Oligonucleotide CDMO Market: Growth, Size, Share, and Trends

Oligonucleotide CDMO Market by Service (Contract Manufacturing (Clinical, Commercial), Development), Type (ASO, SiRNA, (CPG Oligos, gRNA)), Application (Therapeutic, Research, Diagnostic), End User (Pharma, Biotech) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global oligonucleotide CDMO market is projected to reach USD 6.73 billion by 2029, up from USD 2.51 billion in 2024, growing at a CAGR of 21.8% during the forecast period (2024–2029). This market encompasses outsourced development and manufacturing services for a diverse range of oligonucleotides, including antisense oligonucleotides, small interfering RNAs (siRNAs), and other therapeutic oligonucleotides. Growth in this market is being driven by the rising demand for oligonucleotide-based therapeutics, alongside increasing outsourcing of development and manufacturing activities to support the advancement of personalized medicines.

KEY TAKEAWAYS

- The North America oligonucleotide CDMO market accounted for a 43.1% revenue share in 2023.

- By service type, the contract manufacturing market segment dominated the market with 42.0% share in 2023.

- By stage, the commercial stage segment is projected to grow at the fastest rate of 22.1% during the forecast period.

- By type, the Antisense Oligonucleotide (ASO) segment is projected to grow at the fastest rate from 2025 to 2030.

- By application, the therapeutic application segment is expected to dominate the market.

- By end user, the Pharma & Biotech companies segment will grow the fastest during the forecast period.

- Bachem, Thermo Fisher Scientific and Agilent Technologies were identified as some of the star players in the oligonucleotide CDMO market (global), given their strong market share and service footprint.

- Companies such as, Synoligo Biotechnologies and Oligo factory have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The oligonucleotide CDMO market is expected to witness substantial growth owing to the growing focus on the development and commercialization of oligo-based therapeutics, the advantages of outsourcing contract development and manufacturing, the rising adoption of precision and personalized medicine, and continuous technological advancements. Furthermore, the increasing use of oligonucleotides in CRISPR-Cas9 applications presents significant opportunities for market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ businesses in the oligonucleotide CDMO market is being shaped by technological advancements, growing therapeutic demand, and evolving outsourcing trends. Innovations in oligo synthesis, purification, and analytical technologies, along with the increasing adoption of precision and personalized medicine, are enabling faster development and scalable manufacturing of complex oligonucleotide therapeutics. Additionally, rising focus on antisense oligos, siRNAs, and CRISPR-based applications is creating new opportunities for CDMOs, while the advantages of contract development and manufacturing are driving end users to rely more heavily on CDMO partners.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing focus on development and commercialization of oligo-based therapeutics

-

Advantages of contract development and manufacturing

Level

-

Complexities associated with therapeutic oligonucleotide manufacturing

Level

-

Increasing use of oligos in CRISPR-Cas9 applications

Level

-

Lack of sustainable and eco-friendly supply chain

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing focus on development and commercialization of oligo-based therapeutics

The growing focus on the development and commercialization of oligo-based therapeutics is driving the oligonucleotide CDMO market as pharmaceutical and biotech companies increasingly seek specialized partners for synthesis, development, and large-scale manufacturing. Rising investments in antisense oligos, siRNAs, and CRISPR-based therapies, coupled with the complexity of oligonucleotide production, make CDMOs essential for ensuring quality, scalability, and regulatory compliance, supporting faster time-to-market for innovative treatments.

Restraint: Complexities associated with therapeutic oligonucleotide manufacturing

Therapeutic oligonucleotide manufacturing involves complex synthesis, purification, and analytical processes that require specialized equipment and highly skilled personnel. Ensuring consistent quality and meeting stringent regulatory standards while scaling up production can be challenging and costly. These technical demands make the development and manufacturing of novel and highly modified oligonucleotide therapies resource-intensive, affecting timelines and accessibility for some companies in the market.

Opportunity: Integration of multi-omics technologies

The growing adoption of CRISPR-Cas9 technology is driving demand for high-quality oligonucleotides, including guide RNAs and donor templates, for research and therapeutic applications. Developing these oligos requires specialized expertise, advanced synthesis, and stringent quality control, which encourages companies to outsource these activities to experienced CDMOs. By leveraging CDMO capabilities, biopharma and research organizations can accelerate gene-editing programs, ensure regulatory compliance, and focus internal resources on downstream development and therapeutic innovation.

Challenge: Increasing use of oligos in CRISPR-Cas9 applications

Maintaining a sustainable and eco-friendly supply chain presents significant difficulties for the oligonucleotide CDMO market. Oligonucleotide production requires large volumes of chemicals, solvents, and energy-intensive processes, generating substantial waste. Balancing regulatory compliance, consistent product quality, and environmental considerations adds operational complexity and increases costs for CDMOs, making it harder to scale production efficiently while minimizing environmental impact.

Oligonucleotide CDMO Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Leveraged CDMO expertise to develop and manufacture oligonucleotide-based drug substances using novel manufacturing technology | Access to specialized engineering infrastructure, R&D, and GMP-grade production; accelerated development of oligonucleotide therapeutics for oncology, rare diseases, and genetic disorders; enhanced global manufacturing capacity; potential annual orders up to USD 125 million |

|

Established a US-based CRO to provide oligonucleotide CDMO services, including large-scale production of long-chain gRNAs for genome editing therapies | Proximity to Boston biotech startups enables rapid customer engagement and sample provision; access to the world’s first scalable, high-purity gRNA production technology; strengthens presence in the US, the largest pharmaceutical market; supports timely and efficient development of genome editing therapeutics |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The oligonucleotide CDMO market ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including service providers (Bachem, Thermo Fisher, Others) and end users (Pfizer, Merck & Co., others). Service providers deliver a range of specialized development and manufacturing services for oligonucleotide-based therapeutics and related nucleic acid products. End users, including pharmaceutical and biotechnology companies, diagnostic firms, and other stakeholders, utilize these services to expedite drug development, ensure high-quality production, and efficiently bring novel oligonucleotide-based therapies to market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Oligonucleotide CDMO Market, By Service Type

Various services offered by CDMOs within the oligonucleotide CDMO market include contract manufacturing, contract development, and other specialized services. Among these, contract development is expected to witness the fastest growth, driven by the increasing complexity of oligonucleotide-based therapeutics, the need for customized process development, and the rising demand for integrated solutions that accelerate drug development while ensuring regulatory compliance and high-quality production.

Oligonucleotide CDMO Market, By Type

By type, the oligonucleotide CDMO market includes antisense oligonucleotides (ASOs), small interfering RNAs (siRNAs), and other oligos. ASOs are in high demand, as they are widely used in therapies for genetic disorders, rare diseases, and cancer. Their complex development and manufacturing processes lead companies to outsource to specialized CDMOs for scalable, high-quality production.

Oligonucleotide CDMO Market, By Application

Therapeutic applications accounted for the largest share of oligonucleotide CDMO services in 2023, as pharmaceutical and biotech companies increasingly focused on developing oligo-based drugs for oncology, genetic disorders, and rare diseases. The complexity of producing GMP-grade therapeutic oligonucleotides, along with the need for regulatory compliance and large-scale manufacturing, drives companies to rely on specialized CDMOs, making therapeutics the primary application segment.

Oligonucleotide CDMO Market, By End User

The oligonucleotide CDMO market serves a diverse range of end users, including pharmaceutical and biotechnology companies, diagnostic laboratories, and other organizations. Among these, pharmaceutical and biotechnology companies held the largest share, as they are the primary developers of oligonucleotide-based therapeutics. Their reliance on specialized expertise, large-scale GMP-compliant manufacturing, and regulatory support enables them to accelerate drug development and ensure high-quality production, driving their dominant position in the market.

REGION

Asia Pacific to be fastest-growing region in global oligonucleotide CDMO market during forecast period

The Asia Pacific oligonucleotide CDMO market is expected to be the fastest-growing region during the forecast period, driven by rising investment in biopharmaceutical R&D, the expansion of domestic CDMOs with advanced manufacturing capabilities, supportive government initiatives, and a growing pipeline of oligonucleotide-based therapeutics for rare and chronic diseases.

Oligonucleotide CDMO Market: COMPANY EVALUATION MATRIX

In the oligonucleotide CDMO market matrix, Bachem (Star) leads with a strong market share, broad service portfolio, and global infrastructure, enabling widespread adoption of oligonucleotide manufacturing across therapeutic and research applications. Thermo Fisher Scientific and Agilent also feature strongly as Stars, leveraging strategic acquisitions, specialized expertise, and extensive distribution networks to maintain their leadership positions. Among Emerging Leaders, ST Pharm, Sumitomo Chemical, and WuXi AppTec are steadily expanding their capabilities through advanced manufacturing technologies, scalable GMP-compliant production, and entry into high-demand therapeutic segments, such as ASO, siRNA, and CRISPR-based oligonucleotides. While Bachem currently dominates in terms of scale and market influence, these Emerging Leaders demonstrate strong growth momentum and technological innovation, positioning them to potentially advance into the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Bachem (Switzerland)

- Thermo Fisher Scientific Inc. (US)

- Agient Technologies, Inc. (US)

- Wuxi Apptec (China)

- Maravai Lifesciences (US)

- Lonza (Switzlerland)

- Eurofins Scientific (Luxembourg)

- Danaher Corporation(US)

- Genscript (US)

- Syngene International Limited (India)

- EuroAPI (France)

- Ajinomoto Co., Inc. (Japan)

- ST Pharm (South Korea)

- Kaneka Corporation (Japan)

- Polypetide Group (Switzerland)

- Aurigene Pharmaceutical Services Ltd (India)

- Biospring (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 2.34 Billion |

| Market Forecast in 2029 (Value) | USD 6.73 Billion |

| Growth Rate | CAGR of 21.8% from 2024-2029 |

| Years Considered | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, and Middle East & Africa |

| Leading Segment | Contract manufacturing led the service type segment with a 42.0% share |

| Leading Region | North America held a 43.1% share of the oligonucleotide CDMO market in 2023 |

| Market Driver | Rising focus on oligo-based therapeutics development and commercialization |

| Market Constraint | Complexities in therapeutic oligonucleotide manufacturing |

WHAT IS IN IT FOR YOU: Oligonucleotide CDMO Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-Level Market Segregation | Country-level market size breakdown for therapeutic oligonucleotide CDMO services, cross-correlated with contract development demand |

|

| CDMO Benchmarking | Benchmarking of CDMO partners by service type (manufacturing vs. development) with focus on ASO and siRNA |

|

| Market Sizing | Market sizing of diagnostic applications for oligo CDMO services across Asia Pacific with end-user profiling |

|

| Competitive Mapping | Competitive landscape mapping and regional expansion opportunities in Europe and North America | Revealed partnership white spaces with 5 pharma/biotech leaders |

RECENT DEVELOPMENTS

- September 2025 : Hongene Biotech, a nucleic acid therapeutics CDMO, has signed a non-exclusive licensing deal with UMass Chan Medical School to supply exNA monomers and exNA-modified oligonucleotides, strengthening its RNA chemistry CDMO portfolio and enabling researchers to develop more stable, tissue-specific RNA therapeutics beyond liver-targeted applications.

- August 2025 : Cohance Lifesciences invested approximately USD 2.8 million (INR 230 million) in a new cGMP oligonucleotide building block facility in Hyderabad, adding up to 700 kg of annual GMP capacity for modified nucleosides and LNAs, thereby strengthening its global CRDMO platform across next-generation RNA therapeutics.

- April 2025 : Sumitomo Chemical has established a new US-based CRO to expand its oligonucleotide CDMO business, focusing on large-scale, high-purity gRNA production for genome editing therapies.

- July 2024 : Agilent has completed its USD 925 million acquisition of BioVectra, expanding its oligonucleotide and CRISPR CDMO capabilities with added scale in siRNA, antisense, gRNA, and new modalities including mRNA, pDNA, lipid nanoparticles, and fill–finish services.

Table of Contents

Methodology

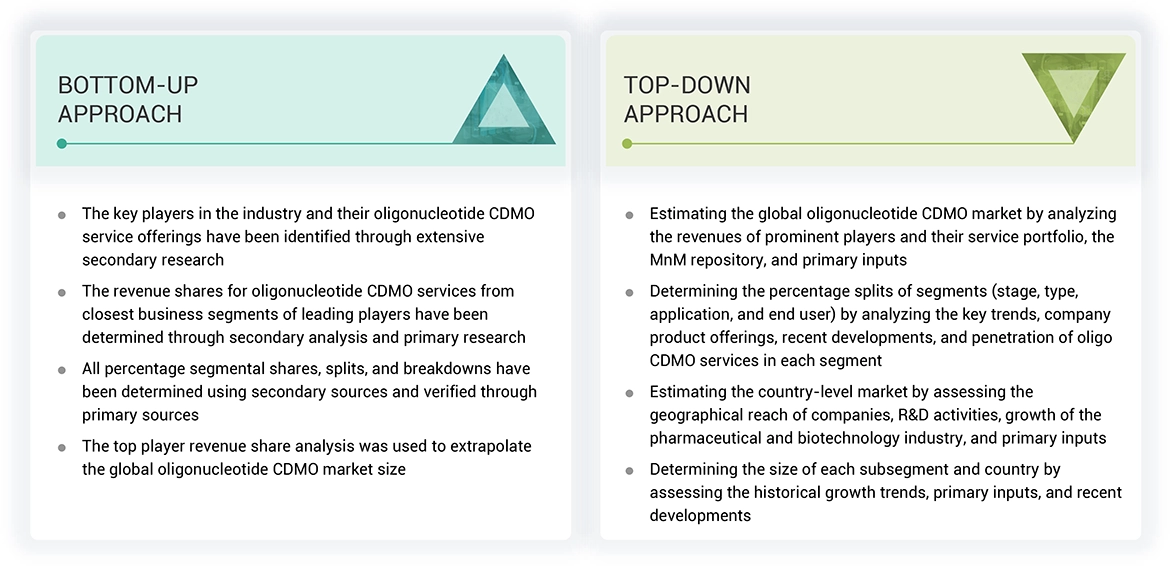

The research study involved the wide use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global oligonucleotide CDMO market. Extensive interviews were conducted with various primary participants, including key industry members, subject-matter experts (SMEs), C-level managers of leading market players, and industry consultants, to obtain and verify qualitative and quantitative information and evaluate the growth scenarios of the market. The global market size is estimated through secondary research (top-down and bottom-up) followed by data triangulation with inputs from industry experts to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the technical, market-oriented, and commercial study of the oligonucleotide CDMO market. The secondary sources used for this study include BioPlan Associates, Pharmaceutical Research and Manufacturers of United States Food and Drug Administration (US FDA), European Medicines Agency (EMA), National Center for Biotechnology Information (NCBI), corporate & regulatory filings, such as annual reports, SEC filings, investor presentations, and financial statements; business magazines & research journals; press releases; and trade, business, and professional associations among others. These secondary sources were also used to obtain major information about key market players, and market segmentation corresponding to industry trends, regional/country-level markets, market developments, and technology prospects. Secondary data was collected and analyzed to arrive at the market size of the global oligonucleotide CDMO market, which was further validated through primary research.

Primary Research

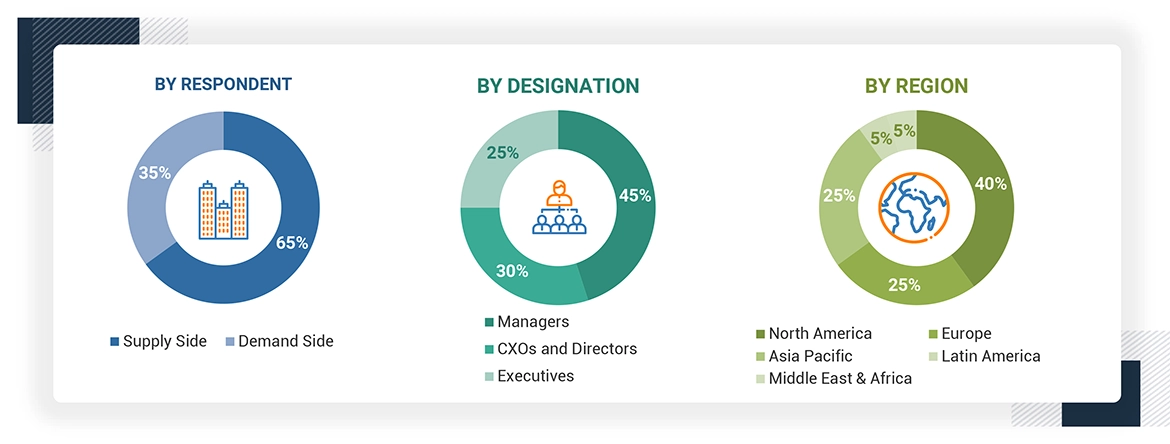

Extensive primary research was conducted after acquiring basic knowledge about the global oligonucleotide CDMO market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as pharmaceutical & biopharmaceutical industries from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. The primary interviews were conducted across six major regions, including North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Approximately 65% and 35% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the oligonucleotide CDMO market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The Oligonucleotide CDMO market involves outsourcing oligonucleotide development and manufacturing services to specialized contract development and manufacturing organizations (CDMOs). The market includes assessment of various type of service, type of oligonucelotides, applications and end users of these services.

Stakeholders

- Contract development and manufacturing Service Providers

- Raw Material and Reagent Suppliers

- Technology Providers

- Research Institutes and Academic Centers

- Pharmaceutical and Biotechnology Companies

- Regulatory Authorities

- Healthcare Providers

- Industry Associations and Advocacy Groups

- Public Health Agencies

- Business Research and Consulting Service Providers

- Venture Capitalists

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the Oligonucleotide CDMO market by value by service type, type, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall oligonucleotide CDMO market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to six regions: North America, Europe, the Asia Pacific, Latin America, Middle East and Africa

- To profile the key players and analyze their market shares and core competencies2

- To track and analyze competitive developments, such as service launches, partnerships, agreements, collaborations, and expansions

- To benchmark players within the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of business and product excellence strategy

Key Questions Addressed by the Report

Who are the key players in the oligonucleotide CDMO market?

Key players in the oligonucleotide CDMO market include Bachem (Switzerland), Thermo Fisher Scientific Inc. (US), Agilent Technologies, Inc. (US), EUROAPI (France), ST Pharm (South Korea), Kaneka Eurogentec S.A. (Belgium), Ajinomoto Co., Inc. (Japan), Aurigene Pharmaceutical Services Ltd. (India), , Syngene International Limited (India), PolyPeptide Group (Switzerland), WuXi AppTec (China), EUROAPI (France), Eurofins Scientific (Luxembourg), GenScript (US), Lonza (Switzerland), and Danaher Corporation (US) among others.

Which stage segment dominates the oligonucleotide contract manufacturing market?

The commercial stage segment dominated the market in 2023.

Which applications segment dominates the oligonucleotide CDMO market?

The therapeutic applications segment is anticipated to register the highest CAGR during the forecast period.

Which type segment dominates the oligonucleotide CDMO market?

The contract manufacturing dominated the market in 2023.

What is the size of the oligonucleotide CDMO market?

The global oligonucleotide CDMO market is projected to reach USD 6.73 billion in 2029 from USD 2.51 billion in 2024, with a CAGR of 21.8%.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Oligonucleotide CDMO Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Oligonucleotide CDMO Market