Perforating Gun Market

Perforating Gun Market by Gun Type (Through Tubing Hollow Carrier & Exposed, Wireline Conveyed Casing, TCP), Well Type (Horizontal, Vertical), Depth (Up to 3,000 ft, 3,001–8,000 ft, above 8,000 ft), Pressure, Application, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global perforating gun market is projected to reach USD 1.48 billion by 2030 from USD 1.19 billion in 2025, registering a CAGR of 4.5% during the forecast period. Demand for perforating gun is increasing with the requirement of more horizontal and complex wells requiring multistage completions, along with increased drilling activity and technological improvements.

KEY TAKEAWAYS

-

BY REGIONNorth America holds the largest market share, due to the expansion of horizontal drilling activity, the redevelopment of mature brownfield projects, and the rising demand for crude in key import markets like Europe and the Asia Pacific.

-

BY WELL TYPEHorizontal wells are expected to register the highest CAGR of 4.6% during the forecast period due to their higher reservoir contact, enhanced production efficiency, and the rising adoption of unconventional drilling techniques.

-

BY PRESSUREHigh-pressure guns held 57% of the market in 2024. Despite rising competition from low-pressure equivalents, they remain essential for deepwater and tight formation operations, ensuring durability and safety.

-

BY DEPTHWells with depths of up to 3,000 ft. and 3,001–8,000 ft. represent the fastest-growing segments, with both submarkets expected to post a CAGR of 4.6%.

-

BY APPLICATIONOffshore applications are the fastest-growing segment, driven by a surge in deepwater exploration, the redevelopment of mature offshore fields, and increasing investment in subsea completions.

-

BY GUN TYPEThe tubing-conveyed perforation system segment is expected to hold the largest market share during the forecast period due to its versatile nature and high operational efficiency.

-

COMPETITIVE LANDSCAPECompanies such as SLB, Weatherford, Baker Hughes Company, and Halliburton have been identified as key players in this market. These players have strong and established portfolios, as well as a well-developed market presence.

Perforating guns are essential tools in well-completion procedures and are used in various applications, including the oil & gas sector. This equipment is lowered into wells to appropriate depths to make fractures, allowing for reservoir fluids to flow from the formation and into the wellbore. Rising exploration into untapped or unconventional oil & gas resources, along with increasing oil demand, is expected to drive the market for perforating guns. They are categorised into expendable, semi-expendable, and retrievable, with each type coming with distinct drawbacks and disadvantages.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The perforating gun market is projected to grow at a compound annual growth rate (CAGR) of 4.5% during the forecast period. Leading manufacturers such as Schlumberger (US), Weatherford (US), Baker Hughes Company (US), Halliburton (US), and NOV (US) are expanding their product and service portfolios across the entire value chain to enhance revenue opportunities. As energy companies push to get maximum output from geological formations, the requirement for more efficient, safe, and cost-effective perforation devices will expand, transforming this market into a key player through global energy consumption patterns, driving the market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surging industrialization, urbanization, and rising living standards in emerging economies

-

Growing need for maximizing production potential of mature oil and gas fields through re-perforation

Level

-

Fluctuating oil prices

-

Lack of standardization

Level

-

Re-perforation of old wells

-

Digitalization and automation

Level

-

Safety risks associated with handling, transporting, and deploying explosive charges in oil & gas wells

-

High operational costs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surging industrialization, urbanization, and rising living standards in emerging economies

The rapid rise in global energy consumption, driven primarily by industrialization, urbanization, and rising living standards in emerging economies, continues to amplify the need for robust oil and gas exploration and production (E&P) activities. This increasing energy demand significantly bolsters the demand for advanced perforating technologies, such as perforating guns, which play a critical role in enhancing hydrocarbon recovery rates in both conventional and unconventional reservoirs. According to the International Energy Agency (IEA), global energy demand is expected to grow by approximately 23% by 2045, with over 70% of this growth projected to come from developing economies, particularly in Asia and Africa. Countries like India and China are leading this surge, with India's energy consumption anticipated to double by 2040. Perforating guns, designed to create optimal communication pathways between the reservoir and the wellbore, are indispensable in hydraulic fracturing and well stimulation operations. As energy producers focus on maximizing output from complex geological formations, the demand for more efficient, safer, and cost-effective perforation tools continues to grow, making this segment a key beneficiary of global energy trends.

Restraint: Fluctuating oil prices

Global oil demand continues to grow, with projections averaging 1.1 million barrels per day (mb/d) in 2025, up from 870,000 barrels per day (kb/d) in 2024, according to the IEA. Meanwhile, OECD countries are experiencing a structural decline in oil demand after a modest recovery in 2023. This decline is mainly due to increased energy efficiency, the adoption of electric vehicles (EVs), and strict environmental policies aimed at cutting carbon emissions. Geopolitical events and severe weather disruptions that affect the flow of crude oil and petroleum products can influence crude oil and product prices. These events may generate uncertainty about future supply or demand, leading to higher price volatility. Oil price volatility is linked to the inelasticity, or low responsiveness, of supply and demand to price changes in the short term. Uncertainty in oil demand causes fluctuations in oil prices and becomes a barrier to growth in the perforation guns market.

Opportunity: Re-perforation of old wells

The re-perforation of oil wells is emerging as a significant growth opportunity for the perforation gun market, driven by the need to enhance well productivity, extend reservoir life, and maximize recovery from mature fields. Re-perforation involves deploying perforation guns to create new perforations or improve existing ones in underperforming zones, allowing for better fluid flow and increased hydrocarbon extraction. Several factors are driving the demand for re-perforation: Mature fields contain significant untapped reserves trapped behind damaged or inefficiently perforated zones. Over time, formation damage, scale buildup, and reservoir pressure decline can reduce well performance. Compared to drilling new wells, re-perforation is a lower-cost alternative, making it an attractive option for operators looking to maximize returns on existing assets. Additionally, advancements in perforation gun technology, such as high-precision shaped charges, oriented perforation techniques, and real-time monitoring systems, enable more effective and efficient re-perforation, further encouraging its adoption.

Challenge: Safety risks associated with handling, transporting, and deploying explosive charges in oil & gas wells

The growth of the perforation gun market faces significant challenges due to safety risks associated with handling, transporting, and deploying explosive charges in oil and gas wells. One of the primary safety concerns is the risk of accidental detonation during transportation, storage, or handling. Perforation guns contain sensitive detonators and explosive charges. Another major safety risk arises during wellsite deployment, where misfires, unexpected detonations, or pressure-related failures can lead to injuries, equipment damage, and costly well downtime. High-pressure environments, corrosive well fluids, and extreme temperatures further increase the likelihood of gun failures, premature detonations, or incomplete perforation sequences, posing operational and financial risks. Moreover, stringent regulations such as the International Air Transport Association (IATA) and US Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) guidelines impose strict controls on explosives, making logistics and supply chain management more complex. Gun string malfunctions or detonation failures may also require fishing operations to remove stuck tools, adding to operational delays and well intervention costs. These factors contribute to increasing costs and complexity, making it challenging to expand the efficient use of perforation guns.

Perforating Gun Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Improved refrac performance with reliable custom perforating gun solution | GR Energy Services partnered with Wellmatics to develop a custom perforating gun system addressing operational challenges. Wellmatics created a solution that removed wiring complexity, reduced human error, and minimized misfires, thereby improving perforation reliability. This helped GR Energy Services perform refrac operations more consistently and quickly. The partnership highlights Wellmatics’ dedication to solving client challenges while maintaining quality and delivery, boosting efficiency and field productivity. |

|

Optimized oriented perforation deployment in Argentina’s unconventional well operations | Expro’s Argentina team introduced a gravity-assisted, self-orienting gun system using roller-bearing loading tubes and scalloped gun carriers to achieve reliable 0° orientation. This innovative system was validated in two test wells, where a Multi-finger Imaging Tool (MIT) conveyed by tractor confirmed that 18 out of 20 guns fired between 330° and 30°, meeting the operator’s acceptance range. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The perforating gun market ecosystem analysis shows the interconnections/adjacencies that affect the perforating gun market by showcasing MnM coverage of the market under study. The section highlights the key industries and applications impacting the market under study. The growing perforating gun market is supported by a strong ecosystem of service providers, equipment manufacturers, and technology innovators. Operators benefit from integrated solutions, including advanced shaped charges, digital well planning, and reliable logistics. This collaborative ecosystem ensures faster deployments, higher efficiency, and reduced downtime. Major perforating gun manufacturers are SLB (US), Weatherford (US), Baker Hughes Company (US), Halliburton (US), and NOV (US).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Perforating Gun Market, By Well Type

Despite higher drilling and operational costs compared to vertical wells, horizontal wells are favored for their superior efficiency in boosting oil field production and accessing subsurface reservoirs that are otherwise difficult to reach. According to the Energy Information Administration (EIA) 2024, horizontal wells accounted for approximately 15% of US crude oil production in tight oil formations in 2004, rising to 98% by the end of 2023. Similarly, horizontal wells contributed about 14% of US natural gas production in shale formations in 2004, increasing to 99% by 2023. Schlumberger, a key player in the perforating gun market, reports that around 85% of wells drilled for oil production in the Middle East in 2024 are horizontal. Benefits such as enhanced production rates due to extended wellbore lengths, reduced pressure drops near the wellbore, decreased need for future remedial work, and lower fluid velocities around the wellbore are driving the surge in horizontal well drilling. This trend is expected to further increase the demand for perforating guns.

Perforating Gun Market, By Depth

Wells with depths ranging from 3,001 to 8,000 feet are dominating the market, primarily drilled to extract unconventional oil and gas resources, including shale, tight, and tight gas. North America, particularly the US, is a major hub for the exploration and production of these resources. The Asia Pacific region also holds significant untapped potential in unconventional oil and gas reserves. As a result, the rising upstream activities in this space are projected to create substantial growth opportunities for the perforating gun market within the 3,001–8,000 ft. segment during the forecast period. Perforation operations at these depths require advanced technologies, such as pressure-sensitive perforating guns. Ongoing technological innovations aimed at improving the operational efficiency of these tools are also anticipated to contribute to the market’s growth.

REGION

North America to be the largest market of Perforating gun market

North America accounted for the largest share of the global perforating gun market in 2024. The perforating gun market in North America, segmented into the US, Canada, and Mexico, is primarily driven by the expansion of horizontal drilling for unconventional resources, such as shale gas and tight oil. The ongoing redevelopment of mature brownfield projects also supports market growth. According to the BP Statistical Review of World Energy, technological innovations have driven North American gas production from 1,109.9 billion cubic meters in 2020 to an estimated 1,189.0 billion cubic meters in 2023, and oil production from over 1,060.0 million tons in 2020 to approximately 1,200.0 million tons in 2023. As a leading oil exporter, North America accounted for about 18.5% of the global oil trade in 2023, driven by demand for West Texas Intermediate (WTI) sweet crude oil in key markets such as Europe, China, India, Japan, and other Asia-Pacific countries, which are major consumers of crude oil and refined petrochemicals.

Perforating Gun Market: COMPANY EVALUATION MATRIX

In the perforating gun market matrix, SLB leads with a strong market presence and a wide product portfolio. SLB focuses on agreements to further expand its product offerings. This drives the perforating gun adoption across industries to provide integrated services across all its offshore fields.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.17 Billion |

| Market Forecast in 2030 (Value) | USD 1.48 Billion |

| Growth Rate | CAGR of 4.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, Asia Pacific, North America, South America, Middle East and Africa |

WHAT IS IN IT FOR YOU: Perforating Gun Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Perforating Gun Market by Competitors | • Competitor analysis of total 25 companies for Perforating Gun Market | • Provided few more companies for Perforating Gun Market |

RECENT DEVELOPMENTS

- December 2024 : SLB (US) signed a new agreement with Petrobras (Brazil) to provide integrated services across all its offshore fields in Brazil. Utilizing cutting-edge drilling, cementing, and drilling fluid technologies on up to nine ultra-deepwater rigs, SLB will oversee the development of over 100 deepwater wells.

- September 2024 : Weatherford (US) acquired Datagration Solutions Inc. (US), a machine learning, analytics, and unified data integration pioneer. Through the acquisition, Weatherford is now able to offer one of the most advanced and modern digital solutions for production and asset optimization in the oil and gas sector.

- September 2024 : GEODynamics (US) launched the EPIC Flex Orbit Perforating System, a self-orienting, customizable perforating solution designed to improve efficiency and accuracy in multistage plug-and-perf operations. The system enhances the EPIC Flex suite by allowing the integration of components from any OEM and enabling precise, gravity-based shot placement in various wellbore conditions.

- October 2024 : NOV (US) acquired Fortress Downhole Tools (US), strengthening its portfolio in downhole technology. This acquisition enhanced NOV's capabilities in well completion and intervention solutions, expanding its product offerings for oil & gas operators.

- May 2024 : Expro (US), a leading provider of energy services, completed its acquisition of Coretrax (Scotland), a technology leader in performance drilling tools and wellbore cleanup, well integrity, and production optimization solutions.

Table of Contents

Methodology

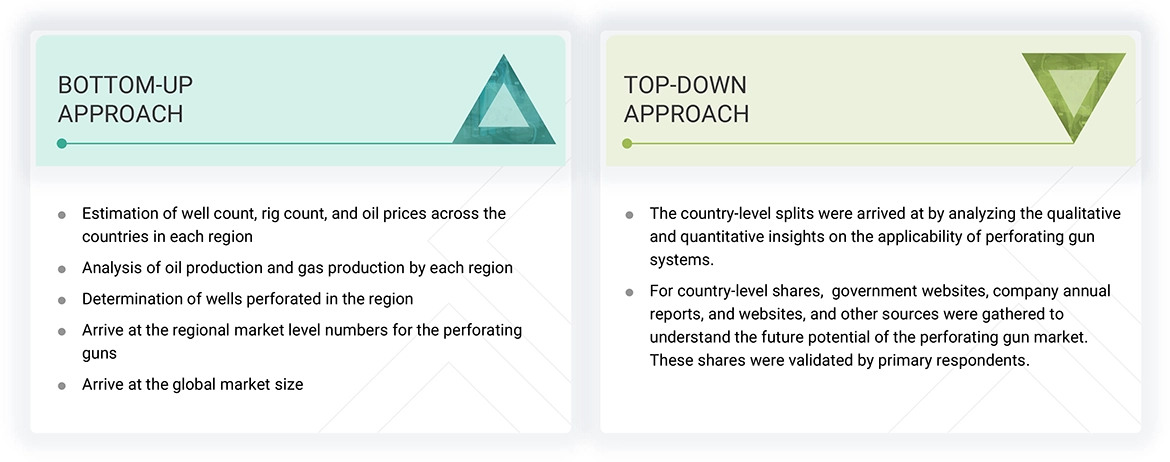

The study involved major activities in estimating the current size of the perforating gun market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the perforating gun market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, and water & environment journal, to identify and collect information useful for a technical, market-oriented, and commercial study of the global market. The other secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

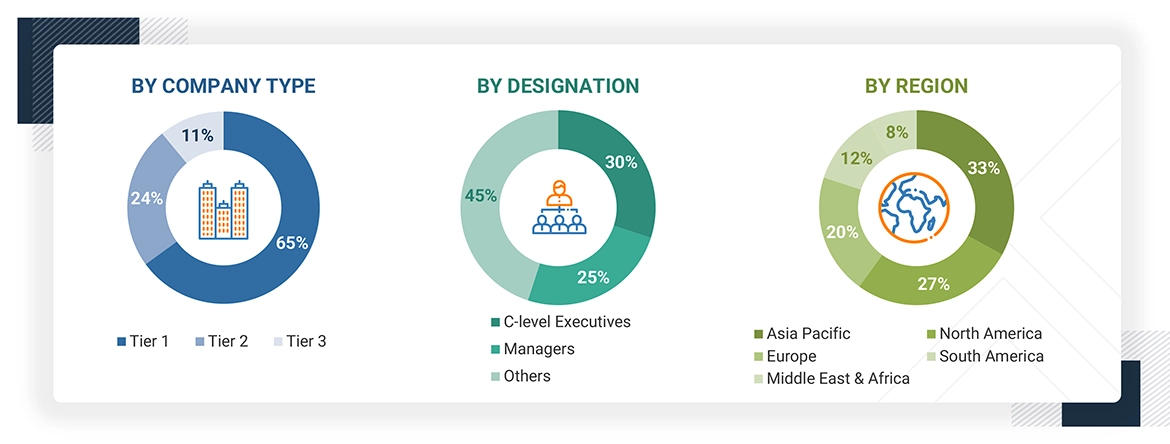

Primary Research

The perforating gun market comprises several stakeholders such as companies related to the industry, component manufacturing companies for perforating guns, government & research organizations, organizations, forums, alliances & associations, perforating gun providers, state & national energy authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by increased investment in the residential, commercial, and industrial sectors. The supply side is characterized by investments & expansion and partnerships & collaborations among big players. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the perforating gun market and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes studying top market players' annual and financial reports and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the market.

Perforating Gun Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A perforating gun is a device that is used for perforation operations in different sectors, especially the oil & gas industry. It is drilled into a well to get to the depth at which it can hook up with the reservoir and then stimulated to create fractures in the casing. These fractures function as conduits, allowing hydrocarbons from the reservoir to flow into the wellbore and rise to the surface. The main goal of a perforating gun is to facilitate a link between the cased wellbore and the reservoir.

The perforating gun market is defined as the sum of global companies' revenues from providing perforating guns and associated services.

Stakeholders

- Perforating gun providers

- Oilfield service companies

- Offshore and onshore rig manufacturers

- Oil and gas field operators

- National oil companies

- Consulting companies in oil & gas industry

- Oil & gas associations

- Government and research organizations

- State and national regulatory authorities

Report Objectives

- To define, describe, segment, and forecast the perforating gun market based on gun type, depth, pressure, well type, application, and region

- To define the market based on type, orientation, and explosives (qualitative)

- To forecast the market sizes for five major regions, namely, North America, Europe, Asia Pacific, South America, and Middle East & Africa, along with their key countries

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide the supply chain analysis, trends/disruptions impacting customers' businesses, market map, ecosystem analysis, regulations, patent analysis, case study analysis, technology analysis, Porter's five forces analysis, trump tariff impact, and regulatory analysis of the market

- To analyze opportunities for stakeholders in the perforating gun market and draw a competitive landscape of the market

- To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them

- To compare key market players for the market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments in the market, such as contracts & agreements, investments & expansions, mergers & acquisitions, product launches, partnerships, joint ventures & collaborations

Note: The core competencies of companies are captured in terms of their key developments and product portfolios, as well as key strategies adopted to sustain their position in the perforating gun market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the perforating gun market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Perforating Gun Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Perforating Gun Market