This study extensively used primary and secondary sources. The research process involved studying various factors affecting the industry to identify segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources such as National Institutes of Health (NIH), US FDA, World Health Organization (WHO), International Trade Administration (ITA), US Census Bureau, and Centers for Medicare and Medicaid Services (CMS) was referred to identify and collect information for the global patient temperature monitoring market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends, to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research phase, a comprehensive approach was employed, involving the interviewing of several sources from the supply and demand sides. These interviews aimed to obtain the quantitative and qualitative information needed to put up this report. Industry experts from core and associated industries, as well as preferred manufacturers, distributors, suppliers, technological innovators, and organizations involved in all facets of this industry's value chain, served as the primary information sources. Numerous primary respondents, including important industry participants, subject-matter specialists, C-level executives of the major market companies, and industry advisers, were the focus of extensive inquiry. The objective was to comprehensively evaluate potential futures and collect and validate significant qualitative and quantitative insights.

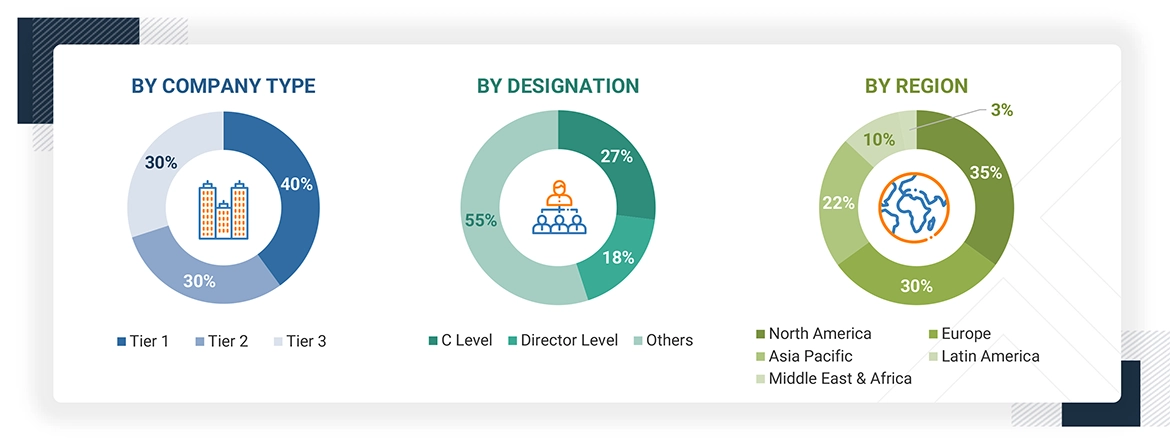

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global patient temperature monitoring market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/subsegments was done for the major players. The global patient temperature monitoring market was split into various segments and sub-segments based on:

-

List of major players operating in the patient temperature monitoring market at the regional and/or country level

-

Product mapping of various patient temperature monitoring product manufacturers at the regional and/or country level

-

Mapping of annual revenue generated by listed major players in the overall patient temperature monitoring market (or the nearest reported business unit/product category)

-

Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

-

Summation of the market value of all segments/subsegments to arrive at the global patient temperature monitoring market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall size of the global patient temperature monitoring market through the above-mentioned methodology, this market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Patient temperature monitoring involves the continuous or periodic assessment of an individual’s core body temperature to evaluate their physiological status, identify early manifestations of illness or infection, and inform clinical decision-making. This practice is integral to patient management across diverse healthcare environments, from primary care consultations to critical care units. It enables prompt recognition and intervention for thermoregulatory disturbances such as pyrexia or hypothermia, thereby enhancing overall patient outcomes through timely and targeted therapeutic responses.

Stakeholders

-

Manufacturers and Vendors of Patient Temperature Monitoring Products

-

Pharmaceutical & Biopharmaceutical Companies

-

Distributors of Patient Temperature Monitoring Products

-

Healthcare Institutions

-

Government Bodies/Municipal Corporations

-

Regulatory Bodies

-

Business Research and Consulting Service Providers

-

Venture Capitalists and Investors

-

Market Research and Consulting Firms

-

Healthcare Providers

Report Objectives

-

To describe, analyze, and forecast the patient temperature monitoring market by product, site, application, end user, and region

-

To describe and forecast the patient temperature monitoring market in key regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

-

To profile key players and comprehensively analyze their market shares and core competencies2 in the patient temperature monitoring market

-

To analyze competitive developments such as product approvals, partnerships, expansions, spinoffs, and collaborations in the patient temperature monitoring market

-

To analyze the impact of AI/Gen AI on the patient temperature monitoring market in terms of its capabilities, potential, use cases, and future

John

Dec, 2022

What was the overall global market size of the patient temperature monitoring market in 2021?.

Alex

Dec, 2022

Which industry is the largest end user in the patient temperature monitoring market?.