Europe Oligonucleotide Synthesis Market Size, Growth, Share & Trends Analysis

Europe Oligonucleotide Synthesis Market by Product (Drugs (ASO, siRNA), Synthesized Oligos (Product (Primers, Probes)), Type ((Custom, Predesigned), Reagents, Equipment), Application (Therapeutic, Research, Diagnostics) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

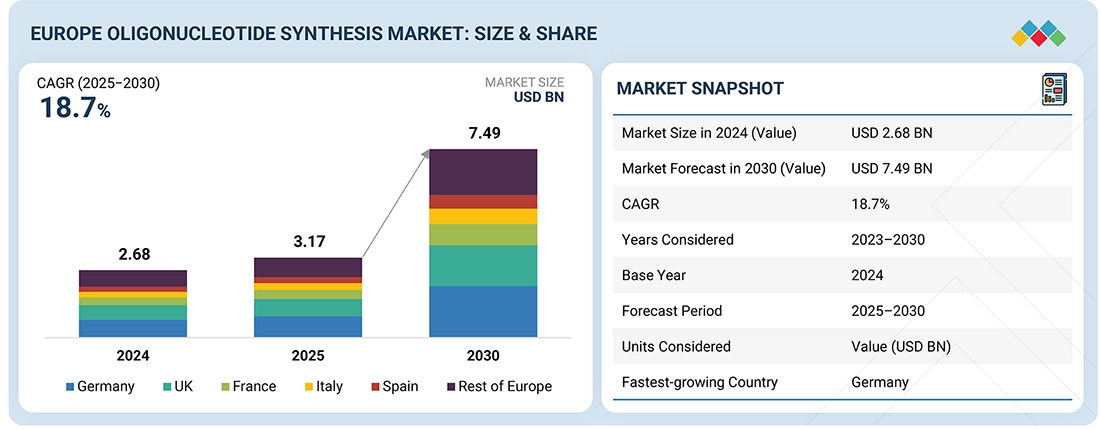

The Europe Oligonucleotide Synthesis market, valued at USD 2.68 billion in 2024, stood at USD 3.17 billion in 2025 and is projected to advance at a resilient CAGR of 18.7% from 2025 to 2030, culminating in a forecasted valuation of USD 7.49 billion by the end of the period. The market is growing due to strong demand from therapeutics, diagnostics, and research. Pharma and biotech companies need high-purity DNA and RNA oligos for siRNA, antisense therapies, aptamers, and gene-editing applications. Diagnostics continues to grow steadily, supported by PCR and RT-PCR testing, NGS library preparation, and emerging liquid biopsy workflows. At the same time, buyers are increasingly requesting more complex chemistries, including modified bases, conjugations, and higher-purity grades for clinical and commercial use.

KEY TAKEAWAYS

-

By CountryGermany accounted for a 26.8% revenue share of the oligonucleotide synthesis market in Europe in 2024.

-

By ProductBy product, the oligonucleotide-based drugs segment dominated the market in 2024 with a share of 66.6%.

-

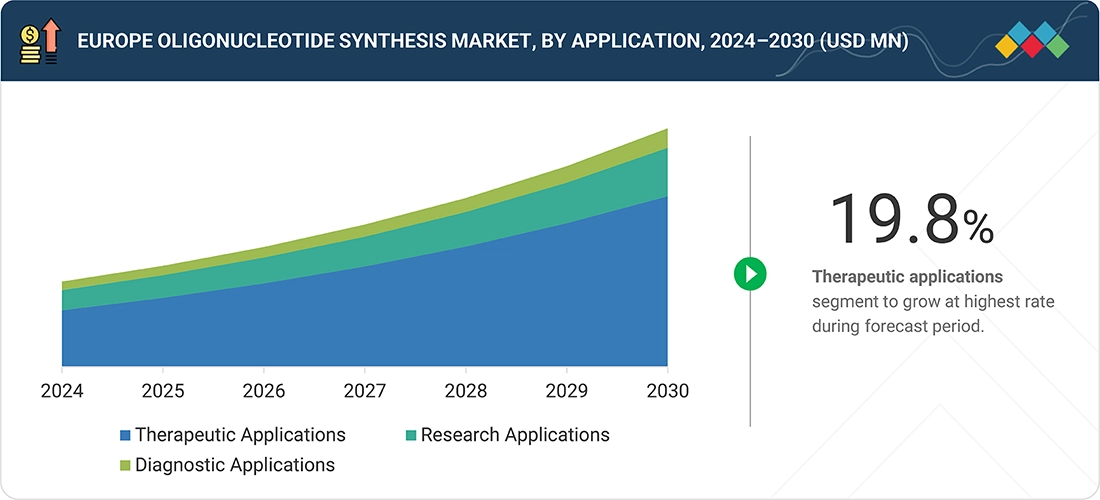

By ApplicationBy application, the therapeutic applications segment is projected to grow at the highest rate from 2025 to 2030.

-

By End UserBy end user, the hospitals segment is projected to witness the highest CAGR from 2025 to 2030.

-

Competitive LandscapeCompanies such as Thermo Fisher Scientific, Danaher Corporation, and Merck KGaA were identified as some of the key market players in Europe, given their strong market share and product footprint.

-

Competitive LandscapeCompanies such as OligoMaker ApS and Biolegio B.V., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The oligonucleotide synthesis market in Europe is growing with the steady rise in oligo-based therapeutics and advanced diagnostics. Pharma and biotech end users are ordering more custom DNA/RNA oligos for ASO and siRNA programs, as well as guide RNAs for gene editing. Demand is also strong from PCR and NGS workflows, where primers, probes, adapters, and index oligos are required in high volumes. Liquid biopsy and other precision medicine workflows are adding new requirements for higher purity and consistent lot performance.

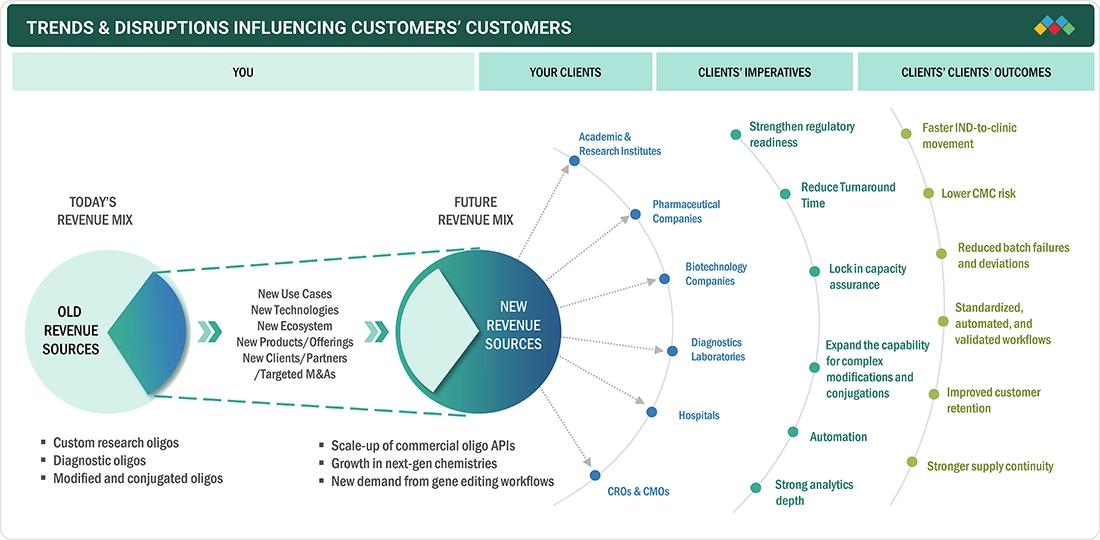

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on stakeholders' business within the Europe oligonucleotide synthesis market is largely influenced by several factors. There is a significant shift toward RNA medicines, and secondly, there is increased use of molecular decision-making in healthcare and life sciences. As PCR/qPCR and NGS are becoming standard techniques for infectious disease testing, oncology profiling, and genetic screening, laboratories require primers, probes, adapters, and index oligos that are reliable and have consistent lot performance. Pharmaceutical and biotech companies are intensively expanding ASO and siRNA pipelines. In such a scenario, the purity of the oligo, accuracy of the sequence, and control of impurities have a direct impact on the efficacy, safety, and timelines of release. Overall, the emphasis on faster turnaround, more stringent QC, and capacity that is assured are becoming important factors that distinguish suppliers serving both diagnostic and therapeutic applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strong push from oligonucleotide therapeutics pipelines

-

Stable demand for primer/probe demand due to routine PCR/qPCR and rising NGS adoption

Level

-

High cost of GMP-grade oligos, especially for long and modified sequences

Level

-

Growth in complex chemistries, conjugates, and next-gen oligo designs

-

Integrated supply from oligo API to downstream processing and support

Level

-

Keeping impurity profiles stable during scale-up

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strong push from oligonucleotide therapeutics pipelines

Europe is steadily scaling up oligonucleotide-based drugs as more programs enter into late-stage development and commercialization. Increasing number of regulatory approvals and clinical trials are driving higher demand for clinical and commercial GMP batches. Each program requires tight control over sequence accuracy, impurities, and batch consistency, leading to repeat orders for high-purity materials and well-validated manufacturing processes. Demand is also increasing for modified chemistries that improve stability and delivery. Overall, therapeutic applications remain the largest driver of both volume and value in Europe’s oligonucleotide synthesis market.

Restraint: High cost of GMP-grade oligos, especially for long and modified sequences

Oligonucleotide synthesis becomes more costly as sequences get longer and more heavily modified. Each added step creates more by-products and reduces overall yield. Purification and isolation are major cost drivers, especially at larger scales. This makes pricing challenging for large diagnostic orders and early-stage biotech companies, and it can slow the ability of developers to quickly increase doses or patient numbers. As a result, cost remains a practical constraint even when demand is high.

Opportunity: Growth in complex chemistries, conjugates, and next-gen oligo designs

Developers are moving past simple DNA oligos toward more advanced therapeutic designs. These include heavy backbone modifications and chemistries focused on improving delivery. Such products command higher prices and often involve longer supply agreements. They also require specialized expertise, which helps set suppliers apart. Europe benefits from strong biotech funding and active clinical development, making complexity-driven growth a clear opportunity for oligo synthesis suppliers.

Challenge: Keeping impurity profiles stable during scale-up

As oligo sequences become longer and more synthesis steps are added, impurity levels tend to increase. Purification and isolation often become major bottlenecks at large scale. Even small changes in reagents or process conditions can alter impurity profiles, creating comparability challenges between clinical phases. This also increases the risk of batch failures or the need for rework. As a result, suppliers need robust, well-controlled processes along with sufficient reactor and synthesizer capacity.

EUROPE OLIGONUCLEOTIDE SYNTHESIS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

During the COVID-19 pandemic, ATDBio expanded its oligonucleotide synthesis capacity more than 10-fold to meet regional demand for primers and probes used in qPCR and LAMP testing. The company supplied large-scale custom primers and probes to universities, hospitals, government programs, and diagnostic labs supporting the UK’s national testing effort. | Enabled rapid scale-up of primers and probes for high-throughput diagnostic testing across Europe. Supported public health efforts by supplying tens of millions of test-ready oligos and strengthening local sourcing and standardization of critical reagents. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe oligonucleotide synthesis market ecosystem includes suppliers of core synthesis inputs such as phosphoramidites, solid supports (CPG), activators, oxidizers, deblocking reagents, and high-purity solvents. It also includes synthesizer and automation providers that enable fast, reproducible, small-to-large scale synthesis. A critical layer is purification and analytics, including HPLC/UPLC systems, chromatography resins, desalting platforms, and LC-MS/CE-based characterization that ensure identity and impurity control. The region has a strong base of custom oligo suppliers and GMP oligo CDMOs, supporting projects from early R&D to clinical and commercial API batches. Additionally, it also includes oligo-based therapeutics manufacturers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Oligonucleotide Synthesis Market, By Product

In 2024, oligonucleotide-based drugs dominated the oligonucleotide synthesis market in Europe, by product, due to their rising sales, which required larger, repeat batches of high-value GMP-grade oligos rather than small research quantities. This is mainly because more oligo drugs advance into late-stage trials and commercialization. Thus, this therapy-driven demand is becoming a primary engine of growth for global oligonucleotide synthesis providers.

Europe Oligonucleotide Synthesis Market, By Application

In 2024, the therapeutic applications segment led the Europe oligonucleotide synthesis market, fueled by surging sales of approved oligonucleotide-based drugs like ASOs and siRNAs for rare diseases, neurological disorders, and oncology. As regulatory approvals accelerate and pipelines expand, therapeutic applications are expected to witness significant growth. ?

Europe Oligonucleotide Synthesis Market, By End User

In 2024, hospitals dominated the end-user landscape in the Europe oligonucleotide synthesis market. This is mainly because hospitals and specialty clinics are the largest users of oligonucleotide-based drugs. Most approved and late-stage oligo therapies are prescribed and administered through hospital networks and hospital-owned infusion or treatment centers.

REGION

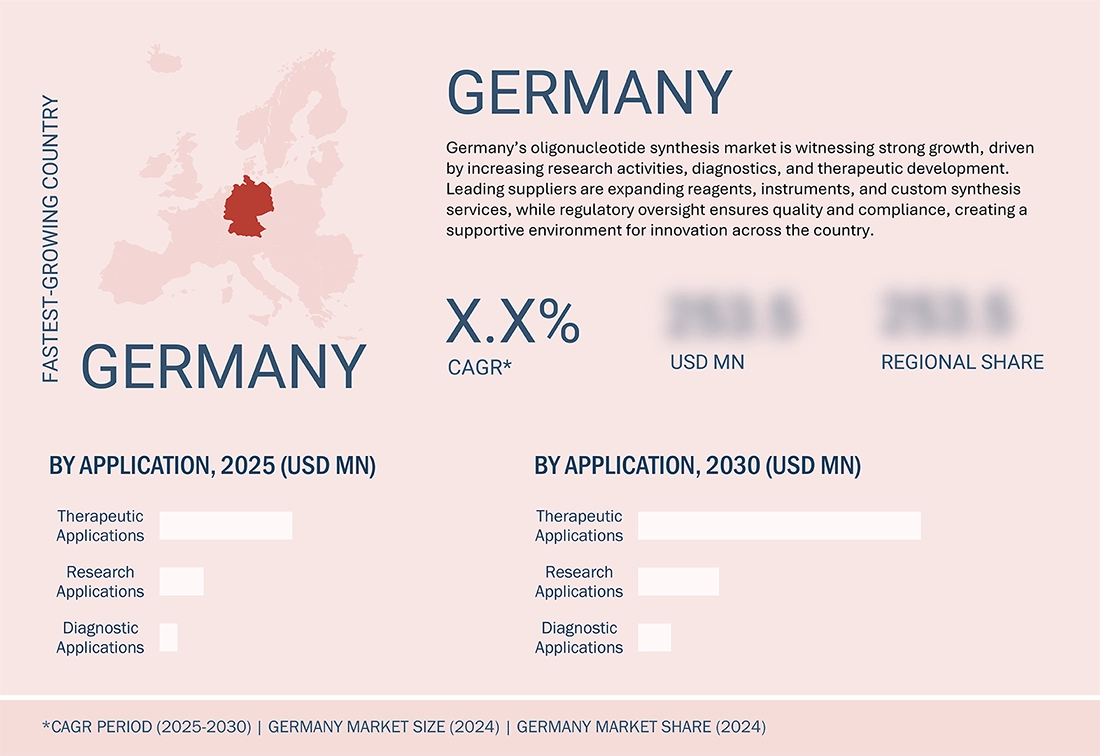

Germany to be fastest-growing country in Europe oligonucleotide synthesis market during forecast period

Germany is projected to be the fastest-growing market for oligonucleotide synthesis within Europe. A highly developed biopharma and research infrastructure creates domestic demand for oligos from both therapeutic and diagnostic communities. The demand for GMP oligos from universities, biotechs, and RNA therapeutic developers is gradually increasing for preclinical, clinical, and commercial applications. The widespread use of PCR, NGS, and molecular diagnostics has now gained profound traction within cancer diagnostics, infectious diseases, and genetic research, and will sustain the demand for oligos, primers, probes, and adapters. With many programs reaching commercial production scales, Germany's oligonucleotide synthesis industry is likely to sustain its steady growth.

EUROPE OLIGONUCLEOTIDE SYNTHESIS MARKET: COMPANY EVALUATION MATRIX

Thermo Fisher Scientific (Star) leads in the market with a diverse portfolio of custom and catalog oligos, primers, and probes, serving research, diagnostics, and GMP-grade synthesis needs. Danaher Corporation (Star), through IDT, supplies high-volume DNA/RNA oligos, qPCR primers, and probes to academic, clinical, and biotech labs across Europe, making it a leading player. Merck KGaA (Star) supports its German base to provide modified oligos, reagents, and custom services for research and diagnostics markets. LGC Limited (Star) and Eurofins Scientific (Star) offer primers, probes, and oligo synthesis services supporting European labs and pharmaceutical partners. OligoMaker ApS (Emerging Leader) and Biolegio B.V. (Emerging Leader) focus on specialized or niche oligo synthesis segments. Novartis AG, AstraZeneca, and Jazz Pharmaceuticals act as therapeutic demand anchors rather than primary oligo service providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Danaher Corporation (US)

- Thermo Fisher Scientific, Inc. (US)

- Merck KGaA (Germany)

- LGC Limited (UK)

- Eurofins Scientific (Luxembourg)

- OligoMaker ApS (Denmark)

- Biolegio B.V. (Netherlands)

- Novartis AG (Switzerland)

- AstraZeneca (UK)

- Jazz Pharmaceuticals plc (Ireland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.68 Billion |

| Market Forecast in 2030 (Value) | USD 7.49 Billion |

| Growth Rate | CAGR of 18.7% from 2025 to 2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors and trends |

| Segments Covered |

|

| Countries Covered | Germany, UK, France, Italy, Spain, Rest of Europe |

| Parent & Related Segment Reports |

Oligonucleotide Synthesis Market Oligonucleotide Therapeutics Market Asia Pacific Oligonucleotide Synthesis Market North America Oligonucleotide Synthesis Market |

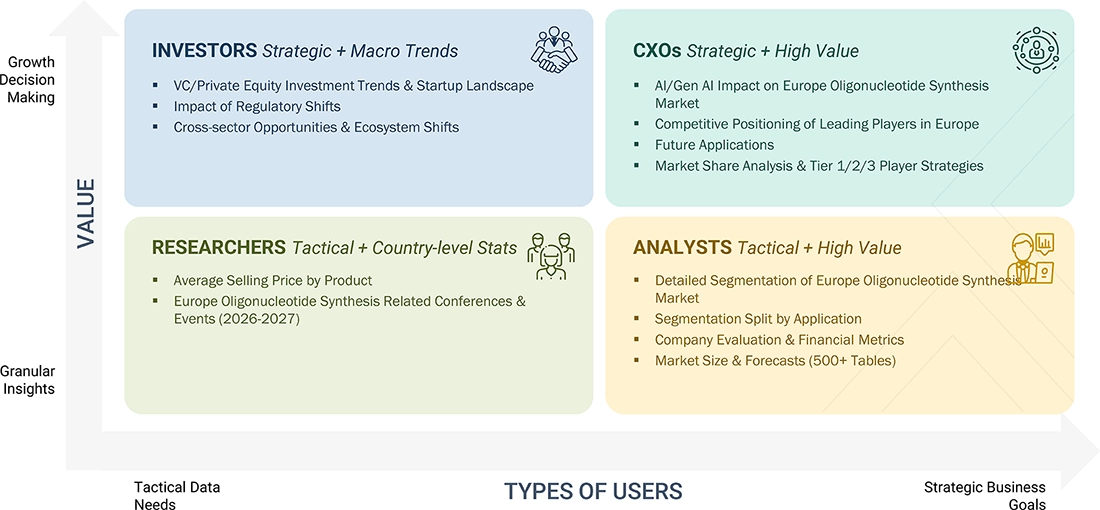

WHAT IS IN IT FOR YOU: EUROPE OLIGONUCLEOTIDE SYNTHESIS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Oligo CDMO aiming to expand Europe-based commercial contracts |

|

|

RECENT DEVELOPMENTS

- February 2024 : Merck opened a new distribution center for its Life Science business in Brazil with an investment of USD 21.75 million (EUR 20 million) to meet the growing demand for life science products and services in the LATAM region.

- November 2023 : LCG Biosearch Technologies, a business unit of LGC Limited, acquired PolyDesign to enhance its oligonucleotide synthesis capabilities using PolyDesign's frit technology.

- October 2023 : Integrated DNA Technologies (IDT) (US), a subsidiary of Danaher Corporation, opened its therapeutic oligonucleotide manufacturing facility in Coralville, Iowa. The facility has eight ISO cleanrooms, purification suites, chemical distribution and storage rooms, quality control labs, analytical lab spaces for product testing, ancillary and office spaces, and shell spaces for future expansion. This facility will produce reagents for cGMP cell & gene therapy, including single-guide RNAs and HDR donor oligos.

Table of Contents

Methodology

This research study extensively used secondary sources, directories, and databases to identify and collect valuable information to analyze the Europe oligonucleotide synthesis market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative & quantitative information and assess the market's growth prospects. The market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used primarily to identify & collect information for the extensive, technical, market-oriented, and commercial study. The secondary sources used for this study include annual reports, SEC filings, investor presentations, World Health Organization (WHO), United States Food and Drug Administration (US FDA), National Center for Biotechnology Information (NCBI), Industry Association of Synthetic Biology (IASB), Biotechnology Innovation Organization (BIO), and Genome Canada. These sources also obtained key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative & quantitative information and assess the prospects of the market. Various primary sources from both the supply & demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate & validate the total size of the Europe oligonucleotide synthesis market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

The total market was split into several segments and subsegments after arriving at the overall market size from the estimation process. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Oligonucleotide synthesis is the chemical process of creating nucleic acid fragments with specific chemical structures or sequences of varying sizes to form a desired product. These fragments, known as oligonucleotides, have several applications in medical & life science research. They can be used for DNA sequencing and amplification, detecting complementary DNA or RNA through hybridization, creating artificial genes, and introducing targeted genetic mutations.

Oligonucleotides are also used to develop therapeutic drugs. These drugs are produced chemically and have different mechanisms of action, such as interfering with gene expression, blocking the production of harmful proteins, or restoring the function of mutated genes.

Stakeholders

- Pharmaceutical & biotechnology companies

- Hospitals

- Diagnostic laboratories

- Academic researchers and government research organizations

- Private research institutes

- Custom oligonucleotide service providers

- Contract manufacturing organizations (CMOs)

- Oligonucleotide equipment manufacturers

- Contract research organizations (CROs)

- Market research & consulting firms

- Venture capitalists

Report Objectives

- To define, describe, and forecast the Europe oligonucleotide synthesis market based on the product, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall Europe oligonucleotide synthesis market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- Track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the Europe oligonucleotide synthesis market.

- To analyze and provide funding & investment activities, brand/product comparative analysis, and vendor valuation & financial metrics of the Europe oligonucleotide synthesis market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Oligonucleotide Synthesis Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Oligonucleotide Synthesis Market