Power Conditioning Unit Market

Power Conditioning Unit Market by Type (Active, Passive), Phase (Single, Three), End User (Industrial & Manufacturing, Commercial, Utilities, Transportation, Residential, Healthcare), Power Rating, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global power conditioning unit market is projected to reach USD 8.02 billion by 2030 from USD 6.18 billion in 2025, registering a CAGR of 5.3%. The power conditioning unit market is on a steady growth trajectory, driven by the rising demand for reliable, high-quality power across industrial, commercial, and residential sectors. The increasing integration of renewable energy sources, such as solar and wind, has heightened the need for efficient power management and voltage stabilization systems. Supportive government policies promoting grid modernization and energy efficiency are further enabling market expansion. Technological advancements in voltage regulation, harmonic filtering, and active power correction are improving the performance and lifespan of electrical equipment, reducing operational costs. Collaborations between equipment manufacturers, utilities, and infrastructure developers are fostering large-scale deployment of advanced PCUs across smart grids, data centers, and renewable energy projects.

KEY TAKEAWAYS

-

BY TYPEBy type, the power conditioning unit market is segmented into active and passive power conditioners, both playing vital roles in ensuring power quality and stability across various applications. Active power conditioners dominate the market owing to their advanced ability to correct power factors, suppress harmonics, and maintain voltage stability in real time.

-

BY PHASEBy phase, the power conditioning unit market is categorized into single-phase and three-phase, each serving distinct power demand requirements across end-use sectors. Three-phase power conditioners account for the larger market share due to their widespread use in industrial, commercial, and utility applications where high-power capacity and efficiency are critical.

-

BY POWER RATINGBy power rating, the power conditioning unit market is segmented into ≤10 kVA, >10–50 kVA, 50–150 kVA, and >150 kVA categories, each catering to different load capacities and application needs. The ≤10 kVA segment is primarily driven by residential and small commercial applications where compact and cost-effective systems are required to protect sensitive electronic equipment. The 10–50 kVA and 50–150 kVA segments find extensive use in mid-sized industries, commercial facilities, and institutional buildings that demand stable voltage and protection from power disturbances. Among all, the >150 kVA segment is projected to record the highest CAGR, supported by rapid industrial expansion, data center development, and renewable energy integration projects requiring high-capacity solutions.

-

BY END USERBy end user, the power conditioning unit market is segmented into industrial & manufacturing, commercial, utilities, transportation, residential, and healthcare. The industrial & manufacturing sector leads the market due to its high-power reliability requirements for automation and machinery. The commercial segment follows, driven by data centers and IT infrastructure growth. Utilities use power conditioners to enhance grid stability, while transportation benefits from growing EV and railway electrification. The residential segment sees rising demand for voltage protection, and Healthcare relies on continuous power for critical medical equipment.

-

BY REGIONAsia Pacific dominated the power conditioning unit market in 2024, driven by rapid industrialization, expansion of manufacturing facilities, and growing demand for reliable power in countries such as China, India, Japan, and South Korea. The region’s focus on renewable energy integration, smart grid development, and digital infrastructure continues to fuel strong market growth.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and agreements. ABB, Eaton, AMETEK Inc., and Schneider Electric have entered into a number of agreements and partnerships to cater to the growing demand for the power conditioning unit market.

The power conditioning unit market is driven by rising demand for stable and high-quality power across industrial, commercial, and residential sectors. Growing industrial automation, renewable energy integration, and data center expansion are key growth drivers. Governments and industries are focusing on improving power reliability and efficiency, further boosting the adoption of advanced power conditioning solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the power conditioning market arises from evolving customer trends and technological disruptions. End users such as data centers, industrial facilities, utilities, and commercial buildings represent the primary clients of power conditioning equipment manufacturers. Changes in energy consumption patterns, grid modernization, and the growing integration of sensitive electronic devices are key shifts influencing this market. These trends directly affect the revenues of end users, as improved power quality reduces downtime and maintenance costs. Increased demand for reliable and efficient electrical performance drives the revenues of solution providers and system integrators, which ultimately impacts the overall revenue growth of power conditioning equipment manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising adoption of renewable and distributed energy growth

-

Burgeoning semiconductor industry

Level

-

Integration challenges with existing infrastructure

-

Competition from alternative solutions

Level

-

Rising data center demand and IoT growth

-

Increasing demand for clean and stable power in critical infrastructure such as healthcare, IT, and defense

Level

-

High costs of power conditioners may limit adoption among small and medium-sized businesses

-

Compliance and regulatory standards Influence market adoption

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of renewable and distributed energy growth

The rapid expansion of renewable power generation is creating significant demand for power conditioning solutions. According to the International Energy Agency, global renewable electricity generation is projected to exceed 17,000 TWh by 2030, representing nearly a 90% increase from 2023 and enough to meet the combined demand of China and the US. By 2025, renewables are expected to surpass coal as the largest source of electricity generation, while both wind and solar are set to overtake nuclear energy by 2026. China remains the global leader, adding nearly 350 GW of capacity in 2023 alone, while the European Union doubled its renewable additions from pre-crisis levels, supported by policies such as the REPowerEU Plan and the Green Deal Industrial Plan. This surge underscores the need for efficient power conditioning solutions to maintain grid stability, ensure a high-quality electricity supply, and integrate variable renewable energy effectively. Government support further reinforces this trend, highlighting the strategic importance of power conditioning in modern energy systems.

Restraint: Integration challenges with old existing infrastructure

The global shift toward modern and efficient power infrastructure is being slowed by the limitations of aging grid systems. Much of the existing electrical infrastructure was originally designed for one-way power flow and stable load conditions, making it ill-suited for the advanced control and responsiveness required by modern power conditioning technologies. Nearly 70% of global transmission lines and transformers are more than 25 years old, operating close to or beyond their intended service lifespans. These outdated assets struggle to support functions such as voltage regulation, harmonic filtering, and reactive power management without major upgrades. Additionally, legacy systems often rely on non-standard or proprietary communication protocols, creating interoperability issues that complicate integration with newer conditioning technologies. The growing disconnect between renewable energy expansion and grid readiness further highlights the integration challenge. At least 3,000 gigawatts (GW) of renewable power projects, of which 1,500 GW are in advanced stages, are currently waiting in grid connection queues, equivalent to five times the amount of solar PV and wind capacity added in 2022.

Opportunity: Rising data center demand and IoT growth drive the need for reliable, high-availability power conditioning systems

The rapid growth of data centers worldwide is reshaping global electricity demand and placing unprecedented emphasis on power reliability. Data centers today consume around 415 terawatt hours (TWh) of electricity, approximately 1.5% of global electricity consumption, and this figure has grown at an annual rate of 12% over the past five years. The surge is largely attributed to the expansion of accelerated servers, driven by AI applications, which are projected to grow by 30% annually, compared to 9% for conventional servers. With the US, China, and Europe leading data center power usage and emerging regions ramping up capacity, maintaining stable and high-quality power has become a critical operational requirement. This rising electricity intensity underscores the growing necessity for advanced power conditioning systems that can safeguard critical infrastructure, mitigate harmonics, and ensure seamless power delivery in high-load digital environments.

Challenge: High costs of power conditioners may limit adoption among SME businesses

Ensuring stable and high-quality power is increasingly important for businesses across industries to maintain operational efficiency and protect sensitive equipment. Power conditioners offer critical functions such as voltage regulation, harmonic filtering, and protection against surges and transients. However, the adoption of these systems often involves significant upfront investment, which can be a considerable barrier for smaller enterprises with limited budgets. For small and medium-sized enterprises (SMEs), the high cost of purchasing, installing, and maintaining power conditioners presents a notable barrier to adoption. Unlike large corporations that can absorb such investments within broader operational budgets, SMEs often operate with constrained financial resources and must prioritize spending across multiple critical areas, from equipment upgrades to workforce development. The expenses associated with integrating power conditioners, including installation, calibration, and ongoing maintenance, can be perceived as disproportionately high relative to immediate business returns, even when the long-term benefits of improved power reliability and equipment protection are considered. Additionally, many SMEs lack in-house technical expertise to manage complex power conditioning systems, making reliance on external support both necessary and costly.

Power Conditioning Unit Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A solar power plant struggled to maintain grid stability due to fluctuating energy inputs, especially during peak sunlight hours, when overvoltage conditions disrupted power quality | Stabilized grid input, enhanced solar utilization, and reduced dependence on non-renewable sources, leading to higher efficiency, improved grid compliance, and a stronger contribution to sustainable energy goals |

|

A leading manufacturing facility operating heavy-duty machinery faced frequent voltage fluctuations and transients, disrupting production lines and inflating maintenance costs | Post-installation, the plant achieved smoother operations with reduced machine downtime, lower defect rates, and enhanced production efficiency driven by a stable and clean power supply |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Ecosystem mapping for the power conditioning market involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, component manufacturers, OEMs, service providers, and end users. This mapping outlines the flow of materials, technology, and value within the ecosystem, highlighting key linkages and dependencies. Raw material suppliers provide essential inputs such as semiconductors, capacitors, metals, and batteries, while component manufacturers produce modules and control systems for OEMs. OEMs such as Schneider Electric, ABB, Eaton, Vertiv, and Delta Electronics deliver complete power conditioning systems to end users. Service providers ensure installation and maintenance, while distributors facilitate product delivery to sectors such as data centers, utilities, industrial facilities, healthcare, and transportation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Power Conditioning Unit Market, by Phase

By phase, the three-phase segment dominated the power conditioning unit market in 2024, driven by its widespread use in industrial, commercial, and utility applications requiring high power capacity and efficiency. Three-phase systems offer superior load balancing, reduced power losses, and improved voltage stability, making them ideal for heavy machinery, data centers, and manufacturing plants. The growing integration of renewable energy sources and expansion of large-scale infrastructure projects further support the adoption of three-phase power conditioners. Additionally, advancements in digital control and monitoring technologies are enhancing the performance and reliability of three-phase systems, solidifying their dominance in the global market.

Power Conditioning Unit Market, by Type

By type, the passive power conditioner segment dominated the power conditioning unit market in 2024, owing to its simple design, high reliability, and cost-effectiveness. These systems are widely used across residential, commercial, and light industrial applications to provide basic voltage regulation, noise filtering, and surge protection. Their low maintenance requirements and long operational life make them a preferred choice in cost-sensitive markets, particularly in developing regions. Additionally, the growing use of electronic devices and small-scale renewable installations has further boosted demand for passive power conditioners, reinforcing their strong market position.

Power Conditioning Unit Market, by Power Rating

By power rating, the >150 kVA segment dominated the power conditioning unit market in 2024, driven by increasing demand from large-scale industrial facilities, utilities, and data centers requiring high-capacity systems to ensure stable and uninterrupted power supply. The rapid growth of manufacturing, renewable energy projects, and smart grid infrastructure has further accelerated adoption of these high-power units. Additionally, their ability to handle heavy electrical loads and provide superior voltage stability makes them essential for mission-critical operations, solidifying the >150 kVA segment’s leading position in the global market.

Power Conditioning Unit Market, by End User

By end user, the industrial and manufacturing segment dominated the power conditioning unit market in 2024, driven by the growing need for stable and uninterrupted power to support automation, robotics, and precision machinery. Power fluctuations can cause significant downtime and equipment damage, prompting industries to adopt advanced conditioning systems for improved reliability and efficiency. The rapid expansion of sectors such as automotive, electronics, and metal processing further fuels demand, especially in emerging economies. Continuous modernization of manufacturing facilities and increasing focus on energy efficiency are expected to sustain this segment’s dominance in the market.

REGION

Asia Pacific is estimated to witness the highest CAGR in global power conditioning unit market during forecast period

Asia Pacific accounted for the largest share of the global power conditioning unit market in 2024, driven by rapid industrialization, expanding manufacturing bases, and growing investments in renewable energy and infrastructure development. Countries such as China, India, Japan, and South Korea witness rising demand for reliable power solutions to support industrial automation, data centers, and commercial facilities. Supportive government initiatives promoting energy efficiency and grid modernization are further accelerating market growth. The increasing penetration of smart grids and distributed energy systems is enhancing the adoption of advanced power conditioning technologies. The presence of key regional manufacturers offering cost-effective solutions continues to strengthen the region’s market position. Advancements in digital technologies, renewable integration, and energy-efficient designs are reshaping product development and adoption trends. As power quality becomes increasingly critical in modern infrastructure, the market is expected to witness sustained expansion across both developed and emerging economies.

Power Conditioning Unit Market: COMPANY EVALUATION MATRIX

Eaton (Star) leads the power conditioning unit market with a broad portfolio ranging from 0.5 kVA to 500 kVA, catering to industrial, commercial, and data center applications. Its leadership stems from advanced power management technologies, high reliability, and modular designs that ensure stable and efficient power delivery. Eaton’s strong global presence and focus on intelligent, energy-efficient solutions strengthen its dominance in maintaining power quality and operational continuity. Rockwell Automation (Emerging Leader) is rapidly growing in this market by leveraging its automation expertise, smart power technologies, and digital integration capabilities, positioning itself as a key innovator driving industrial power efficiency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 5.89 Billion |

| Market Forecast, 2030 (Value) | USD 8.02 Billion |

| Growth Rate | CAGR of 5.3% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, South America |

WHAT IS IN IT FOR YOU: Power Conditioning Unit Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America Power conditioning unit market assessment |

|

|

RECENT DEVELOPMENTS

- July 2025 : Eaton announced the acquisition of Resilient Power Systems Inc., a US-based company specializing in advanced medium-voltage power conversion and solid-state transformer technologies. Through this acquisition, Eaton strengthened its position in the power management and conditioning market, gaining access to Resilient’s innovative solutions designed to enhance efficiency, reliability, and control in applications such as EV charging infrastructure, battery energy storage systems, data centers, and grid modernization. The acquisition aligned with Eaton’s strategy to expand its intelligent power portfolio and support the growing demand for resilient and sustainable electrical systems worldwide.

- May 2025 : ABB Canada and Powrmatic Canada Ltd. signed a regional distribution agreement focused on expanding ABB’s electrification and electrical distribution portfolio across Eastern Canada. While the collaboration primarily targets the distribution of switchboards, panelboards, and safety switches, it indirectly strengthens ABB’s market presence in the power conditioning and power quality segment by broadening access to its voltage regulation, surge protection, and energy management solutions. Through Powrmatic’s extensive contractor network and strong local presence, ABB could deliver more comprehensive electrical infrastructure offerings, integrating both distribution and conditioning technologies, to residential, commercial, and industrial customers across Canada.

- October 2024 : Mitsubishi Electric Power Products, Inc. has acquired Computer Protection Technology, a California-based service provider specializing in critical power and UPS solutions. The move would strengthen MEPPI’s service capabilities across North America by integrating CPT’s regional customer network in Southern California and Nevada with MEPPI’s extensive product portfolio in the critical-power market.

- November 2023 : Schneider Electric and Compass Datacenters expanded their existing partnership by entering into a USD 3 billion, multi-year agreement, under which Schneider would supply modular, prefabricated data-center infrastructure to Compass, leveraging integrated supply chains to deliver finished goods more rapidly, reliably, and cost-effectively.

- August 2021 : Delta Electronics, Inc. signed its first Power Purchase Agreement (PPA) with TCC Green Energy Corporation to procure approximately 19 million kWh of renewable electricity annually. This initiative supported Delta’s RE100 target of sourcing 100 % renewable energy by 2030 and achieving carbon neutrality by 2050. The agreement not only enhanced Delta’s sustainability goals but also strengthened its position in the power-conditioning and energy-management markets by integrating renewable energy sources into its manufacturing operations and improving power-quality performance across its facilities.

Table of Contents

Methodology

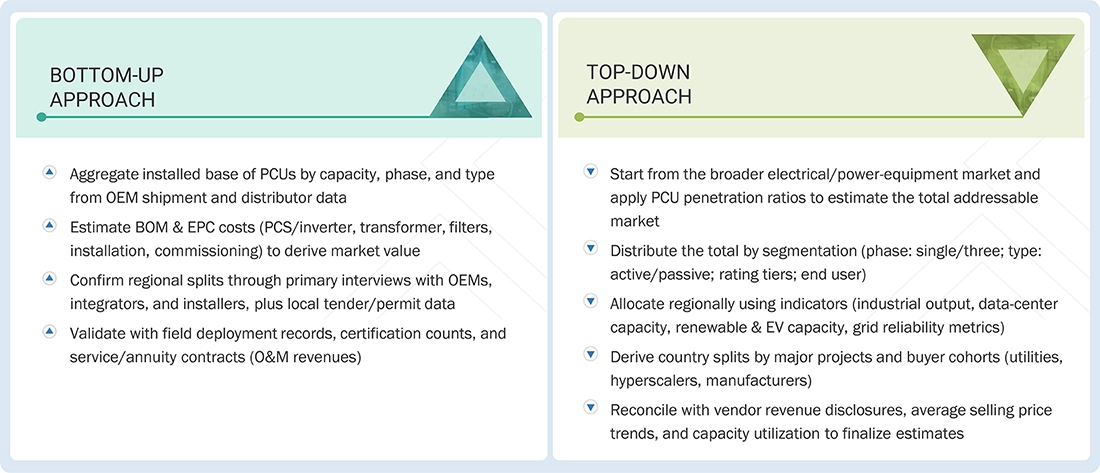

The study involved major activities in estimating the current size of the power conditioning unit market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation techniques were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the power conditioning unit market involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify valuable information for a technical, market-oriented, and commercial study of the power conditioning unit market. The other secondary sources included annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors, manufacturer associations, trade directories, and databases.

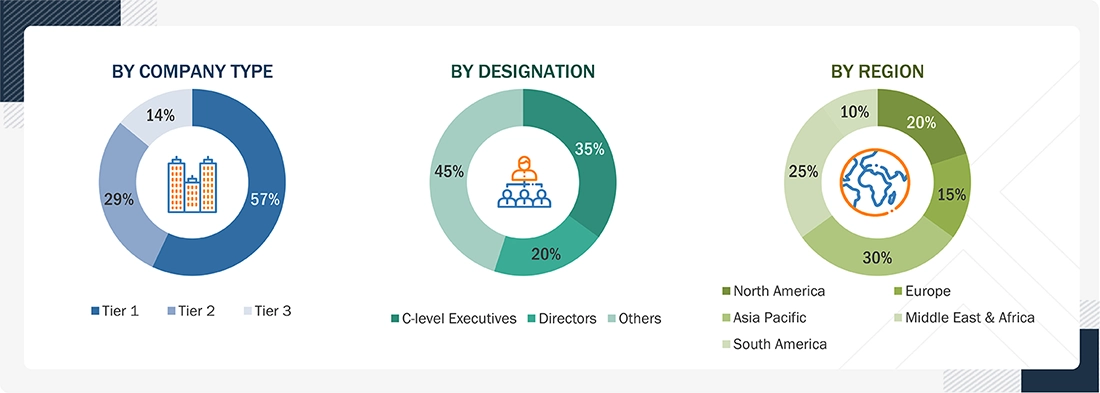

Primary Research

The power conditioning market comprises several stakeholders, such as raw material providers, component manufacturers, power conditioners, integrators, and end users in the supply chain. The rising demand for stable electricity in healthcare and many end users characterizes the demand side of this market. The supply side is characterized by prominent players’ increasing focus on securing contracts from industrial players. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

Note: The tiers of the companies are defined based on their total revenues as of 2024; Tier 1: > USD 1 billion, Tier 2: Between USD 500 million and USD 1 billion, and Tier 3: < USD 500 million. Others include sales managers, engineers, and regional managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the power conditioning unit market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following.

Power Conditioning Unit Market : Top-Down and Bottom-Up Approach

Data Triangulation

The total market was split into several segments and subsegments after arriving at the overall market size from the above estimation process. The data triangulation process was employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Power conditioning systems are essential technologies that manage and improve the quality, reliability, and efficiency of electrical power supplied to end-users. These systems regulate voltage, correct power factors, filter harmonics, and protect sensitive equipment from disturbances such as surges, sags, and transients. Power conditioning is increasingly critical in modern power infrastructure due to the growing integration of renewable energy sources, distributed generation, and the rapid expansion of data centers and industrial automation. By ensuring stable and high-quality power, power conditioners enhance equipment lifespan, reduce operational downtime, and improve overall energy efficiency. Compared to conventional power distribution methods, advanced power conditioning solutions offer advantages such as enhanced reliability, scalability for grid-level and industrial applications, and the ability to integrate seamlessly with smart grid technologies. The power conditioning unit market has been studied for the five key regions: North America, Europe, the Middle East & Africa, South America, and Asia Pacific.

Stakeholders

- Power conditioning equipment manufacturers

- Component suppliers

- System integrators and installers

- Original equipment manufacturers (OEMs)

- Renewable energy plant developers

- Utility companies and grid operators

- Commercial and industrial end users

- Data center operators

- Building management and facility maintenance firms

- Government and regulatory bodies

- Testing, inspection, and certification (TIC) providers

- Research & development institutes

- Energy management solution providers

Report Objectives

- To define, describe, segment, and forecast the power conditioning unit market size, by Type, Phase, power rating, end user, and region, in terms of value and volume

- To forecast the market size across five key regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America, in terms of value and volume

- To provide detailed information about the key drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the power conditioning unit market

- To provide the supply chain analysis, trends/disruptions impacting customer business, ecosystem analysis, regulatory landscape, patent analysis, case study analysis, technology analysis, key conferences & events, the impact of AI/Gen AI, pricing analysis, Porter’s five forces analysis, regulatory analysis, and the impact of the 2025 US tariff on the power conditioning unit generation market

- To strategically analyze the micromarkets with respect to individual growth trends, upcoming expansions, and their contributions to the overall market

- To analyze opportunities for stakeholders in the power conditioning unit market and draw a competitive landscape for market players

- To benchmark players within the market using the company evaluation quadrant, which analyzes market players on various parameters within the broad categories of business and product strategies

- To compare key market players with respect to the market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market ranking and core competencies.

- To track and analyze competitive developments in the power conditioning unit market, including contracts, agreements, investments, partnerships, acquisitions, expansions, and collaborations

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies using the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the power conditioning unit market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Power Conditioning Unit Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Power Conditioning Unit Market