Precision Swine Farming Market

Precision Swine Farming Market by System (Swine Monitoring Systems and Precision Feeding Systems), Offering (Hardware, Software, and Services), Farm Size (Small Farms, Mid-sized Farms, and Large Farms), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The precision swine farming market is projected to reach USD 1.17 billion by 2030 from USD 0.75 billion in 2025, at a CAGR of 9.3% from 2025 to 2030. The market is experiencing strong growth, supported by ongoing innovation in smart farming technologies and digital platforms. Developments in automated feeding, real-time health monitoring, and predictive analytics are enabling producers to enhance herd productivity while reducing operational costs.

KEY TAKEAWAYS

- North America accounted for a 29.3% share of the precision swine farming market in 2024.

- By system type, the precision feeding systems segment is expected to register the highest CAGR of 9.6%.

- By offering, the services segment is projected to grow at the fastest rate of 11.7% from 2025 to 2030.

- By application, the swine health monitoring/early disease detection segment is expected to dominate the market, growing at the highest CAGR of 10.9%.

- By growth stage, the breeding segment is expected to dominate the market.

- Skiold, Merck & Co., and CTB, Inc. were identified as star players in the precision swine farming market, given their strong market share and extensive product footprint.

- Jyga Technologies, WEDA Dammann & Westerkamp GmbH, and Big Herdsman Machinery Co., Ltd., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The precision swine farming market is driven by continuous innovation in digital technologies, including sensors, IoT, artificial intelligence, and automation. These solutions provide real-time insights into swine health, feeding behavior, and environmental conditions, enabling producers to optimize operations and reduce costs. By advancing disease detection, boosting feed efficiency, and promoting adherence to animal welfare and sustainability standards, technology adoption is boosting overall productivity.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets and target applications are clients of precision swine farming manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of precision swine farming manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Utilization of precision feeding technique in swine farming

-

Surging labor costs and rising demand for automation in swine industry

Level

-

High upfront cost and marginal return on investment

-

Lack of technological awareness among swine farmers

Level

-

Increased adoption of swine monitoring technology in developing countries

-

Integration with supply chains

Level

-

Stringent government regulation and trade barriers

-

Connectivity limitations for farms

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Utilization of precision feeding technique in swine farming

Precision feeding involves procedures to provide the exact amount of feed with the proper composition to each pig in the herd at the right time. It has been projected that with this strategy, feeding expenditures can be lowered by more than 4.6%, while nitrogen and phosphorus excretion can both be decreased by more than 38%.

Restraint: High upfront cost and marginal return on investment

The high initial investment is a key factor restraining the adoption of precision swine farming. Monitoring and tracking equipment, feeding systems, IoT modules, sensors, and herd management software are high-cost technologies. Farmers must invest a lot to install these systems, which can affect the return on investment. Most farmers are poor and find investing in these technologies difficult. Moreover, as swine monitoring products have high maintenance costs, they remain unappealing among small-scale farmers.

Opportunity: Increased adoption of swine monitoring technology in developing countries

The adoption of swine monitoring technologies in developing countries is slow, primarily due to high installation costs and low awareness among farmers. However, factors such as the growing demand for pork, increasing per capita income of farmers, increasing herd size, and growing focus of governments on swine farming and agriculture are expected to propel the demand for swine technologies such as automated feeding systems and swine monitoring devices in developing countries in the coming years.

Challenge: Stringent government regulation and trade barriers

Swine farming is one of the most regulated industries in most parts of the world. Regulations control the quantity and quality of pork and establish minimum prices and parameters for its storage and supply. Various trade barriers and government programs are prohibiting several developing countries from attempting to establish trade in regulated markets. These barriers prevent multilateral and bilateral trade negotiations from progressing, thereby decreasing export opportunities and impeding the growth of the swine industry.

Precision Swine Farming Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deploys precision feeding systems and automated monitoring tools across its production units | Improved feed efficiency and reduced waste |

|

Implements IoT-based monitoring and smart climate control systems in swine barns | Early disease detection reduces mortality |

|

Uses digital traceability systems linking farm-level swine data to processors and retailers | Increased supply chain transparency for premium pork branding |

|

Uses wearable sensor technology and welfare monitoring platforms in swine herds | Reduced antibiotic usage through better health monitoring |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Some of the prominent companies in this market include well-established and financially sound manufacturers of precision swine farming products. These companies have been operational in the market for over a decade and have diversified portfolios, the latest technologies, and excellent global sales and marketing networks. Some of the prominent companies in this market include Nedap N.V. (Netherlands), CTB, Inc. (US), Merck & Co., Inc. (US), Boehringer Ingelheim International GmbH (Germany), and YingZi (China).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Precision Swine Farming Market, By System Type

Precision feeding systems hold the largest share in the system type segment of the precision swine farming market, driven by their ability to optimize feed conversion ratios, reduce waste, and lower production costs. These systems use sensors, automation, and data analytics to deliver tailored nutrition to individual pigs or groups, improving growth performance and health outcomes while supporting sustainability goals through efficient resource utilization.

Precision Swine Farming Market, By Application

The application segment of the precision swine farming market includes feeding management, swine identification and tracking, health monitoring, vaccination and drug delivery, and farm or barn climate control. These solutions focus on improving feed efficiency, ensuring traceability, enhancing animal health and welfare, and maintaining optimal housing conditions. Additionally, other applications involve the use of data-driven tools to optimize breeding outcomes and overall operational efficiency, collectively driving productivity and sustainability in swine production.

Precision Swine Farming Market, By Offering

Hardware holds the largest share in the offering segment of the precision swine farming market, as farms widely adopt automated feeding systems, climate control units, sensors, and monitoring devices to improve operational efficiency and animal welfare. The dominance of hardware is supported by the need for reliable infrastructure that enables real-time data collection and system integration, forming the foundation for digital platforms and analytics in swine production.

Precision Swine Farming Market, By Farm Size

Large-sized farms hold the largest share in the precision swine farming market, as their scale of operations demands advanced automation, data-driven monitoring, and integrated management systems to ensure efficiency, consistency, and profitability. Their higher investment capacity and focus on productivity, biosecurity, and compliance with welfare and sustainability standards drive faster adoption of precision technologies compared to small and mid-sized farms

Precision Swine Farming Market, By End User

The end-user segment includes commercial farms, contract farms, and smallholder farms. Commercial farms implement advanced precision technologies to enhance efficiency, productivity, and profitability. Contract farms integrate these solutions within supply agreements to ensure consistent performance and compliance, while smallholder farms adopt them selectively to improve animal health, feed efficiency, and overall farm management. Together, these end users are key drivers of technology adoption and market growth.

Precision Swine Farming Market, By Growth Stage

The growth stage segment covers breeding, gestation, farrowing, nursery, grower, and finisher stages. Precision technologies are deployed across these stages to enhance animal health monitoring, optimize feed efficiency, and improve overall productivity. By delivering stage-specific insights and management solutions, these technologies help reduce mortality, boost growth performance, and ensure efficient resource utilization, supporting profitability and sustainability throughout the swine production cycle.

REGION

Asia Pacific to be the fastest-growing region in the global precision swine farming market during the forecast period

The Asia Pacific region is expected to register the highest CAGR in the precision swine farming market during the forecast period, driven by increasing demand for pork, modernization of livestock operations, and rising awareness of animal welfare and sustainability practices. Countries such as China, Vietnam, Thailand, and India are witnessing rapid growth in pork consumption due to population growth, urbanization, and increasing disposable incomes, prompting producers to adopt advanced farming technologies to improve efficiency and productivity.

Precision Swine Farming Market: COMPANY EVALUATION MATRIX

In the precision swine farming market matrix, Nedap B.V. (Star) leads the market with its advanced portfolio of smart feeding, electronic sow management, and livestock monitoring systems, which enable producers to enhance efficiency, welfare, and data-driven decision-making. Big Dutchman (Emerging Leaders), meanwhile, is emerging as a strong player by expanding its precision feeding and housing technologies, focusing on automation and sustainability, and positioning itself as a key innovator in modern swine production systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.69 Billion |

| Market Forecast in 2030 (Value) | USD 1.17 Billion |

| Growth Rate | CAGR of 9.3% during 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: Precision Swine Farming Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Precision Swine Farming Manufacturers |

|

|

| Feed & Nutrition Manufacturer |

|

|

| Veterinary & Animal Health Provider |

|

|

| Meat Processor/Retailer |

|

|

RECENT DEVELOPMENTS

- July 2025 : Roxell launched the iQon Multifast Feed Delivery System, an advanced solution built on the iQon platform. The system offers smarter mixing and precise feed delivery to enhance efficiency, reduce waste, and improve animal performance.

- September 2024 : Fancom BV introduced the upgraded eYeGrow Weight Monitor, an advanced system designed to provide precise, automated weight monitoring for finisher pigs. This enhancement offers improved accuracy and efficiency in tracking pig growth, contributing to better feed management and overall farm productivity.

- April 2024 : Smart Livestock launched a new methane emissions monitoring system for feedlots. This system caters to the rising demand for sustainable livestock production practices in North America, addressing environmental concerns and regulatory requirements.

- September 2023 : JYGA Technologies introduced the GESTAL L-Track, a cost-effective and precise solution for managing feed bins across various production types. This innovation aims to enhance farm productivity, security, and profitability by streamlining feed management processes.

- January 2023 : Nedap unveiled an innovative precision swine farming platform that integrates its existing products and services into a cohesive solution. This platform aims to streamline swine farm management, providing farmers with enhanced tools to boost productivity effectively.

Table of Contents

Methodology

The study involved two major approaches in estimating the current size of the precision swine farming market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were used to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources, directories, and databases such as Bloomberg Businessweek and Factiva, to identify and collect useful information for a technical, market-oriented, and commercial study of the market. In the secondary research process, various sources, such as company annual reports, press releases, investor presentations, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were used to identify and collect information.

Secondary research was mainly used to gather key information about the industry’s supply chain, the total number of key players, and market classification and segmentation based on industry trends down to the regional level, including key developments from market and technology perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding precision swine farming through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries in North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews.

The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, research, and development teams, as well as related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation.

Primary research also helped us understand the trends related to the precision swine farming market based on system type, offering, and farm size. Stakeholders from the demand side, including swine companies, agricultural cooperatives and distributors, agri-input retailers and dealers, and farmers and growers, were interviewed to gain insights into their perspectives on suppliers, products, and their current usage of the precision swine farming market. This understanding will help us assess the overall market outlook and its impact on business trends.

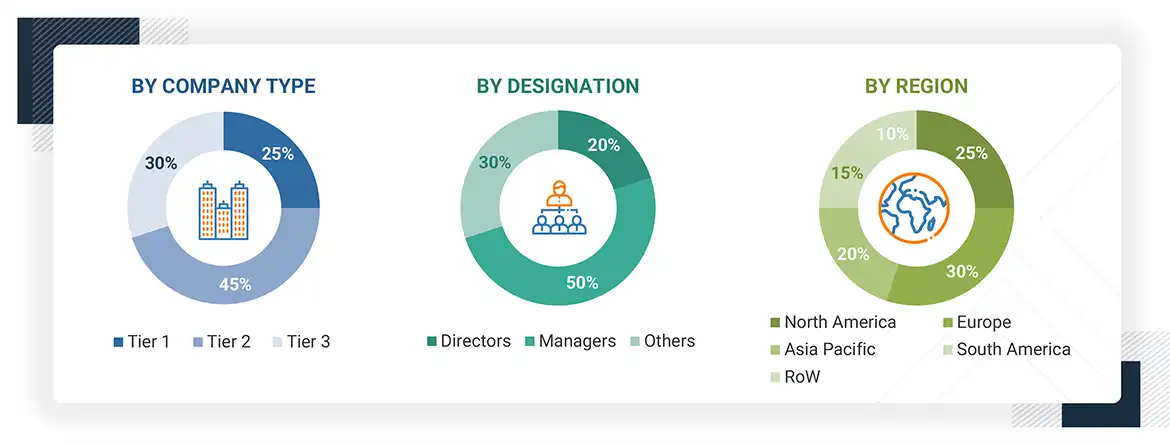

Note: The three tiers of the companies are defined based on their total revenues

in 2022 or 2023, based on the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue =

USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Nedap N.V. (Netherlands) |

Sales Manager |

|

CTB, Inc. (US) |

Territory Sales Manager |

|

Boehringer Ingelheim International GmbH (Germany) |

Regional Marketing Manager |

|

Merck & Co. Inc. (US) |

Operation Manager |

|

YingZi (China) |

Marketing Manager |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the precision swine farming market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Precision Swine Farming Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Wherever applicable, the data triangulation and market breakdown procedures were employed to estimate the overall precision swine farming market and determine the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

Precision swine farming can be defined as the application of engineering techniques in swine farming to monitor, model, and manage swine production. The aim is to manage individual animals by continuous real-time monitoring of health, welfare, production/reproduction, and environmental impact. The various products offered include hardware products, software, and services. The techniques and equipment are used for various applications, including feeding management, swine identification and tracking, swine health monitoring, and vaccination and drug delivery.

Stakeholders

Associations, regulatory bodies, and other industry-related bodies:

- Primary users implementing precision swine farming technologies to optimize swine health, productivity, and efficiency

- Companies developing milking robots, sensors, feeders, wearable devices, and farm management software

- Providers of AI, IoT, and cloud-based analytics platforms for real-time swine monitoring and decision support

- Using swine data to diagnose, prevent, and treat animal health issues

- Innovating new precision swine farming technologies, algorithms, and sustainable swine practices

- National Pork Producers Council (NPPC)

- American Association of Swine Veterinarians (AASV)

- European Pig Producers (EPP)

- European Food Safety Authority (EFSA)

- Food and Agriculture Organization (FAO)

- US Department of Agriculture (USDA)

- Global Roundtable for Sustainable Livestock (GRSL)

- World Veterinary Association (WVA)

Report Objectives

- To determine and project the size of the precision swine farming market based on system type, offering, farm size, and regions in terms of value over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the precision swine farming market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe precision swine farming market into key countries

- Further breakdown of the Rest of Asia Pacific precision swine farming market into key countries

- Further breakdown of the Rest of South America precision swine farming market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Which are the major companies in the precision swine farming market? What key strategies have market players adopted to strengthen their market presence?

The key players in the precision swine farming market include Nedap N.V. (Netherlands), CTB, Inc. (US), Merco & Co. Inc. (US), Boehringer Ingelheim International GmbH. (Germany), YingZi (China), Hotraco (Netherlands), VDL Agrotech (Netherlands), AcuShot Needle Free (Canada), Pulse NeedleFree Systems (US), Henke Sass Wolf (Germany), Big Dutchman (Germany), Pigbrother (Hungary), and Luda.Farm AB (Sweden). Product launches, acquisitions, and expansions were the key strategies adopted by these companies to strengthen their positions in the precision swine farming market.

What are the drivers and opportunities for the precision swine farming market?

The major factors driving the precision swine farming market are the rising global demand for animal protein, which pushes farmers to adopt technologies that boost efficiency and yield, and technological advancements such as IoT, AI, and data analytics that enable smarter, data-driven swine management.

Which region is expected to hold the largest market share?

Europe is projected to account for the largest share of the precision swine farming market, driven by its vast swine population, rising demand for animal protein, government-led modernization initiatives, and rapid adoption of advanced digital farming technologies.

What is the projected growth rate of the precision swine farming market over the next five years?

The precision swine farming market is projected to register a CAGR of 9.3% during the forecast period.

How is the precision swine farming market aligned for future growth?

The precision swine farming market is well aligned for future growth as rising pork demand, increasing farm consolidation, and stricter animal welfare and sustainability regulations drive the adoption of smart technologies. Advances in IoT, AI, and data analytics are enabling swine producers to improve feed efficiency, reduce disease risks, and optimize resource use, while integration with supply chains enhances transparency and traceability.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Precision Swine Farming Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Precision Swine Farming Market