Biosurfactants Market

Biosurfactants Market by Type [Glycolipids (Sophorolipids, Rhamnolipids) and Lipopeptides], Application (Detergent, Personal Care, Food Processing, Agricultural Chemicals), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The market size of biosurfactants is estimated to be USD 2.89 billion in 2030, as compared to USD 1.65 billion in 2025, with a CAGR of 11.79% between 2025 and 2030. Biosurfactants are biodegradable surface-active compounds found in plant oils, sugars, and microbial fermentation. They stand to be exploited as an alternative to synthetic surfactants because they are non-toxic, highly biodegradable, and have strong emulsifying and foaming abilities. Growth in the market primarily results from increasing demand in personal care, household cleaning, food processing, and agricultural applications, driven by advancements in bio-based production technology and a shift towards environmentally friendly formulations.

KEY TAKEAWAYS

-

BY REGIONEurope led the global biosurfactants market with a share of 64.9% in 2024.

-

BY TYPEThe rhamnolipids segment is projected to register the highest CAGR of 16.27% in the biosurfactants market between 2025 and 2030.

-

BY APPLICATIONPersonal care is estimated to be the fastest-growing application in the biosurfactants market with a CAGR of 12.33%, between 2025 and 2030.

-

Competitive Landscape - Key PlayersEvonik Industries AG, Shaanxi Deguan Biotechnology Co., Ltd, Biotensidon GmbH stand out as dominant participants in the global biosurfactants market, supported by their extensive offerings and established industry reach.

-

Competitive Landscape - StartupsLocus Fermentation Solutions, Fraunhofer IGB, and MG Intobio Co., Ltd are gaining visibility in specialized segments, positioning them as promising up-and-coming players in the market.

The biosurfactants market is expected to record robust growth in the years to come, driven by increasing demand for sustainable and biodegradable surfactants, growing awareness of the use of eco-friendly formulations, and the development of microbial fermentation methods. As industries are switching to more environmentally friendly and less toxic ingredients, biosurfactants are becoming popular as an alternative with high performance to synthetic surfactants in both the personal care, detergents, and industrial sectors.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customer trends or disruptions have an impact on consumer businesses. The major consumers of biosurfactant producers are personal care brands, detergent manufacturers, and food and beverage processors. The consumers of these finished products make up the target market. Changes in the trend, including the increased popularity of green cleaning products, the development of sustainable formulations for beauty products, and stringent environmental regulations, have a substantial impact on the revenues of end-use manufacturers. These changing customer demands and sustainability pressures are posing a direct influence on the demand for biosurfactants, hence influencing the volumes and profitability of biosurfactant production.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for green solutions

-

Regulations on use of synthetic surfactants

Level

-

Less commercialization due to high production cost

-

Conventional biobased products gaining popularity

Level

-

Development of cost-effective production techniques

-

Rhamnolipids as antitumor agents and immunomodulators

Level

-

Lack of production technology and cost-competitiveness of rhamnolipids

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for green solutions

The rising global shift toward sustainable and eco-friendly products is a major driver for the biosurfactants market. With growing environmental regulations and consumer awareness, industries such as detergents, personal care, food processing, and agriculture are increasingly adopting biosurfactants as biodegradable and non-toxic alternatives to petrochemical surfactants. Biosurfactants offer superior surface activity and emulsification properties while minimizing ecological impact. As brands and manufacturers pursue carbon neutrality and circular economy goals, the demand for bio-based surfactants continues to expand, reinforcing biosurfactants as a key component of sustainable formulations across industries.

Restraint: Less Commercialization Due to High Production Cost

Despite their environmental benefits, biosurfactants face limited large-scale commercialization due to high production costs. Fermentation-based processes require costly substrates, complex purification steps, and lengthy production cycles, which limit their price competitiveness compared to synthetic surfactants. Additionally, the lack of established infrastructure and economies of scale further elevates manufacturing costs. While ongoing R&D aims to enhance yields through the use of optimized microbial strains and renewable feedstocks, the high cost barrier remains a major constraint for the widespread industrial adoption of these technologies.

Opportunity: Development of Cost-Effective Production Techniques

Technological advancements in biotechnology and fermentation processes present strong opportunities for reducing production costs and improving yield efficiency. Researchers are exploring the use of low-cost feedstocks, such as agricultural residues and waste oils, to enhance economic feasibility. Genetic engineering of microbial strains and process intensification methods are enabling the improved recovery and scalability of biosurfactants. These innovations are expected to enhance commercial viability, opening up new opportunities for biosurfactant applications across various industries, including detergents, cosmetics, pharmaceuticals, and agriculture, while supporting the global sustainability transition.

Challenge: Lack of Production Technology and Cost Competitiveness of Rhamnolipids

Rhamnolipids, one of the most promising biosurfactant classes, face challenges related to production technology and cost competitiveness. Their large-scale synthesis remains complex due to pathogenic microbial strains (like Pseudomonas aeruginosa), costly substrates, and stringent downstream processing requirements. As a result, their market penetration remains lower compared to other biosurfactant types such as sophorolipids and glycolipids. To overcome this, companies and research institutions are investing in safer, engineered strains and continuous bioprocessing systems to improve yields and reduce costs, which could make rhamnolipids more competitive in the future.

biosurfactant-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

REWOFERM RL 100 rhamnolipid used in laundry detergents, hard-surface cleaners, vehicle care, and food-and-beverage cleaning; produced at an industrial scale in Slovakia and usable as a primary or secondary surfactant | Fully biodegradable with excellent cleaning performance, strong foaming, and a mild toxicological profile suitable for next-generation low-impact cleaners |

|

Ferma sophorolipids positioned to replace chemical surfactants in personal care formulations with performance and sustainability advantages | 100% bio-based and palm-free with zero 1,4-dioxane/EO; delivers 5–25× performance, enabling lower use levels and at least a 37% carbon-footprint reduction |

|

SOFORO sophorolipid used in Happy Elephant detergents for laundry and dishwashing as a next-generation cleaning ingredient | Non-foaming profile suitable for machine washing, high washability, and rapid biodegradation for environmental safety |

|

Supplies rhamnolipids and HAA for multi-industry uses including cosmetics, personal care, agriculture, oil recovery, and environmental remediation | Natural, biodegradable biosurfactants with high foaming capacity, wide pH stability, and availability in solid, powder, paste, and liquid forms for flexible formulation |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The biosurfactants ecosystem encompasses the examination of the relationship network among different stakeholders, including suppliers of raw materials, producers, formulators, distributors, and end users. To biosurfactant manufacturers, renewable feedstocks include plant oils, sugars, and microbial cultures, which are supplied by the raw material suppliers. The manufacturers utilize fermentation and bioprocessing technology to produce biosurfactants that exhibit a specific surface-active characteristic, suitable for various applications. The distributors and formulators, in turn, mediate the distance between the producers and the final use industries like personal care, household cleaning, food processing, agriculture, and oilfield chemicals, making sure that they have easy access to the market, regulatory compliance, as well as smooth chains of supply to increase operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Biosurfactants Market, By Type

The sophorolipids segment accounted for the largest market share in revenue in 2024. Sophorolipids are widely adopted due to their strong surface activity, low toxicity, high biodegradability, and broad formulation compatibility across various home and personal care products. Rhamnolipids are the fastest-growing segment, supported by their excellent surface activity, low toxicity, and effective performance in neutral to alkaline conditions, making them increasingly attractive for use in household detergents, personal care formulations, and industrial cleaning applications. Their versatility and eco-friendly profiles offer a balance between performance efficiency and environmental safety.

Biosurfactants Market, By Application

The detergents segment dominated the overall biosurfactants market in 2024. This segment benefits from rising consumer awareness toward eco-friendly and non-toxic cleaning products. Biosurfactants provide excellent emulsifying, foaming, and detergency properties, enabling efficient cleaning even at low concentrations. They are widely used in laundry detergents, dishwashing liquids, and surface cleaners, especially in regions enforcing stricter sustainability norms. The renewable origin, mildness, and biodegradability of biosurfactants make them the preferred surface-active agents for global home and personal care product manufacturers aiming to reduce their environmental footprint.

REGION

Europe to be fastest-growing region in global biosurfactants market during forecast period

Europe accounted for the largest market share in 2024 and is also projected to be the fastest-growing region in the global biosurfactants market during the forecast period. The region’s strong growth is primarily driven by stringent environmental regulations, favorable government policies promoting bio-based chemicals, and the growing preference for sustainable and biodegradable surfactants in industries such as detergents, personal care, and food processing. Leading European countries, such as Germany, France, and the UK, are major producers and consumers of biosurfactants due to their well-established biotechnology infrastructure and strong R&D initiatives.

biosurfactant-market: COMPANY EVALUATION MATRIX

In the biosurfactants market matrix, Evonik Industries AG leads with a strong global presence and a broad, innovation-driven portfolio of sustainable surfactant solutions. The company has established leadership across key application areas, including detergents, personal care, food processing, and agricultural chemicals, supported by its deep expertise in biotechnology and green chemistry. Evonik’s focus on developing high-performance, biodegradable, and low-toxicity biosurfactants, along with its continued investments in R&D and strategic collaborations, positions it at the forefront of the industry’s sustainability transition. Through its scale, technological advancements, and commitment to eco-efficient production, Evonik firmly maintains its position in the leaders’ quadrant of the global biosurfactants market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Evonik Industries AG (Germany)

- Shaanxi Deguan Biotechnology Co., Ltd (China)

- Biotensidon GmbH (Germany)

- Saraya Co., Ltd. (Japan)

- Allied Carbon Solutions Co., Ltd. (Japan)

- Daqing VICTEX Chemical Industries Co., Ltd. (China)

- Stepan Company (US)

- Holiferm Limited (UK)

- Dow Inc. (US)

- Solvay S.A. (Belgium)

- Givaudan SA (Switzerland)

- AGAE Technologies, LLC (US)

- Biosurfactants LLC (US)

- Kaneka Corporation (Japan)

- Kemin Industries, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.49 Billion |

| Market Size in 2030 (Value) | USD 2.89 Billion |

| Growth Rate | CAGR of 11.79% from 2025 to 2030 |

| Actual Data | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Thousand/MN/BN), Volume (Ton/Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: biosurfactant-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based home and fabric care brand planning biosurfactant adoption in detergents and hard-surface cleaners to meet EU ecolabel expectations and qualify regional supply | Supplier landscape and capacity mapping for sophorolipids and rhamnolipids (e.g., Syensqo Mirasoft, Evonik REWOFERM, Holiferm/Sasol), plus compliance checks against EU Detergents Regulation and EU Ecolabel biodegradability criteria | Qualify EU-made, ecolabel-compatible inputs to reduce environmental claims risk and secure diversified European production options |

| North America's personal care manufacturer evaluating “natural origin” surfactant swaps in shampoos, body wash, and hand soaps | Benchmark testing of sophorolipids (Mirasoft SL A60/L60) versus Ferma biosurfactants on cleansing, mildness, solubilization, and formulation stability, with ISO/COSMOS documentation packages for claims support | Demonstrated gentle cleansing with high bio-based content and enable non-ethoxylated, zero-1,4-dioxane positioning where applicable |

RECENT DEVELOPMENTS

- May 2025 : At its Capital Markets Day, Evonik announced plans to increase core profit by USD 1.2 billion by 2027, with a focus on sustainable innovations. This includes expanding its biosurfactant portfolio, such as rhamnolipids and sophorolipids, to meet growing demand for eco-friendly surfactants in personal care, cleaning, and agriculture. The company aims for a 50% revenue share from "Next Generation Solutions" by 2030, aligning with its commitment to sustainability.

- April 2025 : Stepan Company commenced production at its new alkoxylation facility in Pasadena, Texas, in early April 2025. This facility, strategically located in the US Gulf Coast, enhances Stepan's manufacturing capabilities with a capacity of 75,000 metric tons per year for both ethoxylation and propoxylation processes. The expansion aims to meet the growing demand for surfactant technologies across various markets, including agriculture, oilfield, construction, cleaning, and personal care.

- February 2025 : AGAE Technologies inaugurated its largest retrofitted manufacturing plant in Asia, spanning 41,000 square feet with an annual capacity exceeding 1,000 metric tons of rhamnolipid biosurfactants. This facility addresses the growing demand for sustainable, biodegradable surfactants in personal care, agriculture, and industrial applications. The plant's design incorporates advanced foam control technologies and efficient downstream processing, thereby overcoming challenges such as foam management and yield optimization.

- March 2025 : Dispersa Inc. and AGAE Technologies are scaling up biosurfactant production to meet increasing demand. Dispersa is transitioning from 1,000 L pilot reactors to a 50,000 L commercial-scale system, aiming to produce 100 metric tons per year of sophorolipids from food waste. AGAE has opened a 3,800 m² plant in Asia with a capacity of over 1,000 metric tons per year for rhamnolipids, with plans for a US facility in the near future.

Table of Contents

Methodology

The study involved four major activities in estimating the market size for the biosurfactants market. Exhaustive secondary research was conducted to gather information on the market, its peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Following this, market breakdown and data triangulation procedures were employed to determine the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research, which involved conducting extensive interviews with key officials, including CEOs, VPs, directors, and other executives.

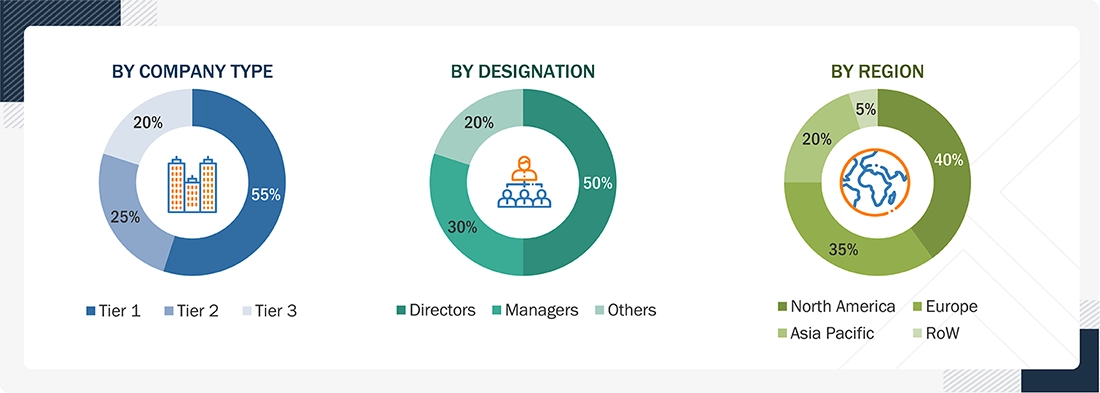

Primary Research

The biosurfactants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the biosurfactants market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

|

COMPANY NAME |

DESIGNATION |

|

Evonik Industries AG |

Senior Manager |

|

Shaanxi Deguan Biotechnology Co., Ltd |

Innovation Manager |

|

Biotensidon GmbH |

Vice-President |

|

Saraya Co., Ltd. |

Production Supervisor |

|

Allied Carbon Solutions Co., Ltd. |

Sales Manager |

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the biosurfactants market. These methods were also used extensively to estimate the size of various market segments and subsegments. The research methodology used to estimate the market size included the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Biosurfactants Market : Top-Down and Bottom-Up Approach

Data Triangulation

According to ScienceAlert, “Biosurfactants can be defined as the surface-active biomolecules produced by microorganisms with a wide range of applications.” Biosurfactants are surface-active compounds produced by the biologically available raw materials through microbial fermentation. They are 100% biodegradable and exhibit superior foaming, wetting, emulsifying, and dispersing properties. Biosurfactants act as secondary metabolites that accumulate at the air-water or oil-water interfaces, forming micellar aggregates by reducing surface tension.

Market Definition

Pet biotics refer to a group of functional ingredients, including probiotics, prebiotics, and postbiotics, that are incorporated into pet foods, treats, toppers, and nutritional supplements to support gut health, digestion, immunity, nutrient absorption, and overall well-being. Probiotics are live beneficial microorganisms, prebiotics are non-digestible fibers that selectively nourish these beneficial microbes, and postbiotics are bioactive compounds produced through microbial fermentation. Together, these ingredients help maintain a balanced gut microbiome and enhance the health and performance of pets.

Key Stakeholders

- Manufacturers, dealers, and suppliers of biosurfactants and their raw materials

- Manufacturers in various end-use industries

- Traders and distributors of biosurfactants

- Regional manufacturers’ associations and biosurfactant associations

- Governments, regional agencies, and research organizations

Report Objectives

- To analyze and forecast the biosurfactants market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To define, segment, and project the size of the global biosurfactants market based on type and application

- To project the market size for the five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, with their key countries

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To track and analyze R&D and competitive developments such as expansions, product launches, collaborations, investments, partnerships, agreements, and mergers & acquisitions in the biosurfactants market

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Biosurfactants Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Biosurfactants Market