Construction Foam Market

Construction Foam Market by Resin Type (PU, PS, PO, Phenolic), Foam Type (Flexible and Rigid), and Region (Asia Pacific, Europe, North America, Middle East & Africa, South America) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The construction foam market is projected to grow from USD 30.02 billion in 2024 to USD 43.96 billion by 2030, at a CAGR of 5.4% during the forecast period. The demand for building materials that are energy-efficient, durable, and lightweight is the primary factor that is driving the market. The rising concern over environmental issues, cutting down on the use of energy, and the insulation standards becoming more strict are the factors pushing the use of polyurethane, polystyrene, and polyethylene foams in residential, commercial, and industrial projects. Governments are also taking initiatives to nurture the market by promoting green buildings and modernizing the infrastructure, while the market is reaping the benefits of the growing trend of prefabricated and modular construction. The constant innovation in foam chemistry and processing technologies is enhancing not only recyclability and structural performance but also alignment with global sustainability goals. Urbanization, renovation, and investment in smart infrastructure are the main drivers of the construction foam market's growth until 2030.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific is expected to witness the fastest growth with a CAGR of 6.4%, in terms of value, between 2024 and 2030.

-

BY RESIN TYPEPolyurethane is projected to be the fastest-growing segment, registering a CAGR of 6.5% in terms of value.

-

BY FOAM TYPEIn the construction polymer foam market, flexible foam held a 40.5% share in 2024.

-

COMPETITIVE LANDSCAPEOwens Corning, Armacell, Kingspan Insulation, LLC, Zetefoams PLC, and Saint-Gobain were identified as some of the star players in the construction foam market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPECertainTeed, Henry Company, Rhino Linings, and Icynene-Lapolla were identified as SMEs in the construction foam market due to their adoption of the latest production technologies and rapid organic growth.

The global construction foam market is experiencing a robust upswing, driven by the increasing investments in infrastructure, the use of energy-efficient materials, and the embracing of green building practices. Polyurethane, polystyrene, and phenolic foams are the polymers that are being widely used in insulation, roofing, flooring, and structural applications, as they have superior thermal resistance and are lightweight in nature, while being quite durable. Government-led movements promoting the adoption of eco-friendly building standards and energy, such as the EU's Energy Performance of Buildings Directive and the US Department of Energy's Better Buildings Initiative, are driving the use of high-quality insulation materials.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global construction foams market is changing, and at a fast pace, through the already existing improvements in the areas of material innovation, eco-friendly building standards, and performance-driven design trends. The need for lightweight, energy-efficient, and long-lasting insulation materials has been the main factor in the use of foams based on polyurethane, polystyrene, and phenolic in residential, commercial, and industrial applications. The progress made in closed-cell formulations, the use of spray foam technologies, and the incorporation of recycled raw materials are the main factors contributing to better energy conservation and thermal performance in buildings. The rising concern regarding sustainable urban development and the setting of net-zero emission targets are the main reasons for the quick adoption of low-emission foams that meet the environmental and fire safety regulations. The alliance of chemical manufacturers, building materials companies, and technology developers is responsible for the insulation systems that are highly efficient and the prefabricated building materials to be introduced into the market. The aforementioned trends constitute the construction foams market’s position as a pillar of the world's energy-efficient, sustainable, and next-generation building solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for energy-efficient insulation materials in residential and commercial buildings

-

Rising construction of green and sustainable infrastructure projects

Level

-

Volatility in petrochemical feedstock prices

-

Stringent environmental and fire safety regulations impacting product formulations

Level

-

Increasing adoption of recyclable and bio-based foams in sustainable construction

-

Growth in retrofitting and renovation activities driving insulation upgrades

Level

-

High upfront cost of advanced foam insulation materials

-

Competition from traditional materials such as fiberglass and mineral wool

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for energy-efficient insulation materials in residential and commercial buildings

The construction industry is seeing a rise in the demand for energy-efficient insulation materials due to the increasing focus on energy conservation and sustainable building practices. The use of polymer foams in buildings has increased, mainly because of their excellent thermal insulation and air-sealing properties. Polyurethane and Polystyrene are being increasingly utilized in walls, roofs, and flooring systems. These materials are very effective in reducing heating and cooling losses, thus allowing builders and property owners to achieve high energy performance and meet stricter green building codes such as LEED and Energy Star. Moreover, the continuous growth of urban infrastructure, along with governmental incentives directed towards energy-efficient housing and commercial areas, is a major contributor to the ongoing adoption of polymer foams in North America and other major markets.

Restraint: Volatility in petrochemical feedstock prices

Volatility in the prices of petrochemical feedstocks is a major factor hindering the growth of the construction foams market. Petrochemical-based raw materials are the primary sources for most polymer foams, particularly polyurethane, polystyrene, and polyethylene, besides propylene, ethylene, and toluene diisocyanate (TDI). The fluctuations in the prices of these intermediates are directly affected by changes in crude oil prices, which in turn are influenced by global supply chain disruptions, geopolitical tensions, and production cuts from major oil-producing nations. As a result of this price volatility, the cost of manufacturing becomes unpredictable, and sometimes, it is even harder for the manufacturers to adopt price and project planning for the long run. The situation is even more difficult because the substitutes with better performance characteristics are very limited, especially in the regions that depend on the import of feedstocks. Therefore, foam manufacturers in the construction sector are always concerned about maintaining profitability while ensuring competitive prices.

Opportunity: Increasing adoption of recyclable and bio-based foams in sustainable construction

The construction industry is opening a lucrative area for recyclable and bio-based polymer foams due to the strong focus on sustainability and the principles of the circular economy. Manufacturers are turning towards foams made from renewable resources like plant-based polyols, CO2-derived polymers, and recycled plastics as the regulatory authority and developers are continuously encouraging the use of low-carbon materials. The use of these materials not only reduces dependence on fossil-based feedstocks but also cuts down carbon emissions to a great extent throughout the product lifecycle. Breakthroughs in the chemical recycling process are allowing the restoration and recycling of polymer foam wastes, which is additionally in line with the global eco-friendly aims and green building certifications. Moreover, construction projects targeting zero energy and carbon-neutral emissions use insulation materials with guaranteed environmental credentials. Hence, eco-friendly and recyclable foams are being defined as the main differentiators for manufacturers who are striving to comply with the new sustainability standards and, at the same time, take the lead in the competition for the next generation of eco-efficient construction materials.

Challenge: High upfront cost of advanced foam insulation materials.

The key challenge to the widespread implementation of polymer foams in the construction sector is still the high upfront cost of the advanced insulation materials. Even though polymer foams like polyurethane, phenolic, and polyisocyanurate give excellent properties in thermal insulation, longevity, and energy savings, they are still costly to install than traditional materials like fiberglass or mineral wool. The central portion of this cost difference can be traced back to the advanced technology in the manufacturing processes, high-standard raw materials, and the exclusive machinery that is used for the foam creation and application. In the case of many small and mid-sized construction projects, these initial costs can be such that the long-term energy savings and operating advantages are not enough to convince the investor. Moreover, the knowledge of the lifecycle cost benefits is so limited among users and contractors that it becomes a barrier to market acceptance in regions that are sensitive to costs. The solution to this problem will be technological advancements, economies of scale, and government policies that emphasize the environmental and economic benefits in the long run of utilizing high-performance insulation foams.

CONSTRUCTION FOAM MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Produces polyurethane and polystyrene foam insulation systems for walls, roofs, and foundations in residential, commercial, and industrial buildings. | Enhances thermal insulation and energy efficiency; supports compliance with green building standards and reduces operational carbon emissions. |

|

Manufactures flexible elastomeric and polyethylene foam insulation for HVAC, plumbing, and mechanical systems used in modern construction. | Prevents heat loss, condensation, and moisture buildup; improves system durability and contributes to overall building energy savings. |

|

Develops polyisocyanurate (PIR) and phenolic foam boards for high-performance insulation in walls, floors, and roof panels. | Provides superior fire safety and thermal performance; enables lightweight, low-carbon building designs aligned with net-zero construction goals. |

|

Supplies cross-linked polyolefin and polyethylene foams for construction applications such as thermal insulation, air barriers, and soundproofing. | Offers excellent thermal stability, recyclability, and acoustic control; supports sustainable and circular material use in building systems. |

|

Produces technical foam materials used for structural cushioning, insulation panels, and vibration control in construction and industrial environments. | Improves acoustic insulation and thermal comfort; enhances material resilience and supports long-lasting, energy-efficient structures. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global construction foam market ecosystem is characterized by strong cooperation and interdependence among partners in the supply chain, including manufacturers, raw material suppliers, and distributors. Key players in the market, such as Owens Corning, Kingspan, and Armacell, are responsible for developing high-quality polyurethane, polystyrene, and phenolic foams, which are used in applications like thermal insulation, soundproofing, and structural support in buildings. Manufacturers depend on raw material suppliers like Dow Inc., Covestro AG, and BASF SE to provide polyols, isocyanates, and essential polymer additives, which not only deliver desired performance characteristics but also support foam sustainability. Distributors such as Worldwide Foam and Foam Factory are committed to making these products available worldwide and tailoring them to meet the diverse needs of different regions. Meanwhile, demand is driven by major construction companies like China State Construction Engineering Corporation (CSCEC), Bechtel Corporation, and Skanska AB, which are increasingly incorporating polymer foams into their energy-efficient buildings and infrastructure projects.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Construction Foam Market, By Resin Type

Polyurethane foam accounts for the largest share of the construction foam market because of its superior insulation effectiveness, mechanical strength, and versatility in building applications. It has low thermal conductivity, low density, and excellent durability. These qualities make it ideal for use in insulation boards, roof panels, doors, and floors. Additionally, both flexible and rigid polyurethane foams are widely used for sealing, bonding, and waterproofing in construction, thanks to their excellent heat and sound insulation properties that significantly reduce energy consumption in buildings. Spray and rigid polyurethane foams are becoming increasingly popular in the market for structural insulation panels, roofing systems, and wall cavities, as they are strong, water-resistant, and durable. As a result, the global construction industry is shifting toward greater use of polyurethane foams in insulation and structural applications, driven by the increasing emphasis on energy conservation and sustainable building standards.

REGION

Asia Pacific will register the largest market share during the forecast period.

The Asia Pacific region is projected to seize the largest market share of the construction foam market during the forecast period, mainly because of the rapid growth of cities, massive infrastructure creation, and the demand for more energy-efficient building materials. Among the countries that are experiencing a boom in construction activities due to government policies like "Housing for All by 2025" and "Make in India" are China, India, Japan, and South Korea. These policies drive large investments in infrastructure across both the residential and commercial sectors. Apart from that, the region benefits from the fact that its raw materials are readily available, lower labor costs, and expanding manufacturing capabilities, which are the reasons why global producers are being encouraged to move their production bases to the region or to increase their production in the region. The Asia Pacific region is not only the world's largest producer and consumer of construction foam but is also strongly supported by governments in terms of green building standards and sustainable urban development.

CONSTRUCTION FOAM MARKET: COMPANY EVALUATION MATRIX

Owens Corning offers a lineup that includes polyurethane and polystyrene insulation materials engineered for maximum thermal efficiency, sound control, and strength. Additionally, the company is well recognized for its ability to deliver the best, eco-friendly building materials and top-tier insulation technologies. These innovations enable Owens Corning to meet the needs of various sectors, including residential, commercial, and industrial, by promoting energy-saving and low-emission building practices while utilizing resources efficiently. Saint-Gobain (Emerging Leader) leverages its well-known brands like ISOVER and Celotex to quickly expand market share by providing high-quality insulation and foam products known for durability, energy efficiency, and recyclability. Saint-Gobain continues to improve by harnessing its extensive material knowledge, expertise in the circular economy, and modern manufacturing methods to develop innovative solutions in lightweight, eco-friendly, and strong foam. Overall, this dynamic situation enhances Saint-Gobain's position as a forward-thinking leader committed to transforming the global construction industry through eco-efficient and high-performance foams.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Owens Corning (US)

- ARMACELL (Luxembourg)

- Kingspan Insulation, LLC (Ireland)

- Zotefoams plc (UK)

- Sheela Foam Limited (India)

- Saint-Gobain (France)

- Dura-Foam (India)

- Duroflex Foam (India)

- Aeroflex USA, Inc. (US)

- Huntsman International LLC. (US)

- FXI (US)

- Woodbridge (US)

- Boyd (US)

- Carpenter Co. (US)

- UFP Technologies, Inc. (US)

- FXI (US)

- TORAY INDUSTRIES, INC. (Japan)

- Vita (Holdings) Limited (UK)

- Trocellen (Germany)

- LaPur GmbH (Germany)

- Joy Foam (India)

- MEGAFLEX Schaumstoff GmbH (Germany)

- Safas (Turkey)

- Organika S.A. (Poland)

- Ikano Industry (Poland)

- King Koil India (India)

- NEVEON Holding GmbH (Austria)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 30.41 Billion |

| Market Forecast in 2030 (Value) | USD 43.96 Billion |

| Growth Rate | 5.40% |

| Years Considered | 2019–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: CONSTRUCTION FOAM MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Construction & Insulation Companies | Conduct comparative benchmarking of polyurethane and polystyrene foams for building envelopes, roofing, and wall insulation under ASHRAE and LEED standards. | Helps builders and developers select optimal foam materials for high thermal efficiency and sustainability compliance. |

| Architectural & Engineering Firms | Provide advanced modeling and simulation studies for foam insulation systems used in energy-efficient and net-zero buildings. | Enables design optimization and supports compliance with national green building codes and performance standards. |

| Roofing & Waterproofing Contractors | Evaluate the performance of closed-cell polyurethane and phenolic foams for roofing insulation, vapor barriers, and waterproof applications. | Enhances energy performance, moisture resistance, and extends roof service life in diverse climatic conditions. |

| Infrastructure Developers | Assess the application of rigid foam panels and structural insulated panels (SIPs) for bridges, tunnels, and prefabricated buildings. | Improves structural integrity, reduces construction time, and enhances long-term durability in infrastructure projects. |

| Green Building Certification Consultants | Develop sustainability assessment models for foam products in line with EPA and Energy Star building efficiency frameworks. | Supports eco-certification goals and carbon footprint reduction strategies for sustainable construction projects. |

| Regulatory & Sustainability Teams | Map recycling infrastructure and material recovery pathways for construction foam waste management across North America. | Promotes closed-loop recycling, aligns with circular economy goals, and supports compliance with regional environmental mandates. |

RECENT DEVELOPMENTS

- September 2024 : Armacell is investing in expanding ArmaGel XG production capacity in Pune (India), next to one of its largest and advanced plants worldwide. They also announced that this new manufacturing facility will reinforce the company’s aerogel capacity by adding 1 million square metres per annum to meet the rapidly increasing demand for aerogel-based insulation.

- May 2024 : Zotefoams signed a Global Alliance Agreement with Suzhou Shincell New Materials Co., Ltd. This agreement involves sharing Shincell’s technology, collaborating on product developments related to the foaming industry, and jointly marketing Shincell’s products alongside Zotefoams’ offerings. By adding Shincell’s technologies, Zotefoams can create a broader range of products, enter new markets, and develop improved future products.

- December 2022 : Kingspan Insulation, LLC acquired Dyplast Products LLC. Dyplast Products will join the North American region of Kingspan's Insulation Division. This acquisition will serve as a platform for Kingspan to develop a technical insulation business in North America that combines Dyplast's firm foundation with the advanced capabilities Kingspan has globally.

Table of Contents

Methodology

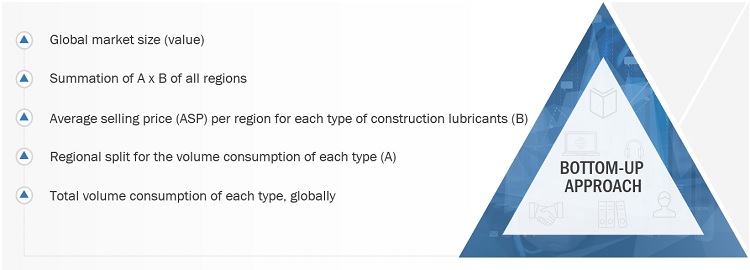

The study involved four major activities in estimating the current size of the construction foam market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering construction foam and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the construction foam industry, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the construction foam market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from construction foam vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using construction foam, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of construction foam and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Shell plc |

Vice-President |

|

ExxonMobil Corporation |

Director |

|

BP p.l.c. |

Project Manager |

|

Chevron Corporation |

Sales Manager |

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the construction foam market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Global Construction Foam Market Size: Bottum Up Approach

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of construction foam.

Market Definition

Construction Foam are materials applied to decrease the friction between moving surfaces and parts. Construction Foam help improve the efficiency of the equipment and machines used in the construction industry. These lubricants tend to have different viscosity applied on different equipment across building and construction industries.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the size of the construction foam market based on base oil, type, equipment, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the construction foam market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the construction foam market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the construction foam market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Construction Foam Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Construction Foam Market