Aircraft Battery Market Size, Share & Trends 2030

Aircraft Battery Market by Chemistry (Lead-Acid, Nickel, Lithium), Density (<100, 100-300, >300 Wh/Kg), Capacity (<20, >20Ah), Propulsion (Conventional, Hybrid, Electric), Platform (Commercial, Military, UAV, AAM), Application Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis<

The aircraft battery market is projected to grow from USD 1.61 billion in 2025 to USD 2.40 billion by 2030 at a CAGR of 8.3%. The procurement volume of aircraft batteries is projected to grow from 1,509.8 thousand units in 2025 to 2,335.6 thousand units by 2030. Growth is driven by electrification, fleet renewal, and sustainability priorities that demand higher energy density, lighter weight, and safer solutions.

KEY TAKEAWAYS

- North America is expected to account for 46.7% of the aircraft battery market in 2025.

- By battery chemistry, the lithium-based segment is projected to grow at the fastest rate, registering a CAGR of 9.0%.

- By battery component, the battery management systems segment is projected to grow at the fastest rate, registering a CAGR of 8.5%.

- By application, the propulsion segment is expected to account for the largest market share from 2025 to 2030.

- DJI, Saft, and EnerSys were identified as star players in the aircraft battery market, given their strong market share and extensive product footprint.

- Inobat, MagniX, and Lyten Inc., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The future outlook for the aircraft battery industry is strong, driven by electrification, hybrid-electric propulsion, and emission regulations. Advancements in lithium-ion and solid-state chemistries, combined with thermal management innovations, are likely to boost efficiency, safety, and energy density, supporting growth across commercial, military, UAV, and advanced air mobility platforms through 2030.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The aircraft battery market is driven by electric and hybrid propulsion adoption, advanced lithium-ion and solid-state technologies, and AI-enabled health monitoring. Emphasis on sustainability, recyclable materials, and lightweight high energy-density designs is reshaping OEM and aftermarket strategies while opening new revenue opportunities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis<

MARKET DYNAMICS

Level

-

Increasing Electrification of Aircraft Fleets Due to Lower Costs

-

Emission Regulations Driving Battery-based Retrofits in Legacy Aircraft Fleets

Level

-

Regulatory and Certification Barriers for Battery Integration

-

Fire Hazards and Thermal Runaway Risks in Aviation Battery Systems

Level

-

Advancements in Chemicals and Battery Technologies

-

Rising Demand for Electric and Hybrid Regional Aircraft

Level

-

Safeguarding Batteries against Probable Operational Failures

-

Frequent Battery Replacements Due to Degradation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis<

Driver: Increasing Electrification of Aircraft Fleets Due to Lower Costs

The shift toward electric and hybrid-electric aircraft is accelerating due to cost savings, sustainability, and operational efficiency. Electric aircraft reduce fuel and maintenance expenses while simplifying propulsion. Supported by R&D in lithium-ion and solid-state chemistries, suppliers like Saft, EPS, and Evolito are driving advancements. Recent milestones, such as Beta Technologies’ ALIA flight, validate operational feasibility and boost OEM adoption.

Restraint: Regulatory and Certification Barriers for Battery Integration

Strict certification standards by FAA and EASA limit rapid battery integration in aircraft. Lengthy approval cycles, extensive testing, and supplemental certifications add delays and costs. Compliance with energy stability, thermal safety, and electromagnetic compatibility requirements slow innovation. Despite demonstrated readiness, programs like Joby Aviation’s continue to face certification hurdles, highlighting regulation as a major bottleneck for faster adoption.

Opportunity: Advancements in Chemicals and Battery Technologies

Next-generation chemistries like solid-state and lithium-sulfur batteries are enabling higher energy density, safety, and efficiency in aviation. Solid-state designs reduce fire risks with compact, lightweight configurations, while lithium-sulfur offers extended range. Innovations from companies like Ampcera and Oxis Energy and collaborations with US DOE highlight strong momentum. These advancements promise longer endurance, lighter systems, and broader adoption in electric aviation.

Challenge: Frequent Battery Replacements Due to Degradation

Lithium-ion batteries face rapid degradation from cycle aging and calendar aging, necessitating frequent replacements. This creates high costs, downtime, and reduced availability in aviation applications with demanding energy needs. Operators report replacements within hundreds of cycles in training and demonstrator aircraft. Until solid-state or lithium-sulfur achieves scalability, degradation will remain a critical challenge, particularly for urban air mobility and short-haul operations.

aircraft battery market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Lithium-ion aviation batteries for Airbus A350 | Provides higher energy density, faster recharge, and extended lifecycle with advanced BMS for improved safety and efficiency |

|

VRLA batteries for general aviation | Ensures reliable starter/backup power with low-maintenance sealed design, reducing leakage risks and operational downtime |

|

Battery pack for Rolls-Royce "Spirit of Innovation" | Achieves record-breaking all-electric flight speeds with 6,000-cell pack and advanced cooling for safe, high-power propulsion |

|

Lithium polymer batteries for UAVs | Enables extended endurance, high-discharge performance, and rapid charging with intelligent monitoring for defense and commercial UAVs |

|

Lithium-ion battery packs for Boeing 787 Dreamliner | Powers auxiliary and backup systems with high reliability, proven safety certifications, and long operational service life |

|

Proprietary high-voltage battery packs for eVTOL aircraft | Powers all-electric air taxis with >200-mile range and high cycle life, balancing fast charging, safety, and energy density for urban air mobility |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The aircraft battery market ecosystem is driven by leading manufacturers such as Saft, Concorde, EnerSys, GS Yuasa, and Teledyne, alongside innovators like EarthX and DJI. System integrators and MRO providers, including Parker, Meggitt, H55, and Mid-Continent, ensure effective deployment and lifecycle support. Aircraft OEMs, airlines, and defense agencies act as key end users, driving advancements in chemistries, integration, and safety compliance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aircraft Battery Market, By Battery Chemistry

Lithium-based batteries dominate as they offer higher energy density, reduced weight, and improved performance compared to traditional chemistry. Their ability to support modern aviation demands makes them the preferred choice for commercial, military, and urban air mobility platforms.

Aircraft Battery Market, By Battery Component

Battery cells lead the segment as they form the core of aircraft energy storage systems, directly influencing performance, safety, and efficiency. Their advancement in design and materials is crucial for meeting stringent aviation requirements.

Aircraft Battery Market, By Energy Density

Batteries with <100 Wh/kg energy density are prevalent in conventional aviation platforms, where safety and reliability outweigh ultra-high-density needs. These chemistries ensure stable operations in auxiliary and backup applications.

Aircraft Battery Market, By Power Capacity

> 20 Ah capacity batteries dominate as they support critical functions such as auxiliary power units and emergency systems. Their ability to provide sustained power makes them essential for demanding aviation applications.

Aircraft Battery Market, By Application

Auxiliary Power Units (APU) represent a key application area, with batteries ensuring reliable backup power for ground operations, engine starts, and emergency systems, driving their increasing adoption.

Aircraft Battery Market, By Propulsion Technology

Conventional aircraft hold the majority share, as batteries in these platforms are vital for backup, engine starting, and supporting modern electrification systems rather than primary propulsion

Aircraft Battery Market, By Lift Technology

Conventional take-off and landing (CTOL) aircraft dominate as they account for the largest share of global fleets, where battery integration supports both auxiliary and safety-critical functions.

Aircraft Battery Market, By Point of Sale

OEM sales lead the market, with growing integration of advanced batteries at the manufacturing stage to meet certification, safety, and sustainability requirements across new aircraft programs.

Aircraft Battery Market, By Platform

Unmanned aerial vehicles (UAVs) are increasingly reliant on batteries due to their need for lightweight, high-performance energy systems. These systems support missions across defense, surveillance, and commercial applications.

REGION

Africa to be fastest-growing region in global aircraft battery market during forecast period

Africa is set to be the fastest-growing region in the aircraft battery market, fueled by strong MRO activity and defense modernization. South Africa’s hub role, with players like SAAT and Denel, and Nigeria’s MRO centers such as Aero Contractors and Caverton, drive recurring demand. Regulatory alignment and local manufacturing further position Africa as a rising aviation battery market.

aircraft battery market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the aircraft battery market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. DJI is positioned as a leading player with a strong focus on advanced battery technologies, while EarthX is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Aircraft Battery Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.54 Billion |

| Market Forecast in 2030 (value) | USD 2.40 Billion |

| Growth Rate | CAGR of 8.3% during 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East, Latin America, and Africa |

WHAT IS IN IT FOR YOU: aircraft battery market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- August 2025 : Lyten announced a binding agreement to acquire Northvolt assets, including 16 GWh of operational battery capacity, 15 GWh under construction, and Europe’s largest R&D center, strengthening its lithium-sulfur battery footprint.

- July 2025 : Lyten secured over USD 200 million in equity funding from existing investors, raising its total to USD 625 million. The funds will support global expansion, strategy execution, and growth initiatives across the US and Europe.

- June 2025 : Saft and Safran entered into a partnership to co-develop an 800V lithium-ion battery for future more-electric and hybrid-electric aircraft, targeting higher power density, faster charging, and reduced environmental footprint.

- June 2025 : Saft and Safran announced a collaboration to jointly develop a 28V lithium-ion battery tailored for aviation platforms, aiming to deliver a compact, lightweight, and maintenance-efficient power source for next-generation aircraft systems.

- May 2025 : Amprius entered a contract manufacturing agreement with a South Korean battery manufacturer to produce its SiCore® cells at scale, expanding capacity for advanced drone and aviation platforms with optimized energy and power performance.

Table of Contents

Methodology

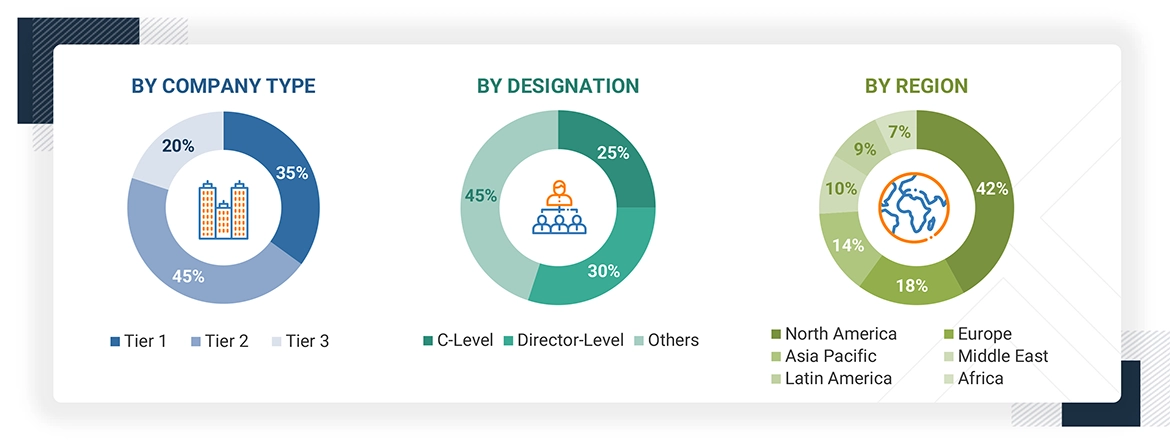

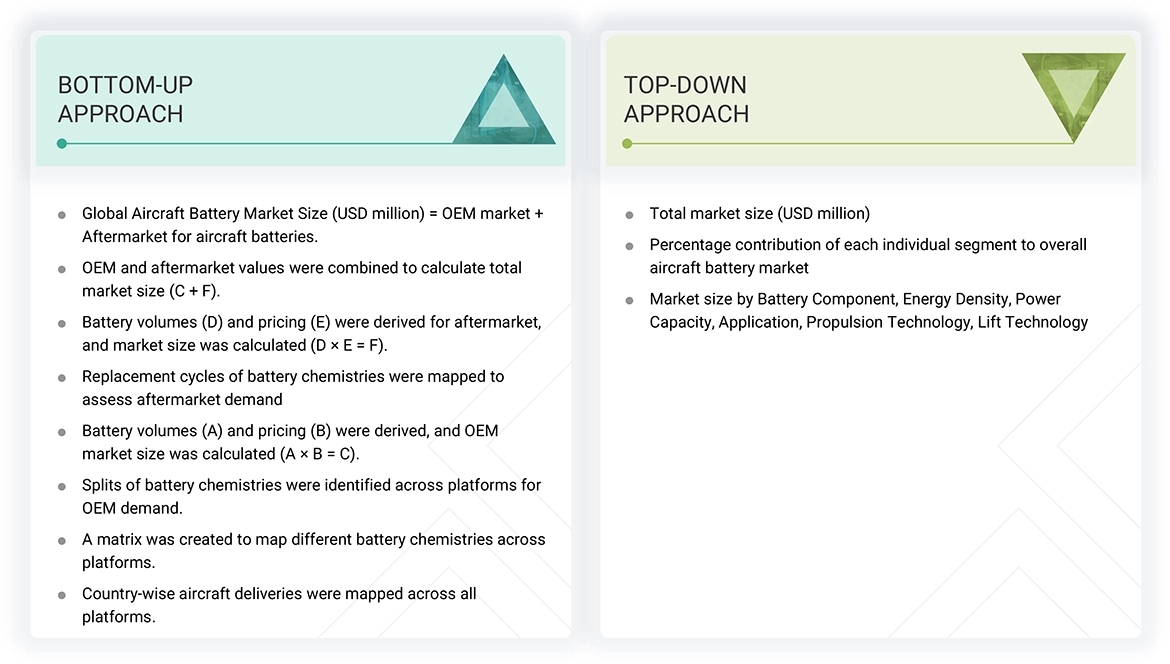

This research study used secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect relevant information on the aircraft battery market. Primary sources included industry experts from the core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess the prospects of the aircraft battery market. A deductive approach, also known as the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The ranking of companies operating in the aircraft battery market was based on secondary data made available through paid and unpaid sources, the analysis of product portfolios of the major companies in the market, and rating them based on their performance and quality. These data points were further validated by primary sources.

Secondary sources referred to for this research study on the aircraft battery market included government sources, such as corporate filings that included annual reports, investor presentations, and financial statements, and trade, business, and professional associations. Secondary data was collected and analyzed to determine the overall market size, which was further validated by various primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the aircraft battery market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa to obtain qualitative and quantitative information on the market. Primary data was collected through questionnaires, emails, and telephonic interviews. Primary sources from the supply side included industry experts, such as vice presidents, directors, regional managers, technology providers, product development teams, distributors, and end users.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from the products, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped us understand the trends related to battery chemistry, battery components, energy density, power capacity, application, propulsion technology, lift technology, point of sale, platform, and region. Demand-side stakeholders, such as CXOs, production managers, engineers, and installation teams of end users of aircraft batteries, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and future outlook of their business, which could affect the aircraft battery market.

Note 1: The tier of companies has been defined based on their total revenue as of 2024.

Note 2: Tier 1 = > USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million

Note 3: C-level designations include CEO, COO, and CTO.

Note 4: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the aircraft battery market. The research methodology used to estimate the market size includes the following details:

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Aircraft Battery Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the size of the aircraft battery market from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for the market segments and subsegments, the market breakdown and data triangulation procedures were implemented, wherever applicable. The data was triangulated by studying various factors from the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

An aircraft battery is an onboard electrochemical source that converts chemical energy into electrical energy for aircraft use. At the pack level, it comprises four essential components: the electrochemical cells that generate power, a battery management system (BMS) that ensures safe operation and balancing, thermal management systems that regulate heat and maintain performance, and enclosures with connectors that provide mechanical protection and integration with aircraft systems. This configuration delivers a certified and reliable power source designed to meet the stringent safety and performance requirements of aviation.

Aircraft batteries perform multiple critical functions, including powering pre-flight checks, starting auxiliary power units and engines, and supplying emergency or essential backup power to avionics and flight-control systems in the event of primary generation loss. In unmanned aerial vehicles (UAVs) and advanced air mobility (AAM) platforms such as eVTOLs, they also serve as a primary propulsion source. The principal chemistries in service are lead–acid, nickel-based, and lithium-based. Lead–acid and nickel technologies are long established across transport and business aircraft, while lithium-based systems are increasingly adopted for their higher energy density, subject to aviation certification standards.

Key Stakeholders

- Aircraft Battery Manufacturers

- Subcomponent Manufacturers

- Technology Support Providers

- Research Bodies

- System Integrators

- Aircraft Manufacturers

- Airline Operators

- Defense Organizations

Report Objectives

- To define, describe, and forecast the aircraft battery market based on battery chemistry, battery component, energy density, power capacity, application, propulsion technology, lift technology, point of sale, platform, and region

- To forecast the size of various segments of the market across North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa

- To identify and analyze the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the aircraft battery market

- To provide an overview of the regulatory landscape with respect to aircraft battery regulations across regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies

- To evaluate the degree of competition in the market by analyzing recent developments, such as contracts, agreements, and acquisitions adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis and revenue analysis of key players

Customization Options

MarketsandMarkets also offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the current size of the aircraft battery market?

The aircraft battery market is estimated at USD 1.61 billion in value in 2025.

Who are the winners in the aircraft battery market?

The winners in the aircraft battery market are DJI (China), EaglePicher Technologies (US), Saft (France), EnerSys (US), and Concorde Battery Corporation (US).

What are some of the technological advancements in the market?

- Battery Cell Chemistries: Advancements in battery cell chemistries enable higher energy density, improved thermal stability, and longer cycle life than legacy solutions. Lithium-ion dominates current adoption, but solid-state and lithium-sulfur chemistries are gaining traction for their ability to reduce fire risk and enhance energy-to-weight ratios. These innovations are critical for aviation, where weight reduction and safety compliance are top priorities.

- Thermal Management Systems: Efficient thermal management is essential to maintain performance and safety in aviation batteries, especially under varying altitude and temperature conditions. Modern systems integrate advanced cooling technologies, heat dissipation materials, and smart monitoring to prevent overheating and thermal runaway. These systems ensure consistent output, longer battery lifespan, and regulatory compliance in demanding aerospace environments.

- Hybrid-Electric and All-Electric Propulsion Systems: Adjacent propulsion technologies are closely linked to battery advancements, as electrified powertrains depend heavily on reliable and high-density energy storage. Hybrid-electric systems reduce fuel consumption and emissions, while all-electric propulsion supports zero-emission operations. Both rely on advanced batteries for scalability, making them a key growth driver in the sector.

What are the factors driving growth in the market?

Key driving factors driving market growth include:

- Increasing electrification of aircraft fleets due to comparatively lower costs

- Emission regulations driving battery-based retrofits in legacy aircraft fleets

- Enhancements in battery design for electric and hybrid aircraft integration

- Increasing deliveries of commercial and military aircraft worldwide

Which region is estimated to account for the largest share of the overall aircraft battery market in 2025?

· North America is estimated to account for the largest share of 46.2% of the aircraft battery market in 2025.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Aircraft Battery Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Aircraft Battery Market