Real-time Location Systems (RTLS) Market in Manufacturing & Automotive

Real-time Location Systems (RTLS) Market in Manufacturing & Automotive by Offering (Tags/Badges, Readers/Trackers/Access Points), Technology (RFID, Wi-Fi, UWB, BLE, Infrared, Ultrasound, GPS, Zigbee), Application (Inventory Tracking, Personnel Tracking) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The RTLS market in manufacturing & automotive is projected to reach USD 2.94 billion by 2030 from USD 1.19 billion in 2025, at a CAGR of 19.9% from 2025 to 2030. The RTLS market in manufacturing & automotive is growing as factories increasingly require real-time visibility of assets, tools, and workflows to reduce downtime and improve production efficiency. Industry 4.0 initiatives and rising automation are driving demand for precise tracking to support predictive maintenance, inventory accuracy, and worker safety.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific is projected to register the fastest growth of CAGR of 21.9%

-

BY TECHNOLOGYThe Wi-Fi technology segment held the largest market share of 34.2% in 2024.

-

BY APPLICATIONThe supply chain management & automation segment is expected to grow at the highest CAGR of 24.8%.

-

COMPETITIVE LANDSCAPESecuritas Technology , Zebra Technologies Corp., and Impinj, Inc. were identified as some of the star players in the RTLS market in manufacturing & automotive, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPESewio Networks and Pozxy have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy

The RTLS market in manufacturing and automotive is growing steadily as factories and assembly plants prioritize real-time visibility, precision tracking, and workflow automation to meet the rising demands of production. Automakers are increasingly deploying RTLS for tool tracking, AGV/robot navigation, worker safety, and just-in-time material flow across complex assembly lines. In manufacturing hubs, real-time asset monitoring, quality control traceability, and collision-prevention systems are becoming essential as plants shift toward smart factory and Industry 4.0 models. The integration of UWB, BLE, and hybrid RTLS with MES, ERP, and industrial IoT platforms is further accelerating adoption by enabling high accuracy, predictive insights, and seamless digital manufacturing operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Emerging technologies are set to disrupt traditional revenue streams by shifting the future revenue mix toward innovation-driven solutions. Key growth areas, such as asset tracking, inventory management, supply chain optimization, and environmental monitoring, fuel the demand across industries, including manufacturing, glass, heavy equipment, tire, and aerospace. Disruptive enablers, including IoT/IIoT, AI, machine learning, and wireless connectivity, accelerate this shift, creating opportunities in fleet tracking, geo-fencing, and smart monitoring. This transition underscores businesses' need to adopt new technologies to stay competitive and capture high-growth revenue streams.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing need for real-time asset visibility and workflow automation

-

Rising focus on worker safety and regulatory compliance

Level

-

High deployment and integration costs

-

Concerns over data security and operational disruptions

Level

-

Industry 4.0 and smart factory initiatives

-

Growing adoption of AGVs, AMRs, and robotics

Level

-

Interoperability issues across diverse systems

-

Complex industrial environments affecting accuracy

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising focus on worker safety and regulatory compliance

Industries with high operational risk—such as automotive, metal fabrication, and heavy machinery—are deploying RTLS to monitor worker movement in restricted or hazardous zones. The ability to detect unsafe proximity to equipment or triggering emergency alerts strengthens compliance with evolving safety regulations. As governments enforce stricter workplace safety norms, factories are prioritizing location-enabled safety systems. RTLS further supports digital evacuation management, muster reporting, and lone-worker tracking. This makes it crucial for ensuring safer, more intelligent, and fully compliant industrial environments.

Restraint: High deployment and integration costs

RTLS implementation in large manufacturing plants requires investment in anchors, tags, calibration, software licenses, and network infrastructure. Integrating these systems into existing MES, ERP, and automation platforms also involves technical expertise and additional costs. For many small and mid-size facilities, these upfront expenses create financial hesitation despite long-term benefits. Moreover, highly customized layouts increase installation complexity, further raising project costs. These economic barriers slow adoption in cost-sensitive markets

Opportunity: Growing adoption of AGVs, AMRs, and robotics

Manufacturing and automotive plants are deploying autonomous robots for material transport, assembly support, and warehouse operations. These systems require precise indoor positioning for navigation, collision avoidance, and fleet coordination. RTLS provides the sub-meter accuracy needed for high-speed robotic workflows, enabling smoother interaction between humans, robots, and equipment. As facilities move toward fully automated material handling, seamless RTLS-robot integration becomes increasingly valuable. This rapidly expanding robotics ecosystem presents strong growth opportunities.

Challenge: Complex Industrial Environments Affecting Accuracy

Manufacturing facilities involve dense metal structures, heavy machinery, and constant movement, all of which interfere with wireless signals and degrade RTLS accuracy. Achieving consistent performance requires advanced calibration and frequent optimization as layouts change. High temperatures, vibrations, and electromagnetic noise further complicate system stability. Maintaining sub-meter precision across large, dynamic shop floors is a technically demanding task. These environmental challenges often require hybrid technologies or enhanced algorithms, increasing operational complexity.

Real-time Location Systems (RTLS) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

RTLS deployed in an automotive assembly facility in Germany to track tools, components, and work-in-progress units across production lines, ensuring precise sequencing and preventing part mismatches. | Improved production accuracy, reduced assembly delays, and higher throughput through real-time visibility of tools and materials. |

|

RTLS-based worker safety monitoring implemented in a metal fabrication plant in the UK, enabling real-time location of personnel in restricted or hazardous zones with automated emergency alerts | Enhanced worker safety, faster incident response, and compliance with industrial safety standards through continuous personnel tracking |

|

RTLS for smart factory automation at a Tier-1 automotive supplier in Spain, integrating location data with AGVs and robotics for synchronized movement and collision avoidance on the shop floor | Increased productivity, optimized material flow, and minimized downtime with coordinated autonomous operations and data-driven workflow optimization |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The RTLS in manufacturing and automotive ecosystem comprises key components, such as hardware and software, which include tags, readers, antennas, and positioning software, utilizing RFID, UWB, BLE, Wi-Fi, and GPS technologies. These systems are applied in asset and personnel tracking, workflow optimization, and inventory management across manufacturing, heavy equipment, tire, glass, and automotive industries. It involves various services, including installation, integration, maintenance, and data analytics. The hardware types include tags, sensors, gateways, and handheld readers, all working to deliver real-time location data, enhancing visibility and operational efficiency.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

RTLS Market in in Manufacturing & Automotive, By Technology

RFID is growing the fastest because it offers a cost-effective, easy-to-deploy solution for tracking parts, tools, returnable containers, and WIP inventory at scale. Its passive tags require no batteries, enabling affordable tagging of thousands of components across automotive assembly lines and supplier networks. Manufacturers also favor RFID for its high read rates, durability in harsh industrial environments, and seamless integration with MES/ERP systems. As plants push for leaner operations and error-free material flow, RFID becomes the preferred technology for mass, high-volume tracking.

RTLS Market in in Manufacturing & Automotive, By Application

Supply chain management & automation is growing the fastest because manufacturers and automotive OEMs are prioritizing real-time visibility of parts, tools, and WIP inventory to eliminate delays and improve production throughput. RTLS-enabled automation supports just-in-time workflows, AGV/AMR coordination, and continuous material flow across warehouses and shop floors. As factories accelerate digitalization and adopt Industry 4.0 systems, RTLS becomes essential for optimizing supply chains, reducing errors, and creating fully connected, automated production environments.

RTLS Market in in Manufacturing & Automotive, By Region

The Asia Pacific is growing the fastest in the manufacturing & automotive RTLS market due to the rapid expansion of automotive production, large-scale industrialization, and strong government pushes for smart factories in China, Japan, South Korea, and India. OEMs and Tier-1 suppliers are adopting RTLS to improve traceability, automate material handling, and enhance worker safety across massive, high-volume plants. The region’s cost-competitive manufacturing ecosystem, rising adoption of AGVs/AMRs, and increasing investments in Industry 4.0 accelerate RTLS deployment. Additionally, growing local solution providers and the availability of affordable hardware further boost adoption.

REGION

The Asia Pacific is expected to be the fastest-growing region across RTLS market in manufacturing & automotive during the forecast period

The Asia Pacific is witnessing the fastest adoption of RTLS as manufacturers prioritize real-time asset tracking, production line optimization, and error-free workflow management to stay competitive in global supply chains. The region’s booming export-driven industries automotive, electronics, and heavy machinery rely heavily on RTLS to streamline inventory movement and reduce downtime. Strong investment in smart industrial parks, along with favorable government digitalization incentives, further accelerates deployment. The availability of low-cost sensors and scalable RTLS platforms also makes implementation more feasible for both large factories and mid-sized manufacturers.

The Asia Pacific real-time location systems (RTLS) market is projected to reach USD 4.71 billion by 2030 from USD 1.64 billion in 2025, at a CAGR of 23.4% from 2025 to 2030. Market growth is expected to be driven by the development of cost-effective, application-specific RTLS solutions, particularly from agile startups in China and India, as well as the increasing use of RTLS tags for asset tracking to maximize return on investment in high-volume manufacturing and logistics hubs. However, the industry faces notable challenges, including escalating concerns about data security and privacy amid rising cyber threats, as well as the significant capital and maintenance costs associated with deploying in diverse, sprawling facilities across the region. These factors may pose barriers to adoption despite the substantial operational benefits offered by RTLS technology in enabling smart factories and supply chain resilience.

The RTLS market in North America is projected to reach USD 5.95 billion by 2030 from USD 2.76 billion in 2025, at a CAGR of 16.6% from 2025 to 2030. The regional market is expected to be driven the rising development of cost-effective, application-specific RTLS solutions, particularly from agile startups. Furthermore, the increasing use of RTLS tags for asset tracking to maximize return on investment contributes to the RTLS market growth in the region.

The Europe real-time location system (RTLS) market is anticipated to expand from USD 1.64 billion in 2025 to USD 4.71 billion by 2030, at a CAGR of 15.8% during the period from 2025 to 2030. This growth is facilitated by the development of cost-effective, industry-specific RTLS solutions from agile European start-ups and established vendors, as well as the increasing adoption of RTLS tags for asset and personnel tracking, thereby offering substantial return on investment across manufacturing, healthcare, and logistics sectors.

Real-time Location Systems (RTLS) Market: COMPANY EVALUATION MATRIX

In the RTLS market in manufacturing & automotive matrix, Securitas Technology and Zebra Technologies Corp. (Star) lead with a strong global presence and a comprehensive portfolio spanning various technologies of RTLS offerings. It also caters to various verticals, including manufacturing and automotive.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Securitas AB (Sweden)

- Zebra Technologies Corp. ( US)

- Impinj, Inc. (US)

- Siemens (Germany)

- Qorvo Inc. (US)

- Ubisense Ltd. (UK)

- Alien Technology, LLC (US)

- Quuppa (Finland)

- BlueIOT (Beijing) Technology Co., Ltd. (China)

- Litum (Turkey)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.03 BN |

| Market Forecast in 2030 (Value) | USD 2.94 BN |

| Growth Rate | 19.9% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: Real-time Location Systems (RTLS) Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM |

|

|

| Electronics/EV Battery Manufacturer |

|

|

| Heavy Machinery & Equipment Manufacturer |

|

|

RECENT DEVELOPMENTS

- September 2024 : Quuppa and ZulaFly formed a strategic partnership to integrate Quuppa’s high-precision RTLS technology with ZulaFly’s advanced healthcare asset and staff safety platform, aiming to revolutionize real-time location services in healthcare settings.

- November 2023 : Impinj, Inc. launched the R720 RAIN RFID reader. It has more processing power and memory than Impinj’s prior-generation reader and helps meet the most demanding requirements of large-scale enterprise deployments.

- November 2022 : Ricoh, a leading provider of imaging and electronic products, partnered with Zebra Technologies to implement Zebra’s RFID solution at its distribution centers in Gotemba, Kawasaki, and Osaka, Japan. This deployment significantly improved the tracking and retrieval of multiple secure digital (SD) cards, which are typically installed as part of the standard checking procedure in multifunction copiers and printers sent in for warranty claim processing.

Table of Contents

Methodology

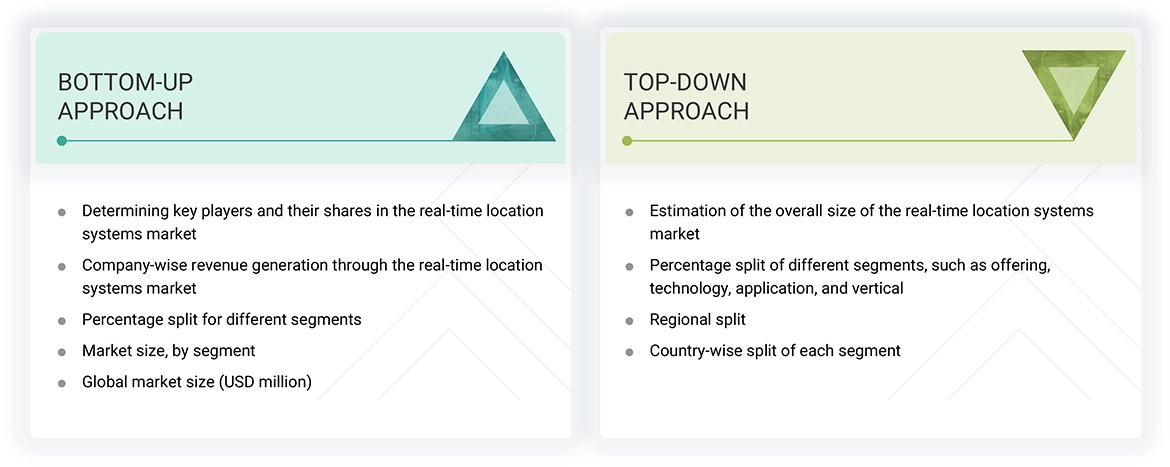

The study involved four major activities in estimating the current size of the real-time location systems (RTLS) market in manufacturing & automotive . Exhaustive secondary research has been conducted to gather information on the market, adjacent markets, and the overall RTLS landscape. These findings, along with assumptions and projections, were validated through primary research involving interviews with industry experts and key stakeholders across the value chain. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Subsequently, market breakdown and data triangulation techniques were applied to determine the sizes of various segments and subsegments. Two key sources, secondary and primary, were leveraged to conduct a comprehensive technical and commercial assessment of the RTLS market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect important information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the RTLS market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions: North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephone interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the RTLS market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Real-time Location Systems (RTLS) Market in Manufacturing & Automotive : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the RTLS market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

A real-time location system (RTLS) is designed to automatically detect, identify, and track the position of objects, individuals, or targets within a defined area with high precision. These systems typically comprise location tags or badges affixed to assets or worn by personnel, a network of readers, sensors, or access points strategically deployed across the facility, and a centralized software platform that processes and visualizes location data in real time. RTLS components communicate wirelessly, leveraging a range of enabling technologies such as radio-frequency identification (RFID), Wi-Fi, ultrasound, infrared (IR), Bluetooth Low Energy (BLE), or global positioning systems (GPS) to accurately determine movement and positioning. The core objective of RTLS is to deliver continuous visibility and situational awareness across sectors, including healthcare, manufacturing, logistics, warehousing, and transportation. By providing real-time tracking of high-value assets and personnel, RTLS helps organizations improve operational efficiency, ensure safety compliance, prevent loss or theft, streamline workflow, and optimize resource utilization, making it a critical tool for data-driven decision-making in dynamic operational environments.

Key Stakeholders

- RTLS Hardware Providers

- RTLS Software Providers

- RTLS-related Service Providers

- Government Bodies and Policymakers

- Industry-standard Organizations, Forums, Alliances, and Associations

- Market Research and Consulting Firms

- Raw Material Suppliers and Distributors

- Research Institutes and Organizations

- Testing, Inspection, and Certification Providers

- Distributors and Resellers

- End Users

Report Objectives

- To define, describe, and forecast the RTLS market in terms of offering, technology, application, and vertical

- To describe and forecast the market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of the RTLS market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the RTLS market

- To analyze opportunities for stakeholders by identifying high-growth segments of the RTLS market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, mergers, and acquisitions, adopted by key market players in the RTLS market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Real-time Location Systems (RTLS) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Real-time Location Systems (RTLS) Market