Veterinary Contract Manufacturing & Research Market Size, Growth, Share & Trends Analysis

Veterinary Contract Manufacturing & Research Market by Service (Discovery, API Development, Regulatory Affairs, Consulting, Packaging & Labeling), Product (API, Fill-Finish, Medical Devices), Animal Type (Companion, Livestock) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Veterinary Contract Manufacturing & Research market, valued at US$5.92 billion in 2025, stood at USD 6.38 billion in 2026 and is projected to advance at a resilient CAGR of 7.7% from 2026 to 2031, culminating in a forecasted valuation of USD 9.24 billion by the end of the period. The market growth is driven by rising outsourcing of drug development and manufacturing, growing demand for advanced veterinary therapeutics such as biologics and vaccines, and the rising need for specialized research, testing, and GMP-compliant production capabilities.

KEY TAKEAWAYS

-

By RegionThe North American veterinary contract manufacturing & research market accounted for a share of 50.3% in 2025.

-

By ServiceBy service, the CDMO services segment is projected to register the highest CAGR of 8.1%.

-

By Product typeBy product type, the medicines segment dominated the market with 80.0% share in 2025.

-

By Animal TypeBy animal type, the companion animals segment is projected to grow at the fastest rate from 2026 to 2031.

-

By End UserBy end user, the multinational animal-health companies segment led the market, with a share of 49.7% in 2025.

-

Competitive Landscape - CRO Key PlayersLabcorp, Eurofins Scientific, and Charles River Laboratories were identified as some of the star players in the veterinary contract manufacturing & research market, given their extensive global reach and comprehensive service portfolios.

-

Competitive Landscape - CRO StartupsVeterinary Research Management, Löhlein & Wolf Vet Research, and Cebiphar, among others, have distinguished themselves among startups and SMEs due to their specialized veterinary expertise and focused service capabilities.

-

Competitive Landscape - CDMO Key PlayersFareva, Argenta Holdco Limited, Aenova Group, and Fareva were identified as some of the star players in the veterinary contract manufacturing & research market, given their large-scale manufacturing capacity, international operations, and broad contract development services.

-

Competitive Landscape - CDMO StartupsCZ Vaccines, Ab7 Group, and EirGen Pharma, among others, have distinguished themselves among startups and SMEs due to their niche vaccine and biologics capabilities and strong innovation-driven product pipelines.

The veterinary contract manufacturing & research market is witnessing steady growth, driven by the expanding development pipelines of animal health companies, rising demand for outsourced R&D and manufacturing, and increasing focus on advanced therapeutics for both companion and livestock animals. New developments such as AI-enabled drug discovery tools, automation in bioprocessing, wearable animal health monitoring technologies, and strategic collaborations between CDMOs, CROs, and veterinary pharmaceutical manufacturers are reshaping the industry landscape and accelerating innovation across the sector.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ businesses in the veterinary contract manufacturing & research market stems from rising animal health needs, increasing therapeutic complexity, and rapid technological advancement. Veterinary pharmaceutical, biotechnology, and vaccine companies are the primary users of outsourced development, manufacturing, and research services, relying on CDMOs and CROs for faster scale-up, specialized expertise, and regulatory compliance. The growing demand for efficient, data-driven R&D, along with pressure to reduce costs and accelerate product launches, is reshaping operational strategies across the animal health sector. These factors are driving a greater reliance on advanced outsourcing partners and integrated service platforms, which in turn influence overall market growth and competitiveness.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in Animal Health Spending

-

Increasing Complexity of Veterinary Biologics

Level

-

Limited Specialized Infrastructure

-

Long Approval Timelines & Regulatory Diversity Globally

Level

-

Geographic Expansion into Emerging Markets

-

Digital CRO Services

Level

-

Difficulty in Clinical Trial Recruitment

-

Difficulty in Scaling Sterile / Biologics Capacity Quickly

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in Animal Health Spending

Rising global spending on companion and livestock animal health is a major driver for the veterinary contract manufacturing & research market. As pet ownership increases and livestock producers seek better disease prevention and productivity solutions, demand for new drugs, vaccines, and diagnostics continues to rise. This growing market pushes animal health companies to expand their pipelines and rely more on outsourced development, manufacturing, and research services, fueling steady growth for CDMOs and CROs.

Restraint: Limited Specialized Infrastructure

A key restraint in the veterinary contract manufacturing & research market is the shortage of specialized facilities and advanced manufacturing infrastructure required for complex biologics, vaccines, and innovative therapies. Many regions lack GMP-compliant production sites, high-containment research capabilities, and skilled technical personnel, limiting the ability of companies to scale up development. This gap increases dependence on a small number of capable service providers and slows overall market expansion.

Opportunity: Geographic Expansion into Emerging Markets

Emerging markets offer significant growth opportunities as countries in Asia-Pacific, Latin America, and the Middle East increase investments in livestock health, disease control programs, and companion animal care. These regions have growing unmet needs, less crowded competitive landscapes, and are increasingly aligned with global standards. CDMOs and CROs can tap these markets by establishing local partnerships, expanding service footprints, and offering cost-effective development and manufacturing solutions.

Challenge: Difficulty in Clinical Trial Recruitment

Recruiting suitable animals for clinical studies remains a major challenge in veterinary drug development. Variability across species, limited access to qualified trial sites, and strict ethical guidelines often slow down enrolment. Additionally, securing participation from pet owners and livestock producers can be difficult due to compliance concerns and logistical barriers. These recruitment challenges extend study timelines, increase development costs, and create operational hurdles for CROs and animal health companies.

VETERINARY CONTRACT MANUFACTURING & RESEARCH MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides end-to-end preclinical and clinical research services for veterinary drugs and biologics, including toxicology, safety studies, and regulatory-ready data packages | Ensures faster study execution, high-quality GLP/GCP compliance, and smooth regulatory submissions for global approvals |

|

Offers specialized analytical testing for veterinary pharmaceuticals, vaccines, and residue monitoring using advanced chemistry and microbiology platforms | Enhances product quality, accelerates batch release, and supports regulatory compliance through accurate, validated testing |

|

Conducts veterinary-focused preclinical studies, disease modeling, and safety/toxicology programs using well-characterized laboratory animal models | Improves predictability of therapeutic outcomes, reduces development risk, and supports faster IND/MAA filings |

|

Provides veterinary drug manufacturing, sterile fill-finish, and formulation development across small molecules and biologics | Enables scalable GMP manufacturing, reduces cost of internal infrastructure, and speeds up commercial supply readiness |

|

Delivers drug discovery, screening, and translational research tailored to companion and livestock therapeutics | Increases R&D efficiency, identifies high-value candidates sooner, and shortens early-stage development timelines |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the veterinary contract manufacturing & research market consists of a diverse network of stakeholders that collectively support innovation, product development, and outsourced research in animal health. Core contributors include specialized CDMOs and CROs offering formulation, manufacturing, analytical testing, and clinical trial services for veterinary pharmaceuticals, biologics, and medical devices. These service providers work closely with animal health companies, veterinary biotech start-ups, and research institutions that rely on outsourcing to accelerate development and reduce internal costs. Technology partners—such as developers of AI, digital data, and automation platforms—also play a growing role by enhancing study design, data management, and operational efficiency. Together, this ecosystem enables faster, more efficient development and commercialization of advanced veterinary therapeutics and solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Veterinary Contract Manufacturing & Research Market, By Service

As of 2025, CDMO services held the largest share of the veterinary contract manufacturing & research market because animal health companies increasingly rely on external partners for formulation, process development, and GMP-compliant manufacturing to reduce internal costs and accelerate product timelines. The growing complexity of veterinary biologics, vaccines, and specialty formulations requires advanced capabilities and infrastructure that many companies prefer to outsource rather than build in-house. As demand for scalable, high-quality production continues to rise, CDMOs remain essential partners, driving their strong market dominance.

Veterinary Contract Manufacturing & Research Market, By Product Type

In 2025, medicines dominated the Veterinary contract manufacturing & research market, because pharmaceutical products—such as therapeutics, vaccines, and biologics—represent the core focus of animal health companies and account for the majority of product development and commercialization activities. The rising prevalence of infectious and chronic diseases in both companion and livestock animals continues to drive strong demand for new and improved veterinary drugs. Additionally, the increasing complexity of formulations, biologics manufacturing, and regulatory requirements pushes companies to rely more heavily on specialized CDMOs and CROs for R&D, analytical testing, and GMP-compliant production.

Veterinary Contract Manufacturing & Research Market, By Animal Type

As of 2025, companion animals held the largest share of the Veterinary contract manufacturing & research market due to rising pet ownership, increased spending on advanced veterinary care, and the humanization of pets are driving strong demand for new therapeutics, vaccines, and specialty formulations for dogs and cats. Chronic and lifestyle-related conditions in pets are becoming increasingly common, prompting animal health companies to expand their research and development (R&D) pipelines and rely more heavily on outsourced development, testing, and manufacturing. As a result, CDMOs and CROs see higher project volumes and consistent demand from the companion animal segment, making it the dominant contributor to market share.

Veterinary Contract Manufacturing & Research Market, By End User

The multinational animal health companies segment is expected to dominate the Veterinary contract manufacturing & research market, because they manage large global portfolios, invest heavily in R&D, and require extensive outsourcing support to meet manufacturing, analytical, and regulatory needs. Their broad pipelines of vaccines, biologics, and therapeutics create consistent demand for CDMO and CRO partnerships to expand capacity, enhance efficiency, and accelerate time-to-market across multiple regions.

REGION

Asia Pacific to be fastest-growing region in global Veterinary contract manufacturing & research market during forecast period

The Asia Pacific veterinary contract manufacturing & research market is expected to register the highest CAGR during the forecast period, driven by expanding livestock populations, rising pet adoption, and increasing investments in animal health infrastructure across major countries, such as China, India, and South Korea. The growing demand for vaccines, biologics, and premium veterinary medicines is driving companies to outsource development and manufacturing to meet the rising volume and quality requirements. Supportive government initiatives, lower operational costs, and the rapid expansion of regional CDMOs and CROs with modern capabilities are further accelerating growth. Additionally, global animal health companies are strengthening their presence in Asia Pacific through partnerships and facility expansions, making it a rapidly evolving hub for veterinary outsourcing services.

VETERINARY CONTRACT MANUFACTURING & RESEARCH MARKET: COMPANY EVALUATION MATRIX

In the veterinary contract manufacturing & research market matrix, Labcorp (Star) leads with a strong market presence supported by its extensive service portfolio, global client network, and deep expertise in preclinical and clinical research for animal health. The company’s leadership is reinforced by its advanced study capabilities, large-scale operational infrastructure, and long-standing partnerships with leading veterinary pharmaceutical companies. Klifovet GmbH (Emerging Leader) is rapidly gaining visibility with its specialized focus on veterinary clinical trials, regulatory consulting, and product development support, which enhance reliability, compliance, and study efficiency for clients. While other established CROs and CDMOs continue to expand capabilities, Labcorp’s scale and Klifovet’s niche expertise position them prominently in the evolving veterinary outsourcing landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Labcorp (US)

- Eurofins Scientific (Luxembourg)

- Charles River Laboratories (US)

- knoell Germany GmbH (Germany)

- Evotec (Germany)

- Klifovet GmbH (Germany)

- Clinglobal (US)

- BioAgile Therapeutics Private Limited (India)

- VETSPIN SRL (Italy)

- Ridgeway Research Ltd. (UK)

- Argenta Holdco Limited (UK)

- Aenova Group (Germany)

- Fareva (France)

- Vetio (US)

- TriRx Pharmaceutical Services (US)

- Indian Immunologicals Ltd. (India)

- Recipharm AB (Sweden)

- LABIANA (Spain)

- Syngene International Limited (India)

- CZ Vaccines (Spain)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2025 (Value) | USD 5.92 Billion |

| Market Forecast, 2031 (Value) | USD 9.24 Billion |

| Growth Rate | CAGR of 7.7% from 2026 to 2031 |

| Years Considered | 2024-2031 |

| Base Year | 2025 |

| Forecast Period | 2026-2031 |

| Units Considered | Value (USD Billion), Volume (API [Metric Tons] and FDF [Thousand Units]) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: VETERINARY CONTRACT MANUFACTURING & RESEARCH MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Service Analysis |

|

Enabled identification of outsourcing patterns, cost drivers, and quality expectations; supported decisions on vendor selection, capability expansion, and service alignment with evolving animal health needs |

| Company Information |

|

Delivered insights on partnership models, pipeline support opportunities, and investment hotspots shaping biologics, vaccine development, and advanced veterinary therapeutics |

| Geographic Analysis |

|

Supported regional strategy planning, helping identify high-growth Asia Pacific markets for service expansion, localization opportunities, and partnership development |

RECENT DEVELOPMENTS

- October 2025 : Aenova Group announced the addition of a new fill-and-finish line at its Latina site. The company stated that this expansion strengthens its ability to meet rising global demand for biologics manufacturing, especially for late-stage clinical and commercial production.

- December 2024 : Clinglobal announced the launch of a new brand within the Group: Clinaxel. This brand reinforced Clinglobal’s dedication to delivering high-quality field clinical trials and regulatory services across North America, Europe, and Africa.

- February 2024 : Argenta Holdco Limited announced that its EMA- and FDA-approved Dundee site expanded its capabilities with a new high-tech blister line, strengthening its labelling and packaging services, and enhancing overall packaging operations.

Table of Contents

Methodology

This research study extensively utilized both primary and secondary sources. It involved analyzing various factors that influence the industry to identify segmentation types, industry trends, key players, competitive landscape, key market dynamics, and the strategies employed by key players.

Secondary Research

This research study utilized a variety of comprehensive secondary sources, including directories, databases such as Bloomberg Business, Factiva, and Dun & Bradstreet, white papers, annual reports, company house documents, investor presentations, and SEC filings from various companies. Secondary research was employed to gather information crucial for an in-depth, technical, market-oriented, and commercial analysis of the veterinary contract manufacturing & research market. This approach also helped identify key players in the industry and allowed for classification and segmentation based on emerging trends at the most detailed level. Furthermore, significant developments about both market and technological perspectives were documented. A database of primary industry leaders was created as part of this secondary research.

Primary Research

In the primary research process, we interviewed a range of sources from both the supply and demand sides to gather qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development, and operations managers, as well as presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, and chief medical information officers related to the veterinary contract manufacturing & research market. Primary sources from the demand side include R&D scientists and researchers in animal health companies, veterinary clinicians, and veterinary biotech firms developing veterinary therapeutics and technologies.

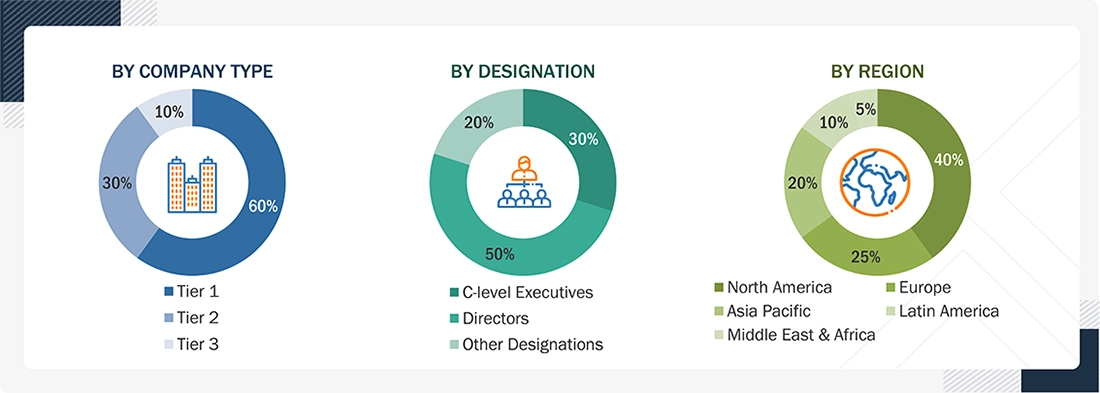

A breakdown of the primary respondents is provided below:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Other designations include sales, marketing, and product/service managers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2025: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

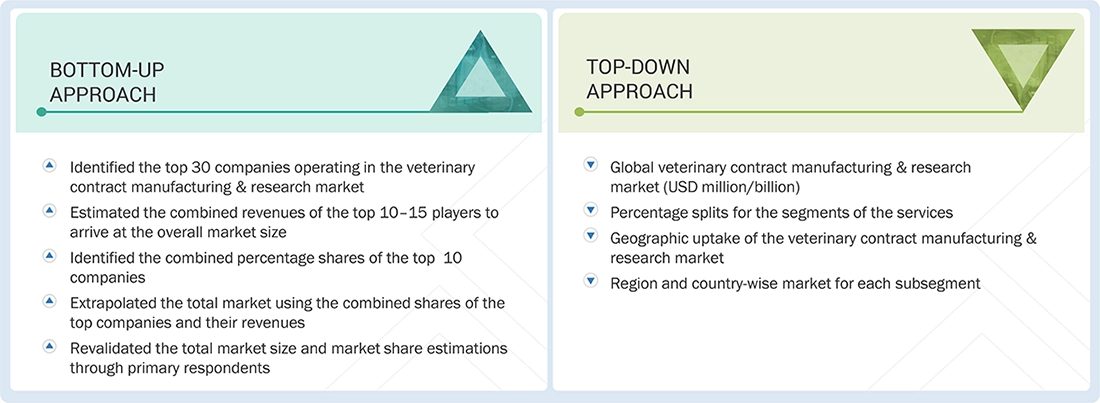

Market Size Estimation

The total size of the veterinary contract manufacturing & research market was determined after data triangulation from three approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the veterinary contract manufacturing & research market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and obtain precise statistics for all segments and subsegments.

Market Definition

The veterinary contract research organization (CRO) market comprises third-party service providers that support animal-health companies in the outsourced research and development of veterinary pharmaceuticals, biologics, vaccines, and related products. Veterinary CROs provide services across the product lifecycle, including discovery support, preclinical studies, target animal safety, clinical field trials, bioequivalence studies, regulatory consulting, and post-approval research, in compliance with veterinary regulatory standards. These services are primarily used by animal-health pharmaceutical companies, biotechnology firms, and vaccine developers to reduce development timelines, access specialized expertise, manage regulatory complexity, and optimize R&D costs without maintaining a complete in-house research infrastructure. The veterinary contract development and manufacturing organization (CDMO) market consists of third-party manufacturers that provide outsourced development, scale-up, and commercial manufacturing services for veterinary drugs, biologics, vaccines, and related products. Veterinary CDMOs support animal-health companies through process and formulation development, API and finished dosage form manufacturing, fill-finish operations, packaging and labeling, quality control, stability testing, and regulatory manufacturing support, operating in accordance with veterinary GMP and biologics regulations. These services enable animal-health companies to outsource capital-intensive manufacturing activities, increase production flexibility, manage capacity constraints, and accelerate market entry, particularly for complex formulations, sterile injectables, and veterinary vaccines.

Stakeholders

- Animal-health pharmaceutical companies

- Veterinary biotechnology companies

- Veterinary biologics & vaccine developers

- Veterinary contract development & manufacturing organizations (CDMOs)

- Veterinary contract research organizations (CROs)

- Preclinical & toxicology research laboratories (GLP & non-GLP)

- Clinical trial management organizations for veterinary studies

- Regulatory consulting firms specializing in VICH / EMA / FDA-CVM

- Quality control & analytical testing laboratories (veterinary-focused)

- Veterinary formulation & process development service providers

- Packaging, filling, and labeling service providers for veterinary products

- Animal research facilities & field trial centers

- Veterinary academic research institutes

- Livestock research institutions & herd-health trial networks

- Raw material suppliers for veterinary APIs, excipients, and biologics components

Report Objectives

- To define, describe, segment, and forecast the veterinary contract manufacturing & research market by service, product type, animal type, end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall veterinary contract manufacturing & research market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the veterinary contract manufacturing & research market in five central regions (along with their respective key countries): North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the veterinary contract manufacturing & research market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, service launches, expansions, collaborations, agreements, and partnerships

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Veterinary Contract Manufacturing & Research Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Veterinary Contract Manufacturing & Research Market