US Veterinary Diagnostics Market Size, Growth, Share & Trends Analysis

US Veterinary Diagnostics Market by Application (Infectious, Bacterial, Endocrine), Technology (Immunodiagnostic, PCR, ELISA, Lateral Flow), Product (Consumables, Instruments), Animal Type (Dog, Cat, Cattle), End User (POC, Veterinary Labs) – Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The US veterinary diagnostics market, valued at USD2.22 billion in 2025, stood at USD2.41 billion in 2026 and is projected to advance at a resilient CAGR of 9.1% from 2026 to 2031, culminating in a forecasted valuation of USD3.74 billion by the end of the period. The market studies specialized tools, kits, and technologies for disease testing, monitoring, and prevention in animals. Pet ownership is increasing in the US and this has led to increased expenditure on animal healthcare, combined with the increasing disease burden caused by infectious and chronic diseases borne by companion and livestock populations. Additionally, there have been constant advancements in molecular diagnostics and rapid testing kits, resulting in enhanced accuracy and efficiency of these tests. These factors are driving the market growth. Moreover, support from government and regulatory initiatives for animal health management is encouraging the setup of veterinary clinics and veterinary reference laboratories, thus driving growth of the market.

KEY TAKEAWAYS

-

By ProductThe instruments segment is projected to register a higher growth (10.4%) than the consumables segment during the forecast period.

-

By TechnologyThe immunodiagnostics segment is estimated to dominate the market with a share of 35.8% in 2026.

-

By Animal TypeThe companion animals segment is estimated to account for the largest share (69.2%) in 2026.

-

By ApplicationThe infectious diseases segment accounted for the largest share during in 2025.

-

By End UserThe veterinary reference laboratories segment dominated the market in 2025.

-

Competitive Landscape - Key PlayersIDEXX Laboratories, Inc., Zoetis Services LLC, and Thermo Fisher Scientific Inc. were identified as star players in the veterinary diagnostics market, given their global distribution network and product footprint.

-

Competitive Landscape - StartupsRandox Laboratories Ltd., BioChek, and Fassisi, GmbH, among others, have distinguished themselves among startups and SMEs by due to their strong product portfolio and business strategy.

The growth of the US veterinary diagnostics market is driven by rising pet ownership, increasing demand for advanced animal healthcare, and continuous innovation in diagnostic technologies. Tools such as immunodiagnostics, molecular tests, and clinical biochemistry analyzers are finding an ever-increasing application for accurate disease detection, timely intervention, and improved treatment outcomes. The increasing incidence of infectious and chronic conditions in companion and food animals, along with increasing emphasis on preventive care, is further contributing to the increased usage of diagnostic tools. Moreover, the expansion of veterinary clinics combined with reference laboratories, increased expenditure on animal health, and rapid and point-of-care testing solutions are improving efficiency and accessibility in veterinary diagnostics. With a growing global animal patient base and enhanced focus on early and precise diagnosis, veterinary diagnostics are set to shape the future of animal healthcare delivery.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The US veterinary diagnostics market's growth is driven by need for increased high-throughput automation in labs, expansion of in-clinic and point-of-care testing, and digitally enabled ecosystems combining AI, molecular diagnostics, and integrated reporting. These technology disruptors offer faster results, greater precision, fewer retests, and earlier interventions. Additionally, they improve the potential for quicker diagnosis-to-treatment timelines, more favorable prognoses, and increased on-the-spot answers inside a single visit all while speeding research translation into real-world care. All these trends are expected to boost the growth of the market in the coming years.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in population of companion animals

-

Increasing demand for animal-derived food products

Level

-

Rising cost of pet care

Level

-

Integration of AI and ML

Level

-

Workforce shortage

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in population of companion animals

Increased population of companion animals is a primary factor driving growth in the market. Pet ownership drives the need for routine health checkups, preventive screenings, and early detection of diseases. As pet owners look for a better quality of life for their pets, they are willing more on their well-being and health. This results in the use of diagnostic consumables and instruments.

Restraint: Rising cost of pet care

A major restraint in the US veterinary diagnostics market is the rising cost of keeping pets. Owing to all these rising expenses, including day to day veterinary check ups, advanced diagnostic tests, imaging, as well as laboratory services, pet health has become unbearable for many. As a result, some pet owners choose to delay or dispel diagnostic procedures in favor of basic care or symptomatic treatment. This cost sensitivity, especially among households without pet insurance, restricts the adoption of even advanced preventive diagnostic solutions, thus restricting total market growth despite increasing pet ownership and awareness in animal health.

Opportunities: Integration of AI and ML

AI-driven automation can facilitate the analysis of samples and their interpretation and reporting, thus decreasing manual workload and reliance on scarce specialist expertise. Through improving diagnostic accuracy, prioritizing urgent cases, and aiding within clinical decision-making, machine learning models can enable clinics and laboratories to accommodate a larger volume with existing staffing while increasing turnaround time and consistency of output of results.

Challenges: Workforce shortage

One of the primary challenges to the growth of the US veterinary diagnostics market is shortage of workforce, which includes trained veterinarians, technicians, and laboratory staff. This talent gap creates workload pressure and limits diagnostic throughput, while lengthening turnaround times for test results. Such clinics and laboratories cannot completely utilize advanced new technology; and this challenge impacts the overall efficiency, quality of service, and patient outcomes.

US VETERINARY DIAGNOSTICS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers a wide range of in-clinic analyzers such as the Catalyst One Chemistry Analyzer and ProCyte One Hematology Analyzer, along with comprehensive reference laboratory services | Rapid and reliable results | Reduced reliance on external labs | Improved treatment outcomes | Enhanced workflow efficiency for clinics |

|

Provides point-of-care diagnostic analyzers for blood chemistry, hematology, and immunoassays through its VETSCAN product line | Designed for small animal, equine, and exotic practices, with cloud-based connectivity for seamless data sharing | Faster in-clinic decision-making | Enhanced connectivity with digital platforms | Reliable results across a broad range of species |

|

Provides advanced molecular, histopathology, and genetic testing | Offers KeyScreen GI Parasite PCR, a leading solution for comprehensive gastrointestinal parasite detection using molecular diagnostics | Highly sensitive detection | Early identification of parasites | Reduced misdiagnosis | Improved preventive care strategies |

|

Offers rapid diagnostic test kits for companion animals and livestock, including solutions for diseases like parvovirus, feline leukemia, and bovine respiratory infections | Reliable point-of-care detection | Support for large-scale herd monitoring | Reduced disease transmission risks |

|

Provides advanced in-house veterinary diagnostic analyzers, such as the BC-5000Vet Hematology Analyzer and BS-240Vet Chemistry Analyzer, tailored for animal healthcare | Cost-effective diagnostics | Quick turnaround | Scalable solutions for different clinic sizes | Robust performance for high sample volumes |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The US veterinary diagnostics market ecosystem comprises diagnostic solution manufacturers that lend their prowess in developing state-of-the-art diagnostic instruments, reagents, and test kits to drive innovation. It also comprises end users, including veterinary professionals, hospitals, and clinics that use these diagnostic products on a large scale. Another vital participant of the ecosystem are regulatory bodies and agencies. These institutions uphold quality and safety of products and ensure compliance standards are adhered to.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Veterinary Diagnostics Market, By Product

By product, the consumables segment is projected to lead the US veterinary diagnostics market as these consumables are used repeatedly in routine testing, including reagents, test kits, and cartridges. Their frequent replacement and wide applicability across multiple diagnostic procedures, from infectious disease screening to hematology and biochemistry tests, drive consistent demand, making consumables a dominant revenue contributor in the market. Additionally, the growing emphasis on preventive care and point-of-care testing further fuels the need for consumables, as these tests require regular use of diagnostic kits and reagents to ensure accurate and timely results.

US Veterinary Diagnostics Market, By Technology

By technology, the immunodiagnostics segment dominated the overall US veterinary diagnostics market in 2025. This technology enables rapid, accurate, and cost-effective detection of a wide range of infectious and chronic diseases in companion and livestock animals. Its broad applicability across various disease types, ease of use, and suitability for point-of-care and in-house testing makes it a preferred choice for veterinary clinics, hospitals, and reference laboratories. Additionally, the growing focus on preventive care and early disease detection further drives the adoption of immunodiagnostic tools, reinforcing their dominant position in the market.

US Veterinary Diagnostics Market, By Animal Type

By animal type, the companion animals segment accounted for the largest share in 2025 in the US veterinary diagnostics market due to the rising pet ownership and increased spending on pet healthcare. Companion animals, specially dogs and cats receive regular health checkups, preventive screenings, and early disease detection tests, which require frequent use of diagnostic instruments and consumables. Additionally, the growing awareness among pet owners regarding the importance of timely and accurate diagnostics further reinforces the dominance of the companion animals segment in the market.

US Veterinary Diagnostics Market, By Application

By application, the infectious diseases segment is projected to account for the largest share during the forecast period as these diseases pose significant risks to companion and livestock animals, leading to high morbidity and mortality if left undetected. Early and accurate diagnosis of infections, such as parvovirus, canine distemper, bovine tuberculosis, and avian influenza, is critical for timely treatment and prevention of outbreaks. additionally, the growing awareness regarding zoonotic diseases, rising pet ownership, and the economic impact of livestock infections further drive the demand for reliable infectious disease diagnostic solutions, which is further driving the growth of the segment.

US Veterinary Diagnostics Market, By End User

By end user, the veterinary reference laboratories segment accounted for the largest share of the US veterinary diagnostics market in 2025. These laboratories offer specialized testing services with advanced instruments and high-throughput capabilities that many clinics cannot provide in-house. They cater to companion animals and livestock, handling complex and routine diagnostic tests. Additionally, the increasing focus on accurate, timely, and preventive animal healthcare reinforces the reliance on reference laboratories, making it a dominant segment in the market.

REGION

US to be fastest-growing country in US Electrosurgery market during forecast period

The growing U.S. electrosurgery market is primarily driven by the accelerated adoption of Minimally Invasive Surgery (MIS) across specialties, combined with continuous technological integration of advanced features like AI-guided systems and robotics for superior precision and safety. This expansion is sustained by the rising volume of surgical procedures due to the aging population and the increasing number of procedures performed in cost-effective clinical settings.

US VETERINARY DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX

In the US veterinary diagnostics market evaluation matrix, DEXX Laboratories, Inc. (Star) has a solid global presence. It offers a comprehensive range of diagnostic instruments, reagents, and test kits, which ensure widespread acceptability in veterinary clinics, hospitals, and reference laboratories. Shenzhen Mindray Animal Medical Technology Co., Ltd. (Emerging Leader) is also gaining traction with innovative diagnostics developed for veterinary applications and positioned for rapid growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IDEX Laboratories, Inc. (US)

- Zoetis Services LLC (US)

- Thermo Fisher Scientific Inc. (US)

- Amtech Diagnostics, Inc. (US)

- bioMérieux (France)

- Neogen Corporation (US)

- Bio-Rad Laboratories, Inc. (US)

- Virbac (France)

- FUJIFILM Holdings Corporation (Japan)

- Shenzhen Mindray Animal Medical Technology Co., Ltd. (China)

- INDICIAL BIOSCIENCE GmbH (Germany)

- Bio Note (South Korea)

- Biogas (Israel)

- Agrotato S.p.A. (Italy)

- Innovative Diagnostics (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 2.22 BN |

| Market Forecast in 2031 (Value) | USD 3.74 BN |

| CAGR | CAGR of 9.1% from 2026–2031 |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD BN), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | US |

| Parent & Related Segment Reports | Veterinary Diagnostics Market |

WHAT IS IN IT FOR YOU: US VETERINARY DIAGNOSTICS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | In-depth assessment of veterinary diagnostic solutions by product type (immunodiagnostics, clinical biochemistry, hematology, molecular diagnostics, urinalysis, microbiology, imaging diagnostics), testing approach (in-clinic/POC vs. reference lab), and animal type (companion animals, livestock) | Analyze emerging trends, including AI-driven diagnostic interpretation, point-of-care analyzers, cloud-based data integration, next-generation sequencing (NGS), and rapid infectious disease panels improving response times and clinical decision-making |

| Company Information | Comprehensive profiles of major players active in the US market, including IDEXX Laboratories, Zoetis, Thermo Fisher Scientific, Randox, Neogen, and other laboratory networks and device providers | Identify strategic partnerships with veterinary hospital chains, R&D collaborations, new product approvals, distributor expansions, and mergers & acquisitions influencing competitive dynamics in the US diagnostics space |

| Geographic Analysis | Regional demand mapping across key US zones (Northeast, South, Midwest, West), with focus on companion animal hubs, livestock-centric states, and high-service-density veterinary networks; evaluation of regulatory and reimbursement environments | Study regional outlook presenting growth opportunities driven by rising pet healthcare spending, expanding specialty veterinary services, livestock disease surveillance programs, adoption of tele-diagnostics, and increased penetration of digital reporting and remote sample processing |

RECENT DEVELOPMENTS

- June 2025 : bioMérieux introduced VETFIRE, a ready-to-use PCR kit designed specifically for equine infectious respiratory diseases. The kit would enable the simultaneous detection of seven different respiratory pathogens in horses.

- May 2025 : Zoetis Services LLC inaugurated a new Diagnostics Reference Laboratory at the UPS Healthcare Labport facility. The facility features expanded capacity and improved logistics. It is designed to meet the growing demand for veterinary diagnostic services and support more efficient testing and delivery across the region.

- January 2025 : IDEXX Laboratories, Inc. introduced IDEXX Cancer Dx, a diagnostic panel aimed at the early detection of lymphoma in dogs. This blood test can be incorporated into panels for ill pets and included as part of routine annual wellness screenings.

- July 2024 : BioNote USA Inc. formed a partnership with MWI Animal Health to distribute its products, including a line of immunofluorescence assay analyzers. This collaboration is expected to significantly expand BioNote’s reach, enabling wider availability of its diagnostic solutions across veterinary clinics and laboratories.

Table of Contents

Methodology

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

This research study used widespread secondary sources; directories, databases such as Dun & Bradstreet, Bloomberg BusinessWeek, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the US pulse oximeters market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends, to the bottom-most level, geographic markets, and key developments related to the market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, and chief medical information officers related to the veterinary diagnostic market. Primary sources from the demand side include veterinary healthcare professionals from hospitals, clinics, reference laboratories, and research institutes.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the US veterinary diagnostics market includes the following details.

The market sizing was undertaken from the global side.

Country-level Analysis: The size of the US veterinary diagnostics market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall US veterinary diagnostics market was obtained from secondary data and validated by primary participants to arrive at the total US veterinary diagnostics market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic evaluation was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, industry experts contacted during primary research validated the assumptions and approaches. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall US veterinary diagnostics market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

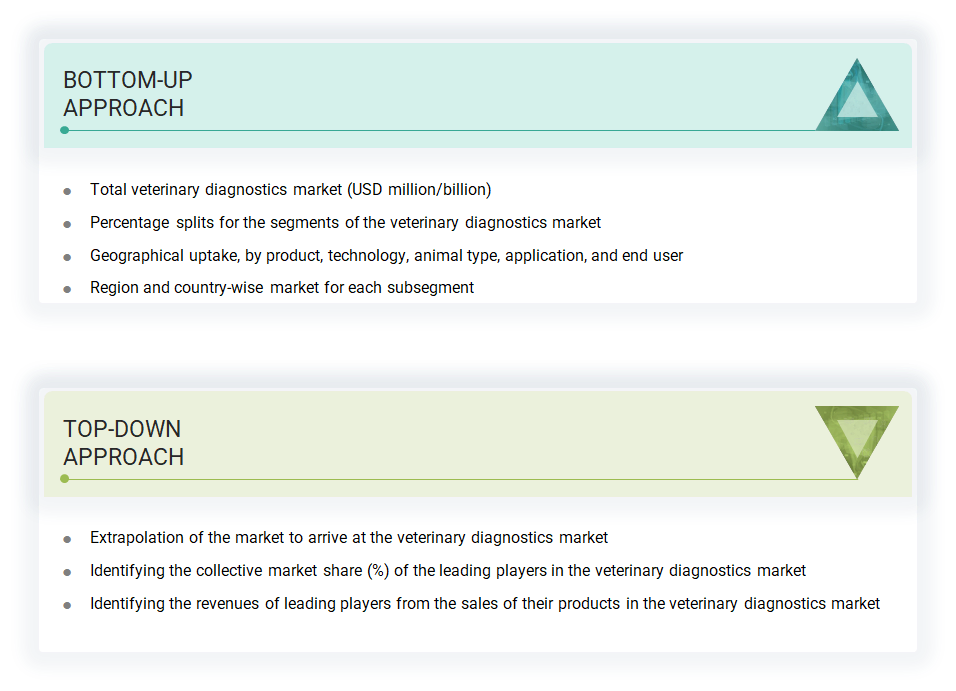

US Veterinary Diagnostics Market Size: Top-Down & Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures described below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying different factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Veterinary diagnostics refers to the diagnosis of animal diseases and disorders using various veterinary diagnostic test kits, tools, and instruments such as clinical chemistry analyzers, hematology analyzers, glucose monitoring systems, urine analyzers, blood gas-electrolyte analyzers, and ELISA test kits.

The veterinarian mainly orders veterinary diagnostic tests to identify parasites, bacteria, viruses, and other disease-causing microbes in companion animals or livestock. Improvements in consumables enable precise detection despite limitations observed by other tests. For instance, a diagnostic test using a new, improved fecal detection test kit by IDEXX Laboratories eliminates the limitations of egg shedding identification. It reduces false-positive cases when diagnosing hookworm antigens in the companion animal intestine. Thus, veterinary diagnostic tests are ordered for all kinds of ailments to enable effective detection and help in treatment planning and decision making by the veterinarian and the companion animal owner.

Stakeholders

- Senior Management

- Veterinary Diagnostic Companies

- Veterinary Clinics & Hospitals

- Pet Owners and Livestock Farmers

- Reference Laboratories

- Veterinarians & Veterinary Technicians

- Animal Health Organizations and NGOs

- Regulatory Authorities

- Research Institutes & Universities

- Distributors & Supply Chain Partners

- Investors & Strategic Partners

Report Objectives

- To define, describe, and forecast the US veterinary diagnostics market by product, technology, animal type, application, end user, and region.

- To provide detailed information about the key factors influencing market growth, such as drivers, restraints, opportunities, challenges, and industry trends

- To strategically analyze the regulatory scenario, Porter’s five forces analysis, value chain analysis, supply chain analysis, ecosystem map, recession impact, and patent analysis

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall US veterinary diagnostics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To strategically profile the key players in this market and comprehensively analyze their market shares and core competencies.

- To track & analyze competitive developments such as acquisitions, product launches, partnerships, and expansions in the US veterinary diagnostics market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Veterinary Diagnostics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Veterinary Diagnostics Market