AI Code Assistants Market Size & Share Report

AI Code Assistants Market by Offering (Generative AI Code Assistants, Developer Platforms, Coding APIs, Workflow Tools), Model Type (General-Purpose, Code-Specialized, Enterprise-Tuned Generative AI Models) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The report for AI code assistants market size is estimated to be USD 8.14 billion in 2025 and is set to grow at a CAGR of 48.1% over the forecast period, to reach USD 127.05 billion in 2032. This is due to the adoption of AI-assisted software development techniques in the enterprise space, enhancing speed and consistency. The advancements in code-oriented large language models are enabling the generation of accurate code with multi-language support and compilation error resolution. The adoption of code pilot services, repository awareness, and custom fine-tuned models for enhancing the productivity of developers and modernizing the traditional applications of enterprises is supporting the market. The usage of AI-assisted DevSecOps, code generation as per security policies, and security patch services are further driving the market. Coding services based on APIs, on-premise solutions, and IDE-based code assistants are revolutionizing the software development and maintenance landscape for cloud as well as hybrid infrastructures.

KEY TAKEAWAYS

-

BY REGIONNorth america is estimated to account for the largest share of the AI code assistans market in 2025.

-

BY OFFERINGBy offering, the generative ai code assistants segment is estimated to account for the largest market share in 2025.

-

BY APPLICATIONThe code generation & transformation segment is estimated to be the largest application in 2025.

-

BY MODEL TYPEBy model type, the enterprise-tuned generative AI models segment is estimated to hold the largest share of the AI code assistants market in 2025.

-

BY END USERBy end user, the BFSI segment is expected to witness the fastest growth between 2025 and 2032.

-

BY COMPETITIVE LANDSCAPEMicrosoft, Google, and OpenAI are positioned as leading players in the AI code assistants landscape, given their strong market share and product, application, and end user footprint.

-

BY COMPETITIVE LANDSCAPETabnine and Synk, among others, have distinguished themselves by strategically securing a strong hold in specialized niche areas, underscoring their potential as emerging leaders.

The market growth is supported by improvements in code-specialized models, large-context reasoning, and repository-aware architectures that allow assistants to handle complex development tasks. These include multi-file refactoring, debugging across dependencies & automated test results. Vendors are prioritizing secure and explainable ai development workflows, particularly in regulated environments. Thus, the demand for private model deployments, governed code-generation pipelines, and tighter integration with developer operation tools is rising.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends in the AI code assistant market are showing that vendors are changing the way they make money, and enterprises are changing the way they get value. Presently, most of the revenues are from general-purpose models and simple coding tools. After that, the majority of the increase is expected to come from enterprise-tuned models, workflow automation, and advanced code transformation capabilities. Such products give vendors more certain and scalable revenue streams. The change for users means that their development cycles will be quicker, the quality of software will be better, the security controls will be stronger, and the digital experiences across applications will be improved.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Automated refactoring assistants with safety checks

-

Driving adoption through automated CI/CD pipeline generation

Level

-

Limiting adoption through potential license-contamination risks

-

Poisoned or low-quality private corpora

Level

-

Advancing security maturity with integrated SCA-guided vulnerability detection

-

Automated legacy-to-IaC migration adapters

Level

-

Preventing adversarial prompting that auto-generates exploits

-

Operationalizing provenance for merged code across forks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Automated refactoring assistants with safety checks

Automated refactoring tools with built-in safety validation are emerging as an important driver of adoption. Enterprises are using these tools to modernize large and complex codebases more efficiently. AI assistants can identify redundant logic, optimize performance, and enforce region-specific regulatory coding standards across repositories. Integrated safety checks, such as static analysis and policy-based controls, help ensure that updates made don't break existing functionality. As organizations accelerate cloud migration and legacy modernization efforts, AI-driven refactoring is becoming a core feature in enterprise development environments.

Restraint: Limiting adoption through potential license-contamination risks

Concerns around license contamination remain a major restraint for enterprise adoption. Organizations are cautious about AI-generated code that may introduce licensing risks, especially in commercial and regulated software products. Limited transparency around training data and the lack of standardized provenance mechanisms make compliance difficult to verify. Thus, enterprises are demanding features such as license-aware generation, attribution controls, and traceable output metadata. Until clearer standards and safeguards are widely adopted, these concerns are expected to slow adoption in IP-sensitive sectors.

Opportunity: Advancing security maturity with integrated SCA-guided vulnerability detection

Integrating AI code assistants with Software Composition Analysis (SCA) tools presents a strong opportunity for vendors. This combination allows assistants to identify vulnerable dependencies and automatically generate compliant fixes during development. Embedding vulnerability insights directly into coding environments enables earlier detection and faster remediation. As software systems become more complex and dependency-heavy, AI-enabled (Software Composition Analysis) SCA integration offers enterprises a scalable approach to improve security and maintain compliance throughout the development lifecycle.

Challenge: Preventing adversarial prompting that auto-generates exploits

Threat of adversarial prompting is an prominent challenge for AI code assistant vendors. Malicious inputs can cause models to generate insecure/exploit-prone code. These risks highlight the need for stringent prompt controls, result validation & security-focused model tuning. As AI assistants become more deeply embedded in development workflows, ensuring consistent and secure outputs across languages and frameworks is crucial. Addressing these risks will be essential to maintaining trust in AI-assisted development software.

AI CODE ASSISTANTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Mollie partnered with Snyk to strengthen its security posture across rapidly scaling payment infrastructure. It integrated Snyk’s developer-first security platform to automate vulnerability detection, dependency risk management, and secure coding workflows. By embedding Snyk’s scanning capabilities into CI/CD pipelines, Mollie aimed to accelerate secure software delivery, reduce remediation backlog, and maintain continuous compliance. | The Snyk–Mollie integration enabled faster identification and resolution of high-risk vulnerabilities, significantly reduced security debt, and accelerated end-to-end development. Mollie achieved stronger compliance alignment, enhanced code integrity across microservices, and streamlined secure deployment processes supporting the delivery of resilient, high-trust digital payment services. |

|

Indeed collaborated with Sourcegraph to enhance engineering productivity by deploying Sourcegraph’s code intelligence platform across its large, distributed codebase. The initiative aimed to improve developer onboarding speed, accelerate complex code search and impact analysis, and support multi-team collaboration for rapid feature development. Sourcegraph’s advanced search and navigation capabilities helped Indeed centralize code insights and reduce time spent locating critical logic across repositories. | The deployment enabled Indeed to significantly boost development velocity, reducing code discovery and analysis time from hours to minutes. Engineering teams reported faster incident investigation, improved code reuse, and more efficient cross-team collaboration. This resulted in accelerated shipping cycles and higher delivery consistency across its global product organization. |

|

Paytm partnered with Zencoder to integrate AI-driven code assistance into its large-scale financial services engineering environment, enabling automated refactoring, faster debugging, and real-time development support across critical payment and merchant-service platforms. The collaboration aimed to reduce engineering turnaround time, improve code quality across legacy and modern stacks, and enhance developer efficiency within complex, high-volume application workflows. | By adopting Zencoder’s AI-enhanced development capabilities, Paytm achieved noticeable improvements in debugging speed, code maintainability, and release-cycle throughput. Teams experienced reduced development friction, more accurate code transformations, and enhanced productivity across payment. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the AI code assistants market is undergoing a substantial positive transformation and is becoming more mature. This development is well supported by a broad spectrum of providers who present code generation tools, developer platforms, APIs, and workflow automation solutions. Besides, big technology vendors are widening the market by providing IDE copilots, DevOps and DevSecOps integrations, coding APIs, and tools for debugging and documentation. All of these offerings create a burgeoning ecosystem that is supporting enterprises to enhance their development speed, keep code quality, and implement AI, assisted engineering methods on a large scale.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI Code Assistants Market, By Offering

The Generative-AI API-code segment wils projected to grow at the fastest rate during the forecast period as businesses are starting to focus on including code intelligence via AI directly in their development systems or platforms. The growing need for scalable code APIs & inference points and repository search services will rise for inclusion in development environments & CI/CD systems and DevSecOps systems. The growing adoption of long-context or multimodal models will translate to an increased utilisation rate, leading to a preference for usage-based models over software tools based on seats purchased. Enterprises turn to RAG-enabled & enterprise-optimised models requiring M&D solutions for deployment & governing.

AI Code Assistants Market, By Model Type

The general-purpose generative models segment is estimated to dominate the AI code assistants market in 2025. This is owed to their universal availability and, therefore, universal adaptability. As they are multi-language, multi-framework & multi-development task generative models, they suit a wide variety of enterprise use-cases. The largest foundational models will continue to be a significant portion of many early deployments of AI code assistants. Large foundation generative models are effective at providing good reasoning with large contextual windows, and are typically not customisable. The majority of commercial copilot products, coding APIs, and enterprise development tools are powered by large foundation models. Similarly, the acceleration of experimenting, prototyping, and broadly adopting the AI-assisted software development will make general-purpose generative models the most deployed engine for code generation, testing and re-factoring.

AI Code Assistants Market, By Application

The debugging & remediation segment is projected to register significant growth in the overall market as businesses transition from generating basic code to relying on artificial intelligence to improve software reliability and resolve issues more quickly. With the increasing complexity of systems and the widespread use of distributed architectures, the need for artificial intelligence (AI) assistants to facilitate the analysis of failures across multiple files and logs has arisen, enabling greater capability to identify and analyze risks associated with system interdependencies and to generate proposed remediation solutions. Improvements in reasoning models and contextual retrieval capabilities have improved the reliability of AI-based remediation. In the current environment, companies are prioritising stability, security, and speed in recovering from errors. Hence, many companies are rapidly adopting AI debugging and remediation tools.

AI Code Assistants Market, By End User

The software/technology segment is estimated to account for the largest share of the market in 2025. This is due to their strong focus on AI-enabled engineering and developing cloud-native applications. Compared with their competitors, organisations that utilise these applications typically have larger development teams and use rapid release cycles, where both productivity and code quality are extremely important. For that reason, AI code assistants utilised by software development teams, DevOps teams, security, as well as platform teams to support refactoring, testing and automating the coding process. As a result of a developed CI/CD process and foundationally established AI support systems, software companies are among the earliest and largest purchasers of AI-driven development tools.

REGION

Asia Pacific to be fastest-growing region in global AI code assistants market during forecast period

Asia Pacific is witnessing high growth in the AI code assistants market. The region benefits from rapid digital adoption, large developer talent pools, and rising enterprise investment in AI-enabled development. Besides these, countries such as India, China, Japan, South Korea, and Singapore are not only expanding cloud infrastructure but also facilitating AI adoption through their respective national programs. The region's expanding IT services and SaaS ecosystem is turning into a heavy user of AI code assistants for application modernization, automated testing, and secure coding.

AI CODE ASSISTANTS MARKET: COMPANY EVALUATION MATRIX

The company valuation matrix for the AI code assistant industry labels Microsoft as a Star Player due to the company’s wide product offerings and strong enterprise adoption rate. Snyk is classified as an Emerging Leader because of its focus on secured software development (powered by AI) and its ability to easily fix code. Based on its increased usage and deeper integration with development workflow, Snyk Is positioned favorably to advance toward the leading quadrant in due time.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Microsoft (US)

- Google (US)

- IBM (US)

- Oracle (US)

- AWS (US)

- Jetbrains (Netherlands)

- Replit (US)

- Synk (US)

- OpenAI (US)

- Anthropic (US)

- Datadog (US)

- Tabnine (Israel)

- Sourcegraph (US)

- Cursor (US)

- Zencoder (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.48 Billion |

| Market Forecast in 2032 | USD 127.05 Billion |

| Growth Rate | CAGR of 48.1% during 2025-2032 |

| Years Considered | 2020-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Region Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: AI CODE ASSISTANTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Software & Technology Provider |

|

|

| Leading Financial Services & Digital Banking Enterprise |

|

|

RECENT DEVELOPMENTS

- October 2025 : Anthropic and Salesforce expanded their strategic partnership to embed Anthropic’s Claude models directly within Salesforce’s Agentforce 360 platform, delivering trusted, enterprise-grade AI code and workflow assistance.

- November 2025 : IBM announced advancements to Watsonx Code Assistant for Z, adding AI-driven code generation and assembler-language support to help enterprises modernize mainframe applications, automate complex code translation workflows, and accelerate the transformation of mission-critical systems.

- November 2025 : Snyk partnered with Continue to integrate AI-powered security scanning and dependency checks into Continue’s development workflow, enabling real-time vulnerability detection and context-aware fix suggestions directly in the developer’s IDE, CLI, or CI pipeline.

- May 2025 : OpenAI launched an advanced version of its Codex-based coding assistant designed to deliver higher code-generation accuracy, deeper multi-language reasoning, and improved integration for developers building sophisticated AI-augmented software applications.

- March 2025 : Tabnine entered a strategic partnership with Dell Technologies to deliver Dell-optimized AI coding solutions that enable enterprises to deploy private, secure code-assistant models on Dell infrastructure, supporting data-controlled, on-premises generative AI development environments.

Table of Contents

Methodology

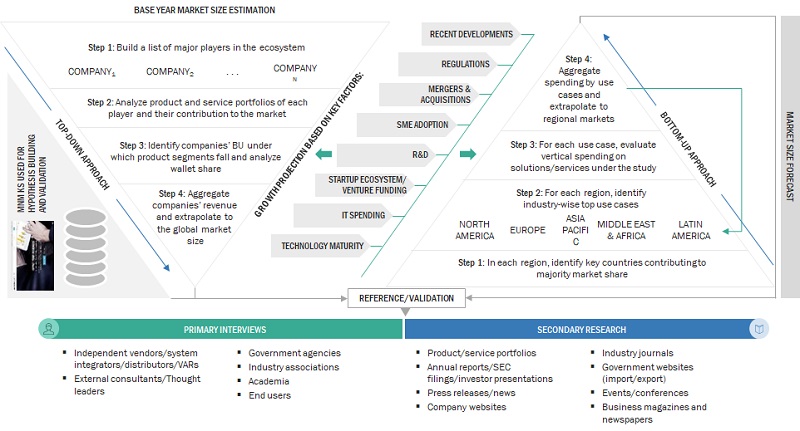

The research study for the AI code assistants market involved extensive secondary sources, directories, and several journals. Primary sources were mainly industry experts from the core and related industries, preferred AI code assistants provider, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering AI code assistants and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites. Additionally, AI code assistants spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, functionality, applications, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and AI code assistants expertise; related key executives from AI code assistants vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using AI code assistants, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of AI code assistants and services, which would impact the overall AI code assistants market

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the AI code assistants market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of tools and services.

Market Size Estimation Methodology-Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the AI code assistants market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of solutions and services, deployment modes, applications, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of AI code assistants and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of AI code assistants and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the AI code assistants market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major AI code tool providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall AI code assistants market size and segments’ size were determined and confirmed using the study

Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to IBM, AI code assistants refer to a suite of advanced software solutions empowering developers and data scientists in the creation, training, and deployment of AI & ML models. These tools collectively enable the seamless integration of AI capabilities into applications and business processes, fostering innovation and efficiency in the development lifecycle.

According to Microsoft, AI code assistants are a comprehensive set of software solutions designed to empower developers in building, training, and deploying AI models.

Stakeholders

- AI code tool vendors

- AI code solution vendors

- Managed service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Value-added resellers (VARs) and distributors

- Distributors and value-added resellers (VARs)

- System integrators (SIs)

- Independent software vendors (ISV)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and predict the AI code assistants market by offering (tools and services), technology, application, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the AI code assistants market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI Code Assistants Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI Code Assistants Market