North America Intelligent Transportation System Market

North America Intelligent Transportation System Market by Roadways, Railways, Airways, Maritime, Advanced Traffic Management Systems, Tolling & Parking Management Systems, Security & Surveillance Systems, Smart Ticketing Systems - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The intelligent transportation system market in North America is expected to reach USD 19.77 billion by 2030, up from USD 15.29 billion in 2025, growing at a CAGR of 5.3% during this period. Market growth is fueled by increasing urbanization, rising traffic congestion, and the growing need for roadway safety and efficient traffic management solutions.

KEY TAKEAWAYS

-

BY COUNTRYBy country, Canada is expected to register the highest CAGR of 6.3% during the forecast period.

-

BY MODEBy mode, the roadways segment is expected to register the largest share during the forecast period.

-

BY ROADWAYS SYSTEM TYPEBy roadways system type, the tolling & parking management systems segment is expected to register the highest CAGR of 9.1% during the forecast period

-

BY APPLICATIONBy application, the information management segment is expected to register the highest CAGR of 7.1% during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSSiemens, Hitachi, and Cubic Corporation were identified as some of the star players in the North America intelligent transportation system market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESCurbiq., neology, among others, have distinguished themselves among SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Countries such as the US, Canada, and Mexico are major contributors to the growth of the North America market. A strong presence of key players offering intelligent transportation systems in the region and significant investments in urban development and road safety projects are driving market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The intelligent transportation system market in North America is undergoing a significant transformation driven by emerging technologies and innovations that will reshape future revenue streams over the next five years. Technologies such as AI-powered traffic management and smart tolling systems are expected to transform the revenue mix in this period. Key trends fueling this change include AI-based traffic prediction, IoT-enabled real-time monitoring and analytics, 5G-connected vehicle-to-infrastructure communication, digital twins for urban mobility planning, and integrated smart parking solutions. These innovations meet end users' needs for reducing congestion, enhancing commuter safety and experience, promoting environmental sustainability, and providing real-time visibility and control.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid development of smart and connected city infrastructure

-

Strong federal, state, and provincial initiatives focused on road safety

Level

-

High capital requirements for deploying advanced systems

-

Integration hurdles with legacy transportation infrastructure

Level

-

Expanding public–private partnerships (PPPs)

-

Increasing need for smart mobility solutions

Level

-

Interoperability and standardization issues

-

Complexities related to data management, cybersecurity, and privacy

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid development of smart and connected infrastructure

The rapid growth of smart-city initiatives across the US and Canada is a key factor driving the expansion of ITS. Cities such as New York, Toronto, Atlanta, and Los Angeles are implementing sensors, adaptive signal control, edge computing platforms, and multimodal monitoring systems as part of broader smart-mobility frameworks. These city projects include real-time traffic analytics, automated incident detection, transit prioritization, and data-driven congestion management, all of which depend heavily on intelligent transportation system technologies.

Restraint: High Capital Requirements for Deploying Advanced Systems

Despite robust governmental backing, the extensive deployment of ITS technologies across North America remains impeded by substantial initial capital expenditures. The implementation of adaptive traffic management systems, roadside communication units, automated tolling infrastructure, and advanced sensor networks necessitates considerable investment in both hardware and software, alongside integration efforts and sustained maintenance. Smaller municipalities and rural areas frequently lack the financial resources required to adopt advanced ITS platforms, leading to inconsistent deployment throughout the region.

Opportunity: Expanding public–private partnerships (PPPs)

Public–private partnerships are emerging as a key opportunity in the ITS market in North America, helping to reduce capital costs and accelerate digital transformation. PPPs are increasingly used for tolling upgrades, freeway management, smart parking, connected corridor projects, and fleet data platforms. Private sector companies bring technical expertise, advanced technology, and financing options, while government agencies provide regulatory support and operational frameworks. This partnership model allows for quicker deployment and adoption of ITS solutions.

Challenge: Complexities related to data management, cybersecurity, and privacy

The expansion of ITS generates large volumes of real-time data from cameras, sensors, connected vehicles, and traffic management systems. Handling, securing, and safeguarding this data poses significant challenges for agencies and vendors. North America faces rising cyber threats targeting transportation infrastructure, including attacks on traffic management centers, toll systems, and emergency communication networks. Public concerns over surveillance, data sharing, and compliance with privacy laws also add complexity. Ensuring strong cybersecurity, resilient data systems, and privacy protections is crucial but remains a major obstacle for ITS adoption throughout the region.

NORTH AMERICA INTELLIGENT TRANSPORTATION SYSTEM MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cubic collaborated with the Metropolitan Transportation Authority (MTA), New York to deploy OMNY, a contactless, account-based fare collection system across subways, buses, and commuter rails. The solution integrates mobile wallets, EMV payments, and a unified back-office system. | Faster passenger boarding, reduced fare-collection bottlenecks, lower cash-handling costs, and seamless scalability for future mobility-as-a-service (MaaS) platforms |

|

Kapsch implemented its traffic-management and tolling software for two multi-lane tolling systems in the US, one along Interstate 15 between Las Vegas and California, and express-lane systems on a state highway in Georgia. The project involved customizing the existing tolling platform to handle US traffic volumes, integrating barrier-free tolling; enabling dynamic/time-variable pricing, aggregating charges for large user bases, and building back-office, user-account and billing systems. | The deployment consolidated multiple tolling systems into a unified platform, enabled dynamic pricing to optimize lane usage, improved toll-collection accuracy through automated image review, and streamlined enforcement and account-management processes. It simplified back-office operations for toll authorities, enhanced customer ease of use by making account management more intuitive, reduced traffic congestion through automated and efficient toll processing, and strengthened overall system scalability and reliability through rigorous testing and accelerated development support. |

|

Iteris was selected to deploy an enhanced ITS Asset Management System (IAMS) for the Georgia Department of Transportation (GDOT) under a five-year sub-contract. The project covers statewide ITS maintenance. The IAMS includes tools for data collection and validation, an expedited service portal, and a feedback tool enabling GDOT’s Network Operations Center (NOC) and Traffic Management Center (TMC) to detect and report field-device outages efficiently. | By deploying the IAMS, GDOT gained a unified, state-wide platform that improves visibility, control, and maintenance efficiency of its ITS infrastructure. The solution lowers both initial and ongoing maintenance costs through structured workflow tools (data-validation, feedback, and service-portal mechanisms), accelerates fault reporting (enabling NOC/TMC staff to log outages in as few as three clicks), prevents duplicate service requests, and supports proactive asset management and lifecycle monitoring of traffic and ITS devices. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The intelligent transportation system ecosystem in North America comprises manufacturers, system integrators, component manufacturers, and end users. The end users of intelligent transportation systems mainly include state departments of transportation, city and municipal transportation agencies, and transit agencies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Intelligent Transportation System Market, By Mode

The airways segment is expected to see the highest growth due to increasing air traffic, rising demand for efficient airspace management, and growing attention to passenger safety and operational efficiency. With the rise in air travel, airports and air traffic control authorities are implementing advanced ITS solutions like real-time flight tracking, predictive maintenance, automated ground handling, and AI-powered airspace management systems.

North America Intelligent Transportation System Market, By Application

The information management application is expected to experience the highest growth due to the increasing demand for real-time data collection, processing, and analysis across transportation networks in North America. With urbanization and vehicle density rising, managing large volumes of data from connected vehicles, sensors, cameras, and infrastructure is essential for efficient traffic control, safety monitoring, predictive maintenance, and decision-making.

North America Intelligent Transportation System Market for Roadways, By System Type and Offering

The intelligent transportation system market for roadways and tolling and parking management in North America is expected to witness the fastest growth due to increasing urbanization, rising vehicle ownership, and growing traffic congestion in cities. Governments and private operators are adopting automated tolling systems and smart parking solutions to improve efficiency, reduce human errors, and enable cashless, contactless transactions.

North America Intelligent Transportation System Market for Railways, By System Type and Offering

The passenger information systems segment is projected to undergo the most substantial growth within the North America Intelligent Transportation Systems (ITS) market for railways. This expansion is primarily fueled by considerable investments in rail modernization, increasing commuter expectations for real-time travel updates, and the development of urban transit networks. Agencies across the United States and Canada are emphasizing digital enhancements, such as real-time arrival displays, mobile notifications, and multimodal trip-planning applications, to enhance service reliability and improve the passenger experience. Furthermore, federal infrastructure initiatives and city-level rail expansion projects are actively accelerating deployment efforts.

North America Intelligent Transportation System Market for Airways, By System Type and Offering

The information systems segment is expected to witness the highest growth rate in the North America ITS market for airways as airports increasingly focus on digital transformation, real-time operations management, and improving passenger experience. Rising air traffic volumes, congestion at major hubs, and the need for more efficient gate, baggage, and flight information coordination are prompting airports to adopt advanced information systems that improve communication among airlines, ground handling teams, and travelers.

North America Intelligent Transportation System Market for Maritime, By System Type and Offering

The automatic identification systems (AIS) segment is expected to experience the highest growth in the North America maritime ITS market due to increasing regulatory focus on vessel tracking, maritime safety, and port efficiency across the US and Canada. Growing cargo traffic, expansion of major ports, and congestion in coastal and inland waterways are fueling the demand for real-time visibility of vessel movements and enhanced collision-avoidance capabilities.

REGION

Canada is expected to be the fastest-growing country across the North America intelligent transportation system market during the forecast period

Canada is expected to achieve the highest CAGR in the North America intelligent transportation system market due to strategic government initiatives, rapid urbanization, and a strong focus on sustainable mobility solutions. Federal and provincial investments in smart infrastructure, such as connected vehicle programs, advanced traffic management systems, and real-time traveler information platforms, are boosting ITS adoption across major urban centers in the country.

NORTH AMERICA INTELLIGENT TRANSPORTATION SYSTEM MARKET: COMPANY EVALUATION MATRIX

In the intelligent transportation system market matrix in North America, Siemens (Star) and Verra Mobility (Star) lead with a strong market presence and a broad product portfolio, driving widespread adoption across state departments of transportation, city, and municipal transportation agencies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Siemens

- Hitachi, Ltd.

- Cubic Corporation

- Conduent Incorporated

- Kapsh TrafficCom AG

- Thales

- Teledyne Technologies Incorporated

- Indea Sistemas S.A.

- Verra Mobility

- TomTom International BV

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 14.79 Billion |

| Market Forecast in 2030 (Value) | USD 19.77 Billion |

| Growth Rate | CAGR of 5.3% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America (US, Canada, Mexico) |

WHAT IS IN IT FOR YOU: NORTH AMERICA INTELLIGENT TRANSPORTATION SYSTEM MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Urban Mobility Authority |

|

|

| US-based Tolling Operator |

|

|

| US-based Automotive & Fleet OEM |

|

|

RECENT DEVELOPMENTS

- February 2025 : Kapsch announced the deployment of an upgraded Advanced Traffic Management System (ATMS) across North America, incorporating real-time monitoring, SCADA/ITS control, CCTV, dynamic message signs, and more.

- September 2024 : Cubic Corporation introduced Umo ScanRide, a new fare payment solution enabling transit agencies to implement account-based fare collection without adding extra onboard hardware.

- February 2024 : Indra Sistemas collaborated with Parsons Corporation to expand smart mobility solutions worldwide and showcases recent successful projects, like equipping the I-485 Express Lanes with advanced tolling systems.

Table of Contents

Methodology

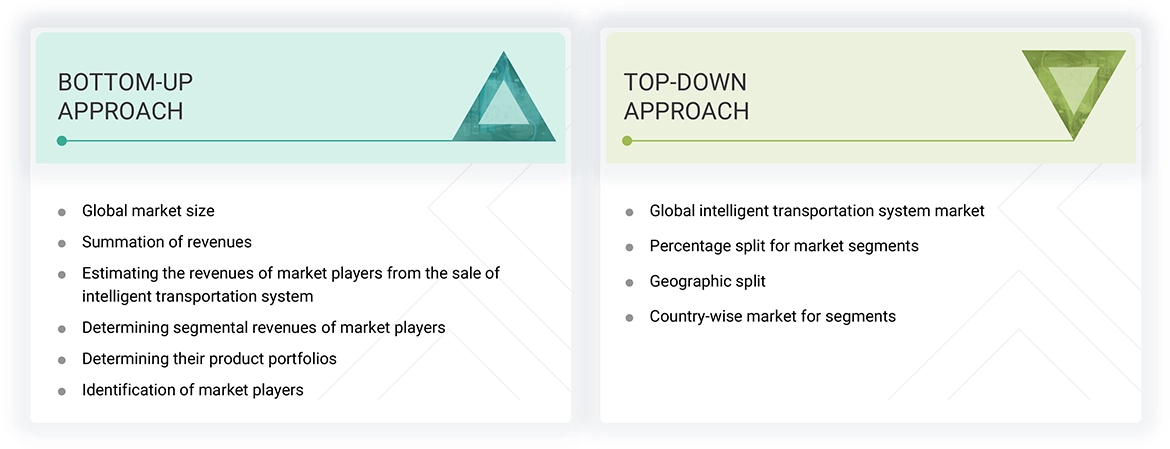

The research study involved four major activities in estimating the North America intelligent transportation system market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. The market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market's value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

Primary Research

In primary research, various sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the North America intelligent transportation system market ecosystem. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary research. This, along with the in-house subject matter experts' opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the North America intelligent transportation system market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

The bottom-up procedure has been employed to arrive at the overall size of the North America intelligent transportation system market.

- Major companies that provide north america intelligent transportation systems were identified. This included analyzing company portfolios, product offerings, and presence across various regions.

- The segment-specific revenues of the companies, particularly those related to north america intelligent transportation systems, were determined.

- The product-specific revenues of the companies, particularly those related to north america intelligent transportation systems, were determined.

- These individual revenue figures were compiled to determine the total revenue generated across the identified companies within the sector.

- The market size for north america intelligent transportation systems was obtained using this consolidated data.

The top-down approach has been used to estimate and validate the total size of the North America intelligent transportation system market.

- Identified top-line investments and spending in the ecosystem and major market developments to consider segment-level splits

- Estimated the overall North America intelligent transportation system market size, then segmented the market by allocating shares based on the segments considered

- Distributed the segment-level markets into regions and countries by aligning regional north america intelligent transportation system activity with economic indicators, north america intelligent transportation system manufacturing presence, and national development initiatives

North America Intelligent Transportation System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides of the North America intelligent transportation system market.

Market Definition

Intelligent Transportation System market involves designing, integrating, and deploying advanced technologies and solutions that enhance transportation networks' efficiency, safety, and sustainability. ITS leverages a combination of communication technologies, sensors, control systems, and data analytics to monitor, manage, and optimize transportation systems across various modes, including roadways, railways, airways, and maritime. These systems are essential for addressing challenges related to traffic congestion, accident prevention, fuel consumption, and environmental impact. Key components of ITS include traffic management systems, advanced traveler information systems, etc. These technologies are integrated with centralized platforms that enable real-time traffic monitoring, predictive analytics, incident detection, and automated response mechanisms. The adoption of ITS is driven by the rising demand for efficient urban mobility, government initiatives to modernize transport infrastructure, and the need for safer and environmentally friendly transportation. With the increasing proliferation of connected vehicles, electric mobility, and 5G connectivity, ITS is evolving to support autonomous transport, integrated multimodal travel, and sustainable urban planning. North america intelligent transportation systems play a vital role in reducing traffic congestion, enhancing commuter experience, lowering emissions, and supporting the development of future-ready smart cities.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Raw material suppliers

- Technology investors

- System integrators

- Electronic hardware equipment manufacturers

- Software solution providers

- Distributors

- Research organizations

Report Objectives

- To define, describe, segment, and forecast the North America intelligent transportation system market size by mode, by application, and by region, in terms of value

- For each mode (roadways, railways, aviation, maritime), a market has been defined, described, and segmented based on system type and offering in terms of value

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the north america intelligent transportation system value chain and ecosystem, along with the average selling price by system and region

- To strategically study the regulatory landscape, tariffs, standards, patents, Porter's Five Forces, import & export scenarios, trade values, and case studies pertaining to the market under study

- To understand micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To assess opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To offer the impact of AI/Gen AI on the North America intelligent transportation system market

- To outline the macroeconomic outlook for the regions under study

- To analyze strategies such as product launches, collaborations, acquisitions, and partnerships adopted by players in the North America intelligent transportation system market

- To profile key market players and comprehensively analyze their ranking based on their revenue, market share, and core competencies

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and the RoW

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Intelligent Transportation System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Intelligent Transportation System Market