Precision Fermentation Ingredients Market

Precision Fermentation Ingredients Market by Ingredient (Whey & Casein Protein, Egg White, Collagen Protein, Heme Protein), Microbe (Yeast, Algae, Fungi, Bacteria), End User, Food & Beverage Application, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global precision fermentation ingredients market is projected to expand from USD 5.02 billion in 2025 to reach USD 36.31 billion by 2030, at a CAGR of 48.6% during the forecast period. The precision fermentation ingredients market is witnessing strong growth as biotechnology enables the production of high-value proteins, enzymes, and fats without animal sources. This innovation supports sustainability, scalability, and clean-label demand across food, beverage, and cosmetic sectors. Increasing R&D investments and partnerships are further propelling commercialization and market expansion.

KEY TAKEAWAYS

-

BY INGREDIENT TYPEThe precision fermentation ingredients market includes whey & casein, egg white, collagen, heme proteins, enzymes, vitamins, and specialty ingredients. Proteins serve as animal-free alternatives, heme provides meat-like flavor, enzymes aid processing, and vitamins and bioactives support functional and specialty applications across food, beverages, and pharmaceuticals.

-

BY MICROBE TYPEMicrobes include yeast, fungi, bacteria, and algae. Yeasts are single-celled fungi used in fermentation, reproducing by budding or spores. Other fungi are mostly multicellular decomposers, some producing antibiotics. Bacteria are single-celled prokaryotes, diverse in shape and function, ranging from beneficial gut microbes to pathogens. Algae are photosynthetic microorganisms, unicellular or multicellular, contributing to oxygen production and used in biofuels, food supplements, and wastewater treatment.

-

BY END USEThe end-use segment includes food & beverages, pharmaceuticals, cosmetics, and others. In food & beverages, products serve in processing, fortification, and functional ingredients. Pharmaceuticals use them in drugs, nutraceuticals, and therapeutic compounds. Cosmetics incorporate them for skincare, haircare, and personal care benefits.

-

BY FOOD & BEVERAGES APPLICATIONThe food & beverages application includes meat & seafood, dairy alternatives, egg alternatives, and other applications. Meat & seafood alternatives focus on plant-based or cultured products mimicking taste and texture. Dairy alternatives include plant-based milk, yogurt, and cheese substitutes. Egg alternatives are used in baking, cooking, and processed foods to replace conventional eggs. Other applications cover bakery, beverages, snacks, and functional foods incorporating protein, fortification, or specialty ingredients.

-

BY REGIONThe market is segmented regionally into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads with advanced technologies and strong R&D, while Europe emphasizes sustainability and health-conscious trends. Asia Pacific is the fastest-growing region due to urbanization and rising demand for processed and alternative products. Latin America grows with agriculture and food processing expansion, and the Middle East & Africa benefit from industrialization, infrastructure development, and increasing consumer awareness.

-

COMPETITIVE LANDSCAPEThe competitive landscape refers to the analysis of key players, their market positioning, strategies, and innovations within a market. It highlights major established companies, emerging players, and startups, focusing on product portfolios, collaborations, mergers & acquisitions, and regional presence. Companies often compete on technology, product quality, pricing, and distribution networks. Understanding this landscape helps identify market leaders, potential disruptors, and partnership opportunities, as well as assess the intensity of competition, barriers to entry, and growth strategies across different regions and end-use segments. Key players in the market include Perfect Day, Geltor, The Every Company, and Impossible Foods.

The precision fermentation ingredients market is expanding rapidly, driven by the demand for sustainable, animal-free, and clean-label proteins, enzymes, and fats. Using microorganisms like yeast and bacteria, companies produce high-quality, consistent, and functional ingredients for food, beverages, nutraceuticals, and cosmetics. Growth is fueled by technological advancements, strategic partnerships, and increasing R&D investments, enabling eco-friendly alternatives that reduce environmental impact while meeting rising consumer preference for ethical, healthy, and innovative products.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The market is being reshaped by trends and disruptions such as precision fermentation, plant-based alternatives, and bioengineered ingredients, transforming traditional production across food, beverages, and pharmaceuticals. Advances in automation, AI, and digitalization are improving efficiency and scalability, while regulatory focus on sustainability and clean labels drives innovation. These changes are creating new business models, enabling smaller players to compete, and accelerating product development. The impact is a shift toward sustainable, functional, and health-focused offerings that meet evolving consumer demands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing investments in precision fermentation

-

Increasing adoption of precision fermentation ingredients

Level

-

High production costs

-

Regulatory hurdles and approval processes

Level

-

Development of novel protein production systems

-

Reduction in production costs

Level

-

Regulatory challenges

-

Lack of scaling production

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing investments in precision fermentation

A key driver for the market is the increasing investment in precision fermentation. Venture capital, private equity, and corporate funding are fueling R&D in bioengineered proteins, enzymes, and alternative ingredients. These investments accelerate innovation, scale-up production, and reduce costs, enabling the commercialization of sustainable and functional products. Growing financial support also attracts startups and encourages collaborations, driving market growth and expanding the adoption of precision fermentation across food, beverages, and pharmaceutical applications.

Restraint: High production costs

A major restraint in the market is the high production cost of precision fermentation and related technologies. Scaling up bioengineered ingredients requires advanced equipment, controlled environments, and specialized raw materials, which increase operational expenses. These costs can limit adoption, especially for small and mid-sized companies, and make end products more expensive for consumers. As a result, price sensitivity and cost barriers can slow market growth despite growing demand for sustainable and alternative ingredients.

Opportunity: Development of novel protein production systems

A significant opportunity in the market lies in the development of novel protein production systems. Innovations in precision fermentation, synthetic biology, and cell-based technologies enable the creation of high-quality, sustainable proteins with improved functionality and reduced environmental impact. These systems can cater to growing demand for plant-based and alternative proteins in food, beverages, and pharmaceuticals. Companies investing in such technologies can differentiate their products, capture new market segments, and drive growth in a rapidly evolving and sustainability-focused industry.

Challenge: Regulatory challenges

A major challenge in the market is regulatory hurdles. Precision fermentation and novel protein products often face complex approval processes across different regions due to safety, labeling, and compliance requirements. Varying standards and slow regulatory timelines can delay product launches, increase costs, and create uncertainty for companies. Navigating these regulations requires significant expertise and investment, which can be particularly challenging for startups and smaller players, potentially limiting innovation and market expansion despite growing consumer demand.

precision fermentation market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Fermentation-based production of collagen and elastin for cosmetics and nutraceuticals | Enables sustainable dairy alternatives with identical functionality and taste as traditional dairy; reduces greenhouse gas emissions |

|

Production of animal-free dairy proteins such as whey and casein through precision fermentation | Optimizes crop quality, ensures balanced nutrition, and supports premium market pricing |

|

Development of egg proteins via yeast-based precision fermentation | Offers functional alternatives for bakery and beverage applications without animal inputs |

|

Use of precision fermentation to produce heme protein for plant-based meat | Replicates meat-like flavor and aroma, enhancing sensory appeal of plant-based products |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The precision fermentation ingredients market ecosystem comprises a network of stakeholders involved in the development, production, and commercialization of bioengineered ingredients. It includes ingredient producers such as established startups like Geltor and emerging players like Myco, equipment and technology providers supplying fermenters, bioreactors, and analytical tools, and raw material suppliers for microbial growth. R&D institutions drive innovation, while regulatory bodies set safety and compliance standards. Food, beverage, and pharmaceutical manufacturers act as end users, and investors and collaborators provide funding and strategic partnerships, collectively supporting market growth and adoption.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fertilizer Market, By Type

As of 2024, the precision fermentation ingredients market is segmented into whey & casein protein, egg white, collagen protein, heme protein, enzymes, vitamins & nutrients, and other specialty ingredients. Whey, casein, collagen, and egg white proteins serve as animal-free functional alternatives, while heme proteins provide meat-like flavors. Enzymes support food processing and industrial applications, and vitamins, nutrients, and other bioactive compounds cater to functional and specialty uses across food, beverages, and pharmaceuticals.

Fertilizer Market, By Microbes Type

As of 2024, the precision fermentation ingredients market is segmented by microbe type into yeast, fungi, bacteria, and algae. Yeast and fungi are primarily used for protein and enzyme production, while bacteria contribute to vitamins, amino acids, and probiotics. Algae provide bioactive compounds, pigments, and functional nutrients. Each microbe type offers unique functional properties and applications, enabling the production of sustainable, high-quality ingredients for food, beverages, pharmaceuticals, and other specialty industries.

Fertilizer Market, By End Use

As of 2024, the precision fermentation ingredients market is segmented by end use into food & beverages, pharmaceuticals, cosmetics, and others. In food & beverages, ingredients are used in plant-based proteins, dairy and egg alternatives, and functional foods. Pharmaceuticals utilize them in drugs, nutraceuticals, and therapeutic formulations. Cosmetics apply these ingredients in skincare, haircare, and personal care products, while the “others” segment covers industrial, agricultural, and specialty applications like enzymes, biofertilizers, and biotech products.

Fertilizer Market, By food & beverages application

As of 2024, the food & beverages application in the precision fermentation ingredients market includes meat & seafood alternatives, dairy alternatives, egg alternatives, and other applications. Meat and seafood alternatives provide plant-based or cultured options mimicking taste and texture. Dairy alternatives include milk, yogurt, and cheese substitutes, while egg alternatives are used in baking, cooking, and processed foods. Other applications cover bakery, beverages, snacks, and functional foods incorporating proteins, enzymes, or specialty ingredients for enhanced nutrition and functionality.

REGION

Asia Pacific to be fastest-growing region in fertilizer market during forecast period

As of 2024, Asia Pacific is the fastest-growing region in the precision fermentation ingredients market, driven by rising population, urbanization, and increasing demand for sustainable and alternative protein sources. China leads this growth within the region due to strong government support, expanding food and beverage industries, rising consumer awareness of health and nutrition, and increasing investment in biotechnology and innovation, making it a key hub for market expansion and adoption of precision fermentation technologies.

precision fermentation market: COMPANY EVALUATION MATRIX

The precision fermentation ingredients market exhibits a dynamic competitive landscape with established leaders and emerging innovators. Company evaluation is based on factors such as market presence, technological capabilities, product portfolio, strategic collaborations, and growth potential. Star players like Geltor lead the market with advanced bioengineered collagen and strong brand recognition, demonstrating scalability and innovation. In contrast, emerging players like Myco are gaining momentum with novel mycelium-based proteins and specialty ingredients, offering unique functional properties. This mix of established and rising companies highlights the market’s growth opportunities, competitive intensity, and the drive toward sustainable, high-quality ingredients.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.62 Billion |

| Market Forecast in 2030 (Value) | USD 36.31 Billion |

| Growth Rate | CAGR of 48.6% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: precision fermentation market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America–based Food & Beverage Manufacturer |

|

|

| European Nutraceutical / Pharma Company |

|

|

| APAC-based FoodTech / Agritech Firm |

|

|

| Global Ingredient Distributor |

|

|

| Investor / Private Equity Firm |

|

|

RECENT DEVELOPMENTS

- 4/1/2025 12:00:00 AM : Formo Foods launched its animal-free cheeses made with koji protein across more than 2,000 REWE, BILLA, and Metro retail locations in Germany and Austria, marking a significant expansion of its product lineup.

- 1/1/2025 12:00:00 AM : Valio entered a long-term research and development collaboration with Swedish startup Melt&Marble to improve the texture, taste, and mouthfeel of plant-based products using precision fermentation fats.

- 4/1/2025 12:00:00 AM : Shiru officially launched two new plant-based ingredients, uPro and OleoPro, into commercial production.

- 6/1/2024 12:00:00 AM : The EVERY Company launched FERMY, a new line of ready-to-mix protein powders for beverages, in partnership with Canada's Landish Foods. The product features EVERY’s precision fermentation-derived egg white protein.

- 1/1/2024 12:00:00 AM : Israeli precision fermentation startup Imagindairy has expanded its operations by acquiring and launching industrial-scale production lines for its animal-free dairy proteins.

- 5/1/2023 12:00:00 AM : French dairy leader Danone made a strategic investment in Israeli foodtech startup Imagindairy, marking a significant step toward developing animal-free dairy products through precision fermentation.

Table of Contents

Methodology

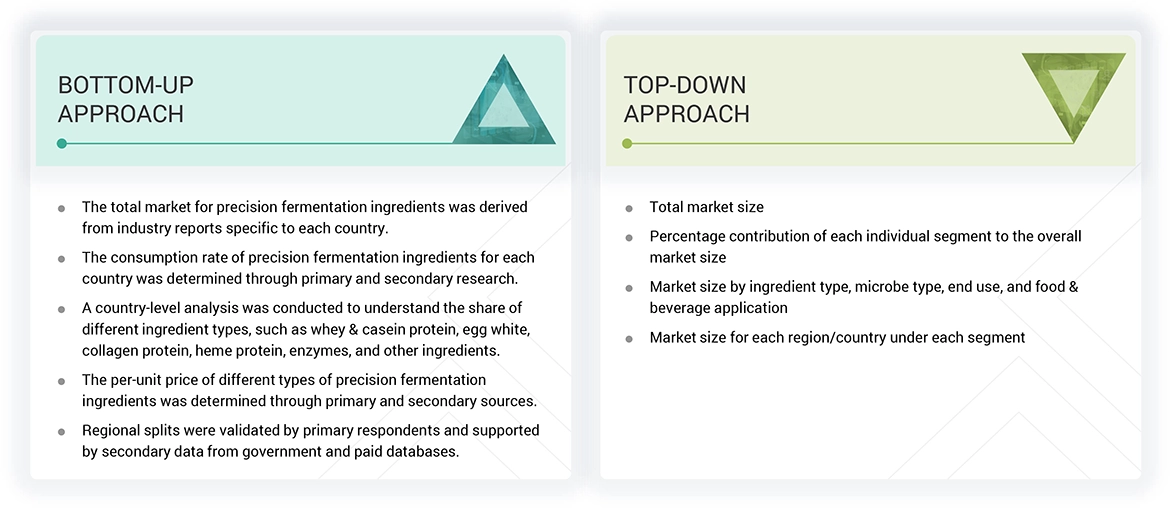

This study involved two major approaches in estimating the current size of the precision fermentation ingredients market. Exhaustive secondary research was carried out to collect information on the market as well as peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

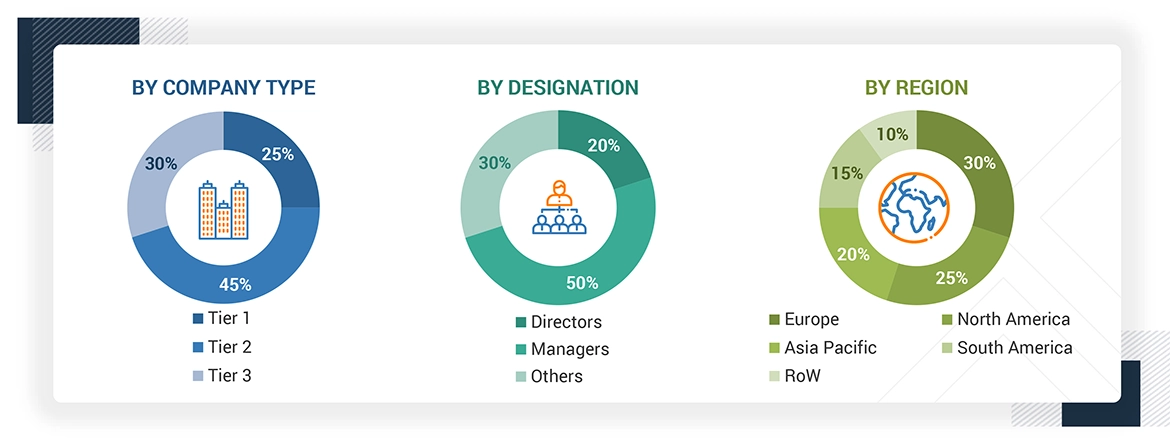

Primary Research

Extensive primary research was conducted after obtaining information regarding the precision fermentation ingredients market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief X officers (CXOs), vice presidents (VPs), directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to precision fermentation ingredients - ingredient type, microbe type, end use, food & beverage application, and region. Stakeholders from the demand side, such as research institutions and universities, agrochemical distributors, and retailers, were interviewed to understand the buyers’ perspective on the suppliers, products, and their current usage of precision fermentation ingredients and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2022 or 2023, as per the

availability of financial data: Tier 1: Revenue >USD 1 billion; Tier 2: USD 100 million = Revenue = USD 1 billion; Tier 3: Revenue

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Perfect Day, Inc. (India) |

Sales Manager |

|

Shiru, Inc. (US) |

Sales Manager |

|

Geltor (US) |

Manager |

|

New Culture (US) |

Operation Manager |

|

Remilk Ltd. (Israel) |

Marketing Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the precision fermentation ingredients market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Precision Fermentation Ingredients Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall precision fermentation ingredients market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Precision fermentation uses microbial host cells as factories to produce specific functional ingredients that can enhance and enable end products predominantly made of plant proteins, cultivated animal cells, or other microbial biomass.

Stakeholders

- Food & beverage manufacturers, suppliers, and processors

- Research & development institutions

- Traders & retailers

- Distributors, importers, and exporters

- Regulatory bodies

- Organizations such as the Food and Drug Administration (FDA), US Department of Agriculture (USDA), European Food Safety Agency (EFSA), EUROPA, and Food Safety Australia New Zealand (FSANZ)

- Government agencies

- Intermediary suppliers

- Universities and industry bodies

- End users

Report Objectives

- To determine and project the size of the precision fermentation ingredients market with respect to the ingredient type, microbe type, end use, food & beverage application, and region in terms of value over five years, from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the precision fermentation ingredients market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe precision fermentation ingredients market into key countries.

- Further breakdown of the Rest of Asia Pacific precision fermentation ingredients market into key countries.

- Further breakdown of the Rest of South America precision fermentation ingredients market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the precision fermentation ingredients market?

The precision fermentation ingredients market is estimated to be USD 5.02 billion in 2025 and is projected to reach USD 36.31 billion by 2030, registering a CAGR of 48.6% during the forecast period.

Which are the key players in the market, and how intense is the competition?

Perfect Day, Inc. (US), Geltor (US), The EVERY Company (US), ImaginDairy Ltd. (Israel), and Shiru, Inc. (US) are some of the key market players.

The market for precision fermentation ingredients is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the precision fermentation ingredients market?

North America currently accounts for the largest share of the precision fermentation ingredients market, fueled by consumers' high demand for sustainable and animal-free products, high R&D capabilities, and a supportive regulatory environment. The presence of key players, cutting-edge food tech infrastructure, and high levels of investment, especially in the US, have made the region a leader in innovation and commercialization in precision fermentation.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the precision fermentation ingredients market?

The precision fermentation ingredients market is driven by rising demand for sustainable, animal-free proteins and rapid advancements in biotechnology. Growing health awareness and environmental concerns further boost market adoption across the food, cosmetic, and pharmaceutical sectors.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Precision Fermentation Ingredients Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Precision Fermentation Ingredients Market