Base Oil Market

Base Oil Market by Group (Group I, Group II, Group III, Group IV, Group V), Application (Automotive Oil, Industrial Oil, Hydraulic Oil, Grease, Metalworking Fluid), and Region (North America, Europe, Asia Pacific, South America, Middle East & Africa) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global base oil market is projected to grow from USD 40.29 billion in 2025 to USD 46.59 billion by 2030, at a CAGR of 2.9% during the forecast period. The base oil market is the backbone of the global lubricants industry since it provides the main raw materials for automotive oils, industrial lubricants, marine oils, and specialty fluids. The market is experiencing gradual growth due to the increasing demand from the automotive and industrial sectors. This is especially true for the emerging economies that are urbanizing quickly and developing their infrastructure. Additionally, the rising global vehicle production and the growing vehicle parc are strengthening the consumption of lubricants, such as engine oils, transmission fluids, and gear oils, which further makes automotive applications a major contributor to the growth of the base oil market.

KEY TAKEAWAYS

-

By RegionAsia Pacific is projected to grow at a CAGR of 3.2% during forecast period.

-

By GroupBy group, the Group III segment accounted for the largest share (17.3%) of the base line market in 2024.

-

By ApplicationBy application, the automotive oil segment accounted for a significant share (52.6%) of the market in 2024.

-

Competitive Landscape - Key PlayersExxon Mobil Corporation, Chevron Corporation, and Saudi Arabian Oil Co. were identified as some of the star players in the base oil market (global), given their strong market share and product footprint.

-

Competitive Landscape - StartupsFormosa Petrochemical Co., Ltd., PBF Energy Inc., and Enilive S.p.A., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Stringent environmental and emission regulations globally are compelling lubricant manufacturers to use low-sulfur, high-viscosity-index base oils that lead to cleaner and more efficient lubricant formulations. In addition, refining process innovations such as hydrocracking, isodewaxing, and gas-to-liquids (GTL) are also increasing the supply of high-performance base oils and supporting overall market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions are reshaping customer priorities and revenue models in the lubricant industry, transitioning from today's high-volume conventional base oil sales to future diversified streams emphasizing premium Group III+, synthetics, renewables, and EV fluids for enhanced profitability. The diagram illustrates how existing revenue sources driven by stable demand from mature fleets and cost-focused blenders evolve into new platforms targeting automotive OEMs demanding low-SAPS, high-VI formulations for aftertreatment compatibility and electrification; manufacturers and end-users prioritizing operational efficiency, extended drains, and circular economy solutions; and regulatory pressures like Euro 7/8, GHG Phase 2, and EU Fit for 55 mandating low-carbon, recyclable base oils with full LCA traceability. This shift influences client outcomes through improved TCO (10-20% savings), compliance readiness, and operational reliability, while enabling producers to capture 15-25% margins on advanced grades amid 4-6% CAGR growth, positioning adaptable firms like Chevron, ExxonMobil, Aramco's Luberef, Sinopec, and PetroChina for resilient market leadership in a sustainability-driven era.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for high-performance lubricants

-

Rapid industrialization in Asia Pacific and emerging economies

Level

-

Volatility in crude oil prices

-

Declining demand for Group I base oil

Level

-

Growth in renewable and bio-based base oils

-

Expansion of re-refining and closed-loop recycling infrastructure for used lubricants

Level

-

EV penetration reducing long-term lubricant consumption

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for high-performance lubricants

The main factor supporting the base oil market is the growing demand for high-performance lubricants for new engines and the modern industrial machinery that needs to be of the highest quality and to provide good functioning, durability, and protection. Additionally, transformation in the automotive industry is driving the need for lubricants with excellent thermal stability, resistance to oxidation and low volatility. This phenomenon is speeding the transition from low-quality to high-quality base oils, which include Group II, Group III, and synthetic. Moreover, stringent emission and fuel consumption regulations are compelling lubricant manufacturers to come up with high-performance products that minimize friction and improve efficiency. This factor, is, in turn, establishing the already strong demand for advanced base oils throughout the automotive and industrial sectors.

Restraint: Volatility in crude oil prices

Crude oil price fluctuations are limiting the growth of the base oil market since crude oil is the main input in base oil production. The production costs, pricing stability, and profit margins of base oil makers are all affected by the frequent changes in the crude prices directly. A sudden increase in crude oil prices means that the cost of feedstock and operations will also be increased, while a sudden decrease can lead to the reduction of profits and affect the long-term supply contracts. This whole situation brings uncertainty that not only makes it harder for producers to plan their capacity and decide on investment but also results in price volatility for the lubricant manufacturers downstream. Also, the fact that base oil prices are not stable can lead buyers to engage in purchase delays or to look for alternative formulations, which would, in turn, hinder the base oil market from growing at a steady rate.

Opportunity: Growth in renewable and bio-based base oils

The rise of renewable and bio-based base oils is an enormous chance for the base oil market, supported by the growing global environmental awareness and the stricter sustainability regulations. Lubricant manufacturers are looking for carbon-neutral and biodegradable substitutes for the traditional mineral base oils to comply with the regulations and at the same time, achieve the corporate sustainability goals. Renewable bio-based base oils obtained from feedstocks like vegetable oils and synthetic esters are less toxic, more biodegradable, and have a small environmental footprint. The adoption of these oils in automotive, industrial, marine, and specialty lubricant applications is becoming easier. As the demand for sustainable lubricants gradually converges with that of renewable and bio-based base oils, base oil producers and technology providers would unlock new growth opportunities.

Challenge: EV penetration reducing long-term lubricant consumption

The increased use of electric vehicles (EVs) in the future will be a long-term challenge for the base oil market as it will cut down the overall lubricant consumption, especially for the traditional engine oils, by a large margin. EVs, as opposed to internal combustion engine (ICE) vehicles, do not need engine oil for the combustion process. This factor is expected to impact the demand for automotive lubricants over the years. Additionally, ICE vehicles' gradual phase-out is anticipated to have a restraining effect on the growth of the automotive sector's base oil demand as the government pushes for the adoption of EVs via incentives and introduction of stringent emission regulations. It is true that EVs still need specialized fluids for their gearboxes, cooling systems, and bearings; however, the overall quantity of lubricants used per vehicle is so much lower that providing it becomes a long-term structural challenge for base oil manufacturers.

BASE OIL MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Base oils are used to formulate passenger car and commercial vehicle engine oils that provide lubrication, cooling, and engine protection. | Improve fuel efficiency | Reduce engine wear | Support long oil drain intervals | Ensure compliance with stringent emission standards |

|

High-quality Group III base oils are used in automatic transmission fluids (ATFs), gear oils, and driveline lubricants. | Enhance thermal stability | Reduces friction | Improve shift performance | Extend component life in modern vehicles |

|

Base oils are used in hydraulic oils, compressor oils, turbine oils, and circulating oils across manufacturing and power generation industries. | Ensure reliable equipment operation | Reduce downtime | Improve oxidation resistance | Lower maintenance costs |

|

Base oils are used in marine engine oils and cylinder oils for ships and offshore vessels. | Provide protection against corrosion | Support operation under high-load conditions | Ensure compliance with marine emission regulations |

|

Base oils serve as a key component in cutting, grinding, and machining fluids used in metal fabrication. | Improve surface finish | Reduce tool wear | Enhance cooling and lubrication | Increase machining efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The base oil ecosystem diagram delineates the interconnected value chain, segmenting stakeholders into raw material suppliers, base oil manufacturers, and end users, underscoring collaboration for lubricant innovation and supply reliability. Raw material suppliers like BP, Motiva (Shell), and Marathon provide essential refinery feedstocks such as vacuum gas oil (VGO) and slack wax, ensuring feedstock security amid volatile crude dynamics. Base oil manufacturers, such as Chevron, ExxonMobil, NYNAS, Idemitsu, Valvoline, ErgON, and Chrysan, transform these into premium Group II/III+ and specialty base oils via hydrocracking and dewaxing technologies, driving quality and performance differentiation. End users strengthening the ecosystem include idemitsu, Valvoline, and Chrysan.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Base Oil Market, By Group

The Group III segment is projected to be the fastest-growing segment during the forecast period. This growth is mainly supported by the increasing use of high-performance and synthetic lubricants in automotive as well as industrial applications. Group III base oils mainly consist of high viscosity index, low sulfur, and excellent oxidation and thermal stability. Additionally, they can be compatible with modern engines and also be used in high-tech lubricant formulations. The global trend of fuel-efficient vehicles, longer oil drain intervals, and stricter emissions regulations is hastening the decline of Group I, and lower-grade base oils as they are replaced by Group III products. Moreover, improvements in hydrocracking and isodewaxing technologies are playing a significant role in the rapid growth of the Group III segment worldwide with Asia Pacific and the Middle East being the main areas of support.

Base Oil Market, By Application

The automotive oil segment is projected to be the largest market during the forecast period. This growth is fueled by the global vehicle production increase and the gradual expansion of the vehicle parc in emerging economies. Additionally, the rising demand for engine oils, transmission fluids, and gear oils across passenger and commercial vehicles is helping base oil consumption significantly. Moreover, the stringent emission regulations and the fuel efficiency standards are pushing the industry to the high-performance lubricant formulations that need the higher-quality Group II, Group III, and synthetic base oils. The rise in the preference for longer oil drain intervals and compatibility with advanced engine technologies is also contributing to the strong growth of the automotive oil segment in the base oil market.

REGION

Asia Pacific is projected to account for largest market during forecast period

Asia Pacific is projected to lead the global base oil market during the forecast period. This growth is mainly due to the region's robust automotive, industrial, and manufacturing sectors. Additionally, urbanization and industrialization in China, India, Japan, and South Korea are leading to a constant increase in the demand for automotive and industrial lubricants. Besides, the region is well-known for its large refining capacity, rising investments in Group II and Group III base oil production, and availability of feedstock at competitive prices. Increased car ownership, more infrastructure projects, and stricter emission regulations that necessitate the use of premium lubricants also contribute to Asia Pacific’s leading role in the global base oil market.

BASE OIL MARKET: COMPANY EVALUATION MATRIX

In the base oil market evaluation matrix, Exxon Mobil Corporation (Star) leads with a strong market share and extensive product footprint, driven by its base oil solutions which is adopted by various end users. S-Oil Corporation (Emerging Leader) demonstrate substantial product innovations compared to their competitors. While Exxon Mobil Corporation dominates through scale and diversified portfolio, S-Oil’s base shows significant potential to move toward the leaders’ quadrant as demand for base continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Exxon Mobil Corporation (US)

- Chevron Corporation (US)

- S-Oil Corporation (South Korea)

- SK Enmove (South Korea)

- Saudi Arabian Oil Co. (Saudi Arabia)

- ENEOS (Japan)

- Shandong Qingyuan Group Co., Ltd. (China)

- Hindustan Petroleum Corporation Limited (India)

- Shell (UK)

- Avista Oil Deutschland GmbH (Germany)

- Nynas AB (Sweden)

- Repsol (Spain)

- Ergon, Inc. (US)

- Calumet, Inc. (US)

- China Petrochemical Corporation (China)

- ADNOC (UAE)

- Phillips 66 Company (US)

- PETRONAS Lubricants International (Malaysia)

- ORLEN (Poland)

- GS Caltex Corporation (South Korea)

- H&R Group (Germany)

- PetroChina Company Limited (China)

- PT Pertamina

- FUCHS (Germany)

- Baker Hughes Company (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 40.37 Billion |

| Market Forecast in 2030 (Value) | USD 46.59 Billion |

| CAGR | 2.9% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: BASE OIL MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEMs & Lubricant Manufacturer |

|

|

| Industrial & Manufacturing End User |

|

|

| Marine & Power Generation Company |

|

|

| Process Oil, Rubber, and Tire Manufacturer | Provision of paraffinic and naphthenic base oils with controlled aromatic content and consistency for use as process oils in rubber compounding, tire manufacturing, and polymer processing |

|

RECENT DEVELOPMENTS

- October 2025 : Aramco strengthened its downstream strategy by acquiring an additional 22.5% stake in Petro Rabigh from Sumitomo Chemical for USD 702 million. This transaction made Aramco the largest shareholder with an approximately 60% equity stake, while Sumitomo retains a 15% stake in the company.

- July 2025 : Chevron Corporation completed its acquisition of Hess Corporation after meeting all closing conditions, including a favorable arbitration ruling on Hess’s offshore Guyana assets. The combined company now holds a highly advantaged global energy portfolio with strong positions in key markets and a high cash-margin production profile.

- January 2025 : MOGoil GmbH, an Ergon company, entered into a distribution partnership with Excel Paralubes to market Pure Performance Group II and Group III base oils in Europe. MOGoil will manage distribution through its storage facilities in Antwerp, Belgium, covering the 70N, 110N, 225N, and 600N base oil grades.

- May 2024 : The merger of ExxonMobil and Pioneer formed a leading unconventional business in the Permian Basin, combining over 1.4 million net acres across the Delaware and Midland basins with an estimated 16 billion barrels of oil equivalent in resources. As a result, ExxonMobil’s Permian production was expected to more than double to about 1.3 million barrels of oil equivalent per day based on 2023 levels. It is projected to reach around 2 million barrels per day by 2027.

- May 2024 : Nordmann expanded its partnership with Ergon International Inc. by consolidating the distribution of Ergon’s naphthenic process and base oils across multiple European regions. The expanded coverage includes the Baltic States, Benelux, DACH region, France, Nordic countries, Serbia, Spain, and the UK. Ergon International, headquartered in Flowood, Mississippi with a European base in Belgium, is a leading global supplier of naphthenic process and base oils for diverse technical and industrial applications.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the base oil market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the base oil value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The base oil market comprises several stakeholders, such as raw material suppliers, manufacturers, distributors, end-use products’ manufacturers, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the base oil market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, technology and innovation directors, and related key executives from various key companies and organizations operating in the base oil market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

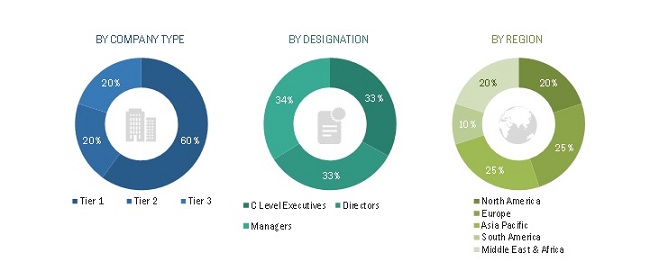

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the base oil market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the base oil market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and experts.

Global Base oil Market Size: Bottom-Up Approach

Global Base oil Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To analyze and forecast the size of the base oil market, in terms of value and volume

- To define, segment, and estimate the base oil market by group, application, and region

- To project the size of the market segments, in terms of volume and value, with respect to five main regions, namely, Asia Pacific, North America, Europe, Middle East & Africa, and South America

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the base oil market for stakeholders and provide a competitive landscape of the market

- To track and analyze competitive developments, such as business expansions, agreements, new product launches, acquisitions, investments, and partnerships in the base oil market

- To strategically profile key players and comprehensively analyze their market share and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of the regional market on the basis of country

- A detailed comparison of product portfolios of various companies

- Details and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Base Oil Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Base Oil Market