US Enteral Feeding Devices Market Size, Growth, Share & Trends Analysis

US Enteral Feeding Devices Market by Type (Nasogastric Tubes, Administration Sets, Nasal Feeding, Nasoduodenal, Syringes, Connectors), Insertion Method, Age Group (Adult, Pediatric), Application (Oncology, Hypermetabolism), End User - Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

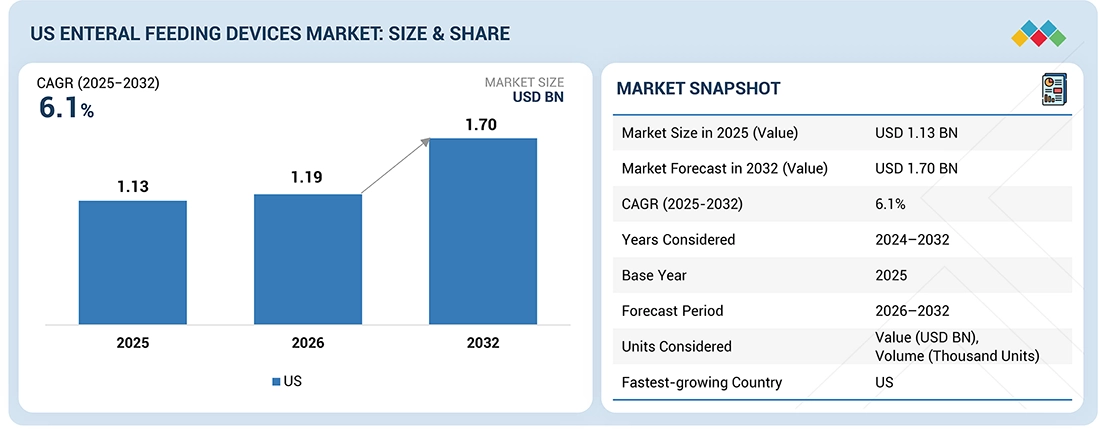

The US enteral feeding device market, valued at US$1.13 billion in 2025, stood at US$1.19 billion in 2026 and is projected to advance at a resilient CAGR of 6.1% from 2026 to 2032, culminating in a forecasted valuation of US$1.70 billion by the end of the period. The market will be driven by the aging population, favorable government initiatives, and opportunities in emerging markets. Material science and technological advancements have greatly enabled advancements and safety associated with enteral feeding devices. The adoption of advanced pump and monitoring systems will impact patient and caregiver benefits positively.

KEY TAKEAWAYS

-

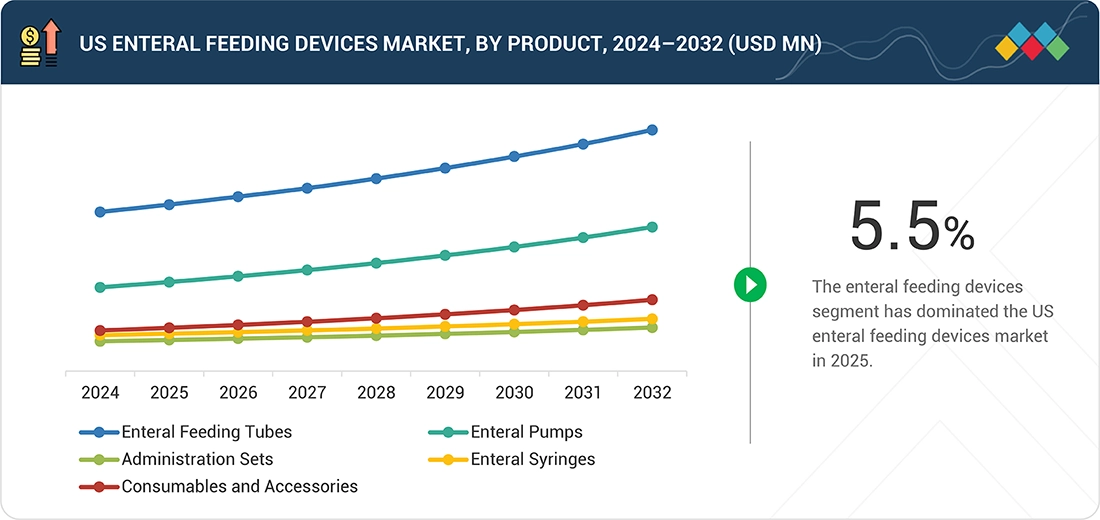

BY TYPEThe enteral feeding tubes segment accounted for the largest share of 45.3% in the enteral feeding devices market in 2025.

-

BY INSERTION METHODThe Transnasal, Transoral, and Percutaneous Endoscopic Insertion (PEG/PEJ) segment accounted for the largest share of 67.3% in 2024. It is expected to witness the highest CAGR of 6.5% during the forecast period from 2026-2032.

-

BY AGE GROUPThe Neonatal Patients segment is expected to witness the highest growth rate of 6.3% during the forecast period.

-

BY APPLICATIONThe Oncology segment has accounted for the largest share of 26.2% in 2024 in the US enteral feeding devices market.

-

BY END USERThe Home Care Settings segment is projected to have the highest CAGR of 6.7% from 2026 to 2032 in the US market for enteral feeding devices.

-

COMPETITIVE LANDSCAPE - MAJOR PLAYERSAvanos Medical, Inc. and Cardinal Health, Inc. represent star players in the US enteral feeding devices market for 2025, in terms of strong market presence, established product portfolios, and significant adoption of their respective offerings for enteral feeding.

-

COMPETITIVE LANDSCAPE - STARTUP/SMELuminoah, Inc. and Gravitas Medical Inc. are emerging companies among startups and SMEs, since their innovative approach will get noticed and bear growth potential within the ecosystem of the US market.

The growth of the enteral feeding devices market in US is fueled by the increasing prevalence of patients with conditions that limit their ability to feed orally due to advanced cancers, strokes, and swallowing dysfunction. Rising demand in elderly care due to comorbidities is also contributing to fueling demand for effective enteral nutritional support. Advances in technology, with better design capabilities to enhance patient comfort, integrated safety systems that reduce the risk of infection and misconnections, and internet capabilities for remote tracking, are contributing towards advancements in clinical and home settings. Higher coverage in population accessible to healthcare resources, better insurance coverage for reimbursement of nutritional therapies, and greater awareness regarding effective care in preventative measures are further contributing toward acceptance and adoption of enteral nutritional support solutions.

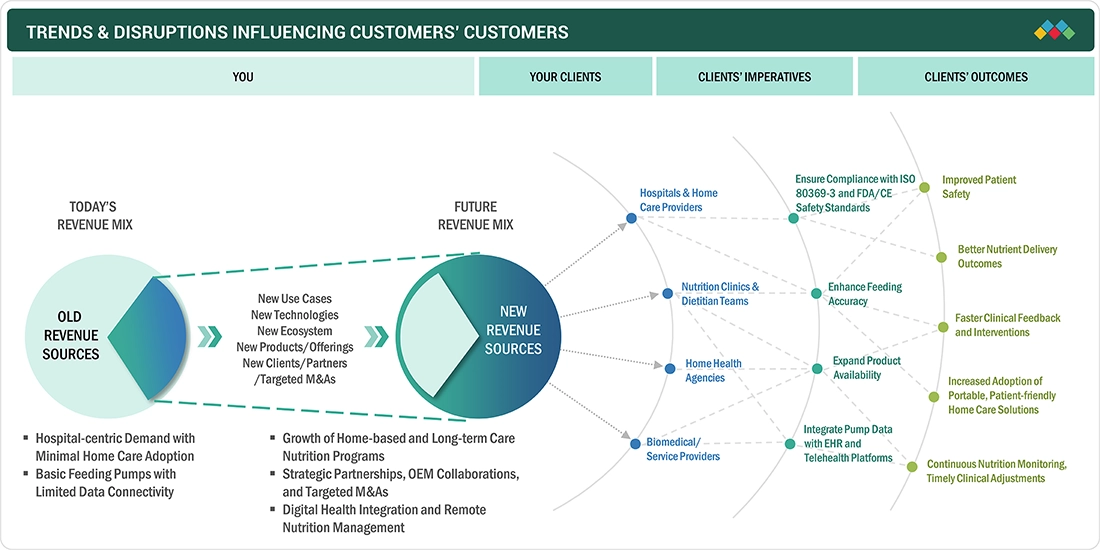

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Technological innovations in the US enteral feeding devices market include smart feeding pumps for real-time monitoring, ENFit safety connectors, and low-profile gastrostomy devices. They help enhance patient comfort and reduce complications. Broader adoption of home health care, rise in chronic diseases prevalence, an aging population, and supportive reimbursement policies are driving home use and clinical adoption of enteral feeding solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing Prevalence of Chronic and Critical Illnesses

-

Rising Geriatric Population

Level

-

Complications Associated with Enteral Feeding Devices

-

Regulatory Compliance and Product Recalls

Level

-

Growing Awareness and Training Programs

-

Emerging Market Penetration

Level

-

Shortage of Intubation Specialists

-

Insufficient Reimbursement Policies in Emerging Economies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing Prevalence of Chronic and Critical Illnesses

In the US, many patients suffering from conditions like, cancer, stroke, chronic obstructive pulmonary disease (COPD), neurological disorders, and gastrointestinal conditions, which eventually develop difficulty swallowing or diminished gastrointestinal function, which places a high demand for nutritional support through enteral routes. More and more patients in hospitals, intensive care, long-term care facilities, and home care require appropriate and safe enteral feeding systems, thereby helping to reinforce the market growth and adoption rate.

Restraint: Complications Associated with Enteral Feeding Devices

Within the US market, complications arising from enteral feeding devices, such as tube obstruction, dislodgement, leakage, aspiration pneumonia, local infections, and gastrointestinal intolerance, may increase patient discomfort and healthcare costs, thereby acting as an impediment to widespread adoption. Moreover, improper tube placement and associated clinical monitoring needs may increase complications and act as a barrier to the adoption of enteral feeding devices, particularly within the home healthcare setting with limited expertise.

Opportunity: Growing Awareness and Training Programs

Opportunities for the US enteral feeding devices market primarily arise due to advancements being made in portable enteral feeding pumps. Advancements in materials, such as the use of materials like silicone and ENFit connectors, and wireless functionality, are creating opportunities for growth. Awareness about nutrition and developments within various healthcare facilities are also encouraging the adoption of enteral feeding devices in the US market.

Challenge: Shortage of Intubation Specialists

Resource constraint is a major challenge to the US enteral feeding devices market. It also experiences a shortage of trained professionals to support placement, management, and ongoing monitoring, which can result in postponement of treatment initiation and poor outcomes. Reimbursement is generally more structured compared to low-income regions; however, some complexity remains in insurance coverage and varied policies from payers for certain enteral nutrition procedures and technologies.

US ENTERAL FEEDING DEVICES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Manufactures full range of enteral feeding pumps, tubes, and nutrition formulas for hospital and home care settings, ensuring safe enteral delivery for critically ill and long-term patients | Reliable nutritional support| Reduced feeding interruptions| Enhanced patient recovery outcomes through integrated feeding systems |

|

Provides enteral feeding tubes, extension sets, and accessories, designed for precise feeding and medication delivery in acute and home environments | Accurate flow control| Reduced risk of misconnections via ENFit technology| Enhanced patient comfort and safety |

|

Offers enteral access devices for safe tube placement and long-term enteral nutrition for adult and pediatric populations | Improved placement accuracy |Lower complication rates| Long-term usability promoting patient mobility and quality of care |

|

Supplies specialized medical nutrition products and enteral tubes designed for disease-specific conditions, including oncology, neurology, and geriatrics | Supports better clinical outcomes| Maintains nutritional status| Complements enteral feeding hardware for complete nutritional therapy |

|

Develops enteral feeding syringes, pumps, tubes, and administration sets for precision and hygiene in intensive care and home care setups | Enhanced dosing accuracy| Robust build for hospital-grade use| Improved infection prevention with closed feeding systems |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The US enteral feeding devices market ecosystem comprises advanced medical device companies, healthcare facilities, and an enabling regulatory structure that sustains safety and innovation. The market drivers include an increase in the prevalence rate of chronic disorders, advances within portable pumps and flexible tubes, and adoption within hospitals, long-term care facilities, and home care services.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Enteral feeding devices market, by product

The enteral feeding tubes segment accounts for the most significant market share in the US market, as these tubes are quite simple devices required for feeding patients who are incapable of taking food orally. Examples of these tubes include nasogastric, orogastric, PEG, and jejunostomy tubes. The large prevalence rates of various chronic disorders and common usage among all age groups fuel demand for feeding tubes.

Enteral feeding devices market, by insertion method

Transnasal, transoral, and percutaneous endoscopic insertion (PEG/PEJ) segment leads in the US market and is also growing at the highest CAGR, as these methods strike a balance between clinical efficacy and comfort for the patients. PEG/PEJ procedures combine long-term enteral access with minimally invasive techniques, making them widely favored both in hospitals and for home care. Their established usage in intensive care, oncology, and neurology wings propels this segment to dominance.

Enteral feeding devices market, by age group

The neonatal patients market is also forecasted to expand at the highest growth rate, due to an increase in survival rates among preterm neonates and because these neonates have partially developed feeding capabilities. Therefore, they often require tube feeding. Consequently, there will be a demand for small, specific enteral devices for neonates.

Enteral feeding devices market, by application

The oncology segment has the largest share in the US because many cancer patients have dysphagia, cachexia, or treatment-related difficulties with feeding, hence requiring enteral feeding support to maintain nutritional status. Enteral devices are integrated into supportive and palliative care regimens to help improve treatment tolerance and outcomes, thereby increasing their adoption in oncology units.

Enteral feeding devices market, by end user

Home care settings are anticipated to have the highest CAGR due to an increasing number of patients with chronic disorders requiring lifelong nutrition, who are migrating from hospital settings to home settings. Improvements are being made in portable pumps, simple tubes, and staff expertise, making enteral nutrition feasible and safe at home.

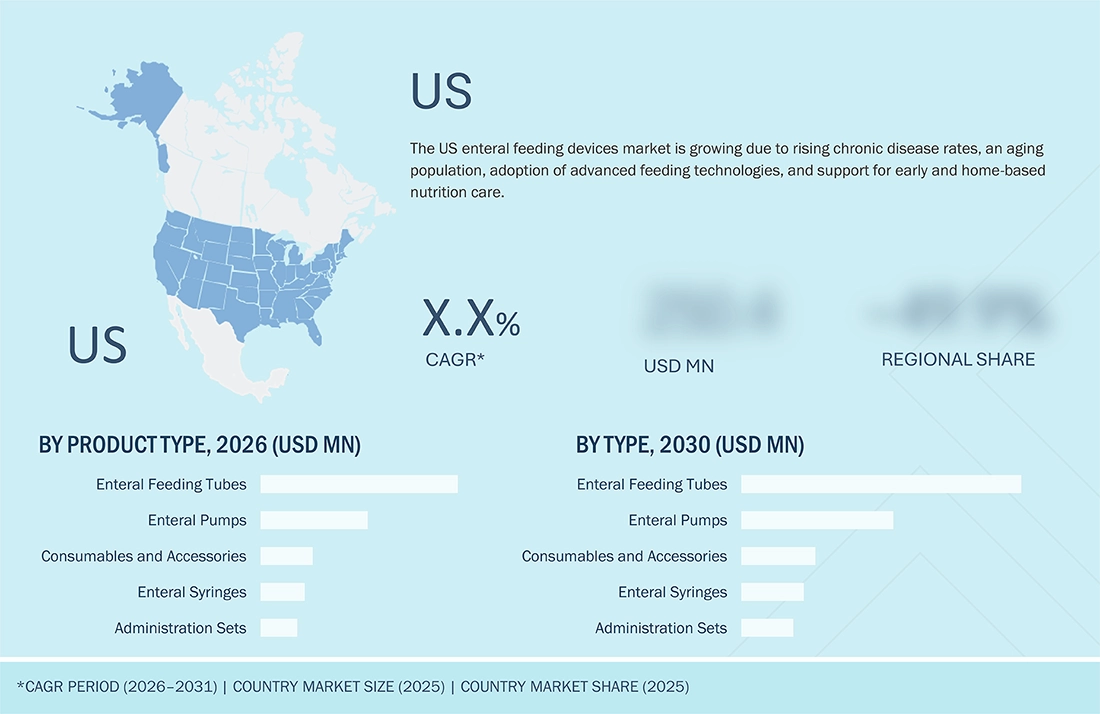

REGION

US to grow at 6.2% CAGR during the forecast period

The presence of chronic conditions, such as cancer, stroke, and gastrointestinal disorders that restrict oral intake and increase reliance on alternative nutritional support, has resulted in increased demand. The high prevalence of chronic diseases requires more conservative management with enteral nutrition. An increasing population of geriatric patients with difficulty in swallowing results in significant adoption of feeding pumps and tubes. The country has a robust healthcare infrastructure and favorable policies for home-based care.

US ENTERAL FEEDING DEVICES MARKET: COMPANY EVALUATION MATRIX

Fresenius Kabi (Star) has a competitive product portfolio offering advanced feeding solutions, precision pumps, and various feeding tubes. Its products highly emphasize safety. Becton, Dickinson and Company, commonly known as BD (Emerging Leader), continues to develop advancements in enteral devices and invests significantly in R&D.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Cardinal Health (US)

- Avanos Medical (US)

- Becton, Dickinson and Company (US)

- Abbott Laboratories (US)

- Baxter International (US)

- Boston Scientific Corporation (US)

- Cook Medical (US)

- Conmed Corporation (US)

- Moog Inc. (US)

- Hollister Incorporated (US)

- Amsino International (US)

- Teleflex Incorporated (US)

- B. Braun SE (Germany)

- Fresenius Kabi (Germany)

- Danone S.A. (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 1.13 BN |

| Market Forecast in 2032 (Value) | USD 1.70 BN |

| CAGR (2025-2032) | 6.1% |

| Years Considered | 2024–2032 |

| Base Year | 2025 |

| Forecast Period | 2026–2032 |

| Units Considered | Value (USD BN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | United States |

| Parent & Related Segment Reports |

Enteral Feeding Devices Market Europe Enteral Feeding Devices Market LATAM Enteral Feeding Devices Market APAC Enteral Feeding Devices Market |

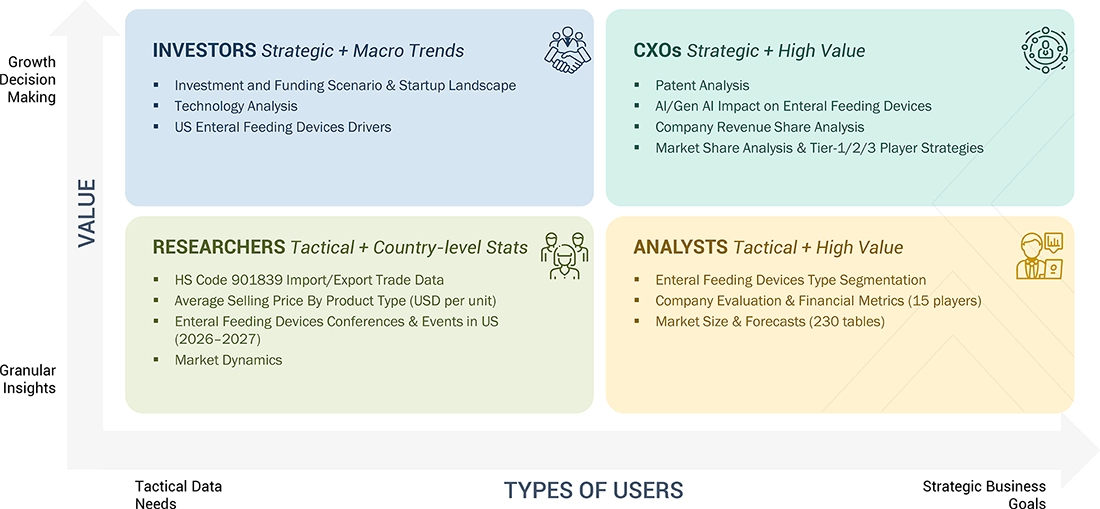

WHAT IS IN IT FOR YOU: US ENTERAL FEEDING DEVICES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Detailed assessment of enteral feeding devices by type, application, age group, insertion method | Analysis of emerging trends such as smart, connected pumps & remote monitoring, personalized nutrition & smart dosing, compact, portable and user-friendly pumps for home & ambulatory use, and low-profile & pediatric/neonatal specialized tubes |

| Company Information | Comprehensive profiles of major players such as Cardinal Health, Fresenius Kabi, Avanos, Danone, B Braun, Boston Scientific Corporation, Nestle, and others | Identification of strategic partnerships, collaborations, licensing agreements, and mergers & acquisitions in US enteral feeding devices market |

| Geographic Analysis |

|

|

RECENT DEVELOPMENTS

- February 2025 : Cardinal Health launched the Kangaroo OMNI enteral feeding pump, a new and advanced model with the ability to deliver customized and precise feeding through greater safety and ease of use functions.

- November 2024 : Avanos Medical, Inc. launched the CORGRIP SR Nasogastric/Nasointestinal Tube Retention System. The product improves tube stability and patient comfort for enteral feeding.

- January 2024 : Cardinal Health acquired Specialty Networks for USD 1.2 billion. With this acquisition, it added technologically enabled capabilities and services that focus on enhancing care coordination.

- September 2023 : Cardinal Health launched its Kangaroo OMNI enteral feeding pump in the US, with sophisticated and customizable functionalities.

Table of Contents

Methodology

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the comprehensive use of secondary sources, directories, databases (such as Factiva, Bloomberg Businessweek, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the US Enteral Feeding Devices Market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. Moreover, a database of the key industry leaders was prepared using secondary research.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and related key executives from various companies and organizations in US Enteral Feeding Devices Market. The primary sources from the demand side include medical OEMs, analytical instrument OEMs, CDMOs, and service providers. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on industry trends & market dynamics.

Market Size Estimation

In this report, the size of the US Enteral Feeding Devices Market was determined using revenue analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the enteral feeding device business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. Meanwhile, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the US Enteral Feeding Devices Market

- Mapping annual revenues generated by major global players from the US Enteral Feeding Devices Market (or nearest reported business unit/product category)

- Revenue mapping of key players to cover a major share of the global market as of 2024

- Extrapolating the global value of the US Enteral Feeding Devices Market

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the US Enteral Feeding Devices Market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the US Enteral Feeding Devices Market was validated using top-down and bottom-up approaches.

Market Definition

Enteral feeding devices are instruments and configurations designed for nutrition administration directly into the gastrointestinal tract, bypassing the mouth. These devices serve medically challenged patients who cannot eat food orally due to swallowing disorders, severe illnesses, or surgical interferences. Enteral feeding can be accomplished through the insertion of tubes from the nose or mouth, which are then placed into the stomach or small intestine to deliver nutrients.

Stakeholders

- Manufacturers and Distributors of Enteral Feeding Devices

- Ambulatory Surgical Centers

- Home Care Facilities

- Healthcare Institutions (Hospitals and Cardiac Centers)

- Research Institutions

- Research and Consulting Firms

- Contract Research Organizations (CROS) and Contract Manufacturing Organizations (CMOS)

- Academic Medical Centers and Universities

- Market Research and Consulting Firms

- Clinical Research Organizations

- Group Purchasing Organizations (GPOs)

- Academic Medical Centers and Universities

- Accountable Care Organizations (ACOs)

Report Objectives

- To define, describe, and forecast the US Enteral Feeding Devices Market on product, age group, application, and end user

- To identify and analyze drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micro markets concerning individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key market players and comprehensively analyze their market shares and core competencies

- To forecast the revenue of market segments concerning five regions, namely North America (US and Canada), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa (GCC and Rest of Middle East & Africa)

- To analyze competitive developments such as acquisitions, agreements, collaborations, expansions, partnerships, and product launches/approvals in the US Enteral Feeding Devices Market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Enteral Feeding Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Enteral Feeding Devices Market