The study involved five major activities to estimate the current size of the vendor-neutral archive (VNA) & picture archiving and communication systems (PACS) market—exhaustive secondary research collected information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study used secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Business, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for companies providing VNA & PACS solutions is assessed using secondary data from paid and free sources; this involves analyzing the product portfolios of major players and evaluating these companies based on their performance and quality. Various resources were utilized in the secondary research process to gather information for this study. The sources include annual reports, press releases, investor presentations, white papers, academic journals, certified publications, articles by recognized authors, directories, and databases.

The secondary research process involved referring to various secondary sources to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of VNA and PACS vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

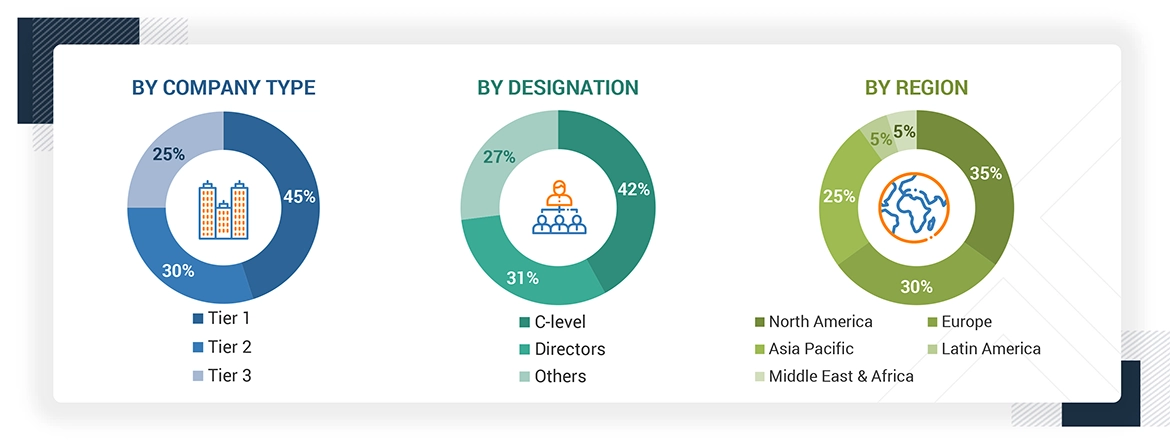

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information and assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of VNA and PACS solutions offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Breakdown of Primary Respondents:

Note 1: Others include sales, marketing, and product managers.

Note 2: Tiers are defined based on a company’s total revenue, as of 2022: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through the bottom-up approach (revenue share analysis) and top-down approach (assessment of utilization/adoption/penetration trends, by product type, modality, deployment, vendor type, application, end user, and region).

Data Triangulation

After arriving at the overall market size, the market size estimation process splits the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides in the VNA & PACS market.

Market Definition

The VNA & PACS market encompasses advanced medical imaging technologies that deliver cost-effective storage solutions and streamlined access to multimodal imaging data. These systems are pivotal within the healthcare IT ecosystem, enabling efficient digitization, storage, retrieval, and sharing of medical imaging data across diverse platforms. By ensuring interoperability and secure management of imaging data, VNA and PACS facilitate improved clinical workflows and enhance collaboration among healthcare professionals.

Stakeholders

-

VNA & PACS Vendors

-

Government Bodies

-

Healthcare Service Providers

-

Clinical/Physician Centers

-

Healthcare Professionals

-

Health IT service Providers

-

Healthcare Associations/Institutes

-

Ambulatory Care Centers

-

Venture Capitalists

-

Distributors And Resellers

-

Maintenance And Support Service Providers

-

Integration Service Providers

-

Healthcare Payers

-

Advocacy Groups

-

Data Security and Privacy Experts

-

Investors And Financial Institutions

-

Industry Associations and Trade Groups

Report Objectives

-

To define, describe, and forecast the global VNA & PACS market by product type, modality, deployment, vendor type, application, end user, and region

-

To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

-

To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall VNA & PACS market

-

To assess the VNA & PACS market with regard to Porter’s Five Forces, regulatory landscape, value chain, ecosystem map, patent protection, and key stakeholder & buying criteria

-

To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the size of the VNA & PACS market with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

-

To profile the key players in the VNA & PACS market and comprehensively analyze their core competencies and market shares

-

To track and analyze competitive developments such as agreements, partnerships, acquisitions; expansions; product launches and enhancements; and R&D activities in the VNA & PACS market.

Growth opportunities and latent adjacency in Vendor Neutral Archive (VNA) & PACS Market