Asia Pacific Personal Protective Equipment Market

Asia Pacific Personal Protective Equipment Market by Type (Hand & Arm Protection, Protective Clothing, Foot & Leg Protection), End-use Industry (Manufacturing, Construction, Oil & Gas, Healthcare, Transportation), and Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific personal protective equipment market is projected to grow from USD 11.28 billion in 2025 to USD 15.30 billion by 2030, at a CAGR of 6.29%, during the same period. Among the major factors of the PPE market growth in the Asia-Pacific region is the rapid expansion of industrial and infrastructure activities all over China, India, Southeast Asia, and emerging manufacturing hubs. This has led to increased demand for advanced worker protection solutions. The region's stringent occupational safety regulations, increased awareness of workplace hazards in high-risk sectors such as construction, chemicals, mining, and electronics manufacturing, as well as the growing presence of large-scale production facilities, are all contributing to the accelerated adoption of PPE. Additionally, the push towards local production of PPE, supported by the government, and the reduced production costs are enhancing supply security and thus sustaining market growth.

KEY TAKEAWAYS

-

BY TYPEThe hand & arm protection segment is projected to be the fastest-growing type of Asia Pacific personal protective equipment market with a CAGR of 6.55% between 2025 and 2030.

-

BY END-USE INDUSTRYThe healthcare industry is projected to register the highest CAGR of 7.64% in the Asia Pacific personal protective equipment market during the forecast period.

-

BY COUNTRYChina dominated the Asia Pacific personal protective equipment market, accounting for a market share of 61.3% in 2024.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSDuPont de Nemours, Inc., 3M company, and MALLCOM INDIA LIMITED are identified as key players in the Asia Pacific personal protective equipment market. These companies have strong market presence and extensive product portfolios.

-

COMPETITIVE LANDSCAPE - STARTUPSPolison Corporation, Pan Taiwan Enterprise Co., Ltd., and JSP Ltd., among other emerging players, have carved out solid positions within specialized niche segments, highlighting their potential to evolve into future market leaders.

The Asia Pacific personal protective equipment market is expected to grow steadily. This growth is supported by the governments of the region tightening occupational safety frameworks, which has resulted in higher compliance-driven procurement across the region. The strong public–private investment in local PPE manufacturing is not only making the supply more resilient but also reducing dependency on imports. Meanwhile, the growing adoption of automation and advanced production technologies is allowing for higher-quality, cost-competitive output to be produced. Moreover, the rising awareness of workplace risks, aided by national safety campaigns and regulatory modernization, is becoming a mainstay of stable, long-term demand for certified PPE.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ businesses in the Asia Pacific stems from fast-evolving trends and disruptions across end-use industries. Manufacturing companies, construction contractors, and oil & gas operators, key clients of PPE suppliers in the region, are increasingly demanding certified, durable, and regulation-compliant protective equipment to meet rising safety standards. These industries serve as the primary revenue drivers for PPE manufacturers, and any shift in their safety priorities, regulatory pressures, or operational risks directly influences PPE spending. As end-users adjust procurement toward higher-grade or technology-enabled PPE, the resulting revenue changes flow through distributors and impact the growth trajectory of Asia Pacific PPE manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High concentration of export-oriented manufacturing hubs

-

National safety modernization programs

Level

-

Fragmented regulatory landscape

-

Price-sensitive buying behavior

Level

-

Localization of meltblown, nonwovens, and polymer feedstock production

-

Upgrading of industrial safety culture

Level

-

Quality disparities

-

Slow harmonization of regional PPE certification standards

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid industrial upgrading

Rapid industrial upgrading in Asia Pacific, mainly due to the growth of precision manufacturing, electric vehicle supply chains, and semiconductor fabrication, is substantially increasing the demand for advanced PPE. These sophisticated, high-tech production environments require more stringent contamination control, improved chemical and thermal protection, and higher safety standards, which in turn compel manufacturers to use more specialized gloves, cleanroom apparel, respirators, and protective clothing. The requirement for trustworthy, certified, and application-specific PPE as a key part of operations is becoming increasingly evident as companies move into more complex, high-value manufacturing. This is resulting in the reinforcement of this trend as a significant market driver.

Restraint: Fragmented regulatory landscape

The regulatory landscape in the Asia Pacific region is the most significant factor hindering the growth of the PPE market. China, India, Japan, and ASEAN countries have different safety standards and certification requirements. Due to this lack of harmonization, manufacturers are less efficient in their operations, as they must customize products and testing protocols for each market, thereby increasing time-to-market and compliance costs. Consequently, cross-border distribution is getting slower and more complicated, thus causing procurement delays and lowering the overall PPE supply scalability in the region.

Opportunity: Rising adoption of automated PPE manufacturing lines

The Asia Pacific PPE market is benefiting from the trend of increasing the use of automated manufacturing lines, which are the most efficient, scalable, and product-consistent way of production. In the glove dipping, mask assembly, and protective clothing fabrication processes, automation helps producers meet the increasing demand, both within the region and in exports, while also reducing labor costs and errors. This innovation makes it possible to deliver standardized PPE of high quality at a faster rate, thus giving a competitive edge and, in turn, leading to the growth of the market in the major industrial hubs of the region.

Challenge: Quality disparities

One of the significant challenges faced by the Asia Pacific Personal Protective Equipment (PPE) market is the disparity in quality between local manufacturers offering inexpensive products and well-certified international brands. The reason for this is that the performance and reliability of products are not always consistent, so buyers are concerned about the credibility of the sellers, which in turn limits the trust these buyers have in PPE made locally. Such a quality difference makes the procurement decision difficult for industrial and healthcare buyers, regional product adoption is slowed, and manufacturers are pressed to raise their standards in terms of certification and quality if they want to maintain their position in the domestic and export markets.

ASIA PACIFIC PERSONAL PROTECTIVE EQUIPMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of cut-resistant gloves, anti-fatigue safety footwear, chemical-resistant sleeves, and heat-resistant PPE across automotive assembly lines | Lower hand injuries | Improved assembly-line efficiency | Higher compliance with the Japan Industrial Safety & Health Act |

|

Use of flame-retardant coveralls, arc-flash protective suits, high-temperature gloves, and respiratory PPE in steel melting shops | Stronger fire/heat hazard protection | Fewer downtime incidents | Improved audit performance under India’s safety regulations |

|

Implementation of smart PPE (sensor-based helmets, fatigue monitors), cut-resistant gloves, and high-grip footwear across major infrastructure projects | Early hazard detection | Fewer worker fatigue incidents | Enhanced site-safety reporting and regulatory readiness |

|

Use of flame-retardant coveralls, gas-detection wearables, anti-static gear, and chemical-splash PPE across refinery and offshore platforms | Lower explosion/chemical exposure risk | Fewer operational disruptions | Improved HSE audit compliance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific personal protective equipment (PPE) market ecosystem is driven by a tightly connected network of raw material suppliers, PPE manufacturers, distributors, and safety-focused end-users across various sectors, including manufacturing, construction, oil & gas, healthcare, and others. Rapid industrial expansion, stricter regulatory enforcement, and rising workplace safety awareness are strengthening demand across the value chain. Local low-cost producers compete with global certified brands, while digital supply platforms and smart-PPE innovators are reshaping procurement and safety practices. Overall, the ecosystem is evolving toward higher certification standards, faster fulfillment, and technology-enabled safety compliance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Personal Protective Equipement Market, By Type

The hand & arm protection segment accounted for the largest share of the Asia Pacific personal protective equipment market in 2024. The labor-intensive industrial environment in the Asia Pacific, combined with the concentration of high-risk manufacturing clusters in China, India, and Southeast Asia, has largely influenced the growth of the hand & arm protection segment. Continuous exposure to mechanical, thermal, and chemical hazards in electronics assembly, automotive components, metal fabrication, and textile processing has resulted in increased demand for cut-resistant, heat-resistant, and chemical-resistant gloves. Moreover, the fast growth of small and mid-sized manufacturing units has been instrumental in reinforcing recurring procurement cycles, thereby maintaining the dominance of this segment in the regional market.

Asia Pacific Personal Protective Equipement Market, By End-use Industry

The manufacturing sector was the largest in the Asia Pacific personal protective equipment market in 2024, as factories in the region continue to operate with high labor intensity, and manual handling is used extensively in processes such as assembly, machining, welding, and material processing. The increasing automation has also led to more interaction between workers and advanced machinery, thus increasing the need for standard protective measures to avoid injuries of mechanical, thermal, and chemical nature. Besides that, manufacturers must contend with stricter safety audits, higher compliance requirements, and increased pressure to reduce production downtime, all of which are reasons for continued investment in safe hand protection, protective clothing, and respiratory safety in manufacturing environments.

REGION

China accounted for the largest share of the Asia Pacific personal protective equipment market in 2024.

In 2024, China accounted for a major share of the Asia Pacific personal protective equipment (PPE) market. The primary reason for this is the country's highly integrated manufacturing ecosystem, which encompasses everything from raw materials to large-scale assembly in concentrated industrial hubs. The strength of this end-to-end supply gives China a better cost efficiency, shorter production cycles, and a stronger supply stability compared to other regional markets. Moreover, China’s rapid adoption of automated manufacturing and expanded certification capabilities has enhanced product quality and export competitiveness, reinforcing its leadership position in the regional PPE landscape.

ASIA PACIFIC PERSONAL PROTECTIVE EQUIPMENT MARKET: COMPANY EVALUATION MATRIX

In the Asia Pacific personal protective equipment market matrix, 3M (Star) leads with a dominant presence, backed by its extensive product portfolio, strong certification standards, and deep penetration across manufacturing, construction, and oil & gas sectors. Its ability to deliver technologically advanced, durable, and regulation-compliant PPE positions it as the preferred partner for large industrial enterprises across the region. MALLCOM INDIA LIMITED (Emerging Leader) is rapidly strengthening its foothold with competitive pricing, localized product development, and expanding distribution networks tailored to Asia Pacific’s fast-growing industrial hubs. While 3M company maintains leadership through scale, innovation depth, and broad regional reach, MALLCOM INDIA LIMITED demonstrates strong upward momentum and is well-positioned to move toward the leaders’ quadrant as demand for high-performance, value-driven, and locally adapted PPE accelerates across the Asia Pacific.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 10.66 BN |

| Market Size in 2030 (Value) | USD 15.30 BN |

| Growth Rate | CAGR of 6.29% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific |

WHAT IS IN IT FOR YOU: ASIA PACIFIC PERSONAL PROTECTIVE EQUIPMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Demand patterns across diverse industries of Asia Pacific | Generic insights on PPE adoption across major end-use industries such as manufacturing, healthcare, construction, and services | Helps client identify priority industries and align product strategies |

| Customer preference indicators | High-level understanding of general user expectations related to comfort, durability, design, and certification | Enables better product positioning and tailoring to customer needs |

RECENT DEVELOPMENTS

- March 2023 : MALLCOM INDIA LIMITED has signed an MoU with the Gujarat government to set up a new PPE manufacturing unit in Sanand, Ahmedabad. The facility will produce gloves, helmets, and safety eyewear, strengthening Mallcom’s capacity to meet the rising demand for industrial safety.

- May 2022 : 3M Company announced an expansion to grow its plant in Valley, Nebraska. The Company is investing approximately USD 58 million to fund the 80,000-square-foot expansion that is expected to create approximately 50 new jobs at the facility. This facility is expected to produce respiratory and hearing protection products.

- January 2021 : Ansell Limited completed the acquisition of the Primus brand & related assets that constitute the life science business belonging to Primus Gloves (India) and Sanrea Healthcare Products. The life science business of Primus develops & sells PPE products.

- August 2020 : DuPont de Nemours, Inc. announced a collaboration with Home Depot (US) to donate rolls of Tyvek 1222A (a type of protective clothing) to Kaiser Permanente to manufacture PPE products.

Table of Contents

Methodology

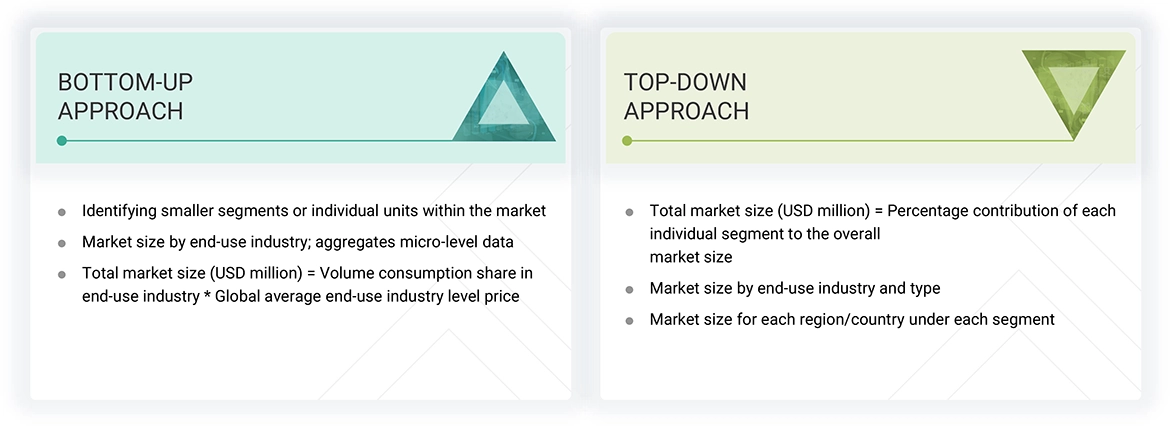

The study involved four major activities in estimating the market size for the Asia Pacific Personal Protective Equipment market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The Asia Pacific Personal Protective Equipment market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the Asia Pacific Personal Protective Equipment market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Honeywell International Inc. | Senior Manager | |

| 3M Company | Innovation Manager | |

| DuPont de Nemours, Inc. | Vice-President | |

| Ansell Limited | Production Supervisor | |

| MSA Safety Incorporated | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Asia Pacific Personal Protective Equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Asia Pacific Personal Protective Equipment Market: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Asia Pacific Personal Protective Equipment industry.

Market Definition

According to the International Safety Equipment Association, Personal Protective Equipment (PPE) is worn to minimize exposure to hazards that can cause serious injuries. PPE protects workers from life-threatening hazards such as chemical burns, explosions, contamination, and falls from heights. It includes gloves, safety glasses and shoes, respirators, earplugs, hard hats, coveralls, and full-body suits. PPE is mainly used in healthcare, manufacturing, construction, oil & gas, mining, transportation, food, and firefighting sectors.

Stakeholders

- Asia Pacific Personal Protective Equipment manufacturers

- Asia Pacific Personal Protective Equipment distributors

- Raw material suppliers

- Service providers

- Government and research organizations

Report Objectives

- To define, describe, and forecast the market size for Asia Pacific Personal Protective Equipment in terms of value

- To provide detailed information about drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze and forecast the Asia Pacific Personal Protective Equipment market by type and end-use industry

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To track and analyze recent developments, such as product launches, deals, and other developments, in the market

- To analyze the opportunities for stakeholders in the market and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Personal Protective Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Personal Protective Equipment Market