North America Lubricants Market

North America Lubricants Market by Base Oil Type (Mineral Oil Lubricant, Synthetic Lubricants, Bio-based Lubricants), Product Type (Engine Oil, Turbine Oil, Metalworking Fluid, Hydraulic Oil), End-use Industry (Transportation and Industrial) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The market size of the North America lubricants industry is projected to reach USD 50.29 billion by 2030, up from USD 44.67 billion in 2025, reflecting a CAGR of 2.40% between 2025 and 2030. The region’s lubricants market is projected to witness steady yet resilient growth, driven by stable automotive demand, rising industrial output, and increasing investments across manufacturing, transportation, construction, and energy sectors in the US, Canada, and Mexico. North America remains one of the world’s most mature and technologically advanced consumers of lubricants, supported by a strong presence of OEMs, leading refiners, established distribution networks, and significant consumption across automotive, commercial vehicle, industrial machinery, marine, and power generation segments. Market growth is further accelerated by the rising adoption of high-performance, energy-efficient, and environmentally compliant lubricant solutions, particularly as regulatory bodies tighten emission standards, encourage the use of cleaner technologies, and promote sustainability in commercial and industrial operations. Continuous innovation in base oil refining, additive chemistry, and advanced formulation technologies is enhancing oxidation stability, wear protection, thermal efficiency, and overall equipment performance, positioning North America as a stable, innovation-led, and performance-driven lubricants market.

KEY TAKEAWAYS

-

By CountryThe US dominated the North America lubricants market, accounting for an 84.5% share in 2024.

-

By Base oilSynthetic lubricants are projected to register the highest CAGR of 3.07% during the forecasted period.

-

By Product typeThe metalworking fluid segment is estimated to register the highest CAGR of 3.40% between 2025 and 2030.

-

By End-use IndustryThe transportation end-use industry accounted for the largest share of the North America lubricants market, in 2024.

-

Competitive Landscape - Key PlayersExxon Mobil Corporation, TotalEnergies SE, and Shell plc stand out as dominant participants in the North America lubricants market, supported by their extensive offerings and established industry reach.

-

Competitive Landscape - StartupsCompanies like Phillips 66, Motul S.A., and Klüber Lubrication are gaining visibility in specialized segments, positioning them as promising up-and-coming players in the market

The market is expected to grow steadily over the coming years, supported by rising demand across automotive, industrial, commercial transportation, marine, and power generation applications. The region’s growth is driven by stable vehicle parc expansion, increasing industrial production, robust commercial fleet activity, and ongoing investments in manufacturing and energy infrastructure across the US, Canada, and Mexico. End users are increasingly prioritizing high-performance, fuel-efficient, and environmentally compliant lubricant solutions, further accelerating the shift toward synthetic, semi-synthetic, low-viscosity, and bio-based formulations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ businesses in the North America lubricants market arises from evolving end-use demand patterns and continuous transformation across mobility, industrial, and energy sectors. Key clients include automotive OEMs and aftermarket service networks, industrial machinery operators, construction and heavy-equipment users, metalworking and manufacturing units, and commercial transportation fleets, each representing major application clusters across the region. Shifts such as tightening emissions and fuel-efficiency regulations, accelerated adoption of electric and hybrid vehicles, rising demand for high-performance synthetic and semi-synthetic formulations, the growth of automation and predictive maintenance in factories, and increasing emphasis on energy-efficient and extended-drain-interval lubricants are reshaping formulation, sourcing, and operational models. These market forces directly influence the revenue streams of lubricant manufacturers and Tier-1 additive suppliers, affecting procurement strategies, base oil selection, blending technologies, and new product development cycles.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for high-performance engines and rising awareness of oil changes

-

Increase in supply of Group II and Group III base oil

Level

-

Geopolitical uncertainty impacting supply chains

-

Rising demand for electric vehicles and reducing price of batteries

Level

-

Leveraging e-commerce industry to increase customer reach

-

Increasing demand for renewable energy

Level

-

Stringent environmental norms and continuous reforms by governments

-

Volatile raw material prices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for high-performance engines and rising awareness of oil changes

In North America, demand for lubricants continues to rise due to the increasing penetration of high-performance passenger and commercial vehicles requiring advanced engine oils, transmission fluids, and specialty lubricants. Consumers are becoming more aware of the importance of regular oil changes for maintaining fuel efficiency, lowering engine wear, and enhancing vehicle longevity—driving higher consumption of premium synthetic and semi-synthetic formulations. Additionally, growth across industrial sectors such as manufacturing, construction, mining, and power generation is boosting the adoption of high-quality industrial lubricants that support equipment reliability, operational efficiency, and maintenance cost reduction. Together, these factors contribute to stable baseline demand across automotive, industrial, and aftermarket channels in the region.

Restraints: Geopolitical uncertainty impacting supply chains

The North America lubricants market is significantly affected by geopolitical volatility, which disrupts the availability of key raw materials such as Group I, II, and III base oils and performance additives. Fluctuating global crude oil prices, trade tensions, shipping route instability, sanctions, and refinery outages contribute to unpredictable cost structures and supply delays. These disruptions challenge lubricant formulators and distributors who rely heavily on global sourcing networks. This uncertainty often results in inventory challenges, higher working capital requirements, and increased vulnerability for small- and mid-scale blenders who lack diversified supply channels.

Opportunities: Leveraging e-commerce industry to increase customer reach

A major growth opportunity lies in the rapid expansion of e-commerce platforms and direct-to-consumer distribution channels across the US and Canada. Online marketplaces allow lubricant manufacturers to reach DIY vehicle owners, small workshops, fleet operators, and industrial buyers more efficiently. Subscription-based oil change services, doorstep delivery of lubricants, virtual compatibility tools, and digital service scheduling are transforming consumer behavior and opening new revenue streams. The rise of digital auto-care ecosystems enables lubricant brands to improve customer engagement, enhance product transparency, and offer tailored maintenance solutions—ultimately increasing brand loyalty and market penetration.

Challenges: Stringent environmental norms and continuous reforms by governments

Tightening environmental regulations from agencies such as the EPA, CARB, and Environment Canada are pushing lubricant manufacturers toward cleaner, low-emission, and eco-friendly formulations. Regulations related to VOC limits, eco-toxicity, lubricant disposal, emissions control, and fuel economy standards require companies to continuously upgrade formulations and invest in research related to biodegradable, bio-based, and high-efficiency lubricants. These policies also create compliance burdens associated with testing, certification, labeling, and performance verification. As regulations evolve, manufacturers must manage rising production costs, reformulation challenges, and heightened scrutiny while maintaining product performance and competitive pricing.

NORTH AMERICA LUBRICANTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Automotive engine oils, driveline fluids, and industrial lubricants (hydraulic, gear, compressor) across the US, Canada, and Mexico. | Broad OEM approvals and premium synthetic ranges that support fuel efficiency, extended drain intervals, and equipment protection in on-road and industrial fleets. |

|

Engine oils for passenger cars and heavy-duty diesel, plus industrial oils and greases for manufacturing, mining, and energy | Strong presence in heavy-duty and off-highway segments, with products designed for durability, soot control, and long-drain performance under severe operating conditions |

|

Passenger car motor oils, heavy-duty diesel oils, transmission fluids, and industrial lubricants supplied across North America. | Leading global lubricant volumes with advanced synthetic and gas-to-liquids-based products, helping reduce friction, improve fuel economy, and extend equipment life. |

|

Branded automotive lubricants (PCMO, motorcycle oils) and industrial fluids distributed through workshops, retailers, and OEM channels. | Strong brand recognition in retail and service networks, with premium synthetic and performance lines targeting engine cleanliness, wear protection, and cold-start performance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The North America lubricants ecosystem comprises a highly integrated network of stakeholders, including base oil producers, additive manufacturers, lubricant blenders, distributors, service providers, and a broad spectrum of end-use industries. Base oil suppliers and chemical companies provide essential raw materials, including Group I, II, and III base stocks and PAO base stocks, along with performance additives such as anti-wear agents, viscosity modifiers, detergents, dispersants, and emerging bio-based and low-toxicity components. Lubricant manufacturers convert these inputs into automotive, industrial, marine, aviation, metalworking, and specialty lubricants designed to meet the region’s stringent performance, efficiency, and environmental regulations. Distributors, wholesalers, retailers, service workshops, and oil-change networks act as critical intermediaries, ensuring nationwide product availability, offering technical support, and facilitating rapid delivery across both B2B and consumer markets. End-use sectors such as automotive OEMs and aftermarket service centers, manufacturing, transportation and logistics, construction, agriculture, marine, power generation, and heavy industries rely on lubricants for equipment protection, improved fuel economy, thermal stability, and operational reliability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Lubricants Market, By Base oil

Mineral oil holds the largest share in the North America lubricant market in 2024 because it offers cost-effectiveness, wide availability, and sufficient performance for a variety of applications across automotive, industrial machinery, construction equipment, and general-purpose lubrication. Its established refining infrastructure, reliable supply chain, and compatibility with a broad range of additives make it the preferred base oil for high-volume, price-sensitive segments. Alongside this, synthetic and bio-based base oils are gaining traction in the North America market, driven by their superior thermal stability, oxidation resistance, longer drain intervals, and performance in high-stress applications. These properties make synthetic-based lubricants the preferred choice for premium automotive OEMs, heavy-duty industrial operations, and environmentally conscious applications across the US, Canada, and Mexico.

North America Lubricants Market, By Product Type

Engine oil dominates the market, supported by a large internal-combustion engine fleet, regular maintenance cycles, and widespread use across passenger vehicles, commercial trucks, and heavy-duty machinery. Its consistent performance, compatibility with existing engines, and availability in conventional, synthetic, and semi-synthetic formulations make it the preferred choice for both aftermarket and OEM applications across the US, Canada, and Mexico. Other lubricant types, such as hydraulic fluids, gear oils, and industrial oils, are growing in specialized segments due to their specific performance requirements. However, engine oil continues to lead in volume and value, as regular oil changes, long-standing maintenance practices, and compatibility with a broad range of vehicles sustain high demand across the region. Despite the gradual adoption of high-performance synthetic alternatives, conventional engine oils remain the backbone of the North America lubricant market.

North America Lubricants Market, By End-use Industry

Transportation dominates the North America lubricant market, driven by high demand from passenger vehicles, commercial trucks, and fleet operations across the U.S., Canada, and Mexico. Frequent maintenance cycles, a large fleet of internal-combustion engines, and established aftermarket infrastructure sustain strong consumption of engine and transmission oils. Industrial lubricants, while growing in specialized machinery and heavy industries, remain smaller in comparison, as transportation continues to account for the largest share of volume and value in the region.

REGION

US held the largest share in the North America lubricants market in 2024

The US is the largest lubricants market in North America, driven by its large automotive fleet, strong industrial base, and high consumption of engine and industrial oils. Mexico is the fastest-growing market, supported by rising vehicle ownership, expanding manufacturing activity, and increasing demand for high-performance lubricants.

NORTH AMERICA LUBRICANTS MARKET: COMPANY EVALUATION MATRIX

In the North America lubricants market, ExxonMobil holds a leading position with a strong regional presence and a comprehensive portfolio spanning automotive, industrial, commercial, and specialty lubricants. The company drives large-scale adoption across passenger vehicles, commercial fleets, manufacturing units, and heavy industries by delivering high-performance, durable, and environmentally compliant lubricant solutions. ExxonMobil’s focus on innovation, advanced synthetic formulations, and expansion of low-emission, fuel-efficient lubricant technologies reinforces its market leadership. Its extensive distribution network, strong partnerships with OEMs and service workshops, and commitment to sustainability enable end users to meet evolving performance requirements, comply with stringent regulatory norms, and achieve long-lasting equipment protection across a wide range of applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Exxon Mobil Corporation (US)

- TotalEnergies SE (France)

- Shell plc (UK)

- Chevron Corporation (US)

- BP p.l.c. (UK)

- ENEOS Corporation (Japan)

- FUCHS SE (Germany)

- PJSC LUKOIL (Russia)

- ENI S.p.A. (Italy)

- Phillips 66 (US)

- Klüber Lubrication (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 43.6 Billion |

| Revenue Forecast in 2030 | USD 50.2 Billion |

| Growth Rate | CAGR of 2.40% from 2025-2030 |

| Actual data | 2020-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Billion/Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America |

WHAT IS IN IT FOR YOU: NORTH AMERICA LUBRICANTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America-based Industrial Lubricants Manufacturer |

|

|

| North America-focused Automotive Lubricants Manufacturer |

|

|

| OEMs & Heavy Machinery Lubricant Users |

|

|

RECENT DEVELOPMENTS

- February 2022 : Chevron Corporation signed an agreement with Bunge North America, Inc. to create renewable feedstocks.

- January 2021 : The joint venture between Whitmore and Shell's strengths to offer multi-sector expertise, advanced equipment technologies and services, and an integrated product portfolio that meets the unique needs of companies in North America.

- August 2019 : TotalEnergies SE acquired aluminum hot rolling oil (AHRO), metallic cold rolling oil (SCRO), and tinplate rolling oil (TPRO) activities from the North American and European markets. This will help the company diversify its product portfolio.

Table of Contents

Methodology

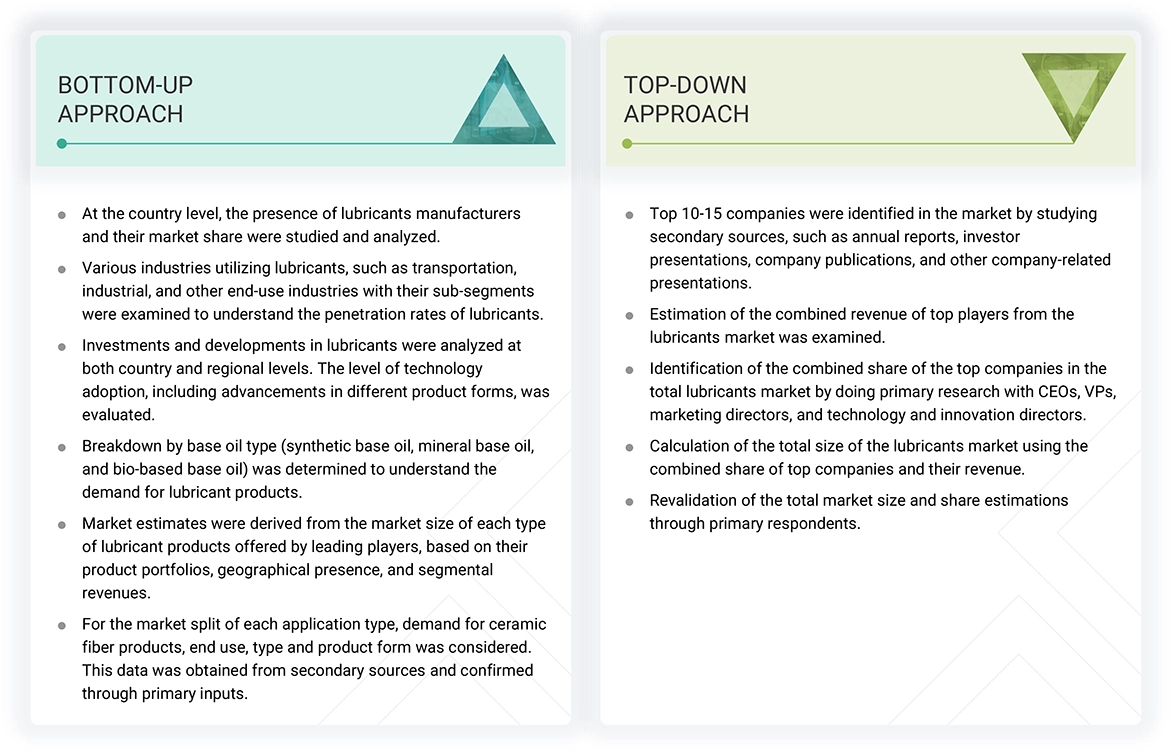

The study involved four major activities in estimating the North America lubricants market size. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below.

Primary Research

The North America lubricants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by engine oil, turbine oil, gear oil, grease, hydraulic oil, compressor oil, metalworking fluid, and others. Advancements in technology and diverse application industries characterize the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Exxon Mobil Corporation | Senior Manager | |

| Shell plc | Innovation Manager | |

| Indian Oil Corporation Limited | Vice-president | |

| BP p.l.c. | Production Supervisor | |

| Chevron Corporation | Sales Manager | |

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the North America lubricants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following parameters:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the North America lubricants industry.

Market Definition

The lubricants market encompasses a range of substances engineered to diminish friction between surfaces, thereby reducing heat generation and facilitating the transmission of forces during movement. These substances also serve to transport foreign particles and regulate surface temperatures. Employed across diverse applications, from industrial machinery and cooking to bioapplications such as artificial joints, medical procedures, and intimate relations, lubricants are pivotal in mitigating friction, wear, heat generation, noise, and vibrations within mechanical systems.

Stakeholders

- Lubricants manufacturers

- Lubricants suppliers

- Raw material suppliers

- Service providers

- Application sector companies

- Government bodies

Report Objectives

- To define, describe, and forecast the North America lubricants market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by base oil type, product type, end-use industry, and region

- To strategically analyze micromarkets with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To strategically profile key players and comprehensively analyze their growth strategies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Lubricants Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Lubricants Market