North America Digital Twin Market

North America Digital Twin Market by Application (Product Design and Development, Performance Monitoring, Predictive Maintenance, Inventory Management, Business Optimization), Industry (Automotive and Transportation, Infrastructure) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

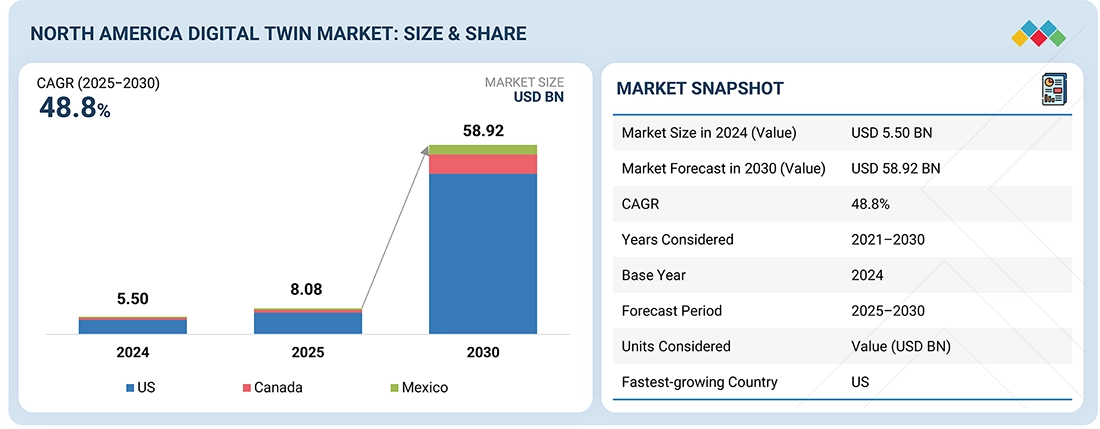

The North America digital twin market is projected to grow from USD 8.08 billion in 2025 to USD 58.92 billion in 2030 at a CAGR of 48.8% during the forecast period. North America’s digital twin industry benefits from a mature cloud, edge, and AI ecosystem that allows for quick implementation and scaling. Significant investments in infrastructure upgrades, grid modernization, and the energy transition are fueling demand for real-time modeling and operational insights.

KEY TAKEAWAYS

-

By CountryThe US digital twin market accounted for a 82.6% revenue share in 2024.

-

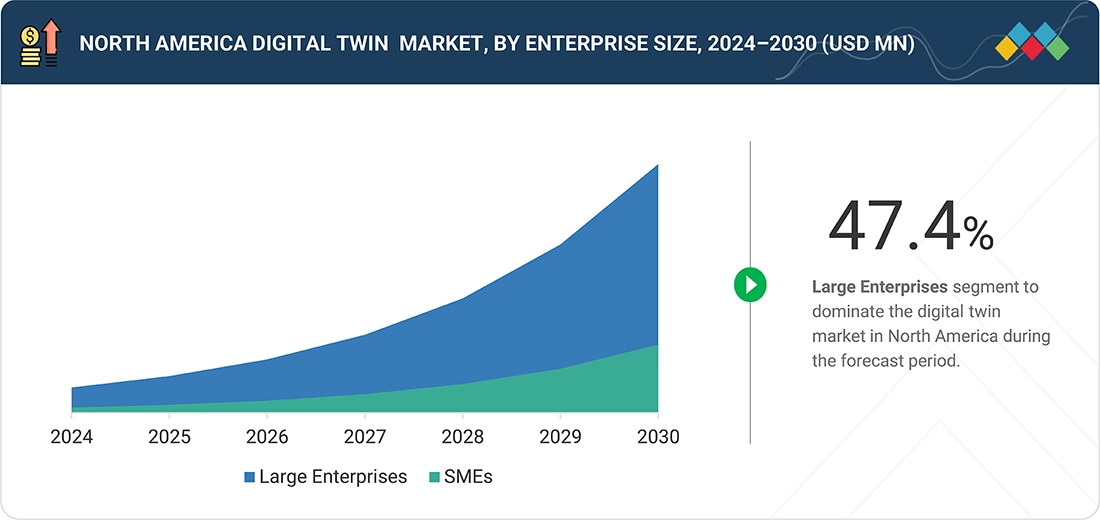

By Enterprise SizeBy enterprise size, the large enterprises segment is expected to register the highest CAGR of 53.0%.

-

By IndustryBy industry, the automotive & transportation segment is projected to grow at the fastest rate from 2025 to 2030.

-

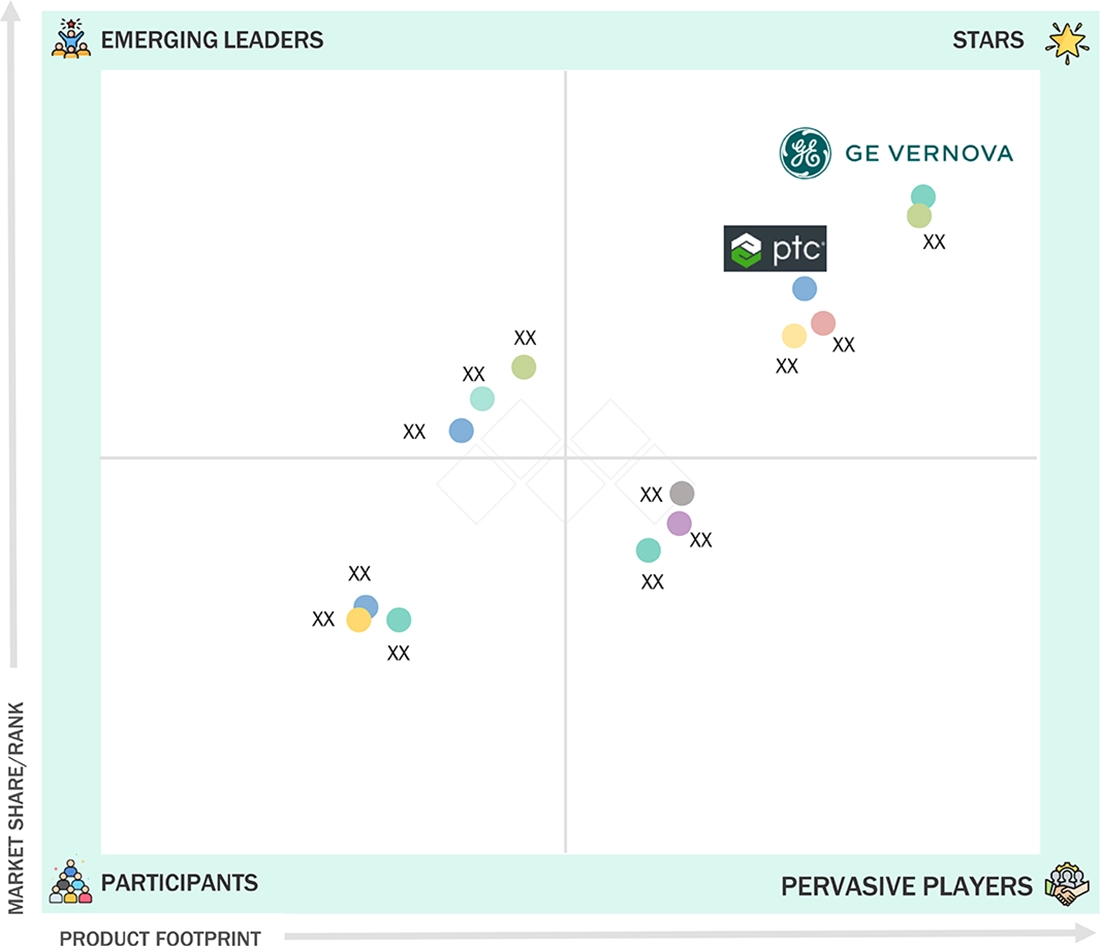

Competitive Landscape - Key PlayersGE Vernova, Siemens, and PTC were identified as some of the star players in the digital twin market in North America, given their strong market share and strong solution footprint.

-

Competitive Landscape - Startups/SMEsRiverlogic, Inc. and Duality Robotics, Inc., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas.

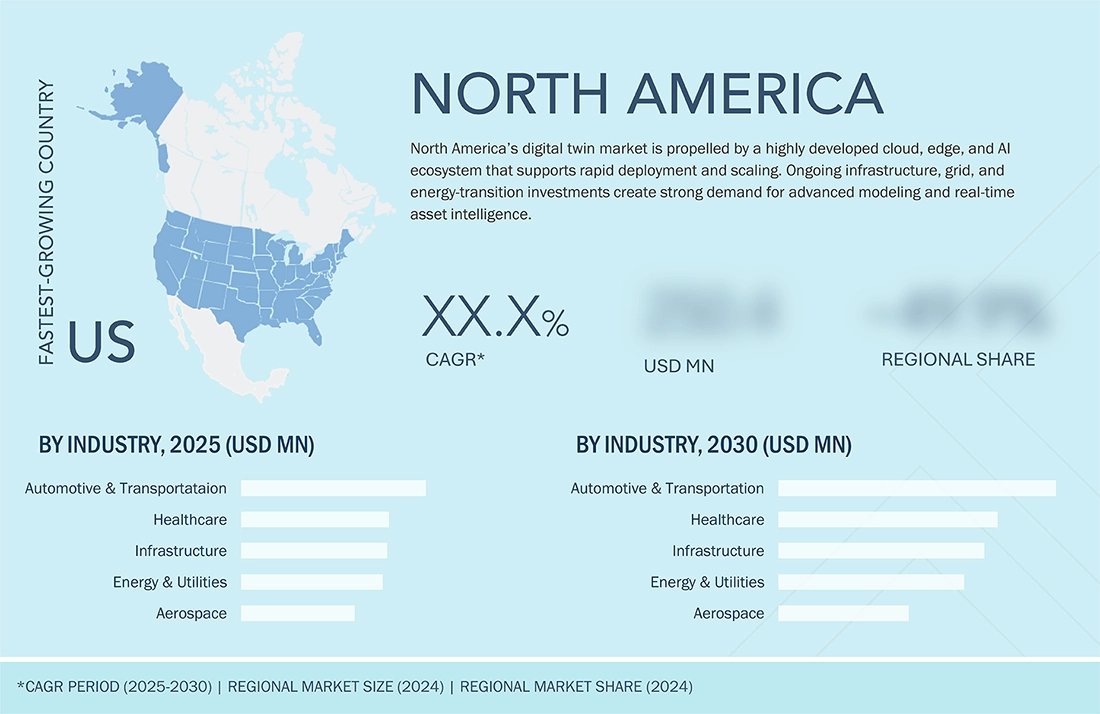

The US is the leading contributor to the North American digital twin market, propelled by its advanced cloud, edge, and AI infrastructure, along with strong investments in industrial digitalization. The nation’s focus on modernizing energy systems, transportation networks, and manufacturing facilities further drives demand for high-fidelity modeling and real-time operational intelligence. With a robust ecosystem of technology providers, industrial OEMs, and innovative startups, the US sets the pace for digital twin adoption across the region.

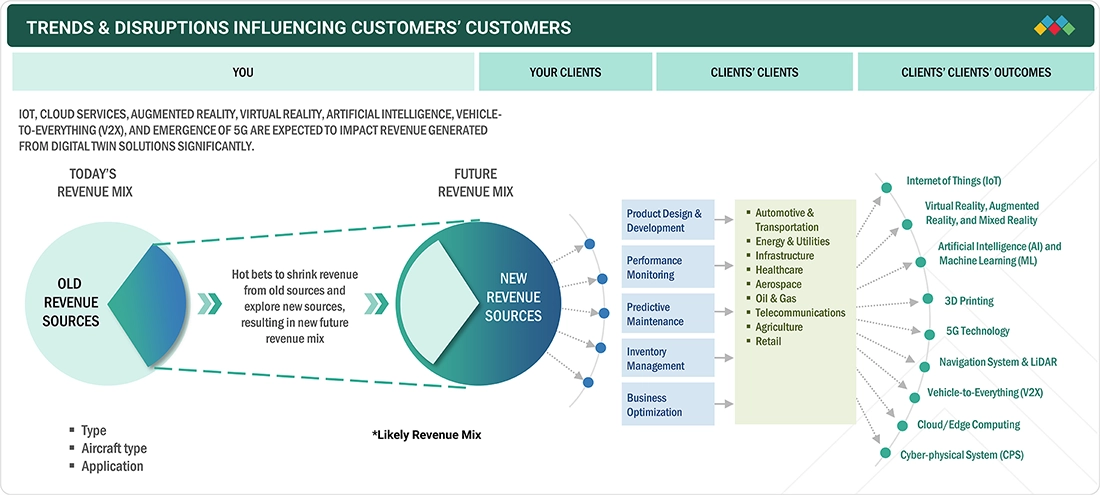

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Organizations are shifting toward digital infrastructure, and the growing focus on digital twins in manufacturing is reducing costs and enhancing supply chains, which is fueling the expansion of the digital twin market. The widespread adoption of AI, ML, IoT, and AR/VR/XR technologies in process and discrete industries is driving growth and will continue to do so over the next 4 to 5 years and beyond. Bringing these technologies into traditional factory environments has transformed industries such as aerospace, automotive & transportation, retail, infrastructure, and others, opening new opportunities for sustainable and optimized production.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advanced cloud, edge, and AI ecosystem enabling scalable digital twin deployments

-

Infrastructure and energy-modernization policies accelerating adoption

Level

-

Cybersecurity and regulated-data concerns

Level

-

Expanding grid modernization and clean-energy initiatives requiring high-fidelity modeling

-

Growing adoption of digital twins in healthcare, buildings, and smart-city operations

Level

-

Volatility in raw material prices

-

Limited interoperability standards across vendors and industries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advanced cloud, edge, and AI ecosystem enabling scalable digital twin deployment

North America benefits from one of the world’s strongest concentrations of cloud, edge computing, and AI technologies, supported by major hyperscalers and industrial software leaders. This ecosystem enables organizations to deploy high-performance digital twins quickly, integrate real-time data at scale, and run complex simulations without heavy on-premise infrastructure.

Restraint: Cybersecurity and regulated-data concerns

Many North American industries, especially utilities, healthcare, and critical infrastructure, operate under stringent cybersecurity and data-protection requirements. Digital twins often need access to operational technology networks, engineering files, and high-frequency sensor data, which raises concerns about exposure of sensitive systems. These security and compliance risks lengthen procurement cycles, demand extensive validation, and slow the integration of digital twins into live operational environments.

Opportunity: Expanding grid modernization and clean-energy initiatives requiring high-fidelity modeling

The region’s shift toward renewable energy, distributed energy resources, and modernizing aging grid infrastructure drives strong demand for digital twin technologies. Utilities and transmission operators are increasingly using advanced modeling to predict load, optimize asset performance, and handle variability from wind, solar, and battery storage systems. This change creates significant opportunities for digital-twin providers to support planning, reliability, and real-time operational decisions.

Challenge: Limited interoperability standards across vendors and industries

Digital twins need to combine data from various engineering tools, IoT platforms, legacy OT systems, and enterprise applications. Since interoperability standards vary across vendors and industries, organizations struggle to develop unified, scalable twins. This lack of consistency causes delays in integration, increased costs, and difficulties in replicating digital-twin solutions across multiple facilities or business units.

NORTH AMERICA DIGITAL TWIN MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides digital twins for gas turbines, steam turbines, and wind turbines that support performance monitoring, predictive maintenance, and fleet optimization | Improves asset reliability, reduces unplanned outages, increases energy output, and strengthens maintenance planning for power producers |

|

Uses the Siemens Xcelerator, Teamcenter, and MindSphere portfolios to create product, production, and infrastructure digital twins that simulate designs, manufacturing processes, and building or mobility systems | Accelerates design cycles, improves manufacturing efficiency, reduces commissioning time, and enhances operational visibility across the asset lifecycle |

|

Delivers virtual twin capabilities on the 3DEXPERIENCE platform for aerospace, automotive, life sciences, and built-environment applications, enabling unified product and system modeling | Increases design accuracy, strengthens collaboration, reduces engineering errors, and allows system behavior validation before physical deployment |

|

Offers simulation-driven digital twins built on multiphysics modeling, including structural, thermal, fluid, and electromagnetic analysis, connected with real operating data | Improves prediction of product performance, reduces dependence on physical prototypes, enhances reliability, and supports safer system designs |

|

Provides industrial digital twin capabilities through ThingWorx combined with CAD and PLM data from Creo and Windchill, with optional AR support using Vuforia to monitor and manage equipment | Increases asset uptime, improves service and maintenance efficiency, accelerates troubleshooting, and enables real-time operational insights |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Digital twins merge physical and virtual worlds, creating real-time digital copies of assets, processes, and systems that offer unmatched insights and optimization capabilities. This comprehensive ecosystem involves leading technology providers such as Dassault Systèmes, Bosch, ANSYS, Inc., PTC, Ansys, and Siemens, who supply the core platforms, simulation tools, and IoT connectivity that power digital twin technologies. These solutions serve various industries—from automotive and aerospace to healthcare and retail—transforming how organizations design, monitor, and enhance their operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Digital Twin Market, By Enterprise Size

As of 2024, large enterprises represent the dominant users of digital twin solutions in North America, supported by their capacity to invest in advanced cloud, AI, and simulation technologies. These organizations oversee complex asset portfolios such as industrial facilities, energy systems, transportation infrastructure, and large buildings, which makes digital twin adoption both practical and high-value. Their stronger IT and operational technology integration capabilities, larger technical teams, and more mature cybersecurity frameworks also enable smoother deployment and scaling.

North America Digital Twin Market, By Industry

In 2024, the automotive & transportation sector accounted for the largest share of digital twin adoption in North America, driven by the industry's strong emphasis on vehicle design optimization, autonomous system development, and predictive maintenance for fleets and transportation assets. Automakers and suppliers utilize digital twins to expedite prototyping, enhance manufacturing efficiency, and enhance safety validation. Transportation operators, including rail and logistics networks, rely on digital twins for monitoring asset health, optimizing routes, and planning operations. The region’s robust automotive R&D base and ongoing investments in smart mobility technologies further strengthen this sector’s leadership in digital twin usage.

REGION

US to be fastest-growing country in North America digital twin market during forecast period

The US is the fastest-growing country in the North American digital twin market due to its strong technology ecosystem, rapid enterprise digitalization, and substantial investments in advanced manufacturing, energy transition, and smart infrastructure. Industries in the US are actively adopting digital twins to enhance product design, improve operational reliability, and accelerate predictive maintenance across the automotive, aerospace, utilities, and healthcare sectors. The presence of leading cloud providers, industrial software companies, and research institutions further drives innovation and accelerates deployment.

The digital twin market in Europe is projected to reach USD 49.32 billion by 2030, up from USD 7.08 billion in 2025, at a CAGR of 47.4% from 2025 to 2030. The growth of the europe digital twin market is driven by the region’s aggressive sustainability and decarbonization agenda, which pushes industries to adopt advanced modeling and real-time monitoring to meet strict EU regulations. This push for energy efficiency, emissions tracking, and lifecycle optimization is accelerating digital twin deployments across manufacturing, energy grids, transport networks, and buildings, making sustainability compliance a major catalyst for market growth.

The Asia Pacific digital twin market is projected to reach USD 4.57 billion in 2025 and USD 32.57 billion in 2030, growing at a CAGR of 48.1% from 2025 to 2030. The regional market growth is fueled by large-scale infrastructure development and strong government initiatives promoting digital transformation across emerging and developed economies. China, Japan, South Korea, and India are increasingly adopting advanced simulation and real-time monitoring technologies to enhance manufacturing productivity, improve asset performance, and support smart city programs. Rising investments in sectors such as automotive, electronics, energy, and transportation further accelerate digital twin deployment.

NORTH AMERICA DIGITAL TWIN MARKET: COMPANY EVALUATION MATRIX

In the digital twin market matrix in North America, GE Vernova and PTC (Star) are leading entities, possessing substantial market share and a comprehensive product portfolio. Their prominence is driven by profound roots in industrial operations and robust integration with tangible assets. GE Vernova offers mature digital twin solutions for turbines, grids, and energy systems, which are extensively utilized by utilities and power producers throughout the region. PTC provides industrial-grade digital twins via ThingWorx, complemented by CAD and PLM data, rendering it highly effective for manufacturing, service operations, and equipment monitoring.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Siemens (Germany)

- GE Vernova (US)

- ANSYS, Inc. (US)

- PTC (US)

- Dassault Systèmes (France)

- Honeywell International Inc. (US)

- Rockwell Automation (US)

- Emerson Electric Co. (US)

- Robert Bosch GmbH (Germany)

- Bentley Systems, Incorporated (US)

- Autodesk Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.50 Billion |

| Market Forecast in 2030 (Value) | USD 58.92 Billion |

| Growth Rate | CAGR of 48.8% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | US, Canada, Mexico |

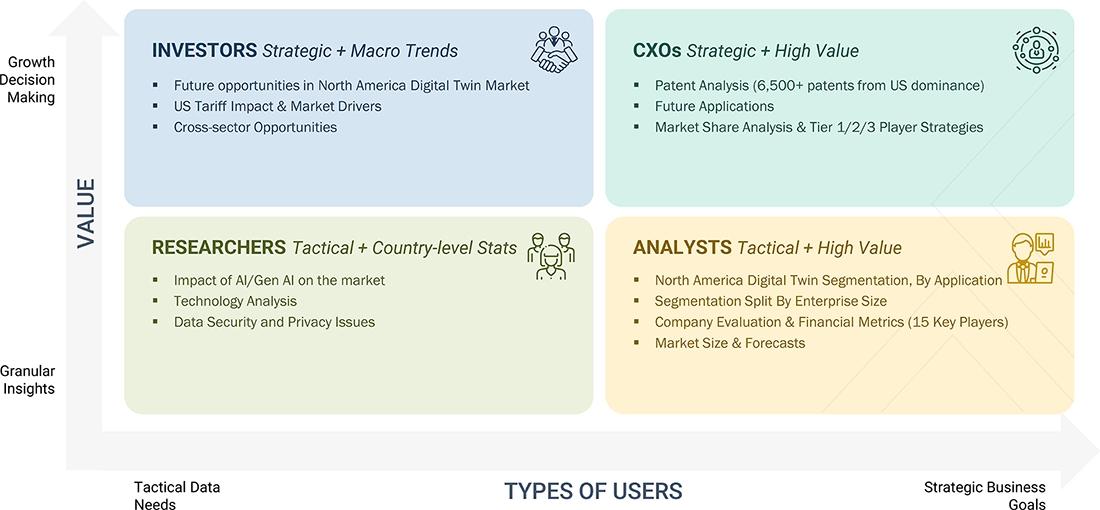

WHAT IS IN IT FOR YOU: NORTH AMERICA DIGITAL TWIN MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Manufacturing & Industrial Operator | Vendor landscape & platform benchmarking (PTC, Siemens, Ansys, etc.) | TCO/ROI modeling for specific asset classes (e.g., turbines, production lines) |

| Digital Twin Platform Vendor | Competitive profiling (features, pricing, GTM) across key verticals | Market adoption benchmarking (e.g., automotive vs. energy vs. smart cities) |

| IoT & IIoT Sensor Supplier | Analysis of data requirements for high-fidelity digital twins | Partnership ecosystem mapping (integration with leading software platforms) |

RECENT DEVELOPMENTS

- September 2025 : PTC (US) announced the availability of its Servigistics service supply chain optimization solution, highlighting updates focused on its predictive digital twin of the service parts supply chain. Servigistics uses this digital twin, along with its established Multi-Echelon Optimization (MEO) capabilities, to model service parts behavior, forecast demand, and support decision-making throughout the supply network.

- January 2025 : At CES 2025, Siemens announced a partnership with JetZero to support the development and production of the company’s blended-wing aircraft. JetZero will leverage the Siemens Xcelerator platform to create detailed digital twins of both the aircraft and its planned US greenfield “Factory of the Future.”

- March 2025 : Emerson Electric Co. (US) completed the acquisition of Aspen Technology (US). This acquisition enhanced Emerson's position in industrial automation by adding advanced software capabilities to its portfolio. This move allows Emerson Electric Co. to provide more comprehensive digital solutions by integrating its control systems with Aspen Technology's powerful tools for simulation, optimization, and asset performance, supporting Emerson's strategy to lead in industrial software and offer greater value to customers.

Table of Contents

Methodology

The study involved major activities in estimating the current market size for the North America Digital Twin Market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the North America Digital Twin Market.

Secondary Research

The market for companies offering digital twin is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the North America Digital Twin Market through secondary research. Approximately 30% of the primary interviews were conducted with the demand-side respondents, while approximately 70% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary research. This, along with the in-house subject matter experts' opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the North America Digital Twin Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

A digital twin is a virtual replica or digital copy of a physical object, process, or system. It serves as a digital counterpart that accurately captures the essential characteristics and behaviors of the real-world entity. Digital twins utilize advanced technologies such as sensors, data analysis, and simulations to collect real-time data from their physical counterparts. This data is then used to create and maintain an up-to-date digital representation that closely resembles the behavior of the actual object or system. The primary purpose of digital twins is to provide valuable insights and drive operational improvements in the business. By analyzing the digital twin, organizations can gain a deeper understanding of how the physical entity will perform, identify opportunities for enhancement, and test different strategies or scenarios before implementing them in the real world. Digital twins find applications in various industries, such as manufacturing, healthcare, transportation, energy, and construction.

Key Stakeholders

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Analysts and strategic business planners

- End users of digital twins across various industries such as the aerospace, automotive & transportation, energy & utilities, oil & gas, infrastructure, healthcare, agriculture, retail, telecommunications, and other industries (semiconductors, chemicals, paper & pulp, and food & beverages)

Report Objectives

- To define, describe, and forecast the North America Digital Twin Market size, by industry, application, and enterprise, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To give ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter's five forces analysis, key stakeholders and buying criteria, key conferences and events, regulatory bodies, government agencies, and regulations pertaining to the market under study

- To analyse the impact of AI and the US Tariff on the North America Digital Twin Market

- To offer a detailed overview of the process flow of the North America Digital Twin Market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the North America Digital Twin Market

- To understand opportunities for stakeholders by identifying high-growth segments of the North America Digital Twin Market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies

- To analyze competitive developments, such as product launches, deals (mergers, acquisitions, partnerships, cooperation, alliances, collaborations, agreements, contracts, and investments), and others (expansions) in the North America Digital Twin Market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Digital Twin Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Digital Twin Market