Recycled Carbon Fiber Market

Recycled Carbon Fiber Market by Type (Milled, Chopped), Source, Manufacturing Process, End-use Industry (Automotive & Transportation, Consumer Goods, Sporting Goods, Industrial, Aerospace & Defense, Marine), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The recycled carbon fiber market is projected to reach USD 0.31 billion by 2030 from USD 0.16 billion in 2025, at a CAGR of 13.3% from 2025 to 2030. Recycled carbon fiber is obtained by recovering fibers from composite waste or retired components using specialized thermal or chemical processes. While not identical to virgin fiber, it maintains strong mechanical properties, making it a cost-effective and sustainable alternative. Its use is growing in sectors such as automotive & transportation, consumer goods, and sporting goods where both performance and environmental responsibility are priorities.

KEY TAKEAWAYS

-

BY TYPEThe recycled carbon fiber market includes chopped and milled fibers. Chopped fibers are widely used in thermoplastics and automotive applications, while milled fibers are favored in coatings, adhesives, and conductive materials for their improved dispersion and reinforcement properties.

-

BY SOURCEAerospace and automotive scrap are the primary feedstocks for recycled carbon fiber, with additional input from other industrial waste streams. The source directly affects fiber quality, recovery efficiency, and cost structure.

-

BY MANUFACTURING PROCESSMechanical, chemical, and thermal recycling methods are used to recover fibers. Each process offers unique benefits in terms of fiber integrity, scalability, and suitability for end-use applications..

-

BY END-USE INDUSTRYRecycled carbon fiber is increasingly used in automotive & transportation, consumer goods, and sporting goods due to its lightweight and cost-effective properties, making it an ideal choice for large-scale adoption.

-

BY REGIONThe market in Europe is expected to grow fastest, with a CAGR of 13.9%, driven by stringent environmental regulations and strong adoption in the automotive & transportation, and aerospace & defense sectors.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as Procotex, Vartega Inc. and Mitsubishi Chemical Group Corporation. These companies are advancing recycling technologies and broadening end-use adoption, reflecting the growing demand for sustainable and cost-effective alternatives to virgin carbon fiber.

The recycled carbon fiber market is poised for strong growth, supported by advancements in recycling technologies and the rising demand for sustainable materials. Industries are increasingly adopting recycled carbon fiber for its balance of high strength, lightweight properties, and cost efficiency, making it valuable in automotive & transportation, aerospace & defense, sporting goods, and industrial applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenue of end users. Consequently, the revenue impact on end users is expected to affect the revenue of recycled carbon fiber suppliers, which, in turn, impacts the revenue of recycled carbon fiber manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for carbon fibers from composites industry

-

Regulations on eco-friendly products

Level

-

Lack of technical knowledge

-

Use of economic products

Level

-

Increased use of recycled carbon fiber in aerospace sector

-

Revolutionizing carbon fiber waste for sustainable pressure vessels

Level

-

Promoting recycled carbon fiber for commercial applications

-

Length constraints in recycled carbon fiber utilization

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for carbon fibers from composites industry

The rising demand for carbon fibers in the composites industry increases the need for high-performance materials at lower costs. Since virgin carbon fiber is expensive, manufacturers turn to recycled carbon fiber, which offers similar properties at a significantly reduced price. This cost-performance advantage drives the growth of the recycled carbon fiber market.

Restraint: Lack of technical knowledge

The growth of the recycled carbon fiber market is limited by a lack of technical knowledge in manufacturing processes that preserve the fiber’s mechanical properties. Many recyclers struggle with process standardization, design consistency, and quality maintenance, making it challenging to match the performance of virgin carbon fiber. This knowledge gap restricts wider adoption and market expansion.

Opportunity: Revolutionizing carbon fiber waste for sustainable pressure vessels

Recycled carbon fiber is emerging as a key material for producing lightweight and durable hydrogen storage tanks, combining performance with cost efficiency. Innovative processes, like the DEECOM method, reclaim continuous fibers from end-of-life tanks while retaining the strength of virgin material for reuse in advanced manufacturing. As hydrogen technology grows, adopting recycled carbon fiber supports sustainability, addresses material shortages, and enhances circularity in high-performance vessel production.

Challenge: Length constraints in recycled carbon fiber utilization

Unlike virgin carbon fiber, which can be manufactured in continuous, theoretically endless lengths, recycled carbon fiber typically inherits the fiber length of its source material either from end-of-life (EOL) waste components or from production scrap generated during manufacturing. As a result, the fiber length of recycled carbon fiber is inherently limited, which imposes constraints on its performance characteristics and potential applications.

Recycled Carbon Fiber Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Lightweight structural and semi-structural auto components (body panels, interiors, wheels) | 30-40% weight, 20-40% cost reduction vs virgin CF, emissions/energy savings, EV performance |

|

Pyrolysis-recovered fibers used in hoods, chassis, and body parts for sports/EV models | Improved fuel economy, compliance with emissions regulation, lightweight/strength |

|

rCF for composite reinforcement in industrial goods and high-end OEM applications | Custom product forms, closed-loop recycling, 20-40% cost savings, up to 40% less CO2 |

|

Mobile on-site recycling systems processing carbon fiber composite waste into reusable recycled fibers | Clean, local, compliant closed-loop recycling, reduced carbon emissions and costs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The recycled carbon fiber ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. The raw material suppliers provide carbon fiber waste to recycled carbon fiber manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Recycled Carbon Fiber Market, By Type

The chopped recycled carbon fiber accounted for the largest market share in 2024. It is suitable for various compounding processes and industrial mixing, such as injection molding. Its high strength-to-weight ratio enables manufacturers to create lightweight and durable products, which is particularly beneficial in industries such as automotive & transportation,and aerospace & defense. By incorporating chopped recycled carbon fiber into their products, companies can significantly reduce weight, thereby improving fuel efficiency and performance.

Recycled Carbon Fiber Market, By Source

The aerospace scrap segment dominated the overall recycled carbon fiber market in 2024. Aerospace scrap is a preferred source for recycled carbon fiber due to its high-quality fibers that closely match the properties of virgin carbon fiber. The aerospace industry produces substantial composite waste from both manufacturing processes and retired components, offering a reliable and abundant supply for recycling. This makes aerospace scrap ideal for creating high-performance recycled carbon fiber.

Recycled Carbon Fiber Market, By Manufacturing Process

Thermal recycling accounted for the largest share in the global recycled carbon fiber market. This process efficiently recovers fibers from composite waste while retaining much of their mechanical strength. Techniques like pyrolysis and superheated steam treatment are cost-effective and scalable, making them suitable for industrial applications. This recycling technology also allows for the direct reuse of recovered fibers in high-performance products, driving its widespread adoption.

Recycled Carbon Fiber Market, By End-use Industry

The automotive & transportation industry held the largest share in 2024. With the growing shift toward lightweight materials for fuel efficiency, emission reduction, and sustainability, major automotive manufacturers are increasingly adopting recycled carbon fiber as a cost-effective alternative to virgin fibers. Recycled carbon fiber is widely used in automotive parts like underbody shields, interior panels, monocoque chassis, and reinforcement brackets.

REGION

Europe to be fastest-growing region in global recycled carbon fiber market during forecast period

The recycled carbon fiber in Europe is expected to register the highest CAGR during the forecast period, due to stringent environmental regulations and strong government initiatives promoting sustainability and circular economy practices. The region also has a well-established aerospace & defense, and automotive industry, generating significant composite waste for recycling. European companies are investing heavily in advanced recycling technologies, further driving market growth.

Recycled Carbon Fiber Market: COMPANY EVALUATION MATRIX

In the recycled carbon fiber market matrix, Procotex (Star), a Belgian company, leads the market through its high-quality chopped and milled recycled carbon fiber products, which find extensive applications in the automotive & transportation, aerospace & defense, industrial, and construction sectors. Gen 2 Carbon Limited (Emerging Leader) is gaining traction with its technological advancements in fiber reclamation. While Procotex dominates with scale, Gen 2 Carbon Limited shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.15 Billion |

| Market Forecast in 2030 (value) | USD 0.31 Billion |

| Growth Rate | CAGR of 13.3% from 2025-2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Thousand), Volume (Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, North America, Asia Pacific, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Recycled Carbon Fiber Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Recycled Carbon Fiber Manufacturers |

|

|

| Carbon Fiber Composites Manufacturer |

|

|

| Aerospace Scrap Supplier |

|

|

| Automotive Recycled Carbon Fiber Customer |

|

|

RECENT DEVELOPMENTS

- June 2025 : Vartega Inc. partnered with Syensqo to advance sustainable high-performance plastics through a breakthrough in carbon fiber recycling. This partnership enables scalable, cost-effective closed-loop recycling that produces high-quality recycled carbon fiber without sacrificing strength, cost, or durability.

- March 2025 : Hera SpA established FIB3R, the first industrial-scale plant in Europe to recycle and regenerate carbon fiber in Imola, Italy. The plant uses a state-of-the-art pyro-gasification process that recycles carbon fiber composites to produce 160 tons of recycled carbon fiber (rCF) annually.

- August 2024 : Hera SpA partnered with the Visa Cash App RB Formula One Team to use recycled carbon fiber for the production of VCARB's F1 car. The partnership is fully consistent with the F1 team objectives of decarbonization and development of the circular economy.

Table of Contents

Methodology

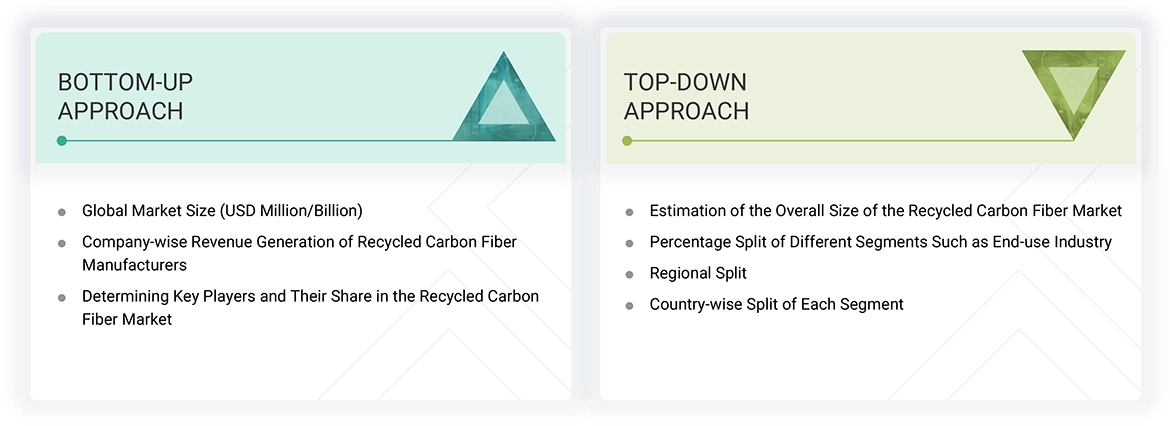

The study involves two major activities in estimating the current market size for the recycled carbon fiber market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering recycled caron fiber and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the recycled carbon fiber market, which was validated by primary respondents.

Primary Research

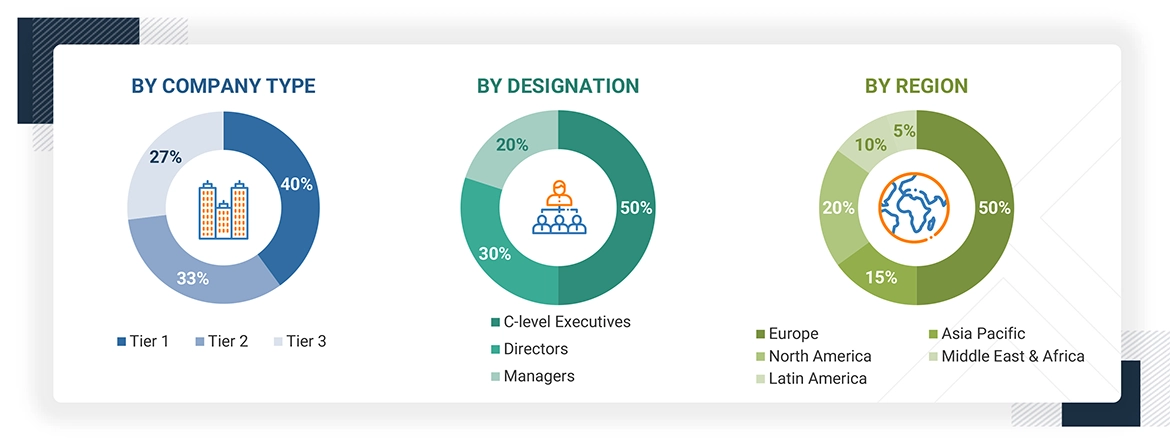

Extensive primary research was conducted after obtaining information regarding the recycled carbon fiber market scenario through secondary research. Several interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), business development/marketing directors, product development/innovation teams, related key executives from the recycled carbon fiber industry, system integrators, component providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, source, manufacturing process, end-use industry, and region. Stakeholders from the demand side, including CIOs, CTOs, CSOs, and installation teams of customers/end users for recycled carbon fiber services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of recycled carbon fiber and future outlook of their business which will affect the overall market.

Breakup of Interviews with Experts:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the recycled carbon fiber market includes the following details. The market size was determined from the demand side. The market was upsized based on the demand for recycled carbon fiber in different end-use industries at the regional level. Such procurements provide information on the demand aspects of the recycled carbon fiber industry for each industry. For each industry, all possible segments of the recycled carbon fiber market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Recycled carbon fiber is obtained from manufacturing waste and end-of-life composite components. It is also known as reclaimed carbon fiber, recovered carbon fiber, or upcycled carbon fiber. Pyrolysis and solvolysis manufacturing techniques are used to recover carbon fiber from scrap. This fiber is compatible with thermoplastic and thermoset resins. It can be mixed with virgin fiber to form composite structures.

Stakeholders

- Recycled Carbon Fiber Manufacturers

- Recycled Carbon Fiber Distributors and Suppliers

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the recycled carbon fiber market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global recycled carbon fiber market by type, source, manufacturing process, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Which are the major companies in the recycled carbon fiber market? What key strategies have market players adopted to strengthen their market presence?

Major companies include Toray Industries, Inc. (Japan), Mitsubishi Chemical Group Corporation (Japan), Procotex (Belgium), Vartega Inc. (US), Carbon Conversions (US), Gen 2 Carbon Limited (UK), Shocker Composites (US), Carbon Fiber Recycling (US), Alpha Recycling Composites (France), Carbon Fiber Remanufacturing (US), CATACK-H (South Korea), Hera SpA (Italy), and Pyrum Innovations AG (Germany). Key strategies adopted include product launches, acquisitions, and expansions.

What are the drivers and opportunities for the recycled carbon fiber market?

The market is driven by increasing demand from the composites industry and growing use of recyclable, lightweight materials in the automotive and transportation sectors.

Which region is expected to hold the largest market share?

Europe is expected to lead the market due to rising demand for cost-effective, high-performance sustainable materials and the presence of established manufacturers.

What is the projected growth rate of the recycled carbon fiber market over the next five years?

The market is projected to grow at a CAGR of 13.3% during the forecast period.

How is the recycled carbon fiber market aligned for future growth?

The market is poised for strong growth, supported by increasing adoption of recycled carbon fibers in the automotive and transportation industries for improved fuel efficiency and longer driving range.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Recycled Carbon Fiber Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Recycled Carbon Fiber Market

Silviya

May, 2022

Seeking for data on Recycled Carbon Fiber Market by Type, Source, End-use Industry and Region - Global Forecast to 2026 ! What would be the price of the study ?.

Akira

May, 2022

What is the future of Recycled Carbon Fiber Market Size, Share, Growth till 2030 ? Please share the data.

Jane

May, 2022

What is the growth of Recycled Carbon Fiber Market in 2027 ? Market Size, Market Share, Key players and such related data..