North American Air Circuit Breaker Market

North American Air Circuit Breaker Market by Type (Plain Air Circuit Breaker, Air Blast Circuit Breaker), Voltage (Low-voltage, Medium-voltage), End User (Industrial, Commercial, Residential) and Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The North American air circuit breaker market is estimated to be valued at USD 0.82 billion in 2025 and reach USD 1.08 billion by 2030, at a CAGR of 5.7% during the forecast period. The North American air circuit breaker market is driven by a growing emphasis on grid modernization, infrastructure upgrades, and the integration of smart technologies across power distribution systems. ACBs are widely used in industrial, utility, and commercial sectors, where the ability to handle high current loads with precision and safety is essential. Their use is particularly prominent in mission-critical installations such as data centers, airports, large manufacturing plants, and energy facilities, where any electrical fault can lead to significant financial and operational disruptions.

KEY TAKEAWAYS

-

BY COUNTRYThe US is the leading market for air circuit breakers in North America and is expected to grow at the highest CAGR of 5.9% during the forecast period.

-

BY TYPEAir blast circuit breakers held 61.2% of the market in 2024. Their market leadership is attributed to their superior performance in high-voltage and high-speed switching applications.

-

BY VOLTAGEMedium voltage accounted for 80.1% of the market in 2024 due to their widespread use in large industrial plants, data centers, and power distribution substations.

-

BY APPLICATIONIndustrial applications are expected to register the highest market growth during the forecast period.

-

COMPETITIVE LANDSCAPECompanies such as Eaton, Siemens, and ABB have been identified as star players in the North American market. These companies have strong product portfolios, wide reach, and a well-developed customer base.

The North American air circuit breaker market is driven by grid modernization, infrastructure upgrades, and the integration of smart technology. ACBs are essential in industrial, utility, and commercial sectors for handling high loads safely. North America's push for decarbonization and electrification promotes renewable energy and electric vehicles, creating new protection challenges that ACBs address with high capacity and reliability.

MARKET DYNAMICS

Level

-

Growth in Data Centers and Critical Infrastructure

-

Industrial Automation and Electrification

Level

-

High Initial Cost of Installation

-

Space Constraints in Retrofitting Projects

Level

-

Rising Investments in Renewable Energy Infrastructure

-

Expansion of Power Grids

Level

-

Growing Popularity of Solid-State Circuit Breakers

-

Regulatory Pressure Around Arc Flash Safety

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in Data Centers and Critical Infrastructure

The growth of hyperscale and edge data centers across the U.S. is significantly driving the demand for air circuit breakers, as these facilities require high-performance electrical protection systems that ensure uninterrupted operations. With the surge in cloud computing, artificial intelligence, IoT, and 5G applications, data centers are consuming more energy and operating at higher load capacities than ever before. Air circuit breakers are preferred in such environments due to their high breaking capacity, ability to manage large current fluctuations, and suitability for low-voltage power distribution systems. Their durability and ease of maintenance also make them ideal for mission-critical environments where electrical failures can result in costly downtime or data loss.

Restraint: High Initial Cost of Installation

One of the key restraints affecting the growth of the North American air circuit breaker (ACB) market is the high initial installation cost. Air circuit breakers are significantly more expensive than alternative solutions such as molded case circuit breakers (MCCBs) or miniature circuit breakers (MCBs), both in terms of unit price and associated installation and commissioning costs. This price difference stems from ACBs' complex design, advanced features, larger size, and greater capacity to handle high current levels and frequent switching operations. Additionally, their installation often requires more sophisticated electrical panels, protective relays, and integration with digital monitoring systems, which further drives up the total cost.

Opportunity: Rising Investments in Renewable Energy Infrastructure

The North America air circuit breaker market is growing due to increased investments in renewable energy, especially large-scale solar and wind projects. Countries like the U.S. and Canada aim for net-zero emissions by 2050, investing in expanding renewable power and upgrading electrical infrastructure. Initiatives such as the U.S. Department of Energy's SETO and WETO have funded billions for solar and wind tech. Projects like California’s DRECP and New York’s Clean Path NY support gigawatt-scale renewable integration, requiring medium-voltage switchgear and circuit protection that can handle high fault currents, boosting air circuit breaker adoption.

Challenge: Growing Popularity of Solid-State Circuit Breakers

One of the most notable emerging challenges for the North American air circuit breaker (ACB) market is the rising popularity of solid-state circuit breakers (SSCBs). As digitalization and space optimization become priorities in modern electrical infrastructure, SSCBs are gaining traction due to their ultrafast switching capabilities, compact design, and ability to be embedded into smart systems. This new generation of breakers threatens to disrupt the demand for conventional air circuit breakers, particularly in applications where size, speed, and precision are crucial. Unlike air circuit breakers, which rely on mechanical components and air arcs to interrupt current flow during fault conditions, solid-state breakers use power electronics such as IGBTs (insulated-gate bipolar transistors) or MOSFETs to instantaneously detect and interrupt faults, often within microseconds.

MARKET ECOSYSTEM

The North American air circuit breaker market ecosystem features a robust, interconnected network of raw material suppliers, manufacturers, distributors, and end users, as illustrated in the provided image. Leading manufacturers like Eaton, Schneider Electric, and Siemens rely on materials from major suppliers, including ArcelorMittal, Nucor, Prysmian, and Southwire, to produce air circuit breakers for power distribution applications. These products are delivered to the market through prominent distributors such as Graybar, Rexel, and Wesco, ultimately reaching key end users including Duke Energy, Southern Company, and PG&E. The ecosystem is driven by increasing investments in grid modernization, heightened demand for reliable power infrastructure, and ongoing industrial automation, fostering strong interdependence among market participants to deliver efficient and reliable power distribution solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Air Circuit Breaker Market, By Type

The air blast circuit breaker segment is expected to capture a greater market share because of its better performance traits and applicability in medium-voltage and high-demand applications. Air blast circuit breakers utilize compressed, high-pressure air to rapidly and effectively extinguish arcs, and as such, are suited for applications that demand the high-speed interruption of fault currents, such as power plants, industrial substations, and large business complexes. Their high-speed performance capability to manage frequent operations and guarantee greater electrical safety ranks them higher than simple air circuit breakers in mission-critical applications.

North America air circuit breaker Market, By Voltage

The low-voltage segment is expected to hold the largest market share during the forecast period, primarily due to its extensive use in the industrial, commercial, and infrastructure sectors. Low-voltage air circuit breakers, typically rated below 1 kV, play a vital role in protecting electrical circuits in industrial plants, commercial facilities, data centers, hospitals, and institutional building environments, where electrical security, equipment protection, and power continuity are paramount. They are preferred due to their simplicity of installation, economic implications, and compatibility with intelligent monitoring systems and are therefore appropriate for contemporary energy management approaches.

North America Air Circuit Breaker Market, By Application

The industrial application segment is the largest in the market due to the region’s strong concentration of manufacturing, oil & gas, mining, and heavy engineering operations that require continuous, reliable power protection for critical machinery and processes. These facilities rely on medium- and low-voltage air circuit breakers to safeguard equipment, prevent costly downtime, and support widespread adoption of automation and smart factory principles. As investments in industrial infrastructure and electrification rise, the demand for robust, high-capacity air circuit breakers accelerates, solidifying the industrial segment’s dominant market position.

REGION

US to be the largest and fastest-growing region in the North America air circuit breaker market during the forecast period

The US is expected to dominate the North American air circuit breaker market during the forecast period, driven by massive infrastructure upgrades, increasing industrial automation, and robust policy support for clean energy integration and grid reliability. As the American government launches projects under the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA), considerable investments are going into modernizing substations, replacing old switchgear, and making power distribution networks more resilient. The nation's robust industrial sector, growing data center count, and increasing use of clean energy sources, such as wind and solar, have heightened the demand for smart air circuit breakers that can manage power safely and efficiently.

North American Air Circuit Breaker Market: COMPANY EVALUATION MATRIX

In the North America air circuit breaker market matrix, Eaton (Star) leads with wide regional coverage and a comprehensive product portfolio, powering resilient solutions for utilities, commercial, and industrial sectors through strong partnerships and innovation in digital protection features. Schneider Electric (Emerging Leader) is rapidly gaining market share by introducing advanced, IoT-integrated air circuit breakers for smart grid applications and supporting the integration of renewable energy, driven by investments in automation and modernization across the US and Canada. Both companies are bolstered by robust R&D, local manufacturing expansion, and continuous alignment with regulatory safety and energy standards, propelling large-scale adoption among utilities, data centers, and industrial operators.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.78 Billion |

| Market Forecast in 2030 (Value) | USD 1.08 Billion |

| Growth Rate | CAGR of 5.7% from 2025-2030 |

| Years Considered | 2021-2024 |

| Base Year | 2024 |

| Forecast Period | 2030 |

| Units Considered | Value (USD Million/Billion), Volume (Unit) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | US, Canada, and Mexico |

WHAT IS IN IT FOR YOU: North American Air Circuit Breaker Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America Specific Market | Provided North America-specific air circuit breaker market sizing and trends | Enables strategic planning, resource allocation, and sales focus based on North America regional opportunities |

RECENT DEVELOPMENTS

- April 2023 : Havells India entered into a commercial agreement with Swedish tech startup Blixt Tech AB to introduce Solid State Circuit Breaker (SSCB) technology in the domestic market. By introducing SSCB, Havells is strengthening its position in the switchgear segment. It also highlights Havells’ focus on innovative and future-ready solutions, said a joint statement.

- February 2023 : Mitsubishi Electric Corporation announced on February 16, 2023, that it had entered into an acquisition to wholly acquire Scibreak AB, a Swedish company that develops AC circuit breakers. The two firms aim to strengthen the competitiveness of their unified business by working closely on developing DCCB technologies for high-voltage direct current (HVDC) systems to support the increasing global deployment of renewable energy.

- August 2023 : Hitachi Energy and Eversource collaborated to introduce the first EconiQ 420-kilovolt circuit breaker in the United States. This innovative technology aims to help Eversource reduce its environmental footprint and achieve its sustainability goals. Hitachi Energy is preparing to install the world’s first environmentally friendly EconiQ™ 420-kilovolt (kV) circuit breaker for Eversource in the US. This new technology eliminates the use of sulfur hexafluoride (SF6), marking the first deployment of a 420 kV SF6-free circuit breaker in the country.

Table of Contents

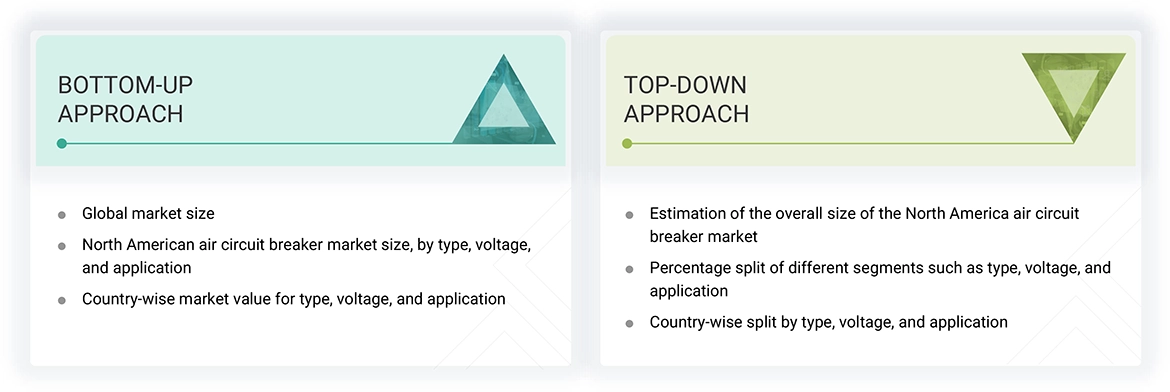

Methodology

The study involved major activities in estimating the current size of the North American air circuit breaker market. Exhaustive secondary research was done to collect information on the peer markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

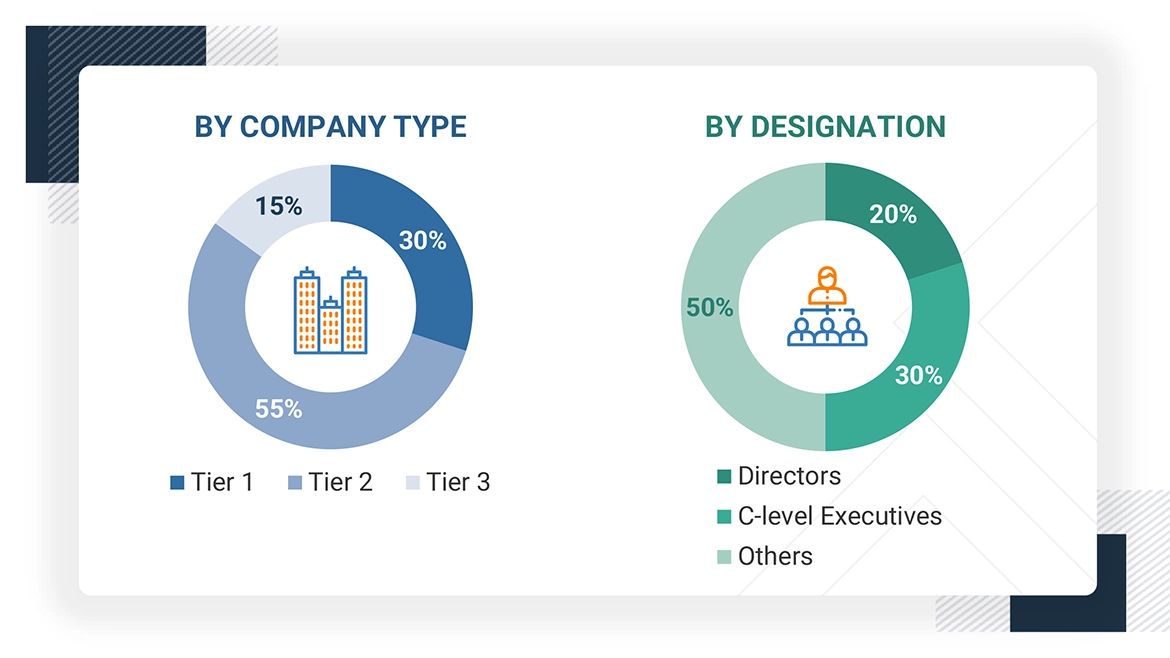

Primary Research

The primary research for this report involved interviews with sources from both the supply and demand sides to gather qualitative and quantitative insights. Supply-side sources included industry experts such as CEOs, VPs, and marketing directors from companies in the North American air circuit breaker market.

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. The following is the breakdown of primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the North American air circuit breaker market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

North American Air Circuit Breaker Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

An air circuit breaker (ACB) is one of the crucial electrical protective devices employed to break and isolate damaged parts of low- and medium-voltage power networks in the event of overcurrent, short circuit, or ground fault. In contrast to other breakers, which employ oil, gas, or vacuum as arc-quenching media, ACBs are based on compressed air as the arc-quenching medium. Once it detects a fault, the breaker quickly separates its contacts and emits a high-pressure burst of air to quench the electrical arc, thereby protecting the electrical system from harm and avoiding equipment damage or risk of fire. Air circuit breakers are extensively utilized in power generation stations, industrial plants, commercial buildings, and infrastructure facilities because they are highly dependable, simple to maintain, and can be equipped with digital monitoring and control capabilities. In recent times, ACBs have also been highly compatible with smart grid devices and have incorporated features such as predictive maintenance, remote operation, and real-time diagnostic tools to maximize system uptime and efficiency.

Stakeholders

- Air circuit breaker manufacturers, dealers, and suppliers

- Assembly, testing, and packaging vendors

- Electrical distribution utilities

- Medium-voltage equipment manufacturers

- Government agencies, energy departments, and regulatory authorities

- Smart grid solution providers

- Low- and medium-voltage substation operators and EPC firms

- Industry associations, electrical engineering societies, and standards organizations

- Public & private power generation, transmission & distribution companies (utilities)

- OEMs and system integrators

Report Objectives

- To describe and forecast the North American air circuit breaker market, in terms of value, based on type, voltage, and application

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the North America air circuit breaker market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments, and perform a supply chain analysis of the North American air circuit breaker market

- To analyze the opportunities for various stakeholders by identifying the high-growth segments of the North American air circuit breaker market

- To profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as contracts, agreements, expansions, product launches, investments, and acquisitions, in the North American air circuit breaker market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Key Questions Addressed by the Report

What was the size of the North American air circuit breaker market in 2024?

The North American air circuit breaker market was valued at USD 0.78 billion in 2024.

What are the major drivers for the North American air circuit breaker market?

Major drivers for the North American air circuit breaker market include increasing investments in grid modernization, rising demand for reliable and safe power distribution, replacement of aging electrical infrastructure, and growing integration of renewable energy sources. Additionally, the adoption of smart and digital substations, along with expanding industrial and commercial sectors, is boosting demand for advanced air circuit breakers across the region.

What will be the largest country-wise market in North America for air circuit breakers during the forecast period?

The United States is expected to be the largest country-wise market for air circuit breakers in North America during the forecast period. This is driven by substantial investments in upgrading aging grid infrastructure, increasing adoption of renewable energy, rapid industrial growth, and the country’s strong push toward smart grid and substation modernization initiatives.

Which type is expected to hold the largest market share during the forecast period and why?

Air blast circuit breakers are expected to hold the largest market share during the forecast period due to their ability to efficiently interrupt high fault currents in medium-voltage and high-voltage systems. Their superior arc-quenching capability, faster operation, and suitability for frequent switching applications make them ideal for large-scale industrial plants, power generation stations, and utility substations. In North America, where reliability and safety in electrical infrastructure are critical, air blast circuit breakers are favored for their durability, low maintenance needs, and long operational life, ensuring consistent performance in demanding environments.

Which end-use industry will hold most of the market share in the coming years?

The industrial segment is expected to hold the largest market share of the North American air circuit breaker market in the coming years due to the increasing demand for reliable and uninterrupted power supply across manufacturing, oil & gas, mining, and heavy engineering sectors. This segment rely heavily on medium- and low-voltage protection systems to safeguard critical machinery and ensure operational continuity. With growing investments in industrial automation, smart factories, and the electrification of industrial processes, the need for durable and high-capacity air circuit breakers is rising, solidifying the industrial segment’s dominance.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North American Air Circuit Breaker Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North American Air Circuit Breaker Market