment in maritime safety to drive market

10.6.3

COUNTRY-SPECIFIC COASTAL CHARACTERISTICS

10.6.4.1

Maritime defense priorities and national hydrographic efforts to drive market

10.6.5.1

Expansion of coastal engineering and marine monitoring programs to drive market

11

COMPETITIVE LANDSCAPE

Uncover market dominance tactics and future leaders shaping industry competition.

219

11.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2025

11.3

REVENUE ANALYSIS, 2021–2024

11.4

MARKET SHARE ANALYSIS, 2024

11.5

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

11.5.5.1

Company footprint

11.5.5.2

Region footprint

11.5.5.4

End user Footprint

11.5.5.5

Platform Footprint

11.6

COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

11.6.1

PROGRESSIVE COMPANIES

11.6.2

RESPONSIVE COMPANIES

11.6.5

COMPETITIVE BENCHMARKING

11.6.5.1

List of start-ups/SMEs

11.6.5.2

Competitive benchmarking of start-ups/SMEs

11.7

BRAND/PRODUCT COMPARISON

11.8

COMPANY VALUATION AND FINANCIAL METRICS

11.9

COMPETITIVE SCENARIO

11.9.3

OTHER DEVELOPMENTS

12

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

244

12.1.1.1

Business overview

12.1.1.2

Products offered

12.1.1.3

Recent developments

12.1.2

TELEDYNE TECHNOLOGIES INCORPORATED

12.1.4

TRITECH TECHNOLOGIES LIMITED

12.1.8

IMAGENEX TECHNOLOGY CORPORATION

12.1.9

FURUNO ELECTRIC CO., LTD.

12.1.11

BEIJING HYDRO-TECH MARINE TECHNOLOGY CO., LTD.

12.1.12

SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.

12.1.13

HI-TARGET NAVIGATION TECH CO., LTD.

12.2.1

NANJING VASTSEA-TECH MARINE CO, LTD.

12.2.2

SEAFLOOR SYSTEMS INC.

12.2.6

SATLAB GEOSOLUTIONS

13.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3

CUSTOMIZATION OPTIONS

TABLE 1

USD EXCHANGE RATES

TABLE 2

ECOSYSTEM ANALYSIS FOOTPRINT

TABLE 3

ROLE OF COMPANIES IN ECOSYSTEM

TABLE 4

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7

MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8

LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9

IMPORT DATA FOR HS CODE 9015-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 10

EXPORT DATA FOR HS CODE 9015-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 11

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

TABLE 12

KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 13

KEY CONFERENCES AND EVENTS, 2025–2026

TABLE 14

KONGSBERG: AVERAGE SELLING PRICE OF MULTI-BEAM ECHO SOUNDERS, BY VESSEL TYPE, 2024 USD MILLION

TABLE 15

TELEDYNE TECHNOLOGIES INCORPORATED: AVERAGE SELLING PRICE OF MULTI-BEAM ECHO SOUNDERS, BY VESSEL TYPE, 2024 USD MILLION

TABLE 16

NORBIT ASA: AVERAGE SELLING PRICE OF MULTI-BEAM ECHO SOUNDERS, BY VESSEL TYPE, 2024 USD MILLION

TABLE 17

AVERAGE SELLING PRICE TREND OF MULTI-BEAM ECHO SOUNDERS, BY REGION, 2024 (USD MILLION)

TABLE 18

MULTI-BEAM ECHO SOUNDER DELIVERIES, BY VESSEL TYPE, 2021–2030

TABLE 19

BUSINESS MODELS IN MULTI-BEAM ECHO SOUNDER MARKET

TABLE 20

COMPARISON BETWEEN BUSINESS MODELS OF KEY PLAYERS

TABLE 21

TECHNOLOGY USAGE BY KEY PLAYERS

TABLE 23

MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 24

MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 25

DEPTH-RELATED INSIGHTS

TABLE 26

MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021–2024 (USD MILLION)

TABLE 27

MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025–2030 (USD MILLION)

TABLE 28

MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 29

MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 30

MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 31

MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 32

MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 33

MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 34

MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 35

MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 36

MULTI-BEAM ECHO SOUNDER MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 37

MULTI-BEAM ECHO SOUNDER MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 38

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 39

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 40

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 41

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 42

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 43

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 44

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 45

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 46

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 47

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 48

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 49

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 50

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021–2024 (USD MILLION)

TABLE 51

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025–2030 (USD MILLION)

TABLE 52

US: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 53

US: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 54

US: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 55

US: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 56

US: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 57

US: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 58

US: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 59

US: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 60

US: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 61

US: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 62

CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 63

CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 64

CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 65

CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 66

CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 67

CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 68

CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 69

CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 70

CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 71

CANADA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 72

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 73

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 74

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 75

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 76

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 77

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 78

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 79

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 80

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 81

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 82

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 83

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 84

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021–2024 (USD MILLION)

TABLE 85

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025–2030 (USD MILLION)

TABLE 86

UK: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 87

UK: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 88

UK: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 89

UK: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER,2025–2030 (USD MILLION)

TABLE 90

UK: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 91

UK: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 92

UK: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 93

UK: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 94

UK: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 95

UK: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 96

FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 97

FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 98

FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 99

FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 100

FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 101

FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 102

FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 103

FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 104

FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 105

FRANCE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 106

GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 107

GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 108

GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 109

GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 110

GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 111

GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 112

GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 113

GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 114

GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 115

GERMANY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 116

NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 117

NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 118

NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 119

NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 120

NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 121

NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 122

NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 123

NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 124

NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 125

NORWAY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 126

DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 127

DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 128

DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 129

DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 130

DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 131

DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 132

DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 133

DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 134

DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 135

DENMARK: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 136

REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 137

REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 138

REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 139

REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 140

REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 141

REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 142

REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 143

REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 144

REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 145

REST OF EUROPE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 146

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 147

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 148

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 149

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 150

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 151

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 152

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 153

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 154

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 155

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 156

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 157

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 158

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021–2024 (USD MILLION)

TABLE 159

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025–2030 (USD MILLION)

TABLE 160

CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 161

CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 162

CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 163

CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 164

CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 165

CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 166

CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 167

CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 168

CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 169

CHINA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 170

INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 171

INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 172

INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 173

INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 174

INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 175

INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 176

INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 177

INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 178

INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 179

INDIA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 180

JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 181

JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 182

JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 183

JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 184

JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 185

JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 186

JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 187

JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 188

JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 189

JAPAN: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 190

SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 191

SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 192

SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 193

SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 194

SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 195

SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 196

SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 197

SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 198

SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 199

SOUTH KOREA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 200

REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 201

REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 202

REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 203

REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 204

REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 205

REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 206

REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 207

REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 208

REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 209

REST OF ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 210

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 211

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 212

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 213

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 214

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 215

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 216

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 217

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 218

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 219

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 220

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 221

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 222

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021–2024 (USD MILLION)

TABLE 223

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025–2030 (USD MILLION)

TABLE 224

UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 225

UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 226

UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 227

UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 228

UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 229

UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 230

UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 231

UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 232

UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 233

UAE: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 234

SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 235

SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 236

SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 237

SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 238

SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 239

SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 240

SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 241

SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 242

SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 243

SAUDI ARABIA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 244

ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 245

ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 246

ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 247

ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 248

ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 249

ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 250

ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 251

ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 252

ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 253

ISRAEL: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 254

TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 255

TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 256

TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 257

TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 258

TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 259

TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 260

TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 261

TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 262

TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 263

TURKEY: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 264

AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 265

AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 266

AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 267

AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 268

AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 269

AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 270

AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 271

AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 272

AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 273

AFRICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 274

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 275

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 276

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 277

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 278

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER,2021–2024 (USD MILLION)

TABLE 279

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 280

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 281

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 282

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 283

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 284

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 285

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 286

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2021–2024 (USD MILLION)

TABLE 287

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025–2030 (USD MILLION)

TABLE 288

BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 289

BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 290

BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 291

BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 292

BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 293

BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 294

BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 295

BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 296

BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 297

BRAZIL: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 298

MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 299

MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 300

MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 301

MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 302

MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 303

MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 304

MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 305

MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 306

MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2021–2024 (USD MILLION)

TABLE 307

MEXICO: MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025–2030 (USD MILLION)

TABLE 308

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2025

TABLE 309

MULTI-BEAM ECHO SOUNDER MARKET: DEGREE OF COMPETITION

TABLE 310

REGION FOOTPRINT

TABLE 311

DEPTH FOOTPRINT

TABLE 312

END USER FOOTPRINT

TABLE 313

PLATFORM FOOTPRINT

TABLE 314

LIST OF START-UPS/SMES

TABLE 315

COMPETITIVE BENCHMARKING OF START-UPS/SMES

TABLE 316

MULTI-BEAM ECHO SOUNDER MARKET: PRODUCT LAUNCHES, 2021–2025

TABLE 317

MULTI-BEAM ECHO SOUNDER MARKET: DEALS, 2021–2025

TABLE 318

MULTI-BEAM ECHO SOUNDER MARKET: OTHER DEVELOPMENTS, 2021–2025

TABLE 319

KONGSBERG: COMPANY OVERVIEW

TABLE 320

KONGSBERG: PRODUCTS OFFERED

TABLE 321

KONGSBERG: PRODUCT LAUNCHES

TABLE 322

KONGSBERG: OTHER DEVELOPMENTS

TABLE 323

TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

TABLE 324

TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

TABLE 325

TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

TABLE 326

TELEDYNE TECHNOLOGIES INCORPORATED: OTHER DEVELOPMENTS

TABLE 327

NORBIT ASA: COMPANY OVERVIEW

TABLE 328

NORBIT ASA: PRODUCTS OFFERED

TABLE 329

NORBIT ASA: PRODUCT LAUNCHES

TABLE 330

NORBIT ASA: DEALS

TABLE 331

NORBIT ASA: OTHER DEVELOPMENTS

TABLE 332

TRITECH TECHNOLOGIES LIMITED: COMPANY OVERVIEW

TABLE 333

TRITECH TECHNOLOGIES LIMITED: PRODUCTS OFFERED

TABLE 334

TRITECH TECHNOLOGIES LIMITED: PRODUCT LAUNCHES

TABLE 335

TRITECH TECHNOLOGIES LIMITED: DEALS

TABLE 336

TRITECH TECHNOLOGIES LIMITED: OTHER DEVELOPMENTS

TABLE 337

R2SONIC LLC: COMPANY OVERVIEW

TABLE 338

R2SONIC LLC: PRODUCTS OFFERED

TABLE 339

R2SONIC LLC: OTHER DEVELOPMENTS

TABLE 340

EXAIL: COMPANY OVERVIEW

TABLE 341

EXAIL: PRODUCTS OFFERED

TABLE 343

EXAIL: OTHER DEVELOPMENTS

TABLE 344

WASSP LIMITED: COMPANY OVERVIEW

TABLE 345

WASSP LIMITED: PRODUCTS OFFERED

TABLE 346

WASSP LIMITED: PRODUCT LAUNCHES

TABLE 347

WASSP LIMITED: DEALS

TABLE 348

IMAGENEX TECHNOLOGY CORPORATION: COMPANY OVERVIEW

TABLE 349

IMAGENEX TECHNOLOGY CORPORATION: PRODUCTS OFFERED

TABLE 350

FURUNO ELECTRIC CO., LTD.: COMPANY OVERVIEW

TABLE 351

FURUNO ELECTRIC CO., LTD.: PRODUCTS OFFERED

TABLE 352

COHORT PLC: COMPANY OVERVIEW

TABLE 353

COHORT PLC: PRODUCTS OFFERED

TABLE 354

COHORT PLC: DEALS

TABLE 355

COHORT PLC: OTHER DEVELOPMENTS

TABLE 356

BEIJING HYDRO-TECH MARINE TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

TABLE 357

BEIJING HYDRO-TECH MARINE TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

TABLE 358

BEIJING HYDRO-TECH MARINE TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

TABLE 359

SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: COMPANY OVERVIEW

TABLE 360

SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: PRODUCTS OFFERED

TABLE 361

HI-TARGET NAVIGATION TECH CO., LTD.: COMPANY OVERVIEW

TABLE 362

HI-TARGET NAVIGATION TECH CO., LTD.: PRODUCTS OFFERED

TABLE 363

EDGETECH INC.: COMPANY OVERVIEW

TABLE 364

EDGETECH INC.: PRODUCTS OFFERED

TABLE 365

EDGETECH INC.: PRODUCT LAUNCHES

TABLE 366

EDGETECH INC.: OTHER DEVELOPMENTS

TABLE 367

PICOTECH LTD.: COMPANY OVERVIEW

TABLE 368

PICOTECH LTD.: PRODUCTS OFFERED

TABLE 369

PICOTECH LTD.: PRODUCT LAUNCHES

TABLE 370

PICOTECH LTD.: DEALS

TABLE 371

NANJING VASTSEA-TECH MARINE CO, LTD: COMPANY OVERVIEW

TABLE 372

SEAFLOOR SYSTEMS INC.: COMPANY OVERVIEW

TABLE 373

GEOACOUSTIC LTD.: COMPANY OVERVIEW

TABLE 374

R3VOX INC.: COMPANY OVERVIEW

TABLE 375

BAYWEI SONAR: COMPANY OVERVIEW

TABLE 376

SATLAB GEOSOLUTIONS: COMPANY OVERVIEW

TABLE 377

WATER LINKED: COMPANY OVERVIEW

TABLE 378

BEIJING LCOCEAN: COMPANY OVERVIEW

TABLE 379

CERULEAN SONAR: COMPANY OVERVIEW

TABLE 380

ITER SYSTEMS: COMPANY OVERVIEW

FIGURE 1

MULTI-BEAM ECHO SOUNDER MARKET SEGMENTATION

FIGURE 2

RESEARCH DESIGN MODEL

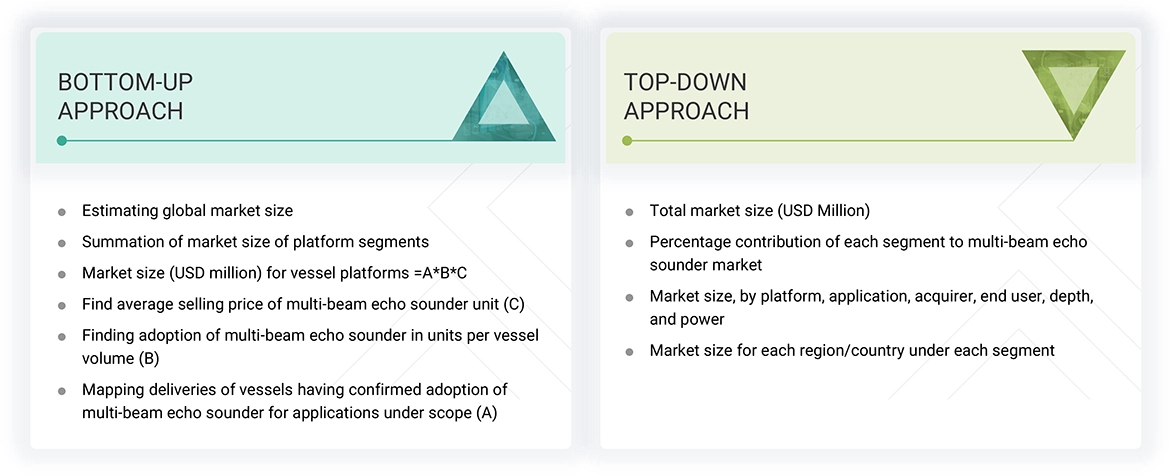

FIGURE 4

BOTTOM-UP APPROACH

FIGURE 5

TOP-DOWN APPROACH

FIGURE 6

DATA TRIANGULATION

FIGURE 7

HYDROGRAPHIC AGENCIES TO BE LARGEST SEGMENT DURING FORECAST PERIOD

FIGURE 8

SEABED MAPPING TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

FIGURE 9

SHALLOW TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

FIGURE 10

EUROPE TO ACCOUNT FOR HIGHEST SHARE IN 2025

FIGURE 11

REGULATORY EMPHASIS ON DETAILED HYDROGRAPHIC DATA TO DRIVE MARKET

FIGURE 12

SURFACE VESSELS TO BE LARGER THAN UNDERWATER VESSELS DURING FORECAST PERIOD

FIGURE 13

SHALLOW SEGMENT TO BE LARGER DURING FORECAST PERIOD

FIGURE 14

NORWAY TO EXHIBIT FASTEST GROWTH IN 2025

FIGURE 15

MULTI-BEAM ECHO SOUNDER MARKET DYNAMICS

FIGURE 16

GLOBAL FLEET SIZE, BY VESSEL TYPE, 2023 VS. 2024

FIGURE 17

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 18

VALUE CHAIN ANALYSIS

FIGURE 19

ECOSYSTEM ANALYSIS

FIGURE 20

IMPORT DATA FOR HS CODE 9015-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

FIGURE 21

EXPORT DATA FOR HS CODE 9015-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND)

FIGURE 22

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

FIGURE 23

KEY BUYING CRITERIA FOR TOP THREE END USERS

FIGURE 24

TOTAL COST OF OWNERSHIP FOR MULTI-BEAM ECHO SOUNDERS

FIGURE 25

INVESTMENT AND FUNDING SCENARIO, 2020–2024

FIGURE 26

BUSINESS MODELS IN MULTI-BEAM ECHO SOUNDER MARKET

FIGURE 27

EVOLUTION OF MULTI-BEAM ECHO SOUNDER TECHNOLOGY

FIGURE 28

TECHNOLOGY ROADMAP

FIGURE 29

IMPACT OF AI/GEN AI ON MULTI-BEAM ECHO SOUNDER MARKET

FIGURE 30

SUPPLY CHAIN ANALYSIS

FIGURE 31

PATENT ANALYSIS

FIGURE 32

MULTI-BEAM ECHO SOUNDER MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

FIGURE 33

MULTI-BEAM ECHO SOUNDER MARKET, BY DEPTH, 2025 VS. 2030 (USD MILLION)

FIGURE 34

MULTI-BEAM ECHO SOUNDER MARKET, BY CREWED AND UNCREWED VESSEL PLATFORM, 2025 VS. 2030 (USD MILLION)

FIGURE 35

MULTI-BEAM ECHO SOUNDER MARKET, BY REMOTE-CONTROLLED AND AUTONOMOUS VESSEL PLATFORM, 2025 VS. 2030 (USD MILLION)

FIGURE 36

MULTI-BEAM ECHO SOUNDER MARKET, BY UNDERWATER AND SURFACE VESSEL PLATFORM, 2025 VS. 2030 (USD MILLION)

FIGURE 37

MULTI-BEAM ECHO SOUNDER MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

FIGURE 38

MULTI-BEAM ECHO SOUNDER MARKET, BY REGION

FIGURE 39

NORTH AMERICA: MULTI-BEAM ECHO SOUNDER MARKET SNAPSHOT

FIGURE 40

EUROPE: MULTI-BEAM ECHO SOUNDER MARKET SNAPSHOT

FIGURE 41

ASIA PACIFIC: MULTI-BEAM ECHO SOUNDER MARKET SNAPSHOT

FIGURE 42

MIDDLE EAST & AFRICA: MULTI-BEAM ECHO SOUNDER MARKET SNAPSHOT

FIGURE 43

LATIN AMERICA: MULTI-BEAM ECHO SOUNDER MARKET SNAPSHOT

FIGURE 44

REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021–2024 (USD MILLION)

FIGURE 45

MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

FIGURE 46

COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

FIGURE 47

COMPANY FOOTPRINT

FIGURE 48

COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

FIGURE 49

BRAND/PRODUCT COMPARISON

FIGURE 50

FINANCIAL METRICS (EV/EBIDTA)

FIGURE 51

COMPANY VALUATION (USD BILLION)

FIGURE 52

KONGSBERG: COMPANY SNAPSHOT

FIGURE 53

TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

FIGURE 54

NORBIT ASA: COMPANY SNAPSHOT

FIGURE 55

EXAIL: COMPANY SNAPSHOT

FIGURE 56

FURUNO ELECTRIC CO., LTD.: COMPANY SNAPSHOT

FIGURE 57

COHORT PLC: COMPANY SNAPSHOT

FIGURE 58

SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: COMPANY SNAPSHOT

FIGURE 59

HI-TARGET NAVIGATION TECH CO., LTD.: COMPANY SNAPSHOT

Growth opportunities and latent adjacency in Multi-Beam Echo Sounder Market