Asia Pacific Oligonucleotide Synthesis Market Size, Growth, Share & Trends Analysis

Asia Pacific Oligonucleotide Synthesis Market by Product {Drugs [ASO, siRNA], Synthesized Oligos [Product (Primers, Probes), Type (Custom, Predesigned)], Reagents, Equipment}, Application (Therapeutic, Research, Diagnostics) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific Oligonucleotide Synthesis market, valued at USD 1.76 billion in 2024, stood at USD 2.08 billion in 2025 and is projected to advance at a resilient CAGR of 18.5% from 2025 to 2030, culminating in a forecasted valuation of USD 4.88 billion by the end of the period. This expansion is driven by increasing demand from therapeutics, diagnostics, and research. Pharma and biotech companies in the region are boosting their use of high-purity DNA/RNA oligos for siRNA, antisense therapies, gene editing, and mRNA research. China, Japan, South Korea, and India are major demand centers. Their growth is fueled by strong biologics pipelines and local manufacturing growth.

KEY TAKEAWAYS

-

By CountryThe China oligonucleotide synthesis market accounted for a 34.3% revenue share in 2024.

-

By ProductThe oligonucleotide-based drugs segment dominated the market in 2024 with a revenue share of 66.6%.

-

By ApplicationThe therapeutic applications segment is projected to register a CAGR of 19.6% from 2025 to 2030.

-

By End userThe hospitals segment is projected to grow at the fastest rate from 2025 to 2030.

-

Competitive LandscapeThermo Fisher Scientific, Danaher Corporation, and Biogen were identified as the key players in the Asia Pacific oligonucleotide synthesis market, given their strong market share and product footprint.

-

Competitive LandscapeBiolytic Lab Performance, Inc. and Biolegio B.V., among others, have distinguished themselves among start-ups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The Asia Pacific oligonucleotide synthesis market is growing rapidly due to the region’s expanding pipeline of oligo-based therapeutics and the increasing adoption of advanced molecular diagnostics. Pharma and biotech end users are more frequently requesting custom DNA/RNA oligos for ASO and siRNA programs. Additionally, precision medicine and liquid biopsy testing are boosting demand for reliable, high-performance oligos in Asia Pacific.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on stakeholders’ businesses in the oligonucleotide synthesis market in Asia Pacific is influenced by several clear shifts. The region is experiencing a significant move toward RNA-based medicines. This trend is supported by a growing number of local and global pharma programs operating in Asia Pacific. Another change is that molecular decision-making is becoming routine in healthcare and life sciences, increasing the demand for high-quality oligos in both clinical and research environments. As PCR/qPCR and NGS become standard tools for infectious disease testing, oncology profiling, and genetic screening, labs are purchasing large volumes of primers, probes, adapters, and index oligos.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High growth in oligo-based therapeutics in pipeline

-

NGS becoming more routine in cancer and precision testing

Level

-

Limited number of GMP-scale sites in some countries

Level

-

Localizing GMP oligo supply to reduce lead time and import risk

-

Focus on complex chemistries and conjugates

Level

-

Proving impurity control and product characterization at higher complexity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High growth in oligo-based therapeutics in pipeline

Asia Pacific is seeing more RNA programs move from discovery to clinical stages. This directly increases demand for custom DNA/RNA oligos at higher purities. End users also need process-ready designs, including modified backbones, stabilizing chemistries, and conjugations. As programs advance, the focus shifts to GMP-grade supply and strict release testing. Suppliers capable of scaling are likely to receive repeat orders.

Restraint: Limited number of GMP-scale sites in some countries

Capacity distribution varies across the Asia Pacific region. Some markets have strong CDMO clusters, while others depend on imports. This results in longer lead times and more qualification efforts for end users. It also slows down local commercialization plans for oligo APIs. As more programs enter late-stage trials, this issue worsens. Regulatory expectations for control strategies add to this challenge.

Opportunity: Localizing GMP oligo supply to reduce lead time and import risk

Asia Pacific end users increasingly demand regional supply security. Local GMP capacity can decrease shipping delays and customs issues. It can also facilitate faster tech transfer and closer collaboration on CMC. This is advantageous for clinical programs that require quick turnaround. As regulatory expectations grow, qualified regional partners are becoming strategic.

Challenge: Proving impurity control and product characterization at higher complexity

Therapeutic oligos have closely related impurities that are difficult to separate. As chemistries become more complex, analytics are expected to evolve accordingly. Techniques like LC-MS and advanced chromatography are becoming essential. Specifications must be defensible and consistent across different sites. Regulations highlight manufacturing, characterization, and analytical control requirements specific to synthetic oligos. This presents a significant challenge for Asia Pacific suppliers in scaling their quality systems.

ASIA PACIFIC OLIGONUCLEOTIDE SYNTHESIS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Tan Tock Seng Hospital co-developed and validated the A*STAR Fortitude Kit for SARS-CoV-2 detection. It includes the needed reagents in set quantities, including primer/probe chemistry used in RT-PCR workflows. | Less in-house reagent prep and fewer sourcing issues |More consistent results because primer/probe supply is standardized |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific oligonucleotide synthesis market ecosystem includes suppliers supporting both research-grade and therapeutic oligo production. This begins with core synthesis inputs such as phosphoramidites, solid supports (CPG), activators, oxidizers, and deblocking reagents, among others. These are increasingly sourced through a mix of global chemical suppliers and expanding local Asia Pacific manufacturers, helping to improve lead times and supply security. The ecosystem also comprises synthesizer and automation providers that enable higher throughput and more consistent mid-to-large scale synthesis. As demand for complex oligos grows, there is a stronger emphasis on process control, in-line monitoring, and robust data collection to meet customer specifications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Oligonucleotide Synthesis Market, by Product

In 2024, the Asia Pacific oligonucleotide synthesis market was led by the oligonucleotide-based drugs segment. The market's growth is driven by increased consumption of oligonucleotide therapeutics. This applies to various indications such as Spinal Muscular Dystrophy and Duchenne Muscular Dystrophy (DMD), among others. Additionally, companies are working to secure approval across different countries in this region.

Asia Pacific Oligonucleotide Synthesis Market, By Application

In 2024, therapeutic applications dominated the Asia Pacific oligonucleotide synthesis market. This is mainly because oligonucleotide-based drugs are expanding faster in the region. More siRNA and antisense programs are entering late-stage development. As more RNA medicines are commercialized, demand driven by therapy is expected to remain the primary growth factor for this segment.

Asia Pacific Oligonucleotide Synthesis Market, By End User

In 2024, hospitals became a key end-user segment in the Asia Pacific oligonucleotide synthesis market. Oligonucleotide-based drugs are entering mainstream healthcare. With more late-stage siRNA and antisense drugs, hospitals are now the primary focus for their administration, including prescribing, administering, and tracking side effects. This makes them the largest end-use market for oligonucleotide synthesis.

REGION

China is expected to be the fastest-growing country in the Asia Pacific Oligonucleotide Synthesis market during the forecast period

China is the fastest-growing country in the Asia Pacific oligonucleotide synthesis market. Growth is supported by a large and expanding biopharma industry and increasing demand from both therapeutic and diagnostic end users. The country has a strong concentration of RNA drug developers, biotech innovators, and expansive CDMO capacity, which is boosting orders for GMP-grade oligos across preclinical, clinical, and early commercial stages.

ASIA PACIFIC OLIGONUCLEOTIDE SYNTHESIS MARKET: COMPANY EVALUATION MATRIX

Danaher (Star) is a key player in the Asia Pacific oligonucleotide synthesis market for research and diagnostic oligos, mainly through Integrated DNA Technologies (IDT). IDT has a strong presence across academic labs, clinical labs, and test developers in Asia Pacific. Maravai LifeSciences (Emerging Leader) is gaining momentum in Asia Pacific by meeting the increasing demand for high-complexity and modified oligos used in research and diagnostics. Through TriLink BioTechnologies, it is well-positioned to support modified DNA/RNA oligos for assay developers and OEM customers. Biogen (Star) remains a major source of therapeutic demand that influences the Asia Pacific market through global production and supply requirements. Its antisense portfolio, including SPINRAZA, which is approved across various Asia Pacific countries, supports growth. Astellas Pharma Inc. (Emerging Leader) is expanding its presence in the oligonucleotide therapeutics space in Asia Pacific through ongoing investments in advanced modalities. The company's acquisition of IVERIC Bio is a key development supporting this growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Danaher Corporation (US)

- Thermo Fisher Scientific, Inc. (US)

- Biogen (US)

- Alnylam Pharmaceuticals, Inc. (US)

- Agilent Technologies, Inc. (US)

- Kaneka Corporation (Japan)

- Astellas Pharma Inc. (Japan)

- Nippon Shinyaku, Co. Ltd. (Japan)

- Biocomma Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.76 BN |

| Market Forecast in 2030 (Value) | USD 4.88 BN |

| Growth Rate | CAGR of 18.5% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors and trends |

| Segments Covered |

|

| Countries Covered | China, Japan, India, Australia, South Korea, Rest of Asia Pacific |

| Parent & Related Segment Reports |

Oligonucleotide Synthesis Market Oligonucleotide Therapeutics Market North America Oligonucleotide Synthesis Market Europe Oligonucleotide Synthesis Market |

WHAT IS IN IT FOR YOU: ASIA PACIFIC OLIGONUCLEOTIDE SYNTHESIS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Reagent/consumables supplier looking to grow diagnostics oligo revenue in Asia Pacific |

|

|

RECENT DEVELOPMENTS

- April 2024 : Nippon Shinyaku, Co., Ltd. entered into a joint research agreement with MINA Therapeutics to potentially develop nucleic acid drugs to treat rare diseases of the central nervous system. Through this agreement, MINA Therapeutics will provide Nippon Shinyaku RNAa therapeutics, which are oligonucleotides that can increase the transcription of a target gene.

- July 2023 : Astellas Pharma Inc. acquired IVERIC Bio, Inc. for ~USD 10 million to expand its capabilities in the ophthalmology disease area.

- June 2023 : Merck invested approximately USD 76 million (EUR 70 million) at its site in Nantong, China, to expand production capabilities for high-purity reagents, increasing the annual output by several thousand tons.

- May 2023 : The Life Sciences segment of Pall Corporation was integrated with Cytiva's Bioprocess business and continues to function under the Cytiva brand name. This integration has strengthened Cytiva's biotechnology business.

Table of Contents

Methodology

This research study extensively used secondary sources, directories, and databases to identify and collect valuable information to analyze the Asia Pacific oligonucleotide synthesis market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative & quantitative information and assess the market's growth prospects. The market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used primarily to identify & collect information for the extensive, technical, market-oriented, and commercial study. The secondary sources used for this study include annual reports, SEC filings, investor presentations, World Health Organization (WHO), United States Food and Drug Administration (US FDA), National Center for Biotechnology Information (NCBI), Industry Association of Synthetic Biology (IASB), Biotechnology Innovation Organization (BIO), and Genome Canada. These sources also obtained key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative & quantitative information and assess the prospects of the market. Various primary sources from both the supply & demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

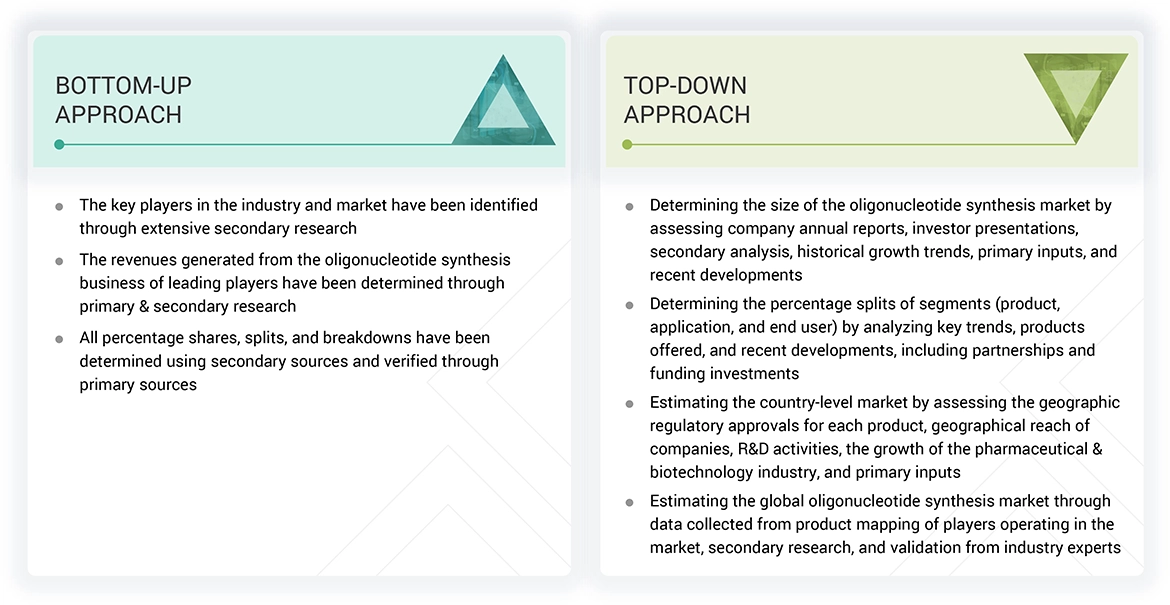

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate & validate the total size of the Asia Pacific oligonucleotide synthesis market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

The total market was split into several segments and subsegments after arriving at the overall market size from the estimation process. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Oligonucleotide synthesis is the chemical process of creating nucleic acid fragments with specific chemical structures or sequences of varying sizes to form a desired product. These fragments, known as oligonucleotides, have several applications in medical & life science research. They can be used for DNA sequencing and amplification, detecting complementary DNA or RNA through hybridization, creating artificial genes, and introducing targeted genetic mutations.

Oligonucleotides are also used to develop therapeutic drugs. These drugs are produced chemically and have different mechanisms of action, such as interfering with gene expression, blocking the production of harmful proteins, or restoring the function of mutated genes.

Stakeholders

- Pharmaceutical & biotechnology companies

- Hospitals

- Diagnostic laboratories

- Academic researchers and government research organizations

- Private research institutes

- Custom oligonucleotide service providers

- Contract manufacturing organizations (CMOs)

- Oligonucleotide equipment manufacturers

- Contract research organizations (CROs)

- Market research & consulting firms

- Venture capitalists

Report Objectives

- To define, describe, and forecast the Asia Pacific oligonucleotide synthesis market based on the product, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall Asia Pacific oligonucleotide synthesis market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- Track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the Asia Pacific oligonucleotide synthesis market.

- To analyze and provide funding & investment activities, brand/product comparative analysis, and vendor valuation & financial metrics of the Asia Pacific oligonucleotide synthesis market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Oligonucleotide Synthesis Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Oligonucleotide Synthesis Market