Autonomous Forklift Market

Autonomous Forklift Market by Tonnage (<3, 3-5, >5), Navigation (Laser, Vision, Optical Tape, Magnetic, SLAM, Inductive Guidance), Sales Channel, Application, End-use Industry, Forklift Type, Propulsion, Component, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global autonomous forklift market is projected to grow from USD 2.73 billion in 2025 to USD 5.07 billion by 2032 at a CAGR of 9.3%. The growth of the autonomous forklift market is driven by several key factors, including the rapid expansion of e-commerce, rising labor costs, and the growing need for improved warehouse efficiency and safety. Businesses are increasingly turning to automation to enhance productivity, minimize operational risks, and gain a competitive edge. The market is further propelled by advancements in AI, IoT, and sensor fusion technologies, particularly the integration of LiDAR and 3D vision systems which enable real-time path optimization and precision navigation in warehouse.

KEY TAKEAWAYS

-

BY NAVIGATION TECHNOLOGYLaser-guided navigation holds a dominant position in the autonomous forklift market owing to its high precision offering millimeter-level accuracy and its ability to function without reliance on physical markers or magnetic tapes. This makes it particularly suitable for high-density and dynamically changing warehouse environments. Its capability to generate and update spatial maps in real time ensures consistent operational performance even under low light or reflective surfaces, where vision or magnetic based systems often struggle. The Asia Pacific region is projected to account for the largest share of this technology, primarily due to its lower implementation cost relative to LiDAR-based systems, making it a preferred choice in cost-sensitive markets.

-

BY APPLICATIONThe material handling segment holds the largest share of the autonomous forklift market, as tasks like stacking and precise load placement require advanced navigation and accurate localization to coordinate with automated storage systems and prevent collisions. In manufacturing, autonomous forklifts are commonly used to store and retrieve materials for production processes. Models below 5 tons are particularly favored by OEMs, incorporating technologies such as barcodes, cameras, and RFID to enable fast and reliable product identification.

-

BY TONNAGE CAPACITYBelow 3-ton autonomous forklifts are used primarily for indoor applications in e-commerce, retail, and 3PL warehouses to handle lighter loads such as pallets and cartons. These forklifts operate efficiently in narrow aisles and can be easily retrofitted into existing warehouse layouts, making them the most practical and scalable platform for automation deployment. Whereas above 5-ton autonomous forklifts are heavy-duty machines used in steel plants, metal factories, and logistics yards. Typically powered by diesel or gasoline engines used mainly for outdoor industrial operations.

-

BY FUEL SOURCEElectric autonomous forklifts are projected to dominate the market in 2025, driven by their ability to integrate seamlessly with automated warehouse systems, improving operational efficiency and reducing overall costs. Meanwhile, hydrogen fuel cell forklifts are gaining traction among companies prioritizing sustainability, as they deliver zero emissions during operation. Leading manufacturers such as Toyota, Hyster-Yale, and Linde are at the forefront of offering a diverse range of hydrogen-powered forklift solution

-

BY TYPECountries such as China, Japan, South Korea, and India are experiencing rapid industrial growth, driving the demand for automation in warehouses and manufacturing facilities. The rise of e-commerce players like Lazada (China), Rakuten (Japan), and Flipkart (India) has also led to a surge in warehouse automation, where indoor autonomous forklifts improve efficiency and throughput.

-

BY FORKLIFT TYPEPallet jack segment holds the largest share of the autonomous forklift market in 2025 due to its cost-effectiveness, compact design, and suitability for handling lighter loads in confined spaces. The versatility and efficiency of pallet jacks make them suitable for industries requiring frequent material movement, especially over short distances. These jacks are widely used in the e-commerce, retail, and food & beverage industries.

-

BY SALES CHANNELLeasing autonomous forklifts offers companies, especially small and medium-sized enterprises (SMEs), a cost-effective way to access advanced material handling equipment without the significant upfront capital expenditure. This makes it attractive to businesses looking to improve operational efficiency without a significant financial burden.

-

BY END-USE INDUSTRYThe food & beverage industry is at the forefront of adopting autonomous forklifts, driven by the need to handle perishable goods and the demand for automated processes. Major production hubs such as China and India are expanding their manufacturing and warehousing capabilities, while government initiatives support automation and infrastructure development.

-

BY REGIONAsia Pacific is expected to dominate the autonomous forklift market by 2032, subject to rapid industrialization, expansion of manufacturing hubs, and the growth of e-commerce in China, India, and Japan. According to the National Bureau of Statistics, China alone added USD 5,524.45 million (39,910.3 billion yuan) to the industrial sector in 2023, up by 4.2% over the previous year. This offers a lucrative opportunity for the autonomous forklift market in the region.

-

COMPETITIVE LANDSCAPEThe autonomous forklift market is led by globally established players such as Toyota Industries Corporation (Japan), KION Group AG (Germany), Jungheinrich AG (Germany), and Hyster-Yale Materials Handling, Inc. (US). These companies adopted product launches/developments, partnerships, agreements, mergers & acquisitions, expansions, and contracts to gain traction in the high-growth autonomous forklift market.

The adoption of Industry 4.0 practices and the demand for seamless data exchange with warehouse management and ERP systems are fueling interest in connected, software-defined forklifts capable of collaborative operation within smart factories. Emerging applications in healthcare logistics supported by partnerships between robotics firms and healthcare providers are also expanding market opportunities. However, the industry continues to face challenges such as high initial investment costs, limited interoperability between autonomous systems and legacy infrastructure, and the need for extensive mapping and integration customization, all of which can constrain large-scale deployment across diverse facilities.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The autonomous forklift market is undergoing a rapid transformation driven by technological advancements and evolving logistics demands. Key trends such as warehouse automation, AI-powered navigation, IoT integration, and the rise of connected fleet management are reshaping operational efficiency and safety standards. Additionally, disruptions like labor shortages, sustainability goals, and the shift toward “Automation-as-a-Service” models are accelerating adoption across industries, redefining material handling in indoor and outdoor environments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Increasing demand for automation in warehouses

-

•Growth of e-commerce and logistics industries

Level

-

•High initial investment

Level

-

•IoT technology in autonomous forklifts

Level

-

•Failure of sensing elements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing Demand for Automation in the warehouses and the material handling industry

Rapid e-commerce expansion necessitates efficient and scalable warehouse operations to meet consumer expectations for swift and accurate order fulfillment. Companies are increasingly adopting intelligent robotics and automated guided vehicles (AGVs) that work alongside human workers, significantly improving productivity and safety in complex environments. For instance, in January 2025, Symbiotic, an automation firm, announced a USD 200 million deal to acquire Walmart's robotics unit to enhance the retail giant's automated supply chain capabilities. Additionally, Amazon has been expanding its use of warehouse robots to improve efficiency and reduce employee injuries in 2024. Incorporating advanced technologies, such as AI and IoT, into warehouse operations transforms the material handling landscape and drives significant growth in the autonomous forklift market

Restraint: High Initial Investment

With costs ranging from approximately USD 75,000 to USD 80,000 for an automated forklift compared to USD 30,000 to USD 35,000 for a manual counterpart, many SMEs find it challenging to justify the expense against the backdrop of their operational budgets. Additionally, integrating these advanced systems with existing warehouse management infrastructure is complex and time-consuming, often necessitating modifications that further inflate costs. This complexity also requires ongoing maintenance and recalibration whenever warehouse layouts change, which adds to operational downtime and maintenance expenses. Some suppliers, such as Jungerheinrich AG (Germany) and Toyota Industries Corporation (Japan), offer end-to-end autonomous forklift systems

Opportunity: IoT-integrated autonomous forklifts

IoT connectivity allows for real-time monitoring of critical parameters, such as load weight, forklift location, battery health, and operational efficiency. The data collected is processed through advanced analytics, providing actionable insights that help optimize workflows, reduce idle time, and enable predictive maintenance. The rapid adoption of innovative warehouse solutions and advanced logistics networks in the US and Canada is driving demand. The region's focus on Industry 4.0 and digital transformation further accelerates IoT-enabled forklift deployment. Additionally, OEMs are also leaning toward the integration of IoT in forklifts. For instance, Jungheinrich, in August 2024, integrated its material handling with the Automation, Racking, Safety, and Warehouse Management System (WMS), where these interactions demonstrate the Internet of Things (IoT).

Challenge: Failure of sensing elements

Sensors such as LiDAR, cameras, and ultrasonic devices enable these forklifts to navigate complex environments, detect obstacles, and ensure safe movement. A failure in any of these sensing components can disrupt operations entirely, leading to increased downtime and financial losses for businesses. Furthermore, industrial environments often present challenging conditions affecting sensor performance, including dust, low light, and reflective surfaces. These environmental limitations may cause sensor saturation or misinterpretation of data, complicating object detection and navigation and potentially resulting in collisions or accidents. Addressing these challenges necessitates the development of robust sensor technologies, predictive maintenance strategies, and efficient system integration to enhance reliability, safety, and the overall adoption of autonomous forklifts in industrial and warehouse operations

Autonomous Forklift Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Autonomous forklifts unload pallets at docks under human supervision | 40% labor cost reduction, faster throughput, safer operations, upskilling opportunities |

|

Autonomous indoor/outdoor forklifts | Versatile deployment, reduced infrastructure dependence, scalable operations, enhanced safety |

|

Semi-autonomous forklifts for loading/unloading | Higher utilization, hybrid autonomy for precision tasks, safer, less fatigue, flexible adoption |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

This section highlights the autonomous forklift ecosystem, which comprises autonomous forklift manufacturers, component suppliers, technology providers, end users, and government and regulatory bodies. All stakeholders collaborate to develop advanced autonomous forklifts to help leverage technology, data, and regulatory frameworks to achieve goals

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Autonomous Forklift Market, By Navigation Technology

Laser guidance navigation technology is estimated to dominate the autonomous forklift market during the forecast period. The LGV locates the vehicle’s position using the signals it receives from the reflectors. Some devices calculate and adjust their positioning 30 to 40 times per second, making them highly accurate and reducing the need for corrections. Germany, France, and the Netherlands' automotive, pharmaceutical, and manufacturing industries require precise and efficient material handling solutions, favoring laser guidance over traditional methods

Autonomous Forklift Market, By Application

The material handling industry will dominate the autonomous forklift market during the forecasted period. Forklifts with capacities under 5 tons are widely used to meet the specific requirements of OEMs. These forklifts can quickly identify more products due to technologies such as barcodes, cameras, RFID, and QR codes. Manufacturing growth, especially in the European automobile industry, will drive the demand for forklifts in the region. Industry 4.0 will also drive the adoption of these forklifts in European manufacturing

Autonomous Forklift Market, By Tonnage Capacity

Autonomous forklifts with a tonnage capacity of 3 to 5 tons are gaining significant traction in the material handling market due to their versatility and ability to manage heavy loads in indoor and outdoor applications. The increasing pallet sizes in industries such as metals & heavy machinery, chemicals, and paper & pulp drive demand for these forklifts. Major ports in China, South Korea, and Singapore are integrating autonomous forklifts for container handling, palletized goods, and heavy cargo movement, thereby driving demand for 3-5-ton models suited for outdoor and rugged applications

Autonomous Forklift Market, By Fuel Source

The choice of propulsion is influenced by parameters such as the type of operation, warehouse assets, and budget. Electric autonomous forklifts are expected to be prevalent during the forecast period, subject to the rising inclination toward electrification, resulting in reduced emissions, low operational costs, and easy maneuverability. The expanding electric infrastructure in Asia Pacific, Europe, and North America, which supports government legislation and easy integration with software and hardware technologies, will further contribute to the growth of electric propulsion autonomous forklifts. Whereas Companies such as Toyota Industries Corporation (Japan), Hyster-Yale (US), and Linde (Germany) are making significant strides in hydrogen fuel cell technology, offering diverse hydrogen-powered forklifts to meet diverse operational needs

Autonomous Forklift Market, By Type

Large-scale construction, logistics, and industrial expansion in China, India, and Southeast Asia drive demand for autonomous material handling solutions. Additionally, major shipping ports in China, Japan, and South Korea are integrating autonomous forklifts to enhance efficiency in cargo handling and outdoor logistics operations. However, the rise of e-commerce players like Lazada (China), Rakuten (Japan), and Flipkart (India) has also led to a surge in warehouse automation, where indoor autonomous forklifts improve efficiency and throughput

Autonomous Forklift Market, By Forklift Type

Pallet Jacks are estimated to be the dominating autonomous forklift during the forecast period, due to increased labor shortages and the rapid growth of e-commerce and warehousing. Autonomous pallet jacks streamline tasks such as loading, unloading, and transporting goods, reducing time and improving overall efficiency, making them suitable for transporting goods and material pallets inside warehouses and distribution centers. Many companies are increasingly developing automated pallet jacks for warehouse and distribution operations. In August 2024, Mobile Industrial Robots (Denmark) launched the MiR1200 Pallet Jack, which features an AI-based perception system that enhances pallet detection and reduces pick-and-place cycle times

Autonomous Forklift Market, By Sales Channel

In-house purchasing eliminates recurring lease payments and enables tax benefits, which leads to lower overall operational costs. Additionally, businesses gain unrestricted use of the forklift, allowing customization and adaptation to changing operational needs. However, leasing a forklift gives primary tax advantages as lease payments are typically fully deductible as operating expenses on a company’s tax return. This means businesses can reduce their taxable income by the amount spent on leasing, providing immediate cash flow benefits and lowering overall tax liabilities. Companies such as Linde (Germany), Crown Equipment (US), Jungheinrich AG (Germany), and Mitsubishi Forklift Trucks (Japan) offer forklifts for rent

Autonomous Forklift Market, By End-Use Industry

The food & beverage industry is at the forefront of adopting autonomous forklifts, driven by the need to handle perishable goods and the surge in demand for automated processes. Major production hubs in this industry, such as China and India, are expanding their manufacturing and warehousing capabilities, while government initiatives support automation and infrastructure development. Additionally, digitalization will likely introduce significant changes in the way hospitals operate. This will further increase the need for efficient handling of medical equipment and medicines, along with stringent rules and prohibitions set by the Food and Drug Administration (FDA), fueling the demand for autonomous forklifts

REGION

Asia Pacific to be the largest region in the global autonomous forklift market during forecast period.

The Asia Pacific's huge domestic demand for products and services and significant business growth opportunities have led to the establishment of manufacturing and warehousing units for various industries in the region, such as automotive, metals, heavy machinery, semiconductors, and electronics. This offers an attractive growth opportunity for the forklift market in the Asia Pacific region. OEMs such as Anhui Heli Co., Ltd., Multiway Robotics, Hyster-Yale, and Mitsubishi Logisnext have established product development and manufacturing centers in China, reinforcing the country’s position as a leader in autonomous forklift technology. Additionally, the rapid expansion of the e-commerce industry further drives the autonomous forklift market in countries like India. According to the India Brand Equity Foundation (IBEF), the online grocery market is estimated to reach USD 26.93 billion in 2027, while its business-to-business (B2B) online marketplace will have opportunities worth USD 200 billion by 2030. This boom in e-commerce has created an urgent need for efficient warehousing and logistics solutions, prompting many companies to adopt automated technologies such as autonomous forklifts

Autonomous Forklift Market: COMPANY EVALUATION MATRIX

The figure illustrates the competitive landscape of the global autonomous forklift market, positioning key players based on their market share and product footprint. In the autonomous forklift market matrix, Toyota Industrial Corporation (Japan) (Star) leads with a strong market presence and a broad product portfolio. This reinforces the company's position as a leader in automation and showcases its ability to meet evolving market demands for efficient, automated material handling solutions, enhancing its brand recognition and customer trust

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 2,725.8 MILLION |

| Revenue Forecast in 2032 | USD 5,068.5 MILLION |

| Growth Rate | 9.3% |

| Actual data | 2020 – 2032 |

| Base year | 2024 |

| Forecast period | 2032 |

| Units considered | USD MILLION AND UNITS |

| Report Coverage | Revenue forecast, Regional Market Shares, Competitive Landscape, Driving factors, Trends & Disruption, OEM Analysis, Total Cost of Ownership, and others |

| Segments Covered | • By Tonnage capacity (below 3 tons, 3–5 tons, and above 5 tons) • By Application (manufacturing, warehousing, material handling, logistics & freight, and other applications) • By Navigation technology (laser guidance, magnetic guidance, vision guidance, inductive guidance, optical tape guidance, SLAM, and other navigation technologies) • By End-use industry (third-party logistics, food & beverage, automotive, paper & pulp, metals & heavy machinery, e-commerce, aviation, semiconductor & electronics, chemical, healthcare, and other end-use industries) • By Fuel source (electric, ICE & alternate fuel) • By Sales channel (in-house purchase and leasing) • By Forklift type (pallet jack and pallet stacker) • By Type (indoor and outdoor) |

| Regional Scope | Asia Pacific, Europe, North America, and the Rest of the World |

WHAT IS IN IT FOR YOU: Autonomous Forklift Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Autonomous forklift market, by type, at the country level | • Country-level market for Indoor autonomous forklifts and Outdoor autonomous forklifts gives for countries such as India, Japan, Germany, the US, Canada, and Others | • Market opportunity and investment priority by country and use case. |

RECENT DEVELOPMENTS

- February 2025 : The Linde L-MATIC Core Pallet Stacker, a fully automated pallet stacker that integrates with the MATIC: move software, offering an efficient solution for automated load handling, is expected to be launched in February 2025

- January 2025 : KION Group, NVIDIA, and Accenture showcase warehouses of the future at CES 2025. This includes a digital twin powered by physical AI to improve the performance of intelligent warehouses that operate with automated forklifts, smart cameras, and the latest automation and robotics solutions

- August 2024 : Jungheinrich launched its first Experience Center in the Asia-Pacific region in Singapore. It displayed the integration of Jungheinrich's Material Handling Equipment (MHE) with its Automation, Racking, Safety, and Warehouse Management System (WMS), where these interactions demonstrate the Internet of Things (IoT).

- July 2024 : In collaboration with Fujitsu Limited, Toyota Material Handling Japan (TMHJ), a division of Toyota Industries Corporation, announced the launch of Japan's first cloud-based service for evaluating forklift safety using artificial intelligence (AI).

- June 2024 : Mitsubishi Logisnext CO., LTD launched ESSENTiAL, a new entry-level Mitsubishi Forklift Trucks product designed for light duties and smaller, routine tasks with load capacities of 3-tonne or 6-tonne.

Table of Contents

Methodology

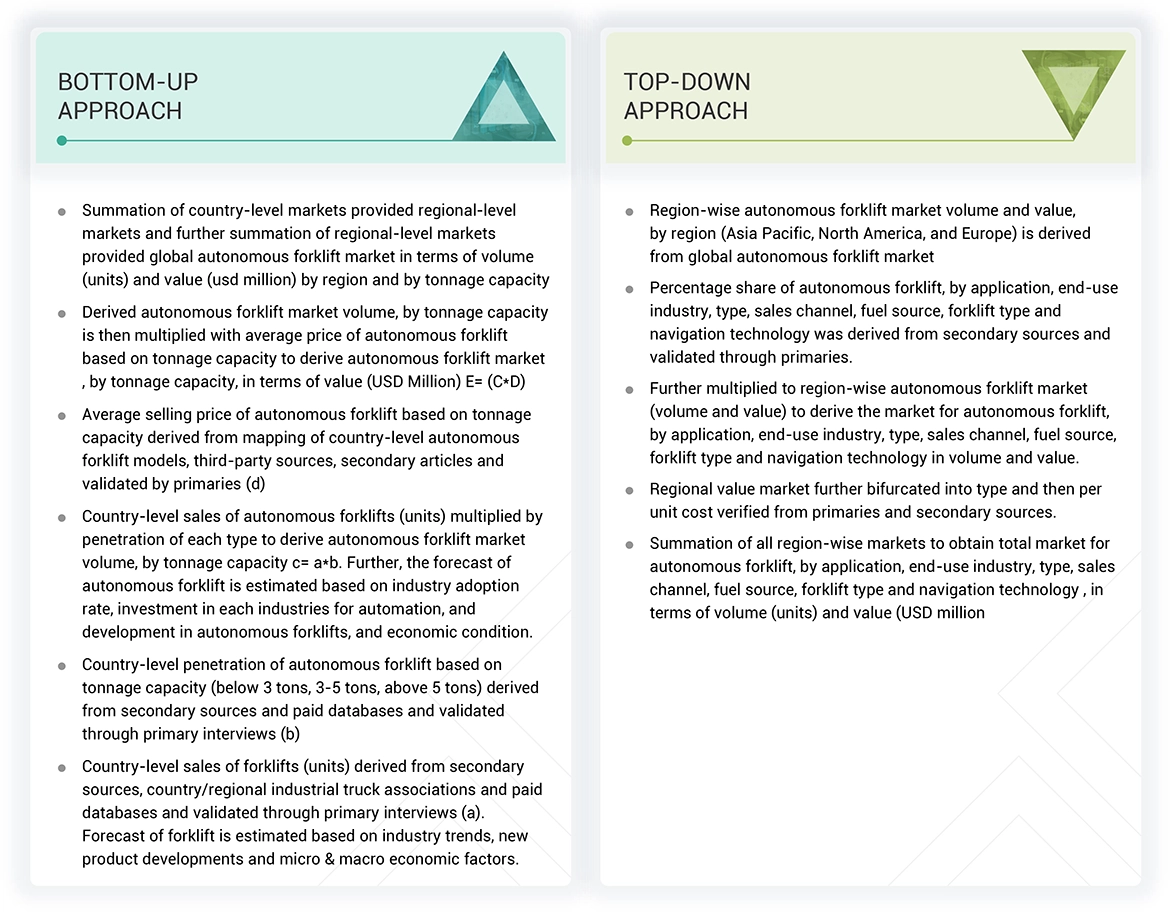

The study involved four major activities in estimating the current size of the autonomous forklift market. Exhaustive secondary research was conducted to collect information on the market, peer, and parent markets. The next step was to validate these findings and assumptions and size them with industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company websites, press releases, industry association publications, Intralogistics magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles were used to identify and collect information useful for an extensive commercial study of the autonomous forklift market.

Primary Research

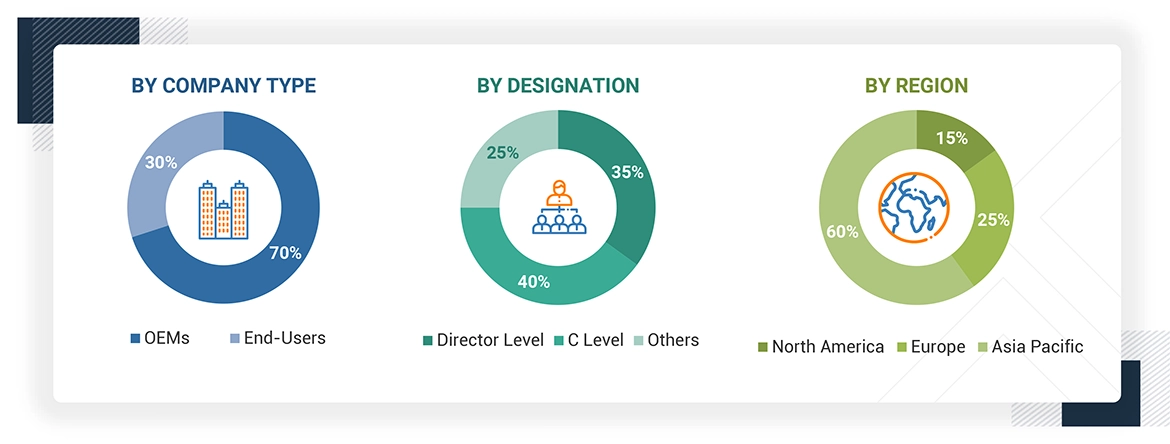

Extensive primary research has been conducted after understanding the autonomous forklift market scenario through secondary research. Several primary interviews have been conducted with market experts from the supply side (autonomous forklift OEMs) and demand side (dealers, e-commerce companies, warehouses, etc.) across major regions, namely, North America, Europe, and Asia Pacific. Approximately 70% and 30% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, design, and marketing, to provide a holistic viewpoint in our report.

After interacting with industry participants, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of the in-house subject-matter experts, led us to the findings described in this report.

Note: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the autonomous forklift market by tonnage capacity and region. The top-down approach was used to derive market size by navigation technology, type, application, forklift type, propulsion, sales channel, tonnage capacity, and end-use industry. To determine the autonomous forklift market size by tonnage capacity, the country-level estimated value share of autonomous forklifts for each tonnage capacity was multiplied by the average selling price (below 3 tons, 3-5 tons, above 5 tons).

The country-level market sizes were summed up to arrive at the regional market size, which was further added to derive the autonomous forklift market size.

Autonomous Forklift Market: Top-Down Approach

The top-down approach was followed to determine the market size by application, end-use industry, type, sales channel, fuel source, forklift type, paper & pulp sector by tonnage capacity, and navigation technology in terms of volume and value for autonomous forklifts. The region-wise autonomous forklift market volume and value by region (Asia Pacific, North America, Europe, Rest of the World) was derived from the global autonomous forklift market. The percentage share of autonomous forklifts by application, industry, type, sales channel, fuel source, forklift type, and navigation technology was derived from secondary sources and validated through primaries. It was further multiplied to region-wise autonomous forklift market volume and value. The market volume and value for autonomous forklifts by application, industry, type, sales channel, fuel source, forklift type, paper & pulp by tonnage capacity, and navigation technology were derived through this. The summation of all region-wise markets was carried out to obtain the total market for autonomous forklifts by type and industry in terms of volume (units) and value (USD million)

Autonomous Forklift Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that are expected to affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Market Definition

As per the Toyota Industries Corporation (Japan), an autonomous forklift is a driverless forklift with unique autopilot technology that provides reliable and accurate driverless operation for transporting, stacking, or picking. The autopilot system can function independently and alongside manually operated equipment systems.

Stakeholders

- OEMs

- Autonomous technology providers

- Hardware & software providers

- Dealer/distributors

- Battery manufacturers

- Robotic providers

Report Objectives

-

To define, describe, and forecast the autonomous forklift market in terms of value (USD million) and volume (units) based on the following segments:

- By Tonnage Capacity (below 3 tons, 3-5 tons, and above 5 tons)

- By Application (manufacturing, warehousing, material handling, logistics, freight, and others)

- By Navigation Technology (laser guidance, magnetic guidance, vision guidance, inductive guidance, optical tape guidance, SLAM, and others)

- By Industry (3PL, food and beverages, automotive, paper and pulp, metals and heavy machinery, e-commerce, aviation, semiconductors and electronics, healthcare, and others)

- By Fuel Source (electric, ICE, and alternate fuels)

- By Sales Channel (In-house purchase and leasing)

- By Forklift Type (Pallet Jacks and Pallet Stackers)

- By Type (indoor and outdoor)

- By Region (Asia Pacific, Europe, North America, and the Rest of the World)

Available Customizations

Along with the market data, MarketsandMarkets offers customizations per company-specific needs.

The following customization options are available for the report:

AUTONOMOUS FORKLIFT MARKET, BY LEVEL OF AUTONOMY

- Level 1

- Level 2

- Level 3

- Level 4

AUTONOMOUS FORKLIFT MARKET, BY TYPE AND COUNTRY

- Further breakup of the North American Autonomous Forklift Market

- Further breakup of the European Autonomous Forklift Market

- Further breakup of the Asia Pacific Autonomous Forklift Market

- Further breakup of the Middle East & Africa Autonomous Forklift Market

- Further breakup of the Latin American Autonomous Forklift Market

AUTONOMOUS FORKLIFT MARKET, BY TYPE AND COUNTRY

-

Asia Pacific

- China

- Japan

- South Korea

- India

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- North America

- US

- Canada

- Mexico

-

Rest of the World

- Africa

- Australia and Oceania

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Autonomous Forklift Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Autonomous Forklift Market

Alex

May, 2022

We would like to know more about Autonomous Forklift Market by level of autonomy (level1, level2, level3)..