Network Emulator Market

Network Emulator Market by Offering (Hardware, Software), Application Type (SD-WAN, Cloud, IoT), Test Type (Performance Testing, Application Testing), Vertical (Telecommunications, BFSI, Government & Defense) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The network emulator market is expected to grow from USD 0.25 Billion in 2025 to USD 0.36 Billion by 2030 at a compounded annual growth rate (CAGR) of 7.4% during the forecast period. The global rollout of 5G networks, including enterprise-level private 5G, has sharply increased the demand for network emulators that can test high-speed, low-latency applications under real-world conditions.

KEY TAKEAWAYS

-

BY OFFERINGThe network emulator market encompasses a range of offerings to simulate real-world network conditions in controlled settings. These offerings include hardware network emulators replicating physical network conditions and software network emulators that virtually mimic diverse network scenarios.

-

BY APPLICATION TYPEThe network emulator market caters to diverse application types such as SD-WAN, IoT, Cloud, and other application types and addresses a spectrum of needs across industries. These applications enable professionals, researchers, and developers to comprehensively test and optimize their products and services in various network conditions. Each application type has its unique requirements, challenges, and goals, and network emulators cater to these specific needs by providing accurate simulation of relevant network conditions.

-

BY TEST TYPEThis section provides information on the segmentation of the network emulator market by test type into performance testing, application testing, and other test types. Network emulators are tools to replicate real-world network conditions in a controlled environment for testing purposes. These conditions may include latency, packet loss, jitter, bandwidth limitations, etc. Companies, researchers, and developers commonly use network emulators to test the performance and reliability of various network-related technologies, such as applications, devices, and services.

-

BY VERTICALThe various industries, including telecommunications, BFSI, government & defense, online gaming, and broadcasting, utilize network emulators for testing the functionality and performance of their applications. These emulators simulate network impairments such as packet loss, latency, limited bandwidth, and jitter that may occur in mobile networks such as GPRS, 3G, 4G/LTE, and 5G, as well as small cell (femtocell, picocell, microcell, and metrocell), and satellite networks. Network emulators are becoming essential for organizations that want to ensure their applications work seamlessly in real-world scenarios.

-

BY REGIONAsia Pacifi is expected to grow fastest, with a CAGR of 9.7%, driven by rise in security spending due to the growing threat landscape. This region, known for its emerging economies including China, Japan, and India, is witnessing significant growth opportunities in network emulators owing to effective government regulations and technological advancements.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships, collaborations, and investments. For instance, in October 2024, Spirent Communications collaborated with the Centre of Excellence in Wireless Technology (CEWiT) to help support the Indian government’s ambitious “Bharat 6G Vision” to position India as a global leader in 6G technology. CEWiT is an autonomous research society of the Indian Institute of Technology Madras (IITM), and the collaboration sees Spirent’s technology being utilized to test and emulate 5G core network functionalities, paving the way for next-generation 6G innovation and development in India.

The AI in retail market is being driven by the growing use of SD-WAN and multi-cloud architectures is driving the need for reliable network validation tools to ensure consistent application performance. The rising complexity of IoT and edge computing environments is also contributing to this demand, as organizations require emulators capable of replicating constrained and highly variable network conditions. Additionally, escalating cybersecurity threats are encouraging businesses to use emulators for assessing network resilience and testing security systems through simulated attacks. Technological advancements, especially the integration of AI, machine learning, and virtualization, are enhancing emulator capabilities, making them more scalable, intelligent, and user-friendly, thereby accelerating adoption across diverse sectors.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Buyers in the network emulator market are encountering several critical challenges that influence their procurement decisions and overall user experience. The high initial investment and constrained budgets pose significant barriers, particularly for small to medium-sized enterprises. Additionally, the complexity of deploying and managing these solutions often necessitates specialized expertise, leading to increased dependency on external resources and extended implementation timelines. Integration difficulties with legacy systems further complicate adoption, frequently requiring costly customization efforts. Moreover, the lack of industry-wide standardization results in limited interoperability and potential vendor lock-in, restricting organizational flexibility. The limited fidelity of some emulators in replicating real-world network conditions can undermine confidence in testing outcomes and affect return on investment. Rapid technological evolution also presents a risk of accelerated obsolescence, while a shortage of skilled personnel exacerbates operational challenges. Collectively, these factors underscore the importance of thorough vendor evaluation, strategic planning, and alignment with internal technical capabilities to ensure successful procurement and deployment.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise of attacks and security breaches on networks

-

Rise in virtualization and cloud adoption

Level

-

Longer timelines and extended R&D requirements for new networking technologies

-

Price sensitivity of network testing and emulators

Level

-

Increasing demand for software-defined networking and virtualization

-

Multi-protocol support and advanced functions provided by same hardware emulator

Level

-

Lack of skilled workforce to comprehend and report issues in networking

-

Fast-changing network requirements to pose challenge for emulators

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise of attacks and security breaches on networks

The rise in cyberattacks and security breaches has been worsened by the widespread implementation of digital solutions, connected devices, and virtualized network infrastructure due to rapid technological advancements. The intricate network structure relies heavily on seamless communication among network points, critical devices, and users. The proliferation of interconnected devices and virtualization technology has increased the vulnerability landscape, leading to an alarming increase in cyber threats. This highlights the urgent need for robust network performance and security testing mechanisms. To prevent potential weaknesses and vulnerabilities that cybercriminals might exploit, it is necessary to conduct thorough regression testing before product release. In this regard, network emulators provide a compelling solution. By offering virtualized environments for comprehensive network performance and security testing, they ensure the resilience of networks and devices under diverse and complex conditions. Network emulators enable organizations to troubleshoot issues effectively, design networks, evaluate application performance, and optimize overall network functionality. As cyber risks continue to intensify, the importance of network emulators in safeguarding digital ecosystems and strengthening against security breaches is a compelling driver for their increased adoption across industries.

Restraint: Price sensitivity of network testing and emulators

Price sensitivity poses a significant restraint, particularly among small and medium enterprises (SMEs) and in cost-conscious regions such as Asia-Pacific, Latin America, and parts of Africa. The high upfront investment required for hardware-based emulators, coupled with expensive software licenses, often deters adoption, especially when return on investment is not immediately apparent. Organizations operating under strict budget constraints tend to opt for basic or open-source alternatives, which, while cost-effective, lack the advanced capabilities of premium solutions. Moreover, price-sensitive sectors such as government, education, and public enterprises frequently prioritize lower-cost offerings due to rigid procurement policies. The growing availability of open-source and cloud-based emulation tools further intensifies pricing pressure on established vendors. This environment challenges companies to justify the cost of premium network testing tools, limiting the broader adoption of advanced network emulation technologies, particularly in testing scenarios for next-generation networks such as 5G, SD-WAN, and IoT.

Opportunity: Increasing demand for software-defined networking and virtualization

As enterprises and telecom providers transition to dynamic, programmable, and virtualized network infrastructures, there is a growing need for robust testing solutions to ensure performance, reliability, and interoperability. Network emulators enable users to simulate complex network conditions, validate the behavior of SDN controllers, and test virtual network functions (VNFs) under diverse scenarios. These tools are particularly valuable in cloud-native and edge computing environments, where network conditions can be highly variable. Additionally, emulators support DevOps and CI/CD workflows by enabling continuous and automated testing of software-defined and virtualized networks. As a result, the demand for flexible, scalable, and software-based emulation solutions is rising, positioning network emulators as essential tools in modern network development and deployment. Network emulators allow users to emulate user experiences on networked applications accurately. With network emulation, users have complete control over the conditions of the virtual test network. Failure to adequately verify an application’s ability to tolerate ever-changing network requirements can lead to errors and failures, resulting in revenue loss and damage to brand reputation. Network emulators can be utilized to test real-time networking conditions in various industries, including defense, BFSI, and retail.

Challenge: Lack of skilled workforce to comprehend and report issues in networking

The lack of a skilled workforce capable of comprehending and reporting issues in complex networking environments poses a significant challenge to the growth of the network emulator market. Network emulation tools are inherently technical and require deep knowledge of protocols, performance metrics, and test configurations to be used effectively. However, many organizations struggle with a shortage of professionals who possess the necessary expertise to operate these tools, interpret diagnostic outputs, and conduct meaningful network performance analysis. This skills gap is particularly evident in emerging markets and non-technical sectors, where formal training in advanced networking or emulator platforms is limited. As a result, organizations often underutilize emulator capabilities or misinterpret results, leading to suboptimal network deployments. The steep learning curve associated with leading emulator tools further exacerbates the issue, forcing many companies to rely heavily on vendor support or external consultants. This not only adds to operational costs but also discourages investment in emulation technologies due to concerns over ROI and internal capability. Consequently, the shortage of skilled personnel remains a critical barrier to the wider adoption and effective utilization of network emulators.

Network Emulator Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Nuasis Corporation provides an IP-based contact center solution. The IP-based multimedia offering provides Nuasis Corporation’s customers with a highly reliable and scalable architecture to manage multiple sites as if they were one large call center. Voice communication over the packet data network has unique requirements and needs improvements. | PacketStorm Communication provided its network emulation test tools to ensure the quality of its products. Voice, file transfers, and web interaction, all these functions were tested to improve the Quality of Service (QoS). Nuasis Corporation was able to emulate the queuing algorithms and traffic prioritization that routers execute to deal with different types of traffic issues simultaneously. |

|

VeriSign operates systems that manage .COM and .NET, handling as many as 21 billion web and email lookups every day. VeriSign also provides managed security services , security consulting, strong authentication solutions, anti-phishing services, and commercial security services to organizations throughout the world. It needs to test SIP solutions developed on a virtual network. | The company chose Spirent Communication’s TTCN-3 Tools, which provides robustness, flexibility, extensibility, and support for the protocols VeriSign desired immediately. It also provides the capability to integrate other protocols with minimal effort in the future. The tool is used to test the company’s home-grown SIP stack with a focus on testing SIP Proxy and Redirect server functionality. |

|

One of the largest banks in the US was embracing a network transformation project of its WAN from Multi-Protocol Label Switching (MPLS) to SD-WAN. The company worked with its system vendor to add SD-WAN capability to its existing switches and infrastructure but ran into significant issues with the integration of the new features. | Calnex’s network emulator was used by the bank to emulate the complex mesh networks and test the SD-WAN updates on the switches in a test lab. The updates were done one at a time, and the services were tested accordingly until the causes of the issues were identified and resolved. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent players in this market include well-established, financially stable network emulator providers of solutions and services, as well as regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Spirent Communications (US), Keysight Technologies (US), VIAVI Solutions (US), Calnex Solutions (UK), Rohde & Schwarz (Germany), Polaris Networks (US), PacketStorm (US), SolarWinds (US), InterWorking Labs (US), Apposite Technologies (US), ADVANTEST (Japan), GL Communications (US), Valid8 (US), Aldec (US), Marben Products (France), Aukua (US), Simnovus (US), EVE-NG Pro (UK), GigaNet Systems (US), Qosmotec Software Solutions GmbH (Germany), TETCOS (India), Modulo Communications Systems (Israel), Nihon Communications Systems (India), and NextGig Systems (US) are the key players operating in this ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Network Emulator Market, By Offering

A hardware-based network emulator is a dedicated and purpose-built device that plays a critical role in the field of network testing, validation, and optimization. Its primary function is to recreate, with precision and authenticity, the diverse network conditions that real-world applications and devices may encounter during their operation. This emulation process occurs within a controlled laboratory or testing environment, where the hardware emulator introduces specific network characteristics to replicate the behavior of actual networks. The underlying concept of a hardware-based network emulator involves the manipulation of network traffic and parameters to simulate a wide range of scenarios. These scenarios include varying network congestion levels, latency (delay), bandwidth constraints, packet loss, and other conditions that networks and applications commonly experience. By replicating such conditions, organizations can thoroughly examine how their networked systems perform and interact, identifying potential weaknesses, bottlenecks, or vulnerabilities.

REGION

North America is estimated to account for the largest market share during the forecast period

North America is comprised of highly developed countries with excellent infrastructure. This has created a strong demand for network emulator solutions. The top contributors to this market in North America are the US and Canada. These countries dominate the market due to their well-established economies, which allow them to invest in new technologies. North America is the most advanced region, with large verticals capable of investing in reliable and advanced IT infrastructure. This creates new opportunities for the adoption of network emulator solutions. Furthermore, technological advancements, such as 4G and 5G technologies, are encouraging telecom providers to adopt network emulator solutions at every network layer. In addition, the region is expected to have the highest R&D and the highest adoption of network emulator technology during the forecast period.

Network Emulator Market: COMPANY EVALUATION MATRIX

In the Network Emulator market, competition is driven by the growing need for precise network testing to ensure performance, reliability, and security across evolving 5G and cloud environments. Keysight Technologies (Star) leads with its advanced solutions like IxNetwork and BreakingPoint, offering end-to-end emulation for telecom and enterprise networks to accelerate innovation and optimize application performance. Interworking Labs (Emerging Leader) is rapidly advancing with its agile and cost-effective tools such as the Maxwell Network Emulator, enabling realistic network condition simulations that help organizations enhance resilience, reduce latency issues, and ensure superior user experiences.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.23 Billion |

| Market Forecast in 2030 (value) | USD 0.36 Billion |

| Growth Rate | CAGR of 7.4% from 2025-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD) Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By offering, application type, test type, vertical, and region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Network Emulator Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) | Regional Analysis: • Further breakdown of the North American Network Emulator market • Further breakdown of the European Network Emulator market • Further breakdown of the Asia Pacific Network Emulator market • Further breakdown of the Middle Eastern & African Network Emulator market • Further breakdown of the Latin American Network Emulator market | • Identifies high-growth regional opportunities, enabling tailored market entry strategies. • Optimizes resource allocation and investment based on region-specific demand and trends. |

| Company Information | Detailed analysis and profiling of additional market players (up to 5) | • Broadens competitive insights, helping clients make informed strategic and investment decisions. • Reveals market gaps and opportunities, supporting differentiation and targeted growth initiatives. |

RECENT DEVELOPMENTS

- June 2025 : Calnex Solutions announced the SNE-X with 400GbE interfaces, the first network emulator of its kind. The SNE-X 400G enables the testing of AI infrastructure and other high-performance computing networks.

- April 2025 : Spirent Communications announced the release of the Octobox STA Automation Package, the industry's first solution to fully automate comprehensive performance testing and validation of client stations and devices on Wi-Fi 6/6E and Wi-Fi 7 networks. The new automation package is designed to dramatically accelerate Wi-Fi station testing by replacing time consuming, inconsistent, and resource-intensive manual testing with structured, repeatable, and scalable validation automated workflows.

- April 2025 : Turn/River Capital acquired Solarwinds, to help customers transform their businesses through simple, powerful, and secure solutions for hybrid and multi-cloud environments.

- February 2025 : Spirent Communications collaborated with the Centre of Excellence in Wireless Technology (CEWiT) to help support the Indian government’s ambitious “Bharat 6G Vision” to position India as a global leader in 6G technology. CEWiT is an autonomous research society of the Indian Institute of Technology Madras (IITM), and the collaboration sees Spirent’s technology being utilized to test and emulate 5G core network functionalities, paving the way for next generation 6G innovation and development in India.

- January 2025 : Four Inc. and Apposite Technologies partnered to bring modern network performance test solutions to the public sector. Apposite Technologies provides advanced network, application and security test solutions for the public sector, supporting federal, state, and local government agencies as well as military organizations.

Table of Contents

Methodology

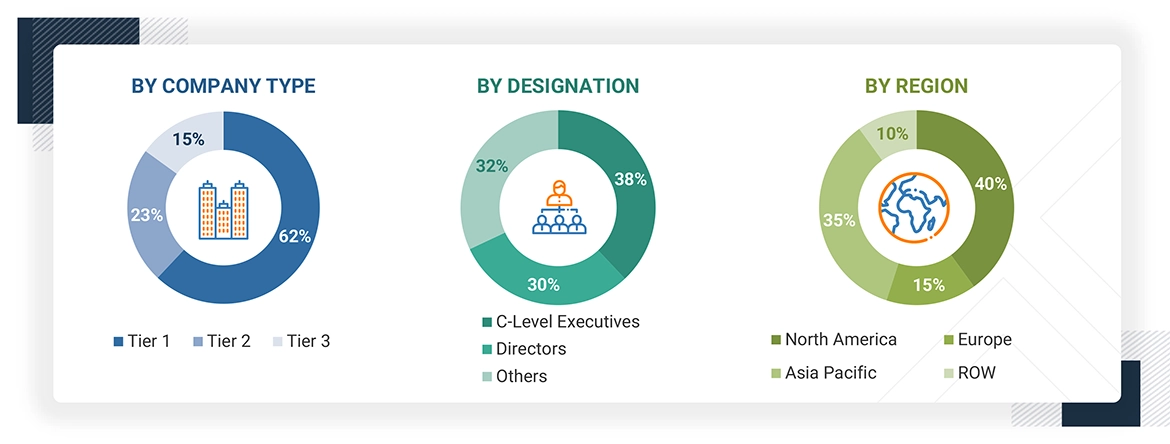

This research study on the network emulator market involved extensive secondary sources, directories, and several journals and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the network emulator market. Primary sources were industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with different primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information, as well as to assess the market’s prospects. These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants. Primary sources were mainly industry experts from the core and related industries, preferred network emulator providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess growth prospects. The following figure highlights the market research methodology applied to make the network emulator market report.

Secondary Research

The market size of companies offering network emulator hardware and software was determined based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals and related magazines. Network emulator spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain the key information related to the industry’s value chain and supply chain to identify key players, market classification, and segmentation according to offerings of major players; industry trends related to the offering, application type, test type, vertical, and regions; and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing network emulator solutions and services. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

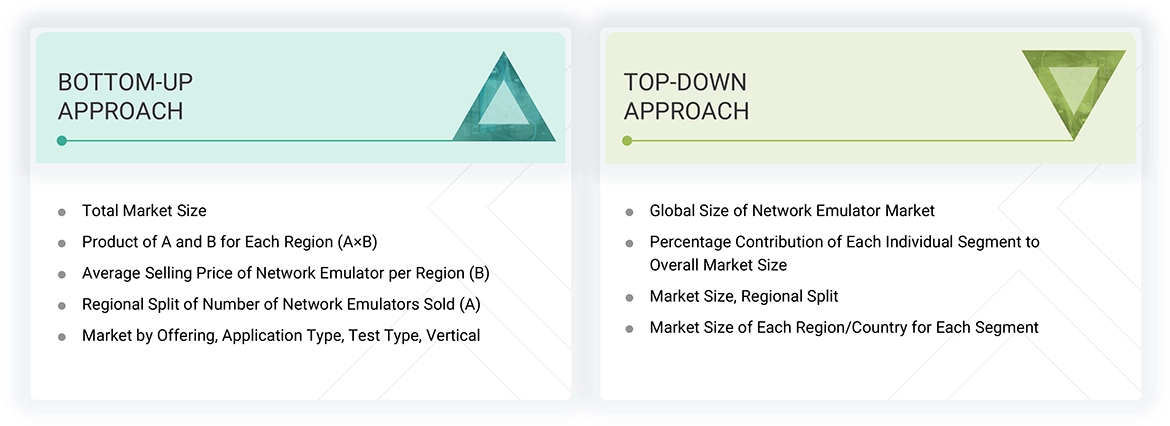

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information. Primary research was conducted to identify the segmentation, industry trends, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Note: Tier 1 companies have revenues greater than USD 10 billion; tier 2 companies' revenues range between USD 1 and 10 billion; and tier 3 companies' revenues range between USD 500 million and 1 billion. Other designations include sales, marketing, and product managers.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the network emulator market. The first approach involved estimating the market size by the summation of the companies’ revenue generated through the sale of services.

Top-down and Bottom-up Approaches

The research methodology used to estimate the market size included the following:

- Primary and secondary research was used to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

- Throughout the process, critical insights were obtained by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- Primary sources were used to verify all percentage splits and breakups, which were calculated using secondary sources.

Network Emulator Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, the market was divided into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from the government entities' supply and demand sides.

Market Definition

Network emulators are products that replicate real-time network performance, enable manipulation of bandwidth constraints, and apply network impairments, such as packet loss, delay, and jitter, to accurately gauge applications’ responsiveness and throughput and the quality of end-user experience, to provide quality assurance, proof of concept, and troubleshooting.

Network emulators can duplicate various network circumstances, encompassing constraints on bandwidth, latency, packet loss, jitter, and an assortment of network topologies. This capability empowers developers, network administrators, and researchers to evaluate the performance of their applications or systems across diverse network conditions, enabling them to proactively pinpoint potential problems before they manifest in an actual operational environment.

Stakeholders

- Network Emulator Vendors

- Network and System Integrators (SIs)

- Managed Service Providers (MSPs)

- Cloud Service Providers

- Internet Service Providers (ISPs)

- Fixed and Mobile Broadband Network Providers

- Communication Service Providers (CSPs)

- Content Delivery Network (CDN) Providers

- Independent Software Vendors (ISVs)

Report Objectives

- To define, describe, and forecast the network emulator market in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To forecast the market based on offering (hardware, software), application type, test type, vertical, and region

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To profile the key market players, including top vendors and startups; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as mergers & acquisitions (M&A), product launches/enhancements, agreements, partnerships, collaborations, expansions, and R&D activities, in the market

Customization Options

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product analysis

- The product matrix provides a detailed comparison of each company's portfolio.

Geographic analysis

- Further breakup of the network emulator market

Company Information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

What is the definition of the network emulator market?

Network emulators are products that replicate real-time network performance, enable manipulation of bandwidth constraints, and apply network impairments, such as packet loss, delay, and jitter, to accurately gauge applications’ responsiveness and throughput and the quality of end-user experience, to provide quality assurance, proof of concept, and troubleshooting.

What is the market size of the network emulator market?

The network emulator market is projected to grow from USD 252.4 million in 2025 to USD 361.4 million by 2030 at a CAGR of 7.4% from 2025 to 2030.

What are the major drivers of the network emulator market?

The major drivers of the network emulator market are the increasing attacks and security breaches on networks, the rise in virtualization and cloud adoption, and the need for reduced downtime in networking.

Who are the key players operating in the network emulator market?

The key market players profiled in the network emulator market include Spirent Communications (US), Keysight Technologies (US), VIAVI Solutions (US), Calnex Solutions (UK), Rohde & Schwarz (Germany), Polaris Networks (US), PacketStorm (US), SolarWinds (US), InterWorking Labs (US), Apposite Technologies (US), ADVANTEST (Japan), GL Communications (US), Valid8 (US), Aldec (US), Marben Products (France), Aukua (US), Simnovus (US), EVE-NG Pro (UK), GigaNet Systems (US), Qosmotec Software Solutions GmbH (Germany), TETCOS (India), Modulo Communications Systems (Israel), Nihon Communications Systems (India), and NextGig Systems (US).

What are the key technological trends prevailing in the network emulator market?

The network emulator market is seeing key trends such as high-density racks and liquid cooling integration, rack-level power distribution and monitoring, modular and scalable rack designs, edge-optimized racks, AI and analytics for rack management, sustainability and green data center design, open rack standards, and security-enhanced rack designs.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Network Emulator Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Network Emulator Market