Vapor Recovery Units Market

Vapor Recovery Units Market by Type (Adsorption, Absorption, Condensation, and Membrane Separation), Application (Processing, Storage, and Transportation), End-use Industry (Oil & Gas, and Chemicals & Petrochemicals), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

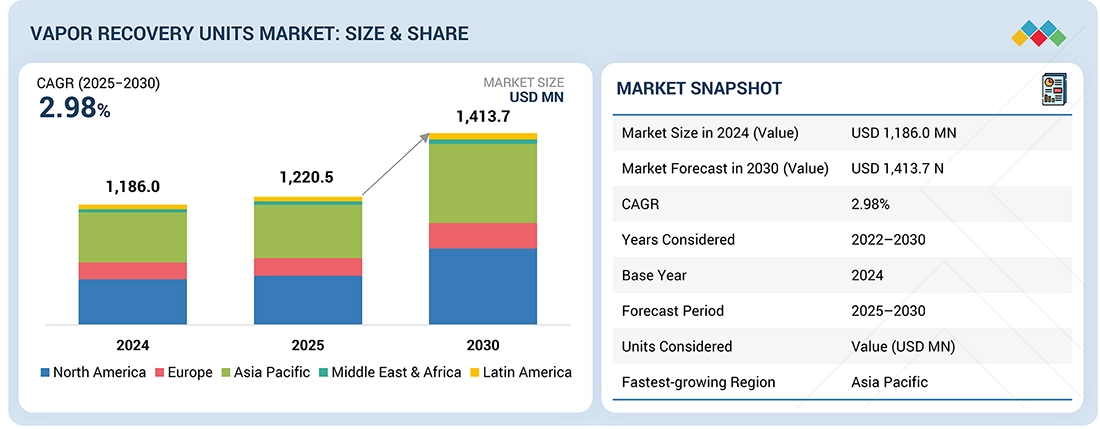

The vapor recovery unit market is anticipated to expand from USD 1220.5 million in 2025 to USD 1413.7 million in 2030 with a compound annual growth rate (CAGR) of 2.98%. The prospects of this market appear promising as the industries are progressively dedicated to emission reduction and compliance with regulations. With increased environmental awareness and more stringent air quality standards, more demand for efficient vapor recovery technology is emerging. Also, emphasis on hydrocarbon recovery, energy efficiency, and sustainability is fueling market growth. Diversification of the oil and gas, chemical, and petrochemical industries, and the technological advances in vapor recovery technologies, will continue to ensure gradual growth of the market in the future.

KEY TAKEAWAYS

-

BY TYPEThe market is segmented by type into adsorption, membrane seperation, condensation, absorption, each offering distinct advantages. Adsorption units utilize porous materials to capture vapors, while membrane separation employs selective barriers for gas separation. Condensation systems cool vapors to recover valuable liquids, and absorption methods use liquid solvents to remove unwanted emissions. As industries prioritize regulatory compliance and environmental responsibility, the market is shifting toward advanced and energy-efficient vapor recovery unit technologies, aligning with sustainability goals and strict emission regulations.

-

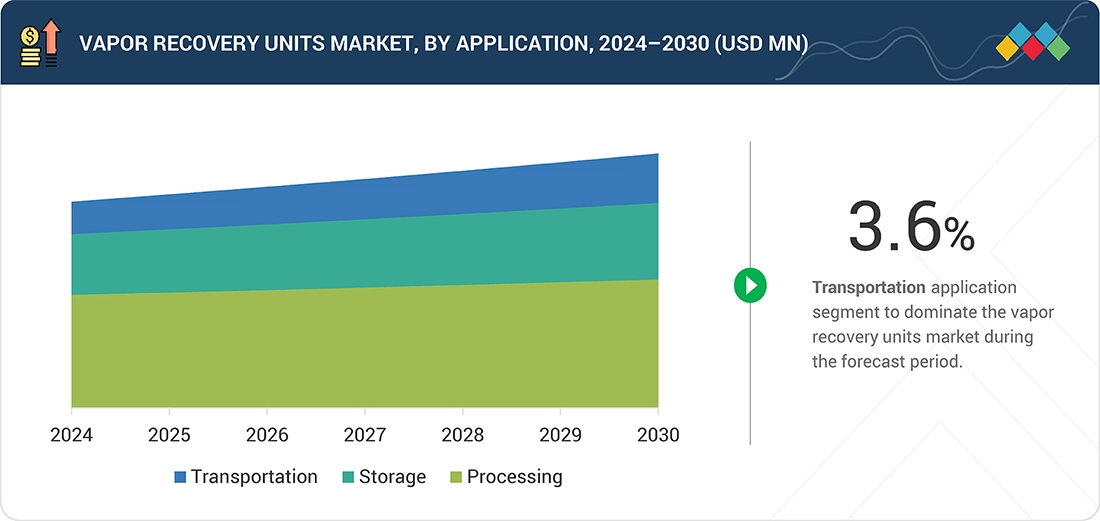

BY APPLICATIONThe market is segmented by application into processing, storage, and transportation. Vapor recovery units are essential for minimizing emissions, recovering hydrocarbons, and ensuring compliance across processing, storage, and transportation applications. VRUs capture VOCs in refineries and chemical plants in processing, optimizing efficiency. They prevent vapor losses from tanks for storage, enhancing safety and sustainability. In transportation, VRUs recover displaced vapors during the loading/unloading of tankers, railcars, and marine vessels, reducing emissions. With advancements in automation and energy efficiency, VRUs play a critical role in regulatory compliance, cost savings, and environmental protection, driving market growth.

-

BY END-USE INDUSTRYThe market is segmented by end-use industry into oil & gas, chemicals & petrochemicals , and other end-use industries. In the oil & gas sector, VRUs efficiently capture volatile organic compounds (VOCs) in refineries, processing facilities, and storage terminals, optimizing operational efficiency and reducing environmental impact. Within the chemical & petrochemical industry, VRUs mitigate vapor losses from storage tanks and production units, enhancing sustainability and safety. In pharmaceuticals, these systems help control emissions from solvent-based processes, while in landfills, VRUs recover methane and other gases, promoting energy recovery and environmental protection. With advancements in automation and energy-efficient technologies, VRUs are becoming indispensable for cost savings, compliance, and sustainability, driving their adoption across various industries.

-

BY REGIONEach regional market presents distinct dynamics shaped by regulatory frameworks, industrial advancements, and the growing emphasis on environmental sustainability. Rising concerns over volatile organic compound (VOC) emissions, stringent air quality regulations, and the increasing adoption of vapor recovery technologies in the oil & gas, chemicals & petrochemicals, pharmaceuticals, and other sectors fuel global market expansion. The heightened focus on emission control and sustainable practices across industries is a key growth driver. Governments worldwide enforce strict environmental regulations, compelling industries to invest in advanced vapor recovery solutions. The oil & gas sector, a major end-user, is accelerating vapor recovery unit adoption to minimize product losses and comply with emission standards. Technological advancements in vapor recovery units, including automated monitoring systems and energy-efficient recovery mechanisms, further propel market growth.

-

COMPETITIVE LANDSCAPEMajor market players in the vapor recovery units market are adopting both organic and inorganic growth strategies, including partnerships, acquisitions, and geographic expansions. Companies such as Dover Corporation (US), and Cimmaron Energy (US), and Zeeco (US) are focusing on collaborations, acquisitions, and expansions to strengthen market reach and enhance consumer accessibility. These strategic initiatives are helping companies address diverse needs across regions while maintaining competitive differentiation.

The global vapor recovery units market is experiencing robust growth, fueled by rising oil and gas production, increasing environmental regulations, and a global shift toward sustainable practices. In 2023, worldwide crude oil production reached approximately 95.6 million barrels per day, with significant contributions from regions like North America (20.4 million barrels per day) and Europe (3.2 million barrels per day), as reported by the U.S. Energy Information Administration. Stringent emission standards, such as the U.S. EPA regulations and the EU’s Industrial Emissions Directive, are driving VRU adoption to reduce VOC emissions across production, refining, and storage processes. This global trend, supported by investments in cleaner technologies, underscores the market’s expansion as nations align with net-zero carbon goals.

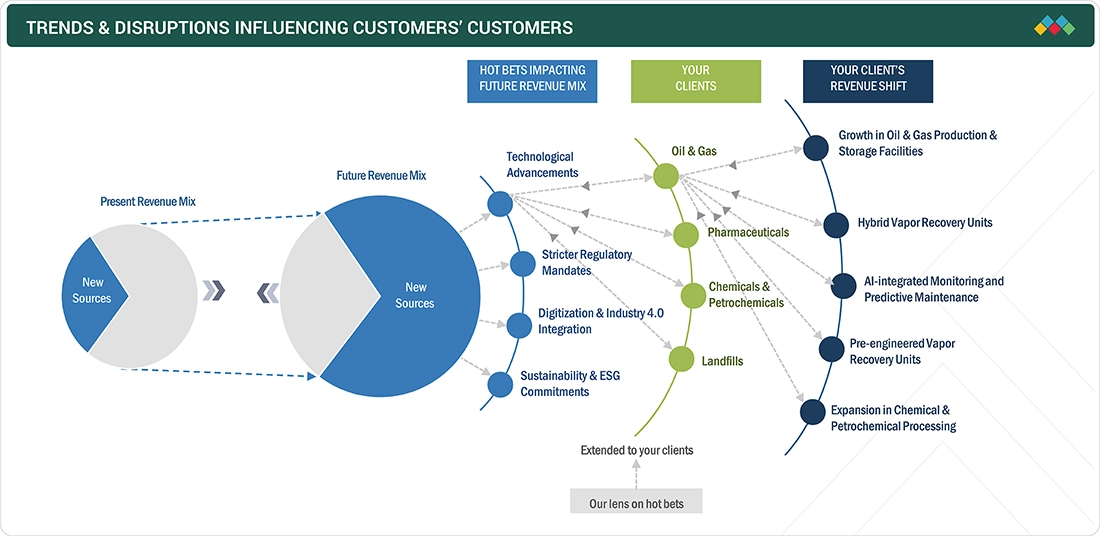

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The vapor recovery units market is shifting from a current revenue mix dominated by traditional absorption and condensation systems for oil & gas storage tanks and refineries to a future mix driven by innovative uses like biogas integration and marine terminal applications, supported by technologies such as membrane separation, IoT monitoring, and strategic partnerships. This evolution serves clients like oil & gas operators, refineries, and biogas producers, who focus on environmental compliance with EPA VOC limits, emission reductions, cost-effective recovery, and operational efficiency. These efforts lead to reduced VOC emissions, cost savings from fuel recovery, improved sustainability, and reliable, compliant handling to support decarbonization.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of oil and gas activities

-

Need for strict regulatory compliance

Level

-

Investment uncertainty and capital expenditure constraints

Level

-

Transformation and automation of vapor recovery units

-

Innovation in vapor recovery solutions

Level

-

Technical challenges associated with compressor selection

-

Environmental risks associated with incorrect handling and installation of vapor recovery units

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Need for strict regulatory compliance

The rising focus on environmental sustainability and air quality control has led to the widespread implementation of stringent regulations governing volatile organic compound (VOC) emissions. Governments and regulatory bodies worldwide are enforcing strict mandates to limit the release of VOCs, which are hazardous pollutants contributing to air pollution, ozone formation, and global warming. In the US, the Environmental Protection Agency (EPA) has implemented the New Source Performance Standards (NSPS) under the Clean Air Act (CAA), requiring vapor recovery units in storage tanks, transportation loading platforms, and oil & gas processing units. These regulations aim to control emissions from oilfields, refineries, and fuel distribution networks by mandating the capture and recovery of hydrocarbons that would otherwise escape into the atmosphere. Similarly, the European Union's Directive 94/63/EC regulates VOC emissions from the storage and distribution of petroleum products, compelling industries to adopt vapor recovery units to minimize air pollution. In Germany, stringent environmental laws such as TA Luft and BImSchG impose additional restrictions on industrial VOC emissions, reinforcing the need for advanced vapor recovery systems.

Restraint: Investment uncertainty and capital expenditure constraints

The high initial investment and installation costs associated with vapor recovery units (VRUs) can be a significant barrier to the growth of the market, particularly for small and medium-sized enterprises (SMEs), as these expenses encompass specialized equipment, installation, and various ancillary costs. Vapor recovery units are designed to recover and recycle volatile organic compounds (VOCs) from storage tanks, pipelines, and industrial processes, requiring advanced components, such as compressors, condensers, separators, and control systems, all contributing to substantial manufacturing costs. The overall price of vapor recovery units depends on factors like capacity, technology type, membrane separation, adsorption, absorption, and industry-specific customization. The installation adds to expenses due to the complexity of integrating vapor recovery units into existing infrastructure, necessitating site assessments, structural modifications, safety evaluations, and skilled labor for engineering and setup.

Opportunity: Transformation and automation of vapor recovery units

The integration of IoT and automation is revolutionizing the vapor recovery unit (VRU) market, enabling real-time monitoring, predictive maintenance, and enhanced operational efficiency. Traditional vapor recovery units rely on manual inspections and scheduled maintenance, often leading to unplanned downtimes, inefficient vapor recovery, and increased emissions. However, the emergence of smart vapor recovery units equipped with IoT sensors, AI-driven analytics, and remote-control systems is transforming the industry by optimizing performance and reducing costs. For instance, real-time monitoring systems in smart vapor recovery units continuously track vapor flow rates, pressure levels, and gas composition, allowing operators to instantly detect leaks, anomalies, and inefficiencies. For instance, Cimaron's Smart Vapor Recovery Units (Smart VRUs) revolutionize emission control by integrating advanced automation, real-time monitoring, and cloud connectivity. Smart vapor recovery units are designed for industries like oil & gas, biogas, and marine terminals. Smart vapor recovery units efficiently capture and recover vapors, turning emissions into revenue. Equipped with OptiLink edge technology, these units enable seamless connectivity to field sensors, providing instant operational insights and eliminating costly retrofits. Cimaron's StyleLink360 platform also enhances system performance with real-time analytics, remote equipment management, predictive maintenance, and emission mitigation. Whether utilizing compression-based technology for oil & gas applications or activated carbon-based systems for terminal and fuel station operations, Cimaron's Smart vapor recovery units ensure maximum efficiency, compliance, and sustainability through continuous monitoring and data-driven optimization.

Challenge: Aging infrastructure

Vapor recovery units (VRUs) play a crucial role in capturing and reprocessing hydrocarbon vapors, yet their effectiveness is significantly impacted by the technical challenges associated with compressor selection and operation. Both reciprocating and rotary compressors, commonly used in vapor recovery units, present inherent design limitations that complicate vapor recovery applications, especially when handling liquids-rich gas streams. Reciprocating compressors are valued for their ability to boost pressures beyond 1000 psi, which makes them a preferred choice for specific vapor recovery unit applications. However, reciprocating compressors struggle with low intake pressures, requiring large, costly cylinders. For instance, when inlet pressure nears 0 psi instead of the typical 60 psi, the required cylinder volume increases fivefold, increasing equipment size and expense. Clearance volume inefficiencies further impact efficiency, while liquid carryover can cause catastrophic failures. A robust liquid separation system is essential, adding cost and complexity. Freeze protection measures like heat tracing and insulation are also required in cold climates.How can Grok help?

Vapor Recovery Units Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Zenith Energy, a leading tank storage terminal in the Northeastern US, faced challenges with its aging vapor recovery unit (VRU). The terminal, with a storage capacity of nearly 400,000 barrels for biodiesel, butane, distillates, ethanol, and gasoline, relied on an older Liquid Ring Vacuum Pump (LRVP) system requiring constant upkeep, high maintenance demands, and frequent operational disruptions. The terminal sought to increase loading capacity while reducing its environmental impact and operational costs. | The vapor recovery unit upgrade significantly improved system reliability, increased throughput, and reduced power consumption by over 40%. Emissions were lowered to meet future regulatory standards, aligning with Zenith Energy's ESG goals. The financial impact was substantial, with a return on investment achieved in less than two years without operational downtime. |

|

Operators across the DJ Basin in northwestern Colorado and southeastern Wyoming struggled with efficiently managing multiple gas sources at their sites. Installing separate vapor recovery compressors for each source was cost-prohibitive, driving up equipment expenses, operational complexities, and maintenance costs. A need arose for a more efficient, cost-effective solution to regulate multiple vapor sources while maintaining optimal pressure control. | Flogistix’s Multi-Stream solution, using a single gas compressor to manage multiple vapor sources, saved over USD 1.4 million annually across 60 applications by reducing equipment and operating costs. It captured flash gas for sale, generating additional revenue, and enhanced vapor recovery efficiency. The technology also streamlined operations, lowered lease expenses related to vapor management, emission testing, and permitting, offering a sustainable and economically beneficial solution for the DJ Basin. |

|

An independent E&P company in the Permian Basin faced profitability challenges with tank vapors containing up to 20 GPM of high-value NGLs, but elevated oxygen levels caused pipeline specification issues, leading to flaring and lost revenue. Despite gas blanketing, LDAR, and sealing efforts, and blending with wellhead gas to reduce oxygen, the operator only partially mitigated the problem, lowering BTU richness and profitability. | The EcoVapor ZerO2 system maximized gas recovery by treating tank vapors to meet pipeline specs, eliminating flaring and boosting revenue from high-BTU sales. With a dedicated custody transfer meter, it increased profitability by selling rich tank vapor at premium prices, reduced emissions by ending routine flaring, and enhanced efficiency by centralizing treatment of multiple vapor streams. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis section outlines the network of companies active in the vapor recovery units market. Key stakeholders within this ecosystem include raw material suppliers, system manufacturers, and distributors catering to various end-use industries. Each participant in the ecosystem is interconnected and influenced by value chain efficiency, regulatory standards, technological advancements, and market demand. The diagram below illustrates the major stakeholders in the vapor recovery units market and their respective roles within the ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Vapor Recovery Units, By Type

Absorption is estimated to be the largest segment in the vapor recovery units market in 2024 primarily due to its high efficiency, versatility, and cost-effectiveness in recovering a wide range of volatile organic compounds (VOCs) and hydrocarbons. The technology is particularly favored in oil & gas storage, transportation, and refining applications where liquid absorbents such as glycol or oil can efficiently capture vapors even under fluctuating pressure and temperature conditions. Additionally, absorption-based systems are relatively easier to retrofit into existing infrastructure and require lower maintenance compared to cryogenic or membrane-based alternatives. The growing regulatory emphasis on reducing VOC emissions and improving fuel recovery rates further supports the widespread adoption of absorption technology across both upstream and downstream operations.

Vapor Recovery Units, By Application

Transportation is expected to be the largest application segment in the vapor recovery units market in 2024 due to extensive handling and transfer of crude oil and refined products across global supply chains. These operations release significant volatile organic compounds (VOCs) and hydrocarbons, driving the need for VRUs to meet environmental regulations and reduce product losses. The increasing movement of fuels via trucks, rail, and marine vessels further boosts demand for portable, efficient systems. Additionally, expanding cross-border fuel logistics reinforces the importance of vapor recovery in transportation operations.

Vapor Recovery Units, By End-use Industry

Oil & Gas accounts for the largest share of the vapor recovery units market by end-use sector in 2024. Driven by tight emission standards and sustainability objectives, the oil and gas sector owns the largest share of the vapor recovery units (VRUs) market by end-use in 2024. VRUs are used extensively in upstream, midstream, and downstream processes to recover and reutilize volatile organic compounds (VOCs), thereby enhancing efficiency and minimizing environmental impact. The increasing need for energy globally, coupled with stricter pollution regulations, has truly propelled the application of Vapor Recovery Units (VRUs) in facilities such as refineries, storage terminals, and transportation hubs. VRU technology has emerged as a critical enabler for maintaining smooth operations in the oil and gas industry, particularly as the sector continues to seek opportunities to enhance efficiency and increase resource recovery, driving innovation in VRU technologies.

REGION

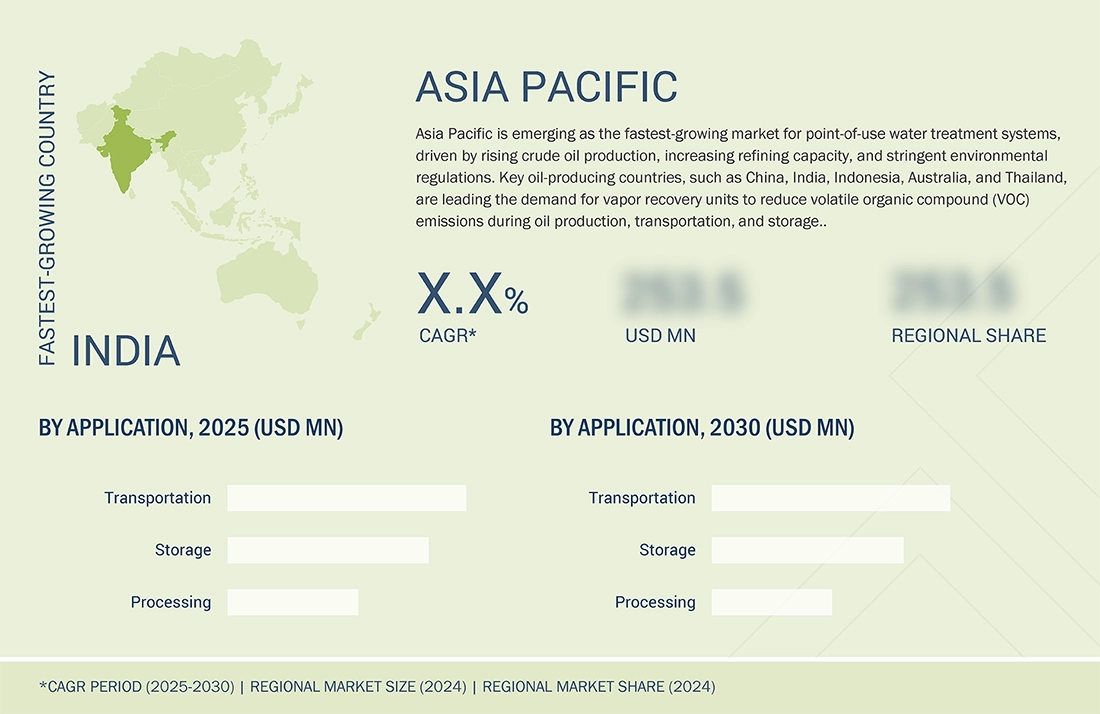

Asia Pacific to be the fastest-growing region in the global vapor recovery units market during the forecast period

Asia Pacific is emerging as one of the fastest-growing markets for vapor recovery units, driven by rising crude oil production, increasing refining capacity, and stringent environmental regulations. Key producing countries, such as China, India, Indonesia, Australia, and Thailand, are leading the demand for vapor recovery units to reduce volatile organic compound (VOC) emissions during oil production, transportation, and storage. According to the Energy Institute, in 2023, China produced approximately 4,208 thousand barrels per day (tbd) of oil, while India's production stood at around 728 tbd. Both countries have adopted strict emission norms, including the Petroleum and Natural Gas Regulatory Board (PNGRB) guidelines in India and China's National Green Development Plan, making VRUs essential in oil & gas operations.

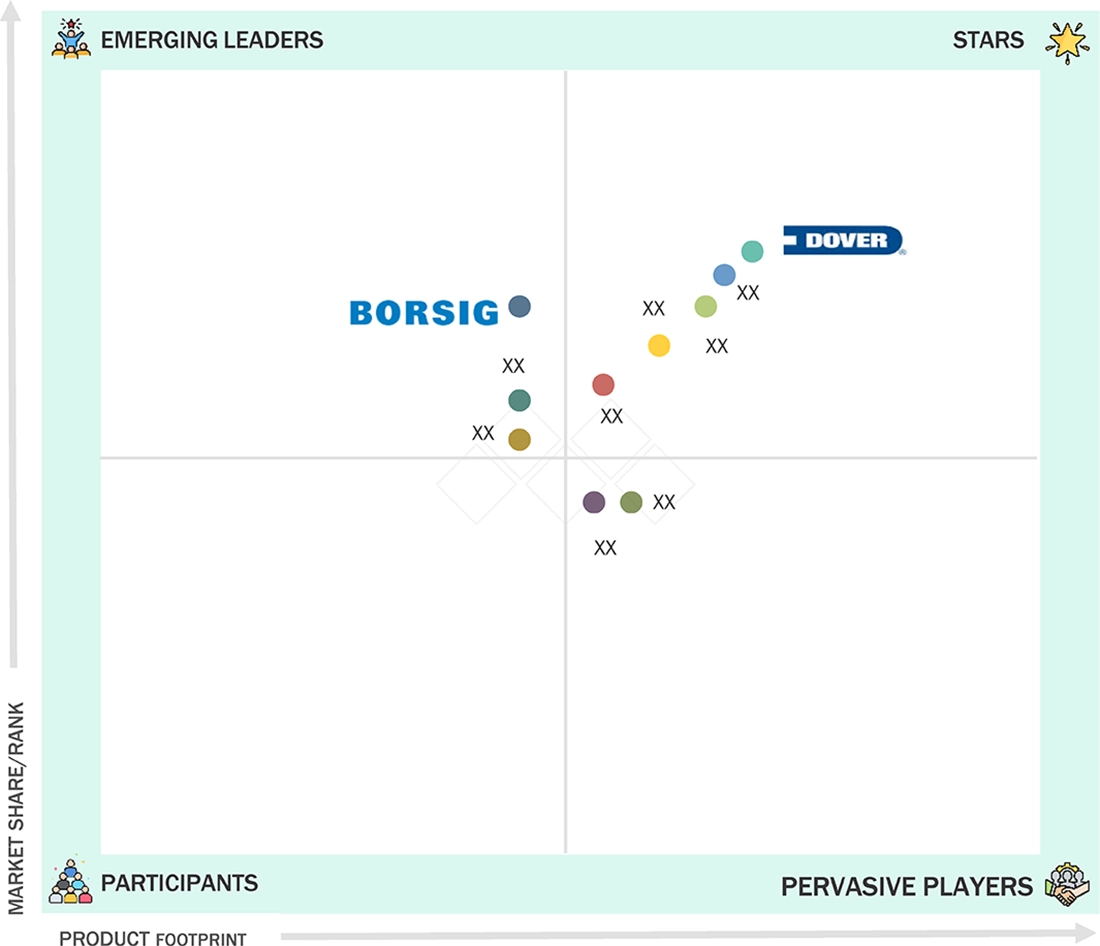

Vapor Recovery Units Market: COMPANY EVALUATION MATRIX

In the vapor recovery units market matrix, Dover Corporation (Star) leads with a strong market share and broad product footprint, supported by its advanced vapor management technologies, robust customer base, and established presence across end-use industries. The company’s continued focus on system efficiency, emission reduction, and compliance solutions reinforces its leadership position. BORSIG GmbH and Cool Sorption (Emerging Leaders) are rapidly strengthening their presence through technological innovation, system customization, and strategic partnerships in key oil & gas markets. Their growing adoption in upstream and midstream applications positions them well to advance toward the leaders’ quadrant as demand for efficient and sustainable vapor recovery solutions continues to rise globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1,186.0 Million |

| Market Forecast in 2030 (Value) | USD 1,413.7 Million |

| Growth Rate | CAGR of 2.98% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

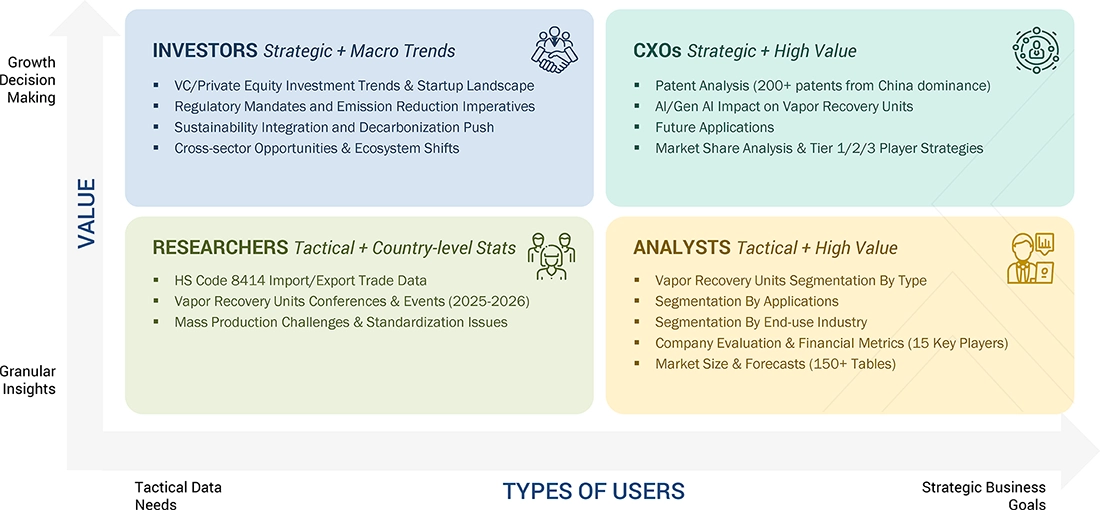

WHAT IS IN IT FOR YOU: Vapor Recovery Units Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| A European VRU manufacturer sought insights into entry barriers and growth opportunities in the Asia-Pacific petrochemical sector, particularly in India and China, to evaluate demand for transportation-focused units amid expanding fuel infrastructure and local emission standards. | Our analysis integrated primary interviews with 30 regulators and downstream operators across APAC with econometric modeling of market data from sources like Eurostat and IEA. Customization included a geo-specific opportunity matrix for storage and railcar loading applications, with scenario planning for tariff impacts under ASEAN trade agreements and a 5-year demand forecast segmented by end-use | Pinpointed priority markets with high CAGRs, leading to acceleration in shortlisting of local JV partners. Uncovered a cost-saving edge through technology adaptations for regional environmental conditions, informing product localization. Included an executive summary infographic and investor pitch template, supporting a funding round for regional expansion. |

RECENT DEVELOPMENTS

- February 2025 : Zeeco Inc. opened the Advanced Research Complex in the US, fueling innovation through cutting-edge infrastructure, knowledge, and real-world testing facilities.

- July 2024 : Dover Corporation acquired Demaco Holland B.V. as part of OPW's Clean Energy Solutions segment.

- January 2024 : Cimarron Energy, Inc. teamed up with CleanConnect.ai to roll out a state-of-the-art emissions management and performance optimization platform.

- May 2023 : BORSIG GmbH completed a 1,400-square-meter office building in Gladbeck, Germany. This eco-friendly building marks the start of an ambitious expansion plan

- December 2022 : Dover Corporation took a big step by acquiring Witte Pumps & Technology GmbH, which is renowned for its precision gear pumps. This acquisition is not only to boost Dover's global presence but also to strengthen its capability to deliver innovative product solutions.

Table of Contents

Methodology

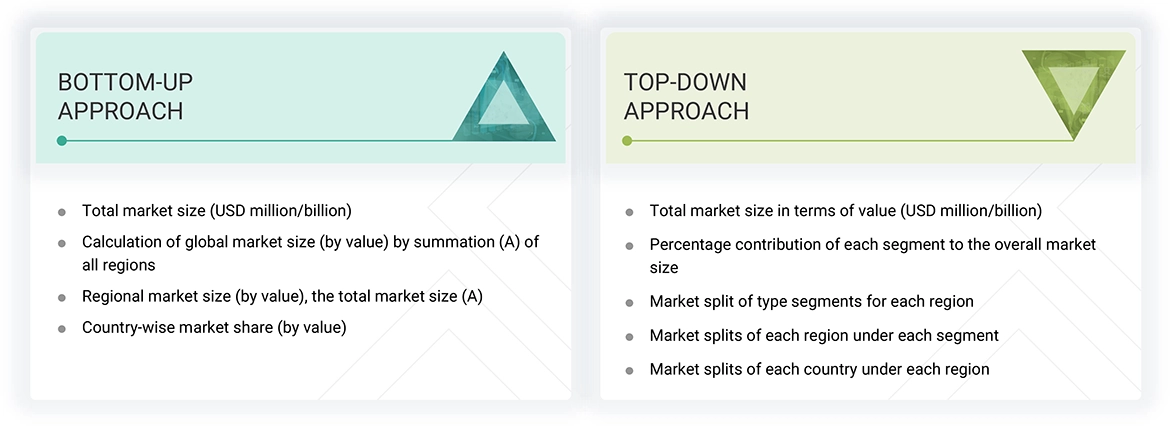

The study involved four major activities for estimating the current size of the global vapor recovery units market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of vapor recovery units through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the vapor recovery units market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for the companies offering vapor recovery units is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources such as Business Standard, Bloomberg, World Bank, and Factiva were referred to, to identify and collect information for this study on the vapor recovery units market. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of vapor recovery unit vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

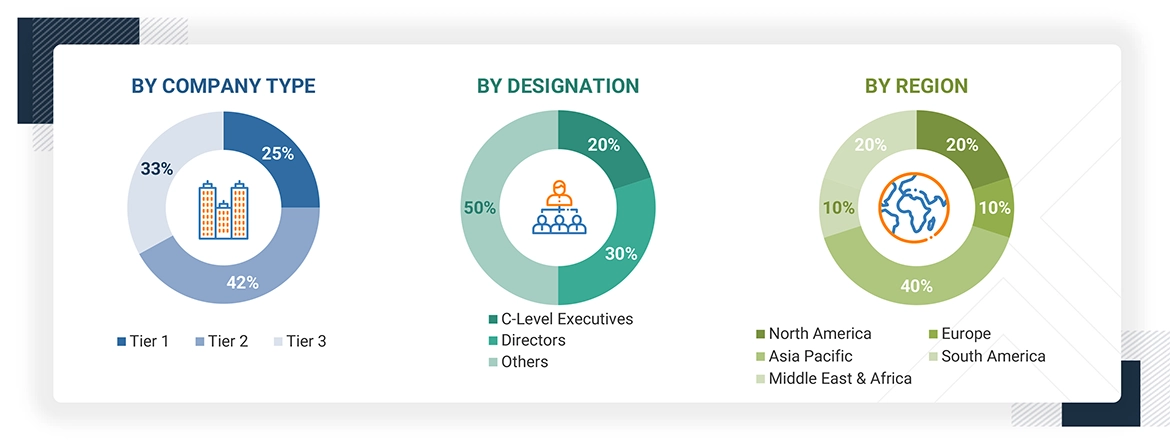

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the vapor recovery units market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of vapor recovery units offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Following is the breakdown of primary respondents—

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the vapor recovery units market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

A vapor recovery unit is an advanced compression device aimed at trapping and recovering low-pressure gas streams of hydrocarbon vapors. Gases recovered are recycled to a larger compressor suction for resale or further processing with maximum revenue at minimum product loss. Besides money-saving benefits, vapor recovery units also serve an important environmental purpose in preventing VOCs and greenhouse gases from venting into the atmosphere, eliminating emissions and related regulatory exposures. Vapor recovery units are used broadly in the oil & gas industry, and also in the chemical and petrochemical industry, in landfills, and in pharmaceutical industries. They facilitate operational efficiency through sustainability measures by reducing air pollution and helping towards stringent environmental regulations.

Stakeholders

- Raw material suppliers and producers

- Regulatory bodies

- Vapor recovery unit technology providers

- End-use industry participants of different segments of vapor recovery units

- Associations and industrial bodies

- Local governments

- Environment support agencies

- Investment banks and private equity firms

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the size of the vapor recovery units market in terms of value.

- To elaborate on the drivers, restraints, opportunities, and challenges in the market.

- To estimate and forecast the market size based on application, end-use industry, and region.

- To forecast the market size, along with segments and submarkets, in the key regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America with their key countries.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide detailed information about the competitive landscape for market leaders.

- To analyze competitive developments such as mergers & acquisitions and expansions & investments in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Vapor Recovery Units Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Vapor Recovery Units Market