Recreational Boat Market Size, Share & Analysis

Recreational Boat Market by Boat Type (Yachts, Sailboats, Personal Watercrafts, Inflatables), Boat Size, Engine Location, Engine Type, Material, Activity Type, Power Source, Power Range, Distribution Channel, Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

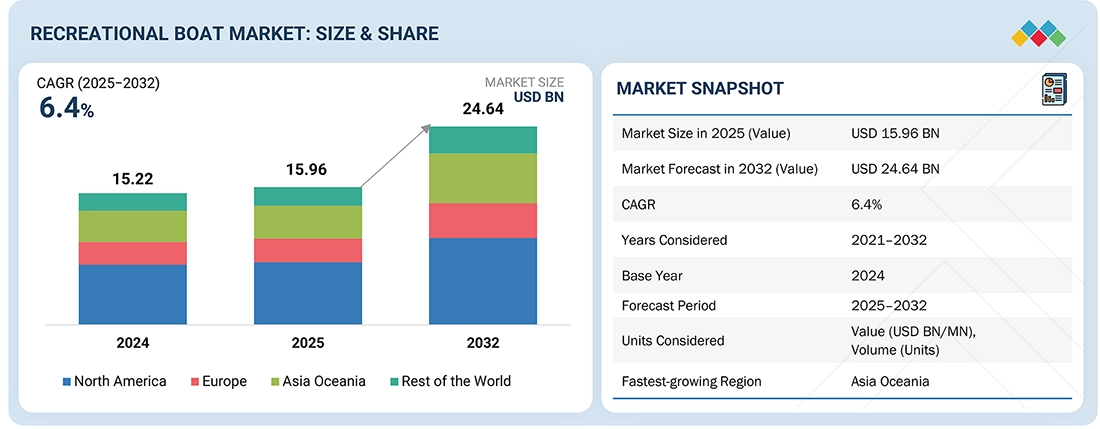

The recreational boat market is projected to reach USD 24.64 billion by 2032, from USD 15.96 billion in 2025, with a CAGR of 6.4%. This growth is driven by advances in onboard technologies, such as digitally integrated control systems and hybrid-electric propulsion. Other key drivers include flexible ownership models, which enhance accessibility, and the rise of high-net-worth individuals, along with innovations in marina infrastructure.

KEY TAKEAWAYS

-

By RegionNorth America is estimated to hold the largest market share of 47.0% in 2025.

-

By Boat TypeThe personal watercraft boats segment is expected to record the highest CAGR of 8.3% during the forecast period.

-

By Activity TypeThe cruising & watersports segment is expected to exhibit the fastest growth from 2025 to 2032.

-

By Boat SizeThe 30–50 feet segment is expected to dominate the market, growing at a CAGR of 7.2%.

-

By Engine LocationThe outboard engine segment is expected to grow at a CAGR of 6.9%.

-

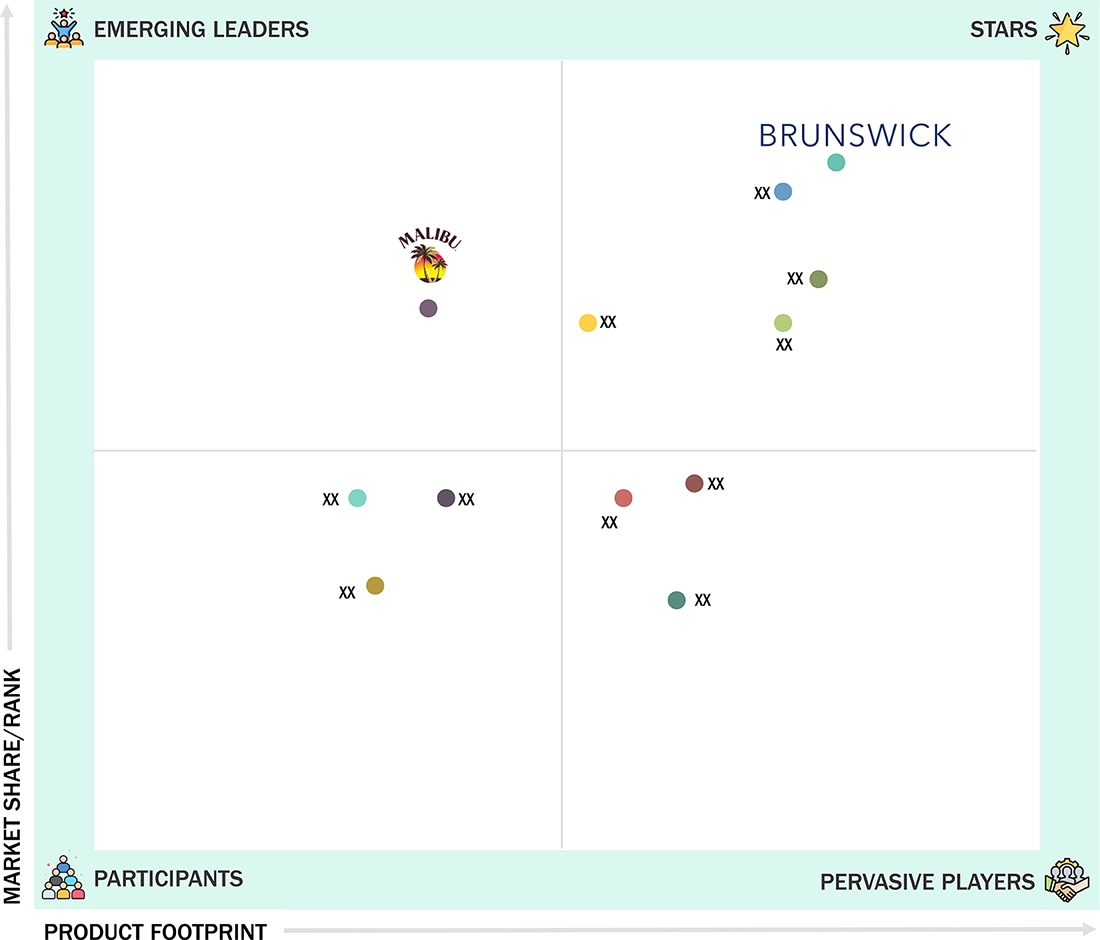

COMPETITIVE LANDSCAPEKey market players have adopted both organic and inorganic strategies to strengthen their market positions. Notably, Brunswick Corporation (US), Yamaha Motor Company (Japan), Groupe Beneteau (France), and Malibu Boats (US) have entered into numerous agreements and partnerships to meet the growing demand for recreational boats across diverse applications.

The recreational boat market is witnessing steady growth, driven by the rising disposable income and increasing demand from younger consumers. New developments, including strategic partnerships between OEMs and material suppliers, investments in new propulsion technologies, and innovations in connectivity features, are reshaping the industry landscape.

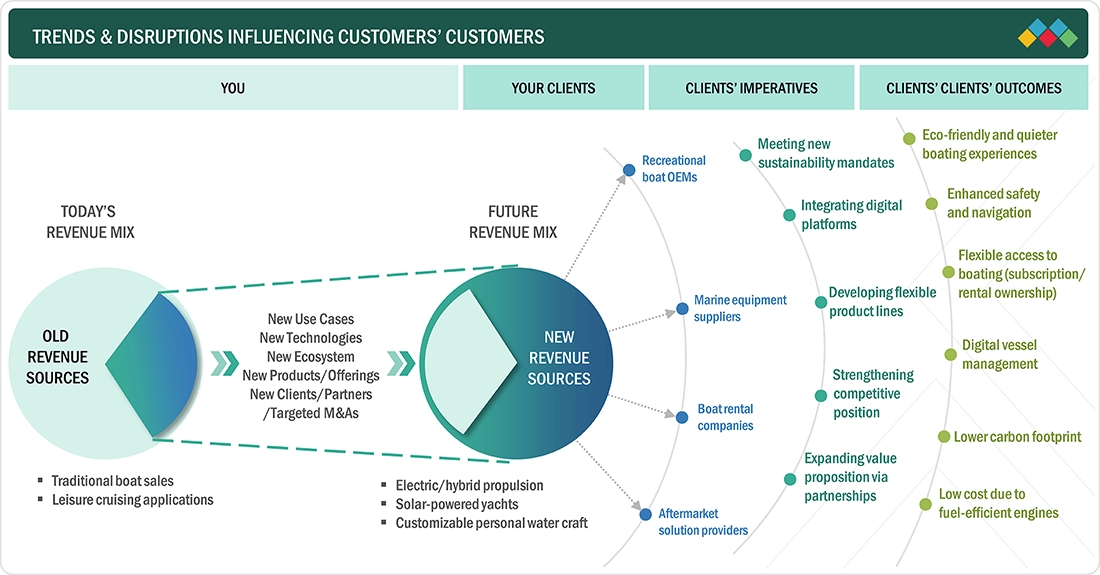

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses arises from customer trends or disruptions. Hotbets are clients of recreational boat manufacturers, and target applications are also clients of recreational boat manufacturers. Shifts, which involve changing trends or disruptions, will affect the revenues of end users. The revenue impact on end users will influence the revenue of hotbets, which will in turn impact the revenues of recreational boat manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Global prosperity and tourism

-

Shifting trend of boat buyers

Level

-

Strict pollution norms for recreational boats

Level

-

Demand for higher horsepower engines and performance

Level

-

High cost of boat ownership

-

Limited electric-charging and docking infrastructure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Global prosperity and tourism

The recreational boat market is gaining strong momentum, driven by multiple factors such as rising disposable incomes, expanding tourism activity, and the increasing prominence of international boat shows. The global disposable income per capita is rising quickly, with the US still having the highest disposable income. Both ICOMIA and UNCTAD highlight Asia Pacific’s growing contribution to global boat production and consumption, already accounting for around 20% of global recreational boat sales in 2024. These interconnected trends are shaping a dynamic and resilient growth cycle in the recreational boating industry.

Restraint: Strict pollution norms for recreational boats

Tightening global environmental regulations are limiting the recreational boating market by raising compliance costs and restricting operational areas. Regulations such as the US Clean Boating Act (CBA) and the EU Battery Regulation (2023/1542), which are set to take effect in 2027, are redefining the manufacturing and operational standards for boats. Meeting these emerging standards requires ongoing monitoring, new reporting tools, and retrofitting older fleets, all of which are shrinking profit margins and slowing the growth of recreational boat adoption.

Opportunity: Demand for higher horsepower engines and performance

The boating industry is shifting toward high-performance outboard engines, especially in the 200–300 horsepower range. According to the National Marine Manufacturers Association (NMMA), this segment shows strong growth as buyers increasingly prioritize speed, power, and handling over entry-level affordability.

Challenge: High cost of boat ownership

High costs of boat ownership come from expensive purchase prices, insurance, mooring, and ongoing maintenance, which can add up to over USD 17,000 annually for mid-sized vessels. These recurring expenses create financial pressure and discourage new buyers from entering the recreational boat market. The challenge is intensified by unpredictable costs, such as repairs and fuel price fluctuations, which strain budgets even more.

recreational-boats-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integration of electric propulsion systems and joystick docking controls in premium models under Mercury Marine and Sea Ray brands. | Enables precise maneuvering, reduced noise and vibration, and supports transition toward low-emission boating. |

|

Adoption of hybrid-electric propulsion and lightweight composite hulls in sailing yachts and motorboats. | Improves fuel economy by 20–25%, reduces emissions, and enhances handling performance. |

|

Use of advanced surf gate systems and integrated telematics for wake and performance optimization. | Provides customizable wake shapes, improves safety, and enhances user experience through digital control interfaces. |

|

Development of high-horsepower (300–450 HP) outboard engines with digital electric steering and connected control systems. | Offers higher torque, smoother operation, and greater control precision for large recreational boats. |

|

Incorporation of composite stringer systems and noise-dampening materials in sport boats. | Reduces vibration and maintenance needs while improving ride comfort and structural strength. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

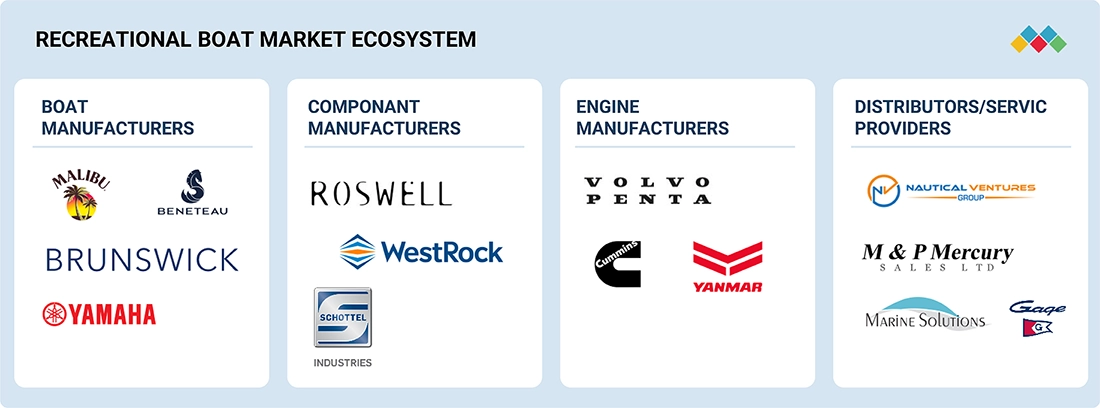

MARKET ECOSYSTEM

This section highlights various players in the recreational boat market ecosystem, primarily represented by raw engine manufacturers, component manufacturers, OEMs, and distributors. Some major recreational boat OEMs are Brunswick Corporation (US), Groupe Beneteau (France), Malibu Boats (US), MasterCraft Boat Company (US), and Yamaha Motor Corporation (Japan).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

BY BOAT TYPE

As of 2024, yachts held the largest share of the recreational boat market and are expected to continue leading the market in 2025 because of their luxury accommodations, spacious designs, and suitability for extended cruising and tourism. Advances in hybrid engines and lightweight composites further improve fuel efficiency and decrease emissions, strengthening the position of yachts alongside motorboats in premium leisure segments.

BY ACTIVITY TYPE

As of 2024, cruising & watersports is the fastest-growing segment in the recreational boat market and will continue to lead growth through 2025 due to rising interest in leisure boating, adventure activities, and tourism. Boat buyers and families are opting for vessels designed for relaxation, day trips, and activities such as wakeboarding, tubing, and water skiing over fishing-specific models. Investments in marina infrastructure, boat sharing, and rental services further boost demand.

BY BOAT SIZE

As of 2024, boats over 30 feet held the largest share of the recreational boat market and will continue leading through 2025 because of their ability to provide more space, comfort, and amenities needed for luxury cruising and long-distance travel. These boats are favored by high-income buyers in regions with mature boating cultures, where extended overnight trips and premium features are in demand. Advances in hull design, propulsion systems, and onboard technology further strengthen the dominance of larger boats in the premium leisure and tourism markets.

REGION

North America to be fastest-growing region in global aerospace materials market during forecast period

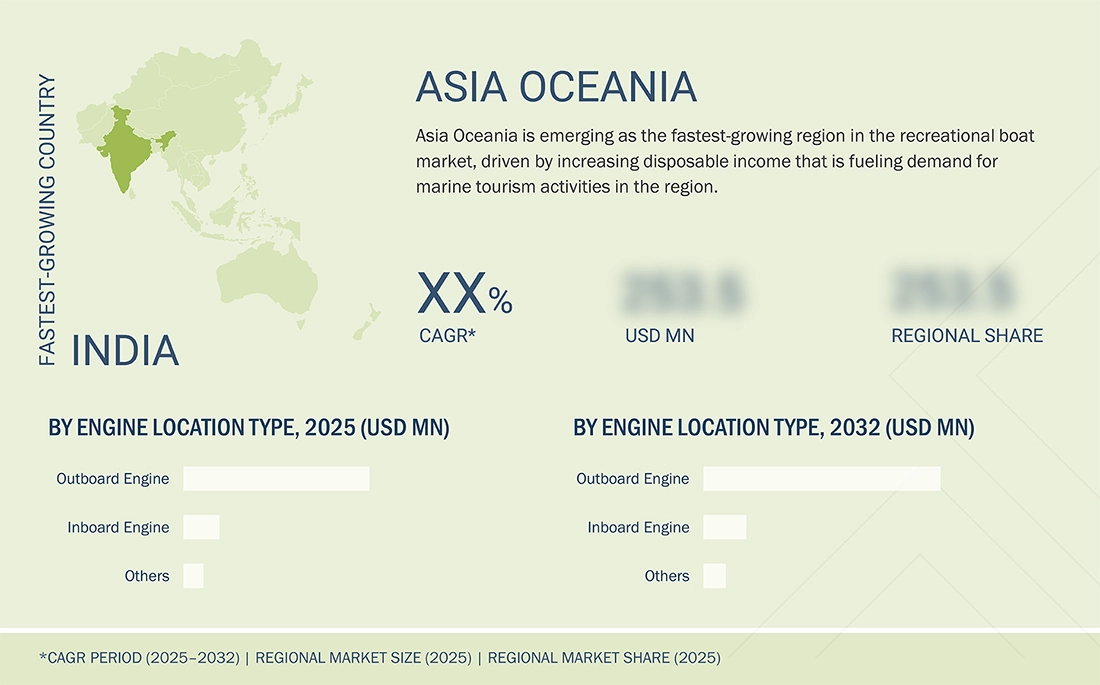

The Asia Oceania recreational boat market is projected to have the highest CAGR during the forecast period, driven by strong demand for leisure and tourism vessels. Leading OEMs and suppliers in China, Japan, and India are adopting advanced materials, such as aluminum and composites, to enhance performance, improve fuel efficiency, and reduce weight. Increased disposable incomes, rapid urbanization, and government-funded marina developments in the region are further accelerating the adoption of recreational boats for marine tourism and eco-friendly activities.

recreational-boats-market: COMPANY EVALUATION MATRIX

In the recreational boat market, Brunswick Corporation (Star) holds a strong market share and offers an extensive product lineup for premium brands like Sea Ray and Boston Whaler. Malibu Boats (Emerging Leader) is gaining recognition with specialized designs for watersports and performance vessels, as well as scale and hybrid propulsion integration. Brunswick dominates large-scale manufacturing, maintaining a strong position with niche products aimed at luxury segments, while Malibu shows significant potential to become a leader as the demand for high-performance and eco-friendly boats continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Brunswick Corporation (US)

- Yamaha Motor Company (Japan)

- Groupe Beneteau (France)

- Malibu Boats (US)

- Polaris Inc. (US)

- MasterCraft Boat Company (US)

- Azimut Benetti Group (Italy)

- Sunseeker International (UK)

- Ferretti Group (Italy)

- Bass Pro Group (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 15.96 BN |

| Market Forecast in 2032 (Value) | USD 24.64 BN |

| Growth Rate | CAGR of 6.4% from 2025-2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD MN/BN), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Oceania, Europe, Rest of the World |

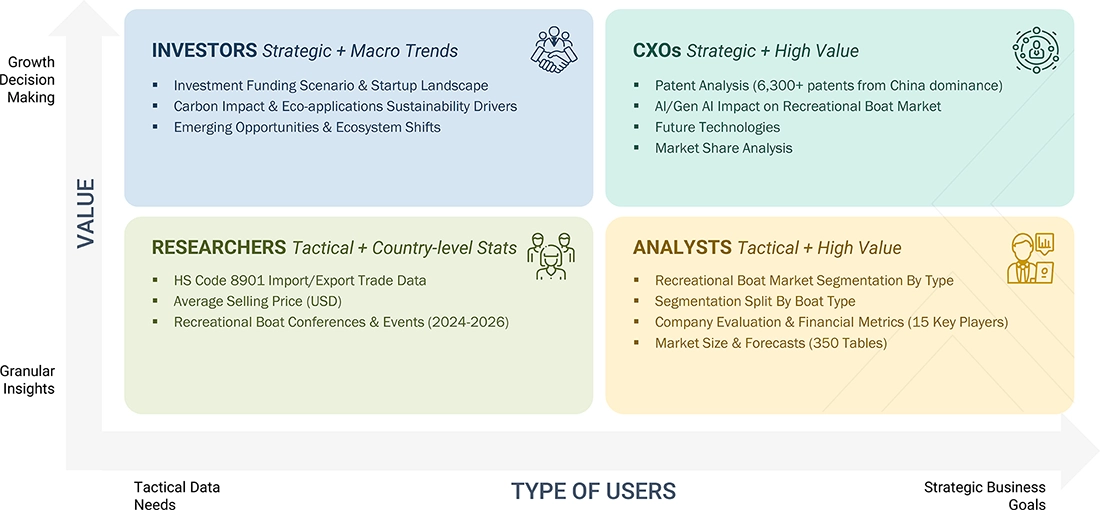

WHAT IS IN IT FOR YOU: recreational-boats-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Boat OEM |

|

|

| Composite Material Manufacturer |

|

|

| Engine Manufacturer |

|

|

| Raw Material Supplier |

|

|

| Dealer/Service Provider |

|

|

RECENT DEVELOPMENTS

- March 2025 : Yamaha announced the launch of the next-generation HARMO boat control system, which integrates an electric propulsion unit and steering system, for the Japanese market in June 2025. The system was first introduced in Europe in fall 2024. It features quiet, efficient electric rim drive propulsion and uses an outboard motor-style mounting for broader compatibility. The new HARMO works with Yamaha’s Helm Master EX system, allowing joystick control and features like SetPoint and Autopilot for easier maneuvering.

- January 2025 : BENETEAU partnered with Alpine and the BWT Alpine Formula One Team for a long-term collaboration. The partnership focuses on innovation through design and quality, aiming for co-branded, limited-edition products and exclusive events for owners. Major joint projects will be announced starting March 2025, leveraging both groups' expertise in luxury, performance, and customer experience to set new standards in their markets.

- May 2024 : Ferretti Group partnered with Flexjet to offer exclusive luxury solutions for ultra-high-net-worth individuals. The agreement provides Ferretti customers access to Flexjet's fleet of over 300 private jets and helicopters, including the Gulfstream G650 and Sikorsky S-76, plus private terminals at locations like Teterboro and Naples. Flexjet clients gain VIP access to boat shows, Riva shipyard tours, and preferential terms on Riva products, with joint events and a planned Riva-inspired interior for a Gulfstream G650.

Table of Contents

Methodology

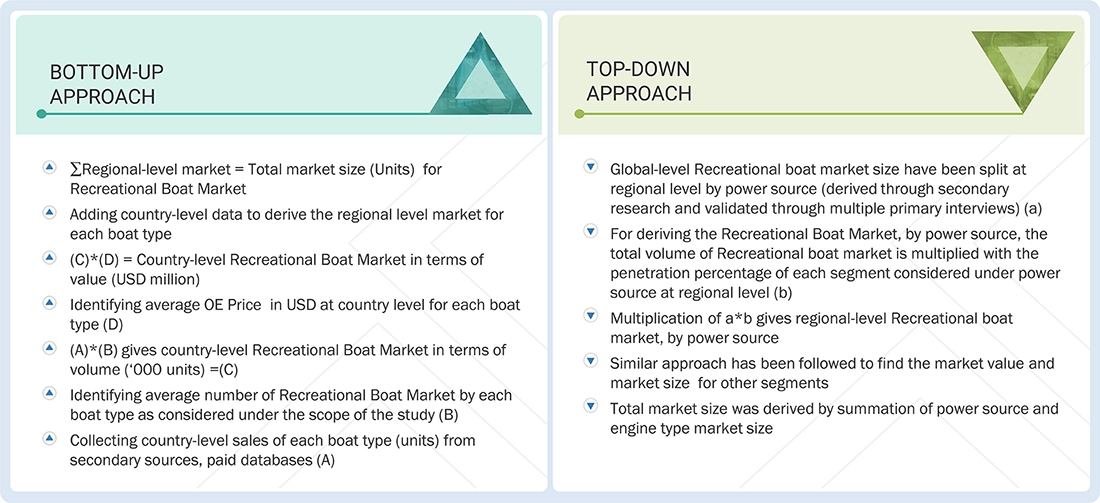

The study encompassed four primary tasks to determine the present and future scope of the recreational boat market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, primary research involving industry experts across the supply chain corroborated and validated these findings and assumptions. The complete market size was estimated by using the bottom-up and top-down methodologies. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of automobile OEMs, Publications of recreational boats, recreational boating associations, National Marine Manufacturers Association (NMMA), International Council of Marine Industry Associations (ICOMIA), country-level boating associations and recreational boating magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases have been used to identify and collect information useful for an extensive commercial study of the global recreational boat market.

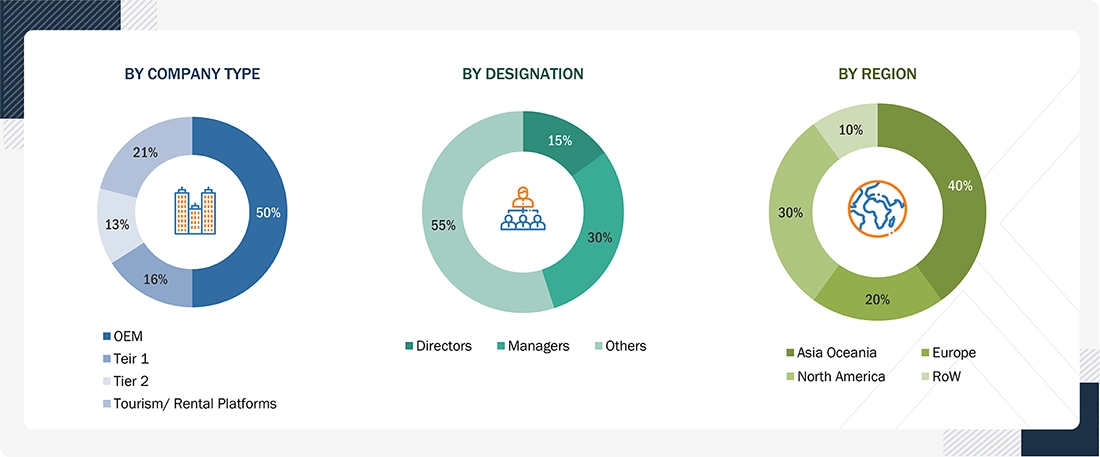

Primary Research

Extensive primary research was conducted after acquiring an understanding of the recreational boat market scenarios through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, trade associations, institutes, Boat show organizers, boat traders) and supply (Boat manufacturers, parts manufacturers) sides across four major regions, namely, North America, Europe, Asia Oceania, and the Rest of the World (RoW). 21% of the experts involved in primary interviews were from the demand side, and 79% were from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted with various departments within organizations, including sales, operations, and administration, to provide a holistic perspective in the report.

Following interactions with industry participants, brief sessions were conducted with experienced independent consultants to reinforce the findings from the primary research. This, along with the opinions of in-house subject matter experts, has led to the findings presented in the remainder of this report. The following is the breakdown of primary respondents:

Note: Tiers of companies are based on the value chain of the recreational boat market; revenues of companies were not considered. Tier 1 companies are engine and parts manufacturers, and tier 2 companies are service or material/component suppliers for the recreational boat market

Others include production managers, manufacturing managers, and engineers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the recreational boat market. These methods were also used extensively to estimate the size of various subsegments, such as in the Boat Type segment. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of volume, have been determined through a combination of primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Bottom-up Approach

The bottom-up approach has been used to estimate and validate the size of the recreational boat market. In this approach, the historic country-level sales of boats have been taken into consideration. The forecast has been based on various micro & macro indicators, including elevated interest rates, persistent inflation that raises production costs, supply chain disruptions, and high disposable incomes. Next, boats are categorized by type (yachts, inflatable boats, personal watercraft, sailboats, and others) & by activity type (cruising and watersports, and fishing). A forecast is then made based on technological innovations, regulatory mandates, and shifting consumer behaviors. Multiplication of country-level boat sales by boat type & activity type-wise percentage split provides country-level market shares by boat type & activity types. The average selling prices of different boat types have been identified at the country/regional level from company websites, third-party applications, and validated by primary experts. Multiplication of country-level volume by average selling price provides country-level market data, categorized by boat & activity types, by value. Country-level addition yields regional-level market, and further summation provides a global market, by both types in terms of volume & value.

Top-down Approach

The size of the recreational boat market, in terms of power source and engine type, has been calculated using the top-down approach. Extensive secondary and primary research has been conducted to understand the global market scenario for the various types of recreational boats used in the marine industry. Several primary interviews have been conducted with key opinion leaders related to recreational boat market development, including key OEMs and Tier-1 suppliers. Qualitative aspects, including market drivers, restraints, opportunities, and challenges, have been taken into consideration when calculating and forecasting the market size.

Recreational Boat Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size of recreational boats using the market size estimation processes explained above, the market was segmented into several segments and subsegments. To complete the overall market engineering process and determine the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The recreational boat market encompasses the design, manufacturing, sale, and use of boats intended for leisure and personal enjoyment activities, such as cruising, fishing, water sports, and sailing. These boats include motorboats, sailboats, yachts, and personal watercraft, equipped with modern propulsion, navigation, and infotainment systems. The market integrates technologies such as GPS-based telematics, electric propulsion, and connected onboard systems to enhance safety, performance, and user convenience. Increasing adoption of digital monitoring, smart displays, and energy-efficient powertrains supports predictive maintenance and sustainability. Overall, the recreational boat market aims to deliver high-performance, user-friendly, and environmentally responsible boating experiences while maximizing operational reliability and consumer value.

Key Stakeholders

- Recreational boat manufacturers

- Dealers and distributors of recreational boats

- Marine engine manufacturers

- Marine parts manufacturers

- Recreational boating associations

- Individual marine experts and consultants

- International unions for recreational boating

- Boat owners

- Boat maintenance and repair service providers

- Boating shows and event organizers

- Insurance companies

- Financing institutions

- Government regulatory agencies

Report Objectives

-

To segment and forecast the recreational boat market, in terms of volume (units) and value (USD Million):

- by boat type (yachts, sailboats, personal watercraft, inflatables, others)

- by boat size (<30 feet, 30–50 feet, >50 feet)

- by engine placement (outboard, inboard, others)

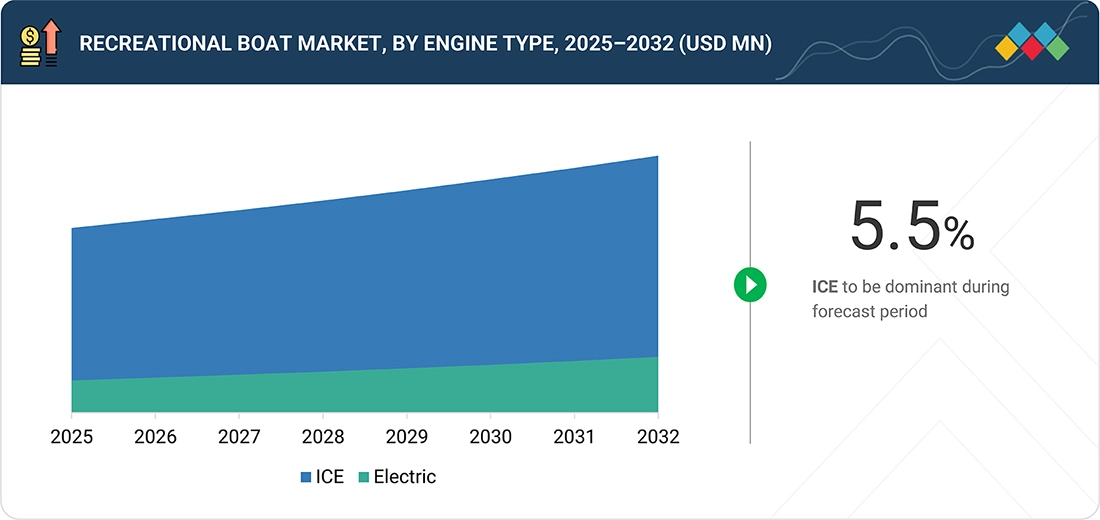

- by engine type (ICE, electric)

- by power range (<100 kW, 100–200 kW, >200 KW)

- by material type (aluminum, fiberglass, steel, others)

- by activity type (cruising & watersports, fishing)

- by power source (engine-powered, sail-powered, human-powered)

- by distribution channel (boat dealership, boat shows, online boat sales)

- by region (North America, Europe, Asia Oceania, and Rest of the World)

- To provide detailed information about the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To track and analyze competitive developments, including product launches, mergers and acquisitions, and other key activities by industry participants

- To strategically analyze the market with supply chain analysis, revenue analysis, and regulatory analysis in the heavy equipment telematics market

- To examine the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

Customization Options

With the given market data, MarketsandMarkets offers customizations tailored to company-specific needs.

- Recreational boat market, by engine location at the country level (for countries covered in the report)

- Recreational boat market, by boat type (for up to three additional countries)

- Recreational boat market, by region (for up to three additional countries)

Geographic analysis

- Further breakup of additional European countries by offering, deployment mode, business function, and vertical

- Further breakup of additional Asia Pacific countries by offering, deployment mode, business function, and vertical

- Further breakup of additional Middle East & African countries by offering, deployment mode, business function, and vertical

- Further breakup of additional Latin American countries by offering, deployment mode, business function, and vertical

Company information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Recreational Boat Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Recreational Boat Market