Building Automation System Market Size, Share & Trends, 2025 To 2030

Building Automation System Market Size, Share & Trends by Facility Management Systems, Security & Access Control, Fire Protection Systems, Building Energy Management Software, Building Automation System Services, Residential, Industrial, Commercial - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The building automation system market size is projected to grow from USD 101.34 billion in 2025 to USD 191.13 billion by 2030, at a CAGR of 13.4% over the forecast period. Growth is driven by the increasing adoption of smart building technologies, rapid urban infrastructure development, and a growing emphasis on energy-efficient and sustainable facilities. Rising government investments in green building programs, smart city initiatives, and IoT-based energy management platforms are further accelerating market expansion. Additionally, the integration of AI-driven analytics, cloud-based monitoring, and advanced sensor networks is enhancing operational efficiency, reducing energy waste, and driving sustained growth across the global commercial, industrial, and residential building sectors.

The building automation software market is experiencing strong growth as commercial, residential, and industrial facilities increasingly adopt smart building technologies to improve energy efficiency, occupant comfort, and operational performance. Building automation software enables centralized control of HVAC, lighting, security, fire safety, and energy management systems through data-driven and IoT-enabled platforms. Rising demand for energy-efficient buildings, government regulations on sustainability, and the integration of AI and cloud-based analytics are key factors driving market expansion, with smart cities and digital infrastructure projects further accelerating adoption worldwide.T

he building automation industry is rapidly evolving as organizations and property developers increasingly adopt intelligent systems to manage HVAC, lighting, security, fire safety, and energy efficiency in commercial, residential, and industrial facilities. By integrating IoT, AI, and cloud-based analytics, building automation solutions provide centralized control, real-time monitoring, and predictive maintenance, enhancing operational efficiency and occupant comfort. Driven by energy conservation initiatives, government regulations on sustainability, and the rise of smart cities, the industry is experiencing strong growth globally, with both mature and emerging markets investing heavily in advanced building management technologies.

KEY TAKEAWAYS

-

BY REGIONThe North America building automation system market dominated, with a share of 34.2% in 2024.

-

BY OFFERINGBy offering, the building energy management software segment is projected to grow at the fastest rate (17.2%) from 2025 to 2030.

-

BY APPLICATIONBy application, the industrial segment is expected to register the highest CAGR of 14.7%.

-

BY COMMUNICATION TECHNOLOGYBy communication technology, wireless technologies are expected to dominate the market.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSJohnson Controls (US), Schneider Electric (France), AND Siemens AG (Germany) were identified as star players in the building automation systems market (global) given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS AND SMESDelta Intelligent Building Technologies (Canada) Inc. (Canada), Spaceti (UK), and 75F (US) have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The building automation system market share is projected to grow significantly over the next decade, driven by rapid digital transformation in building infrastructure, rising demand for energy-efficient operations, and increasing government initiatives toward smart and sustainable urban development.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The building automation vertical primarily comprises commercial property developers, facility management firms, industrial plant operators, and government infrastructure agencies. Building automation systems (BAS) have been widely adopted across these segments to enable centralized control, energy optimization, and operational efficiency. In addition, new opportunities are emerging through the integration of AI- and IoT-enabled energy analytics, cloud-based monitoring platforms, and sensor-driven control systems for real-time building performance optimization. These advancements are expected to shape the next generation of intelligent and sustainable infrastructure ecosystems, driving improvements in energy efficiency, occupant comfort, and cost reduction for both private enterprises and public institutions worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing need to enhance occupant comfort, productivity, security, and safety in residential, commercial, and industrial sectors

-

Incorporation of advanced surveillance and biometric technologies into building automation systems

Level

-

Difficulties in customizing building automation systems

-

Technical complexities associated with installation & maintenance; shortage of skilled professionals

Level

-

Increasing investments by governments and various stakeholders in establishment of smart cities

-

Government-led initiatives to enhance energy efficiency and comply with green building standards

Level

-

Lack of standardized communication protocols

-

Need to keep systems up-to-date with rapid technological advancements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing need to enhance occupant comfort, productivity, security, and safety in residential, commercial, and industrial sectors

Building automation systems (BAS) are progressively being adopted across commercial, residential, and industrial infrastructures to improve occupant comfort, operational efficiency, and energy optimization. The increasing focus on sustainable construction practices, green certifications such as LEED and BREEAM, and net-zero energy objectives is propelling the widespread adoption of BAS. Furthermore, the integration of Internet of Things (IoT), artificial intelligence (AI), and cloud-based monitoring technologies is facilitating predictive maintenance, centralized control, and intelligent energy management, thereby further propelling market growth on a global scale.

Restraint: Difficulties in customizing building automation systems

Despite proven efficiency benefits, BAS implementation often requires extensive customization, integration of systems, and significant initial capital expenditure, potentially impeding widespread adoption—particularly within older or retrofitted structures. The absence of standardization across communication protocols such as BACnet, KNX, and LonWorks frequently results in interoperability challenges among various systems and devices. Furthermore, limited technical expertise coupled with fragmented vendor ecosystems in developing economies continue to serve as significant obstacles to achieving consistent performance and reliability of BAS.

Opportunity: Increasing investments by governments and various stakeholders in establishment of smart cities

The rapid growth of smart city and energy efficiency programs is creating new opportunities for BAS solution providers. Governments and private stakeholders are investing in digitally connected buildings and energy-efficient infrastructure, promoting the adoption of AI- and IoT-enabled automation systems. Additionally, public–private partnerships (PPP) and green building incentives are fostering modernization of aging infrastructure and large-scale retrofitting projects. Vendors are also exploring data-driven service models and cloud-based energy analytics to expand recurring revenue streams and enhance customer value.

Challenge: Lack of standardized communication protocols

As BAS solutions increasingly rely on multi-vendor integration and IoT connectivity, ensuring seamless communication across devices and systems has become a major challenge. The absence of unified standards and inconsistent data exchange protocols can hinder scalability and long-term interoperability. Moreover, concerns regarding cybersecurity, data privacy, and system vulnerability are rising with the adoption of cloud-based BAS platforms. Addressing these through robust encryption, AI-driven anomaly detection, and international standard alignment (ISO, IEC, BACnet) is essential to ensure secure and reliable building automation operations.

BUILDING AUTOMATION SYSTEM MARKET SIZE, SHARE & TRENDS, 2025 TO 2030: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of an advanced building automation system (BAS) integrating HVAC, lighting, and air quality monitoring across hospital facilities for optimized energy and comfort management | Improved air quality and patient comfort, 20% reduction in energy costs, enhanced regulatory compliance, and streamlined facility operations |

|

Implementation of a centralized BAS platform connecting HVAC, refrigeration, and lighting systems across stores to enable real-time energy management and predictive maintenance | Achieved 25–30% reduction in store-level energy use, enhanced equipment uptime, and improved in-store comfort for customers and staff |

|

Integration of a smart room automation system with occupancy sensors and centralized energy management to enhance sustainability and guest experience | 18% reduction in energy consumption, reduced maintenance costs, and improved guest satisfaction through personalized room control |

|

Deployment of a smart campus BAS integrating IoT sensors and analytics for classrooms, dormitories, and labs to optimize energy and environmental conditions | 25% improvement in energy efficiency, better indoor comfort, and real-time data-driven facility planning for sustainable operations |

|

Implementation of a residential BAS enabling centralized control of lighting, HVAC, and water systems through smart apps for luxury housing complexes | 15–20% reduction in energy bills, enhanced resident convenience and security, and improved property value through sustainability features |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The building automation system ecosystem comprises established providers such as Honeywell, Siemens, Johnson Controls, Schneider Electric, ABB, Carrier, Bosch, and Legrand. The synergy among these players is unlocking new opportunities in AI-driven energy optimization, IoT-enabled sensor networks, cloud-based control platforms, and predictive maintenance analytics. These companies are continuously enhancing their portfolios with interoperable solutions, open-protocol architectures, and integrated energy management platforms, driving efficiency, sustainability, and digital transformation across the global commercial, industrial, and residential building segments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Building Automation System Market, by Offering

The building energy management software segment is expected to grow the fastest during the forecast period, driven by rising demand for real-time energy monitoring, HVAC optimization, and intelligent lighting control. The shift toward cloud-based analytics and integrated management platforms is improving interoperability across building systems. In addition, the growing adoption of AI- and IoT-enabled automation solutions is enabling predictive maintenance and sustainability-focused energy performance management.

Building Automation System Market, by Application

The commercial segment held a significant market share in 2024, supported by widespread deployment across offices, retail spaces, hospitals, and hospitality facilities. These establishments increasingly rely on BAS-integrated HVAC, lighting, and security systems to reduce operational costs and enhance occupant comfort. Meanwhile, the industrial segment is gaining momentum, with adoption of automation technologies for energy optimization, asset monitoring, and safety compliance.

Building Automation System Market, by Communication Technology

The wired communication segment held the largest market share in 2024 due to its high reliability, data security, and suitability for large commercial complexes and industrial facilities. However, the wireless segment is projected to grow rapidly, driven by the rising adoption of IoT-enabled sensors and Wi-Fi/Bluetooth-based systems that enable flexible installation and remote control. Service providers are increasingly focusing on cloud interoperability, AI-based fault detection, and automated control to enhance building efficiency and performance visibility.

REGION

Asia Pacific is expected to register the highest CAGR in the global building automation system market during the forecast period

The Asia Pacific region is projected to register the fastest growth rate during the forecast period, driven by strong government focus on net-zero construction, rapid urban development, and large-scale smart city programs across major economies such as India, China, Japan, and South Korea. Governments are prioritizing energy-efficient building policies, mandatory green certification programs, and the integration of IoT- and AI-enabled control systems to modernize commercial and residential infrastructure. The region’s progress is further supported by the declining cost of sensors and communication modules, the expansion of sustainable real estate projects, and regulatory incentives promoting energy-efficient retrofitting. Collectively, these initiatives are accelerating the large-scale adoption of building automation systems market growth across the region’s construction and infrastructure sectors.

The European building automation system market is projected to reach USD 41.21 billion by 2030 from USD 25.35 billion in 2025, at a CAGR of 10.2% from 2025 to 2030. Growth is driven by the accelerating adoption of smart building technologies across commercial, industrial, and residential facilities in Europe, supported by strict EU energy efficiency regulations and national decarbonization targets. The rising need for automated control of HVAC, lighting, security, and ventilation systems, combined with the region’s strong regulatory push toward nearly zero energy buildings and sustainable construction, is significantly boosting BAS integration. Investments in IoT-enabled sensors, cloud-based facility management platforms, and AI-powered building analytics are further strengthening market expansion as European building owners focus on predictive maintenance, real-time energy monitoring, and occupant comfort optimization.

BUILDING AUTOMATION SYSTEM MARKET SIZE, SHARE & TRENDS, 2025 TO 2030: COMPANY EVALUATION MATRIX

In the building automation system (BAS) market trends, Johnson Controls (Star) holds a leading position with a strong global presence, an extensive product portfolio, and proven expertise in integrated building management platforms, HVAC optimization, and smart energy control solutions. The company’s ongoing focus on system interoperability, digital twin integration, and AI-driven building analytics has solidified its status as a top-tier provider across commercial and industrial facilities worldwide. Robert Bosch GmbH (Emerging Leader) is demonstrating notable momentum through innovations in IoT-enabled sensors, energy-efficient automation solutions, and scalable cloud-based platforms, gaining traction in smart infrastructure and green building projects in both developed and emerging markets. Other participants, including Siemens, Honeywell, Schneider Electric, and ABB, are expanding their presence by offering modular, cost-effective, and interoperable BAS solutions tailored to evolving sustainability and regulatory requirements. Collectively, these companies are driving innovation and competitiveness in the global BAS landscape through the growing adoption of AI, IoT, and cloud-based automation technologies that enhance energy efficiency, operational reliability, and building intelligence.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Johnson Controls (Ireland)

- Schneider Electric (France)

- Carrier (US)

- Siemens (Germany)

- Honeywell International Inc. (US)

- Robert Bosch GmbH (Germany)

- Legrand (France)

- Hubbell (US)

- ABB (Switzerland)

- Trane Technologies plc (Ireland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 92.20 Billion |

| Market Forecast in 2030 (Value) | USD 191.13 Billion |

| Growth Rate | CAGR of 13.4% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: BUILDING AUTOMATION SYSTEM MARKET SIZE, SHARE & TRENDS, 2025 TO 2030 REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| ETC System Manufacturer |

|

|

| Highway Authority/Toll Operator |

|

|

| Transportation Ministry/Smart City Agency |

|

|

| Technology Provider/Payment Integrator |

|

|

RECENT DEVELOPMENTS

- May 2025 : Legrand launched the Wattstopper i3 Platform, a next-generation lighting and building intelligence solution. Powered by KODE Labs’ award-winning operating system, the platform marks a significant step forward in smart building management.

- May 2025 : Automated Logic, a part of Carrier and a leading provider of building automation and controls solutions, acquired Logical Building Automation. The acquisition aims to expand Automated Logic’s global footprint and strengthen its position in the building automation and controls market.

- March 2025 : Honeywell International Inc. launched the Honeywell Home X2S smart thermostat at CES 2025. The thermostat is designed for easy installation and features a simple display with buttons, distinguishing it from more high-tech models like the Google Nest Learning Thermostat, which typically use touchscreens.

FAQ

1: What is the size and growth forecast of the building automation software market?

The global building automation software market is experiencing steady growth, driven by the adoption of IoT-enabled smart building solutions, energy management systems, and centralized facility monitoring. The market is expected to grow at a healthy CAGR over the next several years, with increasing deployment across commercial, industrial, and residential buildings worldwide.

2: What are the key trends shaping the building automation industry?

Major trends include integration with IoT, AI, and cloud-based analytics, predictive maintenance, energy optimization, and remote monitoring capabilities. Sustainability initiatives, smart city developments, and government energy efficiency regulations are also driving widespread adoption.

3: How is the building automation software market segmented by devices and applications?

The market is segmented by devices such as HVAC systems, lighting controls, security systems, fire safety, and energy management systems. Applications span commercial buildings, industrial facilities, hospitals, educational institutions, and residential complexes, with commercial buildings currently holding the largest share.

4: What is the status of the building automation system market in Japan and the UK?

-

Japan: The market is growing due to smart building initiatives, industrial automation adoption, and government policies promoting energy efficiency and IoT integration.

-

UK: Adoption is driven by commercial real estate modernization, sustainability mandates, and the increasing use of digital building management systems to optimize energy consumption and operational efficiency.

5: What is the future outlook and growth potential of the building automation software market?

The market is expected to expand significantly, supported by increasing demand for smart, connected, and energy-efficient buildings. Continuous innovation in software platforms, predictive analytics, integration with AI and IoT devices, and regulatory support will drive adoption across industries globally. The market will see growth in both established regions like North America and Europe, and high-potential markets in Asia-Pacific.

Table of Contents

Methodology

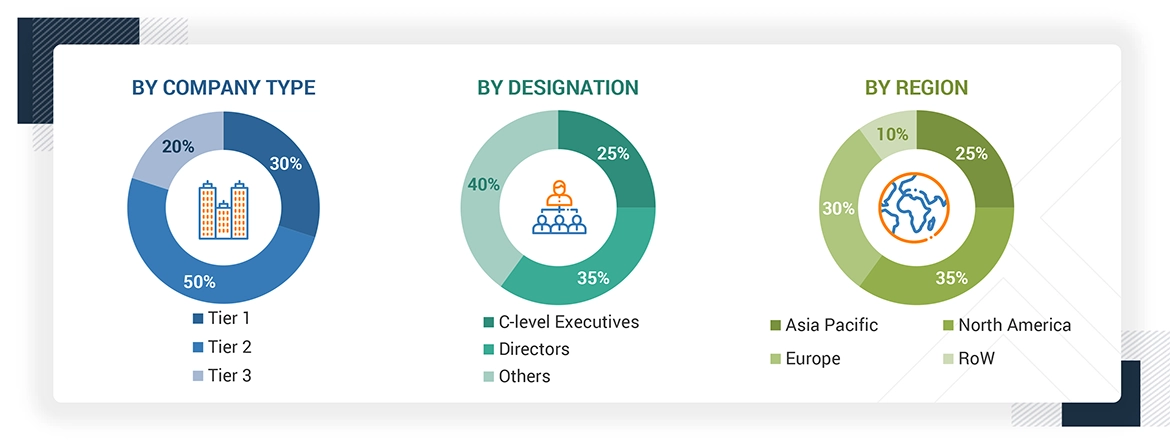

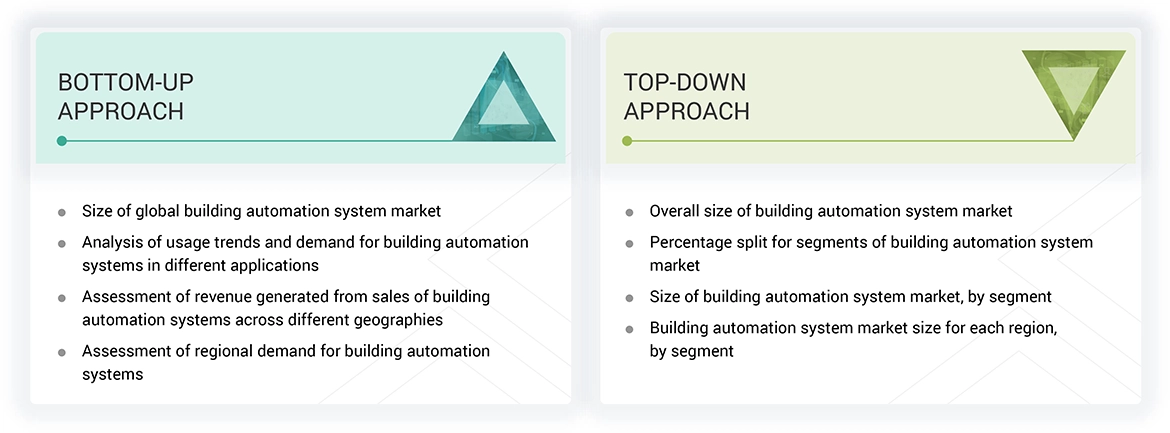

The research study involved four major steps in estimating the size of the building automation system market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation approaches have been adopted to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect important information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry's supply chain, the market's value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding the building automation system market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across major regions— North America, Europe, Asia Pacific, and RoW. This primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been:

Note: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the building automation system and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying major companies that provide building automation solutions and products

- Identifying major segments of building automation system products and solutions across various regions

- Identifying the market share estimates for deployments in different applications by understanding the demand for building automation system products and solutions

- Tracking the ongoing and upcoming developments of building automation system products

- Tracking the ongoing and upcoming offerings of building automation systems and forecasting the market size based on demand, investments, needs, and changes in demand

- Estimating the market size in various regions by analyzing the adoption of building automation system solutions in different applications

- Combining the regional market size for each segment to arrive at regional market estimates

- Interviewing multiple key leaders to understand the scope of the building automation system market, the demand for the product, and the market's future growth.

- Arriving at market estimates by identifying companies that provide building automation system products in different geographic regions and then combining this information to arrive at the market estimates for each region

- Verifying and validating estimates at every level by cross-checking them with the primaries, discussions with leaders, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources, such as annual reports, press releases, white papers, and databases

Building Automation System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, using the market size estimation processes as explained above, the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at each market segment's and subsegment's exact statistics. The data has been triangulated by studying various factors and trends from the demand and supply sides in the building automation system market.

Market Definition

A building automation system (BAS) is a centralized control system that manages and monitors a building's mechanical and electrical equipment, such as HVAC, lighting, security, and fire systems. It integrates various subsystems to optimize energy efficiency, reduce operational costs, and enhance occupant comfort. BAS uses sensors, controllers, and software to automate tasks like adjusting temperature, controlling lighting based on occupancy, or managing ventilation. It is commonly used in commercial buildings, hospitals, and schools to streamline operations and support sustainability goals. Advanced BAS incorporates IoT and smart technologies for remote monitoring and data-driven decision-making.

Key Stakeholders

- Original device manufacturers (ODMs)

- Building automation service providers

- Networking technology vendors

- Real estate developers

- Building automation software and solution providers

- Building automation service providers

- Component suppliers

- Research organizations and consulting companies

- Sub-component manufacturers

- Technology providers

- Building automation system-related associations, organizations, forums, and alliances.

Report Objectives

- To describe and forecast the building automation system market based on communication technology, offering, application, and region in terms of value

- To describe and forecast the market, in terms of value, for various segments in four key regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To forecast the size of the building automation system market for facility management systems, by type, in terms of volume

- To strategically analyze the 2025 US Tariff pertaining to the market under study

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To provide a detailed overview of the building automation system supply chain and its industry trends

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the building automation system market

- To profile the key players and comprehensively analyze their market position in terms of the market share and core competencies2, along with a detailed competitive landscape for the market leaders

- To analyze competitive developments such as partnerships, collaborations, acquisitions, and product launches in the building automation system market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Building Automation System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Building Automation System Market

Sam

Oct, 2015

Do circuit breakers fits into this building automation and controls market? Which report calls them out specifically..

Vivek

Aug, 2013

I am interested in the Building Automation sector in India. What types of controls are sold? What types of building automation software are in play? Who are the major players?.

Barry

Jan, 2014

Hi, I am looking at a potential investment in a sensor start up and would like to understand more about the market for in-building sensors. .

adam

Jul, 2019

Interested in market size and change from controls to integrated along with workforce challenges..

Felix

Mar, 2017

Dear Sir Madam, is it possible to only purchase the Market Overview chapter and if yes, at which price? .

Scot

May, 2019

Looking for new York city , new jersey and Philadelphia data in addition to north America and USA. .

Mark

Mar, 2015

Interested in Building Automation & Controls Market by Product Segment (Lighting control, HVAC control, Security & Access control), Application Vertical (Residential, Commercial, and Industrial), and Geography (North America, Europe, APAC, and ROW) - Global Forecast to 2020.

Susan

Mar, 2019

We are a company working on developing smart sensors. Need to have an understanding on the Building Automation System..

Ricardo

Dec, 2018

Hi there, I work in this market as a product manager and wanted to better understand its prospects for the future. .

Phil

Feb, 2019

We are weighing the opportunity that exists at the confluence of building data (BMS), people data (heath and personal and social performance) and business data (HR, Real Estate, ESG/CR, revenue and costs)..

Charlotte

Jan, 2015

Hi, I am interested in commercial HVAC market. May I request sample of related areas such as Chapter 5.4 Market Dynamics, Chapter 8.3 HVAC Control and etc.? .

Michael

Jan, 2013

My area of interest is HVAC controls systems and need to have an understanding of the same..

Matthias

May, 2019

Looking for information concerning the market growth and competition involved with Building Energy Management Software in continents other than the Americas. .

Aishwarya

Apr, 2021

Interesed in BMS market in Germany.

Laura

Jan, 2015

Seeking market data for sensor manufactures, trends, outlook for upcoming years in the HVAC industry, specific to different targets like residential, commercial, industrial, etc. .

Paolo

Jun, 2016

I see you have 4 reports on smart homes, smart building, home automation, and building automation. What is the difference?.

Lisa

May, 2015

Need to get market sizing of building automation in commercial and industrial buildings, particularly focused on internet connected devices - lights, HVAC, elevators, etc..

Bernd

Mar, 2019

We're concerned with manufacturing automation mainly. Getting more requests now for services in building automation/industrial sector. Wanted to dive deeper into this sector now by research..

Elio

Dec, 2014

Interested in building automation & control systems, energy monitoring systems, advanced HVAC control logics, sustainable buildings..

Stephen

Aug, 2015

Doing some research in this field for a client who may be interested in buying the report. So, I want to share the brochure with them. .

Prayudi

Aug, 2015

I need the list of building controls companies/vendors in USA, Singapore, Asia and their market shares. Does the report contain these information/data?.

Mario

Sep, 2013

Interested in Commercial/Industrial Buildings Markets (Asia and Pacific Rim, EMEA and Latin America), current status, growth potential, players, issues, opportunities, etc..

ALEX

May, 2019

Interested in intelligent building systems to reduce energy, water and maintenance costs on commercial real estate..

Cleber

Oct, 2019

I would like to understand the BACnet industry market share and the main factors that are driving the market. .

Naohiro

Dec, 2016

I understand that this report have some geographical market size data, by Americas, EMEA, APAC, (each total?). We want to see some level of "by country" data, such as major 5-10 countries. Do you provide this kind of data ? If the report have market size data by countries by market product segmentation (means matrix type data), it would be wonderful. .

Gero

Nov, 2013

Interested in market numbers of building automation, segmented by region and product groups as well as future development..

Joe

Aug, 2015

Looking for market share analysis and ranking of Schneider Electric in BMS/BA system market..

vivek

Feb, 2013

Sir/Mam, I am perusing my degree in management and as per my course, I am working on a project related to home automation. Please provide me some insights of the report which will help me to complete my project. .

vivek

Feb, 2013

Interested in information related to companies market share..

Bill

Jan, 2016

I am interested in knowing what type of HVAC controls specifically comprise this report. Also, is it possible to request only portions of the report at a discount. If so, what kind of discounts would apply? .

Shashank

Dec, 2014

Requirements on market share of prominent companies in automation industry in Indonesia and Philippines. What are the product lines offered by these companies. Who are their channel partners in the region of Indonesia and Philippines..

Jolene

Dec, 2014

For quote: has anyone from this industry purchased this report? If so, is there a quote for a corporate license (either by site or by number of users)?.

Anthony

Nov, 2013

Our primary focus is on HVAC, lighting, BMS, and wireless technologies..

Robert

Nov, 2019

Interested in IoT / BAS market leaders (by %-age of market) and highest value product/services to offer with leading CAGR..

Juan

Nov, 2015

I am working in a market study focused on BMS in European commercial building. I would like to know if your report offers valuable information in this market sector. Accessing to information in section 9.3 of the report could be very valuable for our analysis. .

Turo

Oct, 2017

Hi, would it be possible to get a sample of this report for review. We are thinking of purchasing but would like to see a sample first. .

saher

Sep, 2015

I need to prepare a report of college on "the impact of branding on consumers mind in home automation sector" hence wish to study the report..

sandeep

Aug, 2011

I would be grateful to get the information regarding the revenue generated and market share of prominent players in the Control System market..

evelyn

Aug, 2016

I would like to know what is the market size in USD of the BAS in México and in the USA, and its CARG to 2024..

Tamari

Aug, 2019

I am interested in the BAS market in Canada. I think, most relevant to my research will be table 56 - BAS Market in Canada, By Application, 2016–2024 (USD Billion). Could you please send a sample and the price quote for this table? Also, I would like to know if you have a graph, on the market share of key players in Canada? .

Michael

Aug, 2017

I am looking for a report on the industry trend, market size, competitive landscape, etc. for building automation for Singapore in particular and the region. .

Hanna

Aug, 2015

I am currently in discussion with my team lead to buy your report. Could I see one of the sample player profiles - an excerpt of the industry trends..

Ioan

Aug, 2018

I am searching share of Building Energy Management Software or other Building Energy Management elements, as share of the market. We might contact you for the extensive, complete report for our client. .

Thomas

Jun, 2017

I am teaching a course in HVAC controls. The students have been assigned a project to investigate market share of BAS companies. Do you offer any information for students?.

David

May, 2016

Interested in 1) Building automation system by market - by product segments. 2)Communication protocol application and geography..

Robert

May, 2014

I am looking for a sample of the Building Automation and Controls Market 2018-2023 report in order to evaluate it value and justify the expense..

Hülya

May, 2019

I am looking into building automation in the UK to see whether there is an opportunity for a startup software to enter market.

Anne-Laure

Apr, 2019

Need to have market knowledge on services offers related to building automation and room control in the commercial segment (offices, hotels, small retail) global and/or on Europe..

Shubham

Apr, 2015

I want to know the demand of automation in commercial spaces. Usually, commercial offices are on lease/rent, so I am concerned whether the company would grant funds for automation at the time of interior designing since the company does not own the place and may have to shift to other places in the future. Apart from this, I would like to know which is the most significant part of automation(out of lighting, HVAC and others)..

Boris

Mar, 2011

We are a start-up with innovation on access control and I would like to request the market data and company section of the report to help us refine our business case..

Brandon

Feb, 2015

Interested in building automation systems install base. Specifics would be system brand, age of system, square footage of facility, and contact for facility..

SP

Jan, 2015

Interested in BMS market size in India; Market size for stand alone controls/HVAC control components; top 10 players in these segment..

Oriane

Jan, 2019

The scope of the report is extremely unclear: - Which segments of the value chain are included in the report: Are the services (e.g. maintenance and repairing of the controls, energy procurement / energy services etc...) included? or is it just the equipment + installation? .