Oil and gas NDT and Inspection Market Size, Share & Growth

Oil and gas NDT and Inspection Market by Technique (Ultrasonic Testing, Visual, Magnetic Particle, Liquid Penetrant, Eddy-Current, Radiographic, Acoustic Emission), Inspection Services, Equipment Rental, and Calibration - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The oil and gas NDT and inspection market is projected to expand steadily from USD 4.06 billion in 2025 to USD 6.20 billion by 2030 at a CAGR of 8.8%. Growth is primarily driven by increasing exploration, rising crude production, and the need to ensure structural integrity across refineries, pipelines, subsea assets, and storage tanks. Aging infrastructure and growing corrosion-related failure risks are accelerating demand for advanced NDT techniques such as ultrasonic testing, radiography, phased array UT, and digital inspection platforms. Additionally, the integration of automation, Industry 4.0 analytics, and predictive maintenance solutions improves inspection reliability, reduces downtime, and enables long-term asset management. Stricter safety regulations, environmental compliance requirements, and the industry’s shift toward condition-based monitoring further reinforce the adoption of NDT solutions across upstream, midstream, and downstream operations, supporting steady market expansion.

KEY TAKEAWAYS

-

By RegionNorth America accounted for 33.4% of the oil and gas NDT and inspection market in 2024.

-

By TechniqueBy Technique, the ultrasonic testing segment held the largest market share in 2024.

-

By TypeBy type, the transmission pipelines type is expected to register the fastest growth.

-

By ServiceBy service, the inspection services segment dominated the oil and gas NDT and inspection market in 2024.

-

Competitive LandscapeSGS SA, Bureau Veritas, Baker Hughes Company, Applus+, and Intertek Group plc were identified as some of the star players in the oil and gas NDT and inspection market, given their strong market share, service, and technique footprint.

-

Competitive LandscapeStartups such as IMITec GmbH, TeraTonics S.A.S., and Advacam have gained traction in oil & gas NDT and inspection through advanced sensing, digital and robotic platforms, real-time data streaming, cloud-based analytics, and AI-driven diagnostics for automated defect recognition in industrial and infrastructure inspections.

The oil and gas NDT and inspection market comprises techniques and services used to assess the structural integrity, reliability, and safety of pipelines, refineries, storage tanks, and processing infrastructure without causing operational disruptions. The market is driven by the increasing need to prevent leaks, corrosion failures, and unplanned shutdowns, especially across aging assets and high-pressure systems. The emphasis on long-term asset integrity, operational efficiency, and environmental compliance is accelerating demand for NDT solutions, supporting steady market expansion across the oil and gas value chain.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The oil & gas NDT and inspection market is shifting from traditional inspection practices to highly automated, digitalized, and data-driven models. Customers are rapidly adopting drone inspections, IoT-enabled monitoring, digital radiography, and AI analytics to improve accuracy, reduce downtime, and ensure regulatory compliance. Real-time data ecosystems and predictive maintenance are transforming integrity management, allowing early defect detection and asset optimization. Advanced ultrasonic techniques and autonomous inspection platforms are enabling safer evaluations of pipelines, subsea installations, refineries, and storage tanks. These disruptions are reshaping revenue streams as operators prioritize smart, connected inspection platforms over manual approaches.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing inspection demand due to aging pipeline and refinery infrastructure

-

High focus on avoiding costly unplanned shutdowns and improving operational uptime

Level

-

Shortage of certified inspectors and trained technicians

-

High procurement and integration costs of advanced NDT equipment and robotics

Level

-

Increased adoption of digital inspection platforms, AI-driven defect analytics, and data management

-

Growing use of robotic crawlers, drones, and autonomous ILI tools

Level

-

Frequent crude price fluctuations are impacting capital expenditure in the sector

-

Difficult environmental conditions affecting inspection efficiency, particularly offshore

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing inspection demand due to aging pipeline and refinery infrastructure

The oil & gas sector operates extensive networks of pipelines, refineries, storage tanks, and subsea assets, many of which are aging and prone to corrosion, cracks, and fatigue. As infrastructure integrity becomes more critical to safety and regulatory compliance, oil & gas operators are increasing inspection frequencies and seeking advanced NDT methods to prevent leaks, reduce environmental risks, and avoid costly shutdowns. This ongoing need for reliability and asset longevity continues to drive strong demand for NDT and inspection services.

Restraint: Shortage of certified inspectors and trained technicians

A significant challenge for the industry is the limited availability of qualified NDT professionals with specialized certifications (API, ASNT, ISO, etc.). As inspection technologies become more advanced—integrating AI, digital radiography, automation, and drones—the workforce gap widens, slowing adoption and increasing service costs. Limited technical expertise also causes delays in inspection cycles, particularly in subsea and hazardous zones, which restrains market growth.

Opportunity: Increased adoption of digital inspection platforms, AI-driven defect analytics, and data management

There is a growing shift toward digital transformation in oil & gas inspection. Companies are investing in IoT-enabled sensors, drones, real-time monitoring platforms, and AI analytics for automated defect detection and predictive maintenance. This digitalization improves visibility of asset health, reduces downtime, and increases accuracy. Intelligent platforms also streamline data management, reporting, and traceability, making digital technologies one of the strongest growth opportunities in the market.

Challenge: Frequent crude price fluctuations are impacting capital expenditure in the sector

Oil price volatility has a direct impact on spending behavior in the upstream, midstream, and downstream segments. During periods of low crude prices, companies delay inspection schedules, reduce new project investments, and prioritize cost-cutting over maintenance activities. This creates uncertainty in inspection budgets and slows long-term planning, posing a frequent challenge for service providers and technology adoption.

Oil and gas NDT and Inspection Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

SGS performs integrity inspections for upstream and midstream assets using ultrasonic and radiographic testing, as well as corrosion mapping for pipelines and pressure vessels. Its services ensure the detection of defects in welds, storage tanks, and refinery units, while supporting compliance with international safety codes. | By enhancing operational safety and reducing the risk of leaks or catastrophic failures, advanced inspection practices improve reliability across critical oil and gas infrastructure. They maximize equipment uptime by enabling timely preventive maintenance and early defect detection, avoiding unplanned disruptions. Additionally, these methods ensure regulatory compliance while strengthening documentation traceability, supporting audits and long-term safety assurance. |

|

Bureau Veritas provides advanced NDT services, including phased-array UT, digital radiography, and acoustic emissions testing across refineries and offshore platforms. It also delivers certification, risk-based inspection (RBI), and asset integrity management programs tailored for pipelines and petrochemical units. | Advanced digital inspection techniques significantly reduce overall inspection cycle time while improving accuracy and coverage. These capabilities enable long-term asset integrity planning, helping operators minimize downtime through timely and data-driven maintenance decisions. Additionally, the approach ensures adherence to safety requirements, supporting full compliance with API and ASME regulations for pipelines and pressure vessels. |

|

Baker Hughes deploys inline inspection (ILI) robots, corrosion monitoring sensors, and advanced ultrasonic inspection tools for subsea and onshore pipelines. Its solutions integrate real-time data analytics to detect wall thinning, cracks, fatigue, and corrosion. | High-accuracy inspection data enhances early failure detection, enabling operators to address issues before they escalate. This reduces unplanned shutdowns and associated maintenance costs, while supporting condition-based monitoring and predictive maintenance strategies to enhance overall asset reliability. |

|

Applus+ offers comprehensive NDT coverage for refinery turnaround projects, subsea inspections, weld testing, and pipeline integrity programs. Their services include phased array, magnetic particle testing, and drone-based remote visual inspection (RVI) for hazardous zones. | Enhanced inspection efficiency minimizes safety risks for field personnel by reducing the need for manual intervention in hazardous areas. Accurate defect diagnostics extend the lifecycle of aging assets by enabling timely corrective actions. As a result, downtime during shutdown and maintenance operations is significantly reduced, improving overall operational reliability and productivity. |

|

Intertek provides pipeline integrity assessment, corrosion evaluation, and risk-based inspection services using ultrasonic testing, radiography, and positive material identification (PMI). Its digital inspection reporting improves record traceability across multi-site oil & gas operations. | Enhanced accuracy in asset assessments enables better maintenance decisions, while structured documentation ensures strong regulatory compliance. This data-driven approach reduces unexpected failures and delivers notable cost savings. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The oil and gas NDT and inspection market ecosystem comprises key contributors across the value chain, including input and component suppliers such as CeramTec, Hamamatsu, PI, Analog Devices, and Morgan Advanced Materials that provide essential sensors, materials, and electronic components used in inspection systems. Equipment designers and manufacturers, such as Evident, Sonatest, Waygate Technologies, Magnaflux, and Eddyfi, develop advanced testing instruments and platforms for ultrasonic, radiographic, and specialty inspections. Service providers, including SGS, Intertek, Bureau Veritas, Applus+, and DEKRA, deliver field inspection, testing, certification, and maintenance services for critical oil and gas infrastructure. Finally, end users such as ExxonMobil, BP, Shell, Saudi Aramco, and Chevron rely on these solutions to ensure operational safety, regulatory compliance, integrity management, and continuous performance of pipelines, refineries, storage assets, and offshore platforms.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Oil and Gas NDT and Inspection Market, By Technique

In the oil and gas sector, Acoustic Emission Testing (AET) is rapidly growing as a key NDT method, especially for high-risk assets like pipelines, subsea systems, tanks, and refineries. It detects defects such as cracks, corrosion, weld failures, and leaks in real time without disrupting operations, making it ideal for safety-critical environments. The focus on pipeline integrity, leak prevention, and predictive maintenance boosts AET adoption over traditional methods. With the goal to reduce shutdowns and extend asset life, the market is expected to grow at about 7% CAGR, complementing ultrasonic, radiographic, and phased-array testing.

Oil and Gas NDT and Inspection Market, By Services

Inspection services held the largest share in 2024, driven by rising demand for third-party expertise to ensure pipeline integrity, refinery safety, and adherence to strict regulatory and environmental standards. These services are widely deployed across refineries, transmission pipelines, subsea assets, and storage tanks to detect corrosion, cracks, weld defects, and leakage risks, preventing costly shutdowns and operational failures. By relying on specialized inspection providers, oil and gas operators gain access to advanced testing methodologies, certified professionals, and reliable documentation traceability, strengthening compliance and risk management.

Oil and Gas NDT and Inspection Market, By Type

The transmission pipeline segment is among the fastest-growing areas in the NDT and inspection market, driven by the need to maintain aging pipeline networks. The increasing implementation of integrity management programs and strict regulatory oversight has accelerated the adoption of advanced inspection techniques. Technologies such as ultrasonic testing, smart pigging, and digital radiography enable early defect detection, predictive maintenance, and enhanced safety. These solutions help prevent leaks, corrosion, and operational failures, reducing environmental and financial risks.

REGION

The North America region accounts for the largest market share in the oil and gas NDT and inspection market during the forecast period

North America leads the oil and gas NDT and inspection market due to its well-established infrastructure, stringent safety regulations, and focus on operational reliability. Aging pipelines, refineries, and offshore facilities drive demand for advanced inspection services like ultrasonic testing, digital radiography, and remote monitoring. The presence of leading service providers and investment in shale and unconventional oil further strengthens the region’s market position. Overall, technological innovation and regulatory compliance continue to fuel North America’s dominance in the NDT and inspection sector.

Oil and gas NDT and Inspection Market: COMPANY EVALUATION MATRIX

In the oil and gas NDT and inspection market, SGS SA (Star) leads with a dominant market share, supported by a wide service portfolio, strong regional presence, and advanced digital inspection platforms that address complex oil and gas applications. DEKRA (Emerging Leaders) is strengthening its position by leveraging its quality-assurance network to deliver NDT services tailored for the oil and gas sector, combining conventional testing with advanced techniques to provide broad coverage, though slightly less extensive than the star players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- SGS SA (Switzerland)

- Bureau Veritas (France)

- Applus+ (Spain)

- Intertek Group plc (UK)

- Baker Hughes Company (US)

- TÜV Rheinland (Germany)

- DEKRA (Germany)

- Ashtead Technology (Scotland)

- Comet Group (Switzerland)

- Cygnus Instruments Ltd. (UK)

- Element Materials Technology (UK)

- Helmut Fischer GmbH (Germany)

- Nikon Metrology NV (Belgium)

- Sonatest (UK)

- MISTRAS Group (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 4.06 Billion |

| Market Forecast in 2030 (Value) | USD 6.20 Billion |

| Growth Rate | CAGR of 8.8% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Region Covered | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: Oil and gas NDT and Inspection Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Cross-Country Pipeline Operators |

|

|

| Refinery & Petrochemical Plant Operators |

|

|

| LNG Plants & Storage Terminal Operators |

|

|

| Offshore Platform & Subsea Asset Owners |

|

|

| Midstream Storage & Distribution Companies |

|

|

RECENT DEVELOPMENTS

- July 2025 : NDT Global acquired Entegra, a specialist in Ultra-High-Resolution Magnetic Flux Leakage (UHR MFL) in-line inspection services. This strategic acquisition expands NDT Global’s technology portfolio, combining Entegra’s UHR MFL capabilities with NDT Global’s ultrasonic testing, Acoustic Resonance Technology (ART), and data management solutions. The merger strengthens NDT Global’s position in the gas pipeline market, enhances its service offerings, and enables more cost-effective, data-driven, and safer pipeline operations.

- November 2023 : International subsea equipment rental and solutions specialist Ashtead Technology broadened its mechanical solutions service portfolio by acquiring ACE Winches. This marks Ashtead Technology’s eighth acquisition in the last six years, following the 2022 acquisitions of Aberdeenshire-based companies WeSubsea and Hiretech. This strategic move reinforces Ashtead Technology’s comprehensive product and service offerings in both the oil & gas and offshore wind sectors.

- June 2023 : Applus+ signed an agreement in March 2023 and completed the sale of its US NDT and inspection business serving the oil & gas sector to Ten Oaks Group in June 2023.

- April 2023 : Baker Hughes Company signed an agreement to acquire Atlus Intervention in March 2022 and completed its acquisition in April 2023. enhancing oil & gas intervention capabilities, including downhole technology and inspection services, which can involve NDT methods for asset integrity.

- January 2023 : Bureau Veritas inaugurated its new regional headquarters in Riyadh, Saudi Arabia, strengthening its footprint with six offices and five laboratories. The expansion supports Vision 2030, enabling the company to deliver testing, inspection, and certification services, with emphasis on sustainability, ESG, and risk management.

Table of Contents

Methodology

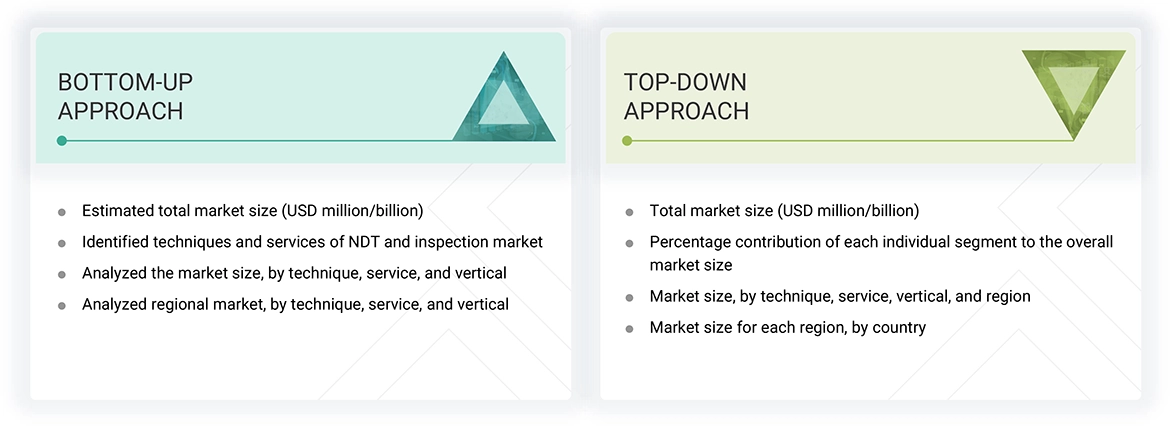

The research study involved four major activities in estimating the size of the oil and gas NDT and inspection market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

The oil and gas NDT and inspection market report estimates the global market size using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding the oil and gas NDT and inspection market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the oil and gas NDT and inspection market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying stakeholders in the oil and gas NDT and inspection market, including regulatory bodies (e.g., ASME, ISO, API), certification agencies, industry associations, consulting firms, equipment manufacturers, service providers, and end users across industries such as oil & gas, aerospace, automotive, power, and public infrastructure

- Analyzing major providers of NDT equipment and services and their key offerings, including ultrasonic testing (UT), radiographic testing (RT), eddy-current testing (ECT), magnetic particle testing (MPT), liquid penetrant testing (LPT), acoustic emission testing (AET), visual inspection systems, and other emerging techniques (e.g., terahertz imaging and near-infrared spectroscopy)

- Studying trends of NDT adoption across sectors such as manufacturing, oil & gas, aerospace, automotive, power, and public infrastructure

- Tracking recent market developments, including regulatory updates, technology advancements (e.g., AI- and IoT-integrated inspection platforms, robotic and drone-based inspection systems), product innovations, facility expansions, and mergers & acquisitions by key players to forecast market size and emerging opportunities

- Conducting multiple discussions with key opinion leaders, including equipment OEMs, service providers, quality assurance consultants, and regulatory auditors to understand real-time adoption trends, technical challenges, and the rising focus on predictive maintenance, automation, and data-driven inspection strategies

- Validating market estimates through in-depth consultations with industry experts—ranging from R&D heads of leading NDT equipment manufacturers to asset integrity managers and technical advisors—and aligning insights with domain specialists at MarketsandMarkets for accurate and reliable market projections

Oil and gas NDT and Inspection Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall oil and gas NDT and inspection market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply-side perspectives. Along with data triangulation and market breakdown, the market has been validated through top-down and bottom-up approaches.

Market Definition

The non-destructive testing (NDT) and inspection market comprises technologies and services used to assess the quality, integrity, and performance of materials or structures without causing damage. NDT techniques, such as ultrasonic, radiographic, eddy-current, visual, and magnetic particle testing, enable flaw detection, stress analysis, and material characterization across critical applications. Inspection, including both visual and instrument-based methods, ensures compliance with quality standards, specifications, and regulations. oil and gas NDT and inspection are essential for ensuring operational safety, product reliability, and process efficiency across industries such as aerospace, manufacturing, oil & gas, automotive, and power. The market is evolving with digital advancements, such as AI, IoT, robotics, and cloud-based platforms, for real-time monitoring and data-driven decision-making.

Key Stakeholders

- Original Equipment Manufacturers (OEMs)

- NDT Equipment Distributors and Suppliers

- Suppliers of Accessories and Consumables for NDT Equipment

- Providers of oil and gas NDT and inspection Services

- Research Organizations, Testing Laboratories, and Consulting Firms

- Government Bodies, Regulatory Authorities, and Policymakers

- Industry Associations, Standards Bodies, and Alliances (e.g., ASNT

- Venture Capitalists and Private Equity Firms

Report Objectives

- To define, describe, segment, and forecast the size of the oil and gas NDT and inspection market, by technique, service, vertical, and region, in terms of value

- To describe the oil and gas NDT and inspection market based on application

- To forecast the market size for the technique segmentation for ultrasonic testing (UT) equipment, in terms of volume

- To forecast the size of various segments of the market in four regions: North America, Asia Pacific, Europe, and the Rest of the World (RoW), in terms of value

- To offer detailed information on drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the oil and gas NDT and inspection market value chain

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To study the impact of AI/Gen AI and the 2025 US tariff on the market under study, along with the macroeconomic outlook for each region

- To analyze opportunities for various stakeholders by identifying the high-growth segments of the market

- To benchmark the key players and analyze their market position in terms of revenue, market share, and core competencies2, and a detailed competitive landscape for the market leaders

- To analyze competitive developments such as product/service launches, agreements, partnerships, collaborations, acquisitions, and investments carried out by players in the oil and gas NDT and inspection market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Oil and gas NDT and Inspection Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Oil and gas NDT and Inspection Market