Wind Turbine Operations and Maintenance Market

Wind Turbine Operations and Maintenance Market by Type (Scheduled Maintenance, Unscheduled Maintenance), Location type (Onshore, Offshore), Turbine Connectivity (Grid-connected, Standalone), and Region - Global Forecast & Trends to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global wind turbine operations and maintenance (O&M) market is projected to reach USD 59.67 billion by 2030, up from USD 39.61 billion in 2025, registering a CAGR of 8.5% over the forecast period. The vast expansion of offshore wind farms and the introduction of predictive maintenance technologies are affecting the market. The implementation of environmental targets and policy mandates across regions is further compelling the market to consider longer-term asset management solutions.

KEY TAKEAWAYS

-

By typeThe unscheduled segment of the wind turbine operations and maintenance market is influenced by the urgent need to respond to unexpected failures of components. The demand for unscheduled maintenance is affected by the age and state of the installed turbine base, as older assets will fail at a higher frequency. These unexpected breakdowns can lead to prolonged turbine downtime, lost energy output, and increased O&M expenses, particularly for offshore wind projects where access and repair costs are significantly higher. However, digitalization is transforming the unscheduled segment by enabling real-time condition monitoring, predictive diagnostics, and automated fault alerts using SCADA data, IoT sensors, and AI.

-

By location typeThe offshore segment of the wind turbine operations and maintenance (O&M) market is clearly changing due to the growth of offshore wind installations and the use of newer technologies. The offshore O&M sector is integrating predictive maintenance strategies, often integrated through AI and IoT deployment to provide real-time monitoring and detection of potential faults and current and/or anticipated failures to limit downtime as well as maintenance costs. The deployment of autonomous systems, like drones and remotely operated vehicles (ROVs), is increasing inspection and maintenance efficiencies. With these technological advancements, the offshore sector is starting to see a realized focus on sustainability, as companies and organizations begin to adapt and implement environmentally friendly maintenance strategies and equipment to minimize their overall environmental footprint.

-

By turbine connectivityThe wind turbine operations and maintenance market is segmented based on turbine connectivity into grid-connected and standalone. The grid-connected segment is projected to dominate the overall wind turbine operations and maintenance market. The market for this segment is projected to reach USD 54.14 billion by 2030. This segment includes utility-scale wind farms where multiple turbines are deployed in an interconnected manner and reliably supply power to the grid in support of large-scale renewable energy integration. The increasing quantity of grid-connected wind turbines installed capacity supported by government policies, advancements in turbine design and operation, and the focus on clean energy are expanding the demand for dedicated O&M services. Recent statistics indicate that 113 GW of wind energy was added globally. In India, the cumulative grid-connected wind power capacity as of March 2025 reached 50,037.82 MW, solidifying the country as a noteworthy contributor to the global wind energy presence. The trend toward a more grid-connected environment is also supported by government initiatives to develop more grid-connected wind turbines.

-

By regionAsia Pacific is estimated to be the largest market for wind turbine operations and maintenance during the forecast period. China leads the regional market in installed wind capacity, supported by strong government backing. Following China, countries like Japan, South Korea, Taiwan, and emerging markets such as Australia are also making significant contributions. These nations have set ambitious targets to expand offshore wind capacity as part of their efforts to achieve net-zero emissions and reduce carbon footprints, further driving the growth of the wind turbine operations and maintenance market. The total operational onshore wind (ONW) capacity for Asia Pacific is expected to double to 1 TW by 2030. Within the Asia Pacific region, GWEC's most current projections indicate that cumulative installed onshore wind capacity will increase from 466 GW at the end of 2023 to more than 1,084 GW by 2030. This is primarily being driven by China, which is forecasted to add over 500 GW of onshore wind by 2030 in addition to the over 400 GW of capacity already operational.

-

Competitive landscapeThe major market players have adopted both organic and inorganic strategies, including expansions, sales contracts, acquisitions, agreements, investments, product launches, partnerships, and collaborations. For instance,

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Emerging technologies such as condition monitoring systems (CMS), remote diagnostics, and predictive analytics are redefining the future revenue mix. Disruptive innovations like AI for predictive maintenance, offshore wind expansion, turbine upgrades, and blockchain are impacting key players, namely wind farm operators, OEMs, ISPs, and renewable energy producers. These shifts align with client imperatives such as cost optimization, reduced downtime, energy efficiency, and digital integration. This highlights a clear transition towards data-driven, tech-enabled operations across the energy and renewables value chain.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Government policies regarding renewable energy targets

-

Expansion of wind energy installations

Level

-

High O&M costs and weather-related constraints

-

Fragmented and evolving regulatory landscape

Level

-

Increasing investments in clean energy projects

-

Increase in aging wind infrastructure

Level

-

Access to offshore sites

-

Overdependence on OEMs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Government policies regarding renewable energy targets

Governments all over the world are implementing powerful renewable energy policies to mitigate climate change, decrease dependency on fossil fuels, and gain energy independence. These policies are often seen in various climate action plans, clean energy road maps, and numerous international obligations. The European Union has committed to a minimum 42.5% share of renewables by 2030 under the REPowerEU plan, with wind energy expected to play a crucial role in meeting this target. European countries are among the most ambitious in harnessing wind energy as part of their broader energy transition strategies. The recently enacted Revised Renewable Energy Directive (RED III) has established a binding target to increase the share of renewable energy to 45% of the European Union’s gross final energy consumption by 2030. Wind energy is expected to play a pivotal role in reaching this goal, given its scalability, technological maturity, and the continent’s strong policy support. This directive is likely to drive substantial investments, accelerate permitting processes, and promote cross-border cooperation to expand both onshore and offshore wind capacities. In India, the National Wind-Solar Hybrid Policy is designed to promote wind-solar hybrid projects, with a target of achieving 500 GW of non-fossil fuel capacity by 2030.

Restraint: High O&M costs and weather-related constraints

Operations and maintenance (O&M) expenses can be a major driver of wind turbine lifecycle costs, especially with offshore wind installations, where they can constitute up to 25–30% of the lifecycle costs. Although offshore wind turbine maintenance faces similar issues as onshore wind farms, offshore maintenance activities (even annual maintenance activities) can be more complicated, expensive, and limited by logistical challenges. The factors that limit maintenance activities at offshore wind farms are largely related to accessibility. Weather conditions, including high wind speeds and rough sea states, can prevent maintenance technicians from safely reaching the turbines. These conditions also reduce the available time for routine maintenance or emergency O&M activities. Technicians can only access wind turbines under permissible weather conditions. The permissible weather conditions typically occur when wind speeds are at or below 15 meters per second (m/s), and wave heights are at or below 1.5 meters (Wave). Such restrictions decrease the operational windows for O&M and, therefore, can lengthen O&M-related downtime. There are also logistical moving parts already at offshore wind farms that can complicate the O&M process, which include SOVs, jack-up barges, and helicopters, all of which factor into O&M operational expenses. Wind technicians also face challenges due to the distance between offshore wind turbines and the shore, with some turbines located more than 50 km away. This distance can lead to delays and higher costs, particularly when performing reactive maintenance.

Opportunity: Increasing investments in clean energy projects

From 2013 to 2022, solar PV and onshore wind were the leaders in global renewable energy investment, attracting 46% and 32% of total investments, respectively. Offshore wind made a slight comeback, accounting for 8% of investments, with solar thermal receiving a mere 5%. Other technologies, including hydropower, biomass, biofuels, geothermal, and marine energies, together received only 7% of the total, with hydropower comprising a sizeable proportion of this group. To facilitate the energy transition, more investment must be made in renewable technologies. The focus on solar and wind energy has intensified, with the two sectors collectively attracting an impressive 95% of total renewable energy investments in 2022. Wind energy is now growing at an extraordinary rate. The total investment for wind in 2023 reached a record USD 180 billion globally, a 20% increase over the previous year. All the actual funding is attributed to increased government targets and supportive policies.

Challenge: Access to offshore sites

Accessing offshore wind turbine locations poses one of the biggest challenges for operations and maintenance (O&M) in the offshore industry. As the offshore wind industry continues to scale, wind farms are being installed further away from shore, often 30 to 100+ kilometers, and in deeper waters. While these remote offshore locations provide stronger and more consistent wind resources, accessing these sites requires a lot of planning, specialized equipment, and financial resources. Many large-scale projects, such as Dogger Bank in the UK or upcoming U.S. Atlantic Coast projects, are often located far offshore (beyond 30 km), which makes maintenance (and even routine maintenance) logistically and financially complicated.

Wind Turbine Operations Maintenance Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The maintenance of wind infrastructures, particularly offshore wind turbines, poses significant challenges due to their remote location and complex operational environments. It is critical to monitor and understand the behavior of wind turbines in real time to predict potential failures, avoid unplanned outages, optimize maintenance schedules, and reduce operational costs. Traditional maintenance practices often fall short in providing timely diagnostics and predictive capabilities, resulting in inefficient operations and increased costs. | To address these challenges, Tekniker, in collaboration with its spin-off ATTEN2, developed a comprehensive monitoring solution for deployment at the Los Monteros wind farm. This solution combines advanced technologies to enable real-time diagnostics and predictive maintenance. It leverages data from the SCADA (Supervisory Control and Data Acquisition) system—tracking key operational parameters such as wind speed, generator speed, pitch angle, active force, gearbox oil temperature, and operational status—along with additional sensors that monitor the degradation and particle count in gearbox oil. Central to the system is Tekniker's proprietary Fingerprint methodology, which analyzes turbine behavior over time, allowing for early detection of anomalies through historical data comparison. These insights are processed using the SAM (Smart Asset Management) platform, which employs intelligent algorithms to optimize equipment performance, extend its operational life, and reduce operating expenses. At Los Monteros, SAM acts as the primary tool for analyzing SCADA and sensor inputs, enabling ATTEN2 to efficiently manage servicing and monitor system alarms. This integrated approach has significantly improved the reliability and availability of the wind turbines, enhanced maintenance efficiency, and lowered operational costs. |

|

Offshore wind farms, such as those operated by Ørsted, face significant challenges in operations and maintenance due to the remote and often inaccessible nature of turbine structures. Traditional maintenance approaches require physical inspections, which can be time-consuming, costly, and pose safety risks to personnel. The need arises for innovative solutions that can reduce manual interventions, enhance safety, and improve the efficiency of O&M activities. | Ørsted has pioneered the integration of 3D laser scanning technology to address these challenges. By employing laser scanners capable of capturing up to two million data points per second, Ørsted creates detailed 3D models of turbine environments. This technology allows for the visualization of hard-to-reach internal structures without the need for physical presence. The high-resolution scans are combined with additional data to form comprehensive digital twins—accurate virtual representations of the turbines. These digital twins enable engineers to conduct assessments, plan maintenance, and simulate interventions remotely from their desktops. This approach not only enhances safety by reducing the need for on-site visits but also improves the quality and effectiveness of maintenance operations. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The wind turbine operation and maintenance ecosystem comprises an entire network of stakeholders involved in ensuring the efficient and reliable operation of wind turbines. It comprises service providers (OEM, ISPs, Owners/Operators), component providers, technology providers, logistics and transportation companies, insurance & warranty providers, and regulatory bodies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Wind Turbine Operations and Maintenance Market, By Type

The unscheduled maintenance of wind turbines is becoming more salient due to the complexity and size of wind energy projects. Unscheduled maintenance is defined as reactive maintenance because it is the result of unplanned equipment failure or breakdown. Unscheduled maintenance can also incur large amounts of downtime due to unplanned failures. Some of the factors creating the need for unscheduled maintenance are age of turbine fleet, harsh environmental conditions, and larger wind turbine sizes. To reduce unscheduled maintenance, the O&M market is increasingly using predictive analytics, remote monitoring, and drone inspections to identify faults before they happen. Along with the introduction of innovation in equipment, the wind turbine O&M market is looking to build supply chain continuity and reliability, as well as workforce training and preparedness. Predictive analytics, digital twins, and better monitoring are reducing surprise failures or unscheduled maintenance. There is a push towards proactive maintenance strategies to improve turbine uptime and reduce emergency interventions.

Wind Turbine Operations and Maintenance Market, By Location Type

This report segments the wind turbine operation and maintenance market based on location type into two segments: Onshore and offshore. The offshore segment experiences distinct operational challenges, including limited accessibility, persistent weather challenges, and the need for deployment of specialized vessels and equipment for maintenance activities, which greatly increase operational costs. However, technological developments, such as remote monitoring, drone inspections, and predictive analytics, are aiding maintenance scheduling to ensure the availability of wind turbines and minimize downtime. At the end of 2023, the global installed capacity for offshore wind generation was around 68.258 GW, which consisted of more than 13,096 turbines. China has the highest installed capacity. India has plans to reach 30 GW by 2030. By May 31, 2023, the US offshore wind energy project development and operational pipeline had a potential generating capacity of 52,687 megawatts (MW), representing an annual increase of 15% from all installed, under construction, approved, and various other licensing stages. These developments indicate a robust and expanding offshore wind energy sector, with significant contributions from China, the US, Europe, and other global markets.

Wind Turbine Operations and Maintenance Market, By Turbine Connectivity

By turbine connectivity, the grid-connected connective segment is projected to register the highest growth during the forecast period. The grid-connected segment of the wind turbine operations and maintenance (O&M) market is experiencing rapid growth due to the increase in global offshore and onshore renewable capacity. In 2023, over 117 GW of new global wind energy capacity was added to the grid, placing global capacity above 1,020 GW. This growth demonstrates the increasing reliance on wind energy and the demand for O&M services necessary to reliably and efficiently generate electricity. In grid-connected wind turbines, both onshore and offshore, O&M service is required to address the many challenges in incorporating variable combinations of wind power into the existing electrical networks. Advanced O&M solutions (e.g., predictive analytics and remote monitoring) are needed to maximize output, minimize downtime, and improve grid reliability, while staving off disruption to the public and avoiding risks associated with repairing faulty assets.

REGION

Asia Pacific to be largest region in global wind turbine operations and maintenance market during forecast period

Asia Pacific is estimated to be the largest market for wind turbine operations and maintenance during the forecast period. China leads the regional market in installed wind capacity, supported by strong government backing. Following China, countries like Japan, South Korea, Taiwan, and emerging markets such as Australia are also making significant contributions. These nations have set ambitious targets to expand offshore wind capacity as part of their efforts to achieve net-zero emissions and reduce carbon footprints, further driving the growth of the wind turbine operations and maintenance market. The total operational onshore wind (ONW) capacity for Asia Pacific is expected to double to 1 TW by 2030. Within the Asia Pacific region, GWEC's most current projections indicate that cumulative installed onshore wind capacity will increase from 466 GW at the end of 2023 to more than 1,084 GW by 2030. This is primarily being driven by China, which is forecasted to add over 500 GW of onshore wind by 2030 in addition to the over 400 GW of capacity already operational.

Wind Turbine Operations Maintenance Market: COMPANY EVALUATION MATRIX

The Wind Turbine Operation and Maintenance market is led by companies such as Vestas and Suzlon, both demonstrating strong industry positions reflected in their respective market matrix placements. Vestas stands out as a market Star, combining substantial market share with extensive product and service expertise, driven by investments in advanced predictive analytics, remote monitoring, and robust operational reliability. Its solutions support high turbine availability, enable optimal performance, and minimize downtime for wind farm operators worldwide. Suzlon, meanwhile, holds the Emerging Leader position, leveraging regional strength, integrated service offerings, and ongoing technological upgrades to expand its footprint in key global markets. Both firms exemplify the sector’s transition to data-driven and technology-enabled operation and maintenance strategies, with a focus on reducing costs, boosting energy efficiency, and enabling sustainable growth. Their activities continually redefine industry benchmarks and accelerate adoption of innovative O&M practices for wind energy assets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 35.62 BN |

| Market Forecast in 2030 (Value) | USD 59.67 BN |

| Growth Rate | 8.5% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa and South America |

WHAT IS IN IT FOR YOU: Wind Turbine Operations Maintenance Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- March 2025 : Siemens Gamesa Renewable Energy, S.A.U. and a TPG-led consortium (with MAVCO Investments) agreed to purchase Siemens Gamesa's onshore wind turbine business in India and Sri Lanka in March 2025. The consortium will own 90% of the onshore business while Siemens Gamesa will own a 10% stake and will license the technology through a long-term licensing agreement. The deal includes the transfer of about 1,000 employees, as well as existing manufacturing facilities, to a new independent company that will manufacture, install, and service onshore wind turbines in the area.

- April 2025 : GE Vernova and BBWind reached their nineteenth agreement to supply onshore wind turbines for community wind farms in Germany. Under this agreement, GE Vernova will supply three 6.0 MW-164m wind turbines for the Heiden and Dorsten projects in North Rhine-Westphalia. The wind turbines will be manufactured at GE's facility in Salzbergen, Germany. This alliance is part of Germany's goal of achieving 80% renewable energy supplies by 2030.

- March 2025 : Goldwind and IC Enterra Yenilenebilir Enerji signed a Memorandum of Understanding (MoU) to explore investment opportunities in renewable energy. This MoU was specifically focused on seizing the potential for collaboration on wind energy projects in Türkiye and in international markets, taking advantage of Türkiye's location.

- March 2025 : Auren Energia and Nordex SE celebrated tackling their first installation of 19 N163/5.X wind turbines, totaling 112 MW, for the Cajuína 3 wind farm in Rio Grande do Norte, Brazil. Included in the contract is a 15-year service period with options to extend out to 30 years. The installation will start early in 2026, with commissioning expected by autumn 2026.

Table of Contents

Methodology

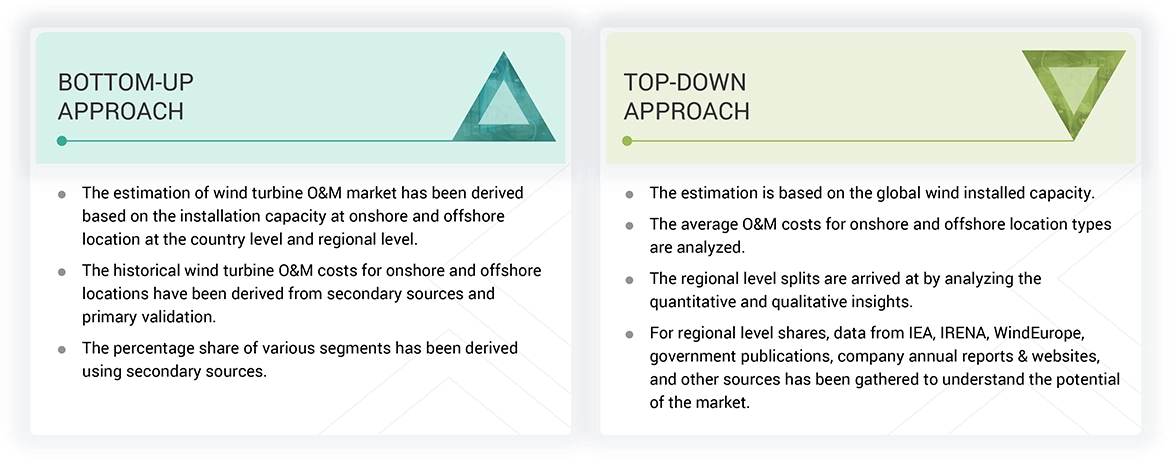

The study involved major activities in estimating the current size of the wind turbine operations and maintenance market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the wind turbine o&m market involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify information useful for a technical, market-oriented, and commercial study of the market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

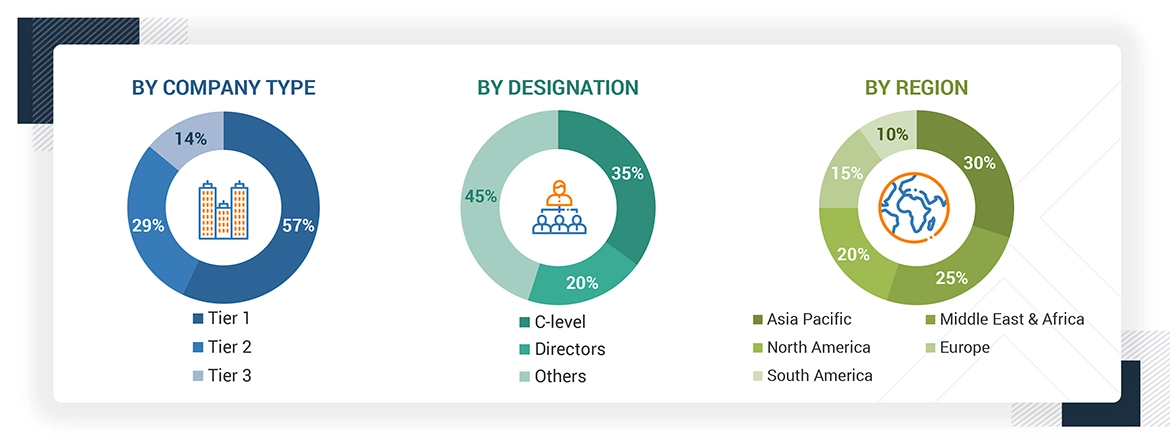

Primary Research

The wind turbine operations and maintenance market comprises several stakeholders, such as equipment providers, service providers, and technology providers in the supply chain. The demand side of this market is characterized by the rising demand for operations and maintenance solutions in various location types, such as onshore and offshore. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following.

Wind Turbine Operations and Maintenance Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Wind energy is generated with wind turbines, which harvest the kinetic energy from the wind through blades. The blades rotate to form a spinning rotor to which the generator is attached, and the generator converts this energy into electricity. Wind turbine operations and maintenance (O&M) is comprised of all maintenance and service tasks (including functional checks, repair, and/or replacement of equipment) that are needed to ensure that wind turbines operate efficiently, reliably, and safely throughout their operational life of 20-25 years. O&M can also include both scheduled (preventive) and unscheduled (corrective) maintenance tasks. The market is assessed based on the revenue generated from O&M activities for wind turbines located in both onshore and offshore wind farms.

Stakeholders

- Government and Research Organizations

- Energy Service Providers (private/government)

- Utilities & Retail Electricity Suppliers

- Original Equipment Manufacturers (OEMs)

- Independent Service Providers (ISPs)

- Asset Owners/Operators

- Technology Providers

- Spare Parts Suppliers & Logistics

- Consultants/Consultancies/Advisory Firms

- Environmental Research Institutes

- Private or Investor-owned Utilities

- State and National Regulatory Authorities

- Investors/Shareholders

Report Objectives

- To define, describe, and forecast the wind turbine operations and maintenance market based on type, location type, turbine connectivity, and region, in terms of value

- To forecast the market size across five key regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, in terms of value

- To provide detailed information about the key drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To provide information pertaining to the supply chain, trends/disruptions impacting customer business, market maps, pricing of hardware solutions, and regulatory landscape pertaining to the market

- To strategically analyze the micromarkets with respect to individual growth trends, upcoming expansions, and their contributions to the overall market

- To analyze opportunities for stakeholders in the market and draw a competitive landscape for market players

- To benchmark players within the market using the company evaluation quadrant, which analyzes market players on various parameters within the broad categories of business and product strategies

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments in the market, such as sales contracts, agreements, investments, expansions, alliances, mergers, partnerships, joint ventures, collaborations, and acquisitions

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the wind turbine operations and maintenance market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Wind Turbine Operations and Maintenance Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Wind Turbine Operations and Maintenance Market