Pharmaceutical-Grade Sodium Chloride Market

Pharmaceutical-Grade Sodium Chloride Market by Grade (API-NaCl, HD-NaCl), Application (Injectables /Intravenous Solutions, Dialysis, Oral Rehydration Salts, Hemofiltration Solutions, Mechanical Cleansing Solutions), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The pharmaceutical-grade sodium chloride market is projected to reach USD 0.77 billion by 2030 from USD 0.59 billion in 2025, at a CAGR of 5.6% from 2025 to 2030. The growth of the pharmaceutical-grade sodium chloride market is driven by increasing demand for sterile IV and injection fluids, as well as infusion therapy, in hospitals and emergency care settings. The increasing prevalence of chronic kidney disease (CKD) and the fast-rising growth of hemodialysis and peritoneal dialysis therapies all contribute greatly to the consumption of high-purity sodium chloride. An increase in the number of cases of dehydration, gastrointestinal disorders, and the consumption of oral rehydration salts (ORS) in the developing regions also helps in the growth of the market

KEY TAKEAWAYS

- Asia Pacific led the global pharmaceutical-grade sodium chloride market, with a share of 66.3% in 2024

- By grade, the HD-NaCl segment is expected to register the highest CAGR of 5.9% during the forecast period (2025–2030) in terms of value.

- By application, the dialysis segment is projected to grow at the fastest rate from 2025 to 2030.

- The market is driven by strategic acquisitions, partnerships, and expansions from leading players such as K+S Aktiengesellschaft (Germany), Südwestdeutsche Salzwerke AG (Germany), Dominion Salt (New Zealand), Morton Salt, Inc. (US), Salinen Austria AG (Austria). These companies are focusing on geographic diversification, and long-term distribution agreements.

- HiTech Minerals and Chemicals Group, J J Chemicals, Macco Organiques, s.r.o., Nandu Chemicals, SALT Minerals GmbH, Tianjin Henghaixin International Trading Co., Ltd., and Markhor Salt Co., among others, have distinguished themselves among start-ups/SMEs.

New supply opportunities are being developed in Asia Pacific, South America, and the Middle East by investments in the healthcare infrastructure and an increase in pharmaceutical manufacturing capacities. Regular inspection of production based on GMO production and high purity level encourages the substitution of industrial-grade salts with pharmaceutical-grade ones. Processes of purification, like MVR and recrystallization, enhance the efficiency and quality of operations. Moreover, strategic alliances, localization of production to minimize dependency on imports, and enhancements to the reimbursement process contribute to the market's long-term growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The trends in the pharmaceutical-grade sodium chloride market include growing interest in injectable drugs, biologics, and dialysis therapy, as well as the increasing use of more sophisticated purification technologies, such as MVR and AI-enabled process control. The disruptions, such as global supply-chain limitations, regulatory restraints, and sustainability demands, are motivating manufacturers to localize production, electronic quality administration, and long-term strategic connections in order to deliver dependable and high-quality supply.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising dialysis treatments

-

Strong demand in North America & Europe

Level

-

Complex regulatory approvals

-

Dependence on a stable supply of raw salt

Level

-

Rising healthcare investment in developing regions

-

Partnerships with hospitals and pharmaceutical companies

Level

-

Audits and documentation burdens

-

Competition from local low-cost producers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising dialysis treatments

The rising demand for dialysis therapies is a major influence of aging populations, diabetes, hypertension, and lifestyle disorders that are leading to chronic kidney disease (CKD) in the world. Hemodialysis and peritoneal dialysis require the continuous and large-scale use of high-purity sodium chloride to formulate dialysate, making pharmaceutical-grade sodium chloride a vital consumable. Consumption demand is further accelerated by the rapid development of dialysis units, the increasing use of home-based dialysis, and improved reimbursement policies. Due to the increasing number of patients, emerging economies are investing substantial sums in dialysis infrastructure to cater to the growing demand, thereby enhancing annual growth. Consequently, dialysis is currently among the most rapidly expanding areas of application, which has led to a gradual long-term demand for pharmaceutical-grade sodium chloride.

Restraint: Complex regulatory approvals

Stringent pharmacopeial standards (USP, EP, BP, JP, and ChP) for the production of pharmaceutical-grade sodium chloride require strict control of purity, endotoxin levels, heavy metals, and microbial contamination. Manufacturers must have GMO-certified plants and pass through intensive documentation, validation, and regulatory audits to comply with expectations. The approval processes are time-consuming and expensive, making entry into the market prohibitively expensive for small-scale producers. Regulatory differences in different regions add to the complexity and slow down commercialization processes globally.

Opportunity: Rising healthcare investment in developing regions

Emerging economies, such as India, China, Brazil, and Southeast Asian countries, are rapidly increasing their capacity to provide healthcare and have made significant investments in hospitals, infusion therapies, biologics manufacturing, and dialysis networks. The rise of government finances and the creation of public-private collaborations are facilitating the development of new pharmaceutical formulations and sterile manufacturing plants that require access to high-purity sodium chloride. De-importation of pharmaceuticals manufacturing would be another solid business prospect for regional pharma-grade salt suppliers. The rise in demand for IV fluids, oral rehydration therapy, and dialysis solutions is projected to be high due to the increase in the number of patients and better insurance coverage. This presents significant revenue opportunities for manufacturers who can produce cost-efficient and high-quality sodium chloride through secure supply channels.

Challenge: Audits and documentation burdens

The manufacturers of pharmaceutical-grade sodium chloride are subject to a broad scope of documentation, compliance reporting, and product traceability requirements within regulatory, quality, and safety frameworks. Suppliers must maintain comprehensive batch documentation, including microbial contamination testing, stability information, and risk reduction records, to meet GMP and audit requirements. Repeated inspections by agencies such as the FDA, EMA, CDSCO, and SFDA increase the complexity and cost of operations. Workload and strain of resources are compounded by meeting various customer-specific audit requirements, particularly by injectable and biologics manufacturers. These issues may make production slower to scale and cause an administrative load, especially to small or new companies.

Pharmaceutical-Grade Sodium Chloride Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

ENASEL implemented a Mechanical Vapor Recompression (MVR) purification system to convert low-grade rock salt with high impurities into high-purity pharmaceutical-grade sodium chloride. The process involved cold leaching to remove magnesium, chemical precipitation to eliminate remaining impurities, controlled evaporation and crystallization to separate NaCl and CaSO4, and final centrifuge washing to achieve a purity of ~99.95%. The purge stream was further processed using the Schweizerhalle brine treatment system, allowing for on-demand switching between food-grade and pharmaceutical-grade salt production. | • Achieved pharmaceutical-grade purity (~99.95%) from low-quality rock salt feedstock • Enabled flexible, continuous production runs of 10,000–40,000 kg/h based on demand • Eliminated need for separate production facilities, reducing CAPEX and operating costs • Improved resource utilization and ensured consistent supply reliability for pharma applications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The pharmaceutical-grade sodium chloride business ecosystem is interdependent and includes raw salt suppliers, purification technology suppliers, pharmaceutical producers, CMOs/CDMOs, packers and logistics providers, regulatory authorities, hospitals, and dialysis facilities. Technology providers and pharmaceutical manufacturers should collaborate to stabilize the purity of GMOs and ensure the reliability of supply for vital medical uses.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pharmaceutical-grade Sodium Chloride Market, By Grade

The fastest-growing grade in the pharmaceutical-grade sodium chloride market is HD-NaCl, as demand is increasing due to the need to deliver IV fluids, dialysis solutions, and injectable formulations in large volumes, where very low levels of impurity are required to ensure patient safety. Rising worldwide incidences in cases of chronic kidney disease and dehydration-related ailments are fueling the intake of dialysis concentrates and infusion solutions that are majorly dependent on HD-NaCl.

Pharmaceutical-grade Sodium Chloride Market, By Application

The most rapidly growing pharmaceutical-grade sodium chloride market is dialysis, as the prevalence of chronic kidney disease (CKD) across the world accelerates because of aging populations, diabetes, and hypertension. Continuous demand is increasing with the expansion of dialysis centers and home dialysis programs, especially in emerging economies. The Government spending and reimbursement assistance in healthcare are also facilitating wider accessibility to dialysis therapy.

REGION

Asia Pacific to be the fastest-growing region in the global pharmaceutical-grade sodium chloride market during the forecast period

The Asia Pacific is the fastest-growing market in the pharmaceutical-grade sodium chloride market due to the high rate of growth in the pharmaceutical manufacturing industry, government spending on healthcare infrastructure, and the increasing production of injectables, IV fluids, and dialysis solutions. The increasing biologics and vaccine production capacity in countries such as China, India, and South Korea is increasing the demand for high-purity sodium chloride in formulation and production. Moreover, Asia Pacific has favorable regulatory reforms and competitive manufacturing costs that attract global pharma companies to set up production bases, which are increasing the growth of markets faster.

Pharmaceutical-Grade Sodium Chloride Market: COMPANY EVALUATION MATRIX

In the pharmaceutical-grade sodium chloride market matrix, K+S (Star) leads with an extensive global footprint and a strong portfolio of high-purity sodium chloride. Groupe Salins (Emerging Leader) is gaining visibility through strategic acquisitions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- K+S Aktiengesellschaft (Germany)

- Südwestdeutsche Salzwerke AG (Germany)

- Dominion Salt (New Zealand)

- Morton Salt, Inc. (US)

- Salinen Austria AG (Austria)

- Merck KGaA (Germany)

- Groupe Salins (France)

- Hub Salt (Pakistan)

- Jiangsu Province Qinfen Pharmaceutical Co., Ltd. (China)

- US Salt (US)

- Macco Organiques, s.r.o. (Czech Republic

- J J Chemicals (India)

- SALT Minerals GmbH (Germany)

- HiTech Minerals and Chemicals Group (India)

- RCI Labscan Group (Thailand)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.56 Billion |

| Market Size in 2030 (Value) | USD 0.77 Billion |

| Growth Rate | CAGR of 5.6% from 2025 to 2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Pharmaceutical-Grade Sodium Chloride Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Pharmaceutical-grade Sodium Chloride Market | Detailed company profiles of pharmaceutical-grade sodium chloride competitors (financials, product portfolio, production capacity) I Applications mapping (Injectables/Intravenous solutions, dialysis, oral rehydration salts, others) | Identified & profiled 20+ pharmaceutical-grade sodium chloride producers across APAC I Mapped demand trends across high-growth segments (Injectables/Intravenous solutions, dialysis, oral rehydration salts, others) |

RECENT DEVELOPMENTS

- December 2024 : Brenntag announced a strategic global partnership with K+S Minerals and Agriculture GmbH, an internationally positioned raw materials producer, for the worldwide distribution of three pharmaceutical-grade salts.

- October 2021 : French-based Groupe Salins, one of Europe’s leading salt producers, acquired Mariager Salt Specialties, thereby strengthening its portfolio with high-grade pharmaceutical salt capabilities and giving Mariager the advantage of a parent company fully dedicated to salt production.

- June 2021 : K+S announced that its high-purity pharmaceutical-grade sodium chloride is being used as the diluent and transportation medium for the COMIRNATY vaccine by BioNTech SE / Pfizer Inc.

Table of Contents

Methodology

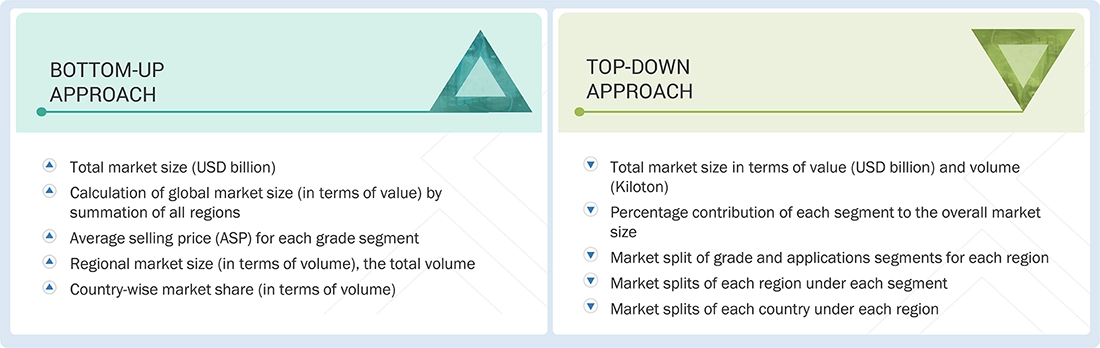

The study involved four major activities to estimate the current size of the global pharmaceutical-grade sodium chloride market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of pharmaceutical-grade sodium chloride through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the pharmaceutical grade sodium chloride market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments of the market.

Secondary Research

The market for companies offering pharmaceutical-grade sodium chloride was determined by analyzing secondary data from paid and unpaid sources, examining the product portfolios of major companies in the ecosystem, and evaluating companies based on their performance and quality. For this study, various secondary sources, such as Business Standard, Bloomberg, the World Bank, and Factiva, were referred to identify and collect information on the pharmaceutical-grade sodium chloride market. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of pharmaceutical-grade sodium chloride vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

During the primary research process, various primary sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the pharmaceutical-grade sodium chloride market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of pharmaceutical-grade sodium chloride offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

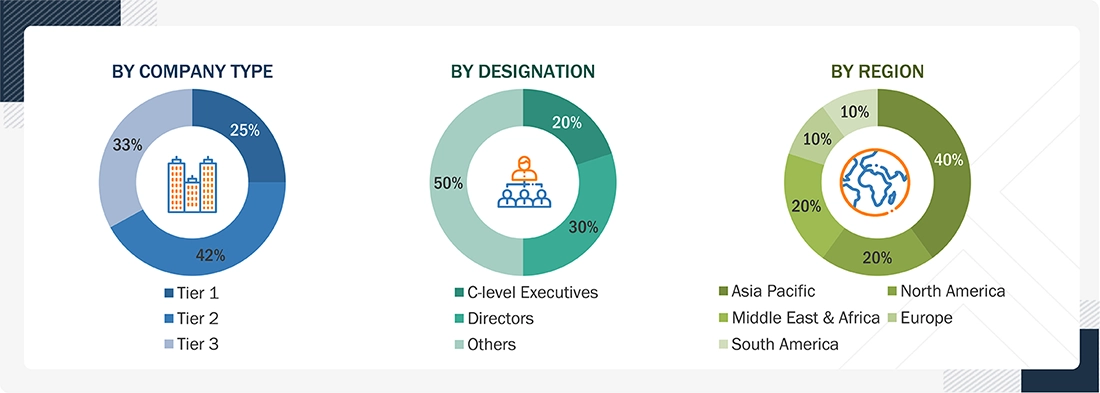

The following is the breakdown of primary respondents:

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global pharmaceutical-grade sodium chloride market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

Pharmaceutical-grade sodium chloride refers to a highly purified form of NaCl (sodium chloride) manufactured under strict GMP conditions and compliant with major pharmacopoeia standards such as BP (British Pharmacopoeia), EP (European Pharmacopoeia), and USP (United States Pharmacopeia). Unlike common salt, this grade is designed for direct medical use in products that enter the body, including injectable and intravenous solutions, dialysis fluids, oral rehydration formulas, hemofiltration solutions, and various cleansing or therapeutic preparations. The market for pharmaceutical sodium chloride is segmented by product form (solid and liquid), grade (such as API-NaCl and HD-NaCl), and application sectors across various regions, including North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Chemically, pharmaceutical-grade sodium chloride consists of sodium and chloride ions arranged in a cubic lattice, delivering consistent density, dissolution behavior, and stability essential for medical formulations. Its assay typically exceeds 99.5%, with extremely low levels of impurities and insoluble matter, making it safe for long-term therapeutic use. This level of quality is ensured through rigorous testing, batch certification, and controlled production environments that prevent cross-contamination. The substance’s reliable performance, predictable solubility, and high purity make it indispensable for hospitals, pharmaceutical manufacturers, dialysis centers, and biotech facilities worldwide.

Stakeholders

- Raw Material & Salt Producers

- Pharmaceutical-grade Sodium Chloride Manufacturers

- Pharmaceutical & Biopharmaceutical Companies

- Healthcare Providers & Institutions

- Regulatory & Quality Authorities

- Distribution & Supply Chain Partners

- Packaging & Material Suppliers

- Technology & Equipment Providers

- Research & Development Organizations

- Investors & Financial Institutions

- End-Users

Report Objectives

- To define, describe, and forecast the size of the global pharmaceutical-grade sodium chloride market, by grade and application, in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To forecast the market size of segments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their respective countries

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as expansions, acquisitions, and partnerships in the pharmaceutical-grade sodium chloride market

- To provide the impact of AI/Gen AI on the market

- To provide the macroeconomic outlook for each region covered under the study, and the impact of the 2025 US tariff on the market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pharmaceutical-Grade Sodium Chloride Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pharmaceutical-Grade Sodium Chloride Market