AI SDR Market

AI SDR Market by Offering (Email Generators, Enrichment, AI Script, Template Generators, Meeting Booking), Use Case (Appointment Scheduling, Prospecting, Outreach, CRMs, Data Management, Follow up, Research, Sales Engagement) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI SDR market is expanding rapidly, with a market size projected to rise from about USD 4.12 billion in 2025 to USD 15.01 billion by 2030, registering a CAGR of 29.5%. As sales teams strive for scalable outreach and higher conversion rates, AI is refining prospecting workflows and boosting efficiency. AI SDR tools, such as lead research bots, email generators, and follow-up sequencers, automate data-heavy tasks to assist human SDRs. These solutions pinpoint high-potential leads, provide tailored messaging, and enhance outreach velocity. Unlike AI agents built for broad sales process automation, AI SDRs concentrate on targeted, revenue-generating tasks, requiring seamless CRM integration and access to real-time sales data. Embedded within sales engagement platforms, AI SDRs leverage behavioral signals and firmographic insights to personalize outreach, enabling reps to focus on high-value prospects and drive performance in dynamic selling environments.

KEY TAKEAWAYS

- North America dominates the AI SDR market by 43.1% market share in 2025.

- By software type, the AI Outreach Assistants segment leads by 27.6% market share in 2025.

- By deployment mode, the cloud-native SaaS is expected to dominate the market.

- By sales channel, the hybrid segment is projected to have the fastest growth rate, during the forecast period.

- By use case, the lead generation & qualification segment is expected to dominate the market.

- Salesforce, HubSpot and Salesloft are identified as some of the star players in the AI SDR market, given their strong market share and product footprint.

- Relevance AI, 11x AI and UserGems, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging leaders.

The AI SDR market focuses on tools that automate lead outreach, qualification, and engagement, helping sales teams scale top-of-funnel activities such as prospecting, cold emailing, LinkedIn outreach, and meeting scheduling. Unlike AI Sales Agents, which cover the full sales funnel including proposals, quoting, renewals, and upselling; AI SDRs specialize in driving pipeline efficiency and consistent lead generation. By integrating with CRM and analytics platforms, these solutions enhance targeted outreach, improve conversion rates, and remain critical for organizations seeking scalable, AI-driven sales development strategies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on sales organizations comes from evolving AI technologies and market disruptions. Main business segments, including enterprises, SMBs, and SaaS companies, are the primary users of AI SDR platforms, while target applications include lead generation, prospect engagement, and pipeline optimization. Changes in platform adoption and innovation cycles directly alter sales workflows, outreach strategies, and account management. This influence spreads across the sales ecosystem, driving investment in AI-driven tools, improving team performance, and boosting conversion rates, ultimately fueling growth and adoption in the global AI SDR market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Rising implementation of hybrid human-AI sales engagement models

-

•Growing adoption of intent-based prospecting and predictive analytics

Level

-

•Inefficiencies in segmentation logic and targeting precision

Level

-

•Emergence of multi-agent AI-driven SDR architectures

-

•Growing sales efficiency through predictive lead qualification

Level

-

•Deficiencies in emotional intelligence and contextual adaptability

-

•Reliance on high-fidelity and contextually accurate data inputs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of intent-based prospecting and predictive analytics

The adoption of intent-based prospecting and predictive analytics is driving growth in the AI SDR market by transforming B2B sales strategies. AI SDR tools leverage machine learning and NLP to analyze behavioral signals—like website visits, content engagement, and social media activity—to identify high-intent prospects. This allows sales teams to prioritize leads with higher conversion potential, optimizing pipeline efficiency and shortening sales cycles. For instance, ZoomInfo reports a 20% increase in lead response rates when targeting prospects actively researching solutions, demonstrating the effectiveness of intent-driven outreach for scalable, personalized engagement.

Restraint: Inefficiencies in segmentation logic and targeting precision

Segmentation inefficiencies and inaccurate targeting remain major barriers to AI SDR adoption. Platforms depend on algorithms to segment leads using firmographic, demographic, and behavioral data, but biased datasets or poorly configured predictive models can lead to irrelevant outreach. This lowers campaign effectiveness and erodes trust in AI-driven prospecting. For example, OneShot.ai reports that 30% of AI SDR campaigns underperform due to segmentation errors, requiring resource-heavy recalibration. High-stakes B2B markets, like SaaS, need precise targeting, and AI’s dependence on repeated retraining limits use among small-to-mid-sized companies that lack the technical capacity to continuously refine segmentation.

Opportunity: Emergence of Multi-agent AI-driven SDR Architectures

Multi-agent AI SDR architectures are speeding up sales automation by deploying specialized agents to handle lead generation, qualification, and personalized outreach. These systems coordinate multi-channel engagement, including voice, email, and chat, boosting efficiency and effectiveness. Real-world implementation shows notable results: in healthcare, AI SDR systems increased appointment bookings by 32% and enhanced patient engagement through smart conversations. Organizations report up to a 40% reduction in sales cycle time and 25% more qualified leads within six months. Multi-agent architectures support real-time analytics and iterative improvements, enabling sales teams to focus on strategic interactions while expanding personalized engagement.

Challenge: Reliance on high-fidelity and contextually accurate data inputs

AI SDRs rely heavily on high-quality, contextually accurate data for effective prospecting. Poor, incomplete, or outdated data leads to misaligned outreach, irrelevant messaging, and lower conversion rates. Over-automation can oversaturate markets, reduce engagement, and damage brand reputation. Regulatory compliance adds another layer of complexity, as mishandling sensitive data introduces legal risks. Implementing rigorous data governance, real-time enrichment, and human oversight helps mitigate these challenges. For example, firms with robust data protocols achieve up to 25% higher conversion rates, illustrating that accurate, contextual data is essential for AI SDR systems to deliver measurable sales performance.

AI SDR Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Keatext boosts lead quality and sales alignment using HubSpot Sales Hub Integration | Increased sales demos by 50%, driven by better workflows and integration, which enhanced marketing team’s key performance metrics. |

|

Artisan empowers BioAccess to overcome manual outreach challenges with AI-driven sales automation | Automated 80% of outbound sales tasks, allowing team to focus on building customer relationships and closing deals. |

|

Spendesk supercharges outreach with Salesloft platform for 10x response boost | By organizing and personalizing outreach, Spendesk achieved 10x increase in reply rates to its prospecting emails. |

|

Netskope SDRs transform prospecting with 6Sense contact data and insights | Real-time insights into prospect research enable SDRs to tailor messaging, leading to more relevant and effective initial conversations with potential buyers. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI SDR market ecosystem consists of various stakeholders. It is categorized based on software types such as AI Outreach Assistants, Conversation Intelligence Tools, AI-powered Sales Engagement Platforms, Lead Research and Enrichment Bots, Email Deliverability Optimizers, and AI Script and Template Generators. These AI SDR tools help streamline outreach, personalize engagement, boost response rates, enrich lead data, and increase overall sales productivity.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI SDR Market, By Software

AI outreach assistants dominate the AI SDR market by automating high-volume, top-of-funnel engagement across channels like email, LinkedIn, and SMS. Using natural language generation, sentiment analysis, and engagement triggers, they deliver personalized, timely outreach that boosts prospecting efficiency and response rates. Their broad applicability across industries and company sizes drives adoption, reducing manual effort and enabling scalable pipeline generation. Integrated with sales engagement platforms, they support automated follow-ups, A/B testing, and real-time optimization. Vendors like Regie.ai and Lavender lead growth with GPT-powered personalization and compliance-aware content.

AI SDR Market, By Deployment Mode

Chrome extensions are experiencing the fastest growth rate in the AI SDR market as lightweight, easily deployable tools that integrate directly into existing sales workflows. Their browser-based design allows instant accessibility without heavy IT involvement, making them popular among SMBs and fast-scaling teams. These extensions streamline prospecting by enabling on-the-go email personalization, LinkedIn outreach, and real-time engagement tracking. With lower deployment costs and seamless compatibility with CRM systems, Chrome extensions offer high flexibility and adoption speed, driving rapid uptake among sales teams seeking quick, scalable AI-driven outreach solutions.

AI SDR Market, By Sales Channel

The inbound sales channel holds the largest market share in the AI SDR market, driven by the increasing volume of leads generated through digital marketing, content campaigns, and website interactions. AI SDR tools for inbound sales automate lead qualification, routing, and personalized follow-ups, allowing sales teams to respond quickly and efficiently. By utilizing AI-driven scoring, contextual engagement, and multi-channel outreach, these solutions improve conversion rates and pipeline velocity. Their dominance is supported by broad applicability across industries, the essential need for timely engagement, and alignment with data-driven sales strategies.

AI SDR Market, By End User

The healthcare & life sciences vertical is experiencing the fastest growth in the AI SDR market, driven by increasing digitization, complex B2B sales cycles, and rising demand for personalized outreach to providers, hospitals, and research organizations. AI SDR tools help automate lead qualification, multi-channel engagement, and compliance-aware communications, enabling faster and more accurate targeting of prospects. Adoption is fueled by the need to manage high-volume outreach, streamline interactions across geographies, and improve engagement with time-sensitive stakeholders, making AI-driven sales automation critical for efficiency and revenue growth in this sector.

REGION

Asia Pacific to be fastest-growing region in AI SDR market during forecast period

Asia Pacific is the fastest-growing region in the AI SDR market, fueled by digital expansion, evolving sales models, and rising demand for automation. Key markets such as India, Japan, South Korea, and Australia are shifting from manual prospecting to data-driven outreach. Growth is driven by SaaS startups, SMB adoption, precision-focused B2B sales, government digitization efforts, and expanding cloud infrastructure. Vendors like Apollo.io and Outreach are tailoring AI-first offerings for regional needs, while rising investment in AI talent further accelerates enterprise adoption.

AI SDR Market: COMPANY EVALUATION MATRIX

In the AI SDR market matrix, Salesforce (Star) leads with a strong market presence and an advanced AI-driven sales engagement ecosystem, enabling large-scale adoption across enterprises seeking automation in prospecting, lead qualification, and personalized outreach. Plivo (Emerging Leader) is gaining traction with its innovative AI-powered communication and engagement solutions, helping businesses streamline SDR workflows and improve customer interactions. While Salesforce dominates with scale and deep enterprise integration, Plivo demonstrates strong growth potential, steadily moving toward the stars’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 2.88 Billion |

| Revenue Forecast in 2030 | USD 15.01 Billion |

| Growth Rate | CAGR of 29.5% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa and Latin America |

WHAT IS IN IT FOR YOU: AI SDR Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) |

|

|

| Leading Solution Provider (Europe) |

|

|

RECENT DEVELOPMENTS

- June 2025 : Salesforce and LIV Golf launched a strategic partnership deploying Agentforce to revolutionize fan and broadcast experiences. The “Fan Caddie” delivers real-time updates, personalized content, and ticketing assistance via mobile, while the “Agent Caddie” enhances live broadcasts with predictive insights. Agentforce also supports tournament operations, player engagement, and international scalability.

- February 2025 : OpenAI and SoftBank established a 50/50 joint venture named SB OpenAI Japan to advance enterprise AI adoption. The partnership introduced Cristal, an AI service tailored for planning, marketing, email automation, and code analysis. Deployed across SoftBank’s units, including Arm and PayPay, Cristal integrates OpenAI’s deep research capabilities into Japanese-language workflows, supported by a planned annual investment of USD 3 Billion.

- January 2025 : HubSpot completed its acquisition of Frame AI, an AI-powered conversation intelligence platform. Frame AI’s technology will be integrated into HubSpot’s Breeze AI suite, enabling the unification of structured and unstructured data such as emails, calls, and meetings across the customer journey. This empowers the creation of hyper-personalized campaigns, improves segmentation, and helps teams deliver more targeted and effective sales efforts.

- January 2025 : ZoomInfo and Salesloft deepened their partnership to directly integrate real-time buyer intent data into Salesloft Rhythm. This collaboration allows sales teams to automate prospecting, prioritize outreach using AI-driven insights, and generate personalized messaging with ZoomInfo Copilot. The integration streamlines sales workflows, enabling faster engagement with high-potential leads and improving overall conversion rates through synchronized data, workflows, and intelligent recommendations.

- June 2024 : 6sense integrated its Revenue AI for Sales with Gong Engage, combining predictive analytics and buyer intent insights within the sales engagement workflow. This enables sellers to prioritize high-intent accounts, identify key decision-makers, personalize outreach, and accelerate pipeline progression. The collaboration enhances productivity and supports data-driven selling across account-based revenue teams.

Table of Contents

Methodology

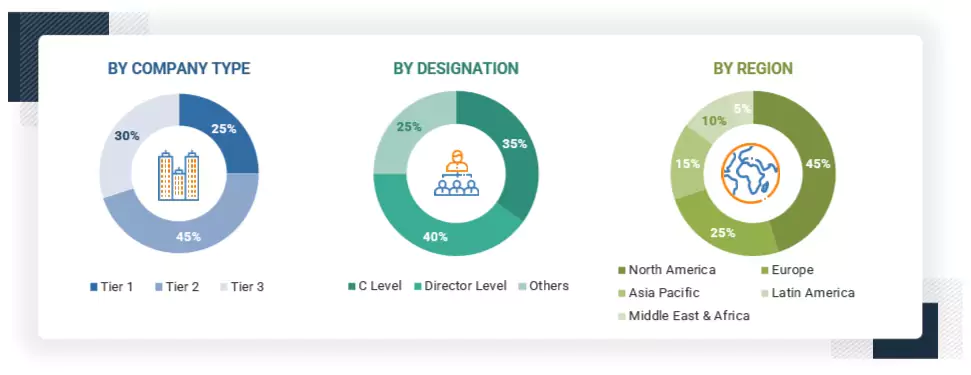

This research study on the AI SDR market involved extensive secondary sources, directories, IEEE Communication-efficient Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred AI SDR providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the AI SDR spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and AI SDR providers. It also included key executives from AI SDR software and service vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between

USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

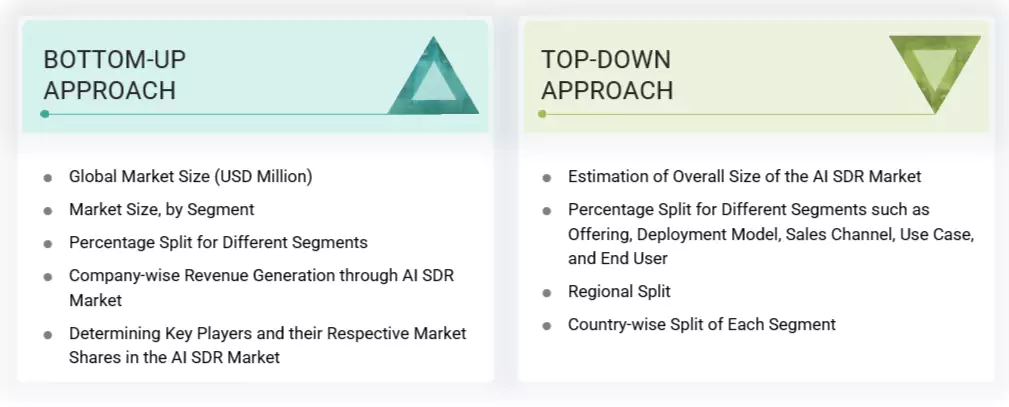

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the AI SDR market. The first approach involved estimating the market size by companies’ revenue generated through the sale of AI SDR products.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the AI SDR market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of AI SDR products across various verticals in key countries within their respective regions was identified as the main contributor to the market share. Cross-validation revealed the adoption of AI SDR products among enterprises, along with various use cases by region. Weightage was given to use cases identified in different regions for the market size calculation. Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included analyzing the AI SDR market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major AI SDR providers, and organic and inorganic business development activities of regional and global players were estimated.

AI SDR Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The overall market size was used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to Salesforce, an AI SDR (AI-powered Sales Development Representative) is an autonomous agent that uses machine learning, natural language processing, and automation to handle top-of-funnel sales tasks. These include automating outreach, qualifying leads, engaging prospects, and scheduling meetings, all in real-time and at scale. By managing repetitive, data-driven activities 24/7, AI SDRs free up human sales teams to focus on creative problem-solving and relationship-building, enhancing overall sales productivity and efficiency.

Stakeholders

- AI SDR providers

- Distributors and value-added resellers (VARs)

- Independent software vendors (ISVs)

- Service providers

- Support & maintenance service providers

- System integrators (SIs)

- Technology providers

- Sales teams & SDR managers

- Sales enablement teams

- Revenue operations teams

Report Objectives

- To define, describe, and forecast the AI SDR market by offering, deployment model, sales channel, use case, end user, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers & acquisitions, in the AI SDR market

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the North American AI SDR market

- Further breakup of the European AI SDR market

- Further breakup of the Asia Pacific AI SDR market

- Further breakup of the Middle East & African AI SDR market

- Further breakup of the Latin American AI SDR market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is AI SDR?

The AI SDR (Sales Development Representative) is defined as a software tool that utilizes artificial intelligence to automate and optimize the sales funnel, encompassing key stages from prospecting to high-value conversions. It includes AI-driven tools designed to identify potential leads through prospecting, qualify leads based on specific criteria, initiate contact via cold outreach, execute personalized email/LinkedIn sequencing, and automate meeting booking to facilitate successful customer engagements. By streamlining these data-intensive and repetitive tasks, the AI SDR enables sales teams to efficiently nurture leads, enhance outreach effectiveness, and drive targeted, high-value conversations, ultimately improving sales performance and revenue outcomes.

Which are the key end users adopting AI SDR market solutions and services?

Key end users adopting AI SDR software and services include Enterprise type (Startups & SMBs, Mid-Market Sales Organizations, Enterprise SDR Teams) and Industry vertical (Retail & E-Commerce, BFSI (Banking, Financial Services, Insurance), Telecommunications, Healthcare & Life Sciences, Education, Media & Entertainment (Marketing & Advertising Agencies, Music & Film Production, Gaming & Sports, Publishing & Print Media, Broadcasting & Streaming), Manufacturing, Travel & Hospitality, Real Estate & Construction, Automotive, Transportation & Logistics, and Other Industry Verticals (Law Firms, Government and Public Sector).

What are the major factors driving the growth of the AI SDR industry?

The AI SDR market is propelled by hybrid human-AI models that blend automation, ensuring contextual relevance and sales efficiency. Intent-based prospecting enables smarter lead targeting and higher conversions. Additionally, platforms that deliver hyper-personalized outreach at scale drive significant sales uplift, reinforcing the value of AI-enhanced engagement strategies.

What challenges are hindering the widespread adoption of AI SDR?

AI SDR systems face critical limitations in replicating emotional intelligence and adjusting to nuanced conversational contexts, often leading to rigid or misaligned outreach. Additionally, their effectiveness is heavily dependent on clean, high-fidelity data; errors or contextual gaps in input significantly degrade personalization and decision-making accuracy across outreach workflows.

Who are the key vendors in the AI SDR market?

The key vendors in the global AI SDR market include as HubSpot (US), Salesforce (US), Dialpad (US), Salesloft (US), 6Sense (US), ZoomInfo (US), Apollo.io (US), OpenAI (US), Clari (US), Cognism (UK), Microsoft (US), GupShup (US), Outreach (US), Vidyard (Canada), Plivo (US), Qualified (US), Otter.ai (US), Conversica (US), Klenty (India), Reply.io (US), Seamless.ai (US), Waalaxy (France), Common Room (US), Artisan AI (US), UserGems (US), Scratchpad (US), Clay (US), Unify (Germany), Lyzr AI (US), Humantic AI (US), Relevance AI (Australia), Regie.ai (US), Salesforge (Estonia), 11x AI (UK), Floworks (US), Warmly (US), Luru (US), AiSDR (US), Bluebirds (US), ChaseLabs (UK), SuperRep.ai (US), SuperAGI (US), Instantly (US), Persana AI (US), Factors.ai (US), and Saleshandy (India).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI SDR Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI SDR Market